Solo 401k Vs Sep Ira What You Should Choose If Are Self

As a self-employed person, you have more control over your retirement plan. One reason is because you get to choose your retirement plan. There are two plans that self-employed people commonly choose between:

- The solo 401k retirement plan and

- The Simplified Employee Pension IRA

In this article, well talk about the features of each plan. At the end, youll get a clear idea of which one you should go for.

Benefits Of A Solo 401

Depending upon the custodian chosen, a Roth option may be available for employee contributions, but not for employer profit-sharing contributions. Likewise, plan loans can be an option. The employee deferral option allows clients to contribute up to the maximum deferral amounts of $19,500 or $26,000 as long as their compensation is at least at these levels.

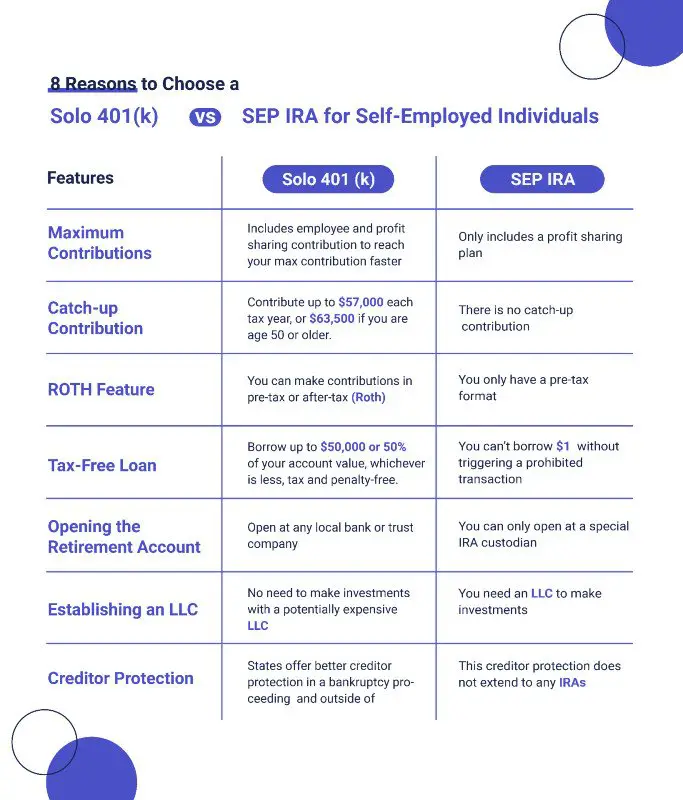

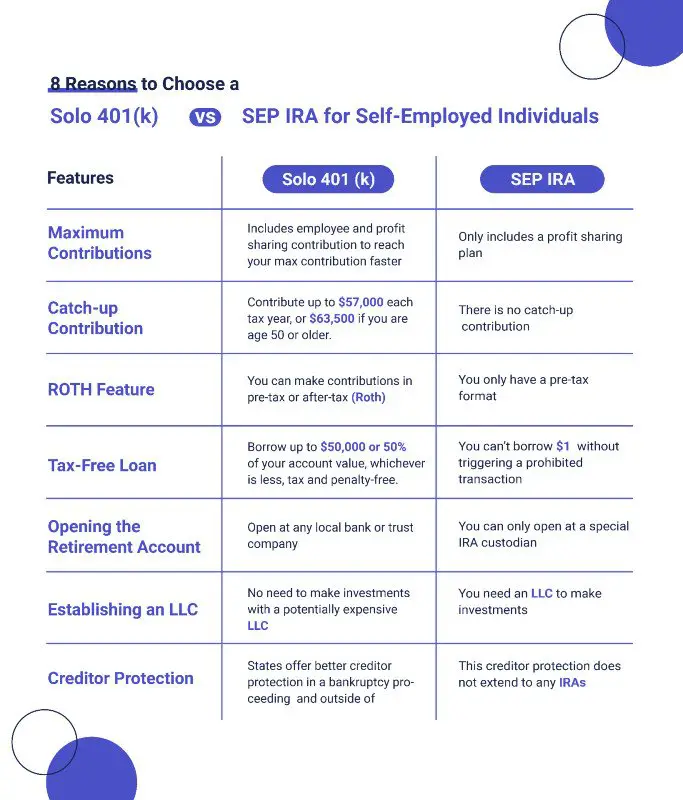

In comparing the two plans, if the maximum salary deferrals are made the Solo 401 can generally be maxed out in terms of total contributions at a lower compensation level than with a SEP-IRA.

