What Defines A Verbal Contract

A verbal contract refers to an agreement between two parties that’s made âyou guessed itâ verbally.

Formal contracts, like those between an employee and an employer, are typically written down. However, some professional transactions take place based on verbally agreed terms.

Freelancers are a good example of this. Often, freelancers will take on projects having agreed on the terms and payment via the phone, or an email. Unfortunately, sometimes clients don’t pull through on their agreements, and hardworking freelancers can find themselves out of pocket and wondering whether a legal battle is worth all the hassle.

The main differences between written and oral contracts are that the former is signed and documented, whereas the latter is solely attributed to verbal communication.

Verbal contracts are a bit of a gray area for most people unfamiliar with contract law âwhich is most of us, right?â due to the fact that there’s no physical evidence to support the claims made by the implemented parties.

Can Being A Corporation Instead Of A Sole Proprietorship Help You Save Money On Taxes

Thats a difficult question to answer because it depends on the individuals tax situation. Corporations file a corporate tax return and pay the corporate tax rate, but corporate owners pay tax on dividends they receive. For sole proprietors, income from all sources is combined to get a net taxable income. The federal tax rates vary depending on the persons tax filing status.

Other factors, like whether the business has a loss or profit, and available tax credits and dividends in each business type also come into play when figuring a business owners personal tax liability. This question is best answered by having a licensed tax professional review your sole proprietorship income on a regular basis.

Can A Owner Of A Business Be An Employee

In general, the owners of an LLC are not regarded as employees of their company and are not entitled to earnings or salaries. Instead, the owner of a single-member LLC is considered a sole proprietor for tax purposes, while the owner of a multi-member LLC is treated as a partner in a general partnership.

You May Like: How Does A Residential Solar System Work

Paying Your Income Taxes As A Self

As a sole proprietor, your personal income and business income are one in the same and the government sees it this way too.

This means that you file Form T2125 Statement of Business and Professional Activities along with your personal T1. Remember: In addition to federal income taxes, youre also subject to provincial income taxes.

Also if you have your business registered under a different name other than your own, youll need a bank account in the companys name to manage your taxes.

While your filing deadline is June 15 , if you are required to make quarterly installment payments, your first payment is due by April 30.

The factors that determine if you have to pay taxes in quarterly installments include:

- If you earn income that doesnt have things like income tax or employment tax payments taken out, missing these deductions may leave you with a tax liability.

- If you earned more than the threshold of $3,000 or more or $1,800 or more in Québec, you will likely have to make quarterly payments.

- You may also owe if you have outstanding amounts from passing the thresholds in the previous tax years.

- These thresholds are applied based on the province or territory where you live.

If you receive a reminder, the one sent in February is for the March and June payments, while the one sent in August is for the September and December payments.

Obtain Necessary Business Licenses

Sole proprietors dont need to get a general state-wide business license in most states.

However, most cities and counties pose individual regulations to different professional licenses and permits and sales permits.

1. Professional licenses

Professional licenses are based on your industry or profession and ensure you can legally provide a particular service.

For instance, tattoo shops, dietitians, massage therapists, and childcare centers, among other businesses, need occupational licenses.

You can apply for the license through your local city, county, or state office. We recommend checking the relevant government website to see if your business requires a license or permit to be allowed to operate legally.

Your business license or permit costs between $20 to $250+, plus renewal fees. The amount youll pay depends on your location and license type.

2. Sales licenses

Most states require retailers to hold a valid sales license, aka a sales tax permit, if they sell taxable goods or services.

In most states, you wont pay anything to register for a sales license. In other states, the annual costs range from $5 to $100.

Whats taxable varies from state to state. Be sure to check with your local revenue office.

Without the appropriate business licenses or permits, you risk incurring hefty fines.

Does a sole proprietor need an Employer Identification Number ?

Sole proprietors dont need an Employee Identification Number unless they hire employees.

Federal taxes

State taxes

Recommended Reading: How Large Is One Solar Panel

Can A Sole Proprietor Pay Himself A Salary

Can I pay myself wages and withhold taxes? Answer: Sole proprietors are considered self-employed and are not employees of the sole proprietorship. They cannot pay themselves wages, cannot have income tax, social security tax, or Medicare tax withheld, and cannot receive a Form W-2 from the sole proprietorship.

