How Do I Claim The Tax Credit

To claim the tax credit, you must file IRS Form 5695 as part of your tax return. You’ll calculate the credit on the form, and then enter the result on your individual tax Form 1040.

If in last years taxes, you ended up with a bigger credit than you had income tax due, you cant get money back from the IRS. Instead, you can generally carry the credit over to the next tax year. Its important to understand that this is a tax credit and not a rebate or deduction. Tax credits offset the balance of tax due to the government .If you failed to claim the credit in a previous year, not to worry! You can file an amended return.

The current residential solar tax credit is set to expire at the end of 2023 after several extensions. So, now is a great time to explore your solar energy options to take advantage of these potential tax credits.

Am I Eligible For A Solar Hot Water Heater Tax Credit

- The water heater may be installed in your primary residence or a secondary home.

- Existing and new homes qualify rentals do not.

- Solar panels must help power the residence and meet the necessary fire and electrical codes.

- At least half the energy generated by the solar hot water heater must come from the sun.

- The system must be certified by the Solar Rating and Certification Corporation.

- The water heated by the solar water heater must be used inside the home.

- More eligibility requirements can be found here.

Whats Covered By The Tax Credit

Homeowners who leverage the 30 percent ITC can plan to see the following covered:

- Cost of solar panels

- Labor costs for installation, including permitting fees, inspection costs, and developer fees

- Any and all additional solar equipment, like inverters, wiring, and mounting hardware

- Home batteries charged by your solar equipment

- Sales taxes on eligible expenses

Also Check: Does My House Qualify For Solar Panels

Are You Eligible To Claim The Federal Solar Tax Credit

In order to claim the federal solar tax credit and get money back on your solar investment, you have to meet the following criteria when filing your 2021 taxes:

- Your solar PV system must have been installed and began operating at some point between January 1, 2006, and December 31 of 2021.

- Your system must have been installed at either your primary or secondary residence.

- You must own the solar PV system, whether you paid upfront or are financing the cost.

- The solar system must have been used for the first time. You only get to claim this credit once, for the original installation of your solar PV equipment. So if you move residences, take your panels with you, and install them on your new roof, you wont be able to claim a second credit.

The Federal Solar Tax Credit In 2022

For homeowners and business owners going solar in 2022, there are a variety of solar incentives available from the federal government, state agencies, and local governments to help reduce the upfront cost. One of the most significant ones is the Federal Solar Investment Tax Credit that has contributed to solar growth for over a decade.

Known to industry professionals simply as the Solar ITC, this incentive is a direct dollar-for-dollar tax credit from the U.S. government that is designed to drive down the cost of installing solar projects on residential and commercial properties. The Solar ITC allows solar customers to claim a one-time tax credit if they finance their solar photovoltaic systems with cash or loans.

The good news is that the solar ITC also benefits households and businesses that do not purchase a home solar system outright. Because it can apply to any system owner, including project financiers, it also translates to benefits for customers that enter a solar lease agreement or a solar power purchase agreement framework.

You May Like: Can You Lease Solar Panels

Am I Eligible For An Insulation Tax Credit

This tax credit has been extended through December 31, 2021, and you may take advantage of it even if you replaced your insulation before 2021. If you were eligible and did not claim it on your return as far back as 2017, you can refile your return for the appropriate year to take advantage of the savings. Consult your tax professional to find out if refiling is right for you.

- This must be your primary residence .

- This must not be a new home or a rental.

- Bulk insulation products such as batts, spray foam insulation and rolls are typically covered.

- The credit can apply to replacing or improving insulation, but its primary purpose must be to insulate.

- You must have a copy of the Manufacturers Certification Statement to qualify.

- More eligibility requirements can be found here.

