Drawbacks To The Solo 401

The solo 401 has the same drawbacks of typical 401 plans, plus a couple others that are specific to itself. Like other 401 plans, the solo 401 will hit you with taxes and penalties if you withdraw the money before retirement age, currently set at 59½. Yes, you can take out a loan or may be able to access a hardship withdrawal, if needed, but those are last resorts.

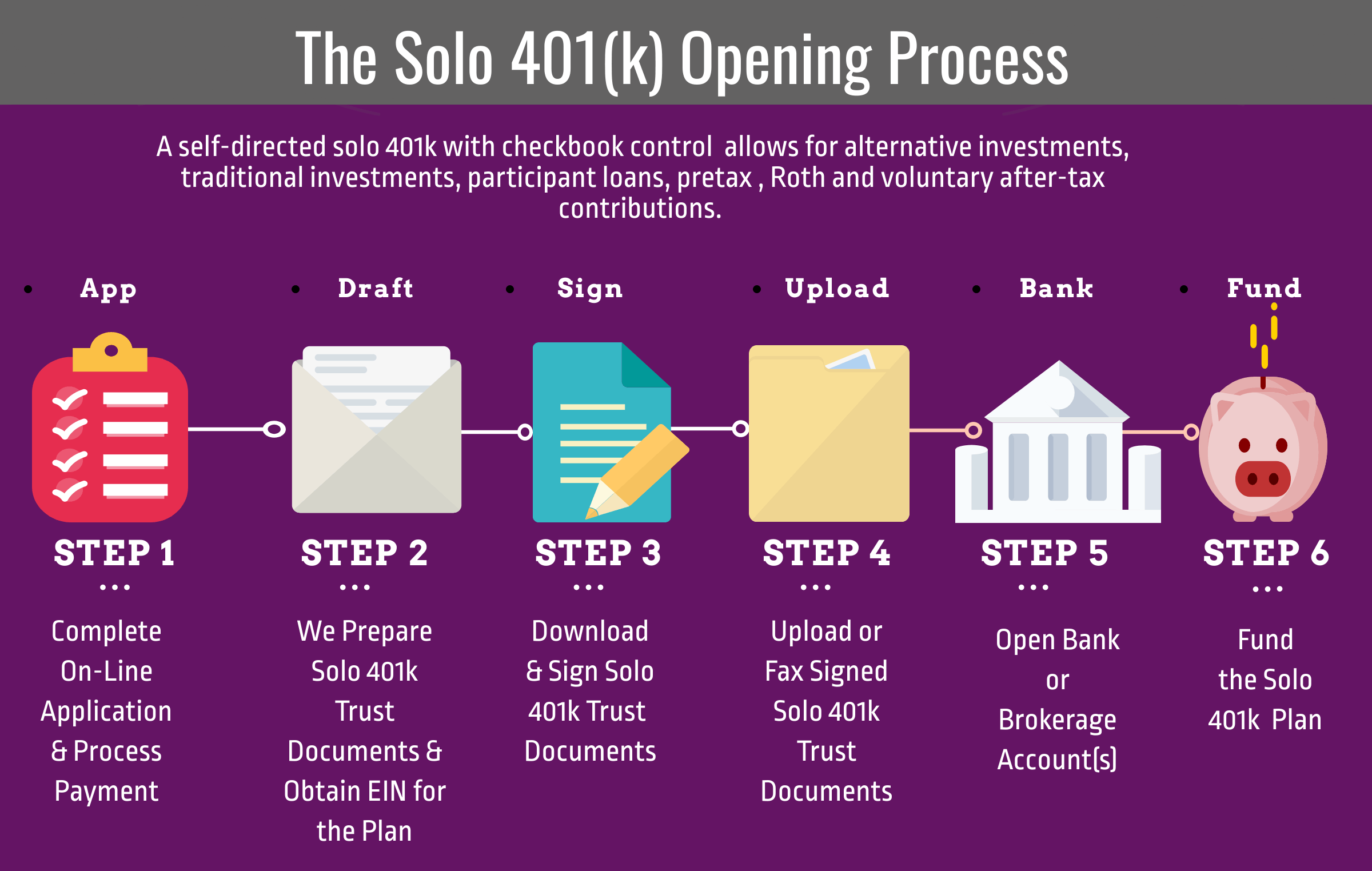

In addition, it can take more paperwork to open a solo 401, but its not especially onerous. You usually wont be able to open the account completely online in 15 minutes, as you would a typical brokerage account. Plus, youll need to get a tax ID from the IRS, which you can do online quickly. On top of this, youll have to manage the plan, choose investments and ensure that you dont exceed annual contribution limits.

