Tax Benefits Of Sole Proprietorship Vs Llc

The tax benefits of sole proprietorship vs LLC are actually the same because both formations are pass through entities in which the business income and expenses pass through to the owner.

With an LLC, you typically have more than one owner who will share the income and expenses of the business, but not always.

Both formations offer the separation of your personal and business finances, but only an LLC actually protects your personal assets in the event something should go wrong with your business.

Youll file taxes the same way with both a sole proprietorship and LLC, so really the only advantage is that limited liability protection an LLC offers that a sole proprietorship doesnt.

Sole Proprietorship Vs Llc: Whats The Difference

Business formation

Starting out as a sole proprietorship is a lot simpler than starting out as an LLC. It doesnt involve any additional paperwork or taxes. All it takes is for the proprietor to come up with an available name and pay a registration fee.

On the other hand, there are several additional steps in the LLC formation process. It requires an agreement with all the partners, appointing a registered agent, and compliance with other tax and regulatory requirements.

Liability

The LLC vs sole proprietor dilemma is primarily a comparison of liabilities. As a sole proprietor, there is no delineation between what you own and what the company owns. This means that theres no difference between what you owe and what the company owes, either.

The main reason people start an LLC is to get the necessary tax and legal protection for their personal assets in case things go wrong.

Management and decision-making

In terms of executive power, the difference between the sole proprietorship and LLC structures is simple.As a sole proprietor, you make all the calls. As an LLC, you need to act within your position in a company in order to enjoy the limited liability protection.

Annual state fees

To run an LLC, you need to pay an annual state fee, which differs based on the state. Not only is this potentially expensive, but it can also become a logistical nightmare.

Corporate maintenance

Taxes

Considerations And Risks Of A Sole Proprietorship

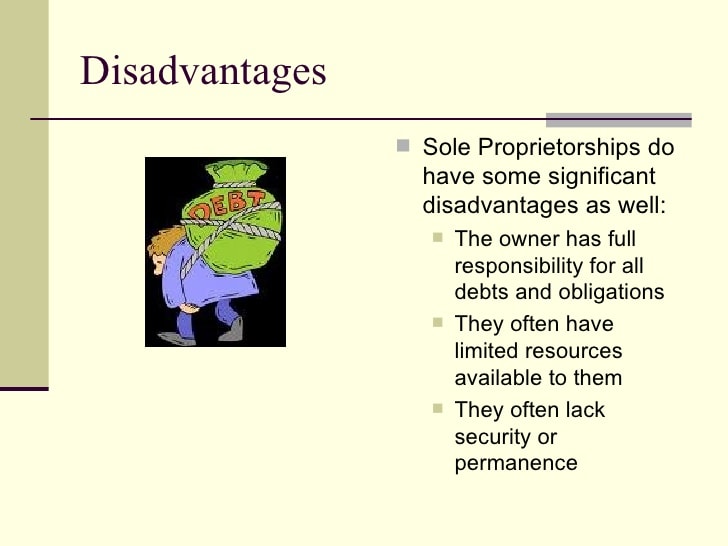

- Youre fully liable. If your business incurs debt, you are personally responsible. Its that simple

- If your business becomes super profitable, it means youll personally pay more taxes. We couldve put this on the list of benefits, but its important to know youll likely jump tax brackets if your business starts making more money

- Raising money is more difficult if youre a sole proprietorship. Financial institutions and investors may require your business to be incorporated before they give you a loan or make an investment

Read Also: How Many Amps Does A 300 Watt Solar Panel Produce

What Is An Llc

An LLC is a limited liability company.

A limited liability company is basically the happy middle between a sole proprietorship and a corporation. You get some of the benefits and protections of a corporation while avoiding some of the downsides of a sole proprietorship.

LLCs are simpler and cheaper structures for taxation purposes. LLC has pass-through taxation, which means their earnings just pass through to the personal income taxes of their members. This means accountants dont have to file a separate tax form for the company, and file much simpler forms than for corporations, which also saves on costs.

I recommend LLCs for companies who expect to grow organically and not seek fundraising to scale. If you sell services I recommend forming an LLC.

What Is An Incorporation

You have the option to incorporate under provincial law or federal law. Companies incorporated under provincial law can operate in any province or territory provided they register as extra-provincial incorporations. Companies must also register extra-provincially in each province or territory where they operate.

Regardless of whether you incorporate under provincial law or federal law, incorporating means that your business operates as its own legal entity, separate from you as an individual. Lets look at some of the advantages and disadvantages of incorporating your business.

