Ability To Raise Capital

Sole proprietors may have more difficulty raising capital than an LLC. This is because potential investors cannot purchase stocks in a sole proprietorship, and banks are wary about lending to businesses that started sans any formal registration process.

Because LLCs can have as many owners as they want, they can offer ownership opportunities to investors in order to raise funds to grow their business.

Formation And Compliance Requirements

Sole proprietorships are the simplest business structure to set up because theres little paperwork involved.

Theres a nominal fee ranging from $10 to $50

What’s The Difference Between An Llc And A Sole Proprietorship

A limited liability company is a legal entity formed at the state level. An LLC exists separately from its ownersknown as members. However, members are not personally responsible for business debts and liabilities. Instead, the LLC is responsible.

A sole proprietorship is an unincorporated business owned and run by one person. This option is the simplest, no muss, no fuss structure out there. You are entitled to all the profits of the business.

However, unlike an LLC, you are also responsible for all of the liability.

Recommended Reading: How Big Is A 1000 Watt Solar Panel

Drawbacks Of Sole Proprietorships

A sole prop might not always be the best choice, depending on your business type and goals. Here are some disadvantages compared to LLCs:

- Personal liability. The owner is responsible for all debts or losses incurred by the business, including lawsuits.

- Difficulty raising capital. Banks and investors are generally less likely to provide financial support for sole proprietorships in comparison to LLCs because its a less formal business entity.

- Everything is on you. Without partners or investors, entrepreneurs are on their own when it comes to making business decisions in a sole prop. Owning and running your own business can be isolating at times.

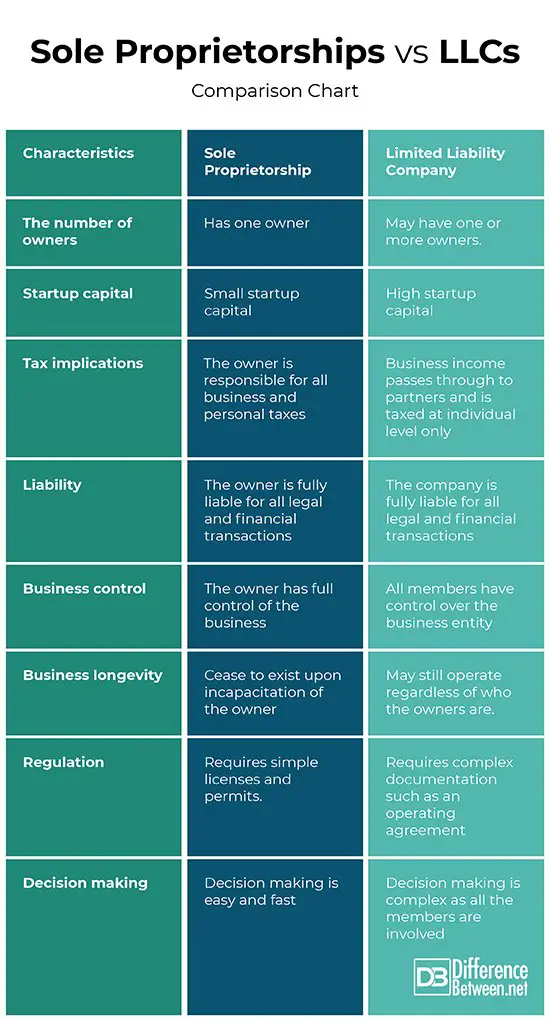

Summary Of Sole Proprietorships Versus Llcs

The importance of the type of a business entity cannot be emphasized enough. Being knowledgeable about the differences between sole proprietorships and LLCs comes in handy for any aspiring business owners, especially in making the critical decision on the type of entity that is ideal for a certain business.

Also Check: Do Solar Panels Need To Face The Sun

Create An Llc Operating Agreement

Creating an LLC operating agreement is the only way for you and your members to legally define your roles and lock down your LLCs management and ownership structure. Having this document in place will also give you something to return to if theres a dispute.

An operating agreement isnt filed with the state its stored in your company records. The operating agreement should outline:

- each members responsibilities.

- how new members will be admitted.

- how existing members may transfer or terminate their membership.

- how profits and dividends are to be distributed.

To learn more, read our What Is an Operating Agreement for an LLC guide.

What Is Sole Proprietorship

So, what is a sole proprietorship? A sole proprietorship is an unincorporated, free-to-form business with just one business owner. The business and owner are one and the same.

When business owners are figuring out how to start a sole proprietorship, theyll need to fill out the appropriate paperwork. Sole proprietors do not need to register with the state in which they are operating, and many sole proprietors operate under their own name.

