Benefits Of A Solo 401

Solo 401s provide some advantages over other types of retirement accounts available to you.

One big advantage is the availability of the Roth option as well as the traditional version. Only the traditional option can be used by those who invest using the SEP IRA, a Keogh plan, or a SIMPLE IRA. The plain-vanilla IRA that is available to all who have earned income is available in Roth or traditional versions but the annual contribution limits are far lower.

One of the main advantages of the solo 401 is that it can accept contributions from both an employee and an employer. That is, if you have a solo 401, you wear both hats and can make contributions in both roles.

Benefits Of A Solo 401 For The Self

Just because you are a one-person outfit, a freelancer, or an independent contractor doesnt mean you have to do without a retirement savings plan or the tax benefits that accompany them.

One option If you are self-employed is the solo 401, also known as an independent 401 plan. In fact, the Solo 401 has some benefits over other types of retirement accounts available to the self-employed.

Solo 401 Employer Contribution Limits And Rules

Youll calculate your employer contribution limit differently depending on whether your business is incorporated.

If youre not incorporated, youll need to calculate your net income. Its a good idea to consult with a tax specialist if you find that calculation to be challenging.

If you have a spouse, he or she must get the same contribution from the company that you do. In other words, if your employer contribution is 15% per year and your spouse participates in your solo 401, you must give them 15% per year as well. The same is true for business partners: You must all get the same employer contribution percentage.

Employer contributions can be made only to a traditional solo 401. These contributions are tax deductible for your business.

Employer contributions are due by the time your business files its tax returns.

If your solo 401 account value exceeds $250,000, youll have to start filing Form 5500 EZ annually. That adds an extra layer of complexity to your solo 401. You can roll over some of your 401 funds into an IRA to avoid triggering that requirement.

Recommended Reading: Is Solar Power Cost Effective

How Does A Solo 401 Work

As a business owner, in terms of 401 contributions, youre the employer as well as the employee.

As an employee, you can contribute up to a total of $19,500 of your income to your 401 accounts in 2021. If youre at least 50 years old in 2021, you can add another $6,500 in catch-up contributions.

You can also make company contributions to yourself. Ill go into more detail about how that works in the section on solo 401 contribution limits.

Other than yourself, the only people who can make or receive contributions within your solo 401 plan are:

- Your spouse. He or she must earn income from your business in order to qualify. By rule, your spouse must receive employer contributions as well.

- Your business partners. If you have a business with multiple owners and zero employees, all the owners can open a shared solo 401 plan.

My Other Business Has Employees But Not The One I Want To Connect To The Solo 401 Does That Still Count

Yes, unfortunately. The IRS can see this as hiding a retirement plan from your employees in another business. If you have employees, you can be subject to “discrimination testing” to make sure that if you are giving yourself retirement benefits or an employer match, that your other employees are also eligible for fair employer match and able to contribute to retirement accounts.

In order to start a Solo K while having full-time employees in another business, you have to prove to your tax accountant and then be able to prove to the IRS that these businesses are not in a controlled group. Here is a link to the law.

If you ignore this and fail to prove to the IRS that your employees in your own company or another company are NOT eligible for the retirement plan you could be subject to forced retirement backpay or legal action from your employees as a violation of ERISA law by enforcement of the Department of Labor. You should open a SEP IRA which is available at Rocket Dollar or a corporate 401 plan.

Don’t Miss: What Are The First Solid Foods For Baby

Solo 401k Contribution Rules

If youre under the age of 50, you can make a max contribution in the amount of $18,000. This amount can be made before or after tax.

On the profit sharing side, your business can also make a 25% profit sharing contribution up to $36,000. That comes out to a combined max of $54,000.

Note: If youre over the age of 50, the contributions are the same, except you can contribute $6,000 extra.

Solo 401 Versus Other Retirement Plans

If you donât think a solo 401 is a good fit for you, here are some other options you may want to consider:

- Simplified Employee Pension IRA: A is another popular option among self-employed individuals with no employees. You may contribute up to the lesser of $61,000 in 2022 or 25% of your net income. Contributions are tax-deferred, and there is no Roth option. You can use one of these accounts if you have employees, too, although youâll have to make mandatory contributions to your employeesâ accounts. This could limit how much you can afford to contribute to your own retirement.

- Traditional or Roth IRA:Traditional IRAs and Roth IRAs are open to all workers, even those who arenât self-employed. You can open them with most brokers, and youâre free to choose from many common investments. You may contribute up to $6,000 in 2022, or $7,000 if youâre 50 or older.

