Is There Tax Credit For First Time Sellers

None for the seller , but there is a profit exemption of $500,000 or $250,000 if you have used the condo for at least 2 of them as your primary residence. 5 years directly for sale. Here’s a short article from the IRS about it.

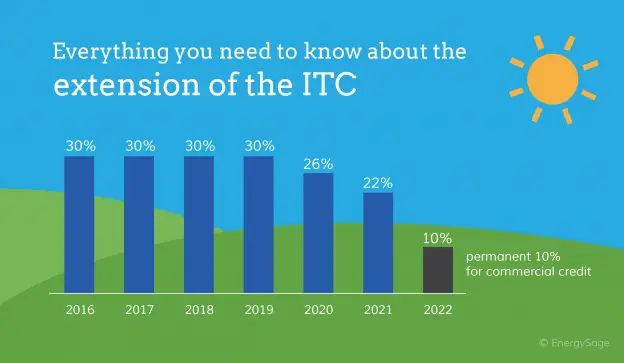

Energy Credits,What is The Definition of Energy Credits?Energy Credits means, Energy Saving Residential Property Credit: This tax credit helps taxpayers pay for eligible residential buildings using alternative energy sources such as solar water heaters and solar panels. In 2021, it will account for 30% of eligible property costs by 2019, 26% in 2020 and 22% in 2021. There is no limit to the number of credits available. In general, you consider labor costs when determining a loan and extendin

Solar Tax Credits Can Still Save You Thousands

Consider investing in solar energy while you can take advantage of the ITC. Keep in mind there are quite a few steps that must be completed before your solar energy investments commissioned. First, you have to get on board. With so many people jumping on the last minute bandwagon, you need to act now to take the credit and save thousands.

How much can you save? Theres no cap on the current 26 percent credit. EnergySage Solar Marketplace estimates you can save $9,000 with your tax credit in 2020. That goes down four percent in 2021, so roughly a credit of $8,640 depending on how costs shake out after the POTUS election. Residential solar energy tax credits bite the dust in 2022 unless Washington extends homeowner eligibility a bit longer.

But until then, any California homeowner can capitalize on the ITC with one caveat. Get your solar panels fully commissioned sooner than later. Installation schedules may tighten up considerably as the end of the ITC draws near. Remember that you must own your new solar energy system outright in order to claim the ITC. Note that the commercial safe harbor provision does not apply to homeowners.

Tracking The Annual Usage Requirement

To ensure you are tracking towards the 687 kWh goal, to monitor your energy data. On average, you will want to use 57 kWh/month. We anticipate all our customers will meet this minimum requirement provided they follow the recommendations above regarding Backup-Only and the backup reserve.

If your system is not on track to meeting the annual usage the SGIP program requires, certain settings of your system may be restricted for example, limiting the share of the systems capacity you can reserve for backup. This may occur 8 months into the year and on the anniversary of that date for the next four years of the program. This would be a temporary restriction, with full functionality restored once you have met the programs cycling requirements.

You May Like: How Tall Are Solar Panels

The Federal Solar Tax Credit

Dont forget about federal solar incentives! With the Investment Tax Credit , you can reduce the cost of your PV solar energy system by 26 percent. Keep in mind that the ITC applies only to those who buy their PV system outright , and that you must have enough income for the tax credit be meaningful.

Property Tax Exclusion For Solar Energy Systems

There are two main ways a reassessment at full market value of your property can be triggered in Californiawhen you sell or buy a house and when theres new construction or major house renovations. Section 73 of the states revenue and taxation code allows a property tax exclusion for qualifying new solar installations. Meaning, your property taxes will not increase if you install solar on your property. This tax exclusion was set to expire in 2016, but is now extended through January 1, 2025. Find out more about the active solar energy system tax exclusion and what qualifies here.

Recommended Reading: What Is The Best Solar Company

What Are The Top Rated Solar Panels

Here are the top five solar panel manufacturers based on the most efficient solar panels they have to offer: SunPower Panasonic LG Hanwha Q CELLS Solaria.

Cost of solar panels for 3 bedroom houseHow much does it cost to install a solar panel system? Cost of solar panels. The average cost of installing solar panels is between $10,626 and $26,460 for a 6 to 12 kW system to power the entire home. The average payback period for solar panels is 7 to 12 years and solar energy saves between $600 and $2,000 per year on electric bills.

