What Is Sole Proprietorship In Canada

A sole proprietorship is an unincorporated business that is owned and operated by a single individual in Canada.

The owner of a sole proprietorship receives all the profits and claims all losses from a business.Sole proprietorship does not have separate legal status from the business. If you are a sole proprietor, you also assume all the risks of the business, personal property and your assets.

If you are a sole proprietor, you can register a business name or operate your business under your own name.

Do I Only Need To File One Schedule C With My Federal Tax Return

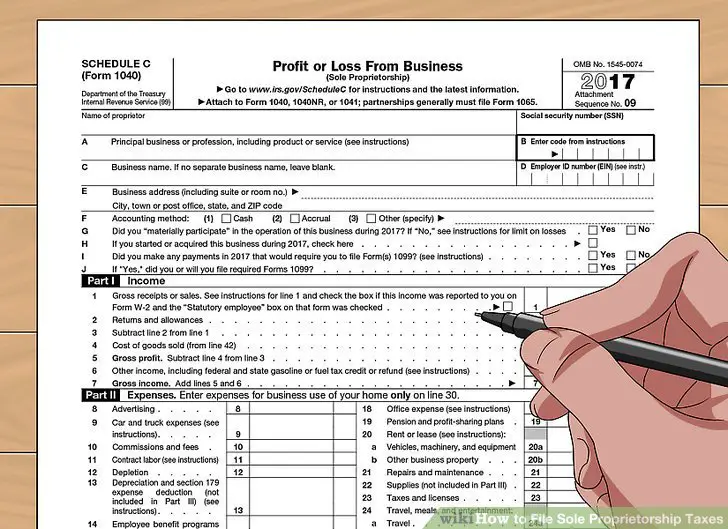

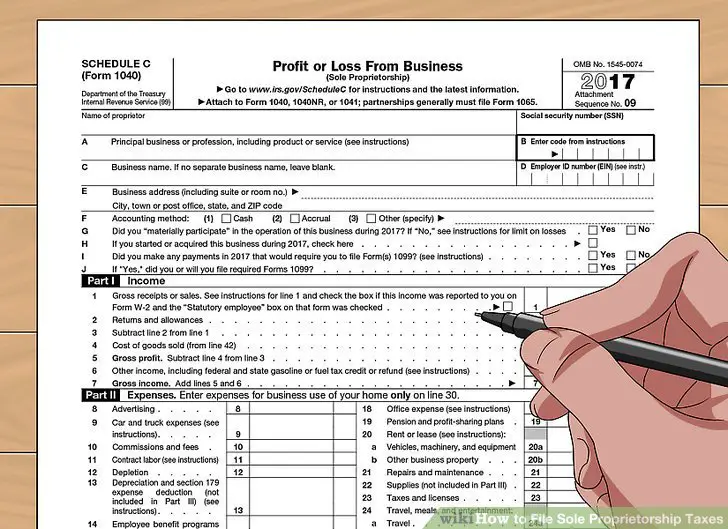

You must fill out a separate Schedule C for each distinct type of work you do. So if you work as a freelance web developer, you only need to file one Schedule C to cover all the web development you do.

But if you also drive an Uber , you would have to report your profits and losses from that business venture separately, using a second Schedule C. Youâll then have to combine all of the separate net income amounts you calculate on each Schedule C before reporting it on Form 1040.

Further reading:The Uber & Lyft Driverâs Guide to Taxes

Filing Using Turbotax Self

- When you prepare your tax return, you will just enter all of your businesss details into the self-employed section of TurboTax Self-Employed.

- All the business-related information is entered into the T2125, Statement of Business Activities, which informs the CRA of your self-employment income and deductions as well as deductions.

- The T2125 is sent to the CRA along with your other tax forms which make up your T1 General return.

- If you own your unincorporated business with a partner , the same T2125 is filled out, however, there is some additional information relating to the partners which is required, and TurboTax Self-Employed takes care of that too.

