Whats The Procedure For Taking A Participant Loan

Taking a participant loan from your 401k is very easy. There are no separate reporting requirements for the loan. All you will need to be able to fund the loan from your 401k to yourself are the proper loan documents.

You can prepare your loan documents at any time after you have set up your Solo 401k plan with Nabers Group.

To have your loan documents prepared you will simply do the following:

- Fill your name, loan amount and repayment terms on the form and click submit

- Your loan documents will be generated immediately for you. Print and sign your loan documents

- Once you sign the documents, you may fund the loan

- Keep your signed loan documents for your records

You should also keep a record of your loan payments back to the plan. This keeps everything in line and documented.

Solo And 401 Rules When You Have Employees And Multiple Businesses

A 401 is a great benefit normally associated with large companies where the employee makes contributions and the employer offers a match. The contribution limits are high and can allow for significant tax deferral on the income you earn each year. What a lot of people may not know is that you dont have to be a large company to have a 401 plan. In fact, you can be the only employee in your own business and have a retirement plan.

If it is just you in your business, your company can start a retirement plan known as a solo 401. The solo 401 allows you to adopt a retirement plan and make personal as well as company contributions to the plan for yourself and any of the owners of the company.

- You must have a business generating ordinary income to make to have a 401 plan.

- You can personally contribute up to $19,000 to the plan.

- Your company can contribute up to 25% of the income it pays you.

- For 2019 the total max 401 contribution is $56,000.

The 401 plan can be self-directed, which means you can invest the funds in almost any opportunity you find . The 401 also has a loan provision allowing you to borrow funds from the plan and use them for anything you want.

What If I have Multiple Businesses With Only Employees in Some?

Controlled Group Rules

| 100% |

Required Distributions For Some Former Employees

A 401 plan may have a provision in its plan documents to close the account of former employees who have low account balances. Almost 90% of 401 plans have such a provision. As of March 2005, a 401 plan may require the closing of a former employee’s account if and only if the former employee’s account has less than $1,000 of vested assets.

When a former employee’s account is closed, the former employee can either roll over the funds to an individual retirement account, roll over the funds to another 401 plan, or receive a cash distribution, less required income taxes and possibly a penalty for a cash withdrawal before the age of 59+1â2.

You May Like: How Much Do Solar Panels Lower Your Electric Bill

Invest In What You Know

With most IRA or 401 plans, you are limited to investing in what the plan provider sells. Since most institutions that provide such plans are Wall Street brokerages, that means stocks, bonds and mutual funds. If you want to invest in real estate or stock of a privately held company, they typically cannot help you because is it just not their business model.

Traditional 401 Vs Roth 401

When 401 plans became available in 1978, companies and their employees had just one choice: the traditional 401. Then, in 2006, Roth 401s arrived. Roths are named for former U.S. Senator William Roth of Delaware, the primary sponsor of the 1997 legislation that made the Roth IRA possible.

While Roth 401s were a little slow to catch on, many employers now offer them. So the first decision employees often have to make is between Roth and traditional.

As a general rule, employees who expect to be in a lower after they retire might want to opt for a traditional 401 and take advantage of the immediate tax break.

On the other hand, employees who expect to be in a higher bracket after retiring might opt for the Roth so that they can avoid taxes on their savings later. Also importantespecially if the Roth has years to growis that there is no tax on withdrawals, which means that all the money the contributions earn over decades of being in the account is tax-free.

As a practical matter, the Roth reduces your immediate spending power more than a traditional 401 plan. That matters if your budget is tight.

Since no one can predict what tax rates will be decades from now, neither type of 401 is a sure thing. For that reason, many financial advisors suggest that people hedge their bets, putting some of their money into each.

Recommended Reading: Is Solar Worth It In Florida

What Are The Contribution Levels And Limits Of A Solo 401

To take full advantage of contributions to a Solo 401 plan you must understand your limits as an employee and employer, as well as contributions allowed on behalf of a spouse if applicable.

When contributing as the employee, you are allowed up to $19,500 or 100% of compensation in salary deferrals for tax years 2020 and 2021. If you are over 50, an additional $6,500 catch-up contribution is allowed for tax years 2020 and 2021. This is the type of contribution that can be made as pre-tax/tax-deferred or Roth deferral or a combination of both. Additionally, as the employer, you can make a profit-sharing contribution up to 25% of your compensation from the business up to $57,000 for tax year 2020 and $58,000 for tax year 2021. When adding the employee and employer contributions together for the year the maximum 2020 Solo 401 contribution limit is $57,000 and the maximum 2021 solo 401 contribution is $58,000. If you are age 50 and older and make catch-up contributions, the limit is increased by these catch-ups to be $63,500 for 2020 and $64,500 for 2021.

