Taxes: Solar Power And The Federal Tax Credit

Daily headlines remind us of how unreliable and vulnerable our traditional power grids are, which is why more and more accountants are exploring the possible taxpayer savings of solar power for their clients. When the suns rays beat down on solar panels, they produce electricity that can be used and stored. With solar panels people can actually own their energy, bringing them potential savings on monthly electric bills, while having access to power during outages.

Furthermore, clients will benefit more when solar power is installed with a battery backup system to prevent monetary losses due to spoiled food, medication, or the inability to work from home. Thats because stored solar energy can keep the lights on and coolers running.

Unfortunately, solar power tax benefits are too often only communicated in the bigger conversation of eco-friendly green initiatives, so not enough accountants are aware of the details. Below are 4 things you need to know when advising your clients:

When it started and what it means now.

How the tax credit rollover factor works.

State & local tax credits.

Depending on the state in which your clients reside, this could be a very significant tax savings. For example, South Carolina presently offers a 25% state tax credit on solar installations. This means that Palmetto State homeowners could potentially benefit from an up to 51% credit on the net cost of their solar system between the combined state and federal incentives.

=======

Q What Improvements Qualify For The Residential Energy Property Credit For Homeowners

A. In 2018, 2019, 2020, and 2021, an individual may claim a credit for 10% of the cost of qualified energy efficiency improvements and the amount of the residential energy property expenditures paid or incurred by the taxpayer during the taxable year .Qualified energy efficiency improvements include the following qualifying products:

- Energy-efficient exterior windows, doors and skylights

- Roofs and roof products

- Insulation

What Type Of Solar Installation Qualify For Federal Tax Credit

Not all kinds of solar installation qualify for the federal tax credit. There are basically two types of solar installation that qualify for this credit. These are :

The solar equipment must be certified for performance by the Solar Rating Certification Corporation or a comparable entity endorsed by the state government where the property is installed.

Also Check: How Much Do Solar Panels Cost In Ohio

What Are The Criteria To Claim The Solar Energy Credit

You can claim the credit once toward the original installation of the equipment. You must own the solar photovoltaic system and it must be located at your primary or secondary residence. If you are leasing solar panels, you don’t get the tax incentives.

There is no maximum amount that can be claimed, though. In addition, if you financed the system through the manufacturer and are contractually obligated to pay for it in full, you can claim the credit based on the full cost of the system.

You don’t even have to be connected to the electric grid to claim the federal solar tax credit, though there are definite financial incentives to being connected.

If Congress doesn’t renew it, the Federal Solar Investment Tax Credit will vanish in 2024.

History Of The Solar Investment Tax Credit

In the early days of solar energy, residential systems were far more expensive than they are now. By many homeowner standards, however, theyre still expensive today. For example, in 2009, it cost $8.50 per watt to install solar panels the current cost per watt, as of publishing, is about $2.40 to $3.22.

This point-of-entry cost into the world of renewable residential solar power dramatically limited the number of homeowners who could take advantage of solar for their home.

The solar investment tax credit was established by the Energy Policy Act of 2005, which established standards for renewable fuels, mandated an increase in the use of biofuels and established renewable energy-related tax incentives.

Under this law, the original policy was set to expire at the end of 2007. However, the solar ITC has been so popular that its expiration date has been extended multiple times.

Solar panel costs have decreased dramatically in the last 20 years, but the ITC can still save individuals and businesses a great deal on their federal taxes.

Today, solar systems are far less expensive due to changes in the industry and the manufacturing of certain parts that make up the solar system. Solar panels, lithium batteries and inverters are all far less expensive to make and buy now than they were in those early days.

Don’t Miss: Are Solar Panels Better For The Environment

Federal Incentives And Rebates

Canadas federal government provides three solar incentives: two of which are exclusively commercial and one which is residential.

a. The Greener Homes Rebate

The Greener homes initiative is a perfect opportunity for homeowners to make their homes more comfortable to live at reduced costs, while at the same time gaining grants from the government for contributing to Canadas goal of achieving net-zero greenhouse gas emissions. The Greener Homes grant will provide homeowners with up to $5,000 for the installation and implementation of a roof or ground-mounted solar system. The government of Canada has provided 700,000 grants of up to $5,000 to help homeowners make energy-efficient decisions and help lower the investment capital required to go solar.

b. Self-employed or Commercial:

The Accelerated Capital Cost Allowance enables commercial producers of renewable electricity to reduce their taxable income in the early years of an assets operation by claiming additional depreciation. The enhanced allowance offers a 100 percent reduction that scales down over time. This commercial incentive can only be claimed on property subject to Capital Cost Allowance rules.

c. Residential or Homeowners:

2. Provincial and Municipality Incentives and Rebates

Solar Investment Tax Credit Recapture Rules

When considering a solar project and how the ITC can reduce costs, be mindful of recapture rules. The ITC vests 20 percent per year, or fully after 5 years.

