Is The Solar Itc Refundable

The solar ITC is not a refundable credit it can only be used against your organizations U.S. federal income tax liability.

However, the solar ITC may be carried back one year and forward up to 20 years for companies that dont have sufficient tax liability to offset for the tax year their solar energy system was placed in service.

A deduction is allowed for 50% of any portion of the solar ITC that remains unused after the 20-year carry forward period.

Using The Federal Tax Credit In Combination With Other Incentives

Aside from the ITC, there are several other solar incentives to consider like rebates, state-sponsored programs, and other tax credits depending on where you live. While some of these financial incentives may impact the ITC, others can be combined to lower the cost of going solar. Heres what you need to know about combining solar incentives with the federal ITC:

- Rebates from your utility company: As a general rule of thumb, subsidies from your utility company will be excluded from income tax returns. So, in this case, any utility rebate for installing solar would be subtracted from your system cost before you can calculate the tax credit.

- Rebates from the state:These types of rebates typically do not reduce your federal tax credit.

- State tax credit:If you get any state tax credit for your solar system, it will not decrease your federal tax credits. However, keep in mind that getting a state tax credit means that your taxable income on federal returns will be higher since you will have less state income tax to deduct.

- Payments from renewable energy certificates: Any time you receive money from selling renewable energy certificates, it will likely be considered taxable income that will increase your gross income. But, it will not reduce your tax credit.

Solar Tax Credit Limit

The best thing about these tax is that they are off-limits, which is a big encouragement for anyone who wants to convert to a solar energy system for their home or business.

It also means that the solar federal tax credit is a flat 26% regardless of the investment size. A flat solar investment tax credit rate makes it easier for businesses that want to scale up and increase their energy generation.

This presents a great opportunity, especially for states with no scarcity of solar energy. Likewise, it will allow homeowners to reduce their utility costs to get a decent return on their efforts for clean and green energy.

You May Like: How To Get Sole Custody In California

How Do Tax Credits Work For Solar

Asked by: Dr. Alf Schamberger

The investment tax credit , also known as the federal solar tax credit, allows you to deduct 26 percent of the cost of installing a solar energy system from your federal taxes. The ITC applies to both residential and commercial systems, and there is no cap on its value.

the federal government will apply the tax credit to a tax refund26% of your total project costsa one-time credit$3,12027 related questions found

Who Is Eligible For The Itc

If you meet the following criteria, you may be eligible to benefit from the solar investment tax credit:

Don’t Miss: What Is The Difference Between Sole Proprietor Llc And Corporation

Calculating Your Federal Tax Credit

Calculating gross system cost EX: = gross cost

Federal tax credit = gross cost x 26%

Please note that the ITC is different from a refund. A refund offers taxpayers money back following the tax cycle. Conversely, a tax credit is an amount of money that may be used to offset your tax liability in the present or future.

