Is Sole Proprietorship Still The Best Option For My Business

If your sole proprietorship is large enough or successful enough to hire employees, then you could be in the position to consider converting your sole proprietorship into an LLC. Forming an LLC is the next step in growing a business.

While being a sole proprietor can be an easy option to run a business with very low profit and low risk, you have zero liability protection.

There are many benefits to holding your business in an LLC, but the most impactful is liability protection. An LLC separates the business owner’s personal assets from the business. This means your personal assets aren’t in jeopardy in the event that the business is sued or can’t pay a debt.

Learn more about getting an EIN as a foreign person.

What Is The Likelihood Of A Cra / Irs Audit For My Amazon E

Businesses are selected for audits for a multitude of reasons. The major reasons why your business can be selected for an audit are:

- Random selection

- Review of a specific industry in a given year

- Lack of compliance in prior years

- Higher than normal or unusual deductions compared to industry averages and benchmarks

- Cross-matching from other businesses

- Anonymous tips from exes, nice neighbours, bad friends through the snitch telephone line

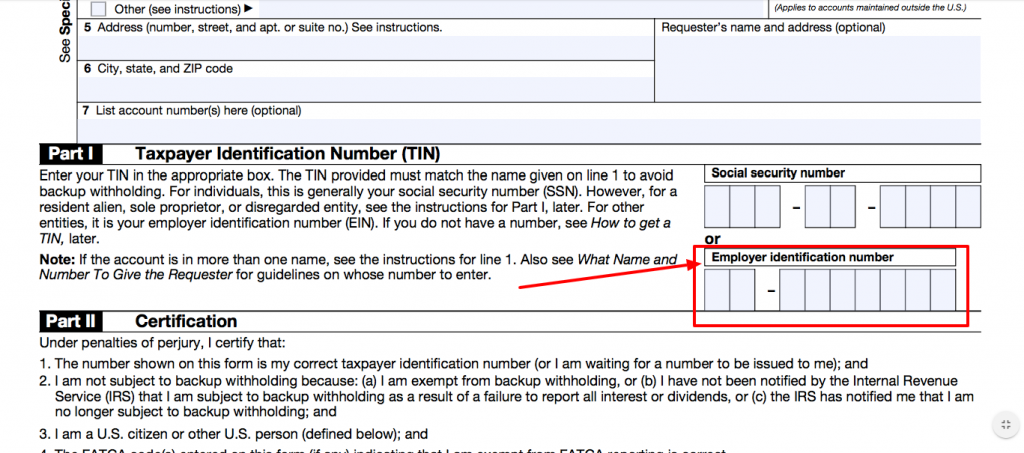

Is Revenue Id The Same As Ein

State tax ID numbers are issued by the department of revenue or similar agency in the state where the business is located. This number is associated only with the state that issues it. The IRS is a national agency, so even if a business relocates and has to get a new state tax ID, its EIN will stay the same.

You May Like: How Many Solar Panels To Power A House Off Grid

What Are The Filing Deadlines For Us Income Tax Returns

For individuals/sole proprietors: 15th day of the 6th month following calendar year-end .

For Canadian corporations with ECI, but no PE: 15th day of the 6th month following the fiscal year-end.

For Canadian corporations with ECI and a PE in the U.S.: 15th day of the 4th month following the fiscal year-end .

You can also request an extension in writing before the deadline .

Non-disclosure penalties can be levied against your business in case you dont file, even if there was no taxable income or full reduction under a tax treaty.

Make sure you file your U.S. income tax returns on time to avoid those penalties.

What Constitutes An Effectively Connected Income For Canadian Amazon Sellers

In order to have ECI in the U.S., you need to have considerable, continuous, and regular business activity. Examples of that activity include:

- Using 3rd Party Logistics like Amazon FBA

- Use of U.S. facilities

- Passing the title of imported goods in the U.S.

- Using dependent agents to conduct business in the U.S.

- Having a US-based bank account

Note that isolated, sporadic transactions will not be considered as the U.S. trade or business income.

Read Also: Are Solar Panels Better For The Environment

How To Find Your Ein If Youve Forgotten It

Your business EIN is the equivalent of an individual’s social security number. In the same way that you guard your social security number, you should take care to safeguard your EIN to reduce your risk of business identity theft. In fact, in its effort to reduce the risk of a taxpayer’s identifying number getting stolen, there is no automated look-up for EINs. However, the IRS has provided guidance on how to find your number if you’ve forgotten it. The IRS’s suggests that take these steps:

- Find the confirmation that the IRS sent when you applied for your EIN

- Contact your bank, state agency, or local agency if you supplied your number to open a bank account or obtain a business license

- Locate a previously filed tax return, which should have your EIN on it.

