How To Form An S Corporation

What Is An Limited Liability Company What Is A Llc Partnership

The limited liability company, or LLC, is the newest type of business form in the United States. The LLC is a unique hybrid: a cross between a partnership and corporation. LLCs have become very popular because they provide the flexibility, informality and tax attributes of a partnership or sole proprietorship, and the limited liability of a corporation.

To form an LLC, one or more people must file articles of organization with their stateâs business filing office. Although not required by all states, it is highly desirable to adopt a written LLC operating agreement laying out how the LLC will be governed. If you donât prepare an operating agreement, the default provisions of your stateâs LLC laws will apply. Operating an LLC is simpler than when you form a corporation. It is not necessary to have officers and directors, board or shareholder meetings, or the other administrative burdens that come with having a corporation.

LLCs are a clear favorite over partnerships because they offer the same tax benefits but also provide limited liability. They are also a serious alternative to corporations, because they are simpler but offer the same limited liability as corporations and have some tax advantages.

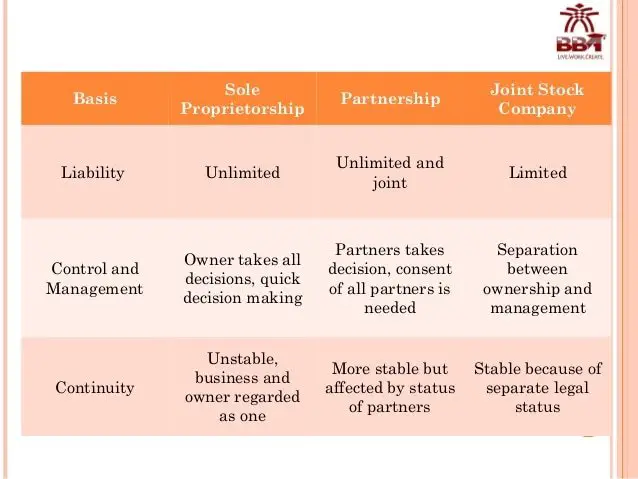

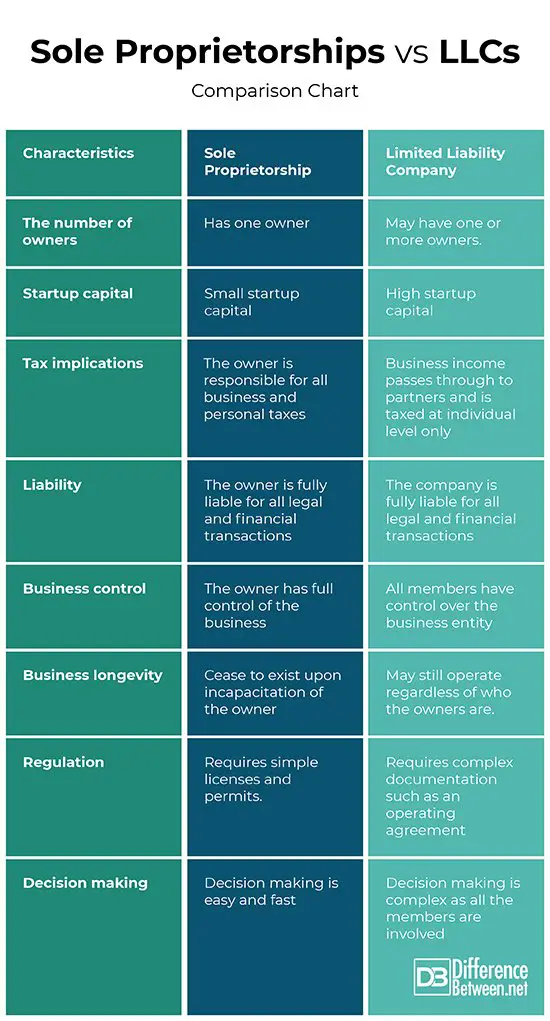

Summary Of Sole Proprietorships Versus Llcs

The importance of the type of a business entity cannot be emphasized enough. Being knowledgeable about the differences between sole proprietorships and LLCs comes in handy for any aspiring business owners, especially in making the critical decision on the type of entity that is ideal for a certain business.

