Is The 30% Investment Tax Credit Refundable

Unlike some other tax credits, like the earned income tax credit, the 30% solar ITC is not refundable. As a taxpayer, you must have a tax liability to offset to claim the ITC. The unused portion of the credit can carry over to future tax years for up to five years.

For non-profits or government agencies which have no tax liability, they currently cannot take advantage of the ITC directly. However, some have partnered with third-parties who have a tax liability and can take advantage of the ITC.

How Do I Make Sure Im Eligible To Claim The Solar Tax Credit

To be on the safe side, your solar project should be fully installed and paid for before 2022 to be absolutely certain that you can claim the tax credit in 2022s taxes.

This isnt a concern in early January 2021, but the urgency increases towards the end of 2022.

Even though physically installing a solar system usually does not take more than a single day, many homeowners do not realize that a solar project may take weeks to complete after contract signing. This is due to factors such as permitting, financing approval, utility approval, and so on. Read more about the solar installation process here.

Therefore, to be 100% sure that you can claim the 26% ITC, the sooner you move forward with your project, the better.

Towards the end of 2022, as word begins to spread about the incentive stepping down, solar installers will likely get busier and busier, meaning your installation may be scheduled farther out than normal.

We Hope You Enjoyed Our Solar Tax Credit 2022 Guide

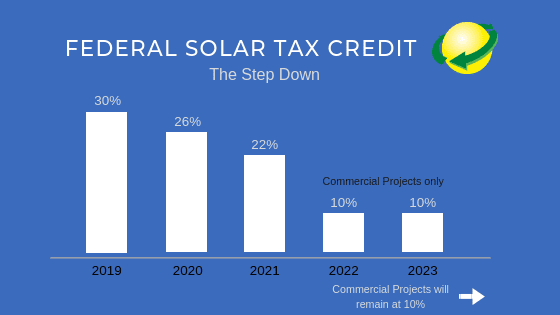

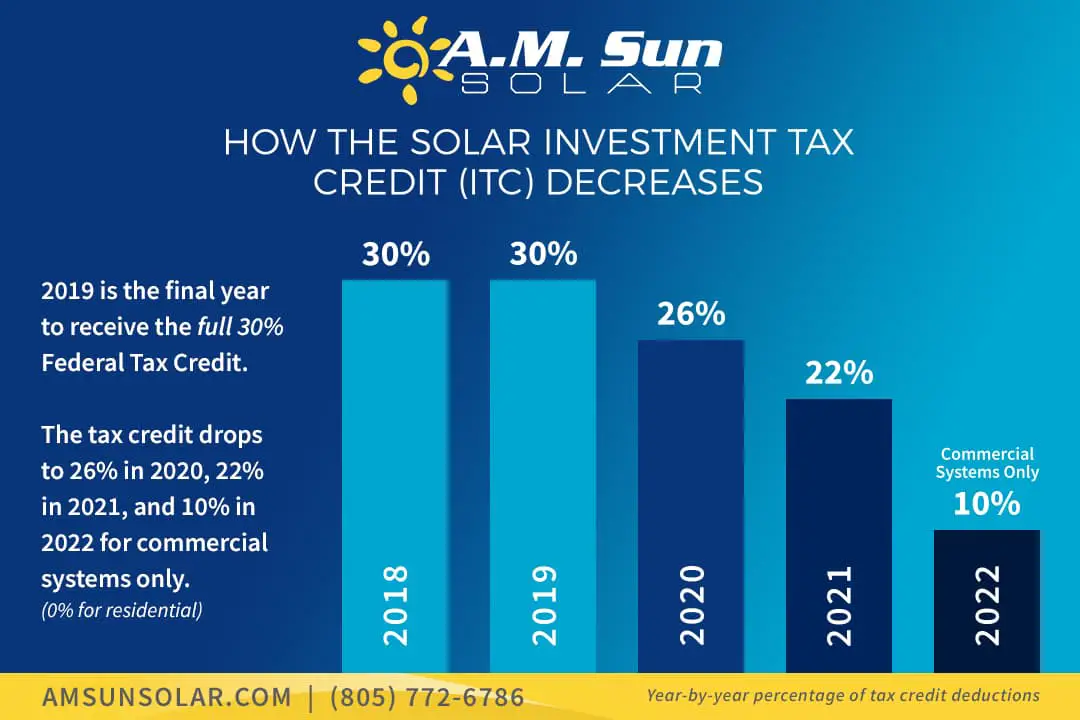

Solar tax credits are still available to taxpayers in 2022. However, they will reduce from 26% of the total cost of installing solar panels to 22% by 2023. Then, in 2024 they will no longer be available to residential taxpayers.

