What’s A Sole Proprietor

A sole proprietor has complete control over the revenue and operations of their business. However, the sole proprietor is also personally responsible for all debts, lawsuits, and taxes their company accrues. So, if their business is sued, personal assets like their home, credit score, and savings are unprotected.

How Do I Register A Sole Proprietorship In Michigan

To establish a sole proprietorship in Michigan, here’severything you need to know.

Thereof, how do you register as a sole proprietor?

To start a sole proprietorship, all you need to dois:

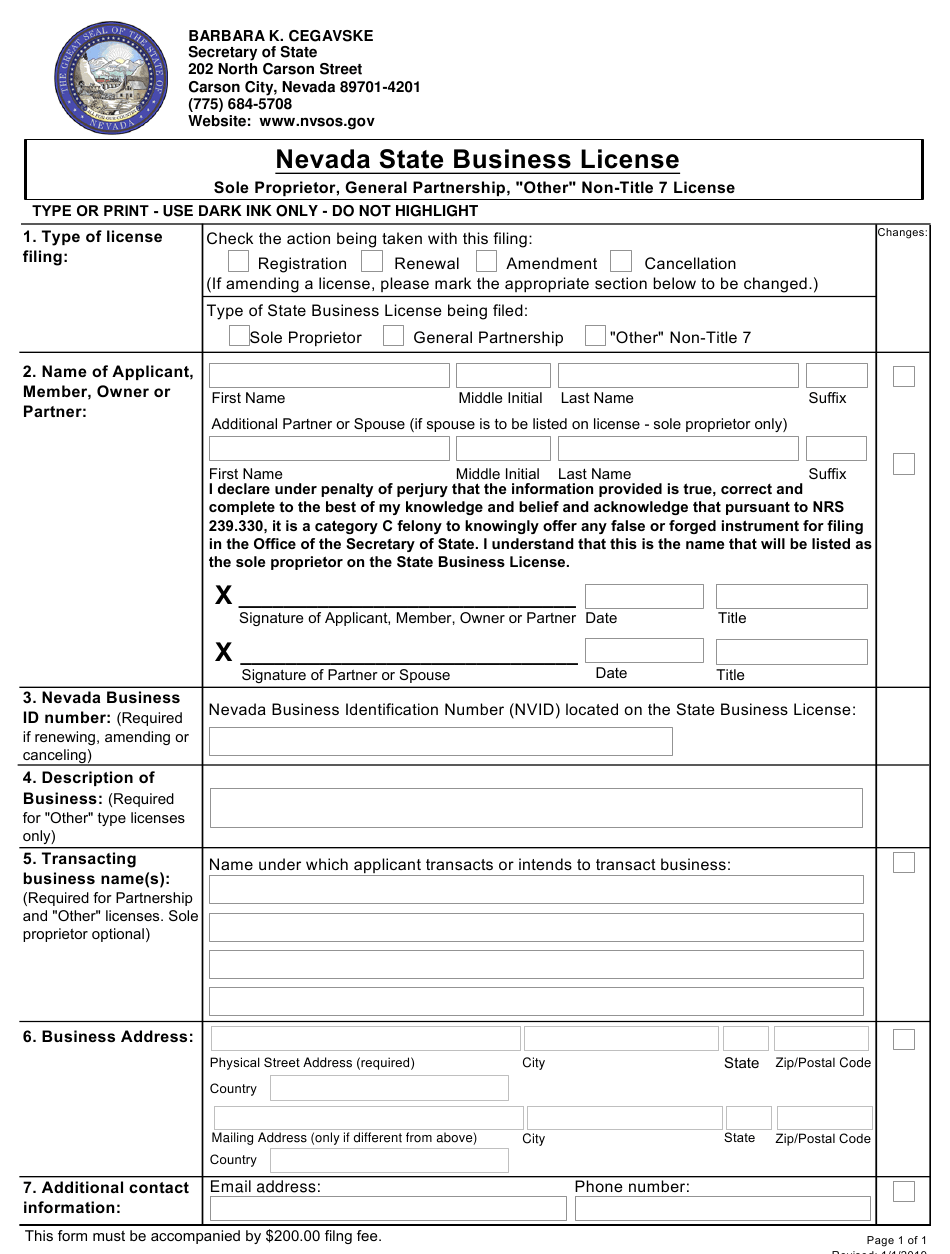

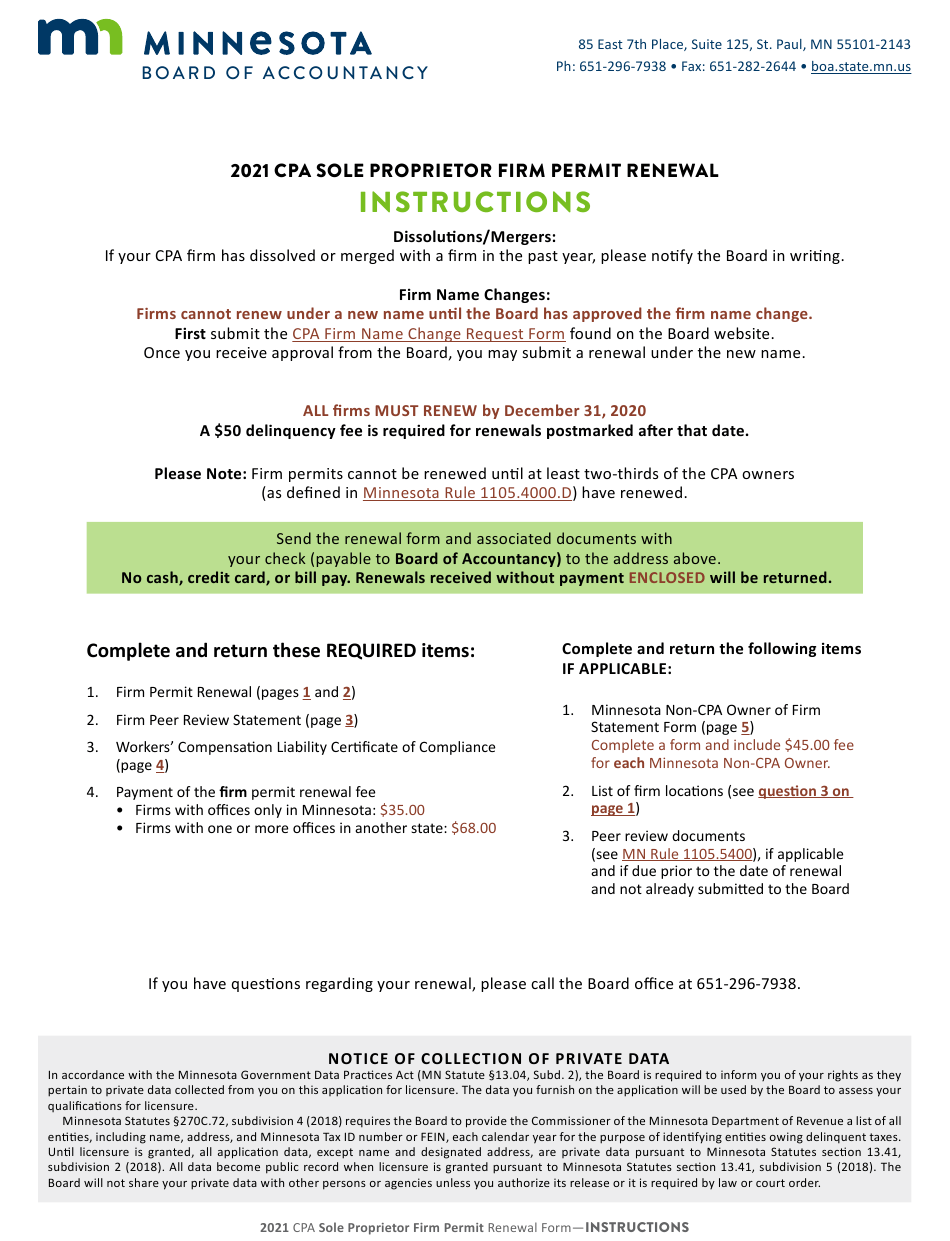

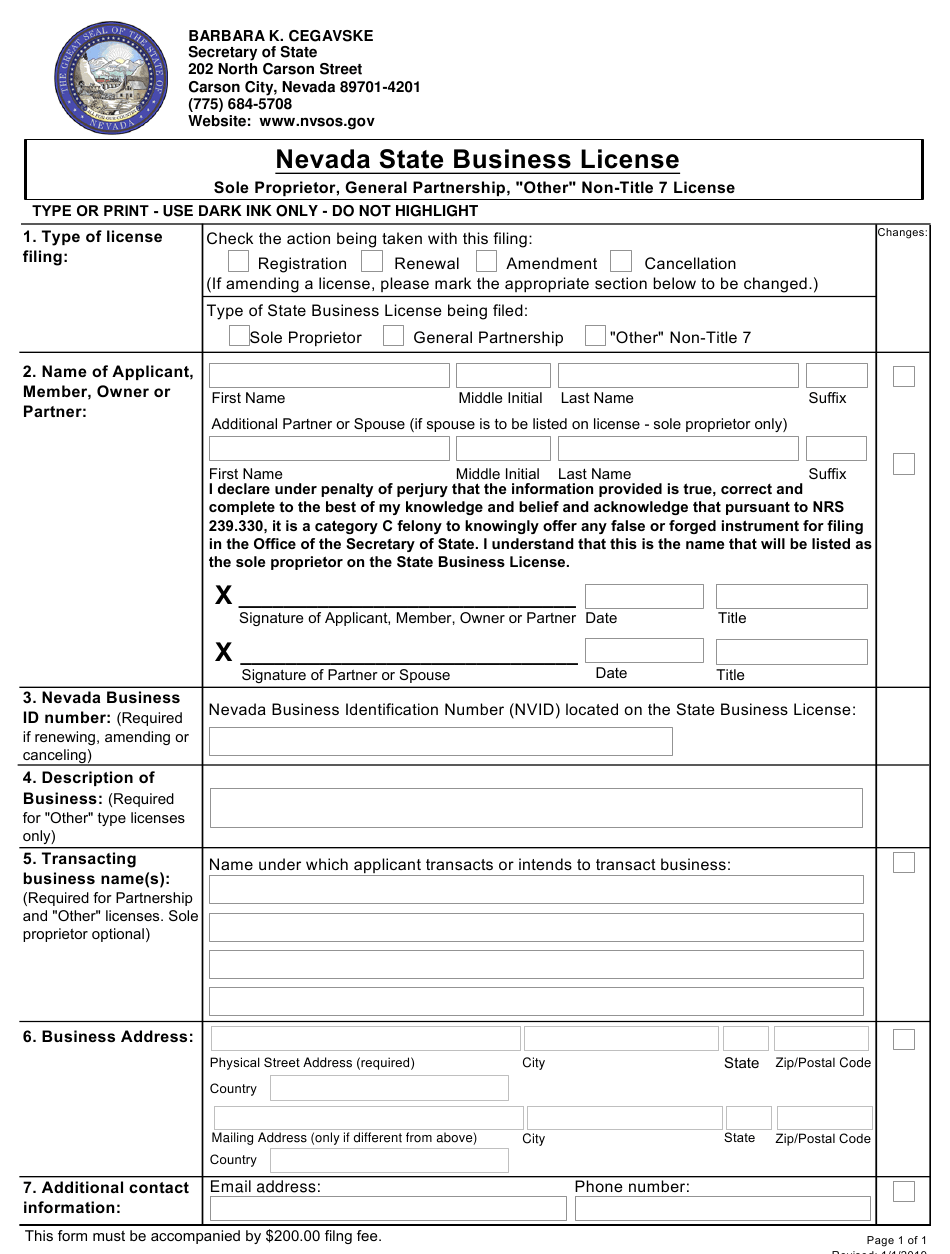

Secondly, do you need a business license for a sole proprietorship? A sole proprietorship is an unincorporatedbusiness with a single owner. Sole proprietors mustobtain various business licenses to operate legally. Mostlocal, state and federal jurisdictions require a businesslicense or permit to carry on a type of trade orprofession.