- Self-directed IRA:Self-directed IRAs are traditional, Roth, or SEP IRAs that allow you to invest your money in real estate and other assets you canât typically invest in with an IRA.

Each account has its pros and cons, so youâll have to decide which is best for you. A SEP IRA might be a better fit if you donât want to deal with the more complex reporting requirements of a solo 401. But solo 401s let you choose between tax-deferred and Roth accounts and take out loans, while SEP IRAs donât allow these things.

You might also like

You May Like: Do Solar Panels Give Off Heat

Is A Solo 401k Worth It

The flexibility around solo 401 contributions, investment options, and relatively low management requirements makes the plan an attractive alternative for small business owners or sole proprietors who want to save for retirement proactively.

Both the salary deferral and the income-sharing contributions are optional and can be adjusted at any time. You could contribute to your solo 401 using either method or not contribute at all in a given year based on the fluctuating profitability of your business.

Contributions to your solo 401 also allow you to leverage other tax incentives that could amount to significant savings in the long run.

Getting Your Solo 401 Started

Once you have established the type of plan you want, you will need to create a trust that will hold the funds until you need them or you reach retirement age. You can select an investment firm, online brokerage, or insurance company to administer the plan for you.

You also need to establish a record-keeping system, so that your investments are accounted for properly.

You May Like: How To Get Business Permit For Sole Proprietorship

Other Financial Benefits Of A Solo 401

The solo 401 can be an excellent choice for those with a side gig as well, especially if theyre already able to live comfortably on their main salary. With the solo 401 you can go above the usual limits of a 401.

While you may contribute to multiple 401 accounts, your total employee contribution to all types of 401s may not exceed the annual maximum contribution, that is, $19,500 in 2020 and 2021.

But the solo 401 can be valuable even if you already have a 401 plan and even if youve maxed out that other plan for a given year. Thats because you can still make an employer contribution, allowing you to exceed the smaller employee-only contribution amount. So the solo 401 allows you to save more with the employer contribution, reducing your business taxes.

Another benefit of the solo 401 is that it doesnt prevent you from taking advantage of other retirement plans such as the IRA. You can still contribute up to the annual maximum there. If youre an individual looking to set up a traditional IRA or Roth IRA, then youll want to look at the benefits of those plans.

Like the typical 401 plan, the solo 401 also allows you to take out a loan against your account. loan.)

While I generally encourage clients to avoid that strategy, it can come in handy at times, Conroy says.

What Are The Individual 401k Eligibility Rules When A Business Owner Has Part Time W

A business owner who employs part-time W-2 employees may be able to exclude them from plan participation. Generally, under federal law you are permitted to exclude the following types of employees:

- Employees under age 21

- Employees with less than one year of service

- W-2 employees who work less than 1000 hours per year

- Certain union employees

Also Check: How Do You Clean Solar Panels On Garden Lights

How Does A Self

The solo 401 is like the classic 401. You contribute into the account from your pre-tax income, and you can invest the savings without paying taxes. However, you will pay taxes on withdrawals when you retire. A self-employed 401 allows your spouse to contribute in the same plan.

A major difference between an individual 401, a standard 401, and other personal 401 options is that you can make more contributions. If you qualify for a self-employed 401, the higher contribution restrictions, and easy administration of the account, makes it an ideal choice for retirement savings.

Solo 401 Plan Design Options

Because solo 401 plans cover few employees and dont require much administration, 401 providers typically charge low fees to administer them. Thats the good news. The bad news is that solo 401 providers often fail to make popular 401 plan design options like participant loans or in-service distributions available to business owners to maximize their profit from these plans.

They rarely make voluntary after-tax contributions available either. These contributions are uncommon today because they make annual nondiscrimination testing difficult to impossible to pass. However, this shortcoming is moot with solo 401 plans because they dont require annual testing.

So why should you want voluntary after-tax contributions in your solo 401 plan? They make mega back door Roth IRA contributions possible. Under this tax strategy, you make voluntary after-tax contributions to your 401 account up to the 415 limit – and then immediately roll them to a Roth IRA where their investment earnings can grow tax-free. For the strategy to work, your solo 401 plan must also allow the in-service distribution of voluntary contributions at any time.

Also Check: How Does Solar Save You Money

Who Qualifies For A Solo 401k Plan

There are two main eligibility requirements: one is that you must be self-employed, and the second is that you must earn self-employment income.

You can typically fit the first requirement if youre a freelancer, sole-proprietor, business owner without any employees , or independent contractor. The second requirement, self-employment income, can be verified through tax records.

