Considerations And Risks Of An Incorporation

- Stricter regulations, youll need to ensure all your paperwork is in order

- Setting up a corporation is more expensive than a sole proprietorship

- Theres a lot more paperwork involved with corporations, including yearly documentation that must be filed with the government

- Including shareholders and directors opens up the potential for internal conflict

- You will have to maintain ongoing paperwork filings to continue to run

Start A Sole Proprietorship Or Partnership

To conduct business as a sole proprietorship or partnership, you need to reserve a business name and register the business.

If you’re going to do business under your name, you do not need to request a business name or register the business with the province.

OPTIONAL: If you’re not sure which business structure you should choose,consider the different business structure options available. You may also want to:

- Explore resources from the Small Business Branch or Small Business BC

- Get advice from a chartered accountant or lawyer before setting up your business

Request and reserve a business name online

Businesses must have their name approved and confirm that it doesn’t conflict with a name already being used by a corporation. Only incorporated companies, cooperatives or societies can guarantee exclusive use of their name. Find out how to choose the right name.

If you’re unable to submit a request online, complete the Name Request form and mail it or drop it off at a Service BC locationwith payment. Make cheque or money order payable to the Minister of Finance.

It takes about 7 to 14 days to process a name request.Once it’s complete, you’ll receive a confirmation email and a name request number you can use to register your business. Be sure to complete the registration before the name request expires . If not, you’ll need to submit another name request. Request priority service if you need to have a name approved in 1 to 2 business days.

Choosing Between Sole Proprietorship Vs Incorporation

There are two common business structures most entrepreneurs choose from: sole proprietorship and incorporation. A third business structure is a partnership, which you can learn more about here. For this article, well focus on sole proprietorship and incorporation and how to decide which one is right for you.

DISCLAIMER: This article and any articles linked below were prepared for our audience by the team at Ownr. These articles were created for informational use only. The information contained within these articles is not to be treated as legal advice. Every business will have its own unique circumstances and should consult a legal professional about their situation in detail.

This page contains affiliate links. If you use these links to make a purchase, we may earn a commission. Learn more about our terms and conditions.

Recommended Reading: Is Vivint Solar A Good Investment

Llc Vs Sole Proprietorship: Formation

You might be surprised to learn that theres nothing specific you necessarily need to do to form a sole proprietorship. In fact, you might be operating a sole proprietorship without even knowing it. Any person selling goods and services without a partner is a sole proprietor by default. Depending on where your business is located, you might need to apply for business licenses or zoning permits to legally operate your sole proprietorship. And any business, including a sole proprietorship, that operates under a trade name, needs to apply for a fictitious business name, also known as a DBA or doing business as certificate. However, thats it as far as formation paperwork goes, making sole proprietorships the easiest and least expensive type of business to start.

An LLC might also need to file for business permits and a DBA . But the most important formation document for an LLC is called the articles of organization. This document establishes your LLCs existence and must be filed with the state in which youre operating. The cost to file articles of organization varies by state, but generally ranges between $50 to $200.

» MORE: Business insurance for LLCs

Llc Taxation And Fees

Limited liability companies are taxed differently from other corporations. An LLC allows pass-through taxation, which is when the business income or losses pass through the business and are instead recorded on the owner’s personal tax return. As a result, the profits are taxed at the owner’s personal tax rate. A single-member LLC is typically taxed as a sole proprietorship. Any profits, losses, or deductions that are business expenses that reduce taxable income are all reported on the owner’s personal tax return. An LLC with multiple owners would be taxed as a partnership, meaning each owner would report profit and losses on their personal tax return.

LLCs avoid the double taxation to which C corporations must pay because they pass all company income through to the tax returns of the individual owners. A C corporation is a legal structure for a corporation in which the owners, or shareholders, are taxed separately from the entity. C corporations, the most prevalent of corporations, are also subject to corporate income taxation. The taxing of profits from the business is at both corporate and personal levels, creating a double taxation situation.

