Llc Vs Sole Proprietorship Comparison

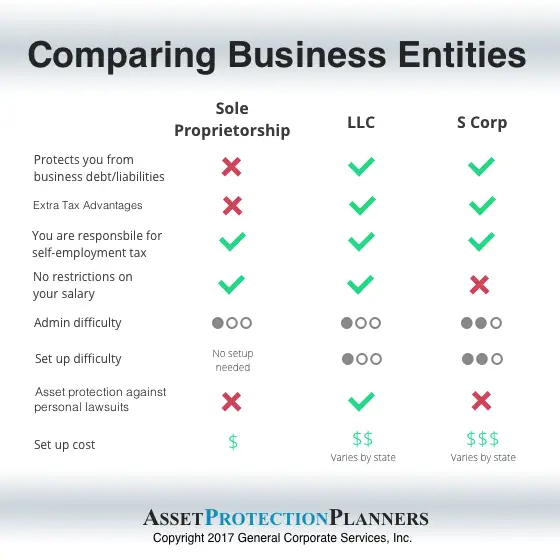

There are four main factors to compare between a sole proprietorship and LLC:

- Liability Protection

- Cost to Register and Maintain

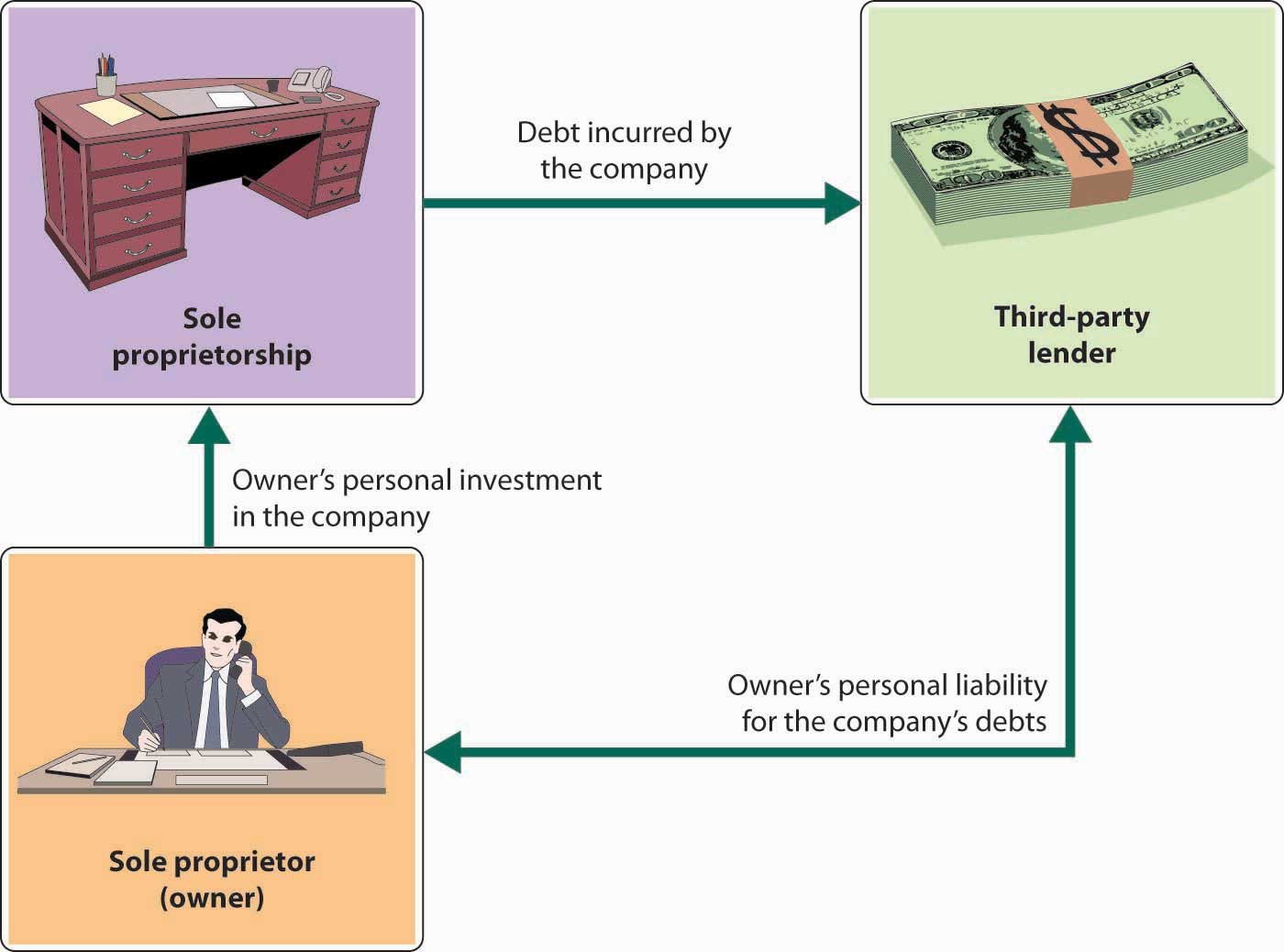

Liability Protection

A sole proprietorship doesn’t offer liability protection, but an LLC does. This value usually outweighs all other factors.

Branding

An LLC owner can use the business’s legal name as its brand name. A sole proprietor must use their surname as the business name or register a DBA name when available.

Pass-Through Taxation

Both sole proprietors and LLCs are taxed as pass-through entities by the US Internal Revenue Service . This means that the business’s profits will pass through to its members to be reported on their personal tax returns. All profits are only taxed once, at each member’s individual income tax rate.

Cost to Register and Maintain

An LLC is a low-cost and low maintenance business structure. A sole proprietorship with a DBA is comparably priced.

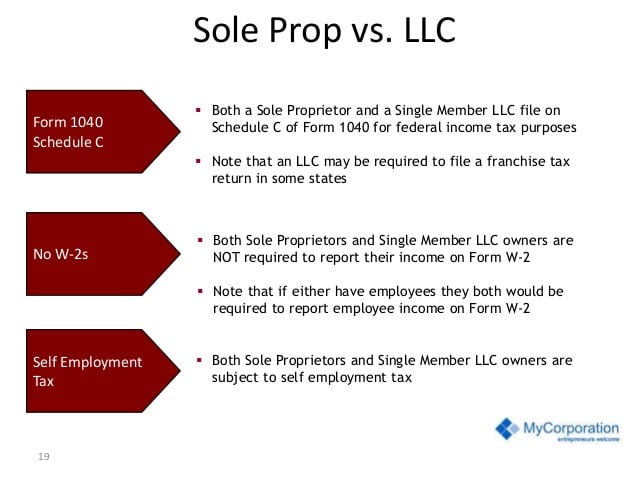

Sole Proprietorship Vs Llc Taxes

When it comes to sole proprietorship vs LLC taxes, not much changes. The IRS doesnt see the LLC as a separate business entity so an LLC passes its profits to the owners who file personal income taxes.

The same is true for a sole proprietorship. The two types file taxes exactly the same way, with the only difference being an LLC usually has multiple members who share the profit/loss and expenses of the business.

The only situation in which your LLC taxes will be different than taxes as a sole proprietorship is if you choose to have your LLC taxed as a corporation.

Selecting A Business Structure

The decision regarding business structure is a decision that a person should make, in consultation with an attorney and accountant, and taking into consideration issues regarding tax, liability, management, continuity, transferability of ownership interests, and formality of operation.

Generally, businesses are created and operated in one of the following forms:

The information on this page should not be considered a substitute for the advice and services of an attorney and tax specialist in deciding on the business structure.

Also Check: Does Solar Power Add Value To Your House

You Also Get A Sense For Their Goals Right

I try to get a sense of the likely trajectory of the business. One of the questions I ask is, If this is successful not win the lottery successful, but if this business achieves what you want it to how much money will it make?