You May Like: Can You Mix Pine Sol And Vinegar

Im Not Sure How To Change From Sole Proprietor To Llc What Do I Need To Do

Since youre a sole proprietor by default, making the change to LLC requires that you register your business with your state. Each state has a different department handling this, but your states small-business office or secretary of state website is a good place to start. Forming an LLC involves a few steps, which vary by location but often include:

Other steps might include assigning a registered agent and certifying that youll keep your records updated in the future. There are also fees, which range from $100 to thousands. Getting final approval can take weeks or even months, so plan in advance for the process to take its course.

You can also enlist the help of a service that does this work for you, freeing up that research and filing time for more important business matters.

Sole Proprietor Vs Independent Contractor

Sole proprietors and independent contractors are both non-employee self-employed persons. Rather than that, they give services or commodities to clients on an individual basis and are not compensated for their job.

Both classes are comparable in that those who fulfill both roles:

- Taxes on self-employment income

- Prepare your income taxes using a Schedule C form.

- Individuals who work for themselves rather than for an employer

The primary distinction between a single owner and an independent contractor is the method of reporting remuneration. While a single proprietor is responsible for tracking their own company costs, an independent contractor will get a 1099 form detailing their earnings over the previous calendar year.

However, depending on the nature of the services given, a single proprietor can obtain a 1099 form from their client.

You May Like: Does Residential Solar Make Sense

Advantages Of Incorporation Vs Sole Proprietorship

Some of the pros and cons have been touched on above. The main advantages of sole proprietorships are that they are simple and inexpensive to set up and offer the owner a greater degree of flexibility and control in operating the business. We recently discussed five of the key advantages of incorporation: limited liability optimizing income and tax deferral easier to raise capital perpetual existence and business name protection. When it comes to Canadian sole proprietorships, the converse is true: a sole proprietor has unlimited personal exposure for business debts and lawsuits tax deferral is not possible raising capital is more difficult the business ends if the owner dies or ceases to operate the business and there is no name protection.

Sole Proprietorship And Corporation Comparison

The biggest advantage of starting a corporation vs. sole proprietorship by far is the personal asset protection that shareholders have in the event the corporation is sued or owes a debt. With a sole proprietorship, the owner is completely responsible for any liabilities or debts of their business which can be an immense risk.

Moreover, corporations can claim self-employment tax savings among other tax benefits, while sole proprietorships offer no tax benefits as an informal business structure. In contrast, sole proprietorships save money with the low cost to establish this business structure, plus they arent liable for unemployment insurance.

Essentially, choosing to form a corporation vs. a sole proprietorship comes down to just a few things:

- Whether your business is small enough to act as an extension of yourself, allowing you to comfortably assume the financial responsibility of your business

- If your business can anticipate the level of growth that will benefit from tax savings, investment opportunity, and personal asset protection offered by a corporation.

You May Like: What Is Silver Sol Good For

Llc Vs Sole Proprietorship Comparison

There are four main factors to compare between a sole proprietorship and LLC:

- Liability Protection

- Cost to Register and Maintain

Liability Protection

A sole proprietorship doesn’t offer liability protection, but an LLC does. This value usually outweighs all other factors.

Branding

An LLC owner can use the business’s legal name as its brand name. A sole proprietor must use their surname as the business name or register a DBA name when available.

Pass-Through Taxation

Both sole proprietors and LLCs are taxed as pass-through entities by the US Internal Revenue Service . This means that the business’s profits will pass through to its members to be reported on their personal tax returns. All profits are only taxed once, at each member’s individual income tax rate.

Cost to Register and Maintain

An LLC is a low-cost and low maintenance business structure. A sole proprietorship with a DBA is comparably priced.

Whats An S Corporation

An S Corporation is a special type of corporation formed through filing a certificate of formation with the office of the Secretary of State where the company is headquartered, as well as the necessary tax documentation with the Internal Revenue Service.