The vesting schedule begins when placing the project in service and steps down on each anniversary thereafter. If the taxpayer chooses to dispose of the Section 1231 solar property prior to five years, the IRS recaptures the unvested portion of the ITC.

This means the taxpayer will have an increased tax bill for the year in which the recapture occurs. The tax bill increases to an amount equal to the unvested ITC and no interest or penalties will apply, assuming the taxpayer files the return on time and correctly.

You May Like: How Many People Have Solar Panels

Don’t Miss: Can You Really Get Solar For Free

Advice For Commercial Taxpayers

If you run a business, then solar tax credits are especially important. You will still be eligible for a 10% tax credit in 2024. However, you are eligible for 26% this year, so its worth moving fast and taking advantage.

Commercial property owners may be eligible to receive the federal solar ITC in addition to other state solar incentives such as PBIs or SRECs. If you lease commercial property and are not sure if your landlord would want to install solar systems, why not pitch the idea?

Also, if you run a small business you might like to read our tax tips for small business tax preparation.

Federal Tax Credit Is Not Calculated From Gross Cost

A lot of homeowners think that the ITC is calculated from the gross cost. That is not the case. As we calculated above, the 30% credit on a $30,000 solar panel system installation would sum up to $9,000. It is only possible if the $30,000 is the net cost. It is against the IRS rules to calculate the gross costs.

In addition, if you received any local or state financial incentives for your residential solar panel installation, it has to be deducted before calculating the 30% credit amount.

Lets dive into this example

Suppose your $30,000 installation qualified for a California solar tax rebate of $2,000 and a $1,000 rebate from your local utility company. It means that your net cost will be $27,000. Hence, the federal solar ITC would then be $8,200 and not $9,000.

Making the ITC calculation from the Gross tax will make you incur a tax bill instead of a deduction.

Recommended Reading: How To Fold Sole F63 Treadmill

When Can I Claim The Solar Investment Tax Credit

One of the requirements of claiming the Solar Investment Tax Credit is that you do so within the same tax year that your installation is completed. This period begins after your solar power system has been fully installed and is operational. If the value of the tax credit you are owed exceeds your solar tax liability during that tax year, you can still capitalize on its full value thanks to a unique provision of the credit.

Though it is a non-refundable tax credit, the ITC employs a solar tax credit rollover system that allows you to collect your credit balance in subsequent years. Based on the present guidelines, you can rollover the balance for the duration of the solar tax credit until it expires at the end of 2023.

What Does The Solar Tax Credit Cover

According to the EERE, you can expense the following items through the federal solar tax credit:

- Panels: Panels can be solar PV panels or PV cells.

- Labor:Labor costs include on-site preparation, assembly, or original installation. These include the permitting fees, inspection costs, and developer fees.

- Additional equipment: The credit covers other components of the solar system, such as balance-of-system equipment, including wiring, inverters, and mounting equipment.

- Batteries: It covers any storage devices charged exclusively by your solar PV panels. This claim works even if the storage is activated in a subsequent tax year to when the solar energy system was installed. Storage devices are still subject to the installation date requirement, though.

- Sales tax: Any sales taxes on these eligible expenses is also covered.

Read Also: Why Go Solar In California

When Does The Federal Solar Tax Credit Expire

The federal solar tax credit is set to expire at the end of 2023. There is hope that the tax credit may be extended once again. The Biden Administration has plans to include a 10-year extension of the tax credit in future legislation. But, theres no guarantee that this will be approved by Congress and it may be at a lower rate.

Because of that, our best advice is to try and add solar panels as soon as possible so youre guaranteed to get the 26% credit.

