Who Can Open A Solo 401

As mentioned, Solo 401s provide self-employed individuals a place to save for their retirement. The term individual is vital because Solo 401s are limited to small business owners with zero employees.

Freelancers and the self-employed tend not to have any employees however, small businesses with even one other employee on the books are not eligible.

There is one caveat to this rule. If your spouse is the only other person employed by your small business, both of you can contribute and receive matching contributions from the business-but more on that in a bit.

Why Might You Need An Ein

You may need to obtain an EIN for a number of reasons, including business, estate, or trust banking, and hiring employees. Businesses also need EINs when they are required to file employment tax returns excise tax returns or alcohol, tobacco, and firearms returns. The following are reasons why you may need an EIN:

- Banking and finance In many cases, banks and credit unions require a valid EIN in order to open a bank account for any type of business, an estate, or non-grantor trusts. Having an EIN may also be helpful for a business seeking to obtain financing or working capital.

- Employees If you are hiring employees , you will need an EIN. This is the number the IRS will use to track your payroll tax remittances. Business owners establishing a form of business other than a sole proprietorship will also need an EIN, regardless of whether or not the business will have any employees. Your EIN will be used to track your business income taxes.

- Self-employed retirement plans A self-employed person who decides to establish a Keogh or Solo 401 plan will need to obtain an EIN in order to facilitate those types of plans federal tax treatment.

- Situations where sole proprietors may need an EIN Sole proprietors who are filing for bankruptcy for their business will need an EIN, as will those who purchase or inherit an existing business that they intend to run as a sole proprietorship going forward.

Who Is Eligible For Solo 401 Payroll And Incorporation Services As Part Of Paychex Solo

If youre self-employed, you may establish payroll and a solo 401 through Paychex Solo if you do not have any employees, are incorporated, and you meet general401 plan qualification requirements. Our incorporation services can help you with the filings necessary to start the process.

You May Like: How Do Companies Match 401k

You May Like: Does Solid And Striped Run Small

What Is A 401k Plan Administrator

An administrator is the individual or entity who handles the administration of an employer-sponsored plan like the 401k. The 401k administrator is often hired by the 401k plan sponsor to handle the day to day activities and reporting of the 401k plan.

With a Solo 401k plan, your business it the plan sponsor. Therefore, your business can choose who will be the Solo 401k plan administrator. To keep record-keeping clean and easy, and to cut the fat of extra costs, most Solo 401k accountholders will act as their own Solo 401k plan administrator.

A 401k plan administrator will often handle the plan contributions, distributions, and other aspects of plan paperwork. This leaves the trustee to handle the investments. With the Solo 401k plan, it is common for the same person to act as 401k administrator and 401k trustee.

It Can Protect You From Identity Theft

As an independent contractor, you are frequently enabling payment by sharing out information that connects you to the work you do for your multiple clients. While many contractors use their social security number for this, doing so makes key personal information vulnerable in the event that a client experiences a data breach.

Getting an EIN allows you to provide clients with a number thats linked to your business finances instead of your personal finances. In the event that your data gets stolen, thieves wont have access to your social security number.

Recommended Reading: What Do I Need For A Grid Tie Solar System

What Is A Solo 401 Plan And How Does It Work

A solo 401 plan, also called a one-participant 401 or a solo K, offers self-employed people an efficient way to save for retirement. There are no age or income restrictions, but participants must be business owners with no employees .

The solo K has very high and flexible contribution limits, typically allowing more contributions than SEPs, traditional IRAs and Roth IRAs or SIMPLEs, says Joe Conroy, CFP and founder of Harford Retirement Planners in Bel Air, Maryland.

One key difference between the solo 401 and other self-employed retirement plans is that employees can contribute all of their salary up to the annual maximum contribution. Theyre not limited to 25 percent of their salary, as in some other plans. This feature can allow them to minimize taxes, though this contribution doesnt help them avoid the self-employment tax.

In other respects, the solo 401 operates like any other 401 plan, whether its a traditional 401 or a Roth 401. If you set up your solo 401 to take tax-deductible contributions, it will operate like a traditional 401, allowing you to contribute pre-tax money and get a break on this years taxes. On the other hand, if you opt for a Roth, youll make after-tax contributions, but will benefit from the tax-free withdrawals in retirement.

