The Framework If Approved Would Represent The Largest Single Investment In The Clean Energy Economy In The Us President Biden Has Said

Build Back Better, if passed in its current form, will include rebates for homeowners who embrace electric heat pumps and other forms of cleaner energy.

A handful of programs in the recently-passed infrastructure bill aim to help U.S. homeowners and renters heat and cool their homes, cook meals, and even shower all while using less energy.

But its the $2 trillion budget reconciliation bill, which Democrats have called Build Back Better, that packs the most energy-saving carrots for individuals and families, and which are meant to push the nation toward net-zero emissions by 2050.

The House passed its version of Build Back Better Friday the bill now goes to the Senate, where it faces opposition from Republicans and an uphill battle against some middle-of-the-road Democrats in a closely divided chamber.

The administrations Build Back Better bill includes $555 billion in tax credits, spending and other incentives to promote wind and solar powerICLN, -0.36% , electric vehicles, climate-minded agriculture and forestry programs and other clean energy ideas, some at the federal and community level and some earmarked for American homes.

And:5 takeaways from the COP26 climate summit investors need to know

All of this is a gradual process.

Steven Nadel, executive director at the American Council for an Energy Efficient Economy

Rebates for clean-energy upgrades at home

All of this is a gradual process, he added.

Other features in Build Back Better

Strengthens The Affordable Care Act And Reduces Premiums For 9 Million Americans

The framework will reduce premiums for more than 9 million Americans who buy insurance through the Affordable Care Act Marketplace by an average of $600 per person per year. For example, a family of four earning $80,000 per year would save nearly $3,000 per year on health insurance premiums. Experts predict that more than 3 million people who would otherwise be uninsured will gain health insurance.

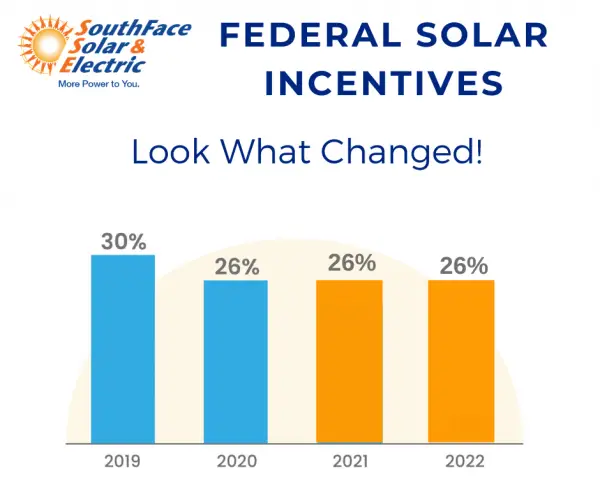

Homeowners Solar Tax Credits

The Build Back Better bill also includes improved tax credits for homeowners. Residents will be able to take a tax credit called the investment tax credit . The ITC is a subsidy for solar installations, and with this new change, the percent would increase from 26 to 30 percent. This tax credit would stay in place for at least 10 more years if the bill goes through as-is.

Read Also: How The Solar Panels Are Made

Delivers Substantial Consumer Rebates And Tax Credits To Reduce Costs For Middle Class Families Shifting To Clean Energy And Electrification

The consumer rebates and credits included in the Build Back Better framework will save the average American family hundreds of dollars per year in energy costs. These measures include enhancement and expansion of existing home energy and efficiency tax credits, as well as the creation of a new, electrification-focused rebate program. The framework will cut the cost of installing rooftop solar for a home by around 30 percent, shortening the payback period by around 5 years and the frameworks electric vehicle tax credit will lower the cost of an electric vehicle that is made in America with American materials and union labor by $12,500 for a middle-class family. In addition, the framework will help rural communities tap into the clean energy opportunity through targeted grants and loans through the Department of Agriculture.

The Build Back Better Framework Is Fully Paid For:

Combined with savings from repealing the Trump Administrations rebate rule, the plan is fully paid for by asking more from the very largest corporations and the wealthiest Americans. The 2017 tax cut delivered a windfall to them, and this would help reverse thatand invest in the countrys future. No one making under $400,000 will pay a penny more in taxes.

