Solar Tax Credit Amounts

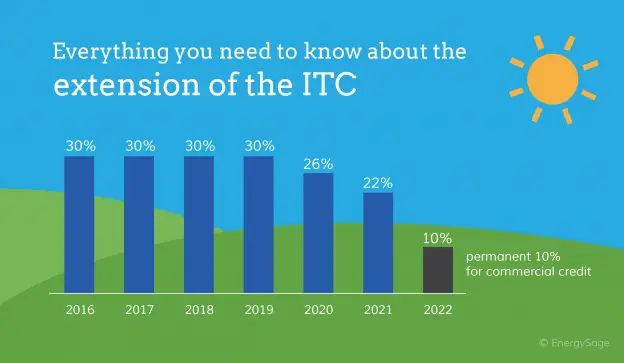

Installing renewable energy equipment in your home can qualify you for a credit of up to 30% of your total cost. The percentage you can claim depends on when you installed the equipment.

- 30% for equipment placed in service between 2017 and 2019

- 26% for equipment placed in service between 2020 and 2022

- 22% for equipment placed in service in 2023

As a credit, you take the amount directly off your tax payment, rather than as a deduction of your taxable income.

New York Solar Sales Tax Exemption

The state of New York charges a 4% sales tax on most products and goods sold within the state. However, to bring down the barriers to entry for homes or businesses looking to invest in solar energy, this tax has not applied to solar energy equipment and installations for residential systems since 2005.

This exemption helps lower the all-in cost for potential solar buyers and serves to make solar energy more affordable with a lower payback period to a greater portion of the population, in alignment with New Yorks goals for increased renewable energy.

Tax Benefits Of Going Solar

Tapping the sun for power offers several benefits. For example, solar power:

- Doesnt pollute

- Reduces our use of coal and other fossil fuels

- Reduces your individual carbon footprint

But since the installation of solar power equipment can be costly, the solar tax credit can help you offset some of the costs.

Read Also: Can You Use Pine Sol On Wood Floors

Also Check: How Do You Clean Solar Panels On Garden Lights

How To Claim The Tax Credit For Solar Panels

Note: Were solar experts at Palmetto, but everyones tax situation is unique, so please consult with a tax expert to determine whats best for you. That said, if youre looking for information on how to file for a solar panel tax credit, heres a general overview of how homeowners can claim their Solar Investment Tax Credit:

How Does The Solar Tax Credit Work And How Much Will I Save

Right now, the Solar Investment Tax Credit is worth 26% of your total system cost. This includes the value of parts and contractor fees for the installation.

As mentioned before, if it costs $10,000 to buy and install your system, you would be owed a $2,600 credit.

You are only allowed to claim the credit if you own your system. This is why were strongly opposed to solar leasing if you can avoid it. If another company leases you the system, they still own the equipment, so they get to claim the incentives.

Youll still get the benefits of cheap, renewable energy if you lease. But missing out on the tax credit is a huge blow to getting a positive ROI from your system.

It makes more sense to take advantage of solar financing instead. Youre still on the hook for a loan, but you retain rights to the incentives that help make solar such a sound investment.

You May Like: How To Become A Sole Proprietor In Illinois

Hawaii State Tax Credit For Solar Hot Water

The same rules apply for getting solar hot water, since Hawaii also boasts a tax credit for solar water heaters. Just like with the solar panels mentioned above, residents of Hawaii can get a 35% tax credit when filing their taxes. The savings, however, is capped at $2,500 for solar water heaters. Although, a one-time $750 rebate is available to existing homes built in 2009 or before.

Read Also: How Much Does An 8kw Solar System Cost

Filing Requirements For The Solar Tax Credit

To claim the credit, you must file IRS Form 5695 as part of your tax return. You’ll calculate the credit on Part I of the form, and then enter the result on your 1040.

- If in 2021 you end up with a bigger credit than you have income tax due a $3,000 credit on a $2,500 tax bill, for instanceyou can’t use the credit to get money back from the IRS. Instead, you can carry the credit over to tax year 2022.

- If you failed to claim the credit in a previous year, you can file an amended return.