Another wrinkle: Once you exceed $250,000 in assets in the plan at the end of the year, youll need to start filing a special form with the IRS each year.

These drawbacks arent especially burdensome, but you should be aware of them.

What Is A Solo 401

A solo 401 is a tax-advantaged retirement account for self-employed business owners. A solo 401 is the same as a large company 401 but limited to just the business owner and his spouse. Like a 401 from an employer, you may be able to make either pre-tax or after-tax contributions and take out 401 account loans. Depending on the account provider you choose, your investment choices and costs may vary.

Solo 401 Early Withdrawal Rules

Early withdrawal rules for Solo 401s depend on which type of account you have. With a few exceptions, you must pay a 10% penalty tax on withdrawals from a traditional Solo 401 account made before you turn 59 ½, plus income taxes on the amount withdrawn.

With a Solo Roth 401, early withdrawals of contributions are free of the 10% tax penalty and income tax payments, but you pay the penalty and income tax on earnings. You cannot withdraw contributions exclusively from a Roth Solo 401, meaning you will have to pay taxes and a penalty on at least part of your early withdrawal.

You May Like: Can You Use Pine Sol To Wash Clothes

Can I Have A Solo 401k And A Regular 401k

If you are a business owner and you have a second job, you could consider having a solo 401 and a regular 401. Find out if this is legal.

If you have a day job and you also run a small business on the side, you can have a retirement account at each job. The IRS allows employees and business owners to have multiple retirement accounts as long as there is no affiliated relationship or legal overlap between the two jobs. Also, you must keep watch of the contributions you make to each account since the contributions are calculated per person and not per plan. If you exceed the IRS contribution limit, you could be charged a penalty on the excess contribution.

The IRS allows workers to contribute to multiple retirement accounts if they have more than one job. You can have a traditional 401 at your day job, and a Solo 401 for your small business. In this case, you can increase your retirement savings while reducing your tax bill for the year. You can contribute up to $58,000 to your Solo 401 in 2021, and another $58,000 to the 401 account. This would result in a combined contribution of $116,000 for the tax year 2020.

Open E*trade Investment Account: Rolling Over From An E*trade Ira

Open a Non-custodial retirement plan account . Include the first 4 pages of your Adoption Agreement and your trust document. These documents can be found in your 401k documents, located on your 401k dashboard.

In section 2, mark that you’re completing a direct rollover to a qualified employer plan and enter your new account number:

Leave section 3 blank.

In section 4, select how you would like to distribute the assets. In this example, we’re rolling over all of the funds from the IRA into the new plan:

Leave Section 5 blankIn Section 6, you should not need to have taxes withheld as this is a direct rollover from one qualified retirement plan to another:

Sign in Section 7.

If filling out the PDF, fax your application and documents to E*Trade at 866-650-0003. You also need to send a valid photo ID of the account holder that is requesting the transfer.

Further supporting documentation to send in with your application:

Complete trust agreement

Trust EIN Letter

Recommended Reading: Does My Solar Power Work If The Power Goes Out

When Do You Have To Take Distributions

Where you were required to take Required Minimum Distributions at age 70 ½ until 2019, the recent passage of the Setting Every Community Up for Retirement Enhancement Act bumped that figure up to age 72.

In short, this means youre required to begin taking distributions once you reach that age. This is unlike the Roth IRA, which doesnt require distributions at any age.

Note that you can take distributions without a penalty any time after you reach the age 59 ½.

Ein Number For Solo 401k Retirement Trust

Now that the solo 401 plan documents have been drafted and provided for your signature, the next step is to obtain the employer identification number for the solo 401 retirement trust.

Obtaining the EIN for the solo 401 plan is covered in our setup fee however, we will need your social security number in order to obtain the EIN. Therefore, if you prefer to obtain the EIN yourself, you can do so in a matter of minutes via the IRS website.

Read Also: Do Solar Panels Heat Up The Earth

The Solo 401 From Rocket Dollar

For individuals with self-employment income, the Solo 401 is the premier retirement account available today. Secure your retirement with unlimited investment options, high contribution limits, and ultimate flexibility.

Notice

in order to make sure we can open all new customers Solo 401s before the important IRS/DOL December 31st deadline. All Solo 401s purchased after this cutoff will not be fulfilled until after . If you are considering a Solo 401, please make your decision in November or early December while there will still be plenty of time for you to sign and approve appropriate documentation and organize year-end contributions with a CPA. Plans established after the deadline but before tax time can have reduced contribution capabilities. This cutoff date is non-negotiable and no exceptions will be granted.