Are you considering going solar-powered this year? If so, you must do so before the end of December 2022. This will ensure that you receive solar tax credit 2022 for the full 26%.

Dig a little deeper into your state solar tax credit offerings. You may find that solar rebates or other solar incentives are available to you, which will further reduce the cost of your solar energy system!

We hope you enjoyed reading this solar tax credit 2022 guide. Read more helpful guides from Tax Savers Online!

Read Also: Is Solar Worth The Investment

What Are Other Incentives To Make Solar Energy Attractive

Prior to 2000, most companies, organizations, or governments installed solar panels for research and development or demonstration projects. These projects were small in scale due to very high costs associated with the technology at the time.

However, in the early 2000s, supportive policies came into play in Europe and the U.S. which began to bring costs down. In Europe, particular countries opted to drive the adoption of renewable energy sources with feed-in tariffs .

These payment mechanisms operate like long-term fixed price power purchase agreements and last 10 25 years with a price well above the market. These agreements drove significant renewable energy buildout.

Am I Eligible For The Federal Solar Tax Credit

Any taxpayer who pays for a solar panel installation can claim the solar tax credit, as long as they have tax liability in the year of installation. You must be the owner of the solar panel system in order to qualify for the tax credit, meaning if you lease your system you are not eligible.

When leasing a system, the solar company will get the tax credit instead of you. We recommend you buy your system outright if you can afford to. The money you save in the long run is more. Leasing also makes it harder to sell your home, as buyers don’t want to take over a 25-year lease.

Also Check: Can You Put Pine Sol Down The Drain

Whats Covered By The Tax Credit

Homeowners who leverage the 26 percent ITC can plan to see the following covered:

- Cost of solar panels

- Labor costs for installation, including permitting fees, inspection costs, and developer fees

- Any and all additional solar equipment, like inverters, wiring, and mounting hardware

- Home batteries charged by your solar equipment

- Sales taxes on eligible expenses

How Other Solar Incentives Affect How Much You Can Get Back

Along with the federal solar tax credit, there are a number of rebates, programs and state tax incentives that you may be eligible for depending on where you live. In some cases, these other financial incentives may impact your federal tax credit. Here’s what you should know:

- Rebates from your utility company: Typically, subsidies from your utility company are excluded from income tax returns. In these situations, the rebate for installing solar must be subtracted from your system cost before you can calculate your tax credit.

- Rebates from state-sponsored programs: Rebates from the state government generally do not reduce your federal tax credits.

- State tax credits: Any state tax credits you get for your residential solar system will not decrease federal tax credits. With that said, getting a state tax credit means the taxable income you report on your federal returns will be higher, as you now have less state income tax to deduct.

- Payments from renewable energy certificates: Any payments you receive from selling renewable energy certificates will likely be considered taxable income. As such, it will increase your gross income, but will not reduce your tax credit.

You May Like: Should You Clean Solar Panels

How Does The Solar Tax Credit Work In 2021

The federal solar tax credit is the most popular financial incentive for homeowners looking to go solar. The 26% tax credit is a dollar-for-dollar reduction of the income tax you owe. Many homeowners think they are not eligible for the solar tax credit because they dont have an additional tax bill at the end of the year.

This is not the case, the federal solar tax credit can get back a refund of the taxes you have already paid out of your weekly or fortnightly paycheck. Also, if you dont have enough tax liability to claim the credit in that year, you can roll over the rest of your credits to future years.

Who Can Claim The Solar Tax Credit

In the United States, alcohol consumption is limited to recreational use. As a recipient of the federal renewable energy tax credit for the household photovoltaic system, the following are required: Your home must belong to you . Its imperative you own and operate your solar panels before buying one. For new or used solar panels, you must own them.

