After Filing Your Illinois Dba

If filing a DBA marks the beginning of your business journey, then there are a few more steps that you should take before getting started:

- Create your Businesss Website – Every business needs a website. Luckily, drag-and-drop builders like GoDaddy and Wix make the job quick and easy. Check out our Best Website Builder article to find the tool thats best for you.

- Get your Business Finances in Order – Youll need to separate your business finances from your personal ones. This is accomplished by opening a business bank account. If your business has long lead times or other cash flow irregularities, you can also look into a business credit card.

- Protect Your Business – While an LLC will help to protect your personal assets in the case of a lawsuit, your businesss assets also need protection. Having the right business insurance will ensure that youre covered if the worst happens. Most businesses start with general liability insurance as their base coverage.

Set Up An Accounting System

Setting up an accounting system for your business is one of the most important things you can do for your company to ensure long-term success.

There is just one problem youre not a numbers person.

Just thinking about financial statements, debits and credits, and accounting software makes your head hurt.

Staying on top of finances not only keeps the business out of trouble with the IRS, but it can be used to track and monitor trends in the business and maximize profits.

Fortunately, understanding the numbers doesnt mean getting a finance degree. Tracking a businesss financials can be done with pen and paper , spreadsheets, accounting software, or hiring a bookkeeper.

Reapply For Business Licenses And Permits

Do not assume that business licenses and permits obtained by a sole proprietorship will remain valid when the business becomes an LLC. Some states and local licensing agencies will not transfer them. Its critical to check the state, county, and municipalitys rules. Without licensing and permit requirements in place, an LLC will not be operating legally.

Tip: Consider using CorpNets business license services to determine requirements and complete applications at the federal, state, and local levels.

Also Check: How Much Is An Off Grid Solar System

Do Llcs Have To Register With The Illinois Department Of Revenue

Yes. Illinois is pretty heavily invested in making sure businesses meet all of their tax obligations. If you conduct business in Illinois, you must register with the Illinois Department of Revenue. You can register online with MyTax Illinois or by filing an Illinois Business Registration Application by mailing it in.

Checklist For Starting A Business In Illinois : : Illinois Business

If your business is a sole proprietorship or a partnership, you must register the business name in the county where you will be conducting business.

May 8, 2017 If you plan to set up as a sole proprietor or partnership, you will need to register using your own name or names. To establish a business

Form a Legal Structure Get an EIN and an IBT Register Locally. structures in Illinois: Sole Proprietorship one person is owner and manager.

The simplest form is a sole proprietorship. The business owner puts in all the money, makes all decisions, pays federal income tax on net income using

Also Check: How To Convert Solar Power To Electricity

Llc Vs Sole Proprietorship: Paperwork And Compliance

The final difference between an LLC vs. sole proprietorship has to do with paperwork and compliance requirements. As we mentioned earlier, a sole proprietorship requires the least amount of paperwork prior to launch. After launch, a sole proprietor only needs to keep up with federal, state, and local taxes. In addition, a sole proprietor might need to renew business permits.

An LLC has more compliance responsibilities. After filing initial articles of organization, LLCs have to file an annual report in many states. An LLC with multiple members has even more responsibilities, such as drafting an operating agreement, issuing membership units, recording transfers of ownership, and holding member meetings. None of these steps are legally required, but are highly recommended for LLCs to preserve liability protection for members. In addition, since an LLC is a registered business entity, dissolving an LLC takes additional paperwork.

How To Become A Sole Proprietor

A sole proprietorship is the simplest entity type for new businesses, and its also a somewhat popular option for entrepreneurs in a number of different industries.

The sole proprietorship is an informal business type that does not require any sort of registration with your state government all you need to do to form one is to start working.

That said, while this business structure lacks official rules and regulations, there are still some general guidelines that you should adhere to when operating a sole proprietorship. As with any other business entity, there are pros and cons of the sole proprietorship. While its incredibly easy to form and maintain, the lack of personal asset protection is a huge drawback.

Lets discuss the various advantages and disadvantages of a sole proprietorship and discover how you can create your own sole proprietorship.

Read Also: How Do Solar Batteries Work

How Do I Write An Operating Agreement

To write an operating agreement, you need to address how your business will handle money, members, votes, management, and more. Not sure how to get started? At Northwest, were here to help your LLC get off on the right foot. When you hire us, we provide your business with a free LLC operating agreement, specific to your management style. Weve spent years developing these agreements and other free LLC formswhich have been used by over a million LLCs.