California Renewable And Solar Energy Incentives

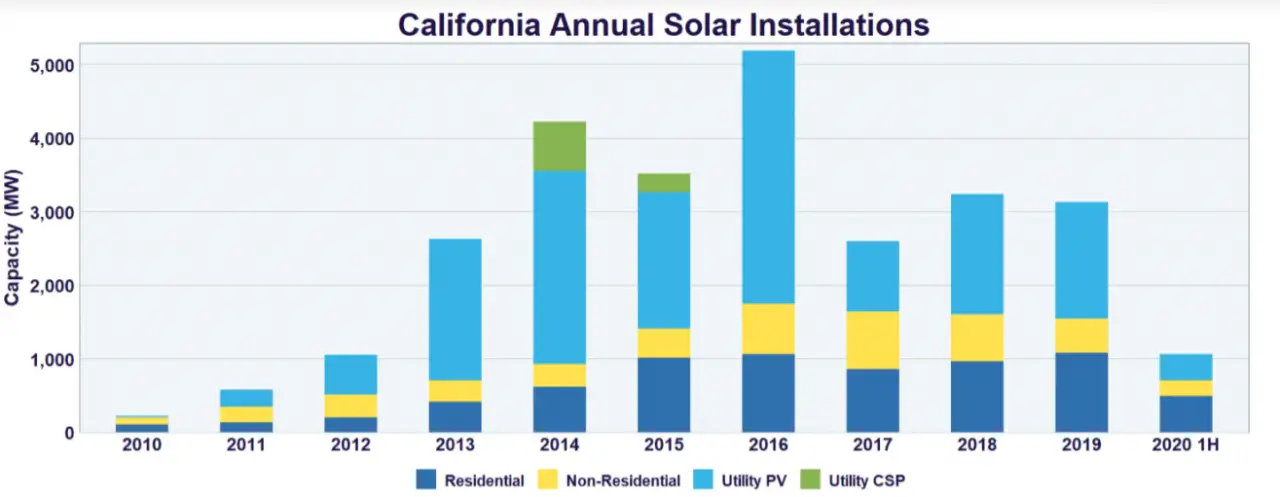

California has long been a leading state in the national solar power and renewable energy initiative. Favorable laws, rebates and performance payments, and high electric prices make going solar in California a very wise economic decision.

In addition, the Federal Government offers a 30% tax credit for the whole installed cost of your system That’s a huge benefit available to you no matter where you live in the US! Talk to a local installer about the incentives available in your area.

Read Also: How To File For Sole Custody In Michigan

How Does The Federal Tax Credit Work For Solar Owners 2019

In order to qualify for the 30% ITC, the construction of a photovoltaic installation must start no later than December 31, 2019. The tax credit increases to 26% for systems from 2020, to 22% for systems from 2021 and to 10% for systems starting in 2022 or later. Any photovoltaic installation commissioned after 2023 can benefit from a maximum tax reduction of 10% regardless of the start of construction.

Federal Tax Credit For Residential Solar Energy

OVERVIEW

The federal solar tax credit for solar energy upgrades to your home may not be around for much longer. Here’s how to claim this credit.

In an effort to encourage Americans to use solar power, the U.S. government offers tax credits for solar-powered systems. Let’s take a closer look at some of the benefits of the solar tax credit and how you can claim it.

Recommended Reading: Do Houses With Solar Sell For More

How Long Will The Federal Solar Tax Credit Stay In Effect

As the saying goes, all good things must come to an end. And the solar tax credit is no exception.

However, the federal government recently extended the federal solar tax credit as part of a federal spending package passed in December 2020.

Under this new bill, residential, commercial, industrial and utility-scale solar projects that begin in 2021 and 2022 will be eligible for 26% tax credit. This number will drop down to 22% for solar projects in 2023, and it disappears completely for residential installs beginning in 2024.

Heres a quick overview showing the value of the federal tax credit over the next couple of years:

- 2020 2022: 26%

- 2023: 22%

- 2024: 0%

You can claim the credit in the same year you complete the installation, so you can claim the full 26% tax refund if you install your system before the end of the year 2022.

The tax credit plays a major part in the return on investment you see from going solar, as well as minimizing the upfront cost of the system however, youll have to wait until after filing to see the overall cost go down. Grid-tie systems pay for themselves either way, but claiming the credit allows you to realize more immediate savings. We cant recommend enough that you capitalize on the full 26% credit, because the value only shrinks after 2022.

