Employee Component: Elective Deferral

Now that weve defined earned income for contribution limit purposes, we can get into the math.

The first component of solo 401 contributions is the elective deferral available to you as your own employee.

For 2020, you can contribute up 100% of your earned income as an employee up to:

- $19,500 for those under 50 years of age as of December 31, 2020, or

- $26,000 for those 50 years of age or older as of December 31, 2020.

It is important to note that if your self-employment income is a side hustle, and if you contribute to your 401 plan through your day job, then you must reduce the employee elective deferral amounts above by any amounts you have contributed to your corporate 401 plan through your employer.

What if you contribute more than is allowed? If you make a mistake and contribute more than the allowable amounts, you can withdraw the excess by April 15, 2021, without penalty, though you will still be subject to tax on any earnings on those overcontributions.

Does My Current Employers 401k Plan Have Any Effect On My Solo 401k Plan Such As Contribution Limit

In your solo 401k plan, there are two types of contributions. The first contribution is for your role as employee in your business, for which the limit is $19,500 . The second type of contribution is for your role as employer which can be 20% of your earnings from self-employment. Added together can total up to a maximum of $57,000 .

When you look at your total contribution as employee, that limitation thats either $19,500 or its $26,000 if youre over age 50. Any contributions you have into your employers 401k plan at another company , need to be factored in within the $19,500 or $26,000 limit.

For example: If you contribute $10,000 at your employers 401k plan and if youre over the age of 50, you can contribute $16,000 as an employee to your Solo 401k plan.

How To Open A Solo 401

You can open a solo 401 at most online brokers, though youll need an Employer Identification Number. The broker will provide a plan adoption agreement for you to complete, as well as an account application. Once youve done that, you can set up contributions. Youll have access to many of the investments offered by your broker, including mutual funds, index funds, exchange-traded funds, individual stocks and bonds.

If you want to make a contribution for this year, you must establish the plan by Dec. 31 and make your employee contribution by the end of the calendar year. You can typically make employer profit-sharing contributions until your tax-filing deadline for the tax year.

Note that once the plan gets rocking, it may require some additional paperwork the IRS requires an annual report on Form 5500-SF if your 401 plan has $250,000 or more in assets at the end of a given year.

If you need help managing the funds in your solo 401, robo-advisor Blooom will manage your 401 at your existing provider. If you want even more comprehensive financial help, you might opt for an online planning service. Companies such as Facet Wealth and Personal Capital offer low-cost access to human advisors and provide holistic guidance on your finances, including how to invest your 401.

You May Like: Does Installing Solar Panels Increase Home Value

So Can I Invest In Real Estate In My Solo 401

Yes, you can, and this is a very popular investment choice for solo 401 owners.

Just make sure that you do not engage in any self-dealing / prohibited transactions in your real estate ventures.

For example, personally guaranteeing any loan taken on a property owned by your solo 401 would be considered self-dealing is typically done through a higher-interest non-recourse loan, meaning that the creditor cant go after you personally).

Also, using a property owned by your solo 401 would also be considered self-dealing.

There are some other traps that one can fall in when investing in real estate through a solo 401, so be sure to work with a qualified professional who can guide you along the way.

