Making Estimated Tax Payments

Estimated tax payments are mandatory for businesses that anticipate owing $1,000 or more over the course of a year. To avoid getting hit with a hefty tax payment come April, sole proprietors need to set a portion of their income, interest and dividends aside each month in order to submit estimated tax payments four times a year. Failing to submit estimated quarterly tax payments could leave your business on the hook for fees and penalties from the IRS.

Not sure what your estimated tax payments should be? Use the previous years tax return to estimate annual income. Then, divide this amount into four even payments to be sent to the IRS in mid-April, mid-June, mid-September and mid-January. Sole proprietors who fail to make estimated payments may be subject to an IRS underpayment penalty in addition to the tax burden they already owe.

Only Llcs Can Choose Corporate Tax Status

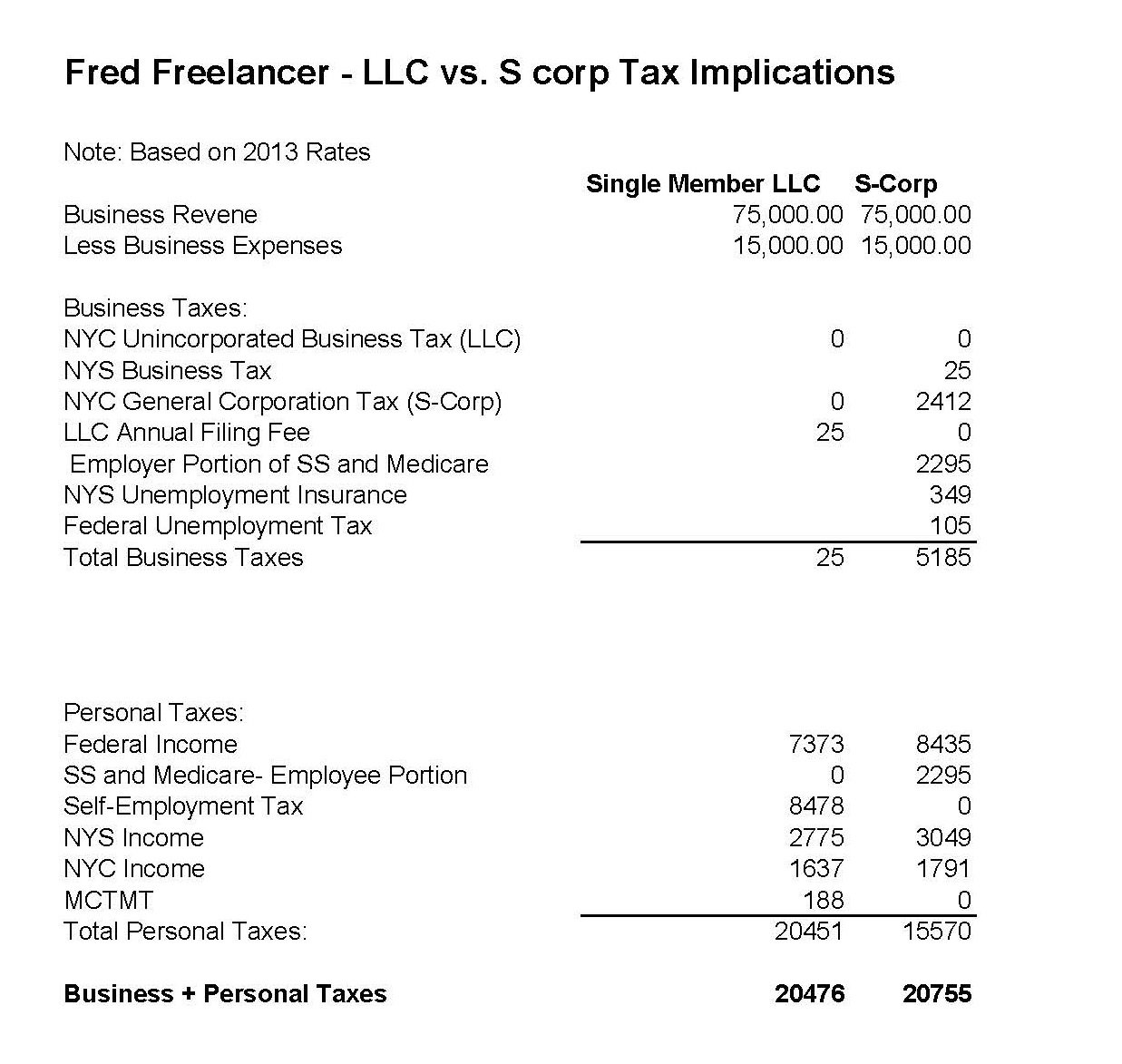

A key difference between LLCs vs. sole proprietorships is tax flexibility. Only LLC owners can choose how they want their business to be taxed. They can either stick with the defaultpass-through taxationor elect for the LLC to be taxed as an S-corporation or C-corporation. An S-corporation is a pass-through entity. If taxed as a C-corporation, the LLC will pay a corporate income tax at the federal level .