Specifically, the framework:

Also Check: Is Solar A Good Investment In California

Ensures Clean Energy Technology From Wind Turbine Blades To Solar Panels To Electric Cars Will Be Built In The United States With American Made Steel And Other Materials Creating Hundreds Of Thousands Of Good Jobs Here At Home

The Build Back Better legislation will target incentives to grow domestic supply chains in solar, wind, and other critical industries in communities on the frontlines of the energy transition. In addition, the framework will boost the competitiveness of existing industries, like steel, cement, and aluminum, through grants, loans, tax credits, and procurement to drive capital investment in the decarbonization and revitalization of American manufacturing.

New Nuclear Power Production Tax Credit

This tax credit applies to projects using nuclear power to generate electricity , and applies only to projects placed in service before the date of enactment of the IRA. The Nuclear PTC rate is 0.3 cents/kWh of electricity produced by the taxpayer at a qualified nuclear power facility. Similar to other tax credits, a full credit equal to five times the base credit can be received assuming compliance with new prevailing wage requirements. The Nuclear PTC will apply to electricity produced and sold after December 31, 2023 and will terminate on December 31, 2032.

Read Also: How To Replace Roof With Solar Panels

Direct Pay Tax Credits For Renewable Energy

The Build Back Better bill restores the production tax credit and investment tax credit to their full values, and taxpayers are eligible for direct pay instead tax equity offsets.

“This allows entities with little or no tax liability to accelerate utilization of these credits, including tax-exempt and tribal entities,” the bill summary reads.

For wind, solar, geothermal, landfill gas, and qualified hydropower projects commencing before 2032, the production tax credit provides a base credit rate of .5 cents/kWh and a bonus credit rate of 2.5 cents/kWh. The base and bonus credit rates phases down to 80% in 2032 and 60% in 2033.

The bill extends the ITC to 30% of full value with a base rate of 6% for property constructed by the end of 2031, then phasing down over two years. There are additional incentives for projects that utilize domestically-produced equipment and for those deployed in low-income communities. A recent study found that clean energy developers are unfairly burdened with transmission upgrade costs.

The ITC is expanded to include energy storage technology and linear generators, each eligible for a 6% base-credit rate or a 30% bonus credit rate through the end of 2031, before phasing down in 2032 and 2033.

A new tax credit is created by the Build Back Better bill for clean hydrogen production beginning in 2022. The base rate of $0.60 or bonus rate of $3.00 is multiplied by the volume in kilograms of clean hydrogen produced during a taxable year.

% Tax Credit For Solar Panels Wind Energy

Homeowners could also get tax breaks to defray the cost of various clean-energy and efficiency-related projects.

One such incentive is a tax credit toward the installation cost of solar panels or other equipment to harness renewable energy like wind, geothermal and biomass fuel. The average residential solar electric system costs roughly $15,000 to $25,000, prior to tax credits or incentives, though several factors determine the final price, according to the Center for Sustainable Energy.

This “residential clean energy credit” extends and enhances an existing tax break. Costs incurred from the beginning of 2022 to the end of 2032 would qualify for a 30% tax credit. The credit would fall to 26% in 2033 and 22% in 2034.

Absent a change in rules, individuals would get a 26% break this year and 22% in 2023 , after which time it’s scheduled to end.

Unlike current law, the proposal also extends the tax credit to battery storage technology. This lets homeowners more easily pair solar installations, for example, with battery systems that store excess renewable energy for later use, according to Jantarasami at the Bipartisan Policy Center.

The tax break for batteries applies to expenditures made starting in 2023.

Also Check: How To Size Off Grid Solar System

Direct Pay Prevents Financing Bottlenecks

A fourth design element that can maximize the impact of clean energy tax credits is refundability and direct pay. Under current policy, renewable energy developers need to have tax liability or partner with an equity investor who has a tax liability to fully monetize tax credits. Most developers do not have tax liability and typically rely on a pool of relatively expensive and limited tax equity from large banks and other corporate players. Allowing renewable developers to receive the tax incentive for which they qualify either as a fully refundable tax credit or via a direct pay mechanism can decouple the renewables from tax equity and drive additional renewable deployment. This decoupling serves two important purposes.