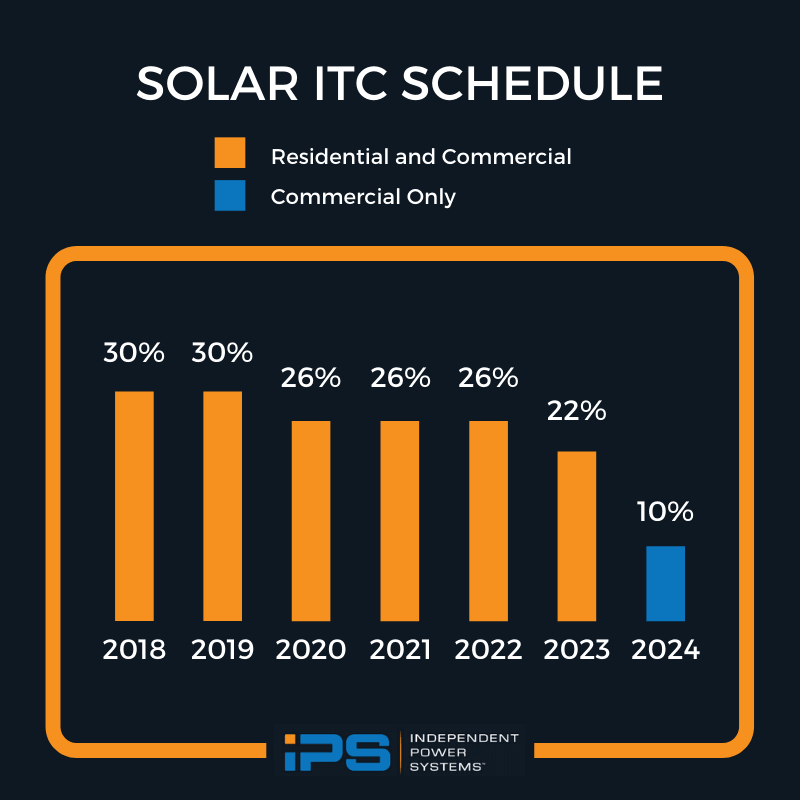

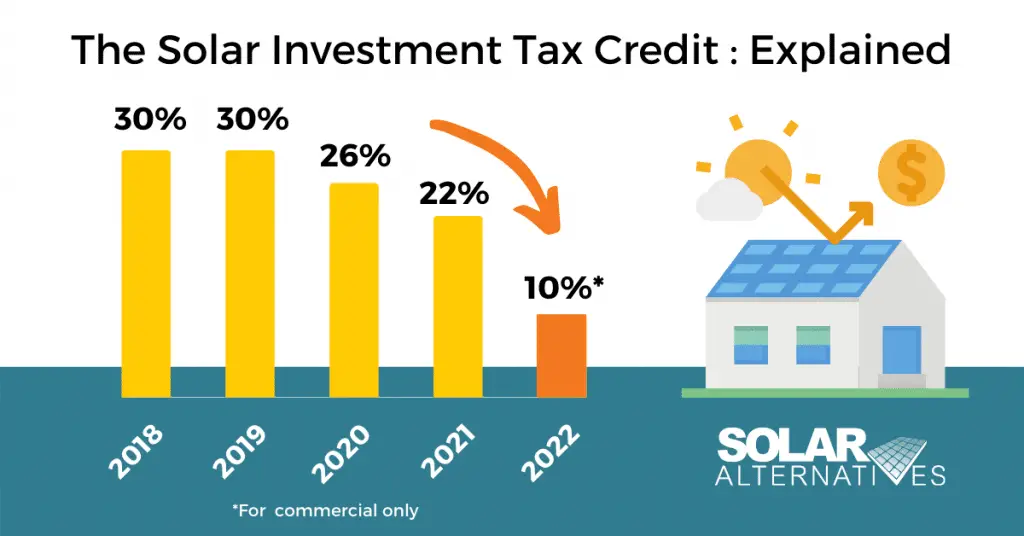

The best time to go solar is now because the 26% ITC will decrease to 22% in 2023 before becoming unavailable for residential solar systems installed in 2024 and beyond.

How Are Rebates Affected

Rebates are solar tax credits given to solar system buyers at the point of sale. They are solar incentives that can reduce the cost of your solar energy system upfront.

They are one-time solar tax credits, so you will not receive them year after year like with other solar incentives such as PBIs or SRECs.

Recommended Reading: Can You Put Solar On A Metal Roof

Frequently Asked Questions: Federal Solar Tax Credit

Will I get a tax refund if the solar investment tax credit exceeds my tax liability?

No, the federal solar ITC is a nonrefundable tax credit. However, if you do not use all of your tax credit, you can carry over the unused amount to the following year.

Can I use the federal solar tax credit against the alternative minimum tax?

Yes, you can use your solar tax credit either against the federal income tax or against the alternative minimum tax.

Will there be another federal solar tax incentive after the current one expires?

A new solar tax credit would require an act of Congress. While it is certainly possible, it isnt something that can be predicted with any certainty.

Can I claim the credit if Im not a homeowner?

