Can I Get Solar Tax Credit If I Do Not Own A Home

The answer is Yes! Internal Revenue Code does not provide that the house on which solar property is installed must be owned by you. The only requirement is that you must be a resident of that home. Even if you live in your parents home, if you pay for the solar system on that house, you can claim the solar tax credit.

Direct Pay Tax Credits For Renewable Energy

The Build Back Better bill restores the production tax credit and investment tax credit to their full values, and taxpayers are eligible for direct pay instead tax equity offsets.

“This allows entities with little or no tax liability to accelerate utilization of these credits, including tax-exempt and tribal entities,” the bill summary reads.

For wind, solar, geothermal, landfill gas, and qualified hydropower projects commencing before 2032, the production tax credit provides a base credit rate of .5 cents/kWh and a bonus credit rate of 2.5 cents/kWh. The base and bonus credit rates phases down to 80% in 2032 and 60% in 2033.

The bill extends the ITC to 30% of full value with a base rate of 6% for property constructed by the end of 2031, then phasing down over two years. There are additional incentives for projects that utilize domestically-produced equipment and for those deployed in low-income communities. A recent study found that clean energy developers are unfairly burdened with transmission upgrade costs.

The ITC is expanded to include energy storage technology and linear generators, each eligible for a 6% base-credit rate or a 30% bonus credit rate through the end of 2031, before phasing down in 2032 and 2033.

A new tax credit is created by the Build Back Better bill for clean hydrogen production beginning in 2022. The base rate of $0.60 or bonus rate of $3.00 is multiplied by the volume in kilograms of clean hydrogen produced during a taxable year.

Start Your Solar Journey Today With Energysage

EnergySage is the nations online solar marketplace: when you sign up for a free account, we connect you with solar companies in your area, who compete for your business with custom solar quotes tailored to fit your needs. Over 10 million people come to EnergySage each year to learn about, shop for, and invest in solar. .

You May Like: How To Change From Sole Proprietor To Llc

Federal Solar Investment Tax Credit

Homeowners and business owners who go solar can make use of the Investment Tax Credit offered by the federal government. The tax credit is a percentage of your system costand theres no cap on the amount.

The ITC is a one-time, non-refundable credit that you receive when you file your taxes for the year you had your solar array installed. You can roll over the tax credit to subsequent years if youre unable to use all of the credit in the first year.