How Much Can I Claim For New Solar Panels On My Tax Return

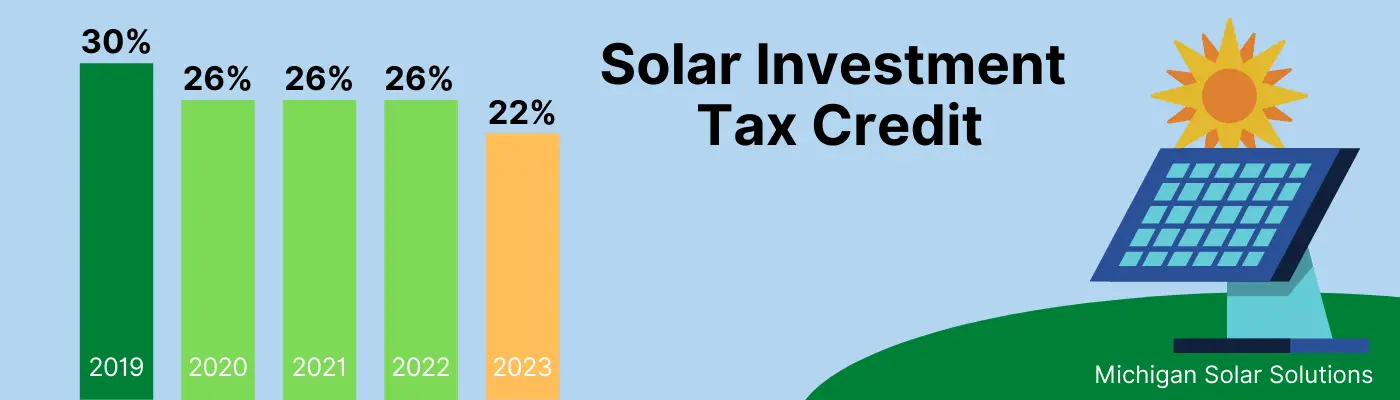

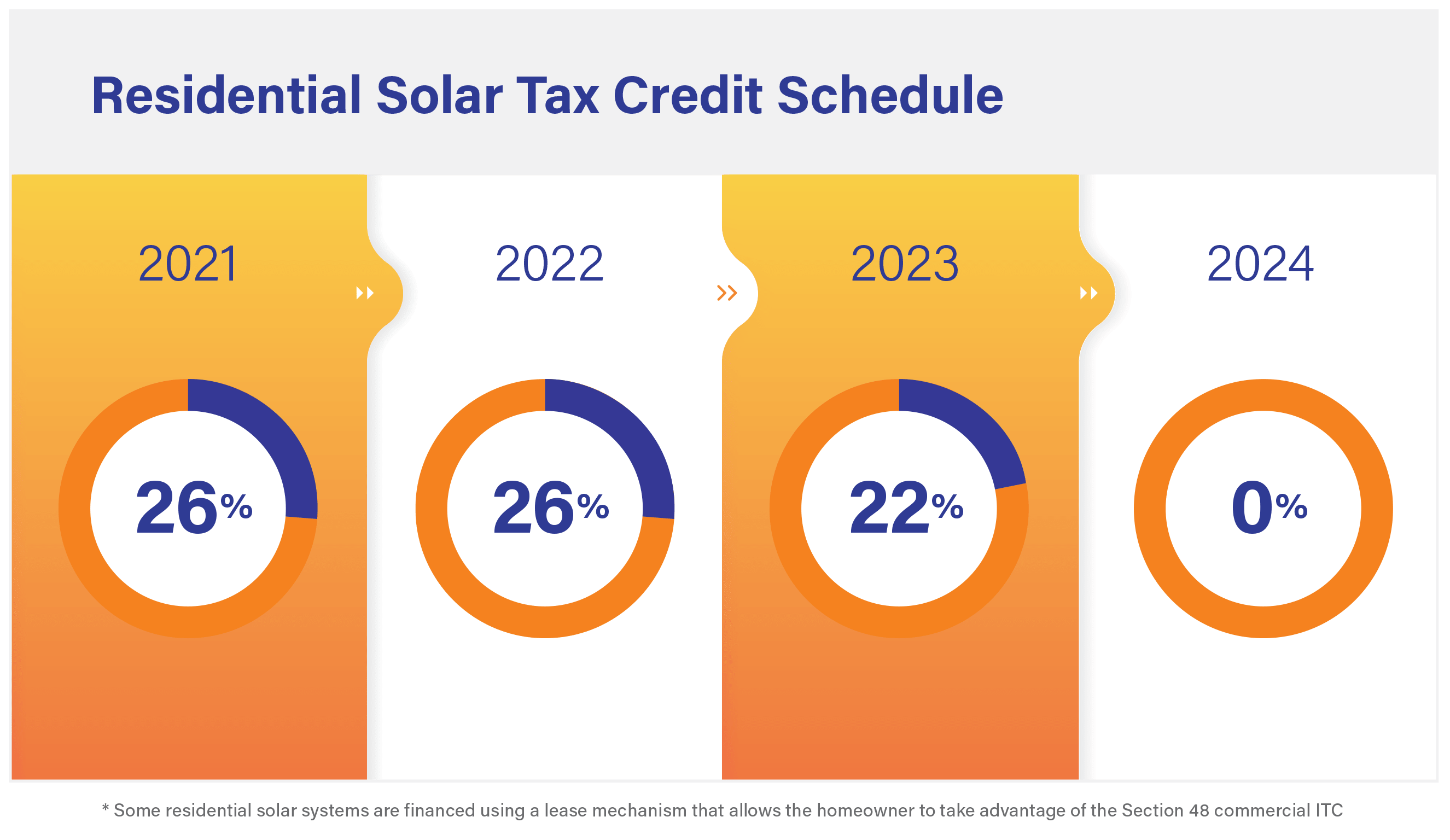

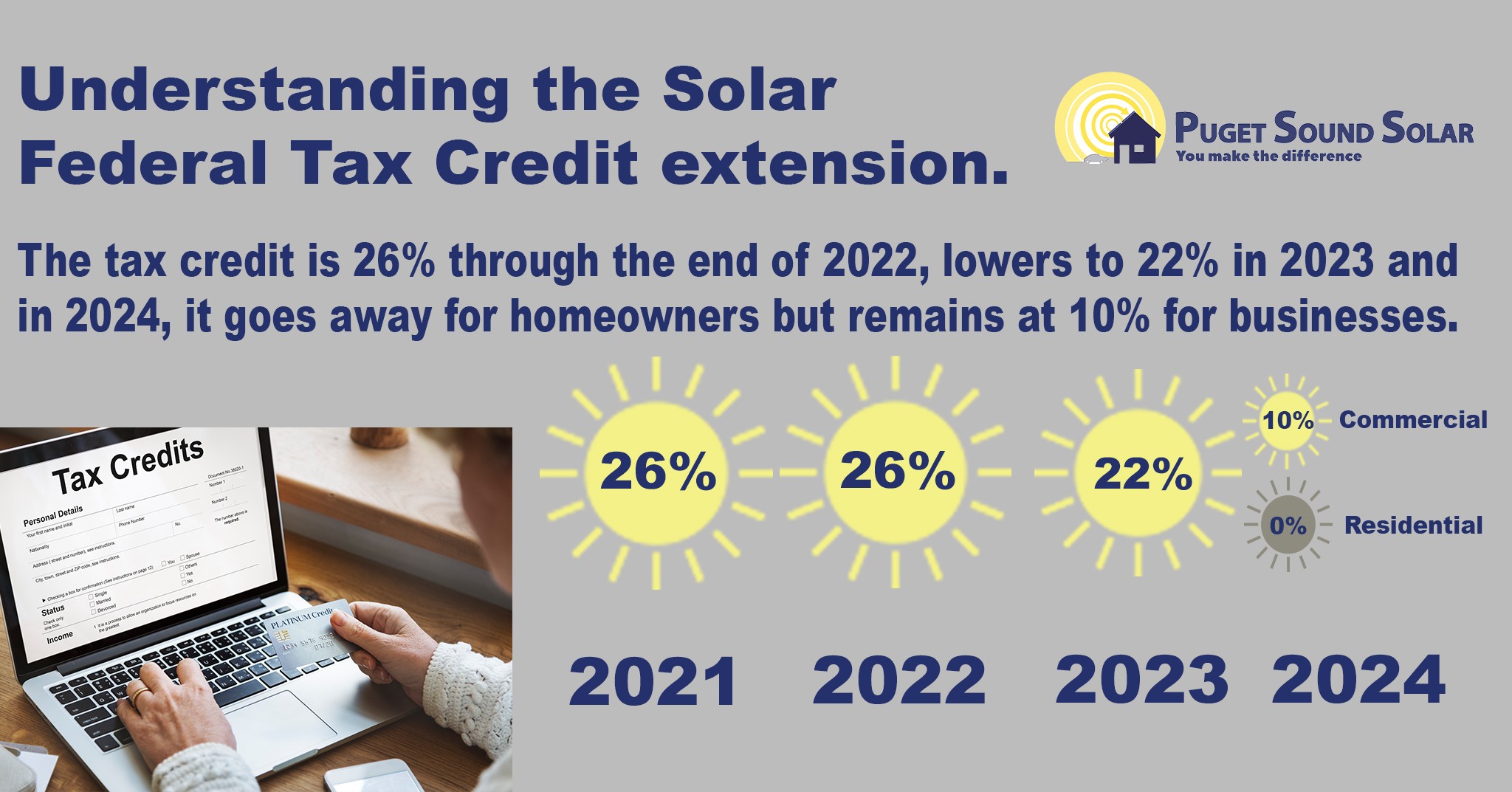

You can receive a tax credit for a percentage of the cost , which varies depending on when the system was/is placed in service.

- 30% for systems placed in service by 12/31/19

- 26% for systems placed in service after 12/31/19 and before 01/01/23

- 22% for systems placed in service after 12/31/22 and before 01/01/24

Other common questions about solar panel tax credits:

Recommended Reading: Selling House With Solar Panels

How To Get The 2021 Federal Tax Credit

With the Renewable Energy credit, you subtract your credit amount from the total tax liability the IRS says that you must pay. There is no limit on the maximum amount that can be claimed,

