How It’s Applied & Who Qualifies

With the federal tax credit , you can deduct 26% of the cost of your solar energy system from your business taxes. This is a dollar-for-dollar credit toward the income taxes that would otherwise go to the federal government. To qualify, the business must have a tax liability upon filing. In other words, if the business owner is going to receive money back from their tax return, then the credit will not be applied for that year and will simply roll forward to the next. The amount deducted is calculated by multiplying 26% by the “tax basis,” which is the amount invested in eligible property. For solar installations, eligible property can include solar panels, installation costs, racking, circuit breakers, energy storage devices, and sales and use tax on the equipment.

Have Investment Income We Have You Covered

With TurboTax Live Premier, talk online to real experts on demand for tax advice on everything from stocks, cryptocurrency to rental income.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Know which dependents credits and deductions

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

-

See which education credits and deductions you qualify for

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Know which dependents credits and deductions

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

-

See which education credits and deductions you qualify for

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

The Homeowners Guide To Energy Tax Credits And Rebates

When you file this year, its especially important to reap the benefits of your households energy-efficiency. There were a number of changes to the tax code for homeowners that took effect in 2019 and remain available for the 2021 tax year. Congress has yet to extend them into 2022, so we put together a list of some common home improvement and renewable energy tax credits that may help you save money on your 2021 tax return before these opportunities expire. Weve also included information on rebates available for energy-efficient appliance purchases to help you save money if you need or want to use your tax savings on energy-efficient appliances.

Read Also: How Much Do Tesla Solar Roof Tiles Cost

How Is The Federal Solar Tax Credit Calculated

The gross system cost can include any improvements needed to facilitate the solar installation. This includes any electrical work needed for the installation such as a panel box upgrade, and also includes roof work under the solar array. Please speak to your tax advisor for specific advice for your given circumstances.

The credit is a dollar for dollar income tax reduction. This means that the credit reduces the amount of tax that you owe. Many clients mistakenly believe that getting a tax return would make them ineligible for the ITC, but this is not the case. As long as youve been paying taxes in some form throughout the year, if you get a tax return and claim your ITC in the same year, your ITC is simply added to the amount of your tax return .

Am I Eligible For A Biomass Stove Tax Credit

This tax credit has been extended through December 31, 2021, and you may take advantage of it even if you installed your biomass stove before 2021. If you were eligible and did not claim it on your return as far back as 2017, you can refile your return for the appropriate year to take advantage of the savings. Consult your tax professional to find out if refiling is right for you.

- This must be used for your primary residence .

- It cannot be used for a new home or a rental.

- The stoves must be used for heat or water heating and have a thermal efficiency rating of at least 75% as measured using a lower heating value.

- You must have a copy of the Manufacturers Certification Statement to qualify.

- More eligibility requirements can be found here.

Also Check: What Is A Solo 401k Vs Sep Ira

Is The Solar Itc Refundable

The solar ITC is not a refundable credit it can only be used against your organizations U.S. federal income tax liability.

However, the solar ITC may be carried back one year and forward up to 20 years for companies that dont have sufficient tax liability to offset for the tax year their solar energy system was placed in service.

A deduction is allowed for 50% of any portion of the solar ITC that remains unused after the 20-year carry forward period.

Is The Solar Tax Credit Going Away

Yes. The solar tax credit is going away completely after 2023. And 2022 the last year to claim the 26% solar federal tax credit. The solar investment tax credit was extended once before in 2015, but that extra time is quickly running out. The table below details how much longer the tax credit is available for, and for how much.

You May Like: How To Mount Solar Panels On Rv

What Is Different About The Solar Itc In 2022

Incentives exist to help jumpstart new industries and encourage widespread adoption, and the solar ITC has accomplished precisely that for the solar sector. According to the Solar Energy Industries Association , the federal solar tax credit helped the industry grow more than 10,000% since 2006 with an estimated 50% annual growth in the past decade alone.