Similarly, it is asked, how do I register a small business in Michigan?

Here are six things you must do to register your businessin the State of Michigan.

Start A Business In Texas

Texas offers the best business ecosystem in the nation and has frequently been named the best state to start a business. Our leading business climate and favorable regulatory environment provide the groundwork small businesses and entrepreneurs need to succeed.

We divided the process of starting a business into seven basic steps. It is advisable to seek the guidance of a professional tax consultant, accountant and/or attorney to help verify that all legal requirements are met before opening up a business.

Follow these steps to help you get started in the state of Texas:

Recommended Reading: How To Make A Solar Cell From Scratch

Starting And Registering A Sole Proprietorship

To register a sole proprietorship, you must choose a business name and describe the business you intend to run. You can find what the requirements for starting a sole proprietorship are, and how to proceed with the registration of the enterprise here.

- plan to carry on commercial activity

- have a Norwegian business address

- be 18 years or older choose “Annet” once you are logged in to the form)

Registering Your Business Name In Ontario

Business names are registered with the Central Production and Verification Services Branch of the Ministry of Government and Consumer Services and are placed on the Public Record maintained by CPVSB for public disclosure. Anyone may search business name information contained on the Public Record for a fee to find the owners or principals behind a business name.

Read Also: Should I Set Up A Sole Proprietorship Or Llc

Community Rallies Around Fairfax’s 29 Diner After Kitchen Fireyour Browser Indicates If You’ve Visited This Link

Wood revamped and reopened the historic 29 Diner in Fairfax City in September 2014, he’s taken care of others – at-risk youth, veterans, the homeless and families in need. And when the pandemic hit, he turned the restaurant into a community kitchen to provide free meals to health-care workers,

Virginia Connection Newspapers

Form Your Business Entity

Youll need a business license in the name of your business. Its best to establish a business structure and business name before you apply for a business license. That way you dont have to reapply or amend your business license later.

Common legal structures for small businesses include:

If you establish an LLC, corporation or nonprofit corporation, youll establish a name for your company when you file formation paperwork with your state. Depending on your state, you may be able to get a DBA from the state, or you may need to file your DBA with your local government.

Also Check: What Are The Benefits Of A Sole Proprietorship

How To Register An Alberta Sole Proprietorship

The information you will need to provide to the provider is your full name, your residence address, a description of the business you will be conducting, the city in which the business will be conducted, the name of the business, the date of the business first commenced, your occupation and a form of identification. You will be required to provide a drivers licence no., a birth certificate no., a passport no. or a health card no. The form does not have to be originally signed. The identification provides the government with your true identity.

The form is called a Declaration of Trade Name pursuant to the Partnership Act .

Register Your Business Name

Sole proprietors have two options when it comes to a business name. Your business name can be the same as your personal name or you can file your business under a different name.

Youll need to use a fictitious business name or a doing business as name if you dont want to use your personal name for your business.

DBAs arent required in most states, however, they come in handy when you open a business banking account or business credit card since these institutions require you to separate your business and personal finances into two different categories.

Each state, county, and municipality has different DBA requirements and registration processes. You can check local government offices and websites for more information about registering your business.

Also Check: How To Select Solar Panel For Home

Why You Need Business Permit

In order to trade in business premises in Kenya, you are required by County Law to make remittance towards the county council of your business location. Failure to do that might cause interruption of business operations.Single Business Permit is a crucial document if your business is looking to apply for Government Tender, borrowing a loan and many more. It is something that you just cant do without.

Advantages Of Sole Proprietorship

It is difficult when you are an intelligent, creative person and you have to agree to the way other people run their business. Of course, you cant interfere as It is their business but sometimes you badly want to give input that can steer it in the right direction but you cant. And that is precisely what one of the advantages of sole proprietorship is you are the one in control.

You captain and steer the ship and you call all the shots. If your business fails or becomes a huge success, It is you who has directed it that way. You answer to no one. Another one of the advantages of sole proprietorship is that complicated tax is so much easier with a sole proprietorship.