If these measures are not successful, you will need to contact the IRS directly to ask the IRS to search for your EIN number. You will need to provide identifying information. In addition, you must be a person that is authorized to receive the number on behalf of the business. For example, you must be a corporate officer of a corporation or a manager of an LLC. If you provide the requisite identification and proper proof of authorization, the IRS employee will give you your EIN number over the phone.

Sole Proprietorship Vs Corporation

A corporation is a legal entity separate from the owners. This type of business structure provides legal protection against losses and liabilities, although it is rather procedural and time-consuming to create. Even if the owners cannot fulfill their responsibilities, corporations continue to operate, which is not the case with sole proprietorships. In terms of employee taxation, corporations have greater flexibility and adaptability.

Also Check: What Can A 25 Watt Solar Panel Run

How Did John Convert His Sole Proprietorship To Llc And Get A New Ein

John Doe is a freelance graphic designer and he started his business as a sole proprietor. A few months down the line, he started getting multiple designing projects from overseas and the workload became much higher than he anticipated. So, he decided to hire some employees so that the workload could be divided and he would be able to achieve his business goals. In order to hire and keep employees as well as tackle the rising requirements of the business, he requires a better office infrastructure. A bigger office infrastructure meant investment and hence he took a loan to expand his business.

This restructuring brought John to the point of thinking of converting his Sole Proprietorship to an LLC, which would help protect his personal assets as well. Moreover, if he doesnt convert his Sole Proprietorship he will be responsible for filing taxes and proper administration for these hires.

So, he converted his sole proprietorship to an LLC by following steps on how he could obtain a new EIN for LLC.

He converted his sole proprietorship to an LLC and obtained a new EIN for an LLC through the following steps:

These five steps are very important towards converting your sole proprietorship to a Limited Liability Company and for obtaining a new EIN for LLC. Apart from this, there will be a lot of paperwork involved right from changing registered LLC names in bank accounts, accounts payable, vendor accounts, mailing addresses, websites, business cards, online listings etc.

When Should I Get An Ein / When Does The Irs Require One

If you have employees, the IRS will require you to have an EIN. If your business withholds taxes for non-wage income that is paid to a nonresident alien you will need one. The IRS also requires some sole proprietors to have an EIN. LLCs, partnerships, corporations, nonprofit organizations, and trusts and estates are all required to have one.

Often banks will require you to have an EIN to open a business account with them. If you plan to apply for any loans orlines of credit for your smallbusiness, you should also have an EIN. This allows you to fully separate your personal credit from yourbusiness credit.

Read Also: How Big Of A Solar Power System Do I Need

When Are Payments Due

Taxes for self-employed individuals is based on the calendar tax year. As discussed earlier a new, first-year business can pay federal taxes at the end of the first year and then may have to pay taxes quarterly . Quarterly payments are due based on the 15th the month after a calendar quarter. For instance, the first quarter is January, February and March. Those taxes would be due on April 15th. The remaining quarters are due June 15, September 15 and January 15.

Dont Miss: How Much Power Can I Get From Solar Panels

When Is An Ein Required For A Sole Proprietor

Basically, getting an EIN allows you, as a sole proprietor, to do make more business moves. Without an EIN, a sole proprietor would not be able to:

- Hire employees

- Have a Keogh or 401

- Buy an existing business

- Form an LLC

- File for bankruptcy

In addition, theres going to be some banks that refuse to set up a business account for you unless you have an EIN.

Even if those are things you dont think youre ever going to need, there are still a number of reasons why having an EIN is a good idea.

- EINs can help you avoid identity theft. Identity thieves can steal social security numbers to file fraudulent tax returns.

- EINs can help you establish independent contractor status. Independent contractor status is distinct from employee status. Using an EIN can make you more attractive to potential clients.

Recommended Reading: Can You Make Solar Panels At Home

Getting An Employer Id Number

You may apply for a tax ID online, via telephone, by fax, or through the mail — but doing it online will save you time.

- Online: This the preferred method for obtaining a tax ID number, available for all business entities whose principal office or legal residence is in the U.S.

- Telephone: Call the Business & Specialty Tax Line at 829-4933 between 7:00 a.m. and 7:00 p.m. , Monday through Friday. International applicants must call 941-1099.

- Fax: Complete Form SS-4 and fax it to the appropriate IRS number. The IRS will send a return fax with your tax ID within four business days.

- Mail: Complete Form SS-4 and send it to the appropriate IRS address. Your EIN will be mailed to you.

