Pattern Energy Group $262 Billion

Pattern Energy Group is a clean energy company that owns and operates power projects in the US, Canada and Chile. They sell any output to power and utility companies in fixed-price purchase agreements.

However, as of June 2019, Pattern Energy had cash and cash equivalents of $124 million compared with $101 million in December 2018. PEGI is in the middle of what is calls a building period although it expects slow dividend growth in the short term, it hopes that by 2020 it will see a 10% annual growth rate in dividends. This is up from an estimate of 5% for 2019.

Key Solar Energy Terms To Know

As with many industries, the solar energy industry has specific terminology that is important to understand. These terms don’t replace the importance of basic GAAP accounting, or following a company’s revenue, cash flow, and other typical metrics, but they will go a long way toward helping you understand solar companies and the industry in general.

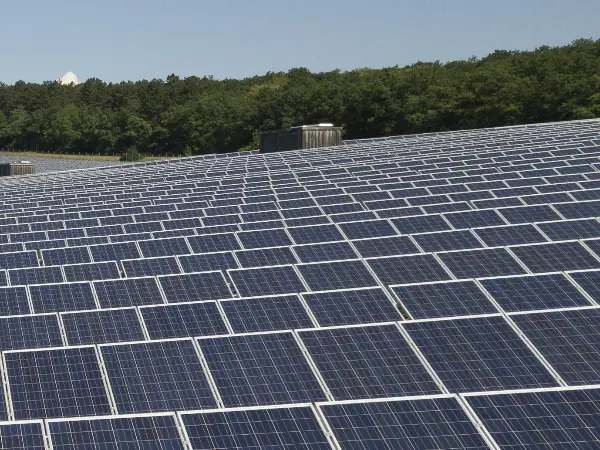

Solar cell: This is the starting point for photovoltaic solar cells. Solar cells are made using one of several technologies, including thin-film, mono-crystalline silicon, and multi-crystalline silicon, just to name a few of the many different types. These cells are then grouped together into the panels you see on rooftops, parking garages, and in utility-scale solar farms. While most solar cells have little to differentiate themselves from competitors and compete almost entirely on price, some manufacturers have proprietary technologies that create some competitive advantage.

Inverter: Solar panels generate DC, or direct-current, electricity, while the power grid supplies AC, or alternating-current, to homes, businesses, and industrial customers. Inverters take the DC current from solar panels and convert it into AC current.

Let’s take a more in-depth look at each of the segments discussed above, and some of the key companies involved.

The Most Popular Solar Stocks To Invest In

Many homes and businesses are looking to reduce their carbon footprints, and solar energy is becoming a popular alternative to oil and gas. The cost of solar panels has dropped 70% since 2014, and its estimated that by 2030, more than one in seven homes will have rooftop solar panels. The U.S. government is also expected to expand solar energy plans.

Since solar energy is becoming more common both in the United States and around the world, its no surprise that solar stocks are becoming a popular investment. They offer long-term opportunities for investors, as the renewable energy sector is only expected to grow in the coming years. Solar energy stocks can be volatile at times, as the industry is still growing, but overall, many investors are looking to them as the country makes the transition from fossil fuels to renewable resources.

Recommended Reading: How To Heat Pool With Solar Panels

The 8 Best Solar Stocks To Buy For February 2022

Noah Zelvis – January 30, 2022

Across party lines in the United States and especially in the international sector, the move toward renewable energy is becoming more mainstream. The best solar stocks could be set to benefit from this push.

According to the International Energy Agency, global renewable energy has grown by 1,200 gigawatts over the last five years.

60% of that energy growth is attributed to solar energy .

Here are some other facts you should know about the industry.

- The cost of solar energy has plunged 90% over the past decade.

For a 50-foot view of the industry, solar energy has witnessed an average annual growth rate of 49% over the last decade alone.

This growth is directly linked to strong federal policies like the Solar Investment Tax Credit.

In addition, there are rapidly declining installation costs and an increase in demand across private and public sectors for clean electricity.

More than 85 gigawatts of solar capacity are installed nationwide, enough to power 16 million homes.

Top 3 Solar Stocks To Buy In April 2022

Across political lines in the US and internationally the move towards renewable energy is becoming more mainstream. Rising concern about climate change, advocacy for green energy, government subsidies, and stimulus packages offered to green energy projects are set to prop up the solar energy sector.

Despite the rising costs of materials globally, the renewable energy trend seems assured by 2026, global renewable electricity capacity is set to grow 60% compared to 2020 levels, as reported by the International Energy Agency. This growth spurt will result in 4,800 GW of renewable energy power or the total current global capacity of fossil fuel and nuclear energy sources.

With such lofty investment goals and ensured growth, ESG investments should have their place in a shrewd investors portfolio. The following three stocks have a lot of potential in this wave of renewable growth.