LLCs can sometimes save money by electing corporate tax status. When a company is taxed as a corporation, dividends from the business are usually taxed at a lower rate than ordinary business income. Plus, retained earnings in a corporation arent subject to income tax. In contrast, LLC members cant treat income as dividends and must pay taxes on all profits of the business, whether retained in the company or not. A corporation is also eligible for more tax deductions and credits.

Llc Vs Sole Proprietorship: How To Choose

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Choosing a business entity structure for your company is one of the most importantbut potentially most confusingdecisions youll make as a small business owner. Unless youre a lawyer or tax expert, the differences between each type of business entity can be hard to understand in real-life terms. However, your choice of business entity does have real-world impact, such as how much you pay in taxes, how much time you have to spend on paperwork, and what happens if someone sues your company.

New business owners are often confused about the difference between a limited liability company and sole proprietorship. In this guide, well look closely at LLCs vs. sole proprietorships, and explain exactly how they differ in terms of formation, taxes, legal protection, and more.

You May Like: How To Calculate Cost Per Kwh Solar

Does An Llc Pay More Taxes Than A Sole Proprietorship

No, an LLC doesnt pay more taxes than a Sole Proprietorship. In fact, having a Single-Member LLC doesnt affect your taxes at all. Its no different than if you operated without an LLC .

You will simply pay your regular tax rate on the LLCs net income.

Do I pay more taxes with an LLC? No, you dont pay more taxes with an LLC than you would as a sole proprietor.

Do I save money on taxes with an LLC? No, you dont save money on taxes with an LLC.

Do I have to pay taxes for my LLC if it has no income? No, if your Single-Member LLC has no income :

- you dont have to report your LLC activities on your personal tax return

- you dont have pay any taxes for your LLC

- you dont need to pay quarterly estimated taxes for your LLC

Understanding A Sole Proprietorship

A sole proprietorship is very different from a corporation , a limited liability company , or a limited liability partnership , in that no separate legal entity is created. As a result, the business owner of a sole proprietorship is not exempt from liabilities incurred by the entity.

For example, the debts of the sole proprietorship are also the debts of the owner. However, the profits of the sole proprietorship are also the profits of the owner, as all profits flow directly to the business’s owner.

Read Also: Why Is Solar So Expensive In The Us

Consider Incorporating Your Business For Tax Reasons

Finally, it pays to compare how a sole proprietorship is taxed to how other business forms are taxed to make an intelligent decision about how to run your business. The primary difference in tax treatment is that sole proprietorship profits are treated as personal income, whereas corporations are taxed separately.

Because sole proprietorship income is taxed as personal income, the tax amount depends on your personal income tax bracket. Corporations, however, are not only taxed separately, but also typically have lower tax rates than personal income. You will often end up paying fewer taxes by incorporating your business than running it as a sole proprietorship.

Despite the fact that many businesses would owe fewer taxes as a corporation, balance that against the added time and expense of having to prepare corporate taxes. For smaller businesses, any tax savings may be outweighed by the cost and complexity of filing a corporate tax return.

What Is Sole Proprietorship In Canada

A sole proprietorship is an unincorporated business that is owned and operated by a single individual in Canada.

The owner of a sole proprietorship receives all the profits and claims all losses from a business.Sole proprietorship does not have separate legal status from the business. If you are a sole proprietor, you also assume all the risks of the business, personal property and your assets.

If you are a sole proprietor, you can register a business name or operate your business under your own name.

Read Also: How Much Do Solar Companies Make

If You Have Questions About Self

Depending on your specific needs, it can be very cost-effective to work with a professional accountant, bookkeeper or both. To contact the CRA, call the number for businesses and self-employed individuals at 1-800-959-5525.

Have a pen and paper ready as well as all your reference information, including your Social Insurance Number Business Identification Number and any other identifying pieces of information. Make sure your phone and patience are fully charged and maybe have a nice cup of tea or a coffee to enjoy if you have to wait on hold for a bit.

Which Taxes Does A Sole Proprietor Need To Know About

These taxes you should be aware of include:

- Personal and business income taxes

- These determine your net tax owing the amount you owe to the CRA after all of your qualified personal and business tax deductions.

