How To Claim Your Tax Credit

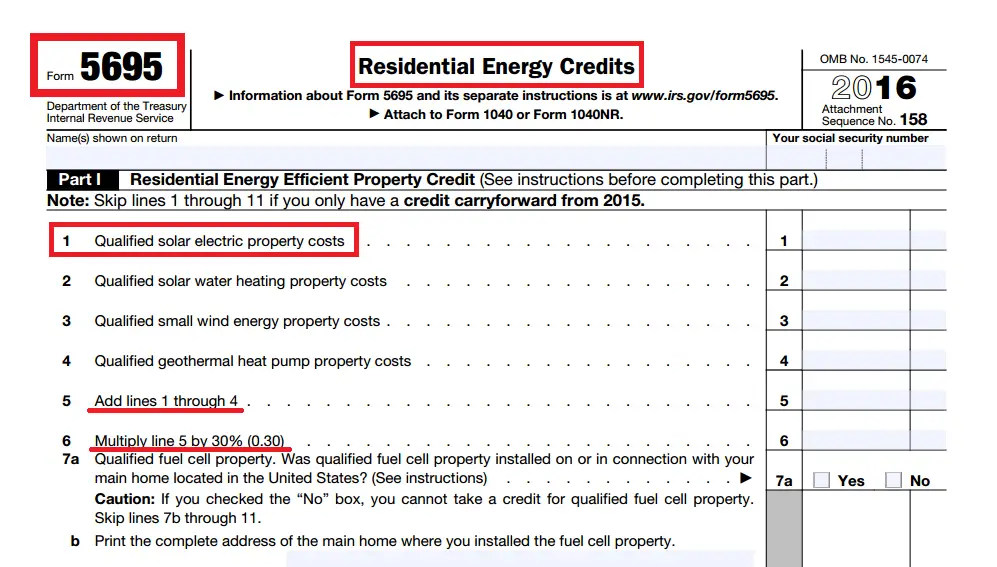

To claim the ITC you will need to file under IRS From 5695. Youll receive your tax credit the following year when you file your taxes for the year in which you installed your panels. If you dont qualify for the entire tax credit in the first year you can roll over the amount over 5 years.

Check this video that walks you through the process for claiming the tax credit.

In conclusion, the federal tax credit is 30% of your gross system cost and is a great opportunity to go green, create clean energy, and save money on home improvement. Now is the time to go solar!

Applying Online Through Cactas

To request a Solar Energy System Tax Credit, you are required to complete an application. The application must be received by May 1 following the year of the installation of the solar energy system or the application will be denied. Once your application is reviewed, it will either be denied or updated to waitlisted status. An application in waitlisted status shall not constitute a promise binding the state the credit is contingent upon availability of tax credits for that particular year.

The application for the tax credit is available online within the Tax Credit Award, Claim & Transfer Administration System . The system is designed so that once you have submitted an application, you can later sign into the system to track its status. The electronic process will create efficiencies in the review and approval of the hundreds of applications received for the Solar Energy System Tax Credit each year. All applications must be entered into CACTAS paper applications are no longer available.

To learn about the amount of tax credits awarded under the program cap, select the Solar Energy System Tax Credit drop down option from the home page. you do not need to sign into CACTAS.

Tax Benefits Of Going Solar

Tapping the sun for power offers several benefits. For example, solar power:

- Doesn’t pollute

- Reduces our use of coal and other fossil fuels

- Reduces your individual carbon footprint

But since the installation of solar power equipment can be costly, the solar tax credit can help you offset some of the costs.

Also Check: Where To Sell Solid Wood Furniture

Solar Tax Credit Step Down Schedule

2019 was the last year to claim the full 30% credit. As of 1/1/2021, the credit has dropped down to 26%.

Heres the full solar Investment Tax Credit step down schedule:

*From 2024 onward, the residential portion of the Solar Tax Credit will be eliminated entirely. A 10% tax credit will remain for commercial, industrial, and utility scale projects only.

