Tax Disadvantages Of A Sole Proprietorship

As a sole proprietor, you are both an employer and the employee. As such, it is necessary to pay both employee and employer taxes each year. As an employee, typically you pay for only half of Social Security and Medicare portions of your taxes and the employer pays for the other half. But self-employed sole proprietors must pay both portions of these taxes.

Since the line between necessary expenses for a business and general living expenses can blur easily when one is self-employed, the IRS tends to take extreme care when reviewing sole proprietor tax returns. This scrutiny can cause issues if sole proprietors have included any personal expenses as a tax-deduction, or have deducted business expenses without keeping proper documentation that the cost was solely for a business purpose. The need to keep detailed documentation can be seen as a disadvantage for business owners, and the possibility of an audit can make any sole proprietor wary. Many owners of sole proprietorships recommend opening up a bank account that is dedicated solely to the business: using the expenses here to determine costs for the business as opposed to personal costs, as well as keeping receipts for any and all business expenses, will help keep documentation clear and concise, should the time come when this documentation is needed.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Pros And Cons Of Incorporation

When you incorporate your business, youre creating a separate legal entity. And one of the biggest advantages is the liability protection that comes with this.

When you incorporate, youre not held personally responsible for any debts or lawsuits incurred by the business. If any legal claims are brought up against the business, then youre not personally responsible for them.

When you incorporate your business, you may be taken more seriously as a business owner. Incorporating can also make it easier to apply for business financing in the future.

However, theres a lot of work that comes with incorporating your business. You have to file your articles of incorporation, hold shareholders meetings and track corporate minutes. If youre a new business owner, you may not be ready to commit to all of that.

Don’t Miss: How Much Does Off Grid Solar Cost

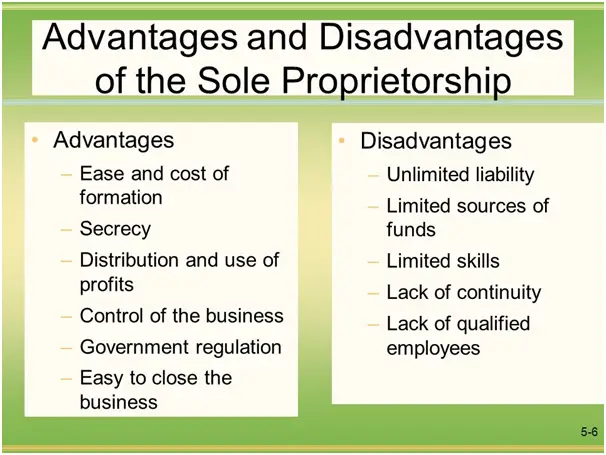

Advantages And Disadvantages Of Sole Proprietorships

Sole proprietors must comply with licensing needs within the states in which they run their business, in addition to local laws and zoning ordinances. A sole proprietorship has no company tax funds. Owners do not normally spend money on sole proprietorships.

Ease of Formation

Starting a sole proprietorship is much easier and less expensive than beginning a corporation. Some states enable sole proprietorships to be shaped without the double taxation requirements affecting most corporations. The proprietorship will be named after the proprietor, or a fictitious title can be utilized to support the enterprises advertising.

Employment

The spouse of a sole proprietor can be employed without being formally declared as a worker. Spouses may also begin a sole proprietorship, although legal responsibility can be solely assumed by one particular person.

Management over all enterprise choices falls to the proprietor. The proprietor may also totally change the sole proprietorship at any time he or she deems necessary.

Liability

The business proprietor is held instantly chargeable for any losses, money owed, or violations of the enterprise. For instance, if the enterprise has any money owed, these funds will probably be drawn from the proprietors personal funds. The proprietor could possibly be sued for any illegal acts initiated by the company. That is drastically different from corporations, whereby the members take advantage of limited liability .

Taxes

Lack of Continuity

When Should A Sole Proprietor Become An Llc

The decision is ultimately yours. But keep in mind that as a new business, legal protection can be important to your well-being and the longevity of your endeavor. Forming an LLC early on can help protect you personally from business liability. It can also make your business appear more stable to lenders and vendors, as well as customers and business partners. In that sense, it can be an investment in your success.

Running a sole prop is as simple as getting to work and tracking your income and keeping it separate. You are the owner and the business, so all decisions are yours to make. That makes it easy to get started, but as your business grows you take on more risk.

Recommended Reading: What Is The Best Solar System

Advantages Of A Sole Proprietorship: Everything You Need To Know

There are several advantages of a sole proprietorship. Many small businesses have owners who choose to function as sole proprietorships. Sole proprietorships are the most common business construction and are owned by one person. This option offers various benefits. Selecting the appropriate enterprise construction is a serious decision, so figuring out some great benefits of operating a sole proprietorship may also help you decide if it’s best for your business.