You and your business are one and your business income is your personal income. But does a sole proprietor need a business license and what about tax? As the sole owner, your business is not taxed separately but you have what is known as pass-through taxation the tax liability is yours and passes through to your personal tax return.

Another advantage is that a sole proprietorship has a simple format to set up and it does not require being legally registered and you can trade under your own name.

You May Like: How Much Can Solar Power Generate

Register Your Business With The Bureau Of Internal Revenue

All sole proprietor are required to register with the Bureau of Internal Revenue . And last June 2020, the BIR has released Revenue Memorandum Circular No 57-2020 to simplify the process of business registration by removing Local Government Unit permits and license in their list of requirements.

However, just a quick note for those who have existing Tax Identification Number , before proceeding with the steps mentioned below, you must first submit update and/or transfer of records to your current BIR Regional District Office prior to submission of new business application.

For first time applicants, meaning without existing TIN, you may proceed with the steps in registering a business in BIR as follows:

- Fill-up the BIR Form 1901 Application for Registration

- Prepare the list of requirements as follows:

- Valid Government ID with Name/Address/Birthdate or PRC ID

- Filled-up and paid BIR Form 0605 Annual Registration Fee of P500.00

- Prepare the sample format of the receipts and/or invoices you will use for sales

- Prepare the books of accounts, such as journals and ledgers, you will use for record-keeping

- DTI Certificate of Registration, if you will use a Trade Name

What About Permits And Licenses

Even sole proprietors require a business license to run their business and you can get a fine if you try to operate without a license. Most businesses, no matter how small, will require this license just to open up a business account. In fact, depending on the kind of sole proprietorship you are running, there may be other licenses too.

You cant, for instance, be running some kind of food business without having the appropriate license such as a health permit for a food business. Does a sole proprietor need a business license for looking after children? Looking after young kids can be a daunting task because theres that part where you have to comply with certain regulations. You will require a business license.

When you are just looking after 3 or 4 kids do you need a license? Nothing is set in stone and each state differs. Some states allow you to have 7 children without a license while others say 4 or 12. You have to get answers in your state because some states will give you a massive fine for each day you operate without a license.

There is always the perhaps type of answer. This is because each state and city may have its own specific licensing regulations. Before opening up a daycare youll need to research your states licensing laws by contacting your local Child Care Resource and Referral agency and child care licensing office so that you know what licenses and permits are required.

Don’t Miss: Why Solar Is Not Worth It

What Is A Business License

Business license is a broad term that refers to any kind of license or permit required to operate your business and provide your services in your location. Various types of business licenses are issued by federal, state, county and municipal agencies.

A business licenses purpose may be to register your business with the government for tax purposes or to ensure you follow industry regulations.

Sole Proprietorship Business Licenses

Related

One of the first steps to starting a business is to apply for any licenses and permits required by your city and state. Sole proprietorships are no exception. Depending on the state, you may need a general business license, professional license, or special license. Additional documents are required for selling alcoholic beverages, tobacco, and other products or services regulated by the federal government.

Read Also: How To Change Your Sole Proprietorship To An Llc

Apply For A Business License

You may have to file for licenses and permits with state, county and municipal agenciesfor example, a sales tax permit from the state, health permits through a department of health, and planning permits through the city.

Look for resources from your state or your local SBA office that gather all the information you need in one place, so you dont have to spend hours researching every relevant agency. Step-by-step guides in your state could walk you through the process and include links to necessary applications on various websites.

In most states and many localities, you can get a general business license online through the proper agencys website. Industry-specific licenses may have a more complicated application process.

You likely wont have to wait long for a business operating license or a sales tax permit to be approved. Other types of licenses and permits may have a longer and more involved review process.

Obtain Licenses And Permits

You must obtain a license or permit to run certain businesses. The Florida Department of Business and Professional Regulation regulates most licensing in the state. If you are running an accounting firm, law firm, or healthcare related business, then a different agency regulates such entities.