When Should I File Sole Proprietorship Taxes

You should file sole proprietorship taxes the moment you begin getting net business income from your activity. With that in mind, you will not have to file each separate receipt from the moment you receive them. You simply have to gather them, and then file by the given deadlines of the IRS.

Depending on the type of tax that you are filing, the chances are that you need to make estimated tax payments on a quarterly basis. The deadlines to file quarterly taxes are typically April 15, July 15, October 15, and January 15.

Dates typically remain the same throughout the years, around the 15th of the month, but they may change depending on whether it is the weekend or a bank holiday. If the deadline falls on such a day, then it will be pushed onto the next working day.

Bear in mind that the IRS expects you to make all of these payments throughout the year. This means that you need to complete Schedule SE as well, in order to determine just how much you will have to pay. If you fail to pay on a quarterly basis and decide to only make the payment upon your annual tax refund, then you risk receiving a penalty.

Don’t Miss: How Much Is It To Install Solar Power

How Is The Sole Proprietorship Taxed

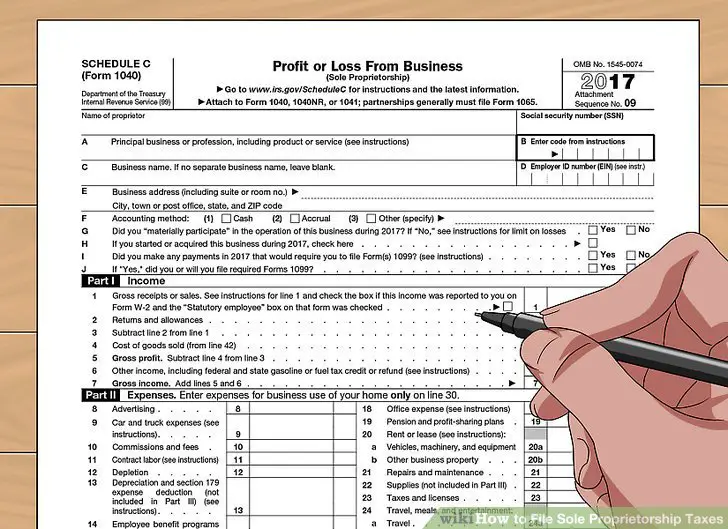

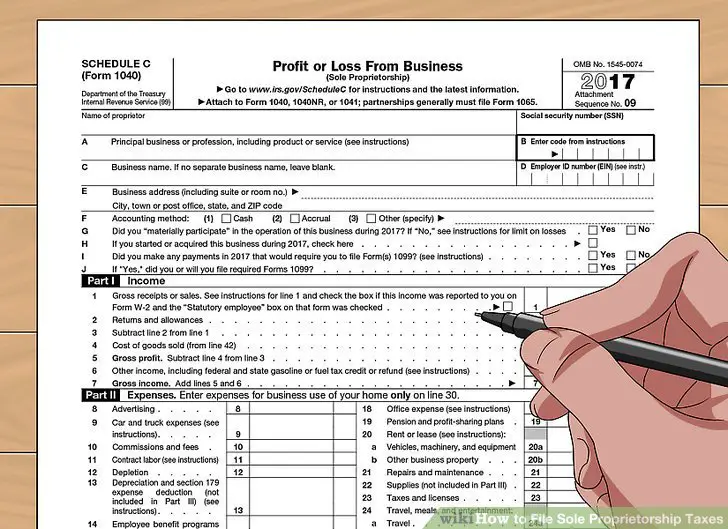

In general, tax reporting for the sole proprietorship is relatively simple when compared to other business entity types. Individuals report their personal income tax liability on Form 1040 . The sole proprietor does not have to prepare or file a separate tax return for the business entity. The Form 1040 allows the individual to report any income from business operations on their personal income tax return on Schedule C.

Example: Melanie has a 9-5 job at a large company. She will receive a W-2 at the end of the year indicating her wages received. She is also a sole proprietor in that she earns money providing professional services to clients. This line of work is not related to her 9-5 job. She will report the W-2 wages on line 1 of the IRS Form 1040. She will report the income and expenses from her business activity on Schedule C of her 1040.

