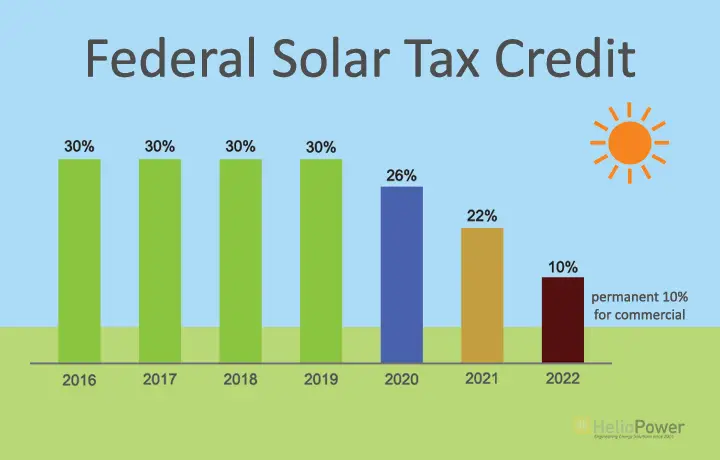

How Big Of A Difference Is A 26% Tax Credit Versus A 30% Tax Credit

The Investment Tax Credit is applied to your solar arrays gross system cost, so the amount you receive is dependent on the amount of solar youre purchasing. The bigger system, bigger credit.

Heres a quick example of the difference in credits in 2019 and 2021 for a $27,000 9 kW solar array.

Installed and claimed in 2019 taxes at the full 30% level, your credit would be $8,100. Installed and claimed in 2021 taxes at the 26% level, your credit would be $7,020.

Thats a savings difference of $1,080 compared to the previous year.

| Year | |

|---|---|

| $7,020 | $19,980 |

While ~$1,000 may not seem like a huge difference to some, if youre already decided to go solar and just waiting for the right moment, you should move forward this year to maximize your savings.

Additional Energy Resiliency Program Incentive

You may also qualify for a significant $1.00 per watt-hour incentive called the Energy Resiliency program. You must meet two criteria to qualify: 1) You live in a High Fire Threat District, Tier 2 or Tier 3 zone as described by the maps linked on this page and 2) either be a qualified low-income resident OR qualify for the medical baseline program, which means that you have medical equipment that must be keep running.

This is a significant rebate, but the program qualifications can be a little confusing. Read the program handbook for more details, or ask your solar installer.

Can I Claim The Credit Assuming I Meet All Requirements If:

I am not a homeowner?

Yes. You do not necessarily have to be a homeowner to claim the tax credit. A tenant-stockholder at a cooperative housing corporation and members of condominiums are still eligible for the tax credit if they contribute to the costs of an eligible solar PV system. In this case, the amount you spend contributing to the cost of the solar PV system would be the amount you would use to calculate your tax credit. However, you cannot claim a tax credit if you are a renter and your landlord installs a solar system, since you must be an owner of the system to claim the tax credit.

I installed solar PV on my vacation home in the United States?

Yes. Solar PV systems do not necessarily have to be installed on your primary residence for you to claim the tax credit. However, the residential federal solar tax credit cannot be claimed when you put a solar PV system on a rental unit you own, though it may be eligible for the business ITC under IRC Section 48. See 26 U.S.C. § 25D, which specifies that eligible solar electric property expenditures must be for use at a dwelling unit located in the United States and used as a residence by the taxpayer .

I am not connected to the electric grid?

Yes. A solar PV system does not necessarily have to be connected to the electric grid for you to claim the residential federal solar tax credit, as long as it is generating electricity for use at your residence.

The solar PV panels are on my property but not on my roof?

You May Like: How Does The Solar Credit Work

Solar Tax Credit Calculator:

It is easy to give you the rate of the solar tax credit. But it is much harder to give you the dollar value for your specific home. Luckily SolarReviews.com has developed one of the most accurate solar calculators. Using data from local solar installs in your area we can give you a very accurate cost guide for your specific home.

It will show you the dollar value of the federal solar tax credit and include any state tax credits if eligible. This gives homeowners who use our calculator the opportunity to figure out if solar is worth it for their home, before talking to solar companies.

Calculate the dollar value of the tax credit

Key Things To Know About The Sgip Program

- There is a separate program budget for each major utility: Southern California Edison, Pacific Gas & Electric, SolCalGas, and San Diego Gas and Electric.

- You can view the current program budgets at the program website. Note: the SDG& E budget is listed under CSE.

- You should apply for the program as soon as your solar installer completes the system design.

- A post-installation inspection will need to be completed.

- The incentive funds will be paid sometime after the inspection is completed and the program administrator determines that everything is in order.

Those are main points, but the program handbook is 139 pages long. You can find it on the home page of the SGIP website.

Recommended Reading: How To File Taxes As A Sole Proprietor

City Of Glendale Solar Solutions Incentive Program

If youâre a customer of Glendale Water & Power, youâll want to know about the Residential Solar Solutions Program.

