What About Permits And Licenses

Even sole proprietors require a business license to run their business and you can get a fine if you try to operate without a license. Most businesses, no matter how small, will require this license just to open up a business account. In fact, depending on the kind of sole proprietorship you are running, there may be other licenses too.

You cant, for instance, be running some kind of food business without having the appropriate license such as a health permit for a food business. Does a sole proprietor need a business license for looking after children? Looking after young kids can be a daunting task because theres that part where you have to comply with certain regulations. You will require a business license.

When you are just looking after 3 or 4 kids do you need a license? Nothing is set in stone and each state differs. Some states allow you to have 7 children without a license while others say 4 or 12. You have to get answers in your state because some states will give you a massive fine for each day you operate without a license.

There is always the perhaps type of answer. This is because each state and city may have its own specific licensing regulations. Before opening up a daycare youll need to research your states licensing laws by contacting your local Child Care Resource and Referral agency and child care licensing office so that you know what licenses and permits are required.

What Is A West Virginia Sole Proprietor

As opposed to a corporation or limited liability company , the sole proprietorship is not a legal business entity. The sole proprietorship is a one-person business that is not considered to be a distinct entity from the person who owns it, and it is frequently operated using the owners personal name.

Do I Need A Business License In Alberta

Although not all businesses are required to obtain municipal licensing, all businesses that operate within Calgary are required to register with The City to obtain a business identification number , and are required to obtain land use approval for the business location even if it does not require a licence.

You May Like: Does Pine Sol Kill Lice

Get Your Federal Tax Number And Consider Federal Tax Filing Options

If your business is a sole proprietorship or one-owner LLC and you wont have employees, you can use your Social Security Number as the businesss federal identification number, although many business owners choose not to for confidentiality reasons. Otherwise, you will need to obtain a federal ID number .

The federal tax form for sole proprietorships is 1040-Schedule C, and for partnerships, Form 1065. For standard corporations, tax filing is with Form 1120. If you wish to be treated as an S-corporation , you must complete Form 2553 Election by a Small Business Corporation within 75 days of forming your business . The IRS doesnt recognize LLCs as a classification for tax purposes. LLCs default to sole proprietorship taxation if one owner, and partnership taxation if more than one owner. However, LLCs can elect to be treated as standard or S-corporations for federal tax purposes through IRS Form 8832. Consult your tax professional for further information and advice.

Can A Sole Proprietor Write Off A Vehicle

If you use a vehicle for work, you can deduct vehicle expenses from your taxable income, regardless of the structure of your business . You can only deduct costs related to your business. If you use a car for business and personal use, you have to divide expenses based on mileage for each. As of 2021, the standard mileage rate for a federal tax deduction was 56 cents per mile . You can also deduct other vehicle costs, including depreciation, registration, loan interest, insurance and lease payments.

Also Check: How To Fund A Solo 401k

Register With Your Province Or Territory

Most businesses need to register with the provinces and territories where they plan to do business. In some cases, sole proprietorships operating under the name of the business owner do not need to register. See the website of your provincial or territorial business registrar for more information on their requirements.

Note: This list of links is provided for your convenience. It may not be a comprehensive list of the registration requirements in all provinces and territories. Please check with the authorities in your provincial or territorial government to determine if there is anything else you need to do.

Obtain Business Licenses And Permits

There isnt a requirement in West Virginia for sole proprietors to acquire a general business license, but depending on the nature of your business you may need other licenses and/or permits to operate in a compliant fashion.

West Virginia has both regulatory and occupational licenses that may apply to your West Virginia sole proprietorship. Thankfully, the state makes license registration quite easy through the WV One Stop Business Portal. More information on licensing in general can be found in the Apply for Licenses and Permits document provided by the West Virginia Business Division.

In addition, you should check to see if your business needs any licenses or permits on the local level.

Often, West Virginia cities and counties will have their own license and permit specifications. For example, Huntington, Morgantown, and Charleston all have their own local business license requirements.

