When Can I Claim The Solar Investment Tax Credit

One of the requirements of claiming the Solar Investment Tax Credit is that you do so within the same tax year that your installation is completed. This period begins after your solar power system has been fully installed and is operational. If the value of the tax credit you are owed exceeds your solar tax liability during that tax year, you can still capitalize on its full value thanks to a unique provision of the credit.

Though it is a non-refundable tax credit, the ITC employs a solar tax credit rollover system that allows you to collect your credit balance in subsequent years. Based on the present guidelines, you can rollover the balance for the duration of the solar tax credit until it expires at the end of 2023.

How Solar Tax Credits Work

The tax credit is a reduction in an individuals or business’s tax liability based on the cost of the solar property. Its a nonrefundable tax credit, meaning you wont get more back than the amount you owe in taxes.

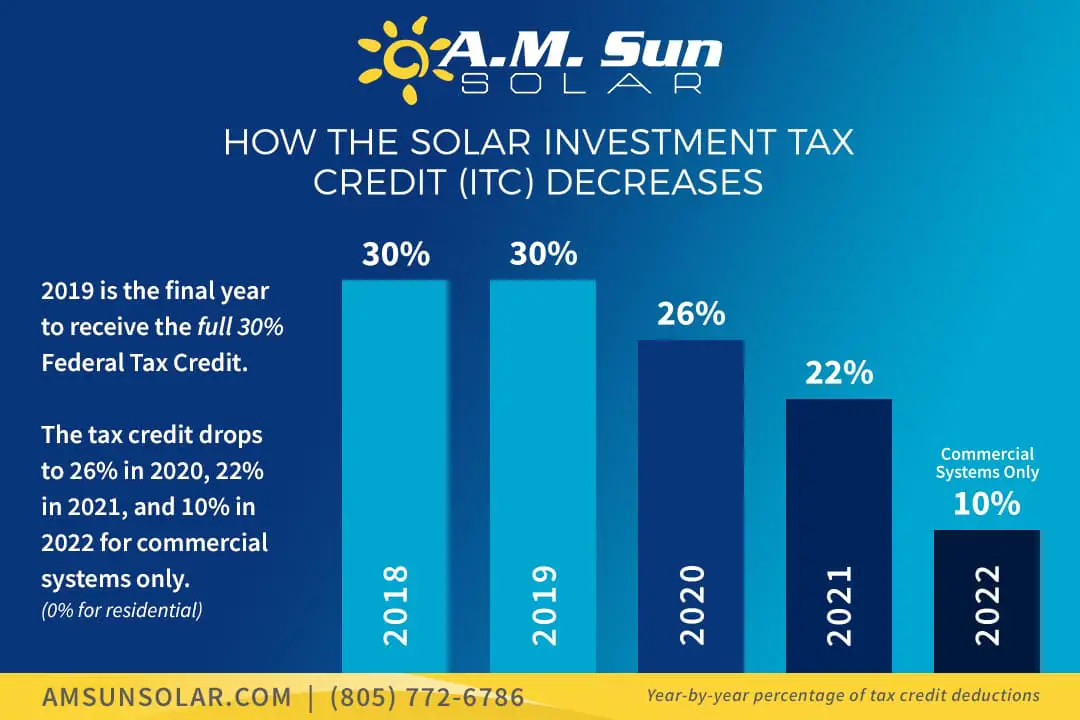

Projects that begin construction in 2021 and 2022 are eligible for the 26% federal tax credit, while projects that begin construction in 2023 are eligible for a 22% tax credit. Residential tax credits drop to 0% after 2023, but commercial projects will drop to 10%.

As of 2021, the solar ITC is a 26% federal tax credit.

Homeowners who purchase a newly built home with a solar system are eligible for the ITC the year they move into the house if they own the solar system. Those who lease a solar system or who purchase electricity through a power purchase agreement are not eligible for the ITC. In this case, its the company that leases the system or offers the PPA that collects the credit.

Anyone wishing to claim the credit should first consult with a tax professional to ensure that they are eligible. It’s smart to speak with an advisor before making a major investment that you intend to claim on your taxes.