The Latest

Disadvantages Of A Sep Ira

- The plan must treat employees the same as you: A SEP IRA is an employer-only contribution. Employees don’t make their own contributions and you must contribute the same percentage of employee compensation as you do to your own account.

- No catch-up contributions: If you’re over the age of 50, there are no catch-up contributions like you see with IRAs and 401s.

- No Roth option: Those who prefer socking away money with after-tax contributions and enjoying tax-free withdrawals are out of luck. There is no Roth option, so while your money will grow tax-free, you will still be on the hook for taxes when you take distributions.

- Penalties for early withdrawal: Like a traditional IRA, if you withdraw your money before age 59 1/2 , you’ll be hit with taxes and a 10 percent bonus penalty.

- Required minimum distributions: You have to withdraw a minimum amount from the account starting at age 72.

You May Like: What Is Pine Sol Good For

You Can Reach Your Maximum Contribution Limit Quicker

A Solo 401k includes both an employee and profit sharing contribution option, whereas, a SEP IRA is purely a profit sharing plan. Business owners with a Solo 401k plan can contribute to their plan both as owners and employees in two ways:

Note: Total contributions cannot exceed $54,000 unless catch up contributions are used by those over age 50.

Round #1 Who Can Participate In Solo 401 And Sep Ira

So lets say youre a TikTok influencer. You just hit 1 million followers. Your income from ads and sponsorships are coming in and you want to invest that money wisely. The good news is you can contribute to either a solo 401 or SEP IRA. But the very important difference is this: With a solo 401, you can contribute both as an employer AND employee. With a SEP IRA, you can only contribute as the employer. Why should you care? If youre the only one in the company, youre not going to care, since youre both the employer & employee. But if you have a W2 employee, say you hired a virtual assistant to help you out, you cannot contribute to a solo 401. Thats why they call it a solo 401. You need to be flying solo. If you have contractors who are 1099 employees, you can still contribute to a solo 401.

Here is one important consideration for the SEP IRA: Because youre contributing as the EMPLOYER, if you contribute 10% of your income to your SEP IRA and you have a W2 employee, then you as the Employer are also required to contribute 10% of your employees income into his/her SEP. The contribution has to be equal across the board.

Round 1 Winner: Its a tie. You can use both if youre self-employed. There is also a con to both if you have a W2 employee.

Bonus Question: What if youre a TikTok influencer, and you set up an S Corp. Can you set up a solo 401 for S corporations?

Recommended Reading: How To Obtain Sole Custody

Traditional Or Roth Ira

Best for: Those just starting out. If youre leaving a job to start a business, you can also roll your old 401 into an IRA.

IRA contribution limit: $6,000 in 2021 .

Tax advantage: Tax deduction on contributions to a traditional IRA no immediate deduction for Roth IRA, but withdrawals in retirement are tax-free.

Employee element: None. These are individual plans. If you have employees, they can set up and contribute to their own IRAs.

How to get started: You can open an IRA at an online brokerage in a few minutes. See NerdWallet’s picks for the best IRA providers for more details.

Take A Look At The Differences Between These Retirement Savings Plans

Small business owners have several options to choose from when it comes to retirement planning. Traditional or Roth IRAs can provide a good start on saving for retirement, but successful business owners often need a plan that allows them to defer much larger amounts on an annual basis.

were introduced as a way to let small business owners establish a retirement account for their businesses without the headaches that come with ERISA-sponsored plans. However, subsequent financial legislation created the solo 401, which also offers a simplified way for business owners to save for retirement and enjoy some of the benefits of a 401 plan that are not available with SEPs. Here’s a look at these two types of plans and how they serve the needs of small businesses.

Recommended Reading: Is Leasing Solar Better Than Buying

The Solo 401k Vs Sep Ira For Self

Solo 401ks and SEP IRAs have both been around for awhile now. Previously, SEP IRAs were considered better only because they had lower administration cost and fees.

However, in recent years, competition among brokerages has made administration cost and fees much lower for Solo 401ks. Most brokerages no longer have fees, aside from for the initial setup.

This means that you, the self-employed business owner or real estate investor, are able to choose the retirement plan thats best for you based solely on the merits. Lets take a look at each.

Open The Account At Any Local Bank

With the Plan, the 401k bank account can be opened at any local bank or trust company. However, in the case of a SIMPLE IRA or a Self-Directed IRA, a special IRA custodian is required to hold the IRA funds.