Also Check: How Much Does Solar Power Cost Per Kwh

How Do I Look Up A Sole Proprietorship In California

If you are looking for a specific sole proprietorship in California, you can sometimes search by the entity number , the identification number provided by the California Secretary of State. Sole proprietors dont always need to obtain an EIN and often use their private social security numbers instead.

Set Up A Sole Proprietorship

If youâre a sole proprietor, you run your own business as an individual and are self-employed.

To establish a sole proprietorship, you must:

- Choose a business name, for tax purposes, even if itâs your name

- Obtain licenses, permits, and zoning clearance

- Visit CalGold for more information

You may:

- File a fictitious business name statement with the county recorder

- Obtain an Employer Identification Number

- Visit the Employment Development Department for more information

Read Also: How To Make Sole Proprietorship Into Llc

Setting Up As A Sole Proprietor In California

If you are considering starting a new business in California, one of the first decisions you must make is what type of business entity you want to form. If you are the sole owner of the business, one option is a sole proprietorship.

Establishing a sole proprietorship in California is generally a simpler process than forming a corporation or an LLC. Sole proprietorships do not need to register with the state. You may need to obtain certain business licenses and permits, file tax and employer identification documents, and file a Fictitious Business Name Statement.

Before taking these steps, entrepreneurs should fully evaluate all options for forming their new businesses. While they are relatively easy to establish, other factors may make sole proprietorships unattractive.

Where Can I Register A Business Name And Obtain A Master Business Licence

Ontario.ca provides access to the governments electronic services that simplify and streamline registration, renewal and reporting processes for Ontario businesses. New entrepreneurs and existing corporations can electronically complete the most important applications to register their business at one location, including applications for Business Name Registration, Retail Sales Tax Vendor Permit, Employer Health Tax and Workplace Safety and Insurance Board. When registering via Business Registration Online and some provincial governments including Ontario), you may apply for the above programs as well as for a Federal Business Number and other CRA programs.

Business names can be searched and registered through ServiceOntario via the following channels:

Note: you must enter the business information yourself when using BRO and the ServiceOntario website. For more information about fees and processing times or to obtain ServiceOntario applications, please visit the ServiceOntario website or call:

Toronto: 416-314-9151

TTY toll-free: 1-800-268-7095

Don’t Miss: How To Get Off The Grid With Solar Power

Select A Name For Your Sole Proprietorship

Sole proprietorships exist under the owner’s legal name, but often owners want to use a different name for business purposes. Choosing an official business name for marketing and advertising purposes can help the business owner expand their reach and can help potential customers understand what types of products or services the business offers.

When considering what business name to use, you will need to confirm that your desired name is not already in use by another business in California. The name you want to use must also not be misleading to the public. For example, adding “Inc.” or “LLC” to your sole proprietorship’s name would be misleading, as those imply that you’ve established a different type of legal entity.

The California Secretary of State’s website provides more information and a tool for checking name availability. Entrepreneurs may also want to check with the U.S. Patent and Trademark Office to make sure another person or business has not trademarked the desired business name.

Launching Your Business In Bellevue

Moving from business idea to a real launch is more than a leap of faith. The first time is always the toughest because you are in unfamiliar territory and rookie entrepreneurs will make a lot of mistakes that prove to be very expensive later on. That is why listening and learning from others is so important.

-

Small Business Village

The successful ecosystem of the neighborhood is a collective, interrelated and interdependent community. Support comes from anywhere and everywhere.

- Bothell SCORE

-

Business License Requirements

- Bothell Business License: Business licenses are authorizations issued by local and state government agencies that allow individuals or companies to conduct business within the government’s geographical jurisdiction.

- Bothell Permits : Practice permits regulate safety, structure and appearance of the business community. They act as proof that your business follows certain laws and ordinances. Requirements vary by jurisdiction, and failure to comply often results in fines or even having your business shut down. Research the permits you need before you start any work, set-up or property purchase. That way, you can make sure compliance is in order and avoid the additional expenses and delays of fixing things later.

