Business Licensing And Names

Sole proprietorships and partnerships have the same responsibilities when it comes to business licenses and name registrations. Although you don’t file formation paperwork with the state to form a sole proprietorship or a partnership, you are not off the hook for other business licenses or permits. Some towns and counties require all businesses to obtain a local license or permit. Depending on the goods or services you provide, you might need specialized licenses from government agencies, such as a food handler’s permit or a license to sell cannabis.

If you want to do business under a name other than your own or your partner’s, you must file for a Doing Business As or a Fictitious Business Name. Check with your Secretary of State for more information.

Tesla’s Elon Musk Tweets Full Self

- With a sole proprietorship, all a business owner has to do is hang a shingle on the door and run the company under the proper rules and regulations of local governing bodies In general, though, it costs very little – even nothing – to file as a sole proprietorship.

- With a limited liability company, the paperwork starts to pile up. First, you must form your company and register it with the proper authorities

You’ll need to complete and file articles of incorporation, which spell out exactly how the business will be run and who’ll be making the decisions. You’ll also need to pay a filing fee of $100 or more and file it with your state’s secretary of state’s office. In all, expect to pay about $1,000 or so to properly file your business as an LLC.

Filing a company as a sole proprietorship is much easier and less expensive than filing as an LLC. With the latter, you’re paying more upfront cash, filling our more paperwork, and takes up way more time than with a sole proprietorship.

How Do You Set Up An Llc Vs Sole Proprietorship

A sole proprietorship begins once you start doing business. You dont need to register your business with your state to exist. However, specific states may require sole proprietors to follow local registration, business licensing, or permit laws. Check the requirements within your state to ensure you are conducting business legally.

To set up an LLC, youll need to file a certificate of organization with your state. You will also need to draw up an LLC operating agreement to outline the company member’s rights and responsibilities. Once youve drawn up this agreement, youre expected to file forms with your state agency and pay the state filing fee.

Don’t Miss: How To Select Solar Panel For Home

Which Is Better: A Sole Proprietorship Or Llc

As with so many questions like this, the answer is: it depends. While obtaining funding or financing can be challenging for any business, the advantages and protections you can enjoy with an LLC cant be understated.

Keep in mind your business goals and what you want to achieve. Dont be scared to get advice or help from seasoned professionals.

This article was originally written on December 3, 2019 and updated on July 21, 2021.

Personal Liability For Business Debt

Neither sole proprietorships nor partnerships shield the owners from the obligations of the business. Creditors can go after your personal assets like your home, bank account, and your car to pay for the debts of the business. The law does not distinguish between you and your business. When the business owns property, so do you. Bringing a lawsuit against a partnership or a sole proprietorship is the same as suing the owners.

When you form a partnership, you could be personally responsible for anything your partner does in the course of running the business. However, you will not be responsible for all of your partner’s actions. For example, if your partner caused a car accident while on vacation, your personal assets would not be on the line to pay for the damage caused by the accident. However, if your business is a delivery service, and your partner were to crash the business truck while on a delivery to a customer, you might be personally liable.

Also Check: How To Make Your Own Solar Cells From Scratch

How Does The Management Structure Differ

In an LLC, the business can be owned by one or more members. Its members usually manage an LLC, but they can also appoint a manager to handle the day-to-day operation.

The membership of an LLC and the way it will be run are laid out in a legal document known as an operating agreement.

In a sole proprietorship, you are truly the boss and call all the shots. There are no partners or members to deal with.

Logistics And Operational Standpoint

Here’s where a sole proprietorship and an LLC can differ.

- With a sole proprietorship, you as the business owner make all the decisions and are the go-to person for business partners, customers and financial professional specialists like an accountant, a banker, or a financial planner.

- With an LLC, there can be a single decision-maker, as designated by the article of incorporation, or decision-making responsibilities can be shared among company executives. Sharing the responsibilities of running a business is much more prevalent – and even desired – in an LLC business structure.

If you like the responsibility of giving orders and making big decisions, you can structure your company as an LLC or a sole proprietorship as a single-source run company. But with an LLC, it’s much more likely that the company is run and managed in a shared responsibility model.

Don’t Miss: How Much Solar Do I Need Rv

What Is The Difference Between An Independent Contractor And A Single Proprietor

Depending on the sort of job they perform and how they are compensated, an independent contractor can be a single proprietor. Certain independent contractors work concurrently for numerous clients, delivering services on a freelance basis. Others perform independent contracting work in addition to full- or part-time employment. A sole proprietor is a sole owner and operator of a business therefore, if this describes you, you can use this commercial phrase to refer to yourself.