Depending on the state in which they live, sole proprietors may need to file for certain business licenses or permits with the state, city, or county. If youre a sole proprietorship, call today for assistance on how to apply for EIN.

Examples of Sole Proprietorships

You may be a sole proprietor and not even know it! Common sole proprietorships include:

- Freelance writers and designers

- Personal trainers

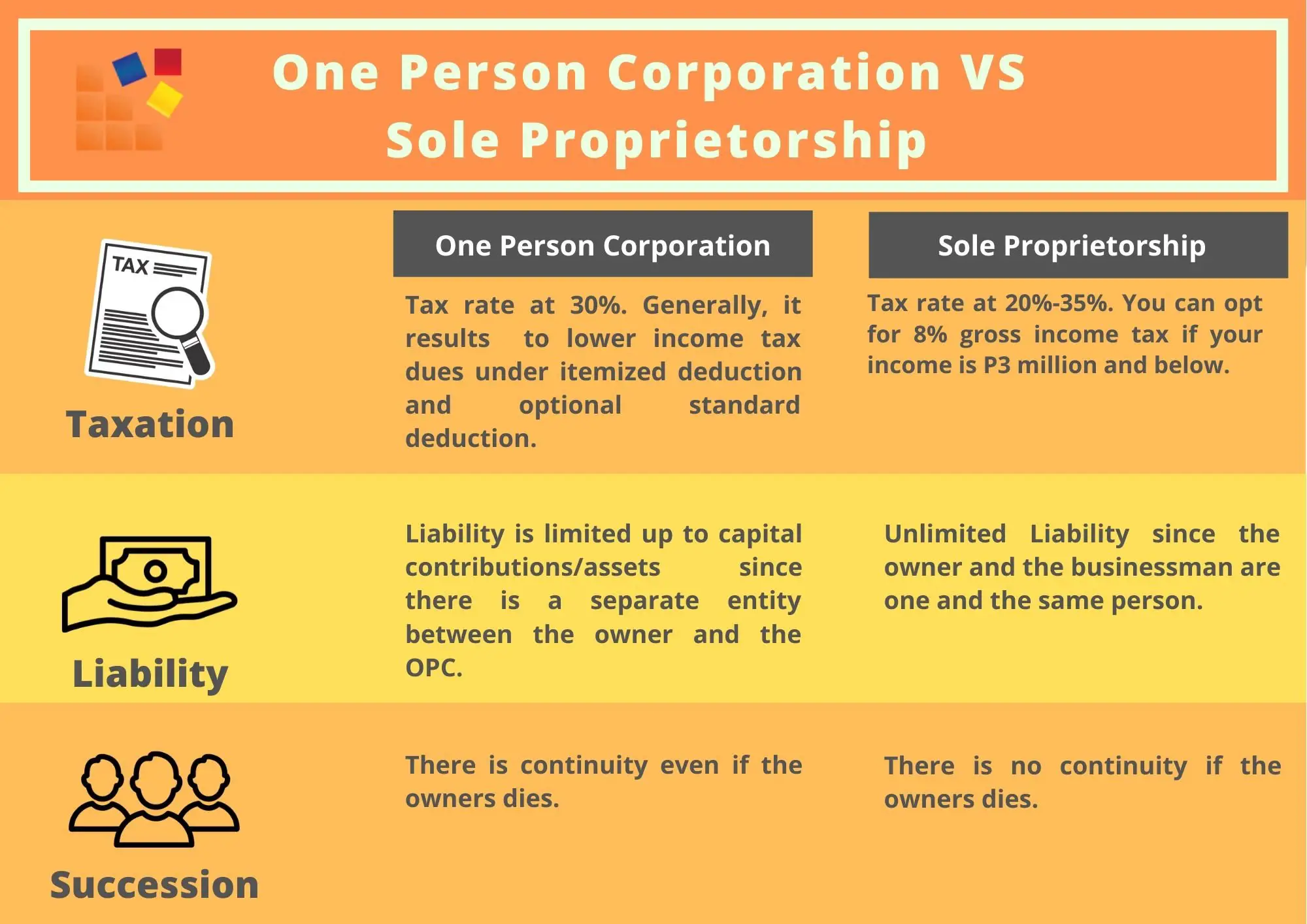

Sole Proprietorship Taxes

A small business owner may choose the sole proprietorship model because the tax process is so simple. Simple taxes is one of the many benefits of a sole proprietorship. Because sole proprietors are indistinguishable from their business, theyll pay personal income tax on profits earned from their business.