Recommended Reading: How To Implement Solar Energy At Home

Estimating Your Sole Proprietorship Taxes

Unlike a traditional employee, as a sole proprietor you don’t have anyone withholding income taxes from your paycheck. This means that it is your job to estimate how much you’ll owe in taxes at the end of each year. You will then make quarterly payments based on your estimations to the Internal Revenue Service and, if required, to your state as well.

Sole Proprietors: File Your Taxes With Confidence

Prepare for tax season with five tips to help sole proprietors get the job done right.

One of the costs of doing business is paying business taxes. As a sole proprietor, youre likely required to file a tax return by April 17, which is the same deadline for individuals this year. If this is your first time filing business taxes, youll need to get acquainted with some new tax forms . The following tips can help you avoid tax blunders sometimes made by sole proprietors.1

Don’t Miss: Should I Do Solar Panels

Lastly Dont Let Taxes Stop You

We know that all this tax stuff can feel a little overwhelming. Dont worry, though! You dont have to figure all this out right away. And you dont have to do this all yourself .

We write articles like this so youre aware of whats to come, but dont let this slow you down! Its more important that you get your LLC formed, get your business off the ground, and start making money. Besides, your taxes arent due for quite some time . So you can read this page to understand the basics, then form your LLC, and get started on your business.

Again, while most people do hire accountants, you dont need to find an accountant before forming your LLC. Most people do that many months after they form their LLC.

Tip: If youre still worried about taxes, heres the simplest thing to do. Leave 1/3 of your profit in your LLC bank account. Dont spend it and dont distribute it to yourself so you can use it to pay the tax bill.

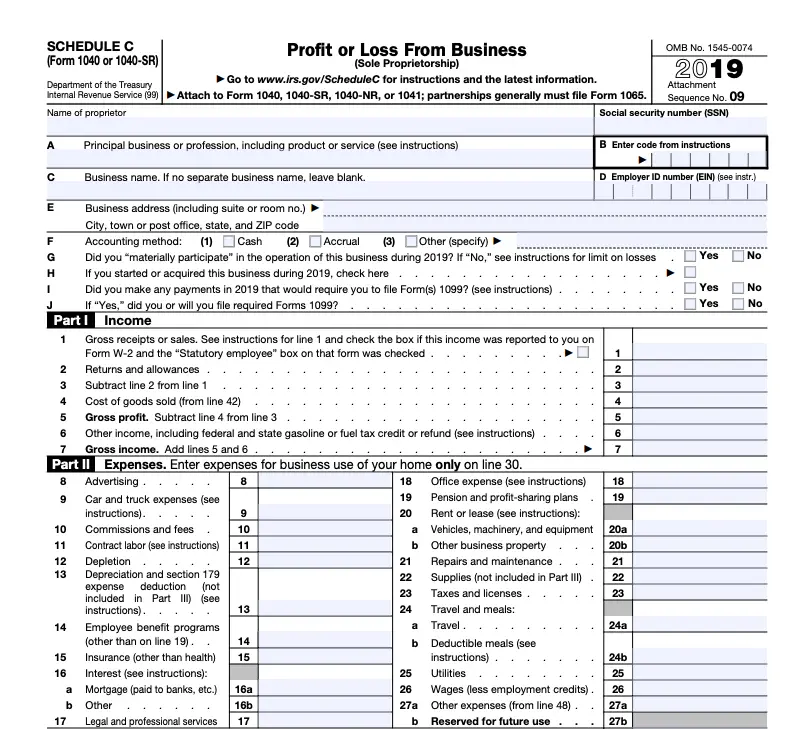

Understanding Your Schedule C

Even if youre working with a tax professional , its valuable to know what a Schedule C is and how its completed. The IRS has a detailed guide, but our hope is that youll find our walkthrough is a bit more friendly.

Line 1 Proprietor and Business Information

- Like most other tax forms, the top part of your Schedule C identifies you and your business.

- Name of proprietor Thats you. Provide your full name, first and last.

- Social security number Enter your nine-digit social security number.

- Its best if the name you provide matches the name you have on your social security card. If your name has changed for any reason, include documentation with your return and notify the Social Security Administration to update your information.

Lines A and B Principal business or profession, including product or service and principal business or professional activity code

- This is the business or professional activity that was the main source of income. If you own more than one sole proprietorship, you will need to complete a separate form for each business.

- If youre in wholesale, retail or production services, you should also give the type of customer or client, for example: Wholesale sale of hardware to retailers.

- The complete list of codes is found at the end of the instruction guide.

Line C Business name

Line D Employer identification number

Line E Business address

Line F Accounting method

Part 1 Income

Also Check: How Many Solar Batteries To Run A House

How To File Your Income Tax As A Sole Proprietor

Running your own business changes your life in so many ways, why would doing your income tax be any different?