As solar becomes more and more mainstream, some argue that the industry has less need for incentives like the ITC. Thanks to continued cost improvements over time, a home solar system is increasingly within the financial reach of homeowners across the country. These price drops have helped make going solar more affordable, which has allowed those with modest budgets to save on their utility bills and reduce their environmental impact.

In response to dropping solar costs, the ITC was reduced from 30% to 26% for both residential and commercial solar applications at the end of 2019. It was originally scheduled to drop even further at the end of 2020, but last December, the 26% rate was extended for all solar systems through the end of 2022. To qualify for the 26% incentive, your solar system must have been under construction before December 31, 2022.

It is important to note that the ITC will drop again to 22% in 2023 for all solar projects that begin construction during the calendar year. After 2023, the ITC permanently drops to 10% for commercial solar projects. For residential customers, the ITC permanently drops to 0%.

What Is The Difference Between A Tax Credit And A Tax Rebate

Its important to understand that this is a tax credit and not a rebate.

A tax credit is a dollar-for-dollar reduction in the amount of income tax you would otherwise owe. For example, claiming a $1,000 federal tax credit reduces your federal income taxes due by $1,000. Tax credits offset the balance of tax due to the government .

Tax rebates are payable to the taxpayer even if they owe no tax. While most people qualify for the solar panel tax credit, there are some who do not. Anyone who does not owe federal income taxes will not be able to benefit from the solar tax credit. And, if youre on a fixed income, retired, or only worked part of the year, you may not owe enough energy taxes to take full advantage of this solar tax credit.

Note: If you do owe sufficient federal taxes the year that you finance or purchase your system, then the credit can be applied to pay off the taxes owed. If you already paid that taxes by withholding it from your paycheck, the federal government will apply the tax credit to a tax refund. This refund can be used to pay down the balance on a loan. Its important to note that the tax credit be carried forward one year, which means that you can use any remainder from this year as a credit towards next years taxes.

Also Check: Are Solo Paper Plates Microwave Safe

How Is The Solar Itc Calculated

The solar ITC is generally calculated by multiplying the applicable ITC percent by the cost of your organizations solar energy system, including equipment such as:

- Solar PV panels, inverters, racking and balance-of-system equipment

- Step-up transformers, circuit breakers and surge arrestors

- Storage devices

Use the calculator above to estimate your hypothetical solar ITC amount.