What Is The Difference Between An Llc And Sole Proprietorship

A Limited Liability Company, or LLC, and a sole proprietorship are both legal entities that can be formed to operate a business. Both structures allow a business owner to legally run their companies, however they each have unique features, advantages, and disadvantages.

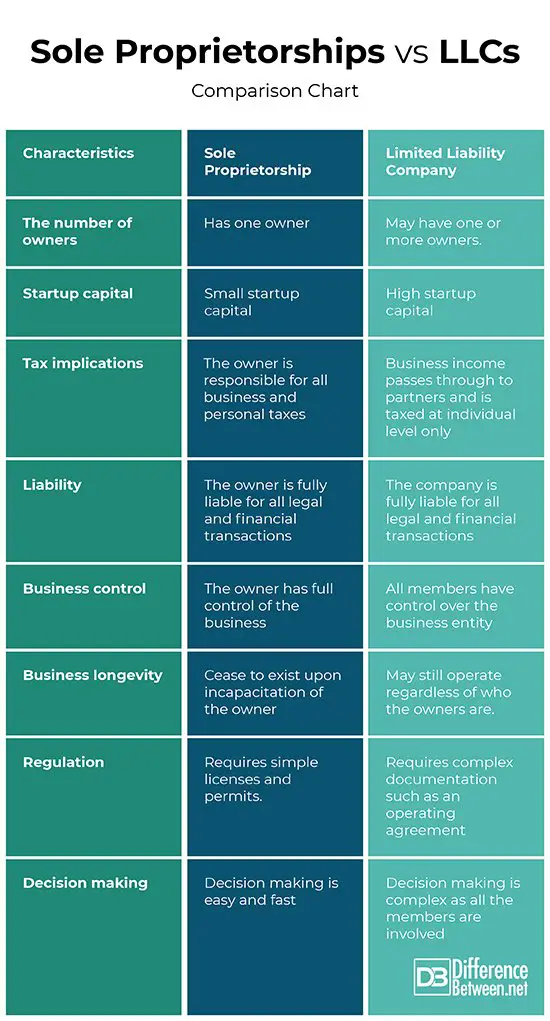

The main ways that an LLC differs from a Sole Proprietorship are:

- Liability protection for the business owner

- Ownership structure

- Government regulation

- Taxes

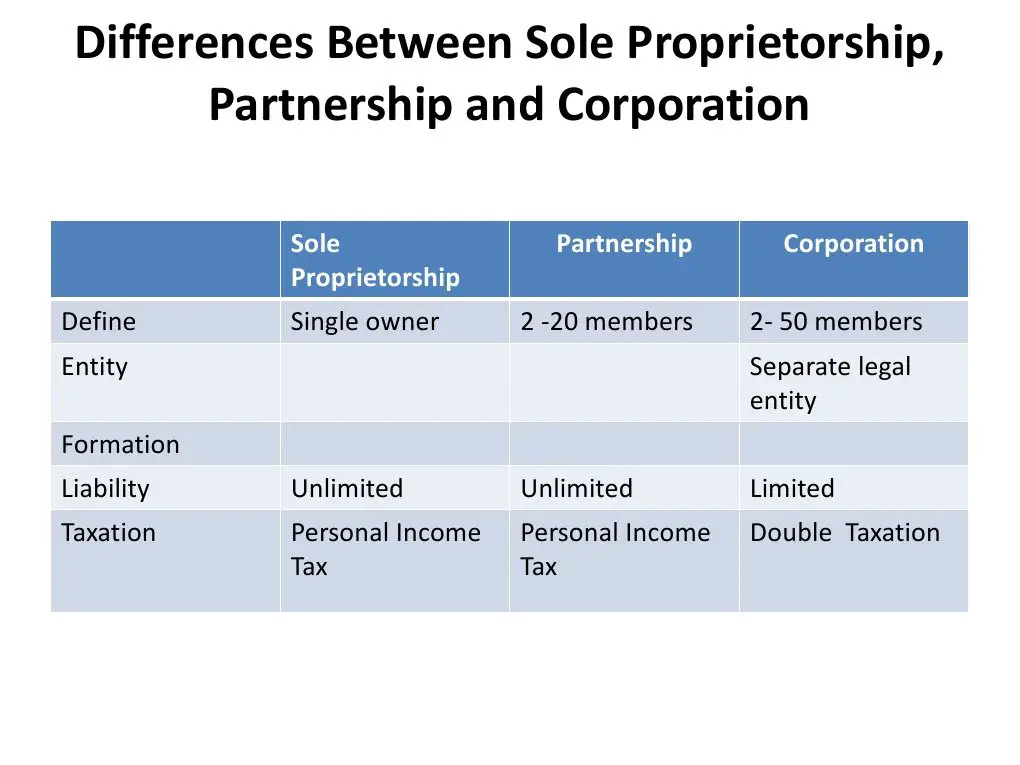

Asole proprietorship is an unincorporated business that is not legally separated from the business owner. There is only one owner, and that owner reports the businesss profits and losses on their individual tax return. The owner is liable for all debt and risk associated with the business.