Whether this is your first year of filing your taxes as a business or youre an old hand, heres a refresher on the three main ways being a sole proprietor changes the process of doing and filing your income tax.

How Do I File Taxes As A Freelancer In Canada

As freelancers work for themselves, ultimately they are self-employed. As such, they would file their taxes as self-employed individuals do. Self-employment taxes are filed with your personal income tax return. The businesss income, net of deductions, must be reported on the T2125 form for professional or business income. The form helps with the calculation of gross income needed to complete the personal tax return.

Recent Posts

Don’t Miss: When Does Solar Tax Credit End

Does Having A Single

No, having a Single-Member LLC doesnt help reduce taxes. It also doesnt increase your taxes.

Remember, Single-Member LLCs taxed as Sole Proprietorships have pass-through taxation. This means income from the LLC is filed on your personal tax return.

Said another way, your taxes are the same whether or not you have an LLC.

Federal And State Income Tax

Sole proprietors file need to file two forms to pay federal income tax for the year. Firstly, theres Form 1040, which is the individual tax return. Secondly, theres Schedule C, which reports business profit and loss. Form 1040 reports your personal income, while Schedule C is where youll record business income.

Your tax bracket and the amount of income tax owed are based on your combined income from both Form 1040 and Schedule C. If your state assesses income tax, youd carry your income numbers from your federal forms over to your state forms to determine how much income tax is due. Again, your income tax liability would be based on the tax bracket you land in, based on your combined business and personal income.

You May Like: Does Pine Sol Kill Mosquitoes

Sole Proprietorship Taxes For Llcs

Moreover, its important to note that even if your business is an LLC, you may still be filing taxes as a sole proprietor. Since an LLC is a legal status granted at the state level, and not a federal tax status, single-member LLCs are subject to sole proprietorship taxation. If your LLC has two members, youll be classified as a partnership for tax purposes however, either single- or multi-member LLCs can elect to file their taxes as a corporation by completing IRS Form 8832.

With this in mind, if your business is an LLC and youre unsure of what your tax status is, youll want to consult with your business accountant or attorney, especially if this individual helped you form your LLC.

Advantages And Disadvantages Of A Sole Proprietorship

The main benefits of a sole proprietorship are the pass-through tax advantage mentioned before, the ease of creation, and the low fees of creation and maintenance.

With a sole proprietorship, you do not need to fill out a tremendous amount of paperwork, such as registering with your state. You may need to obtain a license or permit, depending on your state and type of business. But less paperwork allows you to get your business off the ground faster.

The tax process is simpler because you do not need to obtain an employer identification number from the IRS. You can obtain an EIN if you choose to but you can also use your own Social Security number to pay SSN taxes rather than needing an EIN.

In addition, because you are not required to register with your state, you do not need to pay any fees associated with renewing your registration or any other fees associated with the process. This saves you a lot of money, which is important when starting your own business.

With a sole proprietorship, you don’t need a business checking account, as other business structures are required to have. You can simply conduct all your finances through your own personal checking account.

There are 32.5 million small businesses in the United States.

Thus, entrepreneurs begin as an entity with unlimited liability. As the business grows, they often transition to a limited liability entity, such as an LLC or LLP, or a corporation .

Read Also: How To Get Sole Custody In Texas

Filing Your Sole Proprietorship Taxes

Your sole proprietorship’s profits are treated as simple income on your personal income tax return, but with a few caveats. First, you will be taxed for the full profits of your business, even if you have not personally withdrawn the money. Second, in addition to a traditional personal income tax statement, you will have to fill out a Schedule C and a Schedule SE which you submit alongside your 1040 income tax return to the IRS.

In a sole proprietorship, you can take business deductions just like with other forms of business. This means that you can deduct things such as operating expenses and advertising, as well as business-related travel and entertainment . Start-up costs, such as buying business equipment, can also typically be deducted.

To take advantage of deductions, however, you will need to keep meticulous records. If you’re going to take a deduction, you should be able to demonstrate to the IRS that it was a legitimate business expense.

Finally, it is smart to keep separate accounts for your personal and business expenses. This will help you maintain clear, business-only records. Just as importantly, this will also demonstrate to the IRS if they ever audit you that you tried to separate your business expenditures from your personal ones.

Sole Proprietors Pay Taxes On Business Income On Their Personal Tax Returns

Updated By Diana Fitzpatrick, J.D.

As a sole proprietor you must report all business income or losses on your personal income tax return the business itself is not taxed separately.

Here’s a brief overview of how to file and pay taxes as a sole proprietor — and an explanation of when incorporating your business can save you tax dollars.

Read Also: How To Get Solar Panels