7. No Need for the Cost of an LLC

With a Solo 401k Plan, the plan itself can make real estate and other investments without the need for an LLC, which depending on the state of formation could prove costly. Since a 401 Plan is a trust, the trustee on behalf of the trust can take title to a real estate asset without the need for an LLC.

Recommended Reading: How Much Does A Solar Roof Cost

Which Is Better For Taxes: Solo 401 Or Sep Ira

Say youre an interior designer and you contribute to a SEP IRA. You get to deduct those contributions from your tax return. But once you withdraw from your SEP IRA during retirement, youll have to pay federal and maybe state taxes on the amount you withdraw.

For a solo 401, you can usually choose the tax treatment. If you want to take the tax deduction now, you can contribute to a traditional solo 401. If you want to let your money grow tax-free, you can contribute to a Roth solo 401. You pay the taxes now, but when you withdraw from a Roth solo 401 during retirement, you dont pay a single dime in taxes.

Round 4 Winner: Solo 401 wins again.

When Can I Withdraw Money

A must-ask when considering what type of account to invest in, is when you can access your funds, and whether there will be substantial penalties imposed should you require access earlier than anticipated. The rules are fairly similar for both accounts.

With a SEP IRA, an employee can access their funds and make a withdrawal at any time after the age of 59½.

However, withdrawing money from a SEP IRA will still be subject to the relevant federal income taxes and, if under the age of 59½, the employee may be subject to a 10% penalty.

Solo 401k You cannot take withdrawals from the plan until a trigger event occurs, such as turning age 59½, disability, and/or plan termination. But as your own employer, you could terminate yourself.

Just like with a SEP, withdrawals would be subject to the relevant federal income taxes and, if under the age of 59½, may be subject to a 10% penalty.

You May Like: Do It Yourself Home Solar System

Can You Roll A Sep Ira Into A Solo 401k

Yes, you can rollover SEP IRA funds into a Solo 401k. The IRS allows you to roll SEP IRA funds into any qualified retirement plan. A Solo 401k is a qualified plan. Rolling over SEP IRA funds or assets to a Solo 401k is easy. The Nabers Group Solo 401k provides step by step instructions and customized rollover forms to ensure your rollover happens quickly and correctly.

Many investors decide to roll funds from a SEP IRA into a Solo 401k to capture more investment options. All SEP IRA plans must be held with a custodian. This typically limits your investment options to only what the custodian/broker will provide. In contrast, a Solo 401k is fully self-directed with checkbook control. When you open a Solo 401k with Nabers Group, a bank or brokerage account are included automatically. Youre in complete control. Therefore, you decide where and how to invest your retirement funds. Solo 401k investors commonly invest in real estate, cryptocurrency, gold & silver, crowdfunding, venture capital, and start-ups in addition to traditional assets like stocks, bonds, and ETFs.

Will I Need 3rd Party Administration Or Have To Do A Bunch Of Paperwork

A third-party administrator is a party that handles the contributions, distributions and the various paperwork, reporting and filing aspects relating to pension plans. The administrator is hired by the plan sponsor, which is your business.

Pretty much NO to both.

Solo 401k It depends. If you go with a standard account from a brokerage house, they actually do most of this administration for you, for free even.

But the standard account comes with a few limitations, the most significant of which is that you cant usually borrow off the funds in this simpler setup. At least you cant with Fidelity.

If you want to borrow off of your Solo 401k, you will need to set up a non-prototype account and use third party administration.

I use a company called Ascensus, and it costs about 800/year. The only reason I do this is because I really wanted to be able to borrow the funds if I needed to. The good part of this is that they fill out all of your required paperwork.

Also Check: How Do I Get Solar Panels For My House

Administering A Solo 401 Plan

Once your Solo 401 plan exceeds $250,000 in assets at the end of the year, the IRS requires you file an annual Form 5500 EZ. Or if you ever terminate the plan, you must also file a Form 5500 EZ.

Unlike Traditional 401 plans, there are no compliance testing requirements to ensure Solo 401 plans do not favor highly compensated employees and are non-discriminatory, as long as you have no employees participating in the plan.

These plans can be called Self-Directed 401, Individual 401, Individual Roth 401, Self-Employed 401, Personal 401 or One-Participant 401 depending upon the vendor offering the plan services.

Employee Eligibility And Minimum Coverage Requirements

Generally, employees must be allowed to participate if they’re 21 or older, earn at least $600 in the tax year 2020 , and have worked for the same employer in at least 3 of the past 5 years.