Second, tax equity investors often require a higher return than other sources of equity. Allowing developers to seek out cheaper equity reduces the overall cost of capital for renewable developers, thus reducing the cost of electricity from these projects. We estimate that this shift to cheaper equity could amplify the emission reductions associated with a long-term, full-value, flexible tax credit extension by as much as another 5% in 2031. However, some proposals require a 15% reduction in the incentive payout if a developer opts for direct pay. While such requirements would still prevent financing bottlenecks, they likely negate any additional emission reductions associated with a shift to direct pay.

What A Difference A Year Makes

Last January, hopes ran high that Congress would pass landmark climate legislation in 2021. But with Democrats controlling Congress by a razor-thin margin, President Biden had to walk a tightrope between competing interests within his own party. In the end, Bidens Build Back Better plan got pulled under objections of coal-state senator Joe Manchin , leaving the presidents hallmark legislative initiative in limbo.

Now, as we enter an election year, passing any new laws in Congress just got harder. And the stakes could not be higher. If Republicans regain control of the House and Senate this fall, it will put to an end any meaningful efforts to reduce greenhouse gas emissions at the national level.

Heres a quick rundown on the state of play of federal solar legislation in 2022, with just 10 months to go before the mid-term elections.

Recommended Reading: What Is The Benefit Of Llc Over Sole Proprietorship

Climate And Conservation Investments In Rural Areas Will Transform And Empower Rural Communities

Lastly, the bill establishes and invests $1 billion in a Rural Partnership Program administered by the U.S. Department of Agriculture. Designed to provide flexible, easy-to-access funding for building capacity and supporting locally led development projects, it will empower rural communities, including tribal communities, to build equitable local economies. Investments in rural capacity are critical to ensure that the legislations historic commitments to climate and conservation are transformational for rural America.

Expands Access To Affordable High

Expand access to affordable, high-quality education beyond high school. Education beyond high school is increasingly important for economic growth and competitiveness in the 21st century, even as it has become unaffordable for too many families. The Build Back Better framework will make education beyond high school including training for high-paying jobs available now more affordable. Specifically, the framework will increase the maximum Pell Grant by $550 for more the more than 5 million students enrolled in public and private, non-profit colleges and expand access to DREAMers. It will also make historic investments in Historically Black Colleges and Universities , Tribal Colleges and Universities , and minority-serving institutions to build capacity, modernize research infrastructure, and provide financial aid to low-income students. And, it will invest in practices that help more students complete their degree or credential. The framework will help more people access quality training that leads to good, union, and middle-class jobs. It will enable community colleges to train hundreds of thousands of students, create sector-based training opportunity with in- demand training for at least hundreds of thousands of workers, and invest in proven approaches like Registered Apprenticeships and programs to support underserved communities. The framework will increase the Labor Departments annual spending on workforce development by 50% for each of the next 5 years.

Also Check: Do You Need To Register A Sole Proprietorship

How The Build Back Better Bill Affects Solar Tax Credits

Last Updated on February 28, 2022 by solaralliance

The goal of the Build Back Better Framework is to rebuild the middle class in the United States so that everyone will benefit. The bill includes initiatives centering around climate goals and creating millions of new jobs to rebuild our economy from the ground up.

The climate change plan includes a push towards clean energy technology. This section of the Build Back Better legislation targets incentives around solar power, wind turbine blades and many other significant energy communities. This investment in renewable energy is nothing short of historic, as this is the largest climate change effort in United States history.

Learn more about the different initiatives that may affect the solar industry.

Foreign Tax Credit Limitation

The bill would amend Sec. 904 to apply the foreign tax credit limitation on a country-by-country basis, by taxable unit. Taxable units would include the taxpayer corporation itself, each foreign corporation of which the taxpayer is a shareholder, interests held by the taxpayer in a passthrough entity, and any branch of the taxpayer. The bill would also repeal the carryback of the foreign tax credit. The foreign tax credit changes will apply to tax years beginning after Dec. 31, 2022.

