Can A Sole Proprietor Have A Dba

A sole proprietorship or partnership is not a separate legal entity from its owners, which means they need to file a DBA unless they intend to use their own name for business. Likewise, corporations and LLCs can also use DBAs, however tures like corporations or LLCs can also file DBAs, but it is not as common.

Why Do Most Sole Proprietors Start A Business

As the most common and simplest type of business, sole proprietorships are the most common. Ownership and operation of the business are in the hands of an individual proprietor. One can even pass a business on to heirs as a sole proprietor. It is not necessary for this type of business to pay business taxes.

Advantages Of Registering A Sole Proprietorship

Registering a Sole Proprietorship is the most common form of business operation beginnings in Ontario. The Sole Proprietorship far exceeds the number of General Partnerships under the Business Act or Incorporations in Ontario.

The advantages are as follows:

- Inexpensive to register

- Easy to change or cancel

Also Check: How To Start A Sole Proprietorship In South Carolina

Benefits Of Sole Proprietorship

Sole proprietorship is an unincorporated business that is owned by an individual. You can also choose to organize your business as a limited liability company , corporation or partnership. If you choose to establish a sole proprietorship in Texas, you do not need to file legal documents with the Texas state government when forming a sole proprietorship. You can just begin operating.

Dont Miss: How To Remove Solar Panels

Reach Out To Professionals For Guidance

Every business owners situation has unique qualities that can impact what they need to do to cover all the bases when closing a sole proprietorship or partnership. To make sure no necessary tasks get overlooked, consult the expertise of a trusted business attorney and accounting professional.

This is especially important for partnerships. The businesss partnership agreement should spell out how to go about closing the business. And it should explain how assets and liabilities should be divided among the partners. Unfortunately, things can become complicated if the partnership agreement is not clear or the partners disagree with how to interpret the agreements provisions. Also, states have rules regarding some aspects of winding up a partnership. So, a lawyers assistance can help ensure a smoother process and avoid drama.

Read Also: How To Start A Sole Proprietorship In South Carolina

Recommended Reading: How Much Power Does A 9kw Solar System Produce

What Is An Llc

LLC stands for limited liability company.

These are legal entities formed at the state level. When you start an LLC, youll have to decide where you want to register it. For most of you, that answer is simpleyour home state will almost always be the best option.

LLCs are popular because they combine some of the positive aspects of corporations and partnerships while eliminating some drawbacks of each. Like a corporation, LLC owners and shareholders benefit from limited liability protection . LLCs also provide pass-through taxation, like a partnership.

If Selecting A Corporation Or Llc Structure Get Registered

If the business structure youve chosen is a corporation, limited liability company, or limited partnership, you will need to create the entity or have your attorney do it for you.

- You may have heard that registering your business entity in a state other than Washington is the way to go. Do your homework before acting on that advice! If youre operating your business in Washington, youll need to be registered in Washington. If you do the initial registration in another state, youll need to register in Washington as a foreign entity. You wont save anything in state registration, licensing, and tax costs for your Washington operation, but youll have the added costs of the other state.

- Determine who will be your registered agent, the Washington-based person who will receive your official service of process and business entity notifications. It can be you, your attorney, or an outside party.

- Create Articles of Incorporation or Certificate of Formation , and file them with the Secretary of States office. Filing with the Secretary of State can be done at .

- Create the governance document for your entity: Bylaws Operating Agreement or Partnership Agreement .

Recommended Reading: What Are The Best Solar Panels For Home Use

Capital Requirements Of A Sole Proprietorship

The ability to raise capital for a business is limited by the nature of the business organization. The immediate and long-term financial needs of a business are very important factors in selecting a business organization. Sole proprietorships are the most limiting form of business organization in terms of raising capital. The principal source of capital is the proprietor’s personal wealth or personal credit-worthiness for borrowing purposes.

What Is An Illinois Sole Proprietor

As opposed to a corporation or limited liability company , the sole proprietorship is not a legal business entity. The sole proprietorship is a one-person business that is not considered to be a distinct entity from the person who owns it, and it is frequently operated using the owners personal name.