You Have Freedom And Flexibility

Freedom and flexibility of running your business as a sole proprietorship are included in this business structure. The process of registering as a corporation is longer and costlier, and business operations as an incorporated business are also more complicated.

As a sole proprietor, you arent restricted to complicated and strict regulations. This is particularly attractive to small proprietors who dont have the labour to continually ensure these strict guidelines are adhered to and carry them out. Sole proprietors also have all the decision-making freedom.

You May Like: Can You Clean Walls With Pine Sol

Name Your Sole Proprietorship

With a sole proprietorship, you can name your business using your name, and you can also include a description of the work you do. For example, if your name is Joe Smith and you will open a landscaping business, you can name the company Joe Smith Landscaping without registering your business name. If you would prefer to call your business Trees and Shrubs, you would need to apply for a DBA name.

To apply for your DBA, start by researching name restrictions and availability. Restrictions in most states include avoiding false associations with other businesses or institutions, not using words that describe activities illegal in that state, and avoiding words associated with regulated industries like banking.

To determine name availability, you need to conduct a search of business names. Searches can be conducted through your states Secretary of State website. Most include a searchable database. Try searching for as little of your chosen name as possible, as this will give you more results.

Once youve selected a name, you can register your DBA name. Usually, this can be done online through your local county. Fees will vary between states. Before you take this step, though, its good to determine your businesss domain name. Most companies have at least some online presence, and you dont want to register a name and then discover it isnt available as a website.

If you decide to pursue a trademark, you will need to:

- Complete and submit your online application.

Difficulty In Raising Capital

Selling stock to investors is a popular way for new businesses to gain capital. Sole proprietors canât sell stock to investors. New businesses also get loans from banks. But banks donât like to lend to sole proprietors. If something goes wrong, the individual is responsible for paying back all that money. To banks, that is a risk. Some sole proprietors do find success with crowdfunding, though.

Recommended Reading: How Big Of A Solar Power System Do I Need

Its Simple And Affordable

Whether you want to start a food kiosk, a one-person repair shop, or a freelance writing business, a sole proprietorship is a pretty flexible choice for your corporate form. With less paperwork to file, you only need to keep simple documentation for this business setup. You only need to fill out a simple government form to register a fictitious business name, for example. This government site helps you out by explaining the differences between various corporate entities and how to incorporate in Ontario, Alberta, British Columbia, and Quebec. You may also qualify for sole proprietorship tax deductions.

The Advantages Of A Sole Proprietorship

These are the things that make sole proprietorships the most popular choice:

- The cheapest business structure to form â the costs are limited to registration and acquiring licenses and permits tied to your line of work. These vary from state to state and are different for each profession.

- Very easy to set up â in order to form a sole proprietorship, you donât need to take any formal action, apart from registering the name and getting licenses and permits.

- Deductible business expenses â costs of business activities can be deducted from the income tax these may include car payments, travel expenses, or even certain home expenses if you operate from your home .

- Full business ownership â as a single owner, you make all the decisions on your own, without meetings and voting processes with board members and such. You are free to set your own work schedule and working hours, in accordance with your customersâ demands.

- Simple tax preparation â the owner pays a personal income tax on profits earned from the business. As a sole proprietorship isnât a separate legal entity, it is not taxed separately from the owner. Read more about self-employment taxes.

Also Check: How Many Years Does A Solar Panel Last

A Growing Business Needs The Right Business Structure

With so much to consider in building a businessincluding writing a business plan, raising capital, staying inspired, and knowing when to invest full-time in your startup dreamthe ease of sole proprietorship can feel like a relief. You can begin work without formal registration, and there are minimal upfront costs involved in securing your business name and the appropriate licenses.

Yet be sure to do your homework when you begin to take advantage of the ease of launching a sole proprietorship. Eiko Nakazawa, the founder of early childhood education startup Dearest.io, began her company as a side project while she conducted research and small-scale tests over four months. Talk to other founders with similar business models, as well as people in your industry and investors, she told Ideas by WeWork. If you are open about what youre working on and are able to reach out to many people, you should be able to get relevant feedback and advice. Not only are these helpful for you to plan the next steps, but also useful for you to understand potential pitfalls and challenges.

As you grow, however, its essential to be cognizant of the risks associated with sole proprietorships. Be sure to protect yourself and your personal assets in hiring staff or entering into debt, and consider transitioning to an LLC or corporation if the potential toll becomes too high.

For more tips on launching and scaling a startup, check out all our articles on Ideas by WeWork.

You Can Get Things Done

The whole idea of getting down to work is to accomplish something, right?

However, whether youre trying to decide on which movie to watch on Saturday night, or which accounting software to buy for your business, it can often take a lot longer and be a lot harder when someone else is involved.