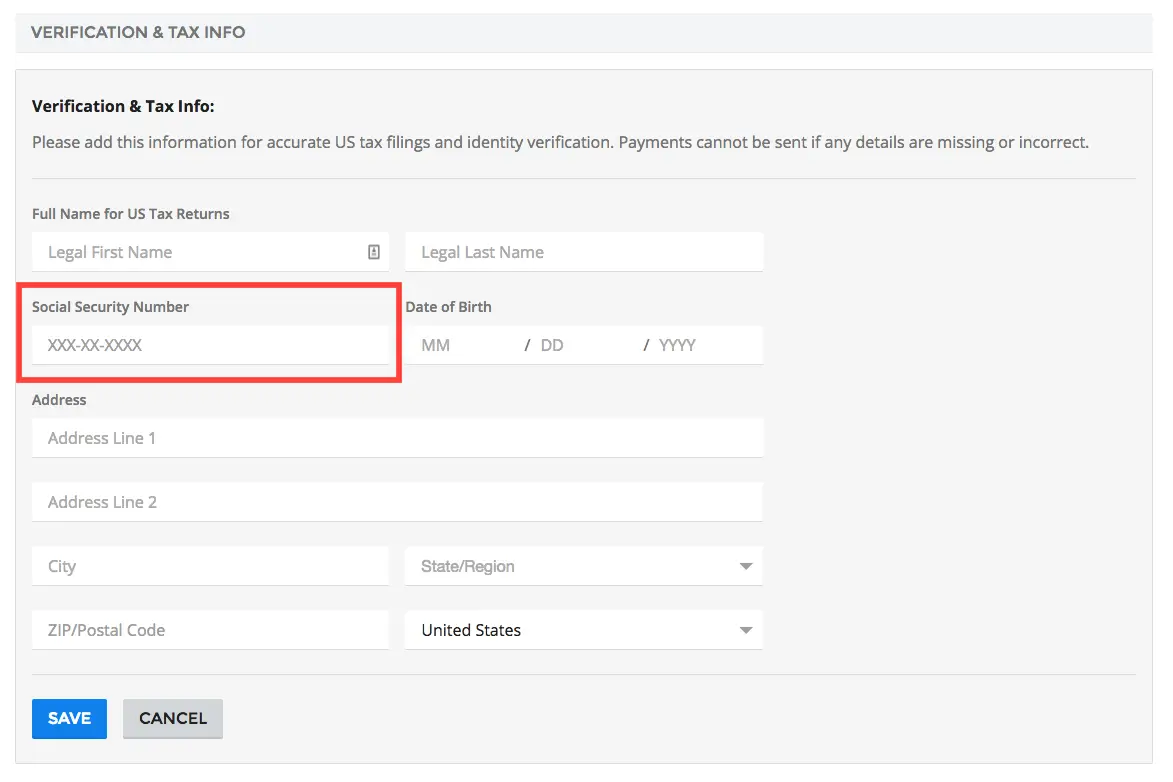

How Do I Get A Fein Number

FEIN is a nine-digit number that the IRS assigns to business entities. The IRS uses this number to identify taxpayers who are required to file various business tax returns.A business is not required to have a FEIN if it has no employees and is organized as a sole proprietorship or Limited Liability Company with one member. The owners social security number may be used instead. However, getting a FEIN in these cases may be wise because chances are a business may be asked for its FEIN in the course of doing business and it prevents the owners social security number from being used as the companys identification number. If the business changes to a partnership or corporation, or if it hires employees, then a FEIN will be required.

You May Like: Is Solar A Good Investment

What Is Sales Tax And How Is It Different From Income Tax

Sales taxes are the amounts that a state/province obligates businesses to collect from customers on behalf of the government. The sales tax amount is charged on top of the sales price of the product and then remitted to the government when the sales tax filing is due. The sales tax is not coming out of businesses pockets.

Whereas income taxes are charged by governments on the net amount between revenues and expenses that was earned by a business during a specific period of time, income tax is an expense to a business.

Get More Options As An Overseas Entrepreneur

Having an EIN can be particularly helpful for starting a business if youre a non-U.S. citizen without a Social Security number. Foreign nationals can apply for an EIN by contacting the IRS. With an EIN in hand, you might be able to apply for a business credit card or open a business bank account before you get a Social Security number. This gives you some headway in launching your business and might even give you a competitive advantage if you need to move quickly.

Don’t Miss: How To Become A Solo Traveller

Can I Get An Ein Without A Business

You do not need an EIN if you don’t have a business, because your social security number will be your Tax ID number.4 min read

Can I get an EIN without a business? An EIN, or Employer Identification Number, is a type of Tax ID number used by the IRS. It identifies your business for tax purposes. You do not need an EIN if you don’t have a business, because your social security number will be your Tax ID number.

What Are The Disadvantages Of The Sole Proprietorship

While the sole proprietorship is fast, easy and inexpensive to start, the major downside is that the assets of the business and the owner are the same. If the business is sued, the business owner could risk losing their personal assets.