If you think tax rates will be higher in the future, like I do, then a Roth can be a very valuable account to reduce your future tax burden in retirement, Conroy says.

When Does It Make Sense To Open A Solo 401

A Solo 401 isnt the right investment strategy for everyone. Here are some scenarios when opening a Solo 401 makes sense:

- Youre a business owner and the only employee of your company: This might seem like a given, since this is the exact person Solo 401s are for, but its worth mentioning that its also the only person Solo 401s are for if youre not self-employed or if you have additional employees it wont work to open a 401.

- Youre self employed and want a retirement plan your spouse can contribute to: Since you can add contributions from your spouse to a Solo 401, opening one could be a strong strategy if your spouse currently doesnt have a retirement plan or if they havent maxed out other retirement contributions.

- You want the ability to take loans from the plan: While taking a loan from your own retirement plan isnt ideal, the realities of being a small business owner could mean you want or need that flexibility.

Also Check: Can You Sell Solar Energy Back To The Power Company

When An Ein Is And Isnt Required

Many people associate EINs with big corporations, but even a freelancer or the owner of a very small business might need an EIN to file business taxes and for other purposes. If you do need a business tax ID, the best practice is to get one as soon as you open your business, as part of your business launch checklist.

The following types of businesses must get an EIN for tax purposes:

-

Any type of business entity with employees .

-

Corporations and any entity taxed as a corporation.

-

Multi-member LLCs.

-

If you buy a business or inherit a business.

-

If you have a Keogh plan or solo 401 retirement plan.

-

If you file for bankruptcy.

For further assistance determining if you need an EIN, check out the IRS questionnaire.

Unless you meet any of the descriptors above, you most likely dont need an EIN. That means millions of sole proprietors, including freelancers, technically dont need an EIN. But there are plenty of reasons to get one anyway.

How To Report The Fair Market Value Of Assets Held By Your Solo 401 Plan To The Irs

The Internal Revenue Service Form 5500-EZ is an annual information return that is required to be filed by every One-Participant Plan , also known as a Solo 401 Plan, with plan asset value in excess of $250,000 as of December 31 of the previous tax year. The purpose of filing and reporting the fair market value of your solo 401 plans assets is to inform the IRS of assets over $250,000.00 annually held in a Solo 401 Plan. You must file the Form 5500-EZ if a plan meets the requirements alone or combined with any other qualified retirement plan owned greater than 80% by the business owner or a related party exceeding $250,000.00.

You do not have to file the IRS form 5500-EZ for a plan year for a one-participant plan if the total of the plans assets and the assets of all other one-participant plans maintained by the employer at the end of the plan year does not exceed $250,000.00, unless the current year is the final plan year of the plan.

Don’t Miss: How Do You Use Solar Panels

Contributing To A Solo 401k

Contact your solo 401k provider for how to rollover existing assets from your traditional, SEP, or SIMPLE IRA.

Use my spreadsheet to calculate how much you can contribute from your self-employment income each year. See Solo 401k For Part-Time Self-Employment. Tax software such as H& R Block or TurboTax can calculate it too. Although it isnt much when your self-employment income is low, I would still contribute each year when you have self-employment income. It keeps the plan active.

Why Do I Need An Ein For A Solo 401k If I Have A Tax Id For My Business

When you set up your business, chances are high you obtained an EIN for your entity. If you have an LLC, partnership, corporation, or even a sole proprietorship – you probably have an EIN.

So, you might be wondering why you needed a new EIN just for your Solo 401k Trust.

EINs and Tax ID numbers are similar to barcodes on different products at the grocery store.

Just like each barcode is unique to a specific product, an EIN is unique to a specific person or entity. Your social security number is similar to a version of an EIN for an individual, instead of an entity.

EINs tell the government about the specific entity, and its taxation status .

If you used your business EIN to open bank accounts for the 401k trust, the government wouldnt have any way of knowing which funds were taxable and which were tax-deferred .

The Nabers Group team obtains a new EIN for your Solo 401k specifically coded in the IRS system as an employer plan. Then, anytime the Solo 401k EIN is used, the IRS knows to treat funds associated with that tax ID Number as tax-deferred or tax-free.