The Federal Tax Credit is different than a tax deduction in that it reduces the amount of income you pay taxes on. A $1,000 credit is worth $1,000 regardless of your tax rate,

If you cant use all of the Federal Tax Credit in one year, you can carry it over later. If your federal taxes are $5,000 for 2021 and youre eligible for an $8,000 tax credit for installing a solar energy system for your home. You can claim the remaining $3,000 tax credit towards your 2022 taxes. However, not every type of solar installation or expenses is eligible for the solar tax credit. Only qualified solar energy systems that meet the IRS guidelines and product electricity are covered.

How Much Of A Credit Can I Claim On My Tax Return For A New Solar Hot Water Heater

You could be eligible for an energy-efficient home improvement tax credit on as much as 30% of the cost, including installation, with no upper limit. But the value of the tax credit is scheduled to decrease over time.

- 30% for systems placed in service by 12/31/19

- 26% for systems placed in service after 12/31/19 and before 01/01/23

- 22% for systems placed in service after 12/31/22 and before 01/01/24

Other common questions about solar hot water heater tax credits:

- Is a solar water heater installed for a swimming pool or hot tub eligible for a tax credit? No.

- Do solar hot water repairs qualify for tax credits? No. They are considered maintenance expenses rather than home improvement expenses and therefore are not eligible.

- Will any ENERGY STAR® solar water heater qualify? Yes, all ENERGY STAR-certified solar hot water heaters are eligible for the tax credit.