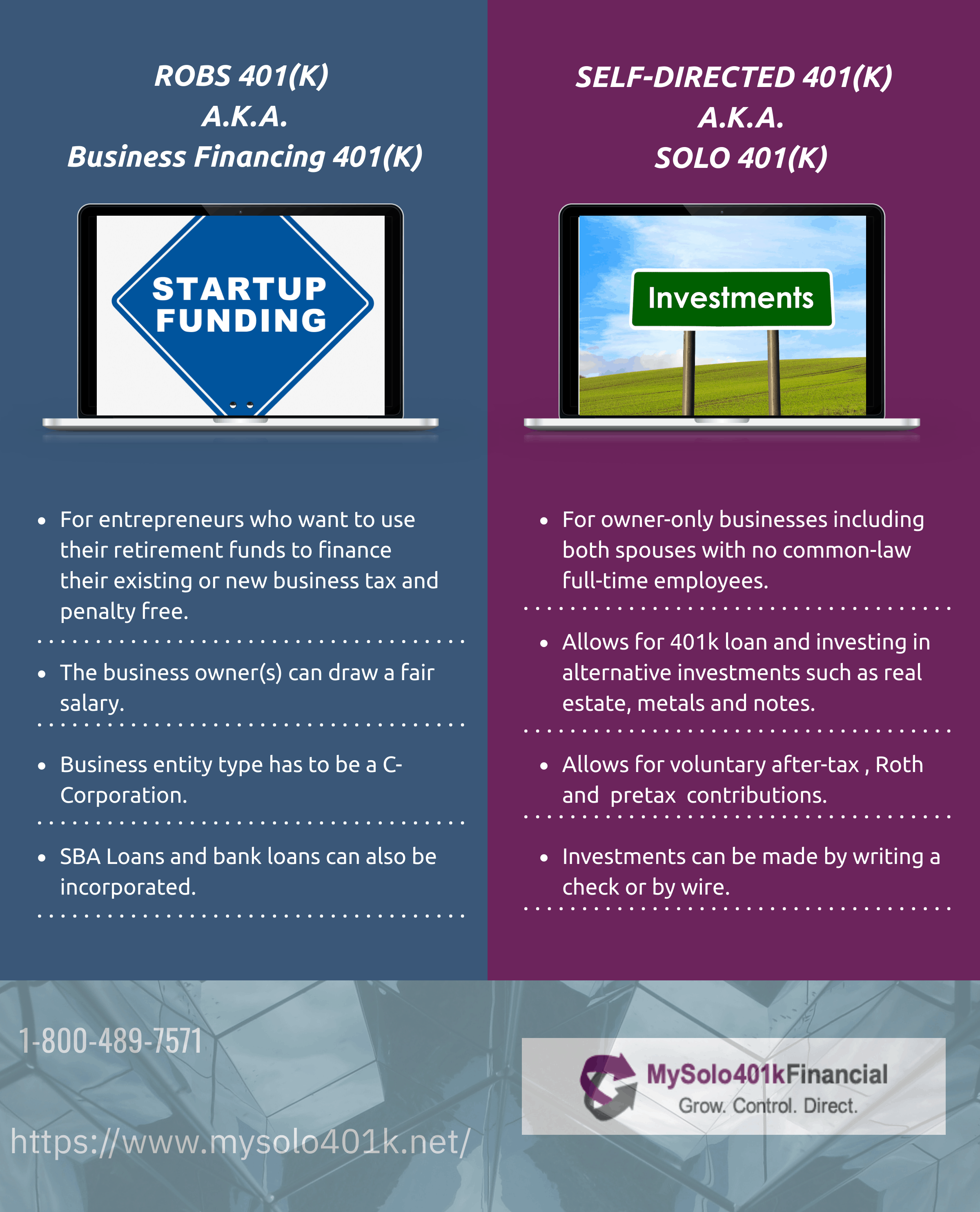

Third Party Solo 401k Providers

If you need something a little more robust that the free prototype plans these five brokerage firms offer, then you need to find a third party service that will create the plan documentation for you.

Some of the common reasons why you’d consider using a third-party service to create your solo 401k documentation:

- You want a choice in brokerage

- You want to invest in alternative assets such as real estate, startups, cryptocurrency, promissory notes, tax liens, precious metals, and more.

- You want checkbook control over your 401k

- None of the prototype providers matches exactly what you’re looking for with options

We’re not going to go in-depth on these providers because this section effectively becomes al-la-carte with what you can get and pay for. I just wanted to list some of the most popular third party plan providers that you can reference in your search for the best plan.