Recommended Reading: Should I Go Solar In Arizona

Tax Clearance And Certificate Of Account Status From The Texas Comptroller Of Public Accounts

After you have finished all of the winding up tasks required to close the LLC, then you will need to request a Certificate of Account Status from the Texas Comptroller of Public Accounts. The Certificate essentially indicates that the LLC has paid its taxes and that it can be dissolved.

To obtain a Certificate of Account Status, you will need to file Form 05-039. The Form can be submitted online or as a physical copy at a Comptroller Field Office .

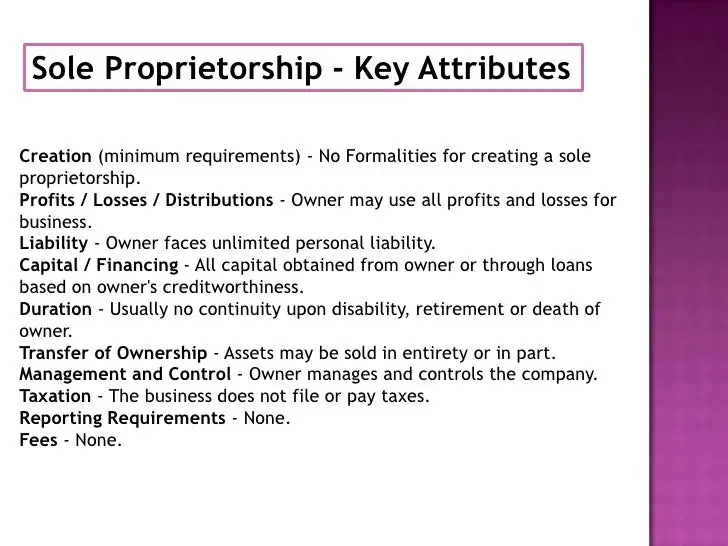

Key Benefits Of A Sole Proprietorship

Sole proprietorships do not face the same ongoing formalities and requirements that corporations or LLCs face. There are no annual reports to file with and fees to pay to the state, no required annual meetings, etc. However, depending on the type of business, as a sole proprietor, you will still need business licenses and permits.Understanding Business Licenses

Also Check: How To Hook Up Multiple Solar Panels

Do Sole Proprietors File Self Employment Tax

Owners of sole proprietorships are not employees they pay self-employment taxes instead. Social Security and Medicare, as well as a 15% self-employment tax, are funded by this tax. You must contribute 3% of the net self-employment income you earn. On top of that, your earnings will be subject to income taxes.

Do I Need To Register A Sole Proprietorship In Ontario

Sole Proprietorships are the most common business structure set up. A Sole Proprietorship allows one individual owner to operate a business in Ontario and inexpensively provides a simple start to your business. If you are using your legal person name to operate your business, it is not mandatory to register a business however, if your company has a business name, registering the Sole Proprietorship is compulsory in the Province of Ontario. Often when an individual uses his or her own personal name for the business, it can limit the accessibility to discounted rates from suppliers and requires much more explanation to third parties, including potential customers, what you do.

Read Also: How Much Electricity Generated By Solar Panel

Advantages Of Sole Proprietorships

Typical advantages of a sole proprietorship include:

- Ease of creation. Owners can establish a sole proprietorship instantly, easily and inexpensively.

- No state paperwork. There is no state filing required to create a sole proprietorship.

- No separate tax filing. There is no separate business income tax filing. Business income or loss is reported on the sole proprietors personal tax return, and any tax is paid at the individual level.

- Few ongoing formalities. Sole proprietorships face few, if any, ongoing requirements or formalities, such as state annual report or ownership meeting requirements as with C corporations, S corporations and LLCs.