Some people would want a business to make $200,000 a year and they would be thrilled. Some want a million dollars. Some want it to be like Google. Those different goals push us in different directions.

Simpler Tax Filing And Accounting

Sole proprietors report the income and expenses for their business activity on Schedule C of the personal tax returns. The IRS provides instructions and forms that self-employed sole proprietors may need to file.

These include forms for personal income tax and accompanying schedule C, self-employment tax forms, and other tax forms for specific situations or industries.

Also, unlike incorporated business entities, sole proprietors typically dont need to pay extra state taxes such as annual franchise taxes, employment taxes, corporate income taxes, and so on. It simplifies accounting for the small business owner.

Read Also: What Solid Foods To Feed 6 Month Old

Does Having A Single

No, having a Single-Member LLC doesnt help reduce taxes. It also doesnt increase your taxes.

Remember, Single-Member LLCs taxed as Sole Proprietorships have pass-through taxation. This means income from the LLC is filed on your personal tax return.

Said another way, your taxes are the same whether or not you have an LLC.

Work As An Independent Contractor

An independent contractor is an individual or entity that agrees to undertake work for another entity. The work is undertaken not as an employee but as one who provides services independently.

Typically, an individual is considered an independent contractor where the recipient of services or the payer controls or directs only the result of the work. Such a person does not guide on what work needs to be done and how.

IRS considers professionals providing independent services like doctors, lawyers, etc as independent contractors.

Such professionals working as independent contractors are a part of the gig economy. It is where people earn income by providing work on demand.

Furthermore, the IRS considers independent contractors either as sole proprietors or single-member LLCs. This means that independent contractors are recognized as self-employed by the IRS.

Since you are considered self-employed, you do not receive a salary as an employee. Rather, you set your pay rates and payment schedules.

Accordingly, you are also not subject to pay any self-employment taxes like social security and medicare taxes, unlike employees.

An individual is considered to be a self-employed person if he:

- Carries out trade or business as a sole proprietor or as an independent contractor

- A member of a partnership that undertakes trade or business

- Carries out trade or business for himself

Don’t Miss: How Fast Do Solar Panels Pay For Themselves

Hiring Employees As A Sole Proprietor Or Llc

Whether youre a sole proprietor or LLC, your workers compensation requirements will likely be the same if you hire an employee. Most states require any business with employees to carry workers compensation, and some states have specific requirements for whether coverage is required for the sole owner.

If you hire employees, its especially beneficial to file as an LLC for liability purposes. Workers compensation insurance would cover an employees workplace injury if one occurs. It wouldnt provide protection for any other kind of liability from an employees negligence or accidental damage of property.

What Percentage Should You Pay Yourself From Your Business

There is no standard formula to pay yourself as a business owner. A sole proprietor, partner, or an LLC owner can legally draw as much as he wants for the owners equity. However, the amount withdrawn must be reasonable and should consider all aspects of business finance. These include operating expenses, debts, taxes, business savings

Don’t Miss: What Is The Best Solar System

Business Taxes: Llc Vs Sole Proprietorship

New business owners often question whether it would better to be taxed as a sole proprietorship or a limited liability company .

Sole proprietorships and single-member LLCs are taxed in the same way by the IRS. The income from either type of business structure passes through to the owner’s tax return.

The most important question isdo you need the personal liability protection of an LLC?

Keep reading below for more details on how these business structures are taxed or visit our guide on how to choose between an LLC vs sole proprietorship.

2021-08-27

How To Pay Yourself As A Sole Proprietor

As a sole proprietor, you are the sole member of your business. This means that you are a self-employed individual. Hence, you do not receive a salary as an employee.

Therefore, you can take an owners draw from the equity of your business. As mentioned above, an owners draw is the amount of money that you can take out from the owners equity for personal use.

The funds drawn from the business are deducted from your business earnings after paying all the business expenses.

When you draw funds from your business, it reduces your capital accounts and hence impacts your owners equity.