How To Claim Your Tax Credit

To claim the ITC you will need to file under IRS From 5695. Youll receive your tax credit the following year when you file your taxes for the year in which you installed your panels. If you dont qualify for the entire tax credit in the first year you can roll over the amount over 5 years.

Check this video that walks you through the process for claiming the tax credit.

In conclusion, the federal tax credit is 30% of your gross system cost and is a great opportunity to go green, create clean energy, and save money on home improvement. Now is the time to go solar!

Read Also: How Much Does A Solid Wood Interior Door Cost

No Refund Check Comes With The Solar Tax Credit Program

According to theSolar Energy Industries Association, Solar Investment Tax Credit is one of the most significant Federal policies supporting solar energy development in the USA. Since its inception, there has been a massive growth of solar adoption in the US by over 10,000%. It has seen the creation of more jobs and also increases in the US economy through billion-dollar investments. However, as a homeowner looking to install solar panels, no cashback comes from solar tax credit California. If, for example, your rooftop solar system installation costs $30,000. If you claim the 30% ITC, you are eligible to save $9,000.

Do you get this as a cash refund?

No, you will not get this claim in cash.

What happens?

Instead of the cash at hand, the money goes to your tax liability. This money helps you a great deal in reducing your yearly tax.

Am I Eligible To Claim The Federal Solar Tax Credit

You might be eligible for this tax credit if you meet all of the following criteria:

- Your solar PV system was installed between January 1, 2006, and December 31, 2023.

- The solar PV system is located at your primary or secondary residence in the United States, or for an off-site community solar project, if the electricity generated is credited against, and does not exceed, your homes electricity consumption. The IRS has permitted a taxpayer to claim a section 25D tax credit for purchase of a portion of a community solar project.

- You own the solar PV system .

- The solar PV system is new or being used for the first time. The credit can only be claimed on the original installation of the solar equipment.

Don’t Miss: How Cheap Is Solar Power

Federal Tax Credit For Residential Solar Energy

OVERVIEW

The federal solar tax credit for solar energy upgrades to your home may not be around for much longer. Here’s how to claim this credit.

In an effort to encourage Americans to use solar power, the U.S. government offers tax credits for solar-powered systems. Let’s take a closer look at some of the benefits of the solar tax credit and how you can claim it.

Solar Renewable Energy Certificate

A Solar Renewable Energy Certificate , sometimes referred to as a Solar Renewable Energy Credit, is another type of state-level solar incentive. After you install your solar power system and register it with the appropriate state authorities, they will track your systems energy production and periodically offer you SRECs as a benefit. You can sell your SREC to your local energy utility to provide payment thats typically considered taxable income.

Also Check: When Is Tesla Solar Roof Available

How Can I Claim The Federal Solar Tax Credit In 2022

If youre ready to take advantage of the federal solar tax credit , but you’re unsure where to start, youre not the only one.

The first step you should take is making sure you check all of the boxes when it comes to the eligibility requirements listed. Remember that if you are leasing your solar system, you are not going to be eligible for the federal solar tax credit even if you meet all of the other requirements.

Once youve double-checked that all of the eligibility statements apply to you, its a good idea to talk to a tax professional about how claiming the tax credit can affect you.

Once youve spoken with a tax professional, the next step is to fill out the IRS 5695 form and add the required information to the form 1040 that you complete at the end of the year.

After completing the form, attach it to your federal tax return.

Click the link for instructions on how to fill out this form.

Frequently Asked Questions

Below are some commonly asked questions related to the federal solar tax credit

What Is The Residential Hawaii Energy Tax Credit For Pv

Originally enacted in 1976, the Hawaii Energy Tax Credit allows individuals to claim an income tax credit of as much as 35% of the cost of equipment and installation of a residential photovoltaic system. The credit is capped at $5,000 per 5 kW system, and multiple systems may be installed on one home.

Systems must be fully installed and capable of operation by the end of the the year in which you are claiming the tax credit. If your credit is more than what you owe in that year, the credits may be rolled forward to subsequent years. Hawaii also offers a refundable credit for PV system owners who do not have sufficient state tax liability the refundable credit is 30% less than the normal tax credit, but state cuts a check directly to the system owner.