Remember, just because you go with a third party provider also doesn’t mean you can’t invest at your favorite firm. For example, you can create a third party solo 401k and then have that 401k held at Fidelity. This gives you access to all of Fidelity’s investment choices, but your options are created by the plan, and NOT Fidelity.

Also, you can use these plans to execute a Mega Backdoor Roth IRA. In fact, several of these companies specifically advertise that they offer it.

This isn’t an exhaustive list. There are also local firms in most areas that can create 401k plan documentation as well.

Read Also: How Do Solar Pool Heaters Work

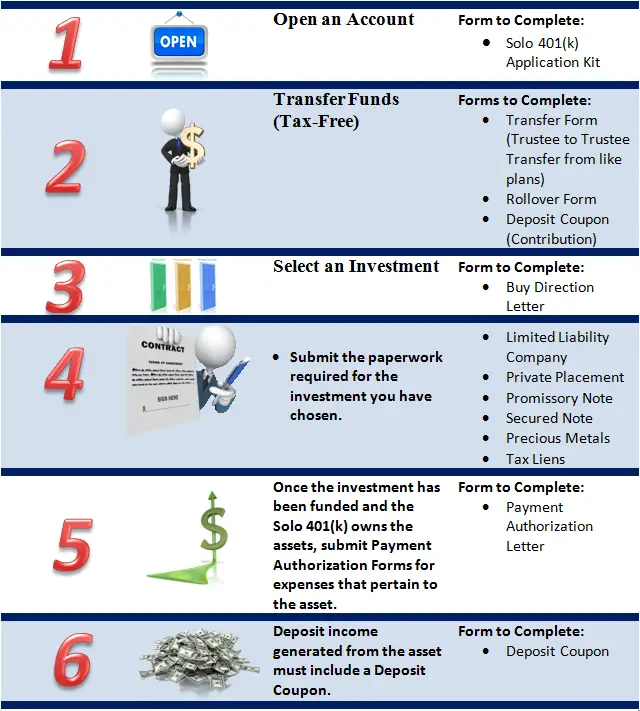

How To Set Up And Start A Solo 401

Opening a solo 401 is surprisingly simple, and the fees arent terribly onerous either, especially if your needs are simple. Now, a solo 401 is not as inexpensive to set up as an IRA which is typically free unless self-directed but you still dont have to break the bank to set up your plan either.

Heres how to open a solo 401:

Contribute To Your Solo 401

Once you set up the Solo 401 account, you can fund the account using a check, wire transfer, or rollovers from old 401s. If the plan allows, you can decide to make monthly installments or one lump sum payment. You can make employee contributions and profit sharing contributions to the Solo 401 up to a contribution limit of $58,000 in 2021.

Read Also: How To Hook Up Solar Panels To Your Home

Best For Account Features: E*trade

E*TRADE

E*TRADE gives you more flexibility with its solo 401 offering. E*TRADE supports both traditional individual 401 plans and Roth 401 plans. You are also able to take out a loan on your 401 balance at E*TRADE, all of which makes E*TRADE best in our review for account features.

-

Choose between traditional or Roth 401 contributions

-

Support for 401 loans

-

No recurring account fees, and commission-free stock and ETF trades

-

Now run by Morgan Stanley, meaning changes are likely

-

High fee for broker-assisted trades and some mutual fund trades

E*TRADE has a long history of supporting online investors, with its first online trade placed in 1983. It is now a subsidiary of Morgan Stanley after an acquisition that closed in October 2020. At E*TRADE, you can choose between traditional and Roth individual 401 plans, which allows you to choose between pre-tax and post-tax contributions. You can also take a 401 loan from an individual 401 account at E*TRADE.

There are no listed fees to open or keep a solo 401 account at E*TRADE. Stock and ETF trades are commission free. The brokerage also supports over 7,000 mutual funds on its no-load, no-transaction-fee list. E*TRADE supports options, futures, and fixed-income bonds and CDs, as well.

Read our full E*TRADE review.