Don’t Miss: How To Make A Solid White Background In Photoshop

Funding For Agriculture Forests And Coasts Will Conserve And Restore The Countrys Natural Carbon Sinks And Reforms Will Make Polluters Pay Their Fair Share

Conservation and restoration of natural areas are a fundamental component of the bills climate solutions, protecting the nations ecosystems while also sequestering and storing greenhouse gases. The Build Back Better Act invests more than $26 billion in the conservation and restoration of forests and public lands and more than $23 billion in agricultural conservation. The adoption of sustainable and climate-smart land management practices can grow the countrys natural carbon sinks, which already sequester 10 percent to 15 percent of annual U.S. emissions, and dramatically reduce emissions from agriculture, which currently account for approximately 10 percent of total U.S. emissions. This type of restoration work creates 12 to 30 jobs for every $1 million invested and could drive upward of $8 billion annually to rural communities.

Additionally, the bill contains provisions to raise revenue through commonsense federal oil and gas reforms that would force polluters, not taxpayers, to pay for the toxic legacy of drilling and mining on public lands. It also restores protections to the coastal plain of the Arctic National Wildlife Refuge, a remarkable wilderness threatened by mandated oil and gas lease sales put in place during the Trump administration.

Targeted Investments In Low

Black, Latino, Indigenous, and other communities of color have for too long been on the front lines of the nations most toxic pollution. The Build Back Better Act invests more than $160 billion to address this legacy of environmental injustice and inequity. Included in this suite of investments is $3 billion for environmental and climate justice block grants to reduce pollution and climate threats in front-line communities $3.5 billion in grant funding to reduce pollution at ports and $29 billion for a greenhouse gas reduction fund, $15 billion of which is dedicated to low- and moderate-income communities. The bill also invests in community air quality monitoring, lead service-line replacements, and the build-out of healthy, clean energy schools. In addition, it advances equitable and sustainable community development and engagement, with investments in climate-ready infrastructure such as affordable housing and public transit.

The bill also commits $30 billion to the development of a Civilian Climate Corps, which will train a new workforce to access clean energy and community resilience jobs and create the equivalent of 300,000 new full-time positions with fair pay and good benefits.

Recommended Reading: Do Solar Panels Add To Home Value

Flexible Tax Credit Payment Options

Low and moderate income communities currently have lower solar adoption rates than higher-income households, in part because they often dont owe enough in taxes to take advantage of the ITC. However, under the BBBA, the ITC would be made refundable for residential installations meaning if you dont have enough tax liability for 30 percent of your solar system, youd get a check from the Internal Revenue Service for the remaining amount.

While you can currently roll over your tax credit, this would allow you to get those returns faster, potentially reducing your dependence on solar loans. The bill also offers a direct pay option for commercial projects, allowing organizations that dont have tax liability access to the cost reduction.

Clean Energy Tax Credits = More Renewable Energy For Americans

Thanks in part to advocates championing clean energy tax credits for more than a decade, this indispensable financial support has been the driving force behind the rise of renewable energy and advocates. Credits enacted in the 2000s allowed wind energy to triple and solar to grow by 52% annually.

By making it more affordable for individuals and developers to pursue such new projects as rooftop solar or an offshore wind farm, clean energy tax credits help break down the barriers to going renewable. Under the new package, this incentive will only grow. In fact, the cost of rooftop solar will decrease by 30% thanks to this act, and the act shortens the payback for a solar project by about 5 years. This will open the door to more Americans making the decision to repower their lives with clean renewable energy right at home.

All this will also lead to clearer skies and more breathable air. The credits are expected to spur enough renewable energy development to slash the countys 2005 greenhouse gas emissions in half by 2030. Lowering these emissions are so important because they warm the planet and are linked to health problems like asthma, heart attacks and cancer.

Don’t Miss: Is Tesla Solar Roof Available