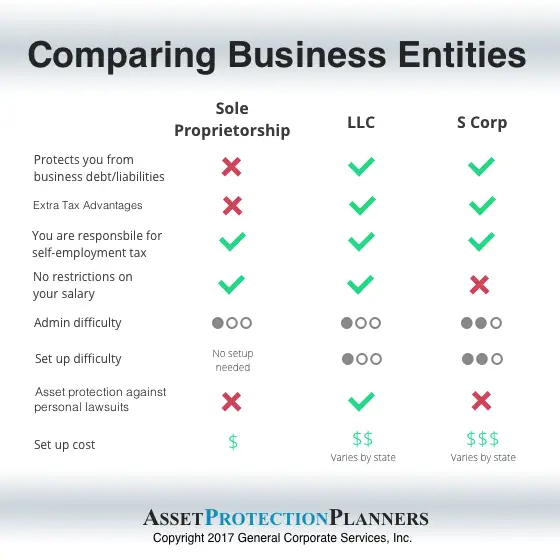

Differences Between Llcs And Sole Proprietorships

Now its time to compare the differences between LLCs and sole proprietorships. There are more differences between these business structures than similarities. Rather than just listing bullet points, well take a closer look at various categories you should evaluate. This will make it much easier for you to decide which one is right for your business.

You May Like: How Much To Add Solar Panels To Your House

What Is A Corporation

A corporation is a new legal entity. When you incorporate, your business becomes a legal entity with the same rights and obligations as a natural person under Canadian law. As the business owner, this means that you no longer have the same legal and financial liability for your business, as that liability is transferred to the new entity that has been created. The new entity, or corporation, can acquire assets, obtain loans, enter into contracts, or be sued.

It Consultant Or Computer/it Specialist

Have you ever run into IT problems? So do countless businesses. As an IT consultant running your own business, you would offer IT troubleshooting services to other companies, resolving issues with both the companys hardware and software solutions. Be open to traveling for this type of sole proprietor business.

You May Like: Do Solar Panels Work In Michigan

How To Start A Sole Proprietorship Business

A sole proprietorship is a common business structure many individuals choose to use when establishing their own company. Sole proprietorships generally cost less to form and require less paperwork than other types of business structures .

There are still some basic steps youll need to follow when forming your sole proprietorship, though.

In this brief guide, well outline everything you need to know about how to start a sole proprietorship business, from the registration process to the pros and cons of this structure.

Set Up Your Operations

- With your federal ID number, state UBI number, your governance document if youre a corporation or LLC , and some cash, you can set up a bank account. When selecting a bank that best meets your needs, consider:

- Access to credit .

- Business products and services and their costs.

- Convenience .

- Staff relationships.

Recommended Reading: How To Start A Solar Panel Installation Company

Do I Have To Pay Franchise Tax In California

A minimum franchise tax of $800 is generally imposed by California law on every corporation incorporated in, licensed to do business, or carrying on business in the state. In its first taxable year, corporations incorporated or entitled to do business in California are not required to pay the minimum franchise tax.

How Do I Register A Sole Proprietorship In Washington State

Recommended Reading: What Is The Average Cost Of A Home Solar System

General Liability Insurance For Your Small Business

Whether youre a sole proprietor or the owner of an LLC, general liability insurance is crucial. General liability insurance covers company assets and is often required to sign contracts. If you are a sole proprietor, liability policies can also help shield your personal assets if you are held liable for an injury or property damage.

General liability insurance can cover the legal fees associated with a lawsuit and provide general protection for property damage and injury of non-employees, product liability, and even advertising injury protection in the event of a lawsuit for slander, libel, or accidental copyright infringement.

What Does Registering As A Sole Proprietor Mean

One of the most affordable and common ways to start a business is through a sole proprietorship. There is no distinction between the business and the owner of this unincorporated business, owned and operated by one person. The profits of your business are yours, and all the debts, losses, and liabilities of the business belong to you.

Don’t Miss: What Will A 25 Watt Solar Panel Run

Start A Sole Proprietorship Or Partnership

To conduct business as a sole proprietorship or partnership, you need to reserve a business name and register the business.

If you’re going to do business under your name, you do not need to request a business name or register the business with the province.

