What Pb Roofing Can Do For Your Commercial Building

As a property or building manager, you must know who performs what during a solar system installation. At PB Roofing, we can perform a ThreatCheck inspection for your commercial building and provide preventative maintenance after the solar panels are installed. We also work alongside solar consulting firms and installation companies, so you dont have to worry about finding a reputable installer. We can also help you navigate the ITC and answer any questions you may have.

What Is A Tax Credit

A tax credit is a dollar-for-dollar reduction in the amount of income tax you would otherwise owe. For example, claiming a $1,000 federal tax credit reduces your federal income taxes due by $1,000. The federal tax credit is sometimes referred to as an Investment Tax Credit, or ITC, though is different from the ITC offered to businesses that own solar systems.

How The Federal Solar Tax Credit Can Benefit Your Business

Since 2008, the U.S. Energy Policy has provided a percentage in tax credits as an incentive for solar panel installation. As of January 1, 2021, all businesses that install solar panels by the end of 2022 will receive a tax credit equal to 26% of the cost of your solar installation. This tax credit is applied to the companys federal income taxes and can significantly reduce or eliminate what is owed back to the government.

Read Also: Where To Install Ring Solar Panel

The First Step To Install Solar Panels

What many property and building owners do not know is that there are steps that need to be taken before solar panels can be installed on a commercial roof. First, the roof must be solar ready. This means your commercial roofing company needs to perform a ThreatCheck inspection of the roof to determine if any repairs or replacements need to be performed before solar panels can be installed. Without this crucial first step, you may not get a full life cycle out of your solar panel investment.

Can You Claim The Solar Tax Credit On An Investment Property That You Own And Rent Out

Yes, you can claim the tax credit on an investment property that you own and rent.

However, it cant technically be claimed under the residential solar tax credit. There are actually two federal solar tax credits: one for homeowners and one for business owners, and in this case, your property would qualify under the business tax credit.

They have slight differences in their step-down schedules and are under different tax code sections, but currently, they are both worth 26% of the cost.

Also Check: How To Write A Solid Cover Letter

How Do I Use The Tax Credit To Pay Down My Loan

Mosaics solar loan programs are built to be flexible, simple and affordable and, in the case of CHOICE loans, the monthly payments are specifically structured with the federal tax credit in mind. However, whether you opt for a CHOICE or a PLUS loan, you have the option of reducing your monthly loan payments by using your federal tax credit or your own savings. Heres how it works:

CHOICE: Mosaics CHOICE loan product is structured with the federal tax credit in mind, with lower monthly payments you can lock in by applying the full amount of your credit. Heres how it works:

- If you make the voluntary CHOICE prepayment before the end of month 18, it can reduce your monthly payment beginning in month 19

- The earlier the CHOICE payment is applied, the lower future payments will be

- If you pay down your loan by less than the specified CHOICE target loan balance, your monthly payment goes up

Its your CHOICE!

PLUS: Mosaics PLUS loan product which can be used to finance other home improvements, in addition to solar and batteries has monthly payments that do not assume the use of the federal tax credit. However, if you opt to use either the tax credit or personal savings to make voluntary prepayments to reduce your loan principal in the first 18 months, your monthly payments will be reduced for the remainder of the loan term just like CHOICE. However, unlike CHOICE, if you choose to not make any extra pre-payments, your monthly payments will not increase.

Logo

How Do I Claim The Solar Panel Tax Credit

To claim the solar investment tax credit in 2021, you will need to complete form 5695 when you lodge your tax return. On part 1 of the form, you will calculate how much you are eligible for, and then you enter that amount on your form 1040.

We have a step-by-step guide on how to claim the solar tax credit by one of our solar experts here at SolarReviews.com. If you need help claiming the tax credit use this article to help you through the process.

Recommended Reading: How To Switch From Sole Proprietor To Corporation

Am I Eligible For The Federal Solar Tax Credit

Any taxpayer who pays for a solar panel installation can claim the solar tax credit, as long as they have tax liability in the year of installation. You must be the owner of the solar panel system in order to qualify for the tax credit, meaning if you lease your system you are not eligible.