Solo 401 Contribution Limits

The total solo 401 contribution limit is up to $58,000 in 2021 and $61,000 in 2022. There is a catch-up contribution of an extra $6,500 for those 50 or older.

To understand solo 401 contribution rules, you want to think of yourself as two people: an employer and an employee . Within that overall $58,000 contribution limit in 2021 and $61,000 in 2022, your contributions are subject to additional limits in each role:

-

As the employee, you can contribute up to $19,500 in 2021 and $20,500 in 2022, or 100% of compensation, whichever is less. Those 50 or older get to contribute an additional $6,500 here.

-

As the employer, you can make an additional profit-sharing contribution of up to 25% of your compensation or net self-employment income, which is your net profit less half your self-employment tax and the plan contributions you made for yourself. The limit on compensation that can be used to factor your contribution is $290,000 in 2021 and $305,000 in 2022.

Keep in mind that if youre side-gigging, employee 401 limits apply by person, rather than by plan. That means if youre also participating in a 401 at your day job, the limit applies to contributions across all plans, not each individual plan.

Read Also: When Do Sole Treadmills Go On Sale

How To Lower Your Small Business Taxes With A Solo 401

Saving Solo: Keep reading to find out how you can reduce your small business taxes with a 401 Retirement Plans for the Self-Employed. Often called a Solo 401 or Individual 401 this tax saving retirement plan can help you slash your tax bill this year and into the future. Not to mention stay on track for your retirement goals. California business owners in the highest income tax brackets could save several hundred thousand dollars in taxes over the next decade when maxing out a solo 401.

What solopreneurs, freelancers, and small business owners need to know and need to do to fund their retirements utilizing a solo 401 Plan. You wont get a current tax deduction but a Roth Solo 401 can help lower your taxes in retirement.

Update: Contributions limits have increased for 2022 to a total of $61,000. Plus an additional $6500 catch-up contribution if you 50 or older. The TCJA Tax Plan makes these plans even more valuable for many small business owners. Defined Benefit Contribution Limits have also increased for 2022. Talk to your Fabulous Financial Planner and CPA about the 20% pass-through tax break.

If nothing else these retirement plans can help you minimize your current tax bill. Do you really want to write a check to the IRS?

Choose Your Solo 401 Provider

The first step in setting up your solo 401 then is to choose your solo 401 provider, who will set up your documents and adoption agreement.

As you do your research, you will find that there are a wide range of providers at a variety of price points.

In general, your account and investment options will be more limited the less expensive your provider, while more expensive providers offer greater flexibility and more investment options for your account.

Also Check: How Many Solar Panels Do I Need For A Camper

Here’s How To Plow Some Of Your Profits Into Retirement Savings

Eric is currently a duly licensed Independent Insurance Broker licensed in Life, Health, Property, and Casualty insurance. He has worked more than 13 years in both public and private accounting jobs and more than four years licensed as an insurance producer. His background in tax accounting has served as a solid base supporting his current book of business.

Just because you are a one-person outfit, a freelancer, or an independent contractor doesn’t mean you have to do without a retirement savings plan or the tax benefits that accompany them.

One option If you are self-employed is the solo 401, also known as an independent 401 plan. In fact, the Solo 401 has some benefits over other types of retirement accounts available to the self-employed.

Do You Qualify For A Solo 401k

Solo 401 Account: Opening Solo 401 Next Steps: The Solo 401 is an Employee Benefit Plan that is exclusively for business owners that have no full-time employees besides themselves and a spouse. The Plan is adopted by a company, not an individual, that has earned ordinary income from the sale of goods or services.