Currently, the residential solar tax credit is set to expire at the end of 2023. If you’re thinking about adding solar energy to your home, now might be the right time to act.

Whether you have stock, bonds, ETFs, cryptocurrency, rental property income or other investments, TurboTax Premier has you covered. Increase your tax knowledge and understanding all while doing your taxes.

Don’t Miss: How To Make Your Own Solar Cells

Frequently Asked Questions About The Solar Tax Credit

Calculating the cost of going solar can be complicated as it is, let alone incorporating other financial incentives and tax credits into your estimate. Check out a few other commonly asked questions related to the ITC for more clarification:

How much is the federal solar tax credit for in 2021?

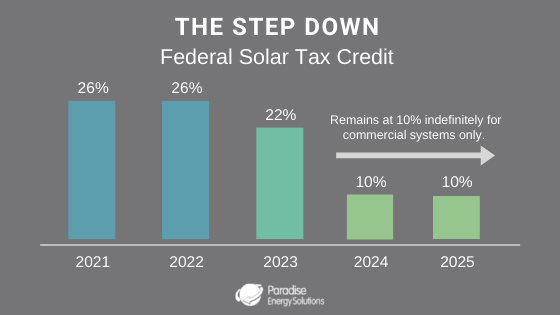

In 2021, the federal solar tax credit will deduct 26 percent of the cost of a system for eligible residential and commercial tax payers. After 2022, new residential and commercial solar customers can deduct 22 percent of the cost of the system from their taxes.

Is the solar tax credit a one-time credit?

Right now, the ITC is a one-time credit. But, you may carry over the excess credit to the next year if you cant use it all when you file. For example, if you only owed $6,000 in taxes but received the $6,200 solar tax credit, youd pay $0 in taxes for the year when you placed the claim. Then, youd also get to reduce next years taxes by the remaining $200.

Will the solar tax credit increase my tax refund?

The solar tax credit will not increase your tax refund. Rather, The ITC amount is applied against your tax liability, or the money you owe the IRS.

Faq: Arizona Solar Incentives

Does Arizona have a solar tax credit?

Yes, when you purchase a home solar system in Arizona, you can claim 25% of its cost as a state tax credit, up to a maximum of $1,000. Keep in mind you can combine this benefit with the 26% federal tax credit, which isn’t limited by a maximum amount.

Is it worth going solar in Arizona?

Yes, your solar panels will be very productive thanks to the abundant sunshine in the state, and you get four tax benefits in addition to power bill savings.

Does Arizona have net metering?

Strictly speaking, Arizona does not have net metering. But you still get partial credit for surplus solar power that gets exported to the grid. Arizona used to have net metering for solar power at full retail price, but the benefit was repealed in 2016.

In states with net metering laws, electric companies must give you full credit for all solar energy sent to the grid. Arizona has “net billing” instead, through which electric companies give you partial credit, assuming their avoided cost per kWh and not the full retail price.

What is the solar tax credit for 2022?

The Arizona state tax credit is 25% of your solar PV system costs, up to $1,000. The federal tax credit will remain at 26% until the end of 2022, and there is no maximum amount.

Also Check: What Tax Forms Do I File For A Sole Proprietorship

City Of Glendale Solar Solutions Incentive Program

If youâre a customer of Glendale Water & Power, youâll want to know about the Residential Solar Solutions Program.

This program offers an upfront cash incentive of $0.25 per installed Watt. This means that if, for example, you install a 6 kilowatt system , you can be eligible for a rebate of $1,500.

Thatâs a pretty sweet deal, but unfortunately that means the program is very popular, and in some years the program has been fully subscribed. This means that if youâre a Glendale homeowner who is thinking of going solar, the sooner you get started the better. The program is first-come, first-served.

Key things to know about this program:

- You should apply for the program as soon as you have a completed system design from your contractor.

- This program is for grid-connected, net metered systems only .

- You will need a Solar Energy Permit from the Building & Safety department and a final building inspection after the install is completed.

- The maximum incentive is $7,500.

This is a great program, but the funds are limited and may not be renewed next year, so try to take advantage of it while you can.