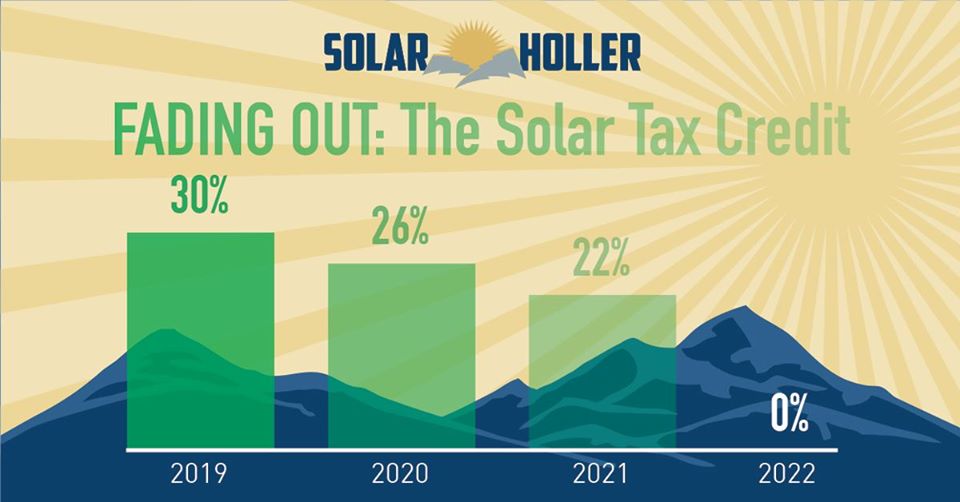

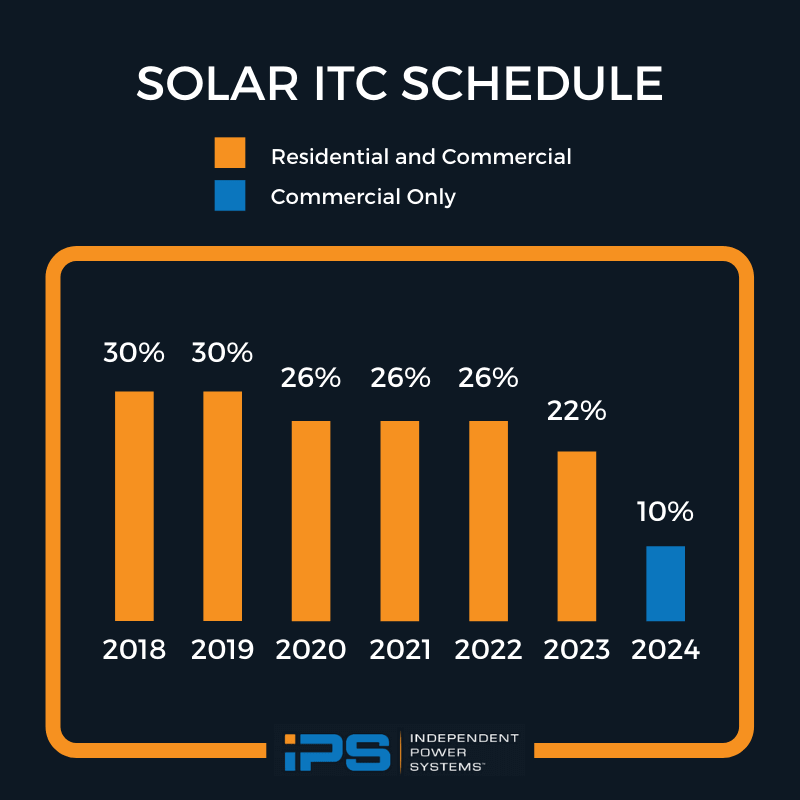

The good news: This tax credit was set to end in 2021, but it was extended until 2023. Yay!

The bad news: The credit decreases over time. Boo.

Heres the plan, as it stands:

- 2021 26% of system cost

- 2022 26% of system cost

- 2023 22% of system cost

- 2024 and beyond no credit for residential systems and 10% for commercial systems

Additional Resource:IRS Instructions for Form 5695

How do I get the tax credit?

In most cases, your solar installer will give you a receipt for the total cost of your system after its installed. You can then give this receipt to your accountant and receive a tax credit off the total cost of your system.

If you cant realize the full value of your credit in the first year, you may be able to roll it forward to reduce your tax burden in subsequent years.

To be sure, we recommend that you consult with a tax expert or accountant. Were not tax experts at Solar United Neighbors, so we cant offer tax advice.

Can I include roof improvement or replacement costs in the credit?

What about battery storage?

Is Your Employer Holding Back Taxes

Most Americans have their employer hold their taxes back from their paycheck automatically. This makes it much easier to calculate your taxes at the end of the year, instead of having to become your own accountant. While the amount held back varies based on your income level, most will have hundreds to thousands of dollars held back in income taxes.

This is where the ITC comes in. The ITC is worth 26 percent of the cost of your installation not just the panels, but also solar components such as your inverter, the racking system, and even a battery backup system like the Tesla Powerwall, assuming you charge the battery backup system with only renewable energy. The federal ITC has no dollar amount cap.

Now, lets say you have a solar installation worth $20,000. The federal ITC would then be a tax credit worth $5,200. This gets applied to your total taxes owed after they have all been calculated, reducing the gross amount of your taxes owed by $5,200.

If you make $85,526 a year , then youll owe $14,605.50 for your federal taxes that year. Your employer will likely be holding this out of your paycheck for you. Now that you have your federal ITC worth $5,200 and apply it to your $14,605.50 held back, that means that you would only actually owe $9405.50.

The additional $5,200 that your employer held back would need to be returned to you. This means that youll be receiving that $5,200 in taxes back which is essentially a refund.

Recommended Reading: What Is The Best Efficiency Of Solar Panels

Getting A Refund From The Arizona Solar Tax Credit

Arizona has a program that is very similar to New Mexicos, with some minor changes to the actual amounts. With the Arizona solar tax credit, the credit caps at $1,000 or 25 percent of the value of the system, whichever is lower. Like the other credits in this article, it will also roll over if you dont use the full amount in a single year, with a maximum of five years.

The way to get a refund on this credit is similar to the others in that youll get your withheld taxes back if the Arizona solar tax credit covers the cost of your state taxes for the year. While this amount might not be as large as the federal or New Mexico credits, its still a tidy sum of cash coming back into your account.