Check out the 2020 Rocket Dollar Solo 401 webinar to learn more about this account and how to use it this year.

Solo 401 Withdrawals And Details

As with all qualified retirement plans, there are rules to when you can and must start taking withdrawals from your Solo 401 plan. You must begin taking the minimum required distribution no later than age 72 . There is a 10% early withdrawal penalty for distributions take before age 59 1/2, but exceptions may apply.

Please refer to the IRS page on individual 401s and review our Solo 401 Guide for additional details.

Read Also: Can You Use Pine Sol On Wood Floors

How To Open An E*trade Account For The Solo 401k

Each brokerage house is different in how they classify their investment-only accounts and applications can update at any time. We have made our best efforts to provide you the most up to date applications here, but please check with ETrade to ensure you have the right application to open an investment-only brokerage account under your Solo 401k plan and trust.

It’s important to remember you’re not opening an E*Trade 401k. Rather, your 401k plan and trust are opening an investment-only account with E*Trade.

E*Trade calls these types of accounts “Non-Custodial Retirement Plan” and they are designed to work with your Solo 401k.

Contribution Limits For Self

You must make a special computation to figure the maximum amount of elective deferrals and nonelective contributions you can make for yourself. When figuring the contribution, compensation is your earned income, which is defined as net earnings from self-employment after deducting both:

- one-half of your self-employment tax, and

- contributions for yourself.

Use the rate table or worksheets in Chapter 5 of IRS Publication 560, Retirement Plans for Small Business, for figuring your allowable contribution rate and tax deduction for your 401 plan contributions. See also Calculating Your Own Retirement Plan Contribution.

Read Also: How To Register A Business Name For Sole Proprietorship

Who Should Get A Solo 401

Solo 401 plans are best for business owners who want the most flexibility in how they save for retirement. Before signing up for a Solo 401, you may also want to consider a SEP IRA or SIMPLE IRA as well.

Solo 401 plans take more paperwork to get started but offer more flexibility in what you are able to contribute. For example, SEP plans only accept employer contributions, while a solo 401 takes contributions from either the employee or employer. SIMPLE IRAs are available to businesses with up to 100 employees. SEP IRAs dont have that limit.

Who Is Eligible For A Solo 401

Solo 401 plans are intended for the self-employed. If you have employees and are looking for a retirement plan, then you have other options such as the or SIMPLE IRA, both of which allow you to provide tax-advantaged benefits to your employees. A lesser-known program called a SIMPLE 401 also allows businesses to set up retirement plans.

While solo 401 plans are intended for one-person businesses, there is an exception. The spouse of the business owner can also participate in the plan. With a spouse in the plan, your small business can really stash away cash for retirement. A qualifying couple could save as much as $114,000 annually in the plan, and even more if they were eligible for catch-up contributions.

Read Also: What Are The Government Incentives For Solar

How Much Can You Contribute To A Solo 401

In 2021, individuals with a Solo 401 can contribute a maximum amount on the employee end and the employer side of the equation.

As an employee, individuals can defer all their compensation up to the annual contribution limit of $19,500 for 2021. The only exception is, individuals ages 50 and older can contribute up to $26,000 as an employee of their company.

Note: These figures are up from 2019, when employee contributions were capped at $19,000 or $25,000 for individuals ages 50 and older.

The rest of the contribution Solo 401 participants can make is on the employer side. Here, you can contribute up to 25 percent of your compensation as defined by the plan up to an annual limit of $58,000 total , or up to $64,500 if youre 50 or older.

How does this actually work in practice? Consider this succinct example:

Ashley, age 51, earned $50,000 in W-2 wages from her small business in 2020. She deferred $19,500 in regular elective deferrals plus $6,500 in catch-up contributions to the 401 plan. Ashleys business contributed 25% of her compensation to the plan for the year, or $12,500. Total contributions to the plan for the 2021 tax season were $38,500.

This is why I strongly recommend using the services of a CPA when you have a Solo 401 plan, or are contemplating establishing one.

For reference, heres how employee and employer contributions limits have changed for Solo 401 plans over the years for retirement savers under the age of 50.

| Contribution Year |

|---|

| $49,000 |

Solo 401 Provider Fees

Most Solo 401 providers charge a fee when opening a Solo 401 account. Investors may also incur additional maintenance costs, in addition to administrative fees charged for services provided in the plan. Most providers also charge mutual fund expense ratios and commissions for trading investments such as stocks and bonds.