When leasing a system, the solar company will get the tax credit instead of you. We recommend you buy your system outright if you can afford to. The money you save in the long run is more. Leasing also makes it harder to sell your home, as buyers don’t want to take over a 25-year lease.

Frequent Form 5695 Questions And Considerations

Q: I got a rebate from my utility company for my solar panels. Do I calculate the 26% tax credit before or after the reduction from the rebate?

A: We get this question all the time, and heres the best answer: You calculate the 26% federal tax credit based on the cost to you AFTER any rebates.

For example, if your system cost $20,000 and you received a $5,000 rebate from the utility, your federal tax credit would be 26% of $15,000, which is $3,900. Heres the tricky part: if your state ALSO gives you a tax credit, you dont need to worry about that amount to calculate your federal credit.

Both state and federal tax credits are calculated based on the amount you paid, minus rebates or grants.

Q: If I installed a solar panel system a few years ago and now I want to add new panels, can I claim the credit?

A: Yes! You can claim the credit for any new costs associated with the addition. You cant go back and claim the credit for the previously-installed equipment. Hopefully you already claimed the credit for those costs back then.

Q: If I install solar and claim the tax credit, will I have to repay the credit to the government if I sell my house within a certain number of years?

A: No! If you install a solar panel system on a home you own, you can claim the whole credit and sell at any point after.

Q: Can I get a tax credit if I install solar panels on rental property I own?

Find out how much installing solar panels will save you annually

You May Like: How To Heal Solar Plexus Chakra

Don’t Miss Out On These Great Benefits

Are you ready to save on your taxes and reduce your energy costs? Were here to help! Contact us to request your free quote. Dont miss out on receiving the full 26% tax credit.

You can also download our ebook that answers the most common questions people ask when investing in solar.

Originally published December 7, 2016, updated January 5, 2021.

What Does The Credit Cover

Homeowners who install and begin using a solar PV system can claim a federal solar tax credit that currently covers 26% of the following costs:

- Labor costs for solar panel installation, including fees related to permitting and inspections

- All additional solar equipment, such as inverters, wiring and mounting hardware

- Energy storage devices that are powered exclusively through the solar panels, including solar batteries

- Sales taxes paid for eligible solar installation expenses

Read Also: What’s The Best Way To Clean Solar Panels

When Does The Federal Solar Tax Credit Expire

The federal solar tax credit is set to expire at the end of 2023. There is hope that the tax credit may be extended once again. The Biden Administration has plans to include a 10-year extension of the tax credit in future legislation. But, theres no guarantee that this will be approved by Congress and it may be at a lower rate.

Because of that, our best advice is to try and add solar panels as soon as possible so youre guaranteed to get the 26% credit.

The best time to go solar is now because the 26% ITC will decrease to 22% in 2023 before becoming unavailable for residential solar systems installed in 2024 and beyond.

How Much Can You Save With The Solar Tax Credit

The amount you save with the solar tax credit depends on two things: the cost of your solar installation and the year in which its installed.