How To Register A Dba In Illinois

Filing an Illinois DBA, also known as an assumed business name, is a simple process that is completed at the county level or with the Illinois Secretary of State depending on your business structure.

A DBA won’t protect your personal assets. Forming an LLC is the best choice for most small businesses. Learn more in our DBA vs LLC guide.

Learn How to Get a DBA in Illinois yourself. Choose your business structure to get started:

Or, use a professional DBA service:

Don’t Miss: How Is Solar Energy Better For The Environment

Sole Proprietorship Laws In Illinois

Entrepreneurs in Illinois who decide to start new business ventures have several choices for business entity structure. The sole proprietorship model is attractive for people who do not anticipate bringing on business partners, as it is relatively easy, fast, and inexpensive to create. While a sole proprietor does not have to register their businesses like they would for a corporation or limited liability company , they must register their business’s name under the Illinois Assumed Business Name Act. Sole proprietors must also comply with additional licensing and permit requirements as applicable.

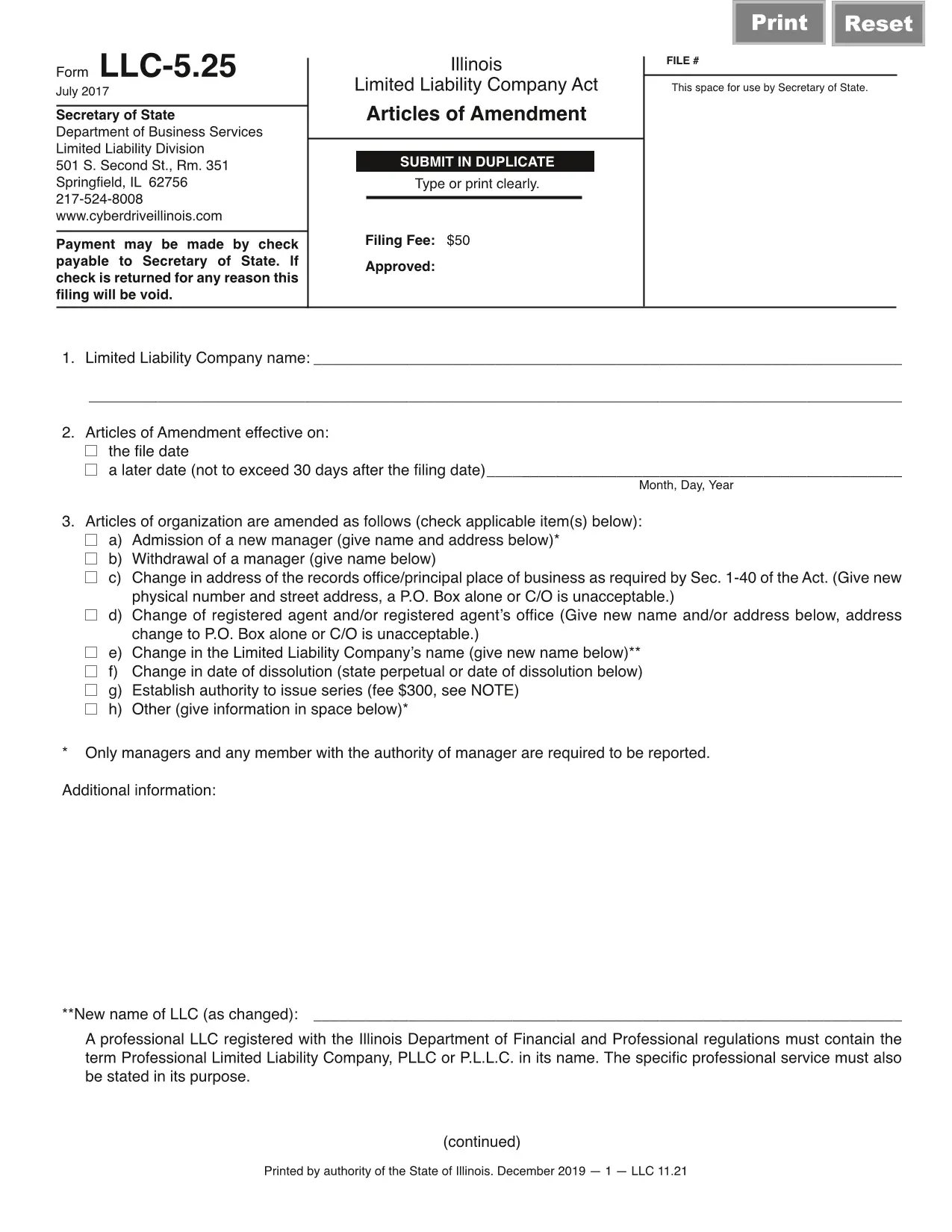

File Registration Paperwork With The State

States require business owners to submit LLC registration paperwork, usually called Articles of Organization, with their Secretary of State office.