So How Do I Claim The Federal Solar Tax Credit

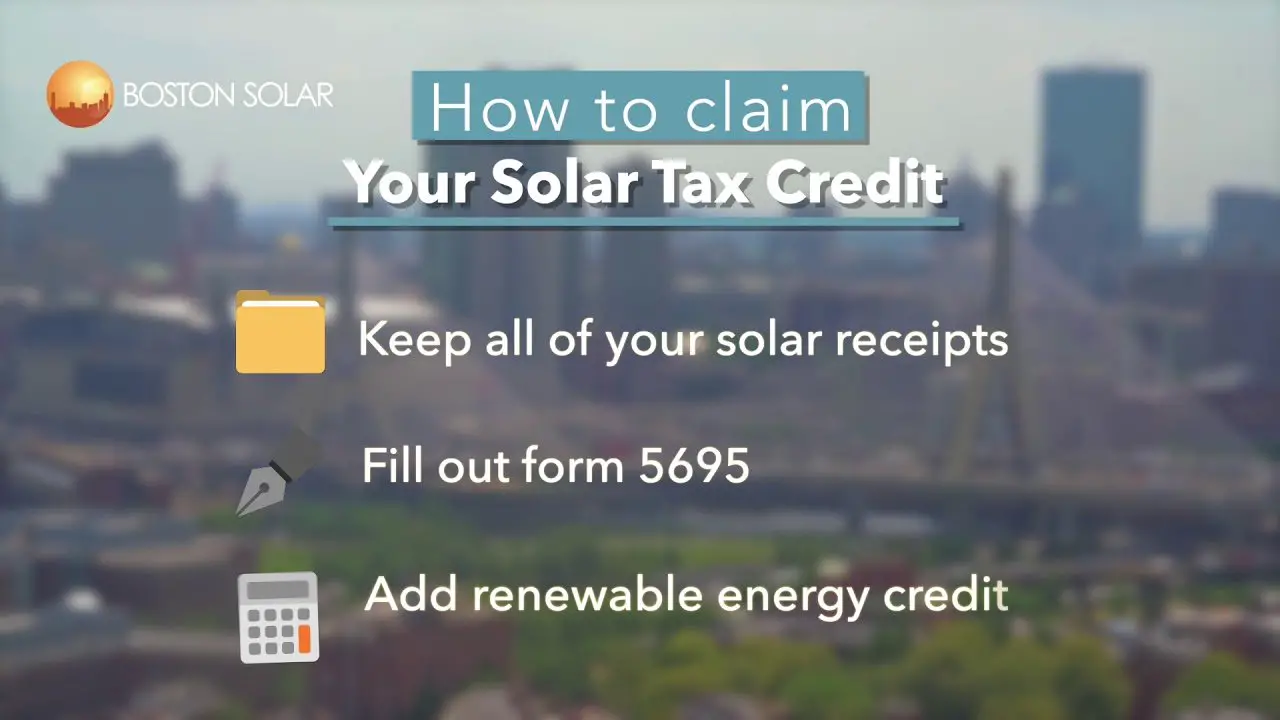

Simple. You claim the Federal tax credit for solar when you file your yearly Federal income tax return. Well, actually, its only sort of simple

Seek professional tax advice first of all, to ensure that you are eligible for the credit. Then complete IRS Form 5695 Residential Energy Credits and include the final results of that form on your IRS Schedule3/Form 1040. Dont forget to attach Form 5695 to your Federal tax return. Instructions on filling out Form 5695 are available at .1 2