Compensation from your business can be a bit tricky. This is calculated as your business net profit minus half of your self-employment tax and the employer plan contributions you made for yourself plan). The limit on compensation that can be factored into your tax year contribution is $285,000 for 2020 and $290,000 for 2021.

The Standard 401 Plan

A 401 is a retirement plan which allows an individual to dedicate income towards retirement. When the funds are designated as such, they receive special tax deferred benefits. In addition to the workers contribution, his/her employer may also contribute towards the retirement fund. These two contributions are known respectively as the Salary Deferral Contribution and the Profit Sharing Contribution.

Most companies farm out their 401 plans to a third party who will typically offer the employees a choice of funds in which to invest.

You May Like: How To Power Your House With Solar Panels

Does A Solo 401 Plan Allow For Roth Contributions

Yes, you can choose to make Roth 401k contributions to your solo plan. Similar to a Roth IRA, you will contribute after-tax dollars and then enjoy tax-free withdrawals at retirement. Just be sure that you specify this designation when completing your opening paperwork. If you need the money early, make sure you know how to take an early withdrawal without a penalty.

How Much Of My Salary Can I Contribute To A 401 Plan

The amount that employees can contribute to their 401 Plan is adjusted each year to keep pace with inflation. In 2021, the limit is $19,500 per year for workers under age 50 and $26,000 for those aged 50 and above. In 2022, the limit is $20,500 per year for workers under age 50 and $26,500 for those aged 50 and above.If the employee also benefits from matching contributions from their employer, the combined contribution from both the employee and the employer is capped at the lesser of $58,000 in 2021 or 100% of the employees compensation for the year .