Articles of Organization documents request information such as:

- Name and address of the LLC.

- The LLCs purpose. To allow for flexibility in business activities, entrepreneurs often answer this in general terms, such as The purpose of the Limited Liability Company is to engage in any lawful activity for which a Limited Liability Company may be organized in this state.

- Name and address of the LLCs registered agent. Sole proprietors do not need to appoint a registered agent, but LLCs and corporations do. A registered agent receives service of process and other important government and legal documents on behalf of the business.

- Whether the LLC will be member-managed or manager-managed. This identifies if the owners will be responsible for day-to-day management or if the LLC will have a designated manager to perform that function.

Most states have an online portal or section of their website where business owners may file their Articles of Organization electronically. While the document is relatively straightforward, realize that any errors on it may delay the entitys formation and create additional costs .

Recommended Reading: Does Pine Sol Keep Bugs Away

Name And Register Your Business

After you’ve spent some time picking a business structure, you deserve some fun. Of course, choosing a business name is one of the most enjoyable and creative parts of establishing a company, but there are a few factors to keep in mind.

It would help to head over to the Illinois Corporation Name Search to ensure your business name is unique. It’s one way to avoid confusing customers and start building your brand. And sole proprietorships and partnerships that are doing business as a trade name other than their business name must set up a “dba” with their local county clerk, according to the Assumed Name Act.

Once youâve locked in a name, you should also register with the IRS and get your federal Employer Identification Number, if applicable. When it comes time to submit your state and federal taxes, you’ll need this ID number. Also, every new business must register with the Illinois Department of Revenue and receive a state tax number. Depending on where your company is located, you might have to register with your city or local government, too.

City Of Champaign Business Services For New And Expanding Businesses

Home Based Businesses

Starting your business from your home can be a great way to grow with low overhead costs. However, there are a number of rules in place for home based businesses to ensure that they do not negatively impact the surrounding neighborhood.

Partner Agency Licensing

- State of Illinois 6.25%

- City of Champaign Home Rule 1.50%

- Champaign County 0.25%

- Champaign County 1.00%

Don’t Miss: Is My House Solar Compatible

Starting A Small Business

May 24, 2020 There is no government filing or approval required to operate your business as a sole proprietor. Millions of Americans do it this way. Just

When a business name is different from the owner full legal name, the Illinois Assumed Name Act requires sole proprietorships and general partnerships

Create An Llc Operating Agreement

Some states require LLCs to create an operating agreement and keep it at the businesss principal office location. Even when a state does not mandate one, an LLC Operating Agreementcan prove immensely beneficial especially for a multi-member LLC. It is an official contract that spells out the management and ownership of the LLC. It provides legal clarification of how the LLC should be run by documenting details like members ownership percentages, voting rights, distribution of profits and losses, and other important considerations. An operating agreement helps to keep everyone on the same page and prevents misunderstandings.

Read Also: How To Register A Business Name For Sole Proprietorship

Set Up A Business Bank Account

LLC owners must maintain a clear separation between their business and personal finances. Doing so shields their personal assets from the businesss liabilities. Also, it helps keep business records organized for tax reporting purposes.

After a state approves an LLCs Articles of Organization and the IRS issues the LLC an EIN, the business owner must set up a business account for the newly formed LLC. An LLC may not use an existing business bank account that was set up for a sole proprietorship.* This also applies to credit cards so that the correct legal entity name is associated with accounts.

Banks help entrepreneurs through the process of closing their sole proprietorships bank account, opening an LLC bank account, and moving existing business funds from the old account to the new one.

*Sometimes, sole proprietors dont even open a separate bank account for their businesses and use their personal bank and credit accounts instead. While thats legal, its not advisable! If the IRS were to audit the business owner, it might be difficult to produce accurate financial transaction documentation.