If, on the other hand, you have chosen to incorporate your business, then you are required to file a separate return, a Corporation Tax Return, or T2, for the business itself. All of your personal income and credits stay on your return and the businesss income and credits stay on its own return.

Choosing your businesss structure is an important decision. Incorporating has its advantages and disadvantages. To learn more about choosing a business structure, check out our tax tip Taking the Leap from Employee to Owner.

You May Like: What Are Solar Shades For Windows

Sole Proprietorship Taxes In The Usa

You will report your business revenue and expenses on Schedule C of your income tax return as a lone proprietor. On your business profits, you will pay federal and state income taxes, as well as self-employment taxes.

You are responsible for paying the full amount of your Social Security and Medicare taxes as a sole proprietor To avoid costs, penalties, and a hefty tax payment in April of the following year, sole entrepreneurs should pay anticipated taxes on their self-employment income quarterly.

How Do I File Taxes As A Freelancer In Canada

As freelancers work for themselves, ultimately they are self-employed. As such, they would file their taxes as self-employed individuals do. Self-employment taxes are filed with your personal income tax return. The businesss income, net of deductions, must be reported on the T2125 form for professional or business income. The form helps with the calculation of gross income needed to complete the personal tax return.

Recent Posts

Recommended Reading: Are Solar Panels Worth It In Pennsylvania

Types Of Sole Proprietorships

A sole proprietor may operate as an independent contractor , a business owner, or a franchisee.

- Independent Contractor: An independent contractor is a self-employed sole proprietor who takes on projects on a contract basis with clients. They have the freedom to choose which clients they take on, but they are often subject to the processes and methods that the client requires.

- Business Owner: Business owners can also be self-employed sole proprietors, but unlike the contractor, there is much more autonomy in how the work is completed for clients, and the operation itself may even be more complex with employees and/or intellectual property.

- Franchisee: Franchise owners may also be sole proprietors. The franchisee benefits from the guidance, brand, business model, etc. in exchange for royalties paid to the franchisor.

Tax Filing For Partnerships

Partnerships are not required to file income tax on earnings or pay taxes at the partnership level if certain conditions are not met. If the partnership grows to a certain point it will have to file a partnership information return and issue slips to the partners. For our example we will assume that the partnership does not have to file a return and the income generated is split between the respective partners and filed on their individual personal income tax returns. Income, deductions, credits, and losses are divided between the partners based on the partnership agreement. There are special considerations in the year a partnership is dissolved.

Don’t Miss: How To Ground Solar Panels

Am I Really A Small Business Owner

When you think of the term small business what comes to mind?

- A small mom & pop store?

- Or, the little deli on the corner that sells those amazing wraps?

Being a small business owner does not require a store-front, nor does it require employees. You are a small business owner if you own a small business.

You are self-employed if you operate a business where you are the business, such as:

- Freelancers

- Ride-share drivers

- Contract writers

Whether you do dog walking as a side gig or sell your veggies at the local farmers market, congratulations, you are self-employed, and you likely have a small business.

A Guide To Sole Proprietorship Taxes

Being a sole proprietor or independent contractor can simplify your finances. However, its important to understand how your business structure affects your taxes. There are tax laws that sole proprietors need to know. This guide explains how to prepare, file, and pay taxes when you run a business alone.

Don’t Miss: What Solid Foods To Feed 6 Month Old

Running Your Business In Bellevue

At the core of any successful business is a focus on creating value, effectively leading people to do quality work and managing the work to optimize costs. Because small business is closer to the customer, they are more sensitive and responsive to market changes. Because they tend to solve value problems, not cost problems they tend to be more innovative.

-

Taxes

Businesses pay several different kinds of taxes, including income tax and property tax. Taxes for businesses can be federal, state, and local. There are also different types of taxes depending on various business activities, like selling taxable products or services, using equipment, owning business property, being self-employed versus having employees.

Obtaining An Unemployment Insurance Employer Account

Sole proprietors who have employees also need an unemployment insurance employer account number. Registration should be done as soon as possible after the first wages are paid for covered employment. It must be done before the due date of the first quarterly wage detail report the employer is required to submit.