So, to make withdrawals, you can write a check against your business bank account and pay for your expenses. This is once the funds are deposited into your bank account. Also, the owners draws are not taxable on the business income. These are considered as part of your personal income and are taxed on your income tax return.

Don’t Miss: Does Tesla Powerwall Need Solar Panels

What If A Sole Proprietor Has A Low

If I operate as a sole proprietor, I can create liability for myself through my actions. But as soon as I hire other individuals to perform work, those individuals become agents of my business and have the power to create liability for me.

While workers can also create liability for an LLC, the LLC owners personal assets should have significant protection from most claims that arise out of the actions of the LLCs workers. This would not be true in a sole proprietorship.

Llc Vs Sole Proprietorship: Taxes

A single-member LLC and a sole proprietorship resemble each other in terms of tax treatment. Both are pass-through entities, which means that the business itself doesnt pay income taxes. The owner reports business income on a Schedule C thats attached to their personal tax return, and the income gets taxed at the owners personal income tax rate.

Multi-member LLCs are also pass-through entities, with each owner reporting and paying taxes on their share of the businesss income. The only difference is that a multi-member LLC must file a business tax return with the IRS, Form 1065, U.S. Return of Partnership Income. In addition, each member must attach a Schedule K-1 to their personal tax return, which shows their share of the businesss income.

In addition to income taxes, both LLCs and sole proprietorships might have additional tax responsibilities. No matter which business structure you adopt, youll need to pay payroll taxes if you have employees. Youll also need to collect state and local sales taxes if you sell taxable goods or services. And finally, as a self-employed business owner, youre responsible for paying self-employment taxes to the IRS. These taxes cover your social security and Medicare tax obligations.

A few states and local jurisdictions levy additional taxes on LLCs. Depending on the state, this might be called a franchise tax, LLC tax, or business tax. Youll also have to pay state and local income taxes and payroll taxes.

You May Like: How Much Does Solar Really Save

And It Costs Money To Have An Attorney Go Over This Stuff So Thats Another Hurdle

I often hear from people who say, I cant afford to do a business if I have to do these things. Its hard to hear and its sad but it doesnt mean theres a good way to proceed without incurring the costs.

In my mind, the costs are worth it because if you find yourself in a lawsuit you lose in two ways I call it money and a stomachache. The people I know who have contract disputes it becomes financially and emotionally burdensome. Youre not sure if youre going to get paid. You worry about your reputation. It weighs on us, and we want to avoid that too.

Llc Taxed As A Sole Proprietorship

Note: This article only applies to Single-Member LLCs owned by US residents and US citizens.

A Single-Member LLC is taxed like a Sole Proprietorship by the IRS for federal tax purposes.

A Single-Member LLC doesnt report taxes to the IRS. It also doesnt pay taxes to the IRS. Instead, the owner of the LLC reports and pays the taxes on their personal tax return.

This is because a Single-Member LLC is a Disregarded Entity and has pass-through taxation.

Do you have a Multi-Member LLC? If so, please see LLC taxed as Partnership.

Don’t Miss: How To Keep Pigeons From Under Solar Panels

How Much Should I Pay Myself As A Business Owner

There is no standard formula for how much you should pay yourself as a business owner. As a sole proprietor, partner, or LLC owner, you can legally draw as much as you want from your equity.

However, you need to consider all the aspects of your business finance. These include operating expenses, debts, taxes, and business savings while determining your pay.

For this, you would first have to look into the net income of your business. This is nothing but the income left after deducting all business expenses from your gross revenue.

After deducting business expenses, the next step is to find out how much you should save for your taxes.

Then, take into consideration your monthly debt payments and then plan for business savings which can be reinvested in the business.

Finally, after considering all the above parameters, you can now determine how much you can pay yourself.

To find out how much money would act as sufficient pay, you would first have to determine your personal needs.

You can first determine your fixed expenses like rent or mortgage. Then, you can work out the variable expenses that are necessary for living and that change each month. For instance, groceries, etc.