This program offers an upfront cash incentive of $0.25 per installed Watt. This means that if, for example, you install a 6 kilowatt system , you can be eligible for a rebate of $1,500.

Thatâs a pretty sweet deal, but unfortunately that means the program is very popular, and in some years the program has been fully subscribed. This means that if youâre a Glendale homeowner who is thinking of going solar, the sooner you get started the better. The program is first-come, first-served.

Key things to know about this program:

- You should apply for the program as soon as you have a completed system design from your contractor.

- This program is for grid-connected, net metered systems only .

- You will need a Solar Energy Permit from the Building & Safety department and a final building inspection after the install is completed.

- The maximum incentive is $7,500.

This is a great program, but the funds are limited and may not be renewed next year, so try to take advantage of it while you can.

Hawaii State Tax Credit For Solar Hot Water

The same rules apply for getting solar hot water, since Hawaii also boasts a tax credit for solar water heaters. Just like with the solar panels mentioned above, residents of Hawaii can get a 35% tax credit when filing their taxes. The savings, however, is capped at $2,500 for solar water heaters. Although, a one-time $750 rebate is available to existing homes built in 2009 or before.

Read Also: How Much Does An 8kw Solar System Cost

Where Did The Solar Itc Come From

With the passage of the Energy Policy Act of 2005, during the George W. Bush administration, the Solar Investment Tax Credit was created. It allowed people getting a solar energy system installed to recoup 30 percent of the total cost of a solar energy system, but residential systems were capped at a $2,000 return. The ITC was scheduled to expire only a few years after it was passed, but in 2008 an extension was passed as part of the Cantwell-Ensign Clean Energy Tax Stimulus Act of 2008 which was part of the Emergency Economic Stabilization Act of 2008 . At that point the $2,000 residential cap on the ITC was removed. Now the ITC is set to expire completely for residential projects at the end of 2016, for commercial projects it will shrink to covering 10 percent of the costs.

Tax Benefits Of Going Solar

Tapping the sun for power offers several benefits. For example, solar power:

- Doesn’t pollute

- Reduces our use of coal and other fossil fuels

- Reduces your individual carbon footprint

But since the installation of solar power equipment can be costly, the solar tax credit can help you offset some of the costs.

Read Also: Can You Use Pine Sol On Wood Floors

How Do I Use The Tax Credit To Pay Down My Loan

Mosaics solar loan programs are built to be flexible, simple and affordable and, in the case of CHOICE loans, the monthly payments are specifically structured with the federal tax credit in mind. However, whether you opt for a CHOICE or a PLUS loan, you have the option of reducing your monthly loan payments by using your federal tax credit or your own savings. Heres how it works:

CHOICE: Mosaics CHOICE loan product is structured with the federal tax credit in mind, with lower monthly payments you can lock in by applying the full amount of your credit. Heres how it works:

- If you make the voluntary CHOICE prepayment before the end of month 18, it can reduce your monthly payment beginning in month 19

- The earlier the CHOICE payment is applied, the lower future payments will be

- If you pay down your loan by less than the specified CHOICE target loan balance, your monthly payment goes up

Its your CHOICE!

PLUS: Mosaics PLUS loan product which can be used to finance other home improvements, in addition to solar and batteries has monthly payments that do not assume the use of the federal tax credit. However, if you opt to use either the tax credit or personal savings to make voluntary prepayments to reduce your loan principal in the first 18 months, your monthly payments will be reduced for the remainder of the loan term just like CHOICE. However, unlike CHOICE, if you choose to not make any extra pre-payments, your monthly payments will not increase.

Logo

And Those State And Local Rebates

It is sometimes possible to receive a cash rebate from your state, municipality, utility company, or other organization that wants to promote solar energy. Rebates are generally available for a limited time and end once a certain amount of solar has been installed in the community. Rebates can help to further reduce your system costs by 10% to 20%.

Also Check: How Many Amps Does A 200 Watt Solar Panel Produce

Solar Investment Tax Credit Extended At 26% For Two Additional Years

By Kelly Pickerel | December 21, 2020

Extended renewable energy tax credits have been included in a $1.4 trillion federal spending package alongside a $900 billion COVID-19 virus relief spending bill. The solar investment tax credit , which was scheduled to drop from 26% to 22% in 2021, will stay at 26% for two more years. The wind industry also received a limited extension of its production tax credit.

This means that solar projects in all market segments residential, commercial, industrial, utility-scale that begin construction in 2021 and 2022 will still be able to receive a tax credit at 26%. All markets will drop to a 22% tax credit in 2023, and the residential market will drop to 0% while the commercial and utility markets will sit at a permanent 10% credit beginning in 2024.

An extension of the ITC has seen support from many outside the industry, including congressional leaders and a group of bipartisan mayors. Various bills have been introduced in the last few years attempting to extend the solar ITC, but nothing has stuck. While there have been attempts to get an investment credit for energy storage installations, nothing involving batteries was included in this spending package.