How To Claim The Federal Solar Tax Credit

You claim the solar tax incentive as part of your annual federal tax return with the Internal Revenue Service . Your solar provider should supply the proper documentation and instructions upon your demand. We have listed the essential steps in claiming the credit here:

We recommend consulting a tax expert and your solar provider to ensure you are correctly claiming the ITC.

You can use the Database of State Incentives for Renewables & Efficiency to see what other rebates and state tax credits are available in your zip code.

Recommended Reading: Can I Change My Ein From Sole Proprietorship To Llc

Can I Claim The Federal Solar Tax Credit For Fiscal Year 2021

Any solar-energy system installed after Jan. 1, 2006, is eligible for the one-time credit.

If your system was installed and generating electricity in your home last year then, yes, you can claim it. But if you buy and install one this year, you’ll have to wait until next tax season to deduct the credit.

Bring your home up to speed with the latest on smart tech, security, utilities, environmental issues and more.

Who Is Eligible For The Federal Solar Tax Credit

Any US taxpayer who purchases a new solar system installation is eligible for the federal solar tax credit. The keyword is âpurchaseâ. Solar leases and solar PPAs are not eligible for the tax credit.

So if you pay upfront or finance your solar panel system and file federal income tax you can receive this tax credit.

Also Check: How Expensive Is Solar Panel Installation

Start Your Solar Journey Today With Energysage

EnergySage is the nations online solar marketplace: when you sign up for a free account, we connect you with solar companies in your area, who compete for your business with custom solar quotes tailored to fit your needs. Over 10 million people come to EnergySage each year to learn about, shop for, and invest in solar. .

Things To Know About The 26% Solar Tax Credit Before It’s Gone

Shannon Higgins

Since 2006, the federal solar investment tax credit has helped thousands of businesses turn free sunlight into clean and affordable energy. But the current 26% ITC is scheduled to drop by 4% beginning in January 2021 — significantly reducing the savings potential for organizations looking to improve their bottom. If your company has been considering a solar investment, read on to learn how this lucrative tax credit is worth your attention now, and what you may miss when it’s gone.

While there are other incentives that can make your commercial solar project drastically more affordable, the federal ITC is arguably the most well-known and lucrative. It’s also currently the most fleeting. That said, there are ways to lock-in the current rate even without a fully completed installation. Curious how? Read on and don’t skip #3.

Also Check: Where Can I Buy Shoe Soles

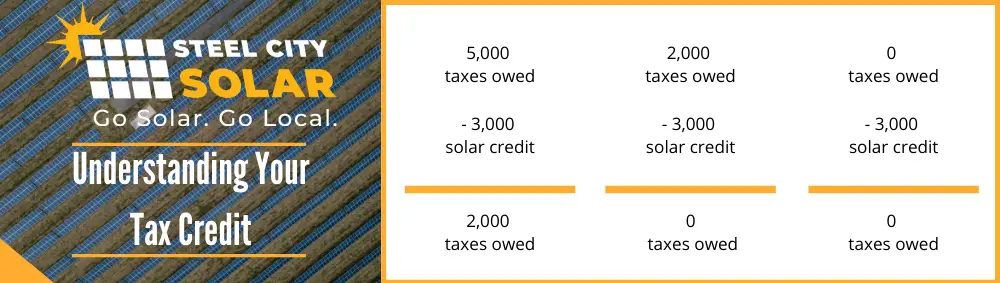

How Does The Tax Credit Work

You can claim the federal solar tax credit as long as you are a U.S. homeowner and own the solar panel system installed in a residence in the United States. The tax credit rolls over for up to five years if the taxes you owe are less than the credit you earn. However, you do not receive any part of the tax credit in your tax refund.

For example, if you have a solar system installed for $19,000, the 26% tax credit saves you $4,940 on your federal tax return the same year the system is activated. This way, you technically pay $14,060 for your solar power system. If your tax liability is less than $4,940, the remainder of the credit will roll over and be applied to your federal income taxes the following year.

Are Solar Batteries Eligible For The Federal Solar Tax Credit

Yes, solar batteries are eligible for the federal solar tax credit. In this document, The National Renewable Energy Laboratory outlines the parts of solar systems that are included. It states: âBattery systems that are charged by the renewable energy system 100% of the time on an annual basis can claim the full value of the ITC.â

You May Like: Are Solar Panels Better For The Environment

What Does The Federal Solar Tax Credit Cover

According to the EERE, the federal solar tax credit covers the following items:

- Panels: The credit covers solar PV panels or PV solar cells.

- Additional equipment: The credit covers other solar system components, including the balance-of-system equipment and wiring, inverters and other mounting equipment.

- Batteries: The ITC covers any storage devices, such as solar batteries, charged exclusively by your solar PV panels. This claim works even if the storage is activated in a subsequent tax year to when the solar energy system is installed. Storage devices are still subject to the installation date requirement.

- Labor: Labor costs for on-site preparation, assembly or original installation. Coverage also includes the permitting fees, inspection costs and developer fees.

- Sales tax: The credit also covers any sales taxes applied to these eligible expenses.

Get Started With Solar Energy Today

Theres never been a better time to switch to renewable solar energy. Not only has the price of solar equipment and electricity dropped significantly in the last ten years, but also do-it-yourself solar installation is now a hassle-free experience that can save you thousands more.

DIY solar panel kits are easy for you or a contractor to install within a weekend. At GoGreenSolar, we guide you through every step of the solar installation process and even offer a permit approval guarantee. Purchase from us with confidence!

Start your solar journey today!

Get a free solar estimate and complimentary solar roof layout from GoGreenSolar. No appointment needed!

Read Also: Will Pine Sol Kill Bed Bugs

Cashing In On Other Solar Incentives

Along with the federal solar tax credit, there are a number of rebates, programs and state tax incentives that you may be eligible for depending on where you live. In some cases, these other solar incentives may impact your federal tax credit. Heres what you should know:

- Rebates from your utility company: Typically, subsidies from your utility company are excluded from income tax returns. In these situations, the rebate for installing solar must be subtracted from your system cost before you can calculate your tax credit. However, the compensation you receive through net metering shouldnt affect your federal tax credit.

- Rebates from state-sponsored programs: Rebates from the state government generally do not reduce your federal tax credits.

- State tax credits: Any state tax credit you get for your residential solar system will not decrease your federal tax credit amount. However, getting a state tax credit means the taxable income you report on your federal returns will be higher, as youll have less state income tax to deduct.

- Payments from renewable energy certificates: Any payments you receive from selling renewable energy certificates will likely be considered taxable income. As such, it will increase your gross income but will not reduce your tax credit.

Who Is Eligible For The Itc

If you meet the following criteria, you may be eligible to benefit from the solar investment tax credit:

- You purchased and installed your PV system sometime between January 1, 2006 and today, or plan to by December 31, 2023.

- Your PV setup is located at a residence or commercial business within the United States.

- Your solar panel system is new or has never been used before the solar tax credit can only be claimed on original equipment installations.

Don’t Miss: Is Solar Worth The Cost

What Is The Residential Federal Solar Tax Credit For Pv

The federal solar tax credit, formally known as the investment tax credit , is a credit equal to 26% of the qualified costs of installing a photovoltaic solar system for the current year, 2021. The ITC was established as a part of the Energy Policy Act of 2005 in an effort to boost the US renewable energy market. The credits were set to hit 0% in 2022 but have been extended out two years as a part of the COVID relief bill.

The two-year extension of the federal Investment Tax Credit for solar projects will retain the current 26% credit for projects that begin construction through the end of 2022, rather than expiring at the end of 2021 as they would have under the initial law. The ITC will fall to a 22% rate for projects that complete construction by the end of 2023, and then fall to 0% for residential solar projects in 2024.

Solar Sam: Helping You Find Affordable Solar Energy Solutions

Solar Sam is a fast-growing local solar provider and professional solar installer. We provide Missouri solar, Kansas solar, and Illinois solar, but we also service the entire continental United States.

Why choose Solar Sam? Solar Sam will help you find quality, expert solar solutions for residential, commercial, and agricultural applications at prices you can afford.

Visit our website for deals that are out of this world! When youre ready to take advantage of this incredible federal tax incentive, give us a call at 833-RU-SOLAR to get started with a free quote.

Solar Sam loves helping our customers power their lives with green energy run by the sun!

Don’t Miss: Do You Need An Inverter For Solar Panels

Q Are There Incentives For Making Your Home Energy Efficient By Installing Alternative Energy Equipment

A. Yes, the residential energy efficient property credit allows for a credit equal to the applicable percent of the cost of qualified property. Qualifying properties are solar electric property, solar water heaters, geothermal heat pumps, small wind turbines, fuel cell property, and, starting December 31, 2020, qualified biomass fuel property expenditures paid or incurred in taxable years beginning after that date. Only fuel cell property is subject to a limitation, which is $500 with respect to each half kilowatt of capacity of the qualified fuel cell property. Generally, this credit for alternative energy equipment terminates for property placed in service after December 31, 2023. The applicable percentages are:

How It’s Applied & Who Qualifies

With the federal tax credit , you can deduct 26% of the cost of your solar energy system from your business taxes. This is a dollar-for-dollar credit toward the income taxes that would otherwise go to the federal government. To qualify, the business must have a tax liability upon filing. In other words, if the business owner is going to receive money back from their tax return, then the credit will not be applied for that year and will simply roll forward to the next. The amount deducted is calculated by multiplying 26% by the “tax basis,” which is the amount invested in eligible property. For solar installations, eligible property can include solar panels, installation costs, racking, circuit breakers, energy storage devices, and sales and use tax on the equipment.

Don’t Miss: What Is Solar Home System

What Is The Federal Solar Tax Credit

The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic system.

The system must be placed in service during the tax year and generate electricity for a home located in the United States. There is no bright-line test from the IRS on what constitutes placed in service, but the IRS has equated it with completed installation.

In December 2020, Congress passed an extension of the ITC, which provides a 26% tax credit for systems installed in 2020-2022, and 22% for systems installed in 2023. The tax credit expires starting in 2024 unless Congress renews it.

There is no maximum amount that can be claimed.

Solar Tax Credit Calculator:

It is easy to give you the rate of the solar tax credit. But it is much harder to give you the dollar value for your specific home. Luckily SolarReviews.com has developed one of the most accurate solar calculators. Using data from local solar installs in your area we can give you a very accurate cost guide for your specific home.

It will show you the dollar value of the federal solar tax credit and include any state tax credits if eligible. This gives homeowners who use our calculator the opportunity to figure out if solar is worth it for their home, before talking to solar companies.

Calculate the dollar value of the tax credit

Read Also: When To Add Solid Food For Baby

What Are The Filing Requirements For Solar Tax Credits

If you are eligible to claim a Federal solar tax credit, you will need to file Form 5695 alongside your tax returns this year. This form is used to calculate the amount of credit you are entitled to. The result will be added to Form 1040.

This is a non-refundable tax credit, so if the credit is worth more than you owe in Federal taxes, you cannot use the credit to get a tax refund. It is possible to carry the credit value over to the following tax year, however.

It remains unclear as to whether unused solar tax credits will still be able to be carried over after 2021, when the program expires.

Important Update On The Solar Energy System Tax Credit

The Iowa Solar Energy System Tax Credit expires and is unavailable under Iowa law for residential installations completed after December 31, 2021. Therefore, any residential tax credit request that does not receive a tax credit award during the 2021 award year will expire under Iowa law and will not carry forward on the waitlist to future years. This result is required under Iowa Code section 422.11L and the version of the federal residential solar tax credit to which Iowa is conformed. Submitting an application before the residential tax credit expires at the end of 2021 is no guarantee a taxpayer will receive an award, as described below.

The Iowa solar energy system tax credit for business installations does not expire at the end of calendar year 2021, but Iowa law provides that it will only apply to installations that begin construction before calendar year 2022, so its availability will be limited in the future. Valid and timely business tax credit requests will not expire under Iowa law and may carry forward on the waitlist to future years.

2021 award year: The Department estimates that valid and complete business or residential applications with a submission date before , will be eligible to receive a tax credit award and certificate during the 2021 award year. The Department is in the process of issuing these tax credit certificates.

Recommended Reading: Can An Llc Own A Sole Proprietorship