Read Also: How Much Does It Cost To Bird Proof Solar Panels

Other Frequently Asked Questions

If the tax credit exceeds my tax liability, will I get a refund?

This is a nonrefundable tax credit, which means you will not get a tax refund for the amount of the tax credit that exceeds your tax liability. Homeowners may get a tax refund at the end of the year due to the tax credit, if the reduction in tax liability means there was overpayment during the year. This can often occur when employers deduct taxes for employees over the course of the year. However, such refund is still limited by the taxpayers total tax liability. However, you can carry over any unused amount of tax credit to the next tax year.

Can I use the tax credit against the alternative minimum tax?

Yes. The tax credit can be used against either the federal income tax or the alternative minimum tax.

I bought a new house that was constructed in 2020 but I did not move in until 2021.

May I claim a tax credit if it came with solar PV already installed?

Yes. Generally, you can claim a tax credit on the expenses related to the new solar PV system that already came installed on the house for the year in which you moved into the house in other words, you may claim the credit in 2021. For example, you can ask the builder to make a reasonable allocation for these costs for purposes of calculating your tax credit.

How do I claim the federal solar tax credit?

Freedom Solar Is An Installer You Can Trust

A solar panel installation is a big project, and its important to know that youre working with a reliable and reputable team. Whether youre an average homeowner or a large business such as Whole Foods or Office Depot, Freedom Solar is dedicated to making our clients switch to solar power an easy and affordable transition.

So if youre thinking about going solar, ready to make the switch to a lifetime of green energy, or interested in reducing your tax burden by lowering your electric bill, were here to help you begin the journey with our 7 Steps to Solar process.

Well find every available financial incentive, practice COVID-19-conscious installation methods, and offer lifetime service and monitoring to meet your needs! Take a look at what our customers say on how we deliver on our promises. Contact us to request a free, no-obligation virtual consultation with one of our energy consultants or, if youd like to learn more about the ITC, visit Energy Sage and the Solar Energy Industries Association .

You May Like: How Much Does 1 Acre Of Solar Panels Cost

Solar Tax Credit Requirements

The solar tax credit is a federal program, so you need to meet certain requirements to qualify:

- The property must be used as your main residence or business location

- You must own the solar energy system outright or have a solar lease or power purchase agreement in place

- The solar energy system must have been installed by December 2022

Do you need help understanding taxes? If youre curious about rebates and income tax, we also wrote a guide to income tax calculators.

When And For How Long Can I Claim The Solar Tax Credit

If youre eligible for the ITC, but you dont owe any taxes during the given calendar year, the IRS will not refund you with a check for claiming the credit. The 26 percent ITC is not refundable. However, according to Section 48 of the Internal Revenue Code, the ITC can be carried back one year and forward 20 years. Therefore, if you had a tax liability last year, but dont have any this year, you can still claim the credit. Likewise, if you had no tax liability last year or this year, you can use the credit any time you have liability over the next 20 years.

Don’t Miss: Do Solar Panels Work In Cloudy Weather

How Will The Solar Tax Incentive Benefit You

Solar panels are generally considered a major home improvement project. But most people go solar with no money down upfront and eventually generate significant long-term savings by reducing or even altogether eliminating their electric bill.

In fact, the average home saves between $20,000 and $40,000 over their solar energy systems lifetime.

The process of going solar typically takes a couple of months to obtain the necessary approvals and inspections, install the system, and then energize it but its well worth the wait. Here are the top financial reasons to go solar.

How Do I Claim The Solar Panel Tax Credit To Claim My Rebate

So lets get to the good stuff. What do you need to do to actually get your hands on this money and reduce the total cost?

Our first bit of advice is to keep all your receipts from the start of your solar installation project. Like any tax incentive, the Federal Solar Tax Credit requires a paper trail. The more you spend on your project, the larger your credit so make sure to keep track of everything!