When youre a sole proprietor, youre the one choosing the software, setting your prices, or deciding which ad to run .

Having that flexibility and nimbleness matters. If you want to be more successful than your competitors, you need to make a better product, provide a better service, or solve customer problems that other people cant.

That often means doing things differently, like, for example, letting people choose what movie to watch right from their living room instead of driving across town to a video store.

As a sole proprietor when you have an idea you want to try, you can try it. You dont have to sell it to a board of directors or prove it to your stockholders.

In fact, freedom and control can be competitive advantages. Annie Withey, the founder of Annies Homegrown, started her business as a sole proprietorship and kept it that way for several years. It gave her the ability to test new ideas and create and take new products to market quickly.

Doing something different often can come with risks. This can be especially true for sole proprietors, so its important to protect your business from the hazards that can come with working on your own.

Read Also: How To Remove Solar Panels

Complete Control As The Business Owner

Sole proprietorships arent just easy to set up, theyre also much easier to run than other businesses. Because its just you, you have complete control over business proceedings. When you have a sole proprietorship, you dont have to worry about things like company officers or registered agents that are included in LLCs or corporations. As the sole owner of your company, you have total control over decisions, finances, and other aspects of how your business functions.

A sole proprietorship allows you to attain a level of privacy and autonomy that is largely unachievable with other business structures. This is namely because the government does not require you to disclose or report information about your business as it does for corporations or LLCs, meaning you are mostly free to run your business as you wish.

How Does Sole Proprietorship Work

A sole proprietorship is not a legal entity on its own â it is conjoined to the owner. This means that there is no legal separation between a sole proprietor and this form of business â therefore, all the business losses are the ownerâs personal losses. Likewise, the owner is personally liable for all the business debts the sole proprietorship obtains.

From the taxation point of view, this means that a sole proprietor can use their Social Security Number as an EIN .

There is no need to pick a business name â the owner can run the business under their own name. The owner can also choose a fictitious name , but it has to be unique and registered with the local state or county agency.

In case you want to see an example of how sole proprietorship is set up, see our article on registering the sole proprietorship in Oregon, USA.

Don’t Miss: Does California Require Solar Panels On New Homes

Operating Freedom And Flexibility

As long as your business remains small, a sole proprietorship is the most flexible business form to change. You can make any change you want, including changing business policies and type of business, without much cost or process. Sole proprietorships also offer a higher degree of control and fast decision making opportunities. Unlike in partnerships or corporations, you dont need consent or approval from partners or officers to make any business decision.

What Is Sole Proprietorship

A Sole proprietorship can be explained as a kind of business or an organization that is owned, controlled and operated by a single individual who is the sole beneficiary of all profits or loss, and responsible for all risks. It is a popular kind of business, especially suitable for small business at least for its initial years of operation. This type of businesses is usually a specialized service such as hair salons, beauty parlours, or small retail shops.

You May Like: How Much Can Solar Panels Produce

Advantages And Disadvantages Of A Sole Proprietorship

The main benefits of a sole proprietorship are the pass-through tax advantage mentioned before, the ease of creation, and the low fees of creation and maintenance.

With a sole proprietorship, you do not need to fill out a tremendous amount of paperwork, such as registering with your state. You may need to obtain a license or permit, depending on your state and type of business. But less paperwork allows you to get your business off the ground faster.

The tax process is simpler because you do not need to obtain an employer identification number from the IRS. You can obtain an EIN if you choose to but you can also use your own Social Security number to pay SSN taxes rather than needing an EIN.

In addition, because you are not required to register with your state, you do not need to pay any fees associated with renewing your registration or any other fees associated with the process. This saves you a lot of money, which is important when starting your own business.

With a sole proprietorship, you don’t need a business checking account, as other business structures are required to have. You can simply conduct all your finances through your own personal checking account.

There are 32.5 million small businesses in the United States.

Thus, entrepreneurs begin as an entity with unlimited liability. As the business grows, they often transition to a limited liability entity, such as an LLC or LLP, or a corporation .

What Is The Legal Definition Of A Sole Proprietorship

The U.S. Small Business Administration defines a sole proprietor as a single person. The business is not distinguished from the owner. The owner is entitled to all profits. He or she is also responsible for losses and liabilities.

Consider freelance writers. They advertise their own services. They complete client projects. They accept their own payments. They file their own taxes.

Many small businesses can work under this structure. They include:

- Academic tutors

- Freelance accountants, graphic designers, web developers, and writers

- Single-person art studios.

Sole proprietors usually work alone. Yet, they can hire employees. In these cases, the business owner handles employee administration. He or she must manage their payrolls and file their taxes.

Don’t Miss: How Much Is The Federal Tax Credit For Solar