Yes, but only under specific circumstances. Specifically, you must be either a tenant-stockholder at a cooperative housing corporation or a member of a condominium complex to claim the federal solar tax credit.

Can I claim the credit if I am not connected to the grid?

You do not have to be connected to the electric grid to claim the solar tax credit. You only need to have a solar power system thats generating electricity for your home.

Can I claim the credit if my solar panels are not installed on my roof, but on the ground on my property?

Yes. The solar panels do not have to be installed on the roof in order for you to claim the tax credit, just so long as they are generating solar energy for your home.

What Are Retcs And How Do They Work

RETCs allow owners of renewable generation facilities to claim a tax credit based on either a percentage of the energy property in the facilitythe Section 48 Investment Tax Credit, or ITCor a fixed rate per megawatt hour generated by the facilitythe Section 45 Production Tax Credit, or PTCpaid for 10 years. There is also a residential ITC found in Section 25D that mirrors the rates under the commercial ITC. Because these credits are not refundable, owners must either have sufficient tax liability and qualify as one of a few eligible entities or must receive outside investment from an eligible entity with sufficient tax appetitea tax equity investorto take advantage of them.

You May Like: What’s The Average Cost Of A Solar Panel

Can I Get Solar Tax Credit If I Do Not Own A Home

The answer is Yes! Internal Revenue Code does not provide that the house on which solar property is installed must be owned by you. The only requirement is that you must be a resident of that home. Even if you live in your parents home, if you pay for the solar system on that house, you can claim the solar tax credit.

The Best State Tax Credits For Solar

When it comes to solar tax credits, some states are better than others.

The best state tax credits for solar can be found in California, Colorado, Connecticut, Delaware, Maryland, Massachusetts, Minnesota, New Jersey, and Pennsylvania.

If youre looking to go solar and want the biggest bang for your buck in terms of solar tax credits and solar incentives, these are the states you should consider moving to.

Also Check: How Much Will A 400 Watt Solar Panel Run

Frequently Asked Questions About The Solar Tax Credit

Calculating the cost of going solar can be complicated as it is, let alone incorporating other financial incentives and tax credits into your estimate. Check out a few other commonly asked questions related to the ITC for more clarification:

How much is the federal solar tax credit for in 2021?

In 2021, the federal solar tax credit will deduct 26 percent of the cost of a system for eligible residential and commercial tax payers. After 2022, new residential and commercial solar customers can deduct 22 percent of the cost of the system from their taxes.

Is the solar tax credit a one-time credit?

Right now, the ITC is a one-time credit. But, you may carry over the excess credit to the next year if you cant use it all when you file. For example, if you only owed $6,000 in taxes but received the $6,200 solar tax credit, youd pay $0 in taxes for the year when you placed the claim. Then, youd also get to reduce next years taxes by the remaining $200.

Will the solar tax credit increase my tax refund?

The solar tax credit will not increase your tax refund. Rather, The ITC amount is applied against your tax liability, or the money you owe the IRS.

Claiming The Solar Credit For Rental Property You Own

You can’t claim the residential solar credit for installing solar power at rental properties you own. But you can claim it if you also live in the house for part of the year and use it as a rental when you’re away.

- You’ll have to reduce the credit for a vacation home, rental or otherwise, to reflect the time you’re not there.

- If you live there for three months a year, for instance, you can only claim 25% of the credit. If the system cost $10,000, the 26% credit would be $2,600, and you could claim 25% of that, or $650.

- $10,000 system cost x 0.26 = $2,600 credit amount

- $2,600 credit amount x 0.25 = $650 credit amount

Don’t Miss: How To Get Solar Rebate

How Does The Solar Tax Credit Work In 2021

The federal solar tax credit is the most popular financial incentive for homeowners looking to go solar. The 26% tax credit is a dollar-for-dollar reduction of the income tax you owe. Many homeowners think they are not eligible for the solar tax credit because they dont have an additional tax bill at the end of the year.

This is not the case, the federal solar tax credit can get back a refund of the taxes you have already paid out of your weekly or fortnightly paycheck. Also, if you dont have enough tax liability to claim the credit in that year, you can roll over the rest of your credits to future years.

Was The Federal Solar Tax Credit Extended

Yes, the solar investment tax credit was extended at the 26% rate for an additional 2 years. It was originally going to drop to 22% in 2021, but now with the new legislation being passed, it will remain at the 26% rate until the end of 2022.

This is great news for homeowners thinking about solar, as the tax credit was voted as the single most important financial incentive in the largest home solar survey.

Don’t Miss: How Much Solar Power Is Needed To Run A House