The fees for establishing an LLC can vary by state but expect to pay nearly $500, which might include the following:

Read Also: How To Install The Ring Solar Panel

How Do You Start A Sole Proprietorship

To start a sole proprietorship you need to for the most part just start your business. It does not require registering with your state. It is recommended to come up with a company name and then apply for a permit or license with your city and state if needed. If you plan to hire employees then you will need an employee identification number from the IRS and if you are going to sell taxable products you will need to register with your state.

Does Your Business Name Need To Be Registered

State regulation of LLCs include required words which must be included in an LLC namefor example, “LLC” or “limited liability company” might be required at the end of an LLC’s name. Registering your LLC does give your name protection within your state.

Sole proprietors don’t face the same requirements. However, if the business owner plans on operating under a company name, instead of under their own name, they will need to register for a “fictitious business name,” or DBA , in their home state.

Don’t Miss: What Is A Solo 401k Plan

Llc Vs Sole Proprietorship: How To Choose

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Choosing a business entity structure for your company is one of the most importantbut potentially most confusingdecisions youll make as a small business owner. Unless youre a lawyer or tax expert, the differences between each type of business entity can be hard to understand in real-life terms. However, your choice of business entity does have real-world impact, such as how much you pay in taxes, how much time you have to spend on paperwork, and what happens if someone sues your company.

New business owners are often confused about the difference between a limited liability company and sole proprietorship. In this guide, well look closely at LLCs vs. sole proprietorships, and explain exactly how they differ in terms of formation, taxes, legal protection, and more.

Tax Difference Between Corporation And Sole Proprietor

How you pay taxes is another difference between a corporation and a sole proprietorship. When you run a sole proprietorship, taxes are simple: You report your income on Schedule C and treat the profits as personal income. If you set up a C corporation, your company pays tax on its profits, while you only pay on the dividends you receive.

A C corporation is the default setting when you incorporate. However, you can elect to form an S corporation, where you treat your business profits as personal income, just like in a sole proprietorship. If getting the best tax deal is a major factor in whether you incorporate, do some number crunching before you decide.

Factor Social Security and Medicare taxes into your considerations. Sole proprietors pay those taxes on their income, but corporate owners don’t pay on the money they withdraw from the corporation. However, if you form an S corporation and work for your company, you have to pay tax on your salary. You must pay yourself a fair salary for your labor. The IRS warns that not paying yourself and taking all your pay in the form of your owner’s draw can get you in legal trouble.

Read Also: How Much To Solar Power A Home

Llc Vs Sole Proprietorship: Paperwork And Compliance

The final difference between an LLC vs. sole proprietorship has to do with paperwork and compliance requirements. As we mentioned earlier, a sole proprietorship requires the least amount of paperwork prior to launch. After launch, a sole proprietor only needs to keep up with federal, state, and local taxes. In addition, a sole proprietor might need to renew business permits.

An LLC has more compliance responsibilities. After filing initial articles of organization, LLCs have to file an annual report in many states. An LLC with multiple members has even more responsibilities, such as drafting an operating agreement, issuing membership units, recording transfers of ownership, and holding member meetings. None of these steps are legally required, but are highly recommended for LLCs to preserve liability protection for members. In addition, since an LLC is a registered business entity, dissolving an LLC takes additional paperwork.

Llc Vs Sole Proprietorship: Which Should You Choose

Many business owners, particularly freelancers or consultants, start out as sole proprietors because its easy. Minimal paperwork is required at the outset, and theres no big outlay of cost, which is attractive for new entrepreneurs, particularly those testing a business idea. Taxes are also simple for sole proprietors, since a separate business tax return need not be filed.

The rubber hits the road as your business starts growing. A sole proprietorship structure offers no legal protection for your personal assets, so you could end up personally bankrupt if your business doesnt succeed as planned, or faces an unexpected challenge. LLC owners, on the other hand, arent personally liable for business debts, so you get more protection in the event of a business bankruptcy or business lawsuit.

On top of this, LLCs offer tax flexibility. Most LLC owners stick with pass-through taxation, which is how sole proprietors are taxed. However, you can elect corporate tax status for your LLC if doing so will save you more money. All 50 states recognize the LLC structure to encourage small business growth. The best business structure for you will depend on many factors, and its best to consult a business lawyer before making this important decision. However, due to the combination of liability protection and tax flexibility, an LLC is often a great fit for a small business owner.