Read Also: How Many Solar Panels Would I Need

Mac Global Solar Energy Stock Index

The “MAC Global Solar Energy Stock Index” is the tracking Index for the “Invesco Solar ETF,” which is an exchange-traded fund that is traded on the New York Stock Exchange ARCA with the ticker symbol of TAN .* Visit www.Invesco.com for more information. Investors cannot invest directly in an index but investors can buy and sell the exchange-traded fund that tracks that index. An ETF holds a basket of stocks in a single fund. An ETF can be bought and sold in an investor’s brokerage account just like an individual stock .

Have Your Documents Ready

Before beginning the process, ensure that all the documents you need for your taxes are readily available. If you recall my previous article on financial planning tips, maintaining proper records is incredibly useful. For that reason, it shouldnt be a surprise to see proper records appearing in an article about tax season tips. Examples of such documents include W9 or 1099 forms, receipts, or canceled checks, anything that shows income. Ensure that you have all of your documents before you begin the process.

Attempting to file in stages, or whenever you find another document, complicates the process. In addition, it also leaves you more liable to making mistakes, or skipping important steps in the process. Besides earned income, be aware that unemployment benefits are taxable. However, stimulus checks are not taxable. Winnings from gambling are also taxable, and also need to be included. Earned income from investments, whether that be equities, cryptocurrencies, or mutual funds, are also taxed.

You May Like: Where To Place Solar Lights In Yard

Huge Opportunity In Solar Stocks

Every crisis creates opportunity. This one is no different.

Whats happening in Eastern Europe is an absolute tragedy. While the war may seem far away, the impacts of the conflict will hit you at home, especially in the form of higher energy prices.

The national average gas price is above $4 per gallon. Thats a record high. And just wait until you get your energy bills this summer

Folks, what were staring at today is a global energy crisis. Not a Russo-Ukrainian energy crisis a global energy crisis that will impact you, me and everyone we know.

Well, except for those whose homes and offices are powered by solar. Their energy costs are going to go down not up.

Wouldnt you like to be one of those folks? Sure. So does everyone. And thats why we are confident in saying that the oil and gas price spike of 2022 will spark enormous growth in the solar industry.

There has truly never been a better time to buy solar stocks that right now.

Smart money knows this already. Thats why solar stocks are surging, while the rest of the market has been crashing.

But you arent late to the party. Were in the first inning of this ballgame. And the runway for further price appreciation in solar stocks remains extensive.

New Ways To Invest In Emerging Markets

The IFC estimates 23 Trillion USD of new investing opportunities in emerging markets from 2016-2030. The study covers 21 emerging markets that represent 62% of the World population. These regions are also responsible for 48% of Global GHG emissions. Affordability has always stopped corporations and governments from going green. The recent policy changes brought with

Also Check: Why Do Solar Panels Face South

Irr Expectations From Solar Rooftop Projects

The ongoing cost reductions in solar PV have become more obvious to policy-makers, investors and incumbent energy companies. This has engendered a new environment in which the growing importance of low-cost renewables is widely recognized. At the same time, solar projects have sprung up in an increasing number of countries, notably in the developing world.

Where Do Solar Stocks Fit In Your Portfolio

Solar energy companies are attempting to serve 2 masters at once. On one hand, solar power is a terrific public good that would greatly reduce fossil fuel consumption and make for a healthier environment. On the other hand, solar power systems are expensive to build and maintain and companies in the sector are often riddled with debt.

When adding solar stocks to your portfolio, be sure to consider the pros and cons of both the individual companies and the industry as a whole. Just because a company is attempting to do good doesnt mean its a well-run firm. Always thoroughly vet solar companies before investing and have a plan for exiting a speculative trade.

Claim FREE Stocks

Also Check: Is Community Solar A Good Deal

Sunpower Corporation $176 Billion

SunPower Corp designs and produces solar panels for both residential and business purposes. Initially, SunPower was an industry favourite thanks to its innovative and efficient solar systems. The enthusiasm from investors saw its share price reach an all-time high of $164 in November 2007. However, the next few years saw the share price tumble to less than $15 after competitors both domestic and international entered the growing solar energy sector looking for a piece of the market share.

With Chinas low-cost solar panels dominating the market and pushing down the prices, SunPowers more expensive panels struggled to compete, which pushed down the companys revenue and caused fluctuations in the share price. The share price fluctuated between $4.55 and $12.00 from 2016 until 2019.

Between January and September 2019, SPWR stock moved up by 169.21% but didnt break above $12 until July. This was on the back of positive Q2 results and a strong US dollar causing revenues to accelerate.

How We Approach Editorial Content

Maintaining independence and editorial freedom is essential to our mission of empowering investor success. We provide a platform for our authors to report on investments fairly, accurately, and from the investors point of view. We also respect individual opinionsthey represent the unvarnished thinking of our people and exacting analysis of our research processes. Our authors can publish views that we may or may not agree with, but they show their work, distinguish facts from opinions, and make sure their analysis is clear and in no way misleading or deceptive.

To further protect the integrity of our editorial content, we keep a strict separation between our sales teams and authors to remove any pressure or influence on our analyses and research.

Read our editorial policy to learn more about our process.