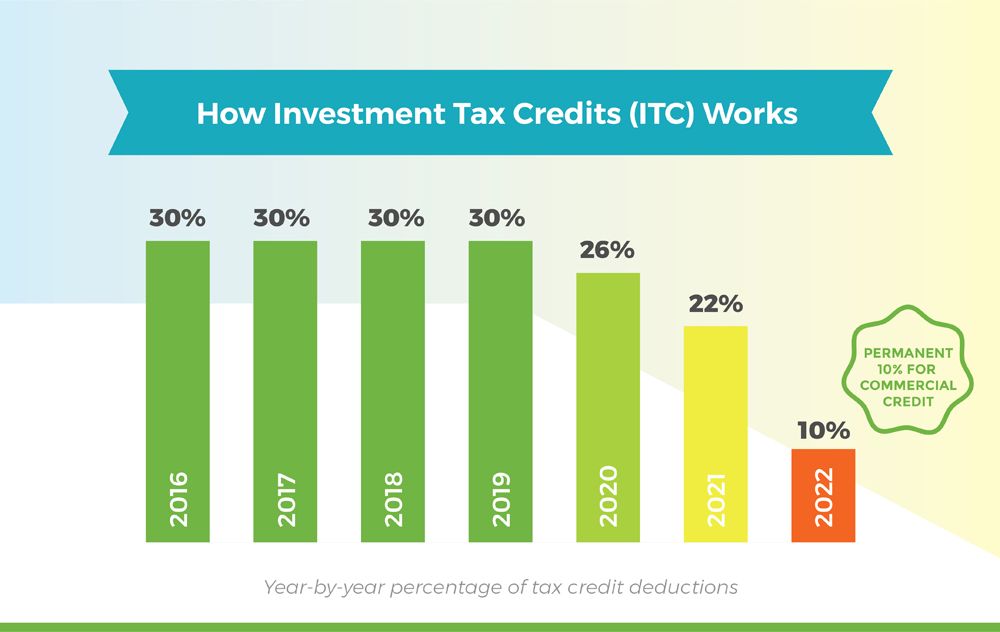

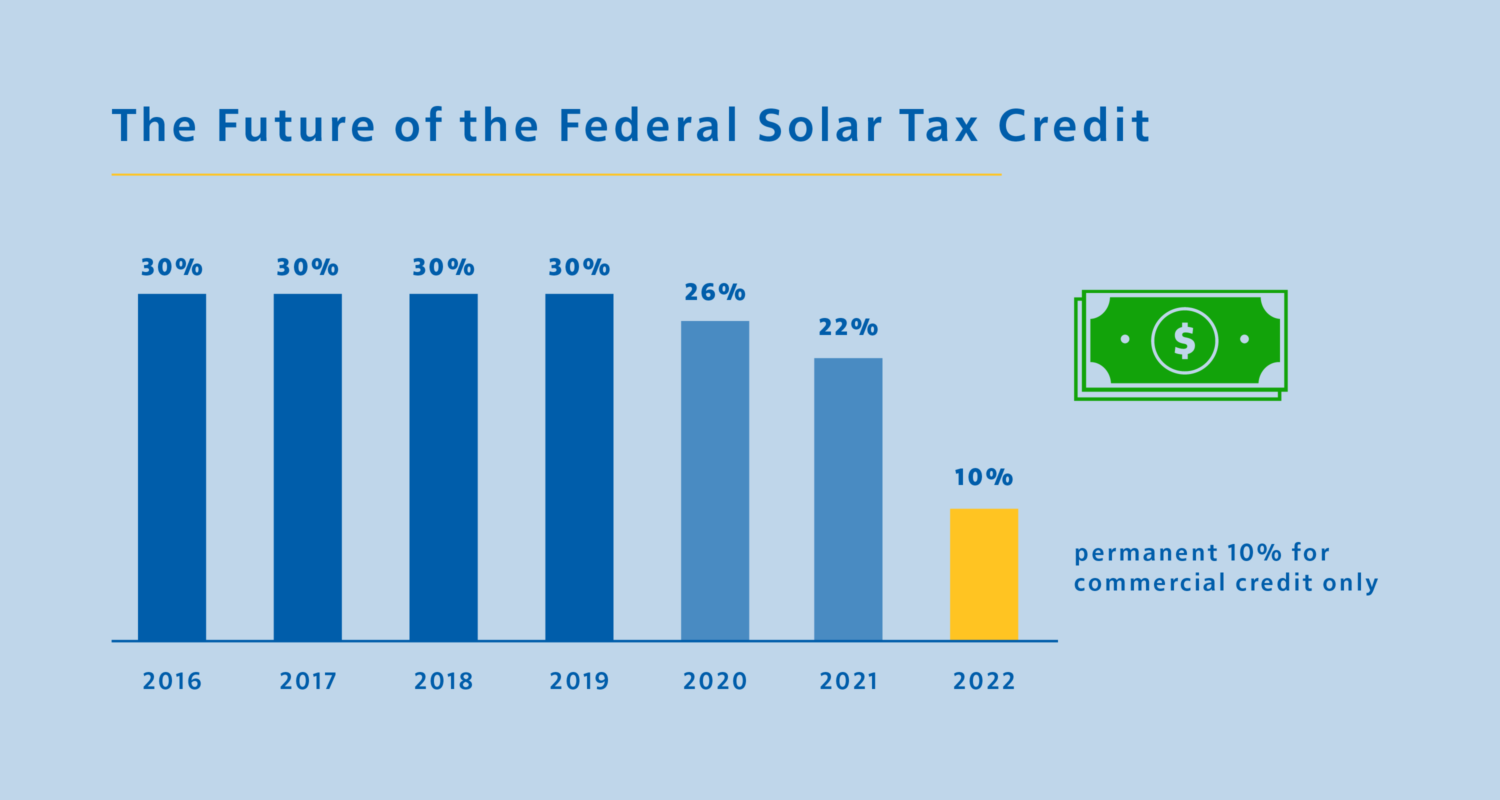

Lets take a look at the ITC schedule as it currently stands, following the 2020 federal solar tax credit extension:

2021-2022: Homeowners and businesses are eligible for a tax credit worth 26% of their total solar installation costs.

2023: Homeowners and businesses are eligible for a tax credit worth 22% of their total solar installation costs.

2024: The ITC is no longer applicable to homeowners. Businesses are eligible for a 10% credit indefinitely.

To see how much you can save, lets look at an example. Say you were to spend $30,000 on your solar installation if the system were installed by the end of 2022, you would be eligible for a tax credit worth 26% of $30,000, which is equal to $7,800.

If you were to wait until 2023 to install your solar panels, that percentage would drop to 22%, and your tax credit for the same project would be $6,600still substantial, but a significant drop.

If you were to wait until 2024 to install residential solar, you would not be eligible for any ITC savings at all.

Recommended Reading: How Many Solar Panels For A House

The Federal Solar Tax Credit: What You Need To Know

Could investing in solar energy pay off sooner than you think? The short answer is, yes. Many residential home solar power systems are eligible for a federal investment tax credit, or ITC.

At the time of this writing, you can get up to 26% of your installation costs back by claiming the tax credit when you file with the IRS. The ITC benefits both residential and commercial customers, and there is no cap on its value.

Wondering how the solar tax credit works in 2021? Well cover everything you need to know in this post.

Lets dive in.

Making Sense Of State And Local Rebates