Don’t Miss: How Much Can Solar Panels Produce

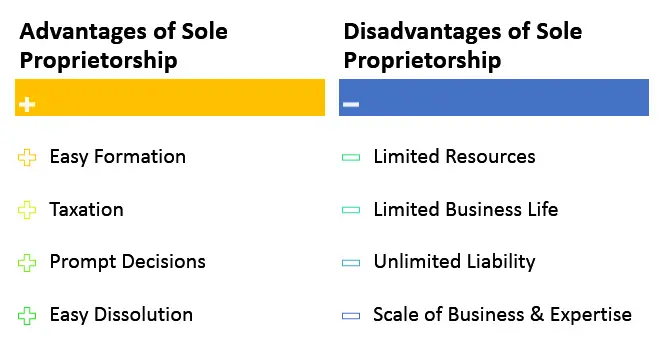

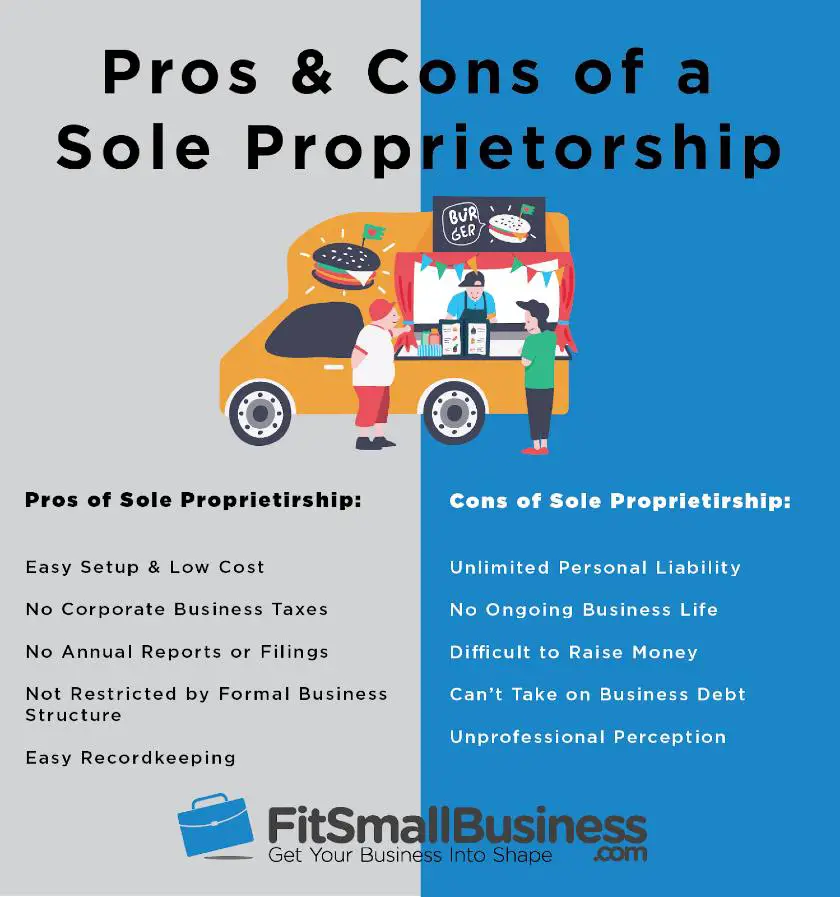

Drawbacks Of Sole Proprietorships

A sole prop might not always be the best choice, depending on your business type and goals. Here are some disadvantages compared to LLCs:

- Personal liability. The owner is responsible for all debts or losses incurred by the business, including lawsuits.

- Difficulty raising capital. Banks and investors are generally less likely to provide financial support for sole proprietorships in comparison to LLCs because its a less formal business entity.

- Everything is on you. Without partners or investors, entrepreneurs are on their own when it comes to making business decisions in a sole prop. Owning and running your own business can be isolating at times.

Sole Proprietor Vs Single

New entrepreneurs have a long list of to-dos when starting their businesses. Among the tasks to check off that list is deciding their business structure. For small businesses with a sole owner and no employees, the two most popular options are:

- Sole proprietorship

- Single-member LLC

So, which one might be the best choice for your business?

I advise you to consider talking with an attorney and accountant to dig into the advantages and disadvantages of each for your specific situation.

Also Check: How To Make A Simple Solar Panel

General Liability Insurance For Your Small Business

Whether youre a sole proprietor or the owner of an LLC, general liability insurance is crucial. General liability insurance covers company assets and is often required to sign contracts. If you are a sole proprietor, liability policies can also help shield your personal assets if you are held liable for an injury or property damage.

General liability insurance can cover the legal fees associated with a lawsuit and provide general protection for property damage and injury of non-employees, product liability, and even advertising injury protection in the event of a lawsuit for slander, libel, or accidental copyright infringement.

What About Personal Liability Protection

With an LLC, your personal assets are considered hands-off when it comes to business debt collection or other claims if your company is sued. In most cases, creditors can’t touch your home, car, or personal bank accounts.