Recommended Reading: How Much Does The Average Solar Panel System Cost

All About The Solar Energy Investment Tax Credit

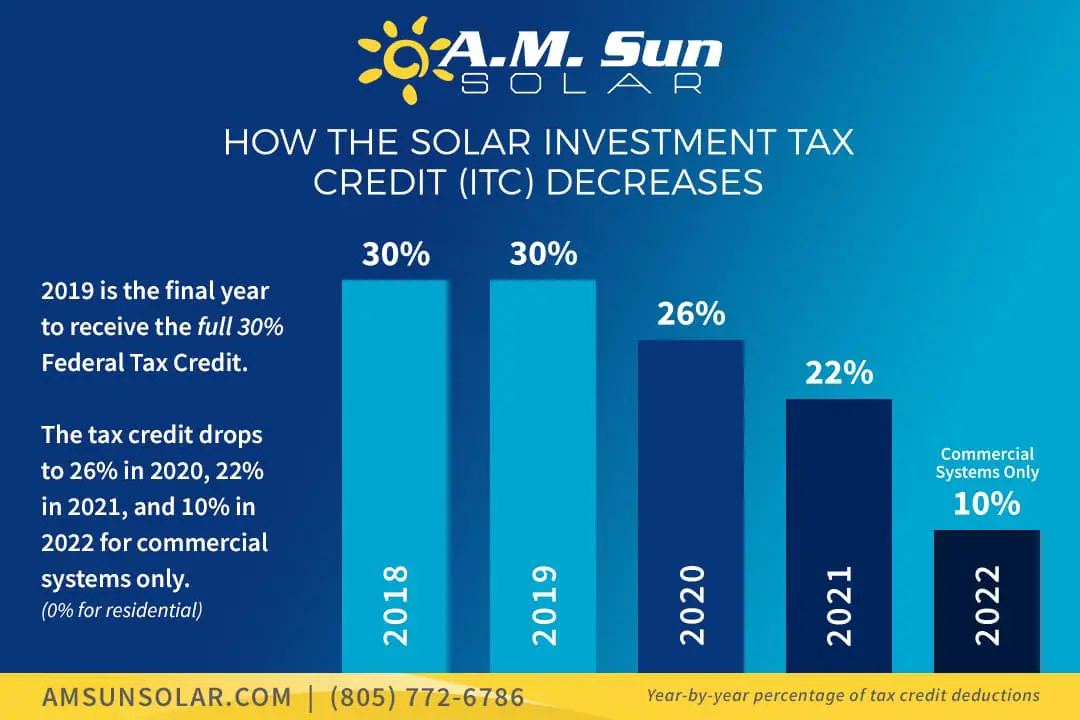

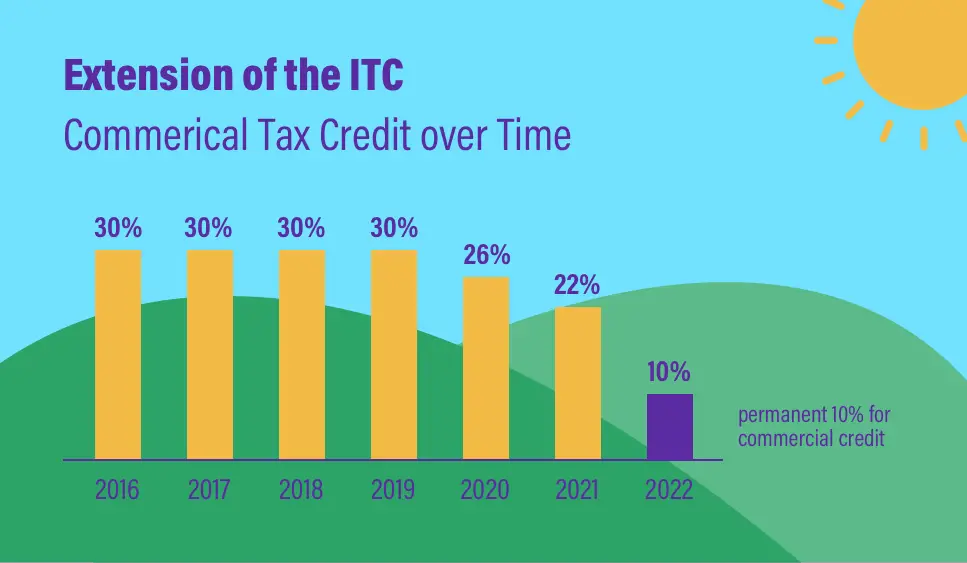

The solar energy investment tax credit has been a major driver of renewable energy uptake across the U.S. since its origination in 2006. Extended two times and reshaped in 2015, the 30% federal ITC is one of the most important federal policy mechanisms to support the deployment of solar energy in the United States. Other incentives have helped along the way as well.

In 2015, many stakeholders successfully advocated for an extension and eventual phase-out of the ITC. Under tax reform in 2018 , the commercial and residential renewable energy ITCs were maintained and the long-term extension through 2021 provided market certainty for companies.

This will allow them to develop long-term investment strategies to ease off the dependency of the credit and rely on margins earned through broader adoption and continued installation growth.

This article pulls on my experience and knowledge acquired from 5 years working in a utility’s regulatory department. It explores the solar energy investment tax credit and its effects on the solar industry, other incentives used to enable solar energy buildout, the cost of solar, and a brief overview of how solar technologies work.

You may come to find solar to be the power generation technology of the future.

What is a Tax Credit?

What is the Solar Energy Investment Tax Credit?

Am I Eligible For The Federal Solar Tax Credit

Any taxpayer who pays for a solar panel installation can claim the solar tax credit, as long as they have tax liability in the year of installation. You must be the owner of the solar panel system in order to qualify for the tax credit, meaning if you lease your system you are not eligible.

When leasing a system, the solar company will get the tax credit instead of you. We recommend you buy your system outright if you can afford to. The money you save in the long run is more. Leasing also makes it harder to sell your home, as buyers don’t want to take over a 25-year lease.

Don’t Miss: What Is The Average Cost Of A Home Solar System

Federal Solar Tax Mechanism

Those eligible for the solar tax can avail a 26% credit on their solar panel cost. These taxes are claimable during the year when you install the solar panels.

