Disadvantages Of Forming An Llc

With an LLC, you have the following drawbacks as well:

- State-related paperwork will be required, including any specific industry licensing.

- Annual state filings will be required as well, including any specific industry licensing fees that are required.

- Besides paying personal federal, state, local and the self-employed version of FICA taxes, you might also be required to pay State Business Taxes and Unemployment Taxes.

- Costs for completing the tax return of an LLC may be higher than that of a sole proprietorship.

What Is A Limited Liability Corporation

A limited liability corporation, better known as an LLC, is a business structure that combines pass-through taxation with the limited liability of a corporation. An LLC is not a corporationit is a legal form of a company that provides protection and limited liability to its owners. Basically, if a corporation and a sole proprietorship had a baby, theyd name it LLC.

What Are The Disadvantages Of An Llc Vs A Sole Proprietorship

The biggest disadvantage of an LLC vs. a sole proprietorship is payroll taxes. These payroll tax rates are typically much higher than the personal income tax rate of sole-proprietorship owners.

This can be a serious disadvantage for a business owner who wants to keep their payroll costs down.

You may be required to pay State Business Taxes and Unemployment Taxes in addition to personal federal, state, local, and self-employed FICA payments.

The cost of filing an LLC’s tax return may be higher in comparison to the sole proprietorships.

Recommended Reading: Does Pine Sol Keep Bugs Away

How Does The Management Structure Differ

In an LLC, the business can be owned by one or more members. Its members usually manage an LLC, but they can also appoint a manager to handle the day-to-day operation.

The membership of an LLC and the way it will be run are laid out in a legal document known as an operating agreement.

In a sole proprietorship, you are truly the boss and call all the shots. There are no partners or members to deal with.

Llc Or Sole Proprietor: Summary

In general, if your company engages in activities that generate any risk an LLC may be the best choice for you.

While it can be a little more labor-intensive and costly to set up and maintain, the personal asset protection alone is often well worth the costs incurred. On the other hand, if your business is more of a hobby, a sole proprietorship can be an excellent way of doing business without taking on any extra regulatory or financial burden.

Need Help Forming an LLC? Check out our Best LLC Services review to learn about the cost of using a professional service to form your LLC.

Also Check: What Is The Best Solar Company

How Do I Form An Llc

You create an LLC by filing paperwork with your state and paying a filing fee. Visit the website for your states secretary of state or other agency in charge of business filings for information, forms, and instructions specific to your state. You can also form an LLC with the assistance of an accountant, lawyer or online business formation company.