This tax credit, and other solar incentives available in Arizona, are some of the reasons why we consider Arizona to be one of our top states for solar this year. Armed with this information, we hope that you will be able to make an informed decision about whether going solar is right for you. Make sure to check out the other available incentives to make sure youre maximizing your savings.

Solar Investment Tax Credit Recapture Rules

When considering a solar project and how the ITC can reduce costs, be mindful of recapture rules. The ITC vests 20 percent per year, or fully after 5 years.

The vesting schedule begins when placing the project in service and steps down on each anniversary thereafter. If the taxpayer chooses to dispose of the Section 1231 solar property prior to five years, the IRS recaptures the unvested portion of the ITC.

This means the taxpayer will have an increased tax bill for the year in which the recapture occurs. The tax bill increases to an amount equal to the unvested ITC and no interest or penalties will apply, assuming the taxpayer files the return on time and correctly.

You May Like: How Many People Have Solar Panels

Is The Solar Energy Tax Credit Refundable

The ITC is a nonrefundable credit. However, according to Section 48 in the Internal Revenue Code, the credit can be carried back one year, or carried forward in the next 20 years.

Therefore, if you dont have a tax liability this year, but you had one last year, youll still be able to claim your credit or if you dont have one this year but will at one point in the next two decades, your credit will still be available for claiming.

What Is The Difference Between A Tax Credit And A Tax Rebate

Its important to understand that this is a tax credit and not a rebate.

A tax credit is a dollar-for-dollar reduction in the amount of income tax you would otherwise owe. For example, claiming a $1,000 federal tax credit reduces your federal income taxes due by $1,000. Tax credits offset the balance of tax due to the government .

Tax rebates are payable to the taxpayer even if they owe no tax. While most people qualify for the solar panel tax credit, there are some who do not. Anyone who does not owe federal income taxes will not be able to benefit from the solar tax credit. And, if youre on a fixed income, retired, or only worked part of the year, you may not owe enough energy taxes to take full advantage of this solar tax credit.

Note: If you do owe sufficient federal taxes the year that you finance or purchase your system, then the credit can be applied to pay off the taxes owed. If you already paid that taxes by withholding it from your paycheck, the federal government will apply the tax credit to a tax refund. This refund can be used to pay down the balance on a loan. Its important to note that the tax credit be carried forward one year, which means that you can use any remainder from this year as a credit towards next years taxes.

Don’t Miss: How To Charge Your Electric Car With Solar Panels

Draft Federal Tax Package Includes Itc Extension And Direct Pay For Solar Incentives

By Kelsey Misbrener | September 15, 2021

The House Ways and Means Committee is currently debating legislation that could cut power sector emissions to between 64% and 73% below 2005 levels by 2031. Under the Build Back Better Act, tax incentives for such clean technologies as wind and solar, energy efficiency, and electric vehicles would be updated and extended through the end of the decade.

Jesse Jenkins, Assistant Professor of Mechanical and Aerospace Engineering at Princeton, explained the incentives in a series of tweets.

Next up: Investment Tax Credit for solar, geothermal, and newly qualifying: energy storage, biogas, microgrid controllers and a couple more.

30% full value for projects begin construction before end of 2031. Phase out over 2032-2033.

33% if you use domestic content.

JesseJenkins

The draft bill grants most of the direct pay wishes of the solar industry too. In the proposed structure, nonprofits, tribal nations and other groups that dont qualify for tax credits can instead receive direct pay refunds for solar projects.

Ok this is critical: the ITC be PTC, 45Q for CCS etc are now eligible for direct pay or fully refundable, rather than only available as offset against taxes owed. This is a game changer. Means no more wasteful tax equity financing!

JesseJenkins

Still, advocacy groups like Environment America are pleased with the current draft.

SEIA also supports the current version of the act.