Use Employer and Agents Self-Service System. You can register for an employer account with the states Unemployment Insurance system online or by phone. See step-by-step instructions to register a new account online.

The state prefers that the automated phone system be used only by employers who do not have access to the Internet. Call 651-296-6141 and press option 4. If the business is a result of a reorganization of, or acquisition from another business, additional information may be required before a tax rate can be assigned.

Also Check: How Can I Get Out Of My Solar Panel Contract

How To File The Taxes As A Sole Proprietor

As simple as it is to pay myself as a sole proprietor, similarly, filing taxes is also very easy for you. When you do a draw in the business bank account, you are not liable to pay the federal or state income tax or give money for social security and medicare taxes. The sole proprietor only needs to file a Form 1040 Schedule C tothe IRS once a year.

If you are a sole proprietor and want to calculate your deduction, then just add up the different business expenses for diverse categories you have done for your business. This can include advertising, car expenses or meals. The expenses can be a big list to add to the deductibles and hence, a sole proprietor must review what he has spent throughout the year by checking the IRS website to know what is considered deductibles.

The personal income tax return for a sole proprietor is easy as it is the remaining business profit once he has paid taxes and deducted the business expenses from the income.

Registration And Tax Requirements

One of the first steps you should take as a new business is registering for various taxes your business must pay the state. Typically, most businesses must pay business tax and sales tax. All business types, except sole-proprietors and general partnerships, must also register for the payment of franchise and excise taxes. . Some businesses are subject to other state taxes as well. Visit the Taxes section of our website to see a comprehensive listing of various state taxes. Each tax page describes who is obligated to pay that tax.

Don’t Miss: How Much Power From Solar Panels

Does Having A Single

No, having a Single-Member LLC doesnt help reduce taxes. It also doesnt increase your taxes.

Remember, Single-Member LLCs taxed as Sole Proprietorships have pass-through taxation. This means income from the LLC is filed on your personal tax return.

Said another way, your taxes are the same whether or not you have an LLC.

Llc Vs Sole Proprietorship: How To Choose

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandheres how we make money.

Choosing a business entity structure for your company is one of the most importantbut potentially most confusingdecisions youll make as a small business owner. Unless youre a lawyer or tax expert, the differences between each type of business entity can be hard to understand in real-life terms. However, your choice of business entity does have real-world impact, such as how much you pay in taxes, how much time you have to spend on paperwork, and what happens if someone sues your company.

New business owners are often confused about the difference between a limited liability company and sole proprietorship. In this guide, well look closely at LLCs vs. sole proprietorships, and explain exactly how they differ in terms of formation, taxes, legal protection, and more.

You May Like: How To Calculate Cost Per Kwh Solar

Also Check: Where Is The Best Place To Install Solid Hardwood Flooring

When Should I File Sole Proprietorship Taxes

You should file sole proprietorship taxes the moment you begin getting net business income from your activity. With that in mind, you will not have to file each separate receipt from the moment you receive them. You simply have to gather them, and then file by the given deadlines of the IRS.

Depending on the type of tax that you are filing, the chances are that you need to make estimated tax payments on a quarterly basis. The deadlines to file quarterly taxes are typically April 15, July 15, October 15, and January 15.

Dates typically remain the same throughout the years, around the 15th of the month, but they may change depending on whether it is the weekend or a bank holiday. If the deadline falls on such a day, then it will be pushed onto the next working day.

Bear in mind that the IRS expects you to make all of these payments throughout the year. This means that you need to complete Schedule SE as well, in order to determine just how much you will have to pay. If you fail to pay on a quarterly basis and decide to only make the payment upon your annual tax refund, then you risk receiving a penalty.

Small Business Tax Myths

My business didnt make any money so I dont have to report anything right? False.

Many businesses dont see a profit in the first year . You are still required to include details of your business on your tax return and if your business actually lost money, you can apply the loss to your other income.

I made less than $5000 so I dont have to file: False.