In a sole proprietorship, there is no separation between you and the business. You are entitled to all of the profits, along with all of the debts and obligations. You can even be held responsible for liabilities caused by your employees.

Recommended Reading: Is Solar Power Worth The Investment

Llc Vs Sole Proprietorship

One of the biggest benefits of choosing an LLC over sole proprietorship is that member liability is limited to how much theyve invested in the LLC. As such, a member isnt personally responsible for the debts of the LLC.

A sole proprietor, on the other hand, would be liable for any debts that are incurred by the business. That said, this liability is dependent upon the rules that govern an LLC. Moreover, if you operate the LLC the same way as you would a sole proprietorship, the liability protections are lost.

For instance, lets say you incurred debts as a sole proprietor. Creditors are allowed to go after your house, vehicle, and other personal properties to satisfy those debts. This isnt the case with an LLC, as you are protected from having your personal assets collected.

Lets now turn our attention to some other factors youll want to consider in your decision to choose either an LLC or a sole proprietorship.

Limited Liability Company Versus A Sole Proprietorship

One of the key benefits of an LLC versus the sole proprietorship is that a members liability is limited to the amount of their investment in the LLC. Therefore, a member is not personally liable for the debts of the LLC. A sole proprietor would be liable for the debts incurred by the business. This liability, however, is dependent upon following the rules associated with an LLC. If you treat the LLC the way you would a sole proprietorship, you lose the liability protections.

For example, creditors can go after a sole proprietors home, car and other personal property to satisfy debts, while an LLC that is properly maintained can protect the owners personal assets.

- Difficult to obtain financing in the business name

- Harder to build business credit

Recommended Reading: What Is The Best Retirement Plan For A Sole Proprietor

Which Is Better An Llc Or S Corp

An LLC is better for a single-owner and likely better for a partnership. An LLC is more appropriate for business owners whose primary concern is business management flexibility. This owner wants to avoid all, but a minimum of corporate paperwork does not project a need for extensive outside investment and does not plan on taking her company public and selling the stock.

In general, the smaller, simpler, and more personally managed the business is, the more appropriate the LLC structure would be for the owner. If your business is larger and more complex, an S corporation structure would likely be more appropriate.

List Of Disadvantages Of Sole Proprietorship

1. Personal and Business Assets One of the drawbacks of sole proprietorship is that the owners money is tied to his business in the sense that finances of the owner and the business are one and the same and that there is no legal separation between the two. If the owners business encounters a problem or incurs debt and other obligations, he can risk losing his personal money to settle these issues. Moreover, his personal properties can be at risk if the business fails or if it faces legal actions from disgruntled employees as opposed in a corporation where personal assets are not connected to the business assets. And although sole proprietorships are not safe from legal issues as other business structures, the owner has to deal with these problems alone compared to owners of corporations where there are other people involved and not only one is liable.

2. Less Capital The flipside of not having partners or other investors in a business is not being able to come up with a large amount of capital to start and sustain the company. Even if the business idea is feasible and looks lucrative, coming up with a substantial amount of money to get the business going can be difficult after some time if there is no additional capital. Unlike in a corporation where there are investors who can make additional investments should the need arises, sole proprietorship often results to some owners relying on their personal money and loans to operate the business.

Recommended Reading: How Does Solar Power Energy Work

Does Your Business Name Need To Be Registered

State regulation of LLCs include required words which must be included in an LLC namefor example, “LLC” or “limited liability company” might be required at the end of an LLC’s name. Registering your LLC does give your name protection within your state.

Sole proprietors don’t face the same requirements. However, if the business owner plans on operating under a company name, instead of under their own name, they will need to register for a “fictitious business name,” or DBA , in their home state.

Advantages Of A Corporation

Despite the ease of administration of an LLC, there are significant advantages to using a corporate legal structure. Two types of corporations can be formed: an S corporation and a C corporation. An S corporation is a pass-through entity, like an LLC, where the owners are taxed on profits and losses of the corporation. A C corporation is taxed at the corporate level, separately from its owners, through a corporate income tax. C corporations are the most common type of corporation.

C corporations have the advantage of allowing profits to remain with the corporation and paying them out as dividends to shareholders. Also, for businesses that eventually seek to issue stock, a C corporation can easily issue shares to raise capital for further expansion of the business.

Corporations offer more flexibility when it comes to their excess profits. Whereas all income in an LLC flows through to the members, an S corporation is allowed to pass income and losses to its , who report taxes on an individual tax return at ordinary levels. As such, an S corporation does not have to pay a corporate tax, thereby saving money, as corporate taxes are higher than ordinary taxes. Shareholders can also receive tax-free dividends if certain regulations are met.