About The Author

Incentive Programs Tax Credits And Solar Rebates New York Is Currently Offering*

Incentive

Value

Federal Solar Investment Tax Credit **

The 26% federal solar tax credit is available for purchased home solar systems installed by December 31, 2022.5

NY State Solar Energy System Equipment Tax Credit

The 25% state solar tax credit is available for purchased home solar systems in New York. 6

NY-Sun Megawatt Block Program

Up to $1,000 for every kilowatt of solar power installed.7

Solar Electric Generating System Tax Abatement

Property tax exemption on the added home value from a solar-plus-storage system.8

Home Solar Project Sales Tax Exemption

4% home solar system state sales tax exemption.9,10

You May Like: How To Create Solar Power

Are You Eligible To Claim The Federal Solar Tax Credit

In order to claim the federal solar tax credit and get money back on your solar investment, you have to meet the following criteria when filing your 2021 taxes:

- Your solar PV system must have been installed and began operating at some point between January 1, 2006, and December 31 of this year.

- Your system must be installed at either your primary or secondary residence.

- You must own the solar PV system, whether you paid upfront or are financing the cost.

- The solar system must either be brand new or have been used for the first time. You only get to claim this credit once, for the “original installation” of your solar PV equipment.

New York State Real Property Tax Exemption

- Form RP 487 from New York State Department of Taxation and Finance

- File this form with your local property assessor. Some municipalities and school districts have opted out and will include the value of the solar installation in your property tax assessment without the exemption. You can call your local assessors office to find out whether your community has opted out, or reference the online list of municipalities that have opted out.

Recommended Reading: What Are The Best Solar Panels For Home Use

State Tax Credits For Solar

A state tax credit is a dollar-for-dollar reduction of the tax you owe. With a state solar tax credit, you can deduct a portion of the cost of your solar panel system from your state tax bill, similar to the federal ITC. These amounts may vary significantly by state and some have a limited pool of funds. Many state rebates are only available on a first-come-first-serve basis.

Fill out our quick form to receive information on the best residential solar panel system for your needs.

Our no-obligation consult examines the cost of installing solar in your home. Well help capture all available rebates and tax incentives for your system.

Is It Possible To Claim The Itc After A New Home Purchase

Due to the benefits of solar power systems, they have now become a key consideration for many homebuyers. If you are considering the purchase of a new house with a solar power system, you are likely still eligible for the Solar Investment Tax Credit.

Even if the installation occurred over one year prior to the purchase or move-in date, the ITC is still applicable. This is because the duration upon which it should be claimed only begins once the system is in use. Therefore, as long as you are the owner and first-time user, you can claim the ITC regardless of the date the house was built or sold. For instance, if you buy a house in 2021 but dont move in until 2022, you can still make your ITC claim during the 2022 tax year.

Recommended Reading: How Does Solar Help The Environment

Frequently Asked Questions: Federal Solar Tax Credit

Will I get a tax refund if the solar investment tax credit exceeds my tax liability?

No, the federal solar ITC is a nonrefundable tax credit. However, if you do not use all of your tax credit, you can carry over the unused amount to the following year.

Can I use the federal solar tax credit against the alternative minimum tax?

Yes, you can use your solar tax credit either against the federal income tax or against the alternative minimum tax.

Will there be another federal solar tax incentive after the current one expires?

A new solar tax credit would require an act of Congress. While it is certainly possible, it isn’t something that can be predicted with any certainty.

Can I claim the credit if I’m not a homeowner?

Yes, but only under specific circumstances. Specifically, you must be either a tenant-stockholder at a cooperative housing corporation or a member of a condominium complex to claim the federal solar tax credit.

Can I claim the credit if I am not connected to the grid?

You do not have to be connected to the electric grid to claim the solar tax credit. You only need to have a solar power system that’s generating electricity for your home.

Can I claim the credit if my solar panels are not installed on my roof, but on the ground on my property?

Yes. The solar panels do not have to be installed on the roof in order for you to claim the tax credit, just so long as they are generating solar energy for your home.

How Do Solar Loans Affect The Solar Tax Credit

There are two types of solar loan in relation to the tax credit. Type 1 has one monthly payment amount. These loans assume that you will submit your tax credit to the lender to buy down your principal and secure that monthly payment. If you do not put your tax credit back into your loan, this will initiate another loan, in the amount of your tax credit, at the same APR.

The second type of solar loan is one in which there is a different payment amount for year one than for the subsequent years. In this type of loan, your payments are based on the entire loan amount. When you receive your federal tax credit, youll have the option to use it to re-amortize your loan to secure lower monthly payments. You can also keep the federal tax credit, and your payments will remain the same. Solar.com can help figure out which solar financing option is best for you.

Recommended Reading: Can I Convert A Sole Proprietorship To An Llc