The corporation and LLC offer liability protection.

Read: Sole Proprietorship vs LLC

Also Check: Can You Negotiate Solar Panels

How Can I Obtain An Ein If Im A Sole Proprietor

Unlike many dealings with the IRS, the process of obtaining an EIN is simple and free of charge. The IRS provides an EIN assistant that allows you to fill out an online application. Alternatively, you can simply fill out Form SS-4. As a last resort, you might consider actually calling the IRS at their toll-free number: 800-829-4933.

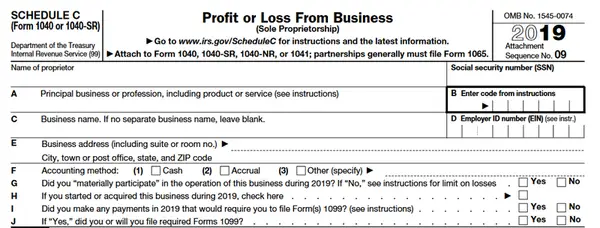

Employer Identification Number For A Sole Proprietor

A sole proprietor must have a federal Employer Identification Number if any of the following apply:

- You have one or more employees. A sole proprietor is not an employee of his own business.

- You file pension tax returns

- You file excise tax returns

- You change your form of business. For example, from a sole proprietorship to an LLC or corporation.

Keep in mind, if you’re a sole proprietor and none of the above conditions apply to you, you can still get an EIN in your own name. In fact, doing so may be a wise decision.

If you’re a sole proprietor and if none of the conditions in the above list applies, and you choose not to get an EIN in your own name, you can use your social security number on your federal tax forms.

Also Check: Can I Get Solar Panels For Free

Find Out If Your Business Needs A Tax Id Number To Operate In Canada

The tax ID number is part of the 15-character program account number assigned to your business by the Canada Revenue Agency . The program account number consists of three parts:

- Nine-digit Business Number that identifies your business

- Two-letter identifier for the program type

- Four-digit reference number for the program account

An account number would look like this: 123456789 RT0001

Think of your Business Number as your business tax ID number because thats why it exists. The CRA assigns your company a Business Number when you first register for any one of the four major program accounts you will need to operate your business:

The nine-digit tax ID number is the same across program accounts the numbers for the program ID and account number will change based on which of the four its referring to. You can apply for the number through The Canada Revenue Agencys Business Registration Online service.

Note that in Quebec, the Business Number does not include your GST/HST accounts. You must register for a separate GST/HST account with Revenu Québec. Its General Information Concerning the QST and the GST/HST provides further clarification.

Several other tax accounts, such as Excise Tax, require a tax ID number/Business Number if they apply to you.

Benefits Of An Ein Even If Its Not Required

Getting an EIN takes anywhere from five minutes with the online EIN application to up to five weeks for the mail-in appliation, depending on your method of submission. A few benefits to consider to having an EIN include:

- Reducing the potential for identity theft since you arent using your SSN for the business

- Using an EIN can help build business credit in some cases

- May be needed when applying for business licenses and permits

Recommended Reading: Is Home Solar Power Worth It

Where Can I Learn About State Income Tax Withholding And/or Sales Tax

Almost all businesses selling retail products are required to collect sales tax. Some businesses providing a service also collect sales tax. Wisconsins sales tax law is that all services are exempt unless specifically listed. Consult the Department of Revenue 608.266.2776 or visit their website.

New Ein For Sole Proprietors

The Employer Identification Number is one of the most important forms of Taxpayer Identification Numbers as it is mandatory for a wide variety of businesses including corporations and LLCs. As a sole proprietor, you can use your Social Security Number for filing tax returns or you can obtain a new EIN and use the same.

Recommended Reading: Can Solar Panels Work On A Cloudy Day

How To Find The Ein For A Sole Proprietorship

Sole proprietors are required to obtain an employer identification number, or EIN, if they have employees, are required to file pension information, pay excise taxes or file returns for alcohol, tobacco or firearms. Although sole proprietors are not required to file for EINs, partnerships and corporations must obtain one. A sole proprietor’s EIN is not public information, and the IRS will not release a sole proprietor’s EIN without a written authorization from the sole proprietor. Corporations that offer public stocks publicly disclose their EINs when they file corporate stock information with the SEC using the EDGAR database, but sole proprietors are not required to file information with the SEC.

Choosing How To Register

Registering as a sole proprietor is good if you are a single owner who operates the business alone. There are no employees, and the owner is responsible for all payment, debts, and receives all business profits.

If you are a single owner or a group who wants the protections of a larger company, an LLC is for you. An LLC is technically a business, but it is considered incorporated and has more flexibility.

It’s important to talk to your accountant when deciding how to register.

You May Like: Is Solar Right For Me