Residential Renewable Energy Tax Credit

The most prominent and recognizable incentive for residential solar customers is the Residential Renewable Energy Tax Credit. According to the official language from the Department of Energy, a taxpayer may claim a credit of 30% of qualified expenditures for a system that serves a dwelling unit that is owned and used as a residence by the taxpayer. In laymans terms, this means that as long as the homeowner is putting solar energy on his/her primary residence, they are entitled to a tax credit that is equal to 30 percent of the total cost of the system.

For example, if someone gets a solar panel installation for $20,000, they are entitled to a $6,000 federal tax credit, thus reducing the net cost of the system to $14,000. The tax credit is an incredible cost-savings tool for homeowners interested in investing in solar and it usually can turn what was a 12-year return on investment into a 7 or 8 year ROI depending on the system size and the homeowners electricity usage.

Read Also: When Do Babies Eat Solid Food

Contact Your San Francisco Solar Installers

The Investment Tax Credit is a generous policy that significantly offsets the cost of new solar roofing. But it wont last long, so make sure to take advantage of it! If youre ready to take the first step, use our easy online form to request your free solar savings assessment today. Well help you understand your options for solar roofing and create a plan to help you make the switch to solar and take full advantage of all applicable tax breaks!

California Sales Tax Exemptions For Energy

California does not offer sales tax exemptions. A sales tax exemption means that homeowners and businesses would not have to pay any state sales tax on their solar panel system. Combine California’s high electric rates, extensive state rebate program , property tax exemptions, and the 30% Federal tax rebate and you have extremely compelling reasons to go solar in California!

Don’t Miss: What Type Of Batteries For Solar Lights

California Proposes Cutting Major Rooftop Solar Incentive After Years Of Debate

Solar panels are seen on rooftops amid the coronavirus disease outbreak, in Santa Clarita, near Los Angeles, California, U.S., June 18, 2020. REUTERS/Lucy Nicholson/File Photo

Register now for FREE unlimited access to Reuters.com

The announcement by the California Public Utilities Commission triggered an outcry from the solar panel installation industry, whose backers have warned such proposals could darken the outlook for new projects and undermine the states efforts to combat climate change.

The PUC justified the proposal, however, saying it would encourage the solar industry to accelerate battery storage technology so excess power can be held in reserve instead of sold, while undoing a policy it said amounted to a multi-billion dollar subsidy for wealthy homeowners at the expense of other utility ratepayers.

Register now for FREE unlimited access to Reuters.com

Under the proposed reforms, Californians with new solar installations would see a discounted rate for power they sell into the grid and a monthly utility charge of $8 per kilowatt to cover the cost of maintaining the grid.

Existing solar owners would be moved to the new structure once their installations have been connected for 15 years, the PUC said. But, they would be offered an incentive to pair a battery with their solar installations before then, which would push them on the new rates sooner.

California is home to about 40% of the nation’s residential solar energy capacity.

California Sales Tax And Property Tax Exemptions

An often overlooked incentive is sales tax relief for solar equipment. California Assembly Bill AB 398 gives partial relief from sales tax for the purchase of solar energy equipment. This is a 3.9375% reduction in sales tax, which can add up to a few hundred dollars in savings. Read this article for an analysis of this bill, or ask your solar installer about it.

Another significant incentive is Californiaâs property tax exclusion for solar equipment. Normally, when you make improvements that increase the value of your home, your property tax assessment increases as well, which raises the tax you pay. This program can mean a tax savings of around a couple hundred dollars or less per year. On a yearly basis this isnât huge, but when you think of the expected 25 year lifespan of a solar PV system, this tax relief can be really significant over time.

This incentive is set to expire in 2025, but it has been extended before, and might be again. Check out the DSIRE website for more details.

TAGS

You May Like: Will Solar Panels Work During Power Outage

Solar Cells Solar Panels And Solar Modules

A solar energy system is defined as any solar collector or other solar energy device that provides for the collection and distribution of solar energy and, where applicable, the storage of solar energy.

Generally, a contract to furnish and install a solar energy system onto a structure or realty is a construction contract which involves furnishing and installing both materials and fixtures. Construction contractors are the consumer of materials they furnish and install and the retailer of fixtures they furnish and install.

How To Claim An Electric Vehicle Tax Credit

- Choose the right electric car. First of all, you need to make sure that the add-on model you purchased is eligible for full credit.