Also Check: How Much Is Electricity With Solar Panels

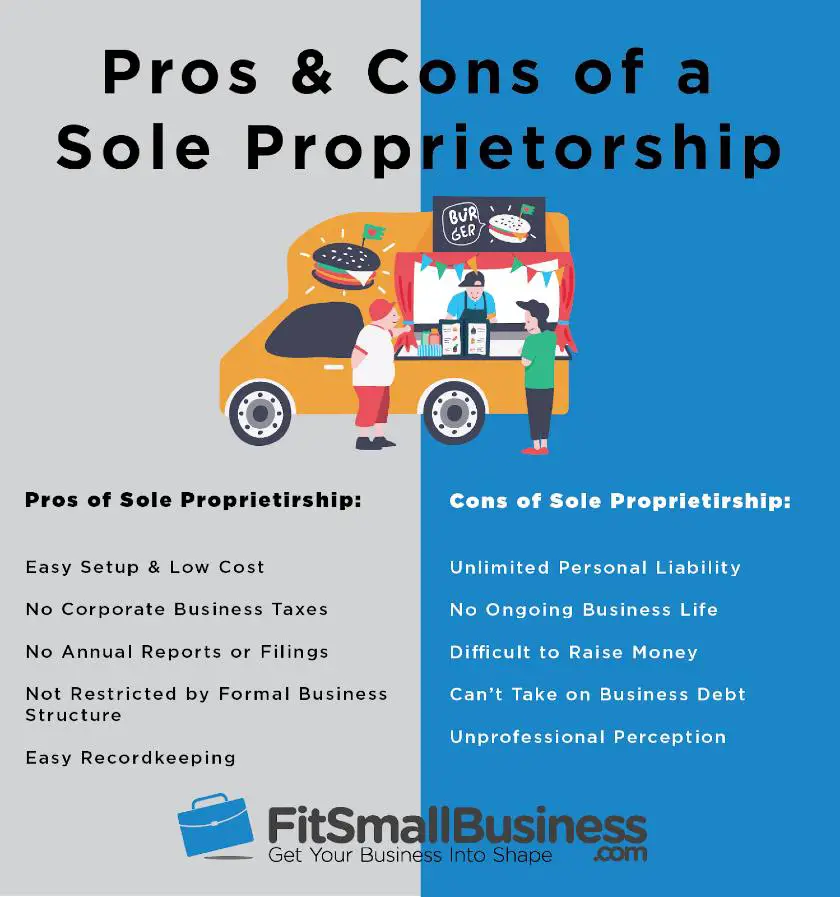

Overview: What Is A Sole Proprietorship

A sole proprietorship is a industry owned and operated by means of one person. Some states permit for joint possession by way of a partner, but for the most part, “sole” method one owner.

Unlike an LLC or corporation, a sole proprietorship does not have to be registered with the state.

If you begin doing trade by yourself, whether or not you are running at the side as a freelancer, construction a consulting firm, or opening a food truck, you are a sole proprietor through default until you carry in a spouse or document business formation bureaucracy with the state.

As a sole proprietorship, what you are promoting is inseparable from you for tax and criminal functions. This simplifies business document management immensely.

Profits from your business “pass through” to your own source of revenue and are reported on Schedule C of your own source of revenue tax go back. This makes a sole proprietorship a simple business to start and run.

On the drawback, as a result of there’s no separate legal entity, if the industry is sued or owes cash, you’re individually responsible. Creditors can come for your own home, cars, financial savings, and different personal assets to fulfill debts.

What Is Sole Proprietorship In California

The most common form of business ownership is a sole proprietorship. It is not considered a separate entity like a corporation but an extension of a single owner or individual. The company and the owner dont exist apart from each other. A sole proprietorship consists of an individual or a married couple. A business is liable for all debt, obligations that are attached to the business including the profits earned. Moreover, all business-related acts involving employees, delegating decisions, and management are attached to the sole proprietor. The life of sole proprietorship continues to exist until it goes out of business or once the owner passes away.

Recommended Reading: How Much Is It To Lease Solar Panels

Landing New Clients And Investors Could Be A Challenge

While it may seem trivial, potential clients and investors sometimes see a sole proprietorship as less professional than a limited liability company or corporation. In some cases, these outside parties may not take your business seriously or may be wary about doing business with you.