What distinguishes this from other types of corporations is the fact that the taxation of the company is similar to a partnership or sole proprietor as opposed to paying taxes based on a corporate tax structure.

Income is sent directly to shareholders annually in the form of distributions, and it is the shareholders who are taxed, not the corporation. The corporation itself remains a distinct, separate entity from the shareholders.

Recommended Reading: Can Solar Panels Run A Whole House

When Should You Open An Llc

There are a few reasons to open up an LLC instead of operating as a sole proprietorship:

- You want to expand the company to more than one owner in the future, which is easy with an LLC

- You want to protect your personal assets from potential financial and legal liability

- You want to take advantage of any applicable local, state or federal tax benefits that come with forming an LLC

In summary, setting up an LLC could position you for growth and protect you from liability. People also consider opening up an LLC when they reach a certain income threshold in their business and the additional fees and paperwork make sense from a tax perspective. This varies by state and the type of business, so its a good idea to speak to your accountant and compare the taxes youll be paying with each business structure.

Which Is Better Llc Or Sole Proprietorship

LLCs or sole proprietorships can be the best choice for your business depending on your businesss needs. For example, sole proprietorships require no registration at the state level and allow for more flexibility since they arent formally organized, but they offer no personal liability protection, which means they arent ideal for many businesses.

Generally, we recommend forming an LLC rather than a sole proprietorship because, in addition to the protection of personal assets, LLCs offer tax benefits and are extremely easy to manage and maintain.

Read Also: Do It Yourself Solar Water Heater

Advantages Of A Sole Proprietorship

When you form a sole proprietorship, you have the following benefits:

- No required state paperwork, unless theres specific licensing such as an occupational license and/or business license.

- No required annual state filings to complete, unless theres specific industry filings required by your industry.

- All profits/losses are passed through to the owners personal tax return. These are typically reported on a Schedule C tax form that is filed with owners personal tax return.

- May enjoy the tax benefits of being self-employed, from deducting certain business expenses , utilizing self-employed retirement plans like Simplified Employee Pension Individual Retirement Accounts , writing off regular business expenses such as , writing off business travel costs, writing off costs to entertain clients and more.

Taxes For A Sole Proprietorship Vs Llc

With both an LLC and a sole proprietorship, the profit of the business passes through to the owners personal tax return. But LLCs have more flexibility in how they are taxed, which may result in tax savings.

Sole proprietors typically report their business income and expenses on Schedule C. This form is filed with the owners personal tax return. The net profit from the business indicates the net profit of the business and it passes through to the owners personal tax return.

Pass through entities like LLCs and sole proprietorships may benefit from the Qualified Business Income deduction that allows them to deduct 20% of QBI. Not all business income qualify, so talk with a tax professional.

Single-member LLCs are automatically treated as sole proprietors for tax purposes, but may elect to be taxed as an S Corporation or C Corporation. This may provide tax savings but will also carry additional requirements. Check with your tax professional to choose the right filing status for your business.

Dont forget about self-employment tax! The current self-employment tax rate is 15.3%. Normally this is split between the employer and the employee, but when you are the employer you pay the full amount yourself.

Also Check: How Much Does Solar Cost In Arizona

Business Funds And Personal Funds

LLCs must have separate bank accounts for business activity and personal use. This includes separate credit cards, debit cards, checking accounts, and savings accounts. Mixing personal and business finances can result in serious penalties.

Sole proprietors do not have to maintain separate accounts for business and personal use. In the eyes of the law, sole proprietors and their businesses are one and the same. With that said, most accountants frown upon this practice and recommend using a separate account for your business. In the event of an IRS audit, this separation will make your life significantly easier. While this isnt a fact per se, its assumed by many that auditors are more likely to scrutinize your records if you mix personal and business finances.