You May Like: Does Home Depot Sell Solar Panels

The Top 15 Solar Energy Stocks In 2022

Solar panel installations are surging as the world tries to stop relying on fossil fuels. And yet, beset by supply chain challenges and cost inflation, solar stocks have had a challenging 2021. But the longer-term trend of more renewables is still good, so now could be a good time to invest. Here is a list of the top 15 solar energy stocks.

Some of our posts may contain links from our affiliate partners. However, this does not influence our opinions or ratings. Please read our Terms and Conditions for more information.

Brookfield Renewable Energy Partners $664 Billion

Brookfield Renewable Energy Partners is, at its heart, a completely different kind of company than the other players on this list, as it is not a producer or installer. BEP is an asset management firm that has a significant focus on renewable energies.

The company is most well-known for its investment in hydroelectric power, however, the industry behemoths interest in solar energy cannot go ignored. In 2017, BEP acquired a 51% interest in TerraForm Power, as well as paying $500 million in 2019 for a stake in X-Elio, a Spanish solar developer. For traders interested in solar, but looking to diversify their ethical investments, Brookfield Renewable Partners can offer exposure to a range of different renewables.

The company does have a renewable power platform, which includes its own utility-scale solar projects. Any renewable energy the company makes is mainly sold to customers at fixed-rates, which gives the company some stability amid volatile power prices. Despite this volatility and a competitive solar industry, BEP has seen sustained share price growth. The companys stock reached an all-time high in August 2019, trading at $37.43.

However, a lot of its operations take place in emerging markets, such as Brazil, which means that BEP reduce their risk through hedging against changing prices and currency rates.

Don’t Miss: How Long Before Solar Panels Pay Off

Maxeon Solar Technologies Ltd

Number of Hedge Fund Holders: 9

Maxeon Solar Technologies, Ltd. became an independent company in 2020, after its spin-off from the California-based SunPower Corporation . Maxeon Solar Technologies, Ltd. manufactures and distributes solar products across 100 countries via extensive retail channels, operating the SunPower brand in all global markets except the United States and Canada.

On November 17, Maxeon Solar Technologies, Ltd. announced earnings for Q3. The company reported a loss per share of $1.34, beating estimates by $0.01. The revenue increased 6.71% year-over-year to $220.49 million, but missed estimates by $5.78 million.

BofA analyst Julien Dumoulin-Smith on December 3 upgraded Maxeon Solar Technologies, Ltd. to Buy from Neutral with a $23 price target, stating that Maxeon Solar Technologies, Ltd. could qualify for tax credits of 11 cents per watt with its proposed U.S. cell and module manufacturing facility.

One of the leading stakeholders of the company is Israel Englanders Millennium Management, holding 121,720 shares worth $2.14 million. Englander increased his stake in Maxeon Solar Technologies, Ltd. by 524% in the third quarter.

In addition to First Solar, Inc. , Sunnova Energy International Inc. , Sunrun Inc. , and Enphase Energy, Inc. , Maxeon Solar Technologies, Ltd. is one of the best solar energy stocks to buy for 2022.

Growth Of Solar As An Attractive Asset Class

Investment in the renewable energy sector is steadily increasing each year. Fossil fuel dependency is unsustainable in all ways, especially from an environmental standpoint. Private equity is following the pattern and has shifted to renewable investment. It currently stands at 80% in 2021. Of the renewable energy options, Solar and On-shore wind have shown the

Also Check: How Much Solar Power Do I Need

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Why Invest In Renewable Energy Stocks

Renewable energy capacity has been increasing fairly quickly in recent years and, as climate change becomes more and more of a hot button issue, this capacity is likely to continue to grow at a faster rate going forwards.

| According to a report by the International Energy Agency , in 2020, renewable energy sources accounted for around 28% of the worlds total electricity generation and the IEA estimates that, by 2030, this figure will be 45%, provided countries stick to new pledges made in 2021. |

As renewable energy has begun to supply an increasing amount of global energy, accordingly, renewable energy stocks have performed increasingly well in recent years. If our demand for more environmentally friendly energy continues to grow, then renewable energy stocks are bound to continue to enjoy the benefits of this.

However, after particularly strong performances in 2020 – last year, 2021, was not a great year for renewable energy stocks, with oil and gas industries stealing the limelight. But with new pledges made by countries around the world at the COP26 climate conference, we could see a shift back in favour of renewable energy stocks this year.

To learn more about investing in renewable energy shares, check out our below webinar on the topic, in which expert trader Jens Klatts talks about why green energy stocks deserve a place in your portfolio!

Free Trading Webinars from Admirals

Recommended Reading: What I Need To Know About Solar Panels

The Top Renewable Energy Stocks Should Generate Strong Returns For Investors

Climate change and socially responsible investing are major catalysts for the clean energy revolution. Those factors will drive trillions of dollars of investment in renewable energy in the decades ahead.

While that rising tide should lift all boats, the top renewable energy stocks should generate some of the best returns for investors. These green energy companies have already proven to be value creators and have the financial strength to capture opportunities that should yield outsized total returns in the coming years.