Sole proprietorships are unincorporated companies, which means you havent formed a separate legal business entity. Clients or investors may be cautious of working with an individual rather than a separate legal business entity.

For example, a larger client may only choose to do business with incorporated businesses instead of sole proprietorships based on a perceived sense of stability.

Some banks even require business owners to incorporate before they lend money. This could stall your growth efforts if you ever need outside funding to take your business to the next level.

Who Must Register Under The Business Names Act

Business Names Act administered by the Central Production and Verification Services Branch applies to:

- sole proprietorships carrying on business under a name other than the individuals full name

- partnerships carrying on business under a firm name other than the full names of the partners

- corporations carrying on business under a name other than their corporate name

- an existing general partnership or limited partnership registering a business name different from the registered firm name

- limited liability partnerships

- extra-provincial limited liability partnerships and

- extra-provincial limited liability companies

Read Also: How Are Solar Panels Made

Is A Business License The Same As A Sole Proprietorship

Once you start a business, you automatically become a sole proprietor earning business income as well. There is no statewide license requirement for businesses operating in California. If you operate a business in your city or county, you might need to obtain licenses, permits, or zoning approval.

What Is A Business License

Business license is a broad term that refers to any kind of license or permit required to operate your business and provide your services in your location. Various types of business licenses are issued by federal, state, county and municipal agencies.

A business licenses purpose may be to register your business with the government for tax purposes or to ensure you follow industry regulations.

Recommended Reading: Can You Pressure Wash Solar Panels

How To Become An Alabama Sole Proprietorship In 2022

If youre currently self-employed in the state of Alabama, or if youre looking to enter the world of one-person business ownership, youve probably looked into becoming a sole proprietor.

The sole proprietorship is the simplest business format in America, but that doesnt mean that there arent rules and regulations to follow when you operate one. In addition, there are some limits to the functionality of a sole proprietorship.

In this guide, we’ll walk you through the steps to setup a sole proprietorship properly, and help you determine whether or not a sole proprietorship is a good choice for your business.

Guru Tip: Its important to understand that a sole proprietorship does not offer personal asset protection as the LLC does. The LLC is the most popular entity for small businesses and is easy to create by doing forming it yourself or hiring a cheap LLC service.

Choose A Business Structure

A business is a legal entity. It can own property, hold bank accounts and is required to pay taxes. There are different types of business entities, each with unique benefits and limitations.

The right choice for you depends on your interests and needs. Youll need sound counsel to understand your obligations regarding your business. Get to know the business structure options and discuss them with your advisors to determine which will be optimal for you. Find legal, tax and business advisors. Good decisions are based on:

- The number of owners now and planned for the future.

- The types of owners – are they all individuals or are they entities ?

- Liability concerns.

- Registration and tax filing requirements and costs.

- Paperwork and entity management considerations.

Sole Proprietorships are owned by a single person or a married couple. These businesses are inexpensive to form and there are no special reporting requirements. The owner is personally responsible for all business debts and for federal taxes.

Washington State Business and Organization Structure Considerations:

NOTE: This information is for reference only, for detailed considerations contact your trusted legal or tax advisors.

You May Like: Does A Solo 401k Need An Ein

Get One Step Closer To Being Your Own Boss

Once you know how to start a sole proprietorship, youll discover its an affordable and relatively easy way to launch your own business. There are few barriers to entry and it allows you to truly be your own boss. However, it does come with some risks, like being vulnerable to unlimited liability.

Determine if a sole proprietorship is the right fit for your business endeavor. When youre ready to move forward, check out these six questions to ask yourself when starting a business.

Can Anyone Start A Sole Proprietorship

One of the easiest types of businesses to start is a sole proprietorship since it does not require the states registration. Unlike corporations or LLCs, you do not need to register when starting a sole proprietorship. It is still necessary to obtain the proper permits and licenses for the company to be in compliance with the law, and you are personally responsible for any debts, lawsuits, or taxes the company accumulates.

Read Also: Can I Convert A Sole Proprietorship To An Llc