Here are some of the expenses that you are allowed to claim:

- Solar equipment

Read Also: How Much Solar Power Can 1 Acre Produce

History Of The Solar Investment Tax Credit

In the early days of solar energy, residential systems were far more expensive than they are now. By many homeowner standards, however, theyre still expensive today. For example, in 2009, it cost $8.50 per watt to install solar panels the current cost per watt, as of publishing, is about $2.40 to $3.22.

This point-of-entry cost into the world of renewable residential solar power dramatically limited the number of homeowners who could take advantage of solar for their home.

The solar investment tax credit was established by the Energy Policy Act of 2005, which established standards for renewable fuels, mandated an increase in the use of biofuels and established renewable energy-related tax incentives.

Under this law, the original policy was set to expire at the end of 2007. However, the solar ITC has been so popular that its expiration date has been extended multiple times.

Solar panel costs have decreased dramatically in the last 20 years, but the ITC can still save individuals and businesses a great deal on their federal taxes.

Today, solar systems are far less expensive due to changes in the industry and the manufacturing of certain parts that make up the solar system. Solar panels, lithium batteries and inverters are all far less expensive to make and buy now than they were in those early days.

Dont Miss: Are Solar Panels Better For The Environment

Is The Solar Tax Credit Refundable

Everyone wants to get a check at the end of tax season, but some of us end up having to send a check instead. With the federal solar tax credit , you wont have to worry about sending in a check but does that mean youll be getting a check? It depends. While the federal solar ITC is technically non-refundable, there are ways that it can get you a check in your mailbox.

Recommended Reading: What Does Invisible Solid Deodorant Mean

Federal Incentives And Rebates

Canadas federal government provides three solar incentives: two of which are exclusively commercial and one which is residential.

a. The Greener Homes Rebate

The Greener homes initiative is a perfect opportunity for homeowners to make their homes more comfortable to live at reduced costs, while at the same time gaining grants from the government for contributing to Canadas goal of achieving net-zero greenhouse gas emissions. The Greener Homes grant will provide homeowners with up to $5,000 for the installation and implementation of a roof or ground-mounted solar system. The government of Canada has provided 700,000 grants of up to $5,000 to help homeowners make energy-efficient decisions and help lower the investment capital required to go solar.

b. Self-employed or Commercial:

The Accelerated Capital Cost Allowance enables commercial producers of renewable electricity to reduce their taxable income in the early years of an assets operation by claiming additional depreciation. The enhanced allowance offers a 100 percent reduction that scales down over time. This commercial incentive can only be claimed on property subject to Capital Cost Allowance rules.

c. Residential or Homeowners:

2. Provincial and Municipality Incentives and Rebates

Here’s How Solar Panels Can Earn You A Big Tax Credit

The federal solar tax credit can slash up to 30% from the cost of a home solar-energy system.

Dan Avery

Writer

Dan is a writer on CNET’s How-To team. His byline has appeared in Newsweek, NBC News, The New York Times, Architectural Digest, The Daily Mail and elsewhere. He is a crossword junkie and is interested in the intersection of tech and marginalized communities.

Since 2006, the Federal Solar Investment Tax Credit has given owners of a home or commercial solar-energy system a one-time deduction on their federal return.

That credit can defray a lot of the cost of a rooftop solar-energy setup: A $20,000 solar photovoltaic system that was installed in 2018, for example, is eligible for a 30% deduction. That essentially brings the price down to $14,000.

There are also additional state and local tax incentives that could save you even more money. And with solar panels running between $15,000 and $25,000, every bit helps.

If you’re thinking about getting solar panels, now is the time. Congress extended the Solar ITC in 2020, but the percentage deduction available is steadily declining — in fact, the credit could soon expire altogether.

Also Check: Is Solid State Drive Better

Hawaii State Tax Credit For Solar Hot Water

The same rules apply for getting solar hot water, since Hawaii also boasts a tax credit for solar water heaters. Just like with the solar panels mentioned above, residents of Hawaii can get a 35% tax credit when filing their taxes. The savings, however, is capped at $2,500 for solar water heaters. Although, a one-time $750 rebate is available to existing homes built in 2009 or before.