You must also obtain licensing or permits related to the workspace. For example, if you are incorporating so you can start a construction project, you need to obtain permits for building and variances for zoning. Check with your target municipality for more information.

Also Check: Does The Government Pay For Solar Panels

How To Set Up A Sole Proprietorship In Texas

This article was co-authored by wikiHow Staff. Our trained team of editors and researchers validate articles for accuracy and comprehensiveness. wikiHow’s Content Management Team carefully monitors the work from our editorial staff to ensure that each article is backed by trusted research and meets our high quality standards.There are 12 references cited in this article, which can be found at the bottom of the page. This article has been viewed 84,645 times.Learn more…

A sole proprietorship is a business owned and operated by one person. You need to do very little to set one up in Texas. Pick a business name and register it with the appropriate office. If you want to hire employees, then you will need to take additional steps.

How Sole Proprietors Are Taxed

Taxes are simple when youre a sole proprietor in California because you and your business are one and the same for tax purposes. You dont need to pay taxes or file tax returns separately for your California sole proprietorship. California taxes you, the owner, on the income you earn from your business, instead.

Instead, you report the income that you earn, or the losses that you incur, on your personal tax return .

If your business earns a profit, youll add that money to any other income that you have. Other income can be interest income or your spouses income if youre married and file jointly. Youll get your total income that will be taxed at your personal tax rate.

If you incur a loss, you can use it to offset income from other sources.

To show whether you have a profit or loss from your sole proprietorship, file IRS Schedule C, Profit or Loss from Business, with your tax return. On the form, list all of your business income and your deductible expenses.

Just remember that, if you have more than one sole proprietor business, you must file a separate Schedule C for each.

Don’t Miss: How Much Do Solar Tubes Cost To Install

Business Identification Number And Business Number

The Central Production and Verification Services Branch assigns a Business Identification Number when a business name is registered in Ontario.

The provincial BIN is different than the federal Business Number . The BN is assigned by the Canada Revenue Agency for federal programs, such as:

- goods and services tax/harmonized sales tax

- import-export accounts

If you are registering a business name under the Business Names Act directly with the Central Production and Verification Services Branch, the following forms must be submitted to the Branch:

Check Your Business Name And Register With The State

Most businesses must be incorporated with the state before registering with the City of Lexington.

Kentucky has a One Stop Business Portal that will walk you through the incorporation process online. This process will:

- register you with the Kentucky Department of Revenue

- help you meet state tax requirements

- take about an hour

After completing the online registration, you will have an official business name. Use this name on your occupational license application.

Visit Kentucky’s One Stop Business Portal to incorporate your business online.

You May Like: How Solar Energy Works Step By Step

Starting A Sole Proprietorship In California

At this point, youre probably wondering how to start a sole proprietorship in California. Weve got good news for you, friend. Because sole proprietorship is the default business form for a one-owner business, when you start a business in California you automatically become a sole proprietor.

Youre probably thinking, Okay, this sounds too good to be true. How much does it cost to register a sole proprietorship in California?

Besides the cost of getting a business license you dont have to pay any fees to register a sole proprietorship. California only requires that you pay registration fees if you form an LLC or corporation.

There are a few details, though, that you need to take care of when setting up a sole proprietorship in California:

Advantages Of Sole Proprietorships

Typical advantages of a sole proprietorship include:

- Ease of creation. Owners can establish a sole proprietorship instantly, easily and inexpensively.

- No state paperwork. There is no state filing required to create a sole proprietorship.

- No separate tax filing. There is no separate business income tax filing. Business income or loss is reported on the sole proprietors personal tax return, and any tax is paid at the individual level.

- Few ongoing formalities. Sole proprietorships face few, if any, ongoing requirements or formalities, such as state annual report or ownership meeting requirements as with C corporations, S corporations and LLCs.

Read Also: Does My Solar Power Work If The Power Goes Out

Can You Run An Online Business Without A License

Your business is regulated by the laws of the state where its registered and the county or municipality where its physically located even if all of your operations happen online. Whether you require a license to operate the business depends on the state and locality. If you sell goods online or in person, most states require you to have a sellers permit or sales tax license.