Also Check: How To Mount Solar Panels On Rv

Llc Vs Partnership Liability

Now that the difference between a partnership vs. LLC has been defined, it is also important to understand the liability protection for each type of entity. Many entrepreneurs will choose to form an LLC precisely because it will protect them from becoming personally liable in case of a debt or lawsuit. In a partnership, however, each member partner will be held personally liable. Furthermore, each member is held legally responsible for all other members actions. Because of this, individuals who wish to form a partnership should be extremely selective when choosing partners. However, this is not to say that those who form an LLC are completely absolved from liability.

In extreme cases, such as when a member commits mismanagement or fraud, an LLC member may be held personally liable. Some may argue that liability protection may be the key distinction and factor to consider when choosing between a general partnership vs. LLC.

Bring On Investors Or Business Partners

If youre doing business as a sole proprietorship, by definition, your business cannot really grow youre in business for yourself, and mostly by yourself. Forming an LLC gives you the legal ability to expand your business by bringing on a business partner or bringing on investors who can buy a share of ownership in your business.

If you have already been doing business on an informal basis with other business partners while being a sole proprietor, forming an LLC is an even better idea: it gives you a formal business entity with a flexible management structure. You can run your LLC as a single-member LLC, or set it up as multi-member LLC. And you can change your LLCs structure and Operating Agreement over time as your business evolves.

The bottom line is that doing business as a sole proprietorship can be too risky during uncertain economic times. By forming an LLC, you can benefit from various legal protections and financial advantages. Forming an LLC makes your business official, real and legitimate in the eyes of the law. It lets your business participate in the financial system with a separate business bank account and business credit. Doing business as an LLC helps protect your personal assets from the worst-case scenarios while opening up additional opportunities for your business to grow.

Ben Gran

You May Like: Are There Any Government Incentives For Solar Panels

How To Activate Each Structure For Your Business

Forming an LLC requires you to file articles of organization, sometimes called a certificate of organization, with the state. Requirements vary by state.

Typically, an LLC operating agreement is drawn up to document the members’ and managers’ rights and duties.

You should also expect to file certain forms with your state agency, usually the Secretary of State, and pay an initial filing fee that can range from $50 to $500. LLCs also have to file annual or periodic reports and pay a required filing fee in most states.

Unlike an LLC, no formal action is required to form your sole proprietorship if you are operating under your own name. If you want to use a different name, you will need to file for a DBA.

You may also need to acquire any mandatory licenses or permits, and these requirements vary by region, state, and industry.

Whether you’re looking for the liability protection and flexibility of an LLC or the less formal, unlimited control of a sole proprietorship, now you have the tools to make a more informed decision for your business and your future.

LegalZoom can help you start an LLC quickly and easily. Get started by answering a few simple questions. We’ll assemble your documents and file them directly with the Secretary of State. You’ll receive your completed LLC package by mail.

Filing Taxes Is Also Simpler With A Sole Proprietorship

For tax purposes, you and your business are viewed as one. The business income is your personal income, so your business isn’t taxed separately like with a corporation. As the sole owner, you benefit from what’s called “pass-through taxation.” The tax liability belongs to you and “passes through” to your personal tax return.

To file taxes, you would report your operating results, including profit or loss, by submitting a Schedule C with your personal 1040 tax return. What’s more, you are not required to pay taxes on the full amount of your sole proprietorship’s income. You only pay taxes on your business profits.

An LLC can also offer similar tax treatment, with profits passing through to your personal tax return.

Don’t Miss: Is It Possible To Make Your Own Solar Panels

Advantages And Disadvantages Of Sole Proprietorships

Like the LLC or SMLLC, sole proprietorships have their own advantages and disadvantages as well.

- It is considered one of the easiest and least costly business types thanks to the absence of filing fees and the need for formal agreements.

- Sole proprietorships are popular for people who want to be their own boss.

- A potential disadvantage is that courts have ruled that doing business under another name does not qualify as creating a separate and distinct legal entity from the owner.

- Insurance coverage might be pricey for sole proprietors.

- Sole proprietorships do not have access to venture capital.

- Sole proprietorships can be limited in scope and their lifetime, which means they end if the business is discontinued or the owner passes away.

About Business Licenses And Permits

Depending on where a business is located, the industry its in, and the business activities it carries out, it might need to obtain a combination of federal, state, and local licenses and permits. I recommend researching the requirements in that order.

Federal licenses apply to businesses in the following industries:

- Agriculture

- Radio and TV broadcasting

- Transportation and logistics

State and local licenses and permits requirements will depend on the nature of your business activities and where your business is located. Some of the most common include:

- Sales tax permit

- Zoning and land use permit

- Building permit

Also Check: How Many Solar Panels To Power A House Off Grid