Homeowners Guide To The Federal Tax Credit For Solar Photovoltaics

Disclaimer: This guide provides an overview of the federal investment tax credit for those interested in residential solar photovoltaics, or PV. It does not constitute professional tax advice or other professional financial guidance. And it should not be used as the only source of information when making purchasing decisions, investment decisions, or tax decisions, or when executing other binding agreements.

Read Also: How To File As Sole Proprietor

Federal Solar Tax Credit Calculator

The good news is that the federal solar tax credit has been extended with the signing of the Federal government Omnibus spending bill. Some key extensions for the Investment Tax Credit are :

- 2-year extension for the residential commercial solar investment tax credit has been extended at 26% through 2022. Now, the phasedown to 22% will occur on January 1, 2023.

- The Sec. 45 production tax credit /investment tax credit , has been extended by one year to December 31, 2021. Projects that begin construction in 2021 will qualify for either the PTC at 60% of its full value or an 18% ITC on the total project cost in the year the project is placed in service.

- The Offshore wind will now have a 30% ITC through Sec. 48 for projects for which construction starts after 2016 through the end of 2025. This change is retroactive, so projects that already started construction after 2016 will be able to access the 30% ITC.

You should note that the federal tax credit for solar system investment not only reduces your tax liability but also can be used to reduce the alternate minimum tax, in case you fall under AMT.

Utah Solar Tax Credit

Residential: Local incentives for local people! The Utah solar tax credit, officially known as the Renewable Energy Systems Tax Credit, covers up to 25% of the purchase and installation costs for residential solar PV projects, capped at $1,600, whichever is less. Learn more and apply here.

The Utah residential solar tax credit is also phasing down. The cap dollar amount you can receive begins to phase down as follows:

- 25% capped at $1,200 until 12/31/21

- 25% capped at $800 until 12/31/22

- 25% capped at $400 until 12/31/23

- Utah tax credit expires in 2024

Commercial: A rooftop solar tax credit is also available for larger commercial projects! The commercial Investment Renewable Energy Systems Tax Credit, for solar photovoltaic systems, is refundable and covers up to 10% of the eligible system cost or $50,000, whichever is less. The Commercial incentive can only be claimed on the same years taxes as when the solar system was installed. Learn more and apply here.

Things to consider if you sign a Power Purchase Agreement

Recommended Reading: Can You Clean Walls With Pine Sol

Massachusetts Is A Remarkable Place To Create And Store Your Own Solar Energy

Aside from Massachusetts remarkable solar tax incentives and rebate programs, our home solar panel and battery storage plans start at $0 down. What’s more, if youre a customer of Eversource, National Grid, Unitil, or any other utility company in Massachusetts, you could earn bill credits for the excess solar power you produce thanks to their net energy metering programs.13 With net metering in Massachusetts, you might save money on your future energy costs.

Sunrun is one of the best solar installers in Massachusetts that you can team up with. If youre curious about creating and storing your own Massachusetts solar energy, use our Product Selector or request a free quote to get one-on-one service from our expert Solar Advisors. It wont cost you a dime to find out if our solar solutions are right for your energy needs.

Form 5695 Instructions: The 3 Steps To Claim The Solar Tax Credit

There are three broad steps youll need to take in order to benefit from the federal solar tax credit:

Make sure you have enough tax appetite to use the federal ITC against your total taxes.

This form validates your qualification for renewable energy credits, and can be obtained online.

Loop your renewable energy credit information into your regular tax form.

You May Like: What Size Solar Panel Do I Need

Expanding Access To Solar

SETO works to create a more equitable clean energy future by addressing the barriers that low- and moderate-income households face in accessing the benefits of solar through innovations in financing, community solar, and workforce development. To this end, the office has set a goal for 2025 that would enable 100% of U.S. energy consumers to choose residential solar or community solar that does not increase their electricity cost. Learn more about equitable access to solar energy.

How Much Is The Federal Tax Credit For Solar Panels

In 2021, the Solar Energy Investment Tax Credit covers up to 26% of the cost of your solar power system. However, you may be surprised to learn that there is no maximum dollar amount that can be claimed as a tax credit for your solar installation! As long as you owe enough in federal taxes for the credit to cover, you can claim up to the full 26%, regardless of how large your solar power installation is.