Similarly, if you bought a piece of real estate youd title the property in the name of the 401k trust and use the 401k trust tax ID number/EIN. Then, when you receive rental income or later sell the property, the IRS knows that income and gains are tax-deferred because that property was connected to your 401k trust EIN.

Also Check: What Is The Best Efficiency Of Solar Panels

It Allows You To Establish Business Credit

According to the Small Business Administration, an EIN is required to establish business credit. Business credit is very similar to personal credit. Like personal credit reports, business credit reports take several factors into account to determine how financially responsible your business is. Much like your personal credit score, business credit scores are used when evaluating loan and credit card applications. In general, the better your business credit score is, the lower your interest rates will be.

You Want To Set Up An Individual 401 Or Sep

In the US, independent contractors have tax-deferred retirement savings options similar to employees participating in company plans. Two of the most common savings plans are individual 401s and SEP-IRAs.

Individual 401s offer many of the same benefits of a traditional 401 and allow self-employed workers to contribute up to $64,500 annually. In order to set up an individual 401, you must have an EIN. A SEP-IRA allows independent contractors to contribute up to 25% or $57,000 whichever is less, annually. Although you dont legally need an EIN to open an SEP-IRA, most institutions will require one.

Read Also: How To Find Solo Travellers

Part I Annual Return Identification Information

Enter the beginning date of the plan and then the ending date.

A) Check for the first return filed for the plan. If this is not the first year filing then leave this unchecked.

B) Typically, do not check this box unless filed Form 5558 for an extension of time.

C) Typically, do not check this box unless this plan is maintained outside the United States.

Section 2 Business Information:

You will enter the basic information for your business or self-employment activity here.

The business name can be your full name if you have a sole proprietorship and have not filed a DBA or fictitious name certificate. A lot of our plans are setup for sole proprietors using their personal name.

A business fax number is not required. We have observed fewer and fewer employers entering a fax number and that is just fine.

The business start date can be approximate and can be as recent as today. There is no minimum age for a business or self-employment activity to adopt a plan.

The business address may be the same as your address. If this is true, you may save time by clicking the same as trustee address checkbox.

Select your business form or type. If you do not have a formal LLC, Corporation, etc, you will mark Sole Prop to indicate you have a sole proprietorship. If you have an LLC taxed as a Corporation, you will select LLC. These entries do not affect your tax election status.

For state of formation, enter the state in which your business was formed. Sole proprietorships are formed by default in the state in which you reside and do business.

Enter your business fiscal year end. This is usually the same as the calendar year end of 12/31, however some corporations have opted for a different fiscal year end.

Don’t Miss: What Is The Lifespan Of A Solar Panel

Helpful Hints For The Solo 401k Plan Administrator

As your own Solo 401k plan administrator, youll want to ask yourself the following:

Because you are allowed to be your own plan administrator with the Solo 401k plan, there is no need for the expense or bureaucratic burden of an outside administrator. By following the simple record keeping best practices, handling your investments wisely and with respect to compliance, and staying on top of reporting for your plan, being your own 401k administrator with a Solo 401k plan can afford you the freedom of total self-direction and checkbook control in your retirement funds.

A Solo 401k plan is surprisingly easy to administer. With the Solo 401k plan by Nabers Group, you do not need a third party administrator. In fact, you are allowed to act as your own administrator. Read on to learn about the roles and duties of a 401k plan administrator and how you can make it work for your retirement plan.

File Business Taxes And Avoid Tax Penalties

If you dont have your EIN by tax day and were supposed to get one, you have to fill out specific paperwork to notify the IRS. If you forget to do that, the IRS might not accept your filing, and you could face penalties for a late return.

Plus, for certain types of tax deductions, such as home office deductions, your chances of an IRS audit decrease if you have an EIN.

If the business owner has any desire to get tax benefits from owning and running a business in-house, such as wanting to deduct a room as an office, then having an EIN will help them make that case better and more effectively, says attorney Janet Gershen-Siegel. Personal office deductions have a tendency to bring on IRS audits. Why not make your case before you have to?

You May Like: How Much Is A Solar Lease

Build Trust With Vendors

As a small-business owner, its not possible to do everything by yourself while building your company. You often have to rely on vendors, suppliers and partnerships with other businesses to achieve your goals. Having an EIN makes such third parties more likely to work with you.