Promote And Market Your Business

Promoting Your Illinois Business

There are many different methods to promote your business in Illinois, but the most effective methods are:

Press Releases

Press releases are a great way to promote your brand and are one of the most cost-effective strategies as they:

- Provides publicity

- Establish your brand on the web

- Improve your website’s SEO, driving more customers to your website

- Are a one-time cost in terms of effort and money

- Have long-lasting benefits

Recommended:TRUiC has negotiated a 25% discount for you on a service that will write and distribute press releases for you.

A Facebook page is a great, free way to interact with your customers. But, it does require ongoing effort to be successful.

A Facebook page can be used to:

- Establish your local business presence

- Showcase your business products and services

- Communicate with your customers

Read Also: How Much To Add Solar Panels To Your House

Business Licensing In Chicago

These information pages can help you get started in learning about some of the laws and registration requirements that may apply to your Experiences on Airbnb. These pages include summaries of some of the rules that may apply to different sorts of activities, and contain links to government resources that you may find helpful.

Please understand that these information pages are not comprehensive, and are not legal advice. If you are unsure about how local laws or this information may apply to you or your Experience, we encourage you to check with official sources or seek legal advice.

Please note that we dont update this information in real time, so you should confirm that the laws or procedures have not changed recently.*

Llc Vs Sole Proprietorship: Operations And Management

A sole proprietorship has a simple operational and management structure because theres just one person at the top. That owner can make any business decisions as they see fit, without input from any third party. Of course, most sole proprietors decide to hire employees, legal experts, accounting experts, and other individuals to help with the day-to-day management of the business. But a sole proprietor only has to ensure their business is operating safely and legally and that theres enough profit to cover business debts.

An LLCs operational and management structure is more complex and is typically outlined in an LLC operating agreement. Though only a handful of states require an operating agreement, most LLCs have one, particularly those with multiple members. The operating agreement outlines each members ownership stake in the business, voting rights, and profit share. An LLC can be collectively managed by the members or managed by an appointed manager.

Usually, LLC members decide on company matters in proportion to their ownership stakecalled membership unitsin the business. For example, a 33% owner would have a one-third vote on company matters, and a 25% owner would have a one-quarter vote. Profits generally are divided in line with ownership percentages. In the previous example, the 33% owner would receive one-third of the business profits, and the 25% owner would be entitled to one-quarter of the business profits.

Recommended Reading: Should I Go Solar In Arizona

Illinois Small Business Information

When starting an Illinois small business, there are many great resources that will help the process run a little smoother. One of the best resources for starting and managing a small business in Illinois is the IDOC or Illinois Department of Commerce and Economic Opportunitys website which includes valuable links to business guides and other pertinent publications related to purchasing, marketing, and financing a business.

In addition, the SBDC or Illinois Small Business Development Center is a fraction of a national network center that works closely with the IDOC. The development center provides personal assistance when it comes to management assistance and business advice such as business planning, marketing, and financial guidance. You can find a link to the SBDC on the IDOC websites homepage.

Another key resource is the Small Business Administration or SBAs website. On their website, youll find upcoming events, timely news, and business resource guides that are directly related to the business process in the state of Illinois. There is a guide for small businesses that is specific to the Illinois area that can be downloaded directly from their website. The SBAs district office is located in Chicago.

Is There Anything Else I Should Be Thinking About

Yes. You should consider the following:

Activities and Licenses

Depending on the activities involved in your Experience, you may need to file a registration, obtain a permit, or follow specific rules that apply to that activity. Information on some activities that may require specific permits can be found here and here.

In addition, our sections on some common activity-specific topics – like guiding tours, Food, and alcohol – provide additional information, but are not exhaustive. You should always check with the city or speak to a lawyer to determine which permits and licenses may be required for the Experience you are offering.

Employees

If you plan to hire employees as part of your business, you may also be required to obtain an employer identification number from the IRS and register with the Illinois Department of Revenue. Sole proprietors without employees may use their Social Security Number instead of an EIN.

Tax and accounting

Also Check: Is Financing Solar Panels Worth It

Does An Illinois Llc Need A Business License

While Illinois doesnt have a state-level business license, some cities and counties require business licenses. For example, Chicago only requires licenses for specific business activities, such as manufacturing or child care. Elgin, on the other hand, requires a general business license in addition to any business-specific licenses.

Need an EIN or a certified copy of your formation docs for your license applications? Northwest can help. You can easily add on these items to your LLC formation order.