No common-law employees. Otherwise, no age or service restrictions.

No age restrictions. Employees must have earned at least $5,000 during any 2 prior years and expect to earn at least $5,000 in the current year.

Also Check: Can Solar Panels Work On A Cloudy Day

Backdoor Roth Ira Planning

The Backdoor Roth IRA is a great planning tool. But the pro-rata rule can cause significant snags. For example, if you execute the two independent steps of a $6,000 Backdoor Roth IRA in a year when you have a separate significant traditional IRA, SEP IRA, or SIMPLE IRA at year-end, you will cause most of the Backdoor Roth IRA to be taxable.

The SEP IRA is a significant roadblock to the ability to execute an efficient Backdoor Roth IRA. A Solo 401 does not cause this problem with the Backdoor Roth IRA. For this reason alone many will want to choose a Solo 401 instead of a SEP IRA, even if they plan on making traditional deductible contributions to the plan.

Section 199a And 80% Deductions

I have previously written about the new Section 199A qualified business income deduction and its impact on self-employed retirement plans. Traditional contributions to both Solo 401 plans and SEP IRAs create, for many taxpayers, deductions that are only 80% deductions. Here is an example.

After self-employment taxes, Joe, a single taxpayer, earns $120,000 from his sole-proprietorship. Joe makes a 10 percent employer contribution to either his Solo 401 or SEP IRA. In the 24 percent marginal tax bracket, he expects to save $2,880 on his federal income taxes. He is surprised to learn that he only saved $2,304 on his federal income taxes.

How is that possible? While Joe is correct that he receives a $12,000 retirement plan contribution tax deduction, he failed to consider that he lost $2,400 of his QBI deduction. A traditional Solo 401 contribution and a SEP IRA contribution is an 80% deduction. In Joes case, he received a net federal income tax deduction of only $9,600 .

Why then would Joe prefer a Solo 401 to a SEP IRA? Because the Solo 401 gives him a planning option that avoid the 80% deduction issue. Instead of making traditional contributions to a Solo 401, Joe can make Roth employee contributions to a Solo 401.

Note further that Joe could possibly implement Mega Backdoor Roth IRA planning by making after-tax contributions to his Solo 401. Many Solo 401 plans do not offer this option, but some do.

The SEP IRA does not offer these options.

Recommended Reading: Can You Put Solar Panels On Metal Roof

How Much Can I Contribute To A Solo 401

There are two types of contributions that can be made:

It is important to consult your accountant to calculate the profit-sharing contribution if you plan to open and contribute to a Solo 401.

When Is The Contribution Deadline For Solo 401 And Sep Ira

For 2020, the contribution deadline for the Solo 401 as well as the contribution deadline for the SEP IRA has been extended to May 17, 2021. This deadline is specifically for the employer contributions.

If youre setting up a solo 401 just now for the tax year 2020, you cannot contribute as an employee, unfortunately. But you can do so for the tax year 2021. The takeaway is you still have time to create and put in money to either a solo 401 or a SEP IRA, as the Employer. Make sure you do this before the deadline. Take a break from uploading your TikTok video for a day!

Round 3 Winner: Its a tie. The Solo 401 contribution deadline and SEP IRA contribution deadline are the same.

Also Check: How Do Solar Batteries Work

Doing The Solo 401 Or Sep Ira Dance

If you are self-employed, one of your many tasks is to plan for your own retirement. While most Americans can rely on their employers 401 for retirement savings, this is not the case for self-employed people.

In some respects, that is an advantage: most employees barely pay any attention to their 401. It is an opportunity for the self-employed to make the best choices possible for their business and personal situation.

The most obvious benefit of saving for retirement is that you will have to retire anyway, one day, and you will need a source of income then. With a retirement account, most people appreciate that it is specifically meant to save for retirement. People also appreciate the tax benefits of the SEP IRA and Solo 401.

The more immediate benefit is that retirement savings in tax-deferred accounts help reduce current taxes, possibly one of the greatest source of costs for small businesses. Of course, the tax saved with your contribution will have to be paid eventually when you take retirement distributions from the SEP-IRA.

When it comes to tax-deferred retirement savings vehicles for the self-employed and owner and spouse businesses, two of them stand out due to their high contribution limits and flexible annual contributions: the SEP IRA and the Solo 401. These two vehicles provide a combination of convenience, flexibility, and efficiency for the task.