An LLC on the other hand provides personal liability protection to a business owner because the business is considered a separate entity from the individual owner. LLCs can have multiple owners and have the option to choose how they are taxed. They can opt to be taxed like a sole proprietorship or as a corporation.

Don’t Miss: What Is Sole Custody Mean

What Is A Limited Liability Company For A Single Owner

One of the most common types of small businesses in the U.S. is a single-owner or single-member LLC. This is a business entity registered in the state of formation, which usually will be where the company does business.

The term single-member is used to recognize that the LLC has one owner, as opposed to an LLC in which there is more than one owner. A single-member LLC has all the same advantagesand disadvantagesof a multi-member limited liability company.

Each state has different requirements for forming an LLC.

Note that you can form your LLC in a different state than where you do business. Each state other than where you initially formed your LLC is a foreign state. You are required to foreign qualify in those states in order to do business there. This generally requires filing an application for authority with that states business entity filing office.

Advantages of a single-member LLC

There are many benefits to forming an LLC versus operating as a sole proprietorship. A single-member LLC is generally shielded from personal liability for debts associated with the business.Note: Single-member LLCs must be careful to avoid commingling business and personal assets. This could lead to what is called piercing the corporate veil and the loss of your limited liability.

However, you do have the option to be taxed differently.

Other benefits of forming a single-member LLC include the following:

Disadvantages of a single-member LLC

Difference Between Llc And Sole Proprietorship

LLC is separate legal entity run by its members having limited liability and it is mandatory for an LLC to get registered whereas sole proprietorship is a sort of business arm of an individual which is not separate from its owner hence its liabilities are not limited and there is no need to register sole proprietor.

There are notable differences between them. When individuals start their businesses, they go for a sole proprietorship. LLC is an extension of sole proprietorship where there are many members who own the company.

In a sole proprietorship, theres no separate entity. Whatever the business earns is the owners responsibility. And as a result, the owner needs to pay personal income taxes. In the case of LLC, its a bit different. LLC and its members have a separate legal entity, but the members need to pay taxes as per the rates of taxes.

A sole proprietorship is managed by the owner himself. But in the case of LLC, sometimes the members run the business or they select few managers who run the business.

You are free to use this image on your website, templates etc, Please provide us with an attribution linkHow to Provide Attribution?Article Link to be HyperlinkedFor eg:Source: LLC vs Sole Proprietorship

The biggest advantage of an LLC is that the liability of a member of the LLC is limited to the investments she has made. However, for a sole proprietorship, the total liability lies with the owner of the business.

You May Like: Can I Use Pine Sol On Tile Floors

Is A Single Member Llc The Same As A Sole Proprietorship

A single member LLC is not the same as a sole proprietorship.

A sole proprietorship doesnt offer the same protections as an LLC.

Even though a single member LLC and sole proprietorship will only have you as the owner and member, as long as you keep your business finances and assets separate from your personal ones, your single member LLC will protect you.

Benefits Of Sole Proprietorships

A sole prop is a common choice for new businesses and entrepreneurs because it offers the following advantages compared to LLCs:

- Simplicity. Its relatively easy and inexpensive to establish. If youre the only owner and employee performing your business activities, then youve already formed your own sole prop. Establishing other business structures, like an LLC, requires paperwork and processing.

- Income tax filing considerations. The owner and business are considered the same entity and generally will only have to file one federal income tax return and one state income tax return so income is only taxed once. Single-member LLCs could offer this same advantage If a second owner joins the businesses, the sole proprietorship will then be required to file partnership tax returns.

- Fewer guidelines. Sole props have fewer regulatory requirements than other business structures. LLCs require a formal registration process including a separate and unique business name and registering an agent to correspond on behalf of the company. Many states charge filing fees for LLCs.

You May Like: Is Going Solar Worth It

Disadvantages Of A Sole Proprietorship

However, with a Sole Proprietorship, you also have the following drawbacks:

- Theres no liability protection against commercial debts, lawsuits and other obligations. This means you can be sued personally for commercial activities, putting your personal assets at risk.

- Outside of friends and family, its nearly impossible to secure equity financing for a Sole Proprietorship, as many investors choose not to invest in a Sole Proprietorship. This could limit the amount of funds available to grow, develop, and sustain your business.

- Its difficult to establish business credit to obtain debt financing for a Sole Proprietorship, as many financial institutions will categorize your request as a personal loan rather than a business loan, which brings all sorts of caps in terms of approval amount potential.