This means that you get credit for installing solar panels if you have purchased them. The amount of tax eligible applies to:

- Cost of equipment

- Cost installation

The tax applies to your income tax liability, and you can roll it over for five years.

The Itc Is Only Available To Solar System Owners If You Decide To Lease Your Solar System You Wont Be Eligible For The Federal Tax Credit

The Energy Policy Act stipulates that only solar system owners are eligible for a tax credit. If you purchase your solar system outright, youll receive the credit. However, many solar companies offer solar lease options. Should you choose to lease your solar system, then you will not receive the solar tax credit.

In many cases, homeowners dont have the upfront cash to buy a solar system. But there are solar loans available that allow you to pay off the system over time, meaning youll still get the tax credit. Again, if you lease your system, you will not be eligible for the solar investment tax credit.

If you have further questions about the solar investment tax credit, and want to know your purchase and lease options for installing solar on your home or business, Ilum Solar can help! Give us a call and well be happy to answer any questions that you may have.

Read Also: Do Solar Panels Work With Snow On Them

Is The Solar Energy Tax Credit Refundable

The ITC is a nonrefundable credit. However, according to Section 48 in the Internal Revenue Code, the credit can be carried back one year, or carried forward in the next 20 years.

Therefore, if you dont have a tax liability this year, but you had one last year, youll still be able to claim your credit or if you dont have one this year but will at one point in the next two decades, your credit will still be available for claiming.

How Do Other Incentives I Receive Affect The Federal Tax Credit

For current information on incentives, including incentive-specific contact information, visit the Database of State Incentives for Renewables and Efficiency website.

Rebate from My Electric Utility to Install Solar

Under most circumstances, subsidies provided by your utility to you to install a solar PV system are excluded from income taxes through an exemption in federal law. When this is the case, the utility rebate for installing solar is subtracted from your system costs before you calculate your tax credit. For example, if your solar PV system was installed before December 31, 2022, cost $18,000, and your utility gave you a one-time rebate of $1,000 for installing the system, your tax credit would be calculated as follows:

0.26 * = $4,420

Payment for Renewable Energy Certificates

When your utility, or other buyer, gives you cash or an incentive in exchange for renewable energy certificates or other environmental attributes of the electricity generated , the payment likely will be considered taxable income. If that is the case, the payment will increase your gross income, but it will not reduce the federal solar tax credit.

Rebate from My State Government

0.26 * $18,000 = $4,680

State Tax Credit

For example, the net percentage reduction for a homeowner in New York who claims both the 25% state tax credit and the 26% federal tax credit for an $18,000 system is calculated as follows, assuming a federal income tax rate of 22%:

0.26 + * = 45.5%

+ = $4,680 + $3,510 = $8,190

Don’t Miss: How Much For Sole Proprietorship

Solar Renewable Energy Certificates

Some states require utilities to generate a certain percentage of their electricity from solar power. If you live in one of these states, your solar power system will generate Solar Renewable Energy Certificates based on the amount of electricity produced by your solar panels. Utilities may have programs under which they may buy your SRECs so that they can count your solar power toward their requirements. Some states and utilities offer Performance-Based Incentives , which pay solar-powered homeowners a per-kilowatt-hour credit for the electricity the systems they own produce. Certain PBI programs require that you install equipment manufactured in your state to qualify. Unlike SRECs, PBIs dont have to be sold through a market, and incentive rates are determined when the system is installed. PBIs may replace or exist alongside net metering policies.

Now, back to those Federal tax credits again.

When Does The Federal Solar Tax Credit End

Congress recently passed an extensive omnibus spending package that included $900 million in coronavirus relief and part of that relief included an extension for the solar tax credit. Under the new legislation, the residential solar tax credit will not expire after 2021. Instead, it will continue at a rate of 26 percent for an additional two years, helping make solar power more affordable to all.

Also Check: How To Be A Solo Practitioner Lawyer

Ready To Start Your Commercial Solar Project

As you can see, if youre buying a solar energy system, timing is everything.

We know investing in solar energy is an important financial decision for your business, and our team is here to help guide you through the process.

Fill out the contact form below or call 844.732.7652 during business hours, and one of our solar energy advisors will talk to you about your ITC eligibility.