Note: Like any business, the sole proprietor will report all revenue generated by the business and all expenses of operations. She must also keep track of specific issues, such as depreciation schedules on business equipment. Despite the simplicity of tax reporting for sole proprietorship income, there are several other tax considerations for the sole proprietor.

Start A Sole Proprietorship Or Partnership

To conduct business as a sole proprietorship or partnership, you need to reserve a business name and register the business.

If you’re going to do business under your name, you do not need to request a business name or register the business with the province.

OPTIONAL: If you’re not sure which business structure you should choose,consider the different business structure options available. You may also want to:

- Explore resources from the Small Business Branch or Small Business BC

- Get advice from a chartered accountant or lawyer before setting up your business

Request and reserve a business name online

Businesses must have their name approved and confirm that it doesn’t conflict with a name already being used by a corporation. Only incorporated companies, cooperatives or societies can guarantee exclusive use of their name. Find out how to choose the right name.

If you’re unable to submit a request online, complete the Name Request form and mail it or drop it off at a Service BC locationwith payment. Make cheque or money order payable to the Minister of Finance.

It takes about 7 to 14 days to process a name request.Once it’s complete, you’ll receive a confirmation email and a name request number you can use to register your business. Be sure to complete the registration before the name request expires . If not, you’ll need to submit another name request. Request priority service if you need to have a name approved in 1 to 2 business days.

You May Like: How To Convert Your Home To Solar Energy

What Sole Proprietors Need To Know About Collecting Sales Tax

What is sales tax?

Sales tax can be broken into two distinct categories federal sales tax and provincial sales tax . The federal sales tax is called Goods and Services sales tax and it is a tax that most small businesses are required to collect on behalf of the government for goods and services sold in Canada. The goods and services tax is a value-added tax of 5%, levied on most goods and services sold for domestic consumption. But, like all such taxes, there are few exceptions even under GST where goods or services are exempt from tax liability. Such exemptions on specified goods or services are granted by the government based on certain conditions. Hence, while determining the tax liability under GST, one needs to check for not only the goods or services that are chargeable to GST, but one also needs to look into the goods or services that are exempt from tax.

Provincial sales tax is different for each province and determined based on the province you do business in, or in the case of e-commerce/remote business: where your customer is located. For a detailed guide on the different provincial sales taxes and how to know which sales tax to charge, check out our article: Provincial Sales Tax and the place of supply rules.

When do you need to collect sales tax?

In order to do collect and remit these taxes, you have to register for a GST/HST number. Once you set up your GST/HST account, youll also want to keep track of your effective date and subsequent filing deadlines.

What Happens If A Sole Proprietor Doesnt Pay Estimated Taxes

The U.S. tax system is pay as you earn, and the IRS expects taxpayers to pay taxes on their income during the year they earn it, rather than waiting until they file their taxes early the following year. If you didnt pay enough tax on your business income during the year, you may have to pay a penalty for underpayment. You may also be charged a penalty if your estimated tax payments are late, even if you receive a refund.

You may be able to decrease the penalty if:

- You increase your withholding from employment income.

- You have uneven income during the year, so you annualize your income and make unequal payments during the year.

- You qualify for later payment due to a casualty or .

- You retire after age 62 or become disabled during the year and didnt make the payments due to reasonable cause.

Recommended Reading: Does My Zip Code Qualify For Free Solar Panels

How Can Deskera Help You With Us Sole Proprietorship Taxes

Deskera Books is an online accounting, invoicing, and inventory management software that is designed with the sole purpose of making your life easier. It is a one-stop solution that caters to all your business needs like creating invoices, tracking expenses, getting insights through financial KPIs, creating financial reports and financial statements, and so much more.

This platform works exceptionally well for all the small businesses that are being set up or need some help, especially in accounting. Whether it is recording your operating income, account payable, account receivable, or even returns on investments, or it is about updating your debit and , Deskera Books has made it all very easy as well as accessible.