Recommended Reading: How To Use Pop Solo Tzumi Microphone

Sole Proprietorship Vs Llc

If you’re starting a new one-person business, you’ll need to decide whether you should run a limited liability company or sole proprietorship.

A sole proprietorship doesn’t protect your personal assets. A sole proprietorship should only be used for very small-scale, low-profit, and low-risk businesses.

An LLC is the best choice for most small business owners because LLCs can protect your personal assets and LLCs are easy and inexpensive to start.

This guide will look at the pros and cons of a sole proprietorship vs LLC and whether forming an LLC will benefit your business.

Recommended:ZenBusiness will form your LLC for $39 .

Should You Start A Sole Proprietorship Or An Llc

At the end of the day the decision to operate as an LLC or sole proprietorship is your choice to make. For the most part, sole proprietorships are perfectly adequate for freelancers or those who dont have any employees or arent concerned about liability. However, many people prefer the comfort associated with an LLC, as they know they are protected. If your business starts to expand to a point where the costs associated with setting up an LLC will be worth the benefits, its certainly worth some consideration. Its also a highly recommended option if you are starting a business that will involve others.

Its best to do your research and consider your own business structure and the benefits of a sole proprietorship vs. an LLC for your own business.

NorthOne is a simple and fast Business Deposit Account. We help builders and makers manage their money by making banking effortless.

Read Also: How Much Does A Sunpower Solar Panel Cost

What Is A Limited Liability Company

A limited liability company offers new business owners something of a win-win from a tax and legal standpoint – the pass-through taxation benefits of a business partnership or sole proprietorship along with the limited liability protection that comes with being a corporation.

Think of an LLC as a blend of a business partnership and a corporation.

The term “limited liability” means exactly that – unlike a sole proprietor, a limited liability business owner is protected against lawsuits, debts, and other financial obligations related to the operation of the LLC. By and large, a limited liability company owner has largely protected himself or herself from creditors and legal trouble.

Differences In Liability Protection

Perhaps the biggest difference between a sole proprietorship and an LLC is the issue of limited liability protection. Sole proprietors have unlimited liability for business debts, lawsuits and other business-related obligations. This means sole proprietors are held personally liable for all debts incurred while operating the business. If the assets of a sole proprietorship are not enough to meet the company’s debts, creditors may go after a sole proprietor’s personal assets to satisfy the obligation.

Operating as an LLC provides the owners of the company with limited liability protection against company debts and obligations. Creditors and parties that initiate a lawsuit against an LLC can not go after an owner’s personal assets as compensation for business-related debts.

Don’t Miss: How Does A Home Solar System Work

S Corporations Pros And Cons

There are distinct advantages and disadvantages to establishing and operating an S corporation. Some of the advantages include:

ProsAn S corporation usually does not pay federal taxes at the corporate level. As a result, an S corporation can help the owner save money on corporate taxes. The S corporation allows the owner to report the taxes on their personal tax return, similar to an LLC or sole proprietorship.

An established S corporation can help boost credibility with suppliers, investors, and customers since it shows a commitment to the company and to the shareholders. S corporations allow the owner to benefit from personal liability protection, which prevents personal assets from being taken by creditors to satisfy a business debt. Also, employees of an S corp are also members, which means they’re eligible to receive cash payments via dividends from the company’s profits. Dividends can be a great incentive for employees to work there and help the owner attract talented workers.

There are also some disadvantages to establishing and operating an S Corporation.

ConsAlthough most states allow the income generated from an S corporation to be taxed on the owner’s personal tax returns, some states do not. In other words, some states choose to tax an S corporation as if it was a corporation. It’s important to check with your local Secretary of State office to determine how S corporations are taxed in your state.

Benefits Of Sole Proprietorships

A sole prop is a common choice for new businesses and entrepreneurs because it offers the following advantages compared to LLCs:

- Simplicity. Its relatively easy and inexpensive to establish. If youre the only owner and employee performing your business activities, then youve already formed your own sole prop. Establishing other business structures, like an LLC, requires paperwork and processing.

- Income tax filing considerations. The owner and business are considered the same entity and generally will only have to file one federal income tax return and one state income tax return so income is only taxed once. Single-member LLCs could offer this same advantage If a second owner joins the businesses, the sole proprietorship will then be required to file partnership tax returns.

- Fewer guidelines. Sole props have fewer regulatory requirements than other business structures. LLCs require a formal registration process including a separate and unique business name and registering an agent to correspond on behalf of the company. Many states charge filing fees for LLCs.

You May Like: Can You Make Money On Solar Panels