The solar tax credit covers any product that directly connects to your solar power system or is needed for the installation, such as solar panels, mounting equipment, inverters, wires, and battery storage systems. The tax credit also covers other items related to getting panels installed on your roof, such as labor costs, assembly, installation, inspection costs, and sales tax.

Also Check: How Do Solar Panels Hook Up To Your House

What About State Solar Tax Credits And Rebates

Some states offer additional tax incentives for installing a solar panel system. With a state solar tax credit, you can deduct a portion of the cost of your solar panel system from your state tax bill, similar to how it works with the Federal tax credits.

These credits vary significantly by state, but your Sunnova dealer will be totally up-to-date on your local incentives and can steer you in the right direction.1

What Is The Phase

The solar tax credit remains at 26% of the price of the system for systems that begin installation by December 30th, 2022. After that, homeowners with systems that begin installation by December 30th, 2023 are eligible for a 22% tax credit. In 2024 the credit for homeowners phases out entirely. After that, only commercial solar system owners are eligible for the Federal Solar Tax credit. They are allowed to deduct 10% of the cost of their system. Homeowners would no longer be eligible for the Federal Tax Credit.

Read Also: What Is The Current Efficiency Of Solar Panels

Solar Panel Tax Credit Faqs

WHAT IF THE SOLAR PANEL TAX CREDIT EXCEEDS MY TAX LIABILITY? WILL I GET A REFUND?

This is a nonrefundable tax credit, meaning you will not get a tax refund for the amount of the solar tax credit that exceeds your tax liability. However, you can carryover any unused amount of the solar tax credit to the next tax year.

CAN I USE THE SOLAR PANEL TAX CREDIT AGAINST THE ALTERNATIVE MINIMUM TAX?

Yes. The tax credit can be used against either the federal income tax or the alternative minimum tax credit.

HOW DO I CLAIM THE SOLAR TAX CREDIT?

HOW MUCH LONGER IS THE SOLAR TAX CREDIT AVAILABLE?

Sadly, the amazing solar tax credit that caused such growth for the solar industry is on its proverbial last leg. In 2022, the tax credit will be 26% and in 2023 it will step down to 22%. Starting in 2024, the tax credit is scheduled to be removed altogether.

The solar investment tax credit was extended once before in 2015, but that extra time is quickly running out. The table below details how much longer the tax credit is available for, and for how much.

|

Year |

Have more questions about the federal solar tax credit? Check out our TOP 10 FREQUENTLY ASKED QUESTIONS ABOUT THE FEDERAL SOLAR TAX CREDIT blog for additional information!

MORE QUESTIONS

Internal Revenue Service, located at 1111 Constitution Avenue, N.W., Washington, DC 20224, and phone at 829-1040.

Now is the time to take advantage of the solar investment tax credit. Contact our team of dedicated solar experts today!

Looking To Go Solar In Northern California Turn To Sandbar

After more than 16 successful years, Sandbar Solar maintains its position as the most established, locally owned solar company in Santa Cruz. Our solar panel installation projects reduce your energy bills and increase your propertys market value. Solar panels for your home or business also make you an important part of the green solutions that help preserve our planet.

Our Santa Cruz solar services include free estimates, custom design, and expert installation. Our portfolio features thousands of residential and commercial solar panel installations across the region. Were proud of our reputation for designing and installing the most efficient solar panels for the Central Coast including Santa Cruz and Monterey counties as well as San Jose and the Bay Area.

If youre thinking of going solar and you live on the Central Coast or in the South San Francisco Bay area, contact us today to get a quote for your project.

About the Author

Scott is the founder of Sandbar Solar & Electric. With a Bachelors Degree in Economics from UC San Diego, Scott has an NABCEP certification, and has lectured on and taught many high-tech construction practices and solar PV technical concepts to education institutions, including Stanford University and state-recognized electrician apprenticeship programs. Scott enjoys sharing his knowledge of the evolving renewable energy space and making a difference in his community.

Also Check: Where Can I Buy Solar Batteries