Read Also: How Much Can A Solar Farm Make

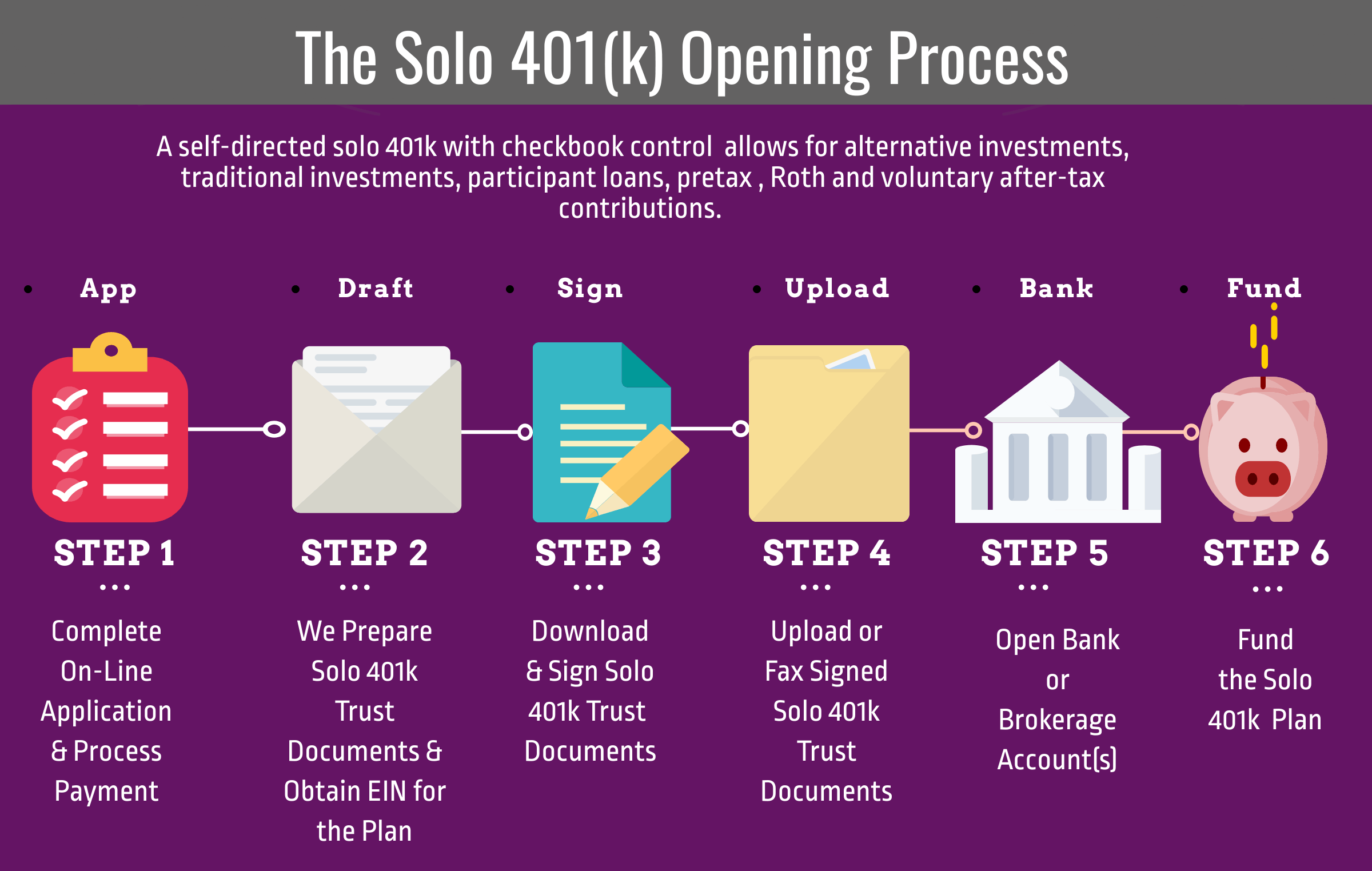

How To Start A Solo 401

Follow the steps below if you’re interested in opening up a solo 401.

Once you’ve done these four things, you may begin choosing your investments and making regular contributions to your account. You can also roll over funds from other retirement accounts in your name if you choose.

You must make your solo 401 employee contributions by Dec. 31, but you have until the tax filing deadline for the year — usually April 15 of the following year — to make your employer contribution.

One last thing to note is that if you have $250,000 or more in your solo 401 by the end of the year, you’re required to submit a Form 5500-EZ information return to the IRS with your taxes for that year so you don’t run into trouble with the federal government.

What Else To Know

Solo 401s can be very advantageous for those who qualify, but there are a few other wrinkles you should know about when deciding if a Solo 401 is right for you.

For starters, opening up a Solo 401 can be more time-intensive than opening a traditional 401. You need to get a tax ID from the IRS , manage your plan, choose your plans investments, and make sure that you dont exceed annual contribution limits.

In addition, once your plan exceeds $250,000 worth of assets, youll need to start filing an IRS Form 5500 EZ for that year, and each year thereafter in which your plan stays at or above $250,000 worth of assets.

Also Check: What Can A 120 Watt Solar Panel Run

Solo 401 Contribution Limits

The total solo 401 contribution limit is up to $58,000 in 2021 and $61,000 in 2022. There is a catch-up contribution of an extra $6,500 for those 50 or older.

To understand solo 401 contribution rules, you want to think of yourself as two people: an employer and an employee . Within that overall $58,000 contribution limit in 2021 and $61,000 in 2022, your contributions are subject to additional limits in each role:

-

As the employee, you can contribute up to $19,500 in 2021 and $20,500 in 2022, or 100% of compensation, whichever is less. Those 50 or older get to contribute an additional $6,500 here.

-

As the employer, you can make an additional profit-sharing contribution of up to 25% of your compensation or net self-employment income, which is your net profit less half your self-employment tax and the plan contributions you made for yourself. The limit on compensation that can be used to factor your contribution is $290,000 in 2021 and $305,000 in 2022.

Keep in mind that if youre side-gigging, employee 401 limits apply by person, rather than by plan. That means if youre also participating in a 401 at your day job, the limit applies to contributions across all plans, not each individual plan.

Can You Cover Your Spouse Under A Solo 401

Although you cannot open a solo 401 if you have any employees, there is an exception if your spouse works for your business and earns income from you.

In that case, your contribution limit would double because you each would be able to contribute up to $19,500 per year as employees, and you could match both contributions up to 25% with your business income.

Recommended Reading: Can Solar Panels Prevent Me From Getting A Mortgage

Next Steps For Your Plan Restatement

For most Solo 401k account holders, the restatement process is clear-cut, unambiguous, and uncomplicated. As your document provider and plan sponsor, we are responsible for ensuring it is an updated document. This is a particularly good reason to have your document provider and plan sponsor be the same company.

You will review the updated document and confirm the data is accurate. You will then need to officially adopt the restated document by signing it. If you have been considering any standalone amendment, this could be the right time to make them. In addition to an updated basic plan document and adoption agreement, you can also expect to receive a copy of the IRS opinion letter and an updated Summary Plan Description , as well as any forms or notices that may be required.