OPTIONAL: If you’re not sure which business structure you should choose,consider the different business structure options available. You may also want to:

- Explore resources from the Small Business Branch or Small Business BC

- Get advice from a chartered accountant or lawyer before setting up your business

Request and reserve a business name online

Businesses must have their name approved and confirm that it doesn’t conflict with a name already being used by a corporation. Only incorporated companies, cooperatives or societies can guarantee exclusive use of their name. Find out how to choose the right name.

If you’re unable to submit a request online, complete the Name Request form and mail it or drop it off at a Service BC locationwith payment. Make cheque or money order payable to the Minister of Finance.

It takes about 7 to 14 days to process a name request.Once it’s complete, you’ll receive a confirmation email and a name request number you can use to register your business. Be sure to complete the registration before the name request expires . If not, you’ll need to submit another name request. Request priority service if you need to have a name approved in 1 to 2 business days.

Is There An Annual Fee For Sole Proprietorship

Keeping up with the states regulations for sole proprietorships is not difficult. It is not necessary to file anything other than your personal tax return. Contrary to LLCs, S-corporations, and C-corporations, which are generally required to file annual reports after they are formed, LLCs do not have to file annual reports.

You May Like: How To Build A Solar Cell At Home

Can A Sole Proprietor Pay Himself A Salary

When paying myself wages, can I lf wages and withhold taxes? A sole proprietor is considered to be independent contractor and not an employee of the business. It is illegal for sole proprietorships to pay themselves wages, withhold income tax, social security tax, and Medicare tax, and give them a Form W-2.

How Much Does A Pa Business License Cost

You’ll almost certainly have to pay application and licensing fees to start a business in Pennsylvania. A Certificate of Organization for a Pennsylvania LLC, for example, costs around $125. If your company is organized as a corporation, sole proprietorship, or partnership, you may have to pay additional fees.

Recommended Reading: Does Solar Work In Winter

Launching Your Business In Kirkland

Moving from business idea to a real launch is more than a leap of faith. The first time is always the toughest because you are in unfamiliar territory and rookie entrepreneurs will make a lot of mistakes that prove to be very expensive later on. That is why listening and learning from others is so important. A member of the Innovation Triangle and Startup 425, Kirkland prides itself on being a center of innovation. The Innovation Triangle is a partnership of Bellevue-Redmond-Kirkland that is focused on inviting technology and innovation-intensive businesses to experiment, develop and prosper in our Eastside communities. Startup 425 is an initiative of five communities on Seattles Eastside , in partnership with the Port of Seattle. Our mission is to provide the tools that experienced workers, students, and entrepreneurs need to go from idea to working business in a successful, sustainable manner. Learn more

-

Business License Requirements

- Business License: Business licenses are authorizations issued by local and state government agencies that allow individuals or companies to conduct business within the government’s geographical jurisdiction.

Pros And Cons Of A Sole Proprietorship

So, why would someone form a sole proprietorship vs. an LLC? The IRS reported in 2016 that over 25.5 million businesses paid taxes as sole proprietors. This business structure is popular for a reason.

There are many benefits of a sole proprietorship, including:

- Easy to form As we detailed above, creating a sole proprietorship is fairly simple and low-cost. Except for any fees you need to pay for your county or state business license plus the DBA application fee, creating a sole proprietorship is practically free. And, even more importantly, the paperwork is minimal.

- Complete control As a sole proprietor, you are the boss in every regard. You are the sole owner, so you can make the rules, collect the paycheck, and decide what direction you want your small business to go.

- Simple tax process Because you and your business are one and the same under a sole proprietorship, youll only need to file two forms: your individual tax return and a Schedule C form. Since your business income is included in your personal income on your tax return, your tax rate may be lower than the standard corporate tax rate of 21%. However, there is a self employment tax that sole proprietors must pay.

A sole proprietorship is a popular and widely used business structure, but that doesnt mean its perfect. Drawbacks to forming a sole proprietorship include:

You May Like: How Much Power Does A 300 Watt Solar Panel Produce