Air Conditioning | Water Heaters | Geothermal Heating | Wind Turbines | Tax Rebates

Read Also: What Is Solar Home System

Solar Investment Tax Credit

The solar Investment Tax Credit is one of the most important federal policy mechanisms to support the growth of solar energy in the United States. Since the ITC was enacted in 2006, the U.S. solar industry has grown by more than 200x – creating hundreds of thousands of jobs and investing billions of dollars in the U.S. economy in the process. SEIA has successfully advocated for multiple extensions of this critical tax credit, including successful passage of the Inflation Reduction Act in August 2022. SEIA also fought for successful passage of many other important tax measures in the IRA, including adding energy storage to the ITC, creating solar manufacturing tax credits, and ensuring interconnection costs are a qualified expense for solar projects under 5 MWac.

Quick facts

Impact of the Solar ITC

The ITC has proven to be one of the most important federal policy mechanisms to incentivize clean energy in the United States. Solar deployment, at both the distributed and utility-scale levels, has grown rapidly across the country. The long-term stability of this federal policy has allowed businesses to continue driving down costs. The ITC is a clear policy success story one that has resulted in a stronger and cleaner economy.

How Does the Solar Investment Tax Credit Work?

Solar on New Residential Homes

Solar Tax Credit Carryover In 2022

If you are interested in claiming the Solar Tax Credit, you will need to do so for the same tax year that your solar system is installed. This means that if you purchased solar panels at the end of 2021 and the installation isnt complete until January 2022, you will claim the Solar Tax Credit on your 2022 tax return.

So, what if the value of the Solar Tax Credit is more than you owe in income taxes? While you cant use the tax credit to receive money back from the IRS, the Solar Tax Credit rollover lets you roll the tax credit back one year and carry the credit forward for up to five years. So, if you didnt owe federal taxes last year, you can still claim the Solar Tax Credit on this years tax return. And if the Solar Tax Credit offers you more than you owe in federal taxes, you will receive the difference in the next tax year until the credit is fully claimed.

For example, if the Solar Tax Credit credits you $3,000 when you owe $2,500 in taxes, that extra $500 from the credit would roll over into the next tax year. That means you wouldnt have to pay anything in the current tax year, and you will receive a $500 credit on next years taxes as well.

You May Like: How Many 100 Watt Solar Panels Do I Need

Future Of The Solar Tax Incentive

Right now, this solar incentive is being phased out, which means its value is steadily decreasing. Unless Congress renews the credit through the Build Back Better Act or other legislation, it will not be available to homeowners past 2023.

Heres an overview of what is currently planned for the future of the tax credit:

| Year Placed In Service |

| 10% |

What Is A Tax Credit

A tax credit is a dollar-for-dollar reduction in the amount of income tax you would otherwise owe. For example, claiming a $1,000 federal tax credit reduces your federal income taxes due by $1,000. The federal tax credit is sometimes referred to as an Investment Tax Credit, or ITC, though is different from the ITC offered to businesses that own solar systems.

Don’t Miss: How Does The Solar Investment Tax Credit Work

Start Your Solar Journey Today With Energysage

EnergySage is the nations online solar marketplace: when you sign up for a free account, we connect you with solar companies in your area, who compete for your business with custom solar quotes tailored to fit your needs. Over 10 million people come to the EnergySage Marketplace each year to learn about, shop for, and invest in solar. .

Bottom Line: What To Know About Federal Solar Tax Credits

The federal solar tax credit is a win for any qualifying individual or business installing a solar system on their property. The tax credit helps offset the cost of the system and can make renewable energy far more affordable and attainable to individuals who would like to live a more sustainable lifestyle.

- Article sources

- ConsumerAffairs writers primarily rely on government data, industry experts and original research from other reputable publications to inform their work. To learn more about the content on our site, visit our FAQ page.

Also Check: Where Can I Buy Solar Shingles

History Of The Solar Tax Credit

The Solar Tax Credit was created in 2005 and originally offered 30% tax credits. In 2020, the tax credit was lowered to 26%. In August 2022, the Inflation Reduction Act raised the Solar Tax Credit back to 30% for another 10 years.

The price of residential solar panels has steadily declined since the launch of the tax credit. According the the Lawrence Berkeley National Laboratorys Tracking the Sun report, solar panel costs have dropped by more than 50% in the last decade. So, the value of the Solar Tax Credit in 2022 is even greater than in past years.