Although you may not owe any taxes on your business income, you may be responsible for Canada Pension Plan contributions. As a small business owner, you pay both your share of CPP and the employers share. The amount due is calculated by TurboTax Self-Employed on your tax return.

I am a student so the money I make is tax-free: False.

The CRA doesnt have special rules for small business owners who are still in school. The details of your self-employment must be included when you file your return.

Recommended Reading: How Much To Make Your Home Solar Powered

Which Turbotax Is Best For Your Business

While all TurboTax products allow you to report self-employment income, TurboTax Self Employed Online is the best choice for doing and filing your income tax if youre a sole proprietor, member of a partnership, or otherwise self-employed. However, if you feel a bit overwhelmed, consider TurboTax Live Assist & Review Self Employed and get unlimited help and advice as you do your taxes, plus a final review before you file.

*TurboTax Live Full Service is not available in Quebec

How Much Tax Do You Pay On Self

As a sole proprietor in Canada, you should plan and set aside 20% to 30% of the income you earned for taxes. You should contact your accountant for accurate dollar figure estimate of your taxes.

Small business taxes typically include:

- Federal taxes

- Canada pension plan payments

- GST/HST payments

The federal income tax rates and brackets for 2020 are:

- Up to $48,535: 15%

Recommended Reading: How Long Do Residential Solar Panels Last

How Strong Is A Verbal Agreement In Court

Most business professionals are wary of entering into contracts orally because they can difficult to enforce in the face of the law.

If an oral contract is brought in front of a court of law, there is increased risk of one party lying about the initial terms of the agreement. This is problematic for the court, as there’s no unbiased way to conclude the case often, this will result in the case being disregarded. Moreover, it can be difficult to outline contract defects if it’s not in writing.

That being said, there are plenty of situations where enforceable contracts do not need to be written or spoken, they’re simply implied. For instance, when you buy milk from a store, you give something in exchange for something else and enter into an implied contract, in this case – money is exchanged for goods.

Canadian Sole Proprietorship And Self

- Agriculture

- Canadian Sole Proprietorship and Self-Employed Tax Filing Guide

In this article we will discuss self employment business income tax reporting and Canadian personal income tax return requirements for sole proprietor individuals in Canada. We have only discussed the business income reporting for sole proprietor business owners. Incorporated business owners will need to report their business income on a T2 corporate income tax return.

Recommended Reading: Can You Really Get Free Solar Panels

How To Pay Myself As A Sole Proprietor

Once you have understood how a sole proprietor works, you should know how to pay myself as a sole proprietor if you are planning to work professionally in this role. It will give you a sound understanding of how much to pay yourself if you are going to pay yourself in the business.

As per the rule, a sole proprietor is an accountant himself who can clear his monthly dues at his own will. It means if I am working as a freelancer and want to pay myself as a sole proprietor, I can simply take out the money from the concerned business bank account at any time and pay myself any time. According to the rule, if my business is making good profits, then the money kept in my business bank account would be considered ownership equity. It is calculated as the difference between the business’s assets and liabilities. This transaction would be counted as a draw and is not considered the salary of the paystub for the sole proprietor. As per the available information, if a business owner wants to perform a draw, then he needs to write a check to himself. Furthermore, this check is not subjected to any kind of taxes such as federal income tax, FICA tax or the state income tax by the government. It is because the IRS treats business profits and a sole proprietorâs income as a single thing.

The steps to pay myself as a sole proprietor would be –

Fact : Almost All Businesses Are Small

The vast majority of U.S. businesses are small, whether they are pass-through businesses or C-corporations. Figure 2 shows the share of businesses with $10 million in receipts by type of business. Receipts generally mean sales, but can include income from legal services, rent received, or portfolio income of a financial firm. In 2014, almost 99 percent of all businesses were small by this standard .4 Almost every sole proprietorship was a small business but 95 percent of C-Corporations were small as well.

Whether a business is a pass-through partnership or an S-corporation, or whether it is a C-corporation is not a good indicator for the size, complexity, or even number of shareholders of a business.

Also Check: How To Pay Sole Proprietor Taxes