Recommended Reading: How Do I Find Out Who Installed My Solar Panels

Tax Incentives Tax Credits And Rebates In Texas*

Incentive

Value

Federal Solar Investment Tax Credit **

The 26% federal solar tax credit is available for a purchased Texas home solar system installed by December 31, 2022.6

TXU Energy Renewable Buyback Plan

Bill credits for the excess solar power a home solar panel installation creates.7

Solar Energy System Property Tax Exemption

Property tax exemption on the added home value from the installed solar panels in Texas.8

Local Utility Company Solar Rebates

Rebate to reduce solars up-front cost or after systems installation.9,10,11,12

Faqs About The Solar Itc

When will the solar investment tax credit expire?

The Solar ITC is currently set to expire for residential customers in 2024. Commercial customers who purchase a solar system after 2023 will still be eligible for the tax credit, which will be set permanently at 10%.

Can I combine the Solar ITC with state and local solar incentives?

Yes. Several states offer solar incentives for residential customers. If there are solar incentives and rebates in your state, you can combine them with the federal tax credit. Visit your states solar page listed at the bottom of this page to learn more about solar incentives and credits by state.

What is covered under the Solar ITC?

The solar investment tax credits covers the following items:

- The cost of the solar panels

- Labor and installation costs such as fees for permits, inspection costs, and developer fees

- Additional solar equipment, including wiring, mounting, inverters, and solar hardware

You May Like: How Much Are Solar Panels Per Watt

How Solar Tax Credits Work

The tax credit is a reduction in an individuals or business’s tax liability based on the cost of the solar property. Its a nonrefundable tax credit, meaning you wont get more back than the amount you owe in taxes.

Projects that begin construction in 2021 and 2022 are eligible for the 26% federal tax credit, while projects that begin construction in 2023 are eligible for a 22% tax credit. Residential tax credits drop to 0% after 2023, but commercial projects will drop to 10%.

As of 2021, the solar ITC is a 26% federal tax credit.

Homeowners who purchase a newly built home with a solar system are eligible for the ITC the year they move into the house if they own the solar system. Those who lease a solar system or who purchase electricity through a power purchase agreement are not eligible for the ITC. In this case, its the company that leases the system or offers the PPA that collects the credit.

Anyone wishing to claim the credit should first consult with a tax professional to ensure that they are eligible. It’s smart to speak with an advisor before making a major investment that you intend to claim on your taxes.

The Best State Tax Credits For Solar

When it comes to solar tax credits, some states are better than others.

The best state tax credits for solar can be found in California, Colorado, Connecticut, Delaware, Maryland, Massachusetts, Minnesota, New Jersey, and Pennsylvania.

If youre looking to go solar and want the biggest bang for your buck in terms of solar tax credits and solar incentives, these are the states you should consider moving to.

Don’t Miss: How To Change From Sole Proprietorship To Corporation

What Is The Solar Panel Federal Tax Credit

First, lets take a short walk down memory lane. The Solar Investment Tax Credit was first offered via the Energy Policy Act of 2005. Thanks to its popularity and its contribution toward renewable energy goals, the ITC has been extended multiple times. While it was originally set to expire in 2007, the current federal solar tax credit extension is set to expire in 2024. Homeowners can use the federal tax credit for battery storage, installing new systems, and more.

Alright, now how does the solar tax credit work? If you want a basic overview of solar incentives without wading through the tax jargon, youre in the right place.

The bottom line is this: When you install a solar power system between 2020 and 2022, the federal government rewards you with a 26% tax credit for investing in solar energy. In short, 26% of your total project costs can be claimed as a credit on your federal tax return for that year.

A quick but necessary disclaimer: were solar experts, not tax accountants! We do our best to give accurate advice, but please check with a professional to be sure youre eligible to claim the credit.

A tax credit is a dollar-for-dollar reduction of the income tax you owe. $1 credit = $1 less you pay in taxes. Its that simple. If you spend $10,000 on your system, you owe $2,600 less in taxes the following year.

What Will Happen To The Solar Tax Credit In 2021

In 2021, the solar tax credit is set to decrease to 22% for both residential and commercial solar. This means that all solar systems that are operational starting from January 1, 2021 will qualify for a 22% credit instead of the current 26%. There will still be no maximum amount that can be claimed your claim will depend on your total system size. In 2022, the residential tax credit is slated to expire , while the tax credit for businesses will drop to 10%.

Image: Energysage.com

You May Like: How Much Power Can I Get From Solar Panels

Am I Eligible To Claim The Federal Solar Tax Credit

You might be eligible for this tax credit if you meet all of the following criteria:

- Your solar PV system was installed between January 1, 2006, and December 31, 2023.