This article originally appeared on JustBusiness, a subsidiary of NerdWallet.

Recommended Reading: Can You Have An Llc And Be A Sole Proprietor

Benefits Of An Incorporated Company

A corporation can continue even if shareholders leave the business for whatever reason. The unlimited lifespan and continuance of a corporation is a big benefit.

Individuals, especially shareholders, have liability protection in a corporation. Unlike a sole proprietorship, the personal assets of individuals within the corporation cannot be seized by creditors, except in certain circumstances.

Corporations also have far more avenues for raising revenue. Access to capital means that the business can grow and develop more easily.

With the potential for tax deferral, corporations also have the opportunity to only be taxed on salaries. That means that it’s possible to not have profits taxed, only personal income.

Limited Liability Company Facts

- An LLC is a legal entity that can be used to run a business or hold assets. It is a hybrid between a sole proprietorship and a corporation.

- LLCs have been available for about 25 years and are becoming the most popular way to structure a business.

- Owners and officers, also called members, are protected from liabilities of the company, including for their own negligence.

Don’t Miss: How Many Solar Panels For 30 Amps

Looking To The Future

Sometimes the difference between a corporation and a sole proprietorship is your dream of the future. With a sole proprietorship, you are the business when you die, your business ceases to exist. If you set up a corporation, it can keep running even after you’re dead.

Even if you aren’t worried about leaving a legacy, incorporating your business can make it easier to grow. Investors, vendors and lenders often see incorporation as proof that you’re serious about your company, which gives them confidence about doing business with you. A C corporation is better than an S corporation or sole proprietorship when it comes to raising capital.

If you’re not sure your ambitions justify incorporating, becoming a sole proprietorship isn’t an irreversible decision. You can start out as a sole proprietorship and then incorporate when you’re satisfied your business can last.

References

Which Is Better An Llc Or S Corp

An LLC is better for a single-owner and likely better for a partnership. An LLC is more appropriate for business owners whose primary concern is business management flexibility. This owner wants to avoid all, but a minimum of corporate paperwork does not project a need for extensive outside investment and does not plan on taking her company public and selling the stock.

In general, the smaller, simpler, and more personally managed the business is, the more appropriate the LLC structure would be for the owner. If your business is larger and more complex, an S corporation structure would likely be more appropriate.

Recommended Reading: How To Be A Solo Practitioner Lawyer

The Process Of Incorporating Your Sole Proprietorship

Changing your sole proprietorship business into a corporation or an LLC could become complicated, depending on your business history. It is extremely important to document each step of this process. You can do your own research and if you feel confident, you may start the process on your own, but it might bring you peace of mind to consult a small business attorney to help you with terminating your sole proprietorship and creating a corporation

-

Choose the Name of Your Company: Once youve chosen your preferred business model, you have to decide if you should keep the name of your business or select another. When you pick a business name, check with the local register of businesses to make sure the name has not already been trademarked. We suggest you register a corresponding domain name for your new companys website, even if setting up your online presence is not your first priority.

-

Transfer Your Financial Information: Youll need to close your old bank account and open a new one for the corporation, as well as obtain a new federal tax identification number from the IRS. You may also need to apply for a state tax identification number depending on which state you incorporate your company in. We recommend you file a final tax return under the old DBA and request that the IRS close out the account and tax ID for the sole proprietorship. Do this after obtaining a new EIN for the new corporation to appropriately complete your business taxes and income tax returns.