After the federal tax credit, the other incentives available to the solar homeowner are at the state and local level. This is where it gets pretty complicated, because there are many different types of incentives that are implemented across the country, and they can come from state governments, local governments, individual utility companies, and non-governmental organizations.

Figuring out all of this on your own can be pretty tricky, so Iâve distilled the available rebates across the United States into the table below so that you can see at a quick glance whether you live in a state where you are likely to get a nice financial reward for going solar. Due to the immense number of programs spread across all the states, municipalities, utility companies, and other governmental organizations, listing the actual programs in this article isnât feasible.

Fortunately, all you need to do is use the solar pricing calculator to find out the details of the rebate programs in your area. It will take into account any of the incentives for your local area and include them in the calculated price and payback period.

Before we review the table, hereâs some definitions for each of the rebate categories:

Renewable energy credits are definitely the most complicated way to implement a solar incentive, and prices for SRECs fluctate on a day-to-day basic, so I recommended visiting the SRECTrade website for up-to-date information.

Don’t Miss: How Do Solar Panels Affect The Value Of My Home

What Is The Solar Panel Federal Tax Credit

First, lets take a short walk down memory lane. The Solar Investment Tax Credit was first offered via the Energy Policy Act of 2005. Thanks to its popularity and its contribution toward renewable energy goals, the ITC has been extended multiple times. While it was originally set to expire in 2007, the current federal solar tax credit extension is set to expire in 2024. Homeowners can use the federal tax credit for battery storage, installing new systems, and more.