- You will have a lower amount of market credibility by not operating under a trade name. Now this could be easily resolved by creating a Doing Business As Name with your states department of revenue or the secretary of state, but this will require fees for establishment and ongoing fees to continue to use the DBA name.

Set Your Business Up for Success & Scalability

Make sure youre taking all the right steps to establish your business and build your business credit. Our course will guide you step by step so you can create a solid foundation and grow your business.

Who Pays More Taxes An Llc Or S Corp

It depends on how the business is established for tax purposes and how much profit is going to be generated. Both an LLC and S corp can be taxed at the personal income tax level. LLCs are often taxed using personal rates, but some LLC owners choose to be taxed as a separate entity with its own federal ID number. S corporation owners must be paid a salary in which they pay Social Security and Medicare taxes. However, dividend income or some of the remaining profits can be passed through to the owner, but not as an employee, meaning they won’t pay Social Security and Medicare taxes on those funds.

Read Also: Who Installed My Solar Panels

Sole Proprietorship Advantages Over An Llc

In a nutshell, starting a sole proprietorship is simpler, less expensive, and less complicated than starting an LLC. One simplification that sole proprietorship offers is that you dont need to separate your business and personal finances by keeping separate bank accounts. If you plan on taking tax deductions based on business expenses, it might be easier to keep your finances separate for tracking purposes, but you are not required to do so by law. You do, however, need to keep accurate financial records for your business, including business income and expenses, in case you are audited by the IRS.

With an LLC on the other hand, by law you must keep separate accounts for business and personal in order to maintain LLC status and the personal liability protection that it affords you. If you mingle your business and personal accounts, then you could lose your limited liability protection. If debt collection or a lawsuit lands you in court, a judge could rule your LLC null and void if you mingle personal and business assets, in which case you lose all liability protection and your personal assets could be used to pay debts or settle legal claims.

Another advantage provided by the simplicity of the sole proprietorship is that you are not required to register your business name if its one and the same as your personal name. If you choose a business name other than your personal name, then you should register your Doing Business As name with your state.

Advantages Of A Sole Proprietorship

When you form a sole proprietorship, you have the following benefits:

- No required state paperwork, unless theres specific licensing such as an occupational license and/or business license.

- No required annual state filings to complete, unless theres specific industry filings required by your industry.

- All profits/losses are passed through to the owners personal tax return. These are typically reported on a Schedule C tax form that is filed with owners personal tax return.

- May enjoy the tax benefits of being self-employed, from deducting certain business expenses , utilizing self-employed retirement plans like Simplified Employee Pension Individual Retirement Accounts , writing off regular business expenses such as , writing off business travel costs, writing off costs to entertain clients and more.

Read Also: When Do Babies Eat Solid Food

Should I Start A Sole Proprietorship Or Llc

The easiest way to answer the question regarding whether you should start an LLC or a sole proprietorship is to look at some of the big pros and cons of each option.

A sole proprietorship, for example, is one of the easiest business entities you can launch. Basically, you just get to jump right in with both feet and start working.

As a sole proprietorship, you are technically the business. This, however, does mean all of your business profits and losses will be factored into your individual taxes. With an LLC, you can sometimes avoid this issue.

The biggest downside to going with sole proprietorship is the fact that you have absolutely no protection. If someone decides to come after you, they can take your business, your house, your car, and all of your money.

One of the main disadvantages is setting up your business as an LLC isnt nearly as simple as sole proprietorship. You have to file documents and complete paperwork all of which includes filing fees. Basically, you have to jump through a few hoops before you can dive in and start working.

When youre deciding whether to start a sole proprietorship or LLC, it really comes down to your personal situation. I can help you make that decision if you email me at

Llc Vs Sole Proprietorship: Formation

You might be surprised to learn that theres nothing specific you necessarily need to do to form a sole proprietorship. In fact, you might be operating a sole proprietorship without even knowing it. Any person selling goods and services without a partner is a sole proprietor by default. Depending on where your business is located, you might need to apply for business licenses or zoning permits to legally operate your sole proprietorship. And any business, including a sole proprietorship, that operates under a trade name, needs to apply for a fictitious business name, also known as a DBA or doing business as certificate. However, thats it as far as formation paperwork goes, making sole proprietorships the easiest and least expensive type of business to start.

An LLC might also need to file for business permits and a DBA . But the most important formation document for an LLC is called the articles of organization. This document establishes your LLCs existence and must be filed with the state in which youre operating. The cost to file articles of organization varies by state, but generally ranges between $50 to $200.

» MORE: Business insurance for LLCs

Also Check: How Does A Residential Solar System Work