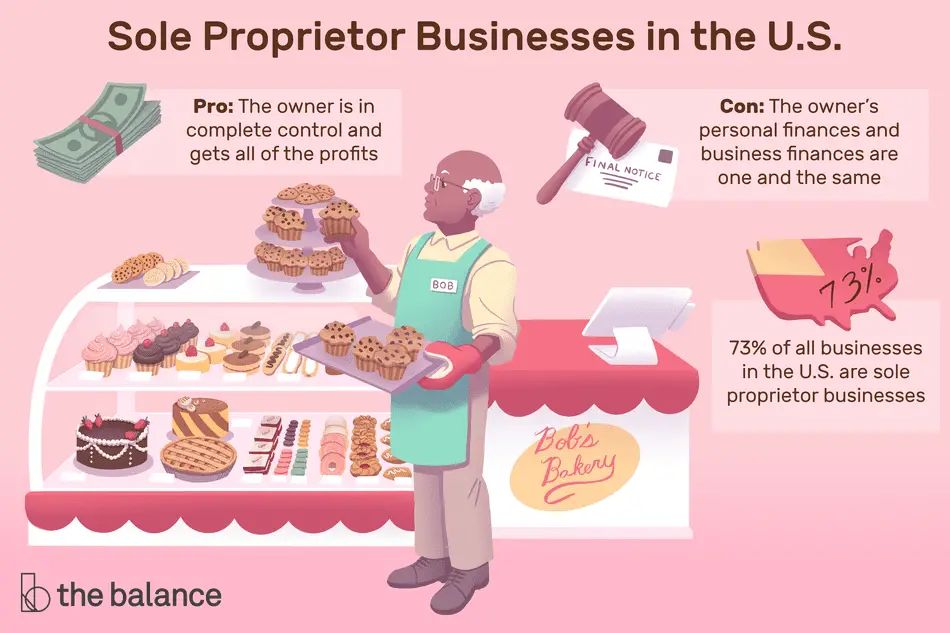

Challenges And Risks Of Sole Proprietorship

One of the major risks of a sole proprietorship is that the owner assumes personal responsibility for any and all liability. That means that if there’s a business debt, creditors are able to satisfy the debt from personal assets like homes or personal bank accounts.

A sole proprietorship is also far more difficult to sell. That’s because assets, licenses, and permits have to be individually transferred and the same bank accounts and tax identification numbers cannot be used.

You May Like: How Does A Home Solar System Work

Are You Incorporated In Canada

Small business owners and incorporated individuals in Canada can use a Health Spending Account to save on their medical expenses. An HSA is a cost effective alternative to traditional health insurance. The plan covers a wide variety of health and dental expenses. You could save thousands of dollars in taxes with an HSA.

Find out more about Health Spending Account , download my free guides:

How to write off 100% of your medical expenses

Are you an incorporated business owner with no employees? Learn how to use a Health Spending Account to pay for your medical expenses through your corporation:

Do you own a corporation with employees? Discover a tax deductible health and dental plan that has no premiums:

What’s in this article

How Sole Proprietorships Work

The sole proprietorship’s key feature is that unlike an incorporated business or a partnership, there is no legal separation between the business and the owner. The business is considered an extension of the owner, so the owner is personally responsible for any debts or liabilities incurred by the business.

Recommended Reading: How Much Is It To Install Solar Power

Disadvantages Of Sole Proprietorships

- The owner is liable for any business debts. Personal assets, such as bank accounts, cars, and homes, are at risk.

- Business assets could be wiped out to pay the owner’s debts. If the owner gets into a car accident and is sued personally, the business can be seized.

- It’s difficult to raise capital, since there is no way to assign shares of the business.

What If You’re Sued

If the paperwork was the only difference between a company and a sole proprietorship, it’s unlikely any individual would incorporate. The big incentive is another difference between a corporation and a sole proprietorship: Corporations protect your personal assets from business debts and lawsuits.

Suppose you start your business with a $20,000 investment and are sued a few months later and end up with a $30,000 judgment against you. If you run a sole proprietorship, you have to dig into your personal savings to pay the extra $10,000. With a corporation, that’s not an issue because your corporation is legally a separate individual. If the company’s money runs out, you’re under no obligation to make up the rest.

This legal shield isn’t absolute. While the standards for breaching the shield vary among states, the Legal Information Institute warns that a business owner who incorporates to cheat people and duck responsibility may be out of luck. Treating the corporation as if it were a sole proprietorship â not keeping corporate funds separate from your own, for example â could convince a judge the corporation isn’t separate. Still, it offers more protection than a sole proprietorship.

You May Like: How Much Does It Cost To Create A Sole Proprietorship