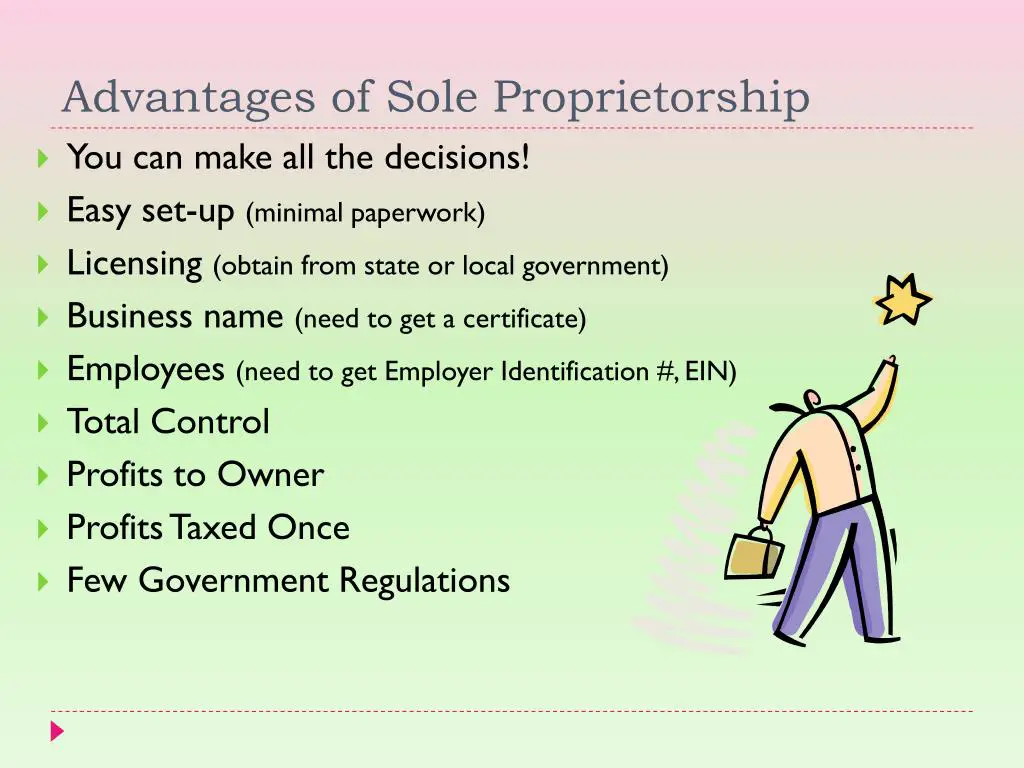

Advantages And Disadvantages Of Sole Proprietorships

Like the LLC or SMLLC, sole proprietorships have their own advantages and disadvantages as well.

- It is considered one of the easiest and least costly business types thanks to the absence of filing fees and the need for formal agreements.

- Sole proprietorships are popular for people who want to be their own boss.

- A potential disadvantage is that courts have ruled that doing business under another name does not qualify as creating a separate and distinct legal entity from the owner.

- Insurance coverage might be pricey for sole proprietors.

- Sole proprietorships do not have access to venture capital.

- Sole proprietorships can be limited in scope and their lifetime, which means they end if the business is discontinued or the owner passes away.

Don’t Miss: How Do I Get Solar Panels For My House

Llc Taxed As A Sole Proprietorship

Note: This article only applies to Single-Member LLCs owned by US residents and US citizens.

A Single-Member LLC is taxed like a Sole Proprietorship by the IRS for federal tax purposes.

A Single-Member LLC doesnt report taxes to the IRS. It also doesnt pay taxes to the IRS. Instead, the owner of the LLC reports and pays the taxes on their personal tax return.

This is because a Single-Member LLC is a Disregarded Entity and has pass-through taxation.

Do you have a Multi-Member LLC? If so, please see LLC taxed as Partnership.

What Are The Legal Requirements Of A Sole Proprietorship

The sole proprietorship is not a legal entity. The business has no existence separate from the owner who is called the proprietor. The owner must include the income from such business in his or her own income tax return and is responsible for the payment of taxes thereon.

You may also like these posts:

Recommended Reading: Does Residential Solar Make Sense

File Articles Of Organization

To form an LLC, you must fill out an official form and send it to your states filing office. Each state has different requirements for the articles of organization.

It is a short, simple document that outlines details about your business. Information on the articles of organization include:

- LLCs name

- Address

- Names of owners

You need to pay a fee to submit your articles of organization. Most submission fees are about $100, but some states charge more.

The articles of organization usually require a registered agent to receive legal papers. If you are the sole owner of the LLC, you are the registered agent. If you have a multi-member LLC, you will need to appoint one member as the registered agent.

When You Convert Your Sole Proprietorship To An Llc You Formalize The Business And Enjoy Limited Liability

Create your LLC with Nolo

Need time on your business name?

To convert a sole proprietorship to a limited liability company , you’ll file the same paperwork as you would if you had created the LLC from scratch. You’ll also update sole proprietorship registrations , bank accounts, and contracts to reflect the change. Becoming an LLC offers you a number of benefits, including protecting your personal assets from the debts of the business and adding credibility to your business by communicating to vendors and customers that you own a formally registered company. However, an LLC is not an option for every company, and converting to that structure might mean you will pay more taxes and fees than had you stayed a sole proprietorship.