Mega Backdoor Roth Solo 401k Ban Question:

Since the Build Back Better bill did not pass in 2021, yes the solo 401k participant can still make voluntary after-tax solo 401k contributions for both 2021 and 2022 and subsequently convert the contributions to the Roth IRA or the Roth solo 401k. Since congress was not able to pass the BBB in 2021 which would have banned both the backdoor and the mega backdoor starting in 2022, if the bill is passed in 2022 it would be effective at the earliest starting in 2023 as this is how retirement regulation generally works .

Recommended Reading: What Is The Lifespan Of A Solar Panel

What Is A Solo 401

A solo 401 is essentially a 401 plan designed for individuals. The plan may also be referred to as an individual 401, i401 or a one-participant 401.

This tax-advantaged retirement plan is generally limited to just self-employed individuals, though spouses who work at least part time for them may be eligible to contribute to one as well. If you ran a small business with only one other employee who was not your spouse, you would not be eligible to save for retirement in a solo 401.

For self-employed people, a solo 401 may offer greater annual contribution limits and bigger tax deductions than a SEP IRA, depending on your income. Solo 401 plans also allow you to make post-tax Roth contributions.

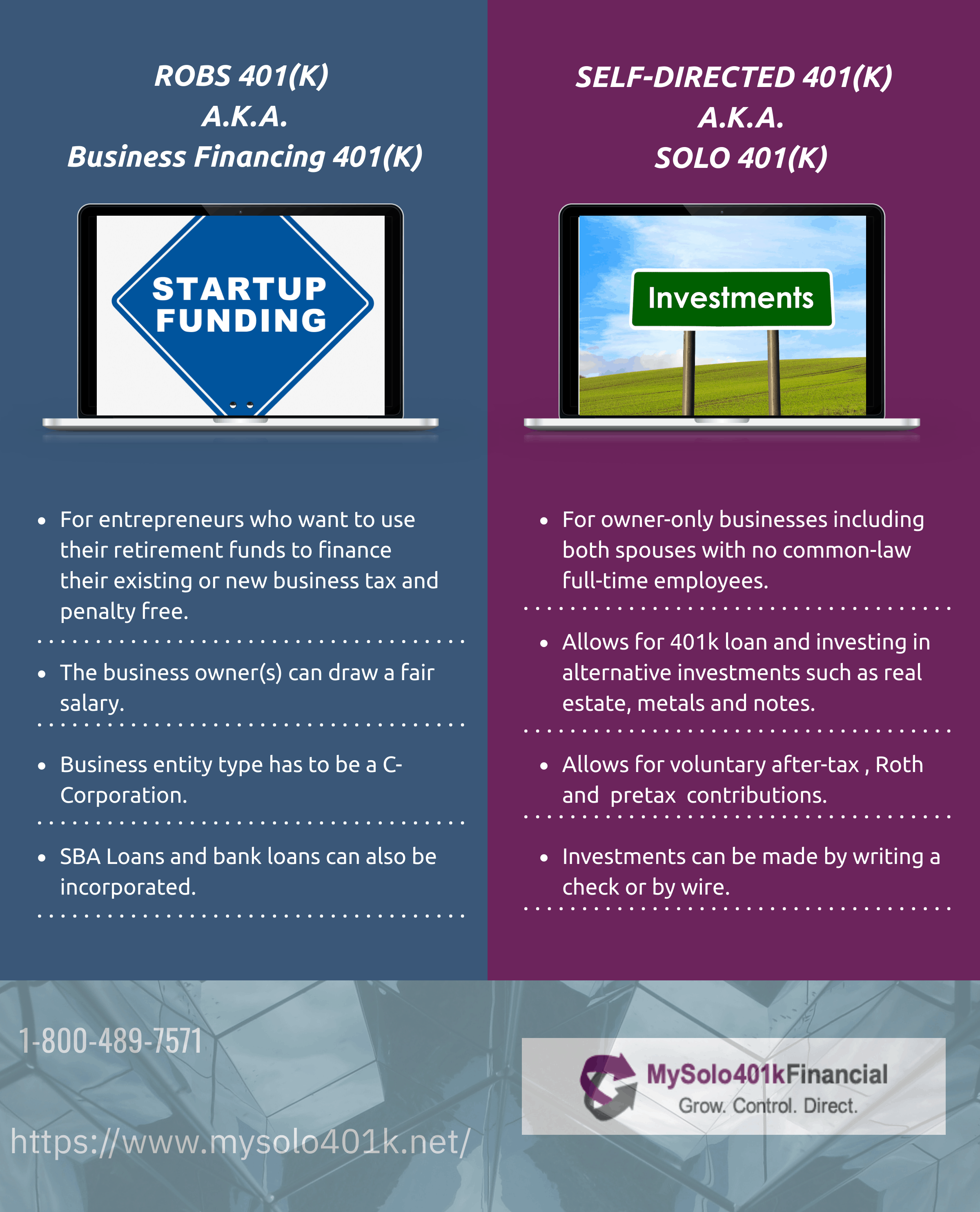

Rollovers As Business Start

ROBS is an arrangement in which prospective business owners use their 401 retirement funds to pay for new business start-up costs. ROBS is an acronym from the United States Internal Revenue Service for the IRS ROBS Rollovers as Business Start-Ups Compliance Project.