In fact, the software comes updated with pre-configured accounting rules, invoice templates, tax codes, and a chart of accounts, to name a few, which makes it super easy for you to comply with sole proprietorship taxation. Deskera Books will also allow you to transfer your data from your previous accounting software by just updating the details on the spreadsheet available on Deskera Books.

Paying Taxes On A Draw

You don’t get taxed on the money you draw out for personal use. It’s not the same as taking a dividend from your shares as a shareholder of a corporation.

Your business tax amount is determined by the net income on the Schedule C you complete each year. That Schedule C income is included in your personal 1040 tax return and is taxed along with other sources of income.

A sole proprietor pays income tax on the net income of the business, NOT on the money the sole proprietor takes out of the business as a draw.

Recommended Reading: How Many Different Types Of Solar Panels Are There

Find The Right Local Sa Accountant Now

Featured Accountant

Article by listed accountant:Rakhi Popat

With less than a week to go for provisional taxpayers to submit their returns, this past week I have had several encounters with small business owners, in particular those operating under sole proprietorships. Most small business owners have asked for an all-inclusive list of what expenses are allowed to be deducted for tax purposes, and what expenses are disallowed. Each business is engaged in unique activities with unique expenses and therefore it is impossible to give an exhaustive list of the expenses that are tax deductible. So I have decided to write this blog with the aim of explaining how taxes work for people who are running their own businesses as sole proprietors.

In the eyes of SARS, the individual and the business are one and the same person, so your tax return is filed in your personal capacity and the taxable income generated by the business is included in your personal tax return which is filed annually via an ITR12 . In addition to filing an ITR12, small business owners need to be registered as provisional taxpayers since they earn income other than by way of a salary. If you are a salaried employee and are also running a small business you also need to be registered for provisional tax. In summary, as a sole proprietor, one needs to file an ITR12 annually and 2 IRP6s .

Another common question asked by sole proprietors concerns home office expenses. The principle is the following :

Know Your Business Structure

“Taxes are complicated and the rules are always changing. Be sceptical of tax advice that you get at a cocktail party or from a friend. Just because something worked for another entrepreneur, it doesnt mean its the right decision for your business.”

The Canada Revenue Agency recognizes three types of business structures:

- Sole proprietorships As implied by the term sole, a sole proprietorship is a small business owned by one person.

- According to Shopify’s Canadian Legal Guide, some of the advantages of a sole proprietorship are:

- It’s easy to set up.

- Your business taxes are filed with your personal taxes.

Also Check: How Reliable Is Solar Power

Overview: What Is Sole Proprietorship Taxation

A sole proprietor is an entrepreneur who owns a business personally and has not incorporated the business. Typically, startups and side businesses are sole proprietorships.

Once your business reaches a certain size, it should be converted to an S corporation or C corporation. These business entity types allow for shares to be sold to outside owners and can reduce business taxes as the corporate tax rate is likely lower than what your personal marginal rate would be at that point.

A sole proprietor does not file a business tax return instead taxes are reported on the personal income return of the owner.

When To Use An Llc

LLCs offer taxation benefits, increased credibility, and most importantly, personal liability protection.

LLCs are recommended for businesses with the following characteristics:

- Larger customer base

- Potential for immediate and sustainable profit

- Increased risk of liability or loss

- Would benefit from unique tax options

Advantages of LLCs

- Personal Liability Protection. LLCs provide personal liability protection. This means your personal assets are protected in the event your business is sued or if it defaults on a debt.

- Tax Benefits. LLCs and have options to customize their tax structure. This allows businesses to use the best tax strategy for their circumstances.

- Growth Potential. LLCs can grow in profit and risk because they provide personal liability protection and tax benefits.

- Credibility and Consumer Trust. LLCs generally earn more trust from both banks and consumers than do informal business structures like sole proprietorships. This can impact a businesss ability to take out loans and can affect marketability.

Ready to Form Your LLC?

Our free guide walks you through the process of LLC formation in all fifty states. In just five easy steps, you can be on your way to owning your own business.

You can also use an LLC formation service to register your LLC for you.

Read Also: Where To Buy Solo Stove

Don’t Miss: What Is The Best Retirement Plan For A Sole Proprietor