Step 1: Select the plan that works best for you

Full Service $995

- Includes 60-minute consultation with a KKOS Associate Attorney

- Plan Set-Up with IRS Approved Documents and Plan EIN

- How-to Plan Binder

- Includes Plan Set-Up with IRS Approved Documents and Plan EIN

- How-to Plan Binder

- Includes Plan Set-Up with IRS Approved Documents and Plan EIN

- How-to Plan Binder

Step 2: Select your annual account

Custodial Account Option$350 for 1 account, $250 for eachadditional/annually

- Receipt of IRS Plan Amendments so that your Plan stays in compliance with the IRS and the DOL

- Directed Trust Company will handle your record keeping and the IRS Filings

- You can obtain checkbook control via a Trust Checking Account or investment Entity

Annual Compliance Plan $150/annually

- Receipt of IRS Plan Amendments so that your Plan stays in compliance with the IRS and the DOL

- Immediate checkbook control via a Trust Account at a bank of your choice

- You will be responsible for your own record keeping and IRS Filings

You May Like: How Many Kwh Should Solar Panels Produce

Solo 401k Contribution Calculator

Now is the time to take a close look at what a Solo 401k can do for your future and your retirement. You start paying much less in taxes today while growing those savings into a wealthy retirement account for your golden years.

Use this Solo 401k Contribution Comparison calculator to estimate the potential contribution that can be made to your Solo 401k plan by comparing it to Profit Sharing, SIMPLE, or SEP plans.

Setup Your Solo 401k Today

Others imitate, but as the #1 Solo 401k provider we innovate. You can be a freelancer, independent contractor, or small business owner. Your business can be structured as a sole proprietorship or a formally structured LLC, C Corp, or S Corp. All of these meet the IRS qualifications for a Solo 401k as long as there are no outside full-time employees in any business owned by you and/or your spouse.

How To Start A Solo 401

Follow the steps below if you’re interested in opening up a solo 401.

Once you’ve done these four things, you may begin choosing your investments and making regular contributions to your account. You can also roll over funds from other retirement accounts in your name if you choose.

You must make your solo 401 employee contributions by Dec. 31, but you have until the tax filing deadline for the year — usually April 15 of the following year — to make your employer contribution.

One last thing to note is that if you have $250,000 or more in your solo 401 by the end of the year, you’re required to submit a Form 5500-EZ information return to the IRS with your taxes for that year so you don’t run into trouble with the federal government.

Don’t Miss: Is An Inc A Sole Proprietorship

The Results Can Be Pretty Incredible

Of course, many self-employed people don’t have the ability to contribute the maximum amount allowed to a solo 401. However, even modest contributions add up over time.

For example, let’s say that you’re self-employed and that you’ll have $80,000 in net self-employment income for 2021. You decide to set aside a total of 10% of your net self-employment income in a solo 401. Not only could this reduce your taxable income by $8,000 for the year, but if you repeat the process every year, you could end up with a retirement nest egg of more than $928,000 after 30 years — and that assumes just 2% annual income increases and a historically conservative 7% annual rate of return.

Imagine if you decided to invest even more. With a solo 401, you can dramatically reduce your taxable income while building up a million-dollar nest egg.

Solo And 401 Rules When You Have Employees And Multiple Businesses

A 401 is a great benefit normally associated with large companies where the employee makes contributions and the employer offers a match. The contribution limits are high and can allow for significant tax deferral on the income you earn each year. What a lot of people may not know is that you dont have to be a large company to have a 401 plan. In fact, you can be the only employee in your own business and have a retirement plan.

If it is just you in your business, your company can start a retirement plan known as a solo 401. The solo 401 allows you to adopt a retirement plan and make personal as well as company contributions to the plan for yourself and any of the owners of the company.

- You must have a business generating ordinary income to make to have a 401 plan.

- You can personally contribute up to $19,000 to the plan.

- Your company can contribute up to 25% of the income it pays you.

- For 2019 the total max 401 contribution is $56,000.

The 401 plan can be self-directed, which means you can invest the funds in almost any opportunity you find . The 401 also has a loan provision allowing you to borrow funds from the plan and use them for anything you want.

What If I have Multiple Businesses With Only Employees in Some?

Controlled Group Rules

| 100% |

Also Check: Should I Form An Llc Or Sole Proprietorship