ROBS plans, while not considered an abusive tax avoidance transaction, are questionable because they may solely benefit one individual â the individual who rolls over his or her existing retirement 401 withdrawal funds to the ROBS plan in a tax-free transaction. The ROBS plan then uses the rollover assets to purchase the stock of the new business. A C corporation must be set up in order to roll the 401 withdrawal.

You May Like: How Much Does It Cost For Solar Panels

What Is A Sep Ira

Congress created the Simplified Employee Pension IRA in 1978 to extend the IRA concept to small businesses. The term pension in this case is a bit archaica SEP IRA is not a defined benefit plan. Rather, it lets the self-employed and small businesses and their employees benefit from simple, tax-advantaged retirement savings accounts similar to personal individual retirement accounts .

SEP IRAs are available from most major brokerage firms and easy to set up. Unlike a traditional 401 plan, SEP IRAs have little to no administrative overhead. Companies with only a single employee can take advantage of SEP IRAs, meaning they can be a good choice for solo entrepreneurs or gig workers.

Most importantly, SEP IRAs offer more generous tax breaks than personal IRAs. In some cases, the tax deduction for a SEP IRA can be nearly 10 times that of an IRA.

Contribution Limits In A One

The business owner wears two hats in a 401 plan: employee and employer. Contributions can be made to the plan in both capacities. The owner can contribute both:

- Elective deferrals up to 100% of compensation up to the annual contribution limit:

- $20,500 in 2022 , or $27,000 in 2022 if age 50 or over plus

If youve exceeded the limit for elective deferrals in your 401 plan, find out how to correct this mistake.

Total contributions to a participants account, not counting catch-up contributions for those age 50 and over, cannot exceed $61,000 for 2022 .

Example: Ben, age 51, earned $50,000 in W-2 wages from his S Corporation in 2020. He deferred $19,500 in regular elective deferrals plus $6,500 in catch-up contributions to the 401 plan. His business contributed 25% of his compensation to the plan, $12,500. Total contributions to the plan for 2020 were $38,500. This is the maximum that can be contributed to the plan for Ben for 2019.

A business owner who is also employed by a second company and participating in its 401 plan should bear in mind that his limits on elective deferrals are by person, not by plan. He must consider the limit for all elective deferrals he makes during a year.

Recommended Reading: Is 14k Solid Gold Real

What Is A Solo 401 And How Does It Work

A solo 401 is a retirement plan for the self-employed.

If youre a business owner, a solo 401 is a way for you to access the same retirement benefits that youd get as a corporate employee.

In this article, Ill explain the myriad of solo 401 rules and compare solo 401s to SEP IRAs. Ill also share with you the solo 401 contribution limits for 2021.

What Are The Solo 401k Eligibility Rules When A Business Owner Has Part Time W

A business owner who employs part-time W-2 employees may be able to exclude them from plan participation. Generally, under federal law you are permitted to exclude the following types of employees:

- Employees under age 21

- Employees with less than one year of service

- W-2 employees who work less than 1000 hours per year

- Certain union employees

Read Also: Do Solar Shades Provide Privacy

Extension Apply To Both Contribution Types Question:

Self-directed 401k contributions deadlines are based on the type of entity sponsoring the solo 401k so you are correct. Please see the following.

- If the entity type is a Sole Proprietorship, the annual solo 401k contribution deadline is April 15, or October 15 if tax return extension is timely filed.

- If the entity type is an LLC taxed as an S-Corporation , the annual solo 401k contribution deadline is March 15, or September 15 if tax return extension is timely filed.

- If the entity type is an LLC taxed as a Partnership , the annual solo 401k contribution deadline is March 15, or September 15 if tax return extension is timely filed.

- If the entity type is a Partnership , the annual solo 401k contribution deadline is March 15, or September 15 if tax return extension is timely filed.

- If the entity type is an S-Corporation , the annual solo 401k contribution deadline is March 15, or September 15 if tax return extension is timely filed.

- If the entity type is an C-Corporation , the annual solo 401k contribution deadline is April 15, or September 15 if tax return extension is timely filed.