- Make sure the car manufacturer always has loans. Each automaker has a sales cap of 200,000 units when it comes to tax breaks.

- Receive a certification letter from the dealer.

- Calculate your tax liability for this year.

Recommended Reading: Is Solar Roof Worth It

Do Utility Companies In California Offer Any Upfront Solar Rebates

Upfront rebates from utilities used to be common, but now only a few utility companies offer them.

LADWP offers a $1,000 solar rebate, as well as some other smaller utilities in the Bay Area. Unfortunately, there is no upfront solar rebate for customers of the big three investor-owned utilities. If you are a customer of another smaller utility company, you can use the calculator below to check to see what rebates you are eligible for.

Find out which solar rebates and incentives you qualify for

Impact Of Solar Tax Credits And Rebates

Incentivizing solar energy at a consumer level is essential to ensuring the industrys long-term prosperity. The more homeowners and businesses take advantage of available solar panel rebates and tax credits, the more it supports the industry. As the industry grows, solar energy will become increasingly more accessible to people of all income levels.

The federal solar tax credit in particular has had a tremendous impact on the solar energy industry. Policymakers saw the industry growth and positive changes that came from the original ITC, which caused them to extend the program from 2016 onward. Its expected that this extension will further drive growth in the solar industry.

Its believed that by 2020, the solar industry will employ 420,000 workers and will create more than 20 gigawatts of solar electricity annually. Its estimated that with these projected numbers, solar electricity will account for 3.5% of all energy consumption in the United States by this time. This is a massive increase from the less than 1% solar provides today.

If you are interested in installing a residential or commercial solar energy system, be sure to research all applicable local, state and federal financial incentives you may be eligible for. For more information on which incentives are available to you, visit Unbound Solars list of local and state incentives.

Don’t Miss: How Much Do Commercial Solar Panels Cost

What Is A Federal Tax Extension

The tax extension allows a person to file and pay taxes at a later date. Some states take federal form and allow tax extension based on that. Others require their own forms and it is best to go to the State Franchise Board website and follow their instructions for applying for a tax extension.

Elon Musk Tesla Solar Panels will be applied only with the Tesla storage battery. Elon Musk Tesla solar panel services cost from $8,200 to $32,800 depending upon the size of solar system. SolarCity Corporation – Elon Musk Tesla Solar PanelsSolarCity Corporation was a traded on an open market organization settled in Fremont, California, that sold and introduced solar energy generation systems just as other related items and services to

Dont Wait Too Long The Solar Tax Credit Is Expiring Soon

2020 is a very important year pertaining to residential energy incentives in California. The Investment Tax Credit grants an amount of 26% of the purchase cost of your solar system to homeowners before 2020. Getting a solar energy system installed in 2020 grants the maximum 26% California solar tax credit before stepping down to 22% in 2021.

The federal government will be offering:

- The tax credit amount is 26% for solar PV systems put into service between 01/01/2020 and 12/31/2020.

- Systems put into service between 01/01/2021 and 12/31/2021 will be eligible for a 22% solar tax credit.

- Systems put into service between 01/01/2022 and 12/31/2022 will be eligible for a 10% solar tax credit.

- After 01/01/2023, the solar tax credit will no longer be available for residential solar installations.

- Unlike the Residential Renewable Energy Tax Credit, the Business Energy Investment Tax Credit will still get a tax credit of 10% for solar energy systems placed into service beyond the end of 2021.

The date that your solar panel system is approved to operate determines the year you can claim your tax credit.

The California tax credit for solar does not have a maximum limit. You can still claim the full 26% California solar tax credit without having to worry about a limit. Whether your solar panel system installation included costs you $10,000 or $1,000,000.

Also Check: How To Start A Solar Panel Installation Company

Am I Eligible To Claim The Federal Solar Tax Credit

You might be eligible for this tax credit if you meet all of the following criteria:

- Your solar PV system was installed between January 1, 2006, and December 31, 2023.

- The solar PV system is located at your primary or secondary residence in the United States, or for an off-site community solar project, if the electricity generated is credited against, and does not exceed, your homes electricity consumption. The IRS has permitted a taxpayer to claim a section 25D tax credit for purchase of a portion of a community solar project.

- You own the solar PV system .

- The solar PV system is new or being used for the first time. The credit can only be claimed on the original installation of the solar equipment.