Also Check: How Much Solar Do I Need Rv

Key Differences Between A Sole Proprietorship And An Llc:

Filing for your business classification. Filing for an LLC usually has a cost, which varies from $50 to about $500, depending on the state where you do business. The process only takes a few weeks in most cases its simple paperwork, but filing and processing with the state will take some time. Theres no cost to becoming a sole proprietor. You need to manage your own tax withholding and insurance, but theres no payment or government filing required to start a business.

If your business has overhead that you need to pay for with a line of credit or loan, an LLC will be more credible and less risky to a lender than a sole proprietorship. The LLC can sometimes offer an ownership interest in the business as collateral for money used to finance business growth or overhead. A sole proprietor cannot offer ownership of the business to another person or entity because it would no longer be a sole proprietorship.

Ownership. A sole proprietorship is owned by one person by definition. If you have LLC status, youre able to include additional owners that are people, corporations, other LLCs, partnerships, trusts, or estates.

Ongoing business status. A sole proprietorship will typically cease to exist if the owner dies or sells the business. An LLC can continue with an operating agreement to protect the assets of the business.

Should I Pay Myself A Salary

Your small business earnings are a reflection of the hard work that you had put in to bring your business to life. Its quite a fascinating experience as a business owner.

However, the challenge that you face is how to pay yourself as a business owner. There are various factors that you should consider while deciding how to pay yourself.

You May Like: Do Solar Panels Need Cleaning

Sole Proprietorship Vs Single Member Llc

A sole proprietorship vs single member LLC look very similar.

The biggest similarity when comparing a sole proprietorship and LLC is that both formations have only one owner and member you.

You should check with your state to determine if a single member LLC is allowed in your state. If it is, and youre ready to form a single member LLC, email me at and I can walk you through the process.

Choosing A State To Incorporate

Since taxes, prices and corporate laws are not the same in every state, it is important to consider your home states advantages and disadvantages when it comes to forming your business.

Some things to consider when youre shopping for states:

- Is it worth incorporating outside your home state , even if that means paying extra tax fees?

- How are corporations taxed? What are the taxes if Im foreign-qualified?

- Would there be an income tax on my corporation?

- Is there a minimum or franchise tax?

- Compare projected revenue against cost of taxes for a given state to recognize any advantages

- Ultimately, the best thing that you can do for your business is research states corporate statutes and find what works best for you.

If youre on the fence, check out our blog post about the seven best states to incorporate.

Also Check: What Is The Active Ingredient In Pine Sol

Who Should Choose A Sole Proprietorship

Small business owners who want to pay payroll taxes on their personal tax returns and avoid double taxation of profits should choose a sole proprietorship or corporate taxation.

Sole proprietorships are ideal for many business owners who are new to the business and want to find the right structure for their business that is also cost-effective.

Which Is Better For Taxes Llc Or Sole Proprietorship

The current self-employment tax rate is 15.3%. Sole proprietors are responsible for paying the balance on their own. As an LLC owner, your business will not pay taxes itself, but the profits and losses will be listed on your personal tax return, but having proper division of finances will do you well in the long run.

You May Like: How Much Is A Solar Panel Lease

Differences Between Llc And Sole Proprietorship

There are important differences between LLCs and sole proprietorships. The most significant difference is whether you have limited liability for the business debts and obligations, as with an LLC, or whether the business liabilities and obligations fall to you personally in the event of a lawsuit or debt collection.

An LLC has distinct advantages in the areas of legal protection and liability. While there are filing fees for setting up an LLC, that cost can be well worth it when compared to the thousands of dollars you could be liable for as a sole proprietor.

On the other hand, it costs no money to start a sole proprietorship. You can also transition into an LLC or other formation option whenever youre ready. This also means dissolving your business is as simple as stopping operations .

Finally, while sole proprietorships have very few regulatory requirements, LLCs are associated with a variety of fees and filings, both initially and ongoing. This can be difficult to manage on your own, which can lead to missing important filings and, in return, incurring penalties.