Line 41200 Investment Tax Credit

You may be eligible to claim an investment tax credit if any of the following applies:

- you bought certain new buildings, machinery, or equipment and they were used in certain areas of Canada in qualifying activities such as farming, fishing, logging, manufacturing, or processing

- you have done work that qualifies for scientific research and experimental development tax incentives

- you employ an eligible apprentice for which you want to claim an Apprenticeship Job Creation Tax Credit

- you have unclaimed credits earned in the last 10 years

- you have received a T3 slip, showing an amount inbox 41

- you have received a T5013 slip, with an amount showing in boxes 186 or 194

- you have received a T101 slip, with an amount showing in box 128

- you have a partnership financial statement that allocates to you an amount that qualifies for this credit

- you have an investment in a mining operation that allocates certain exploration expenditures to you

- you have created licensed child care spaces for the children of your employees

Certain renounced Canadian exploration expenses qualify for the ITC. You can claim this credit if you received Form T101, Statement of Resource Expenses, or a T5013 slip, Statement of Partnership Income, with an amount in box 194. For more information, see Form T2038, Investment Tax Credit .

Recommended Reading: Can You Write Off Solar Panels On Your Taxes

How Big A Tax Credit Can I Get For Going Solar

How many home improvements can you name where someone else will essentially refund up to one-quarter of the total cost of the equipment for you including the cost of installation at the end of the year? Not many, I bet.

But thats the case right now with installing a solar system on your home. You may be able to claim the current Federal residential energy tax credit of up to 26% of the cost of energy-saving improvements to your home on your taxes for 2021! 1

Unfortunately, this is a tax credit that is scheduled to expire. As the chart below illustrates, this solar tax credit will continue at the 26% level only through the end of next year. Thereafter it plummets, and disappears entirely in 2024.

The takeaway from this is clear: Its time to start making some decisions about going solar while the Federal tax credit is still on the table.

And the best way to get you started is by sharing all we know about the solar tax credits you may qualify for if you choose to go solar. 4

History Of The Solar Investment Tax Credit

In the early days of solar energy, residential systems were far more expensive than they are now. By many homeowner standards, however, theyre still expensive today. For example, in 2009, it cost $8.50 per watt to install solar panels the current cost per watt, as of publishing, is about $2.40 to $3.22.

This point-of-entry cost into the world of renewable residential solar power dramatically limited the number of homeowners who could take advantage of solar for their home.

The solar investment tax credit was established by the Energy Policy Act of 2005, which established standards for renewable fuels, mandated an increase in the use of biofuels and established renewable energy-related tax incentives.

Under this law, the original policy was set to expire at the end of 2007. However, the solar ITC has been so popular that its expiration date has been extended multiple times.

Solar panel costs have decreased dramatically in the last 20 years, but the ITC can still save individuals and businesses a great deal on their federal taxes.

Today, solar systems are far less expensive due to changes in the industry and the manufacturing of certain parts that make up the solar system. Solar panels, lithium batteries and inverters are all far less expensive to make and buy now than they were in those early days.

Recommended Reading: Do Solar Screens Save Money

What Are Other Incentives To Make Solar Energy Attractive

Prior to 2000, most companies, organizations, or governments installed solar panels for research and development or demonstration projects. These projects were small in scale due to very high costs associated with the technology at the time.

However, in the early 2000s, supportive policies came into play in Europe and the U.S. which began to bring costs down. In Europe, particular countries opted to drive the adoption of renewable energy sources with feed-in tariffs .

These payment mechanisms operate like long-term fixed price power purchase agreements and last 10 25 years with a price well above the market. These agreements drove significant renewable energy buildout.

So What Am I Waiting For

The phrase theres no time like the present certainly applies here.

At Sunnova, we are prepared to help you with not just the scientific and mechanical aspects of powering your home with clean, renewable solar energy, we hope the information weve presented here will help you understand how to qualify for all of the financial benefits you are entitled to. 1

Sign up to get a custom quote today! Yes, I Want A Free Quote

1. Sunnova makes no guarantees regarding eligibility of any of the systems costs for tax benefits. Sunnova does not provide tax advice. Contact your personal tax advisor for eligibility requirements.2. About Form 5695, Residential Energy Credits:.

You May Like: How Many Watts In A Solar Panel