Alright, now how does the solar tax credit work? If you want a basic overview of solar incentives without wading through the tax jargon, youre in the right place.

The bottom line is this: When you install a solar power system between 2020 and 2022, the federal government rewards you with a 26% tax credit for investing in solar energy. In short, 26% of your total project costs can be claimed as a credit on your federal tax return for that year.

A quick but necessary disclaimer: were solar experts, not tax accountants! We do our best to give accurate advice, but please check with a professional to be sure youre eligible to claim the credit.

A tax credit is a dollar-for-dollar reduction of the income tax you owe. $1 credit = $1 less you pay in taxes. Its that simple. If you spend $10,000 on your system, you owe $2,600 less in taxes the following year.

How Do Other Incentives I Receive Affect The Federal Tax Credit

For current information on incentives, including incentive-specific contact information, visit the Database of State Incentives for Renewables and Efficiency website.

Rebate from My Electric Utility to Install Solar

Under most circumstances, subsidies provided by your utility to you to install a solar PV system are excluded from income taxes through an exemption in federal law. When this is the case, the utility rebate for installing solar is subtracted from your system costs before you calculate your tax credit. For example, if your solar PV system was installed before December 31, 2022, cost $18,000, and your utility gave you a one-time rebate of $1,000 for installing the system, your tax credit would be calculated as follows:

0.26 * = $4,420

Payment for Renewable Energy Certificates

When your utility, or other buyer, gives you cash or an incentive in exchange for renewable energy certificates or other environmental attributes of the electricity generated , the payment likely will be considered taxable income. If that is the case, the payment will increase your gross income, but it will not reduce the federal solar tax credit.

Rebate from My State Government

0.26 * $18,000 = $4,680

State Tax Credit

For example, the net percentage reduction for a homeowner in New York who claims both the 25% state tax credit and the 26% federal tax credit for an $18,000 system is calculated as follows, assuming a federal income tax rate of 22%:

0.26 + * = 45.5%

+ = $4,680 + $3,510 = $8,190

Don’t Miss: How Do I Make My Own Solar Panels

What Is The Solar Investment Tax Credit

The Solar Investment Tax Credit gives solar system owners the opportunity to deduct 26% of their systems cost from their federal income taxes.

In order to incentivize people to make the shift towards solar energy, the federal government in past years gave 30% tax credit to help recoup installation costs quickly. However, the percentage has decreased to 26% in 2020 and will step further down to 22% in 2021.

Frequently Asked Questions About The Solar Tax Credit

Calculating the cost of going solar can be complicated as it is, let alone incorporating other financial incentives and tax credits into your estimate. Check out a few other commonly asked questions related to the ITC for more clarification:

How much is the federal solar tax credit for in 2021?

In 2021, the federal solar tax credit will deduct 26 percent of the cost of a system for eligible residential and commercial tax payers. After 2022, new residential and commercial solar customers can deduct 22 percent of the cost of the system from their taxes.

Is the solar tax credit a one-time credit?

Right now, the ITC is a one-time credit. But, you may carry over the excess credit to the next year if you cant use it all when you file. For example, if you only owed $6,000 in taxes but received the $6,200 solar tax credit, youd pay $0 in taxes for the year when you placed the claim. Then, youd also get to reduce next years taxes by the remaining $200.

Will the solar tax credit increase my tax refund?

The solar tax credit will not increase your tax refund. Rather, The ITC amount is applied against your tax liability, or the money you owe the IRS.

Recommended Reading: How Much Does Solar Cost In Arizona

Are You Eligible To Claim The Federal Solar Tax Credit

In order to claim the federal solar tax credit and get money back on your solar investment, you have to meet the following criteria when filing your 2021 taxes:

- Your solar PV system must have been installed and began operating at some point between January 1, 2006, and December 31 of this year.

- Your system must be installed at either your primary or secondary residence.

- You must own the solar PV system, whether you paid upfront or are financing the cost.

- The solar system must either be brand new or have been used for the first time. You only get to claim this credit once, for the “original installation” of your solar PV equipment.