Tags

Read Also: How To Become A Solo Traveller

To Roll Over Other Plan Assets

If you already have a retirement savings plan for your business, you may be able to roll over or transfer existing plan assets to a Self-Employed 401. Consult with your tax advisor or benefits consultant prior to making a change to your retirement plan.

Assets from the following plans may be eligible to be rolled over into a Self-Employed 401:

- Profit Sharing, Money Purchase, and 401 plans

Deadline To Set Up And Fund

- For taxable years 2020 and beyond, individual 401 plans may be set up by tax filing deadlines plus extensions. Note: It can take 30 or more days to establish a plan.

- Salary deferral portion of the contribution must be deducted from a paycheck prior to year end, with some exceptions for certain business structures.

- Business owner contribution may be made up through the business tax filing due date plus extensions.

Recommended Reading: How To Qualify For Solar Panels

What To Expect When Working With A Broker

Not all brokerage firms are created equal. You can find some that take a hands on approach to managing your finances and others that will step back and allow you to do-it-yourself if that is your preference. You should expect that all brokers will charge a fee or commission. Some brokers might provide additional tools or resources, such as a mobile app or financial educational trading, that could make them a preferable option.

We compared some of the top providers to help you narrow down your list of potential options. There are lots of excellent brokerage firms out there with various pros and cons,

Solo 401 Versus Other Retirement Plans

If you donât think a solo 401 is a good fit for you, here are some other options you may want to consider:

- Simplified Employee Pension IRA: A is another popular option among self-employed individuals with no employees. You may contribute up to the lesser of $58,000 in 2021 or 25% of your net income. Contributions are tax-deferred, and there is no Roth option. You can use one of these accounts if you have employees, too, although youâll have to make mandatory contributions to your employeesâ accounts. This could limit how much you can afford to contribute to your own retirement.

- Traditional or Roth IRA:Traditional IRAs and Roth IRAs are open to all workers, even those who arenât self-employed. You can open them with most brokers, and youâre free to choose from many common investments. You may contribute up to $6,000 in 2021, or $7,000 if youâre 50 or older.

- Self-directed IRA:Self-directed IRAs are traditional, Roth, or SEP IRAs that allow you to invest your money in real estate and other assets you canât typically invest in with an IRA.

Each account has its pros and cons, so youâll have to decide which is best for you. A SEP IRA might be a better fit if you donât want to deal with the more complex reporting requirements of a solo 401. But solo 401s let you choose between tax-deferred and Roth accounts and take out loans, while SEP IRAs donât allow these things.

You might also like

Don’t Miss: Where To Buy Zamp Solar Panels

Differences From A Sep

If you work for yourself, you may already have opened a Simplified Employee Pension.

Here are a few of the key differences to be aware of:

- A SEP-IRA can have more than one participant.

- A SEP-IRA does not offer a catch-up contribution for those who are 50 or over.

- Employee deferral contributions are not allowed with a SEP-RA.

To Mail Contributions To Fidelity

Fidelity InvestmentsCincinnati, OH 45277-0003

Don’t Miss: How To Fund A Solo 401k

Create Plan Documents And Disclosures

After you select a provider, youll receive a package of documents referred to as an employer kit or employer application to set up your plan. You can expect the package to contain several documents and disclosures, and most of the forms are self-explanatory.

Documents that need to be completed for your provider include:

- Client agreement

- QRP basic plan document

- Adoption agreement

Youll need to make initial elections on your investment choices during this phase of the process, but they can be changed at any point in the future. Go through the disclosures to make sure you understand how the plan works and what you need to do to remain compliant, and then sign the appropriate paperwork.

From a regulatory perspective, a Solo 401 is like a traditional 401, but with only one participant. Even though you dont have employees who can participate in your Solo 401, your plan administrator will need to provide disclosures that contain information on the plan and the benefits of tax-free savings.

In addition to requesting information on you and your business, this paperwork may include items that would go on IRS Form 5500 if you have over $250,000 in your account or have additional plan participants. Should you later convert your Solo 401 to a traditional 401 with more participants, you or your plan administrator will need to give each eligible employee the same set of disclosures in an enrollment package.

The primary disclosures for a Solo 401 plan include:

What Are The Tax Benefits Of A Solo 401

Solo 401s share the same tax benefits as their traditional 401 counterparts.

You can elect to contribute pre-tax earnings to your Solo 401 and pay taxes when you distribute your funds during retirement. In turn, youâll lower your immediate income tax obligation.

Or, you can choose to contribute after-tax earnings into a Roth Solo 401, then your distributions during retirement would be tax-free.

Additionally, any matching contributions you make as your employer are tax-deductible for your business, lowering its tax obligation as well.

You May Like: How To Clean Solar Panels Diy