Now Is The Time To Install Solar To Take Advantage Of The Solar Tax Credit

Any tax advisor will tell you that the government creates tax credits to motivate taxpayers to behave in a certain way, whether its giving to charity, purchasing a home, or installing solar panels on the roof of their residence. Often these actions benefit the greater community as a whole, so the government has its own motivation to provide incentives.

Renewable energy or clean energy is once such area, and the government provides an incentive for homeowners to bite the bullet in terms of paying to install solar energy , which otherwise might be cost prohibitive, by providing these homeowners with a tax credit.

Is installing solar panels worth it for the tax credit? According to some estimates, the average cost of installing solar panels on a personal residence was around $16,860, which would currently result in a tax credit of $4,618. Of course, that means you still have to pay thousands of dollars to have solar energy equipment installed, so a better question might be to consider whether or not the energy savings are worth it over time. According to some estimates, your solar panels will pay for themselves in three years. The answer really depends on your location, how much energy you use, and your energy bill. No matter the answer to any of those questions, the tax savings that solar panel installation can provide you with dont seem to have a cloud in sight.

Bonus Video

Read Also: Veranda 5×5 Solar Post Cap

Federal Tax Credit For Solar Attic Fans Extended

Good news for anyone considering a solar attic fan for their home. The federal tax credit that makes it a much more affordable option has been extended. Originally set to step down to a lower percentage tax credit in 2021, the 26 percent rate of 2020 has been extended through 2022.

What is the Investment Tax Credit?The investment tax credit, also referred to as ITC, allows you to apply a federal tax credit to your income taxes if you install a new solar energy unit on your home during the year. Depending on the year, you may experience different tax credits as the credit itself steps down to lesser credit amounts periodically.

Why the Solar Tax Credit is So Great for ConsumersThey offer you a dollar-for-dollar reduction in your tax liability. This means that if you have a tax credit worth $300 then your total tax bill is reduced by $300. This makes the purchase much better than a tax deduction, which only serves to reduce your taxable income. Its a good idea to work with a tax accountant who understands your individual financial and tax situation.

It is important to understand that only those who own their new solar systems qualify for the tax credit. If you lease your unit through a solar installer you will not qualify for the tax credit that allows you to roll over remaining tax credit amounts as long as the tax credit remains in effect.

|

Years |

What Is The Solar Tax Credit

The Solar ITC is a 26% tax incentive on your gross solar system cost.

The only requirements are that you:

Note, if your 26% tax credit is $6,000 total, and you only have $5,000 in personal income taxes one year, you can rollover the remaining $1,000 credit to your next years taxes. The federal government has already extended the incentive expiration date three times before. The most recent extension in 2020 added a 26% extension until 2022 and step down schedule that gradually phases out the credit over a few years. As of January 2021, we are now in the first slab of the tax credit step down with a 4% reduction from 30% to 26%.

Also Check: How To Become A Sole Proprietor In Texas

The Homeowners Guide To Energy Tax Credits And Rebates

When you file this year, its especially important to reap the benefits of your households energy-efficiency. There were a number of changes to the tax code for homeowners that took effect in 2019 and remain available for the 2021 tax year. Congress has yet to extend them into 2022, so we put together a list of some common home improvement and renewable energy tax credits that may help you save money on your 2021 tax return before these opportunities expire. Weve also included information on rebates available for energy-efficient appliance purchases to help you save money if you need or want to use your tax savings on energy-efficient appliances.

How Can I Estimate The Portion Of My Solar Roof That Could Receive The Tax Credit

Your Solar Roof Purchase Agreement provides an estimated allocation of components that may be eligible for a tax credit. This estimated allocation is not intended as tax advice you should discuss this allocation with a tax professional to determine the appropriate tax credit amount in your circumstance.

*The Consolidated Appropriations Act of 2021 signed December 27, 2020, provided a two-year extension of the Investment Tax Credit for solar. The dates above reflect the extension.

Recommended Reading: How Much Can Solar Panels Save Me