If you will be terminating your Solo 401k before July 31, 2022, it should be restated before the effective date of termination using an approved Cycle 3 document.

If you decide to make future discretionary changes, those can be added at the appropriate time, reviewed, and signed. However, the time of restatement can be perfect to include changes to avoid future amendments.

Can A Solo 401 Cover A Spouse

Yes! The IRS allows one exception to the no-employees rule on the solo 401. Your spouse is eligible to contribute to the same plan if he or she earns income from your business.

This is great news because you have the potential to double what youre saving. Your spouse can contribute to the plan up to the $20,500 employee contribution limit, andif theyre in the 50 and older categorythey can add in the catch-up amount.

As the employer, you can then add the additional profit-sharing contribution for your spouseup to 25% of compensation.

Don’t Miss: What Makes A Good Solar Panel

Covering Your Spouse Under Your Solo 401

The IRS allows one exception to the no-employees rule on the solo 401: your spouse, if he or she earns income from your business.

That could effectively double the amount you can contribute as a family, depending on your income. Your spouse would make elective deferrals as your employee, up to the $19,500 employee contribution limit . As the employer, you can then make the plans profit-sharing contribution for your spouse, of up to 25% of compensation.

Cheap And Easy Administration

People find the Solo 401 more attractive because of how easy it is to manage. Unless it is higher than $250,000 in assets, there are no filing requirements. If it does exceed that amount, then you must file Form 5500-EZ. This is a short information form that you to send to the IRS. If you wanted to, you could establish a Solo 401 at a traditional financial group, such as Vanguard. However, you dont receive the same flexibility as if choosing IRA Financial Groups Solo 401 Plan, or a plan from another self-directed IRA company.

The benefits of IRA Financial Groups Solo 401 Plan vs Vanguards Solo 401 Plan are noteworthy:

- IRA Financial Groups Individual 401 Plan allows for the conversion of a traditional 401 or 403 account to a Roth such is not the case with Vanguard

- Vanguard offers no loan feature, whereas we allow you to borrow up to $50,000 or 50% from your IRA account

- At Vanguard, you have no checkbook control, therefore, youre restricted to traditional investments

- Your Individual 401 Plan account must be opened at Vanguard at IRA Financial Group, you can open your account at any local bank

Did You Know?

Real estate is the most popular investment for a Solo 401 it isnt subject to the same sort of volatility as the stock market, and functions under separate forces if you are interested in finding out more about how a Solo 401 can help you, reach out to our specialists today!

Also Check: Can You Get Paid For Solar Energy

Benefit : Ability To Contribute To A Backdoor Roth Ira Without Being Subject To The Pro

After you move all your old accounts , you now have a clean slate to begin contributing to a backdoor Roth IRA. If you have any other non-zero balances in any IRA account, youll be subject to the pro-rata rule if you contribute to a backdoor Roth IRA, which means youll pay unnecessary extra taxes. Not good. You’re convinced you need one now, right? I thought so.

While the Solo 401 benefits probably have you ready to open an account, there are a few other questions worth addressing first.

How To Open Your Solo 401

Opening your account is fairly straightforward. You can open this type of account at most online brokerage firms or with your local financial planner if you prefer. You must have your Employer Identification Number handy, and you will be required to put the details of your plan in writing. This means that you will have to write down the type of account you will be opening as well as the types of investments that will be included in the plan. This could include mutual funds, stocks, bonds, ETFs, or other investment avenues. You will also be required to use the IRS Form 5500-EZ to report the returns from your plan each year before the tax filing deadline.

Read Also: How To Get Sole Custody In California

How Much Money Can I Get

Your loan amount can be 50% of your account value, up to $50,000 maximum:

- Example: If you have $40,000 in your Solo 401k, your maximum loan amount is $20,000

- Example: If you have $500,000 in your Solo 401k, your maximum loan amount is $50,000

The account value is generally understood to be cash you have available. So, if you have $100,000 invested in real estate and $60,000 liquid you would be able to take $30,000 in a participant loan.

You are able to invest the rest of the cash not included in the loan. For example, if you have $100,000 cash in the Solo 401k, you can take a loan of up to $50,000. You are then able to invest the remaining $50,000, even after you have taken out the first $50,000 in the loan to yourself as the participant.

You and your spouse can each take a participant loan from the Solo 401k. The amount you and your spouse can each take out in a loan is directly related to the amounts each of you have rolled in and/or contributed to the Solo 401k.

- Example: If you rolled in $80,000 you can take a loan of $40,000. If your spouse rolled in $200,000, they can take a loan of up to $50,000