How Much Does It Cost To Open An Llc

Youll have a few expenses when forming an LLC. First, theres a one-time formation fee, which costs anywhere from about $50 to a few hundred dollars, depending on your state. You may decide to hire a lawyer or online LLC filing service to prepare and file the paperwork for you. The fee for this varies and is separate from your state filing fee. And if you use a registered agent company to act as your registered agent, youll pay anywhere from about $50 to $300 a year for that service.

In many states, youre required to file an annual report and pay an annual fee or tax. This varies by state but, on average, ranges from $10 to $300 per year .

Recommended Reading: How Much Does A 20kw Solar System Cost

What Are The Tax Implications Of Each Business Structure

To file taxes, you report your operating results, including profit or loss, by submitting Profit or Loss From Business with your personal 1040 tax return. An LLC is very flexible and can also be taxed as a sole proprietorship, a partnership, or a corporation.

A sole proprietor also benefits from pass-through taxation, so you’ll report your business’s income or loss in the same way. The difference is that you don’t have the option to file as a corporation.

You’re also not required to pay taxes on the full amount of your sole proprietorship’s income. Instead, you’ll only pay taxes on the profit of your business.

What Is The Difference Between An Llc And An S Corp

A limited liability company is easier to establish and has fewer regulatory requirements than other corporations. LLCs allow for personal liability protection, which means creditors cannot go after the owner’s personal assets. An LLC allows pass-through taxation, meaning business income or losses are recorded and taxed on the owner’s personal tax return. LLCs are beneficial for sole proprietorships and partnerships. An LLC with multiple owners would be taxed as a partnership, meaning each owner would report profit and losses on their personal tax return.

An S corporation’s structure also protects business owners’ personal assets from any corporate liability and passes through income, usually in the form of dividends, to avoid double corporate and personal taxation. S corporations help companies establish credibility as a corporation since they have more oversight. S corps must have a board of directors who oversee the management of the company. However, S corps can have100 shareholders and pay them dividends or cash payments from the company’s profits.

Recommended Reading: Can Solar Panels Damage My Roof

Llc Vs Corporation: Management

An LLC has a flexible management structure. The entity can be managed by its members or a group of managers, and any member may act as the LLC’s manager. The LLC may also elect to have no distinction between an owner and a manager of the business. Due to its flexible nature, LLC management is less formal which may make it an ideal entity for some entrepreneurs.

What is the difference between “manager-managed” and “member-managed” LLCs? In a member-managed LLC, the owners themselves oversee running the day to day operations, while a manager-managed LLC generally has investors that sit on the side lines, and don’t have any other active role in the business.

A corporation’s management structure is much stricter. A corporation must have a formal structure with a Board of Directors handling the management responsibilities of generating profits for the shareholders. Corporate officers are assigned to handle the day-to-day operations of the business. The shareholders are considered owners of the corporation but remain separate from business decisions and daily operations of the corporation .

However, shareholders retain the power to elect directors, and individual shareholders can be elected as a director or appointed as an officer. The individual rules of any corporation are dictated by its corporate bylaws, which is a detailed set of rules adopted by the Board of Directors after the corporation is formed.

Which Is Better: A Sole Proprietorship Or Llc

As with so many questions like this, the answer is: it depends. While obtaining funding or financing can be challenging for any business, the advantages and protections you can enjoy with an LLC cant be understated.

Keep in mind your business goals and what you want to achieve. Dont be scared to get advice or help from seasoned professionals.

This article was originally written on December 3, 2019 and updated on July 21, 2021.

Read Also: How To Start A Sole Proprietorship In Alabama

Pros And Cons Of Incorporation

When you incorporate your business, youre creating a separate legal entity. And one of the biggest advantages is the liability protection that comes with this.

When you incorporate, youre not held personally responsible for any debts or lawsuits incurred by the business. If any legal claims are brought up against the business, then youre not personally responsible for them.

When you incorporate your business, you may be taken more seriously as a business owner. Incorporating can also make it easier to apply for business financing in the future.

However, theres a lot of work that comes with incorporating your business. You have to file your articles of incorporation, hold shareholders meetings and track corporate minutes. If youre a new business owner, you may not be ready to commit to all of that.