- The solar PV system is located at your primary or secondary residence in the United States, or for an off-site community solar project, if the electricity generated is credited against, and does not exceed, your homes electricity consumption. The IRS has permitted a taxpayer to claim a section 25D tax credit for purchase of a portion of a community solar project.

- You own the solar PV system .

- The solar PV system is new or being used for the first time. The credit can only be claimed on the original installation of the solar equipment.

If I Get Solar Panels On My Rental Property Does It Qualify For The Federal Solar Tax Credit

While the property doesnt have to be your primary residence, according to Turbo Tax, you cant claim the residential solar tax credit for installing solar panels at any rental units you own. However, your rental property may be eligible for the business ITC under IRC Section 48, according to the U.S. Department of Energy.

You also wont qualify for the federal solar tax credit if you are a renter and your landlord installs solar panels since you must own the solar system to claim the tax credit.

You May Like: Should I Do Solar Panels

How It Can Help You

The FSTC accounts for many expenses. These include the solar PV panel, contractor labor costs for onsite installation, system equipment, and even energy storage devices. Anyone can claim the tax credit if they meet the following requirements: they are the homeowner or landlord, it is installed on a residence or vacation home, and is installed on the owners roof or propertynote that this is not a comprehensive list, and you should check the guidelines thoroughly before installation. The tax credit does not apply to leases or community solar programs, depending on how theyre structured.

Solar Tax Credit: Everything You Need To Know As A Homeowner

The federal solar tax credit lets homeowners offset a percentage of solar panel system installation costs through 2023. State tax credits and utility rebates can lower the cost too.

Edited byChris JenningsUpdated August 6, 2021

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

More homeowners are installing solar energy systems and other forms of renewable energy like small wind turbines and geothermal heat pumps to reduce the reliance on fossil fuels, cut down on greenhouse gas emissions, and potentially pay a lower electric bill.

In most real estate markets, homes equipped with solar panels can increase your homes value.

While there are many long-term benefits to going solar, the upfront costs can be expensive. Thankfully, you might be able to qualify for a solar tax credit to offset some of the cost.

Heres what you need to know about the federal solar tax credit:

Recommended Reading: Is My Property Suitable For Solar Panels

How Does The Solar Tax Credit Work And How Much Will I Save

Right now, the Solar Investment Tax Credit is worth 26% of your total system cost. This includes the value of parts and contractor fees for the installation.

As mentioned before, if it costs $10,000 to buy and install your system, you would be owed a $2,600 credit.

You are only allowed to claim the credit if you own your system. This is why were strongly opposed to solar leasing if you can avoid it. If another company leases you the system, they still own the equipment, so they get to claim the incentives.

Youll still get the benefits of cheap, renewable energy if you lease. But missing out on the tax credit is a huge blow to getting a positive ROI from your system.

It makes more sense to take advantage of solar financing instead. Youre still on the hook for a loan, but you retain rights to the incentives that help make solar such a sound investment.

Other Incentives For Going Solar

The federal credit is the easiest solar tax incentive to qualify for but you might qualify for state and local solar tax incentives as well.

Most state and local credits and rebates wont reduce your federal credit but may increase your federal taxable income since youll have less state and local income tax to deduct. These homeowner tax benefits make it easier to recoup the upfront costs of installing solar panels.

You May Like: A Solid Line On The Road Pavement Means

How To Claim The Solar Tax Credit

Report the solar energy property your business began using during the year on line 12b, 12c, or 12ddepending on when construction beganof Form 3468. The investment credit, once calculated on Form 3468, then goes on Form 3800, Part III, line 4a. Form 3800 computes the business credit, which for individuals flows to Schedule 3 of Form 1040.

Make sure not to confuse the solar tax credit for businesses and the residential solar tax credit. The residential credit operates under similar but not identical rules. Form 5695 calculates the residential solar tax credit as part of the nonbusiness energy property credit. The nonbusiness energy property credit then goes on schedule 3 of Form 1040.

The solar tax credit offers significant tax savings. The credit percentage reduces after 2022, so plan now to secure maximum savings for your business.

About the Author

Stephen Sylvester

Stephen Sylvester, CPA helps CPA and finance firms turn expertise into new clients. By transforming esoteric technical iRead more