These parties might want to check your business credit before signing up to work with you. Wholesale distributors often require an EIN check before theyll do business with a retailer. Having an EIN shows that you have a credible business and are a responsible person who will pay the vendor on time.

Solo 401 Early Withdrawal Rules

Early withdrawal rules for Solo 401s depend on which type of account you have. With a few exceptions, you must pay a 10% penalty tax on withdrawals from a traditional Solo 401 account made before you turn 59 ½, plus income taxes on the amount withdrawn.

With a Solo Roth 401, early withdrawals of contributions are free of the 10% tax penalty and income tax payments, but you pay the penalty and income tax on earnings. You cannot withdraw contributions exclusively from a Roth Solo 401, meaning you will have to pay taxes and a penalty on at least part of your early withdrawal.

Recommended Reading: When Should A Baby Start Solid Food

I Have A Single Owner S

I have a single owner S-Corporation with its own EIN. Do I need another EIN for a Self-Directed Solo 401k?

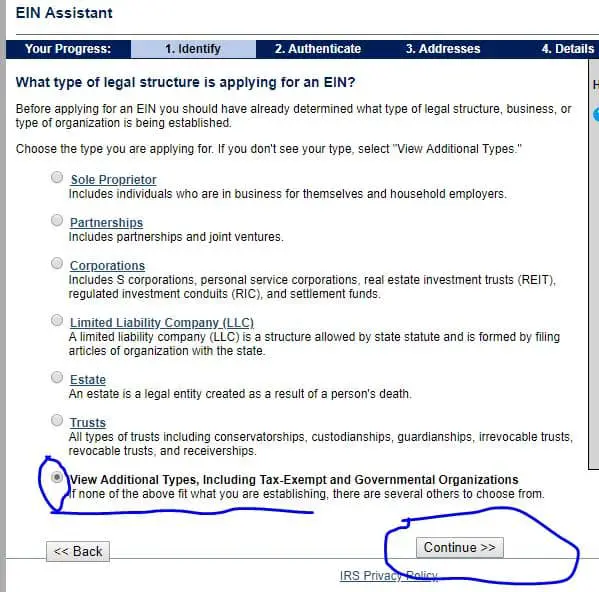

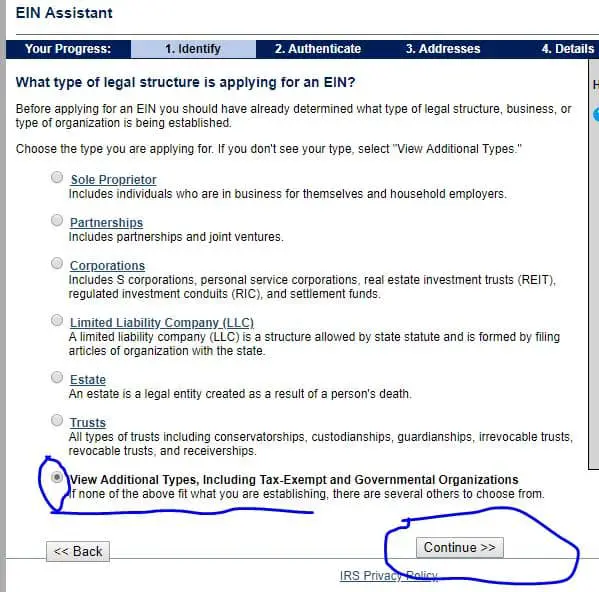

While you can use the S-Corporation EIN for the Self-Directed Solo 401k, I recommend establishing separate one specific for the Solo 401k, which only takes a few minutes to establish via the IRS website for free, to avoid confusion in reporting with the IRS. The EIN for the Solo 401k will be a tax-deferred EIN whereas the one for the S-Corporation is not.

About Mark Nolan

Each day I speak with energetic entrepreneurs looking to take the plunge into a new venture and small business owners eager to take control of their retirement savings. I am passionate about helping others find their financial independence. Having worked for over 20 years with some of the top retirement account custodian and insurance companies I have a deep and extensive knowledge of the complexities of self-directed 401ks and IRAs as well as retirement plan regulations. Learn more about Mark Nolan and My Solo 401k Financial > >