Get Help With Business Formation

Do you have questions aboutbusiness formations andwant to speak to an expert?Post a project todayonContractsCounseland receive bids from LLC lawyers and corporate lawyers who specialize in business formation.

“ContractsCounsel puts on-demand legal services in the cloud. Not only is their service more convenient and time-efficient than visiting brick and mortar offices, but its more affordable tooand Ive been universally impressed by the quality of talent provided. If youre looking for a modern way for your small business to meet legal needs, I cant recommend them enough!”

“This was an easy way to find an attorney to help me with a contract quickly. It was easy to work with Contracts Counsel to submit a bid and compare the lawyers on their experience and cost. I ended up finding someone who was a great fit for what I needed.”

“ContractsCounsel suited my needs perfectly, and I really appreciate the work to get me a price that worked with my budget and the scope of work.”

“I would recommend Contracts Counsel if you require legal work.”

“ContractsCounsel helped me find a sensational lawyer who curated a contract fitting my needs quickly and efficiently. I really appreciated the ease of the system and the immediate responses from multiple lawyers!”

Also Check: How Can I Make A Solar Panel

How To Form An Llc

Below are several of the steps involved in forming an LLC. However, please check with your local state since they may have additional forms and requirements.

It’s important to note that the above list is not comprehensive since each state may have additional requirements. Once established, many states require LLCs to file an annual report, which the state may charge a fee. These fees can sometimes run in the hundreds of dollars per year.

Llc Vs Sole Proprietorship: Pros And Cons

Choosing the right business structure for your new venture is a crucial decision. Many business owners lean toward two of the most popular optionsLLCs and sole proprietorships.

Each one has its fair share of benefits and drawbacks.

The right one for you and your business will depend on several factors. Youll need to consider things like the tax implications, startup costs, regulations, liability protection, and more.

If youre torn between the two, youve come to the right place. This guide will provide you with an in-depth explanation of LLCs and sole proprietorships. Youll learn more about each ones advantages, potential downsides, and the differences between the two.

Read Also: What Are The Best Solar Panels For Home Use

Sole Proprietorship Limited Liability Or Corporation

Ok, so youve done some research, picked a great name, web domain and phone number to back it up, but now its time to get legally recognized as a business.

Sole proprietorship, limited liability , or corporation ? These are all ways that the government can understand what sort of business you are so they can tax you accordingly.

These categories werent that meaningful before you wanted to start your own business, but now youre scratching your head thinking about what they mean!

Similarities Between Llcs And Sole Proprietorships

When comparing LLCs and sole proprietorships side-by-side, its important to recognize that these two business structures share some commonalities.

Heres a quick list of the similarities between LLCs and sole proprietorships:

- Income and expenses must be reported in Schedule C Form 1040.

- Net income is taxable, regardless of whether or not cash is withdrawn from the business.

- They have similar rules for tax deductions .

- An EIN must be obtained if employees are hired.

- Any industry-specific business licenses and permits at the state and federal levels are still required.

- LLCs and sole proprietors both have the option to register a DBA name.

As you can see, from taxation to paperwork filing, LLCs and sole proprietorships do have a handful of things in common.

Read Also: Can You Run Pool Pump With Solar Cover On

How Do You Start A Sole Proprietorship

To start a sole proprietorship you need to for the most part just start your business. It does not require registering with your state. It is recommended to come up with a company name and then apply for a permit or license with your city and state if needed. If you plan to hire employees then you will need an employee identification number from the IRS and if you are going to sell taxable products you will need to register with your state.

Llc Vs Sole Proprietorship

The LLC vs. Sole Proprietorship debate is not going away anytime soon, and for a good reason.

LLCs offer an extra layer of protection against liability and other issues, but they also come with a higher cost to set up.

Sole proprietorships are cheaper to maintain, but nothing is protecting the individual if something goes wrong. So which should you choose? Here are some things to consider before making your decision!

Also Check: How To Charge Ev With Solar Panels