Do consider other expenses like phone bills, cable TV, dining expenses, etc. Accordingly, if you have a good amount of earnings, you can pay yourself well.

However, if the earnings are less, you need to have a clear understanding of your priorities in personal life and in business.

Find The Ideal Structure For Your Business

Clearly, there are many factors to consider when choosing the best legal structure for your business. For cost, simplicity, and control, the sole proprietorship is the clear winner. But the LLC has the edge for risk management and flexibility.

Both structures qualify for pass-through taxation, with additional tax options available to LLCs. If you consider all of these factors, and talk them through with your financial, insurance, and legal advisors, you can ensure that your small business has a firm foundation for your biggest plans.

The Motley Fool has a Disclosure Policy. The Author and/or The Motley Fool may have an interest in companies mentioned.

Don’t Miss: What Is Federal Tax Credit For Solar

Do Entrepreneurs Usually Have This Figured Out Early On

Most of the businesses we see are starting small, so at least some growth is required. The real question is, on what scale? Some businesses wont make money unless they are big. For example, its difficult to have an online dating service with only 500 users. With other businesses, the answer is I dont know because they could envision a successful business on either a small or a big scale.

For example, lets say someone wants to open a boba drink place. Maybe theyre going to have one store, although their hopes are that its many stores. But either would be OK. Then you have to plan a company that gives the business options in the future.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Read Also: Is Solar Worth The Cost

Can An Llc Be An Individual Or Sole Proprietor

A limited liability company cannot be a sole proprietor, but an individual can do business as an LLC. If you are a sole proprietor, you own and operate your own business, but it is not a corporation. A limited liability company is a business structure that is not a corporation and not a sole proprietorship. If you wish, you can register a business that you own and operate by yourself as a LLC, protecting you from business liabilities while still keeping the tax benefits of a sole proprietorship.

How Does The Management Structure Differ

In an LLC, the business can be owned by one or more members. Its members usually manage an LLC, but they can also appoint a manager to handle the day-to-day operation.

The membership of an LLC and the way it will be run are laid out in a legal document known as an operating agreement.

In a sole proprietorship, you are truly the boss and call all the shots. There are no partners or members to deal with.

You May Like: Why Does Pine Sol Smell So Good

Responsibilities As An Llc Owner

When changing from a sole proprietorship to an LLC, you must examine existing contracts carefully. Depending on the contractual language, you may or may not be able to assign the responsibilities you had as a sole proprietor to the LLC. If the contract doesn’t allow for this, you must discuss the arrangement with the other party.

Your responsibilities as an LLC owner to the LLC itself should be detailed in the LLC’s operating agreement. Overall, though, as an owner, you have a duty of care that requires you to act in good faith and exercise reasonable care in carrying out your responsibilities concerning the LLC.

You must treat the LLC as a separate entityincluding keeping all personal assets separateotherwise, you risk losing the protection of limited liability.

Changing from a sole proprietorship to an LLC may be a smart move for your business as well as for the protection of your personal assets. Still, you should be aware that you could end up paying more in taxes and fees with an LLC than you would have if you had stayed a sole proprietor. Because there are so many individualized considerations involved in making this decision, professional legal advice is recommended.

Should My Business Be An Llc Sole Proprietorship Or Partnership

The type of business structure you choose should be dependent on a lot of factors, some of which may include:

- How many owners/members youll have in your business

- The expected size of your business

- Whether there is any particular business structure/tax entity that offers tax benefits for your industry

- How well you get along with partners and owners

- The inherent risk and potential for liability of your business

Read Also: Are There Solar Powered Generators

Convert Sole Proprietorship To Llc

To convert a sole proprietorship to LLC, you should file the paperwork and pay the fees to start an LLC.

Once youve filed the paperwork and paid the required fees, your application will be approved and you will officially be an LLC. Yes, it is really that easy!

If you are ready to convert sole proprietorship to LLC for your business, email me at today.