What Is The Federal Investment Tax Credit

Think of the ITC like a coupon for 26% off your home solar installation, backed and funded by the federal government. In the year that you install solar, the ITC can greatly reduce or even eliminate the taxes that you would have otherwise owed to the federal government.

The ITC was originally created by the Energy Policy Act of 2005, and was set to expire just two years later at the end of 2007. Thanks to the ITC, the growth of the solar industry helped create hundreds of thousands of jobs, injected billions of dollars into the US economy, and was a significant step towards cutting down on greenhouse gases, so it was very popular.

According to the Solar Energy Industries Association , The ITC has helped the U.S. solar industry grow by more than 10,000% percent since it was implemented in 2006. As a result, Congress has extended the expiration date multiple times to continue supporting that growth, including the latest extension that was part of the COVID relief bill and sets the expiration date at the end of 2023.

Also Check: How Much Solar For A Tiny House

How Is The Federal Solar Tax Credit Calculated

The gross system cost can include any improvements needed to facilitate the solar installation. This includes any electrical work needed for the installation such as a panel box upgrade, and also includes roof work under the solar array. Please speak to your tax advisor for specific advice for your given circumstances.

The credit is a dollar for dollar income tax reduction. This means that the credit reduces the amount of tax that you owe. Many clients mistakenly believe that getting a tax return would make them ineligible for the ITC, but this is not the case. As long as youve been paying taxes in some form throughout the year, if you get a tax return and claim your ITC in the same year, your ITC is simply added to the amount of your tax return .

What Are Other Renewable Energy Options For Homeowners

Homeowners that are interested in renewable energy for their home, but are concerned about the cost risks associated with rooftop solar, should consider Community Solar. Community Solar farms get their energy from the same place that rooftop arrays do the sun. Both sources can offer long-term cost savings and a brighter, more renewable future for generations to come, but Clearway Community Solar does not require any installation and homeowners see savings in their monthly electricity bills instead of an expiring tax credit.

Clearway Community Solar Farms help subsidize the energy load on local municipal power grids, offsetting the cost of delivering it to homes. Homeowners that participate in a local Community Solar project, in turn, receive solar credits that are applied to their monthly electricity bill.

To find out more about how Clearway Community Solar works,.

You May Like: How Many Homes Use Solar Power

So How Do I Claim The Federal Solar Tax Credit

Simple. You claim the Federal tax credit for solar when you file your yearly Federal income tax return. Well, actually, its only sort of simple

Seek professional tax advice first of all, to ensure that you are eligible for the credit. Then complete IRS Form 5695 Residential Energy Credits and include the final results of that form on your IRS Schedule3/Form 1040. Dont forget to attach Form 5695 to your Federal tax return. Instructions on filling out Form 5695 are available at .1 2

Bottom Line: What To Know About Federal Solar Tax Credits

The federal solar tax credit is a win for any qualifying individual or business installing a solar system on their property. The tax credit helps offset the cost of the system and can make renewable energy far more affordable and attainable to individuals who would like to live a more sustainable lifestyle.

- Article sources

- ConsumerAffairs writers primarily rely on government data, industry experts and original research from other reputable publications to inform their work. To learn more about the content on our site, visit our FAQ page.

Read Also: How Much Do Solar Panels Cost In San Antonio

What About State Solar Tax Credits And Rebates

Some states offer additional tax incentives for installing a solar panel system. With a state solar tax credit, you can deduct a portion of the cost of your solar panel system from your state tax bill, similar to how it works with the Federal tax credits.

These credits vary significantly by state, but your Sunnova dealer will be totally up-to-date on your local incentives and can steer you in the right direction.1

Does The Residential Solar Tax Credit Apply To New Home Purchases

If you buy a new home that already has solar installed, you can still claim the Solar Investment Tax Credit in the year that you move in, regardless of when the house was originally built or sold. For example, if your home was built in 2019, and then you bought it in 2020, but didnt move in until 2021, then you would claim the ITC on your 2021 taxes.

Keep in mind, the ITC can only be claimed once, so youll want to check and make sure that your builder hasnt already claimed the credit. If your builder has claimed it, then you may be able to ask for a reasonable allocation for those costs, and factor that into the final purchase price.

Don’t Miss: How Much To Register Sole Proprietorship

How Much Is The Federal Tax Credit For Solar Panels

In 2021, the Solar Energy Investment Tax Credit covers up to 26% of the cost of your solar power system. However, you may be surprised to learn that there is no maximum dollar amount that can be claimed as a tax credit for your solar installation! As long as you owe enough in federal taxes for the credit to cover, you can claim up to the full 26%, regardless of how large your solar power installation is.

The solar tax credit covers any product that directly connects to your solar power system or is needed for the installation, such as solar panels, mounting equipment, inverters, wires, and battery storage systems. The tax credit also covers other items related to getting panels installed on your roof, such as labor costs, assembly, installation, inspection costs, and sales tax.