How Does The Federal Solar Investment Tax Credit Work

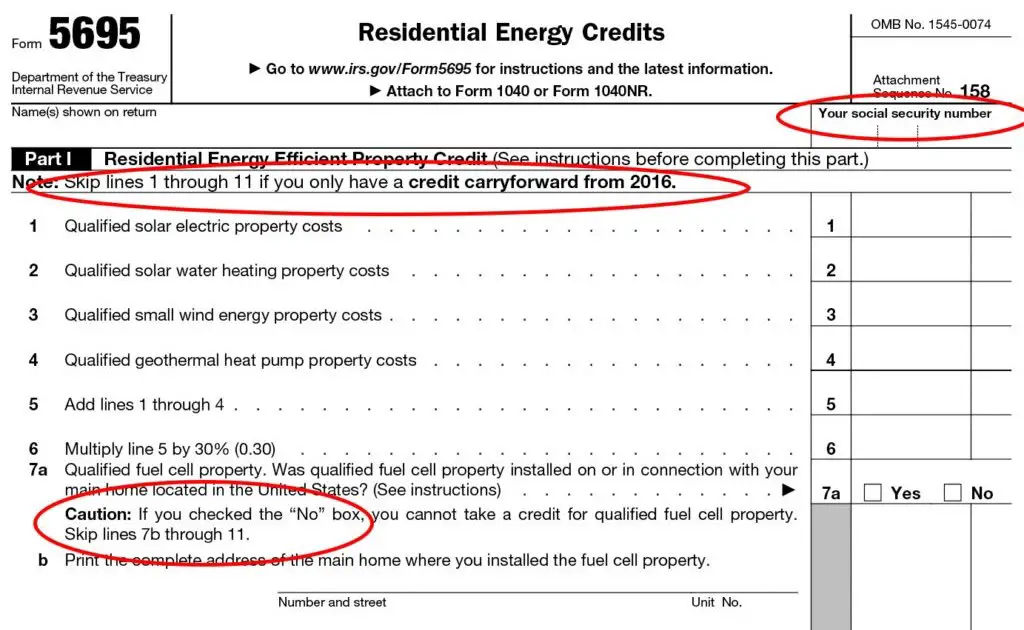

The solar ITC in 2022 offers system owners a tax credit worth 26% of the total solar installation cost, including all parts and labor. So, if you purchased a solar system that cost $10,000, you would qualify for a $2,600 credit that you could apply to your next IRS bill. In effect, your solar installation would end up costing only $7,400 . System owners would simply include IRS form 5695 in their next annual tax filing.

However, the ITC has undergone significant changes in the past few years, with even bigger ones on the horizon. And if you are thinking about going solar, it is important you understand the impact of these developments because the amount of the tax credit is expected to decrease over time.

Also Check: How To Become A Solar Dealer

What Do You Need To Do To Claim The Federal Tax Credit

Lets look at the steps you need to follow if youre filing your own taxes. First, we recommend that you use online tax filing to use the correct forms and not make any mistakes.

To claim the tax credit, youll need to file Form 5695 with your tax return. This is the form designed for residential energy tax credits.

Is The 26% Itc Refundable

So what happens if you are eligible for the ITC, but you dont owe any taxes for that year? Will you receive a refund check for $5000 from the IRS, according to the example above? Sadly not, as the 26% ITC is not a refundable credit. Thankfully, according to Section 48 of the Internal Revenue Code, the ITC can be carried back 1 year and forward 20 years. Which means that if you had a tax liability last year but dont have one this year, you are still entitled to claim the credit. However, if you havent had any tax liability for the past year and for this year, you are entitled to keep the credit on your records and can use it over the next 20 years.

Needless to stress out this again, we are not tax attorneys, so make sure you confirm with your tax representative for the most up-to-date ITC information.

Recommended Reading: Can I Have An Llc And A Sole Proprietorship

Do I Qualify For The Federal Solar Tax Credit

The Office of Energy Efficiency & Renewable Energy states the following criteria determines whether you can qualify to claim the federal solar tax credit:

- Date of installation: You installed your solar system between Jan. 1, 2006, and Dec. 31, 2023.

- Original installation: The solar PV system is new. The credit can be claimed only on the original installation of solar equipment and not the repurposing or reuse of an existing system.

- Location: The solar system is located at your primary residence or secondary home in the United States. It may also be used for an off-site community project if the electricity generated is credited against your homes electricity consumption and does not exceed it.

- Ownership: You own the solar PV system. You cannot claim the credit if you are leasing or in an agreement to purchase electricity generated by the system, including a solar power purchase agreement .

Does My Business Qualify For The Solar Itc

To qualify for the solar ITC, the commercial solar energy system must generally be located in the U.S. and be:

- Tangible depreciable or amortizable property

- This means land and intangible assets like power purchase agreements are ineligible.

Recommended Reading: How Much To Get Solar Panels On Your Roof

Q Are There Incentives For Making Your Home Energy Efficient By Installing Alternative Energy Equipment

A. Yes, the residential energy efficient property credit allows for a credit equal to the applicable percent of the cost of qualified property. Qualifying properties are solar electric property, solar water heaters, geothermal heat pumps, small wind turbines, fuel cell property, and, starting December 31, 2020, qualified biomass fuel property expenditures paid or incurred in taxable years beginning after that date. Only fuel cell property is subject to a limitation, which is $500 with respect to each half kilowatt of capacity of the qualified fuel cell property. Generally, this credit for alternative energy equipment terminates for property placed in service after December 31, 2023. The applicable percentages are:

Tax Benefits Of Going Solar

Tapping the sun for power offers several benefits. For example, solar power:

- Doesn’t pollute

- Reduces our use of coal and other fossil fuels

- Reduces your individual carbon footprint

But since the installation of solar power equipment can be costly, the solar tax credit can help you offset some of the costs.

Don’t Miss: How Expensive Are Solar Panels

Here’s How Solar Panels Can Earn You A Big Tax Credit

The federal solar tax credit can slash up to 30% from the cost of a home solar-energy system.

Dan Avery

Writer

Dan is a writer on CNET’s How-To team. His byline has appeared in Newsweek, NBC News, The New York Times, Architectural Digest, The Daily Mail and elsewhere. He is a crossword junkie and is interested in the intersection of tech and marginalized communities.

Since 2006, the Federal Solar Investment Tax Credit has given owners of a home or commercial solar-energy system a one-time deduction on their federal return.

That credit can defray a lot of the cost of a rooftop solar-energy setup: A $20,000 solar photovoltaic system that was installed in 2018, for example, is eligible for a 30% deduction. That essentially brings the price down to $14,000.

There are also additional state and local tax incentives that could save you even more money. And with solar panels running between $15,000 and $25,000, every bit helps.

If you’re thinking about getting solar panels, now is the time. Congress extended the Solar ITC in 2020, but the percentage deduction available is steadily declining — in fact, the credit could soon expire altogether.

Here’s what you need to know about the federal solar tax credit, including who qualifies for it, what it covers and when it might end. We also have guides on how to finance your solar-energy system, how to estimate solar panels’ efficiency and the best way to winterize your solar panels.

Other Common Questions About Roof Tax Credits:

- Is a roof replacement eligible for a tax credit? Yes, see above for details on how to claim this tax credit.

- Does a new roof qualify for a tax credit? Not for a brand new home, but an energy-efficient replacement roof would qualify when installed on your primary residence. Search for ENERGY STAR-certified roof products here.

- Can roof repairs be used to claim the tax credit? Usually not. The federal government typically considers repairs as current expenses, meaning those necessary to maintain a property. Replacing a roof, in contrast, is considered a capital improvement and therefore does qualify for the tax credit.

- Are metal roofs eligible for a tax credit? Yes, in certain circumstances. The product must be certified by ENERGY STAR®. You can learn more here. The tax credit is generally for up to 10% of cost .

- Does an asphalt roof qualify for the tax credit? Yes, if it has appropriate cooling granules. The tax credit is for up to 10% of cost with a lifetime limit of $500. Find out more here.

- Does the tax credit apply to roof coatings? No.

- Are new roof shingles eligible for a tax credit? If you are replacing your roof, the cost of materials can be claimed as a tax credit to the amount allowed by law . If you are simply replacing or repairing certain shingles, that does not qualify for a tax credit.

Discover more home improvement tax credits and energy-efficient appliance rebates:

Air Conditioning | Water Heaters | Geothermal Heating | Wind Turbines | Tax Rebates

Also Check: Where Is Pine Sol Made

What Does The Federal Solar Tax Credit Cover

According to the EERE, the federal solar tax credit covers the following items:

- Panels: The credit covers solar PV panels or PV solar cells.

- Additional equipment: The credit covers other solar system components, including the balance-of-system equipment and wiring, inverters and other mounting equipment.

- Batteries: The ITC covers any storage devices, such as solar batteries, charged exclusively by your solar PV panels. This claim works even if the storage is activated in a subsequent tax year to when the solar energy system is installed. Storage devices are still subject to the installation date requirement.

- Labor: Labor costs for on-site preparation, assembly or original solar installation. Coverage also includes the permitting fees, inspection costs and developer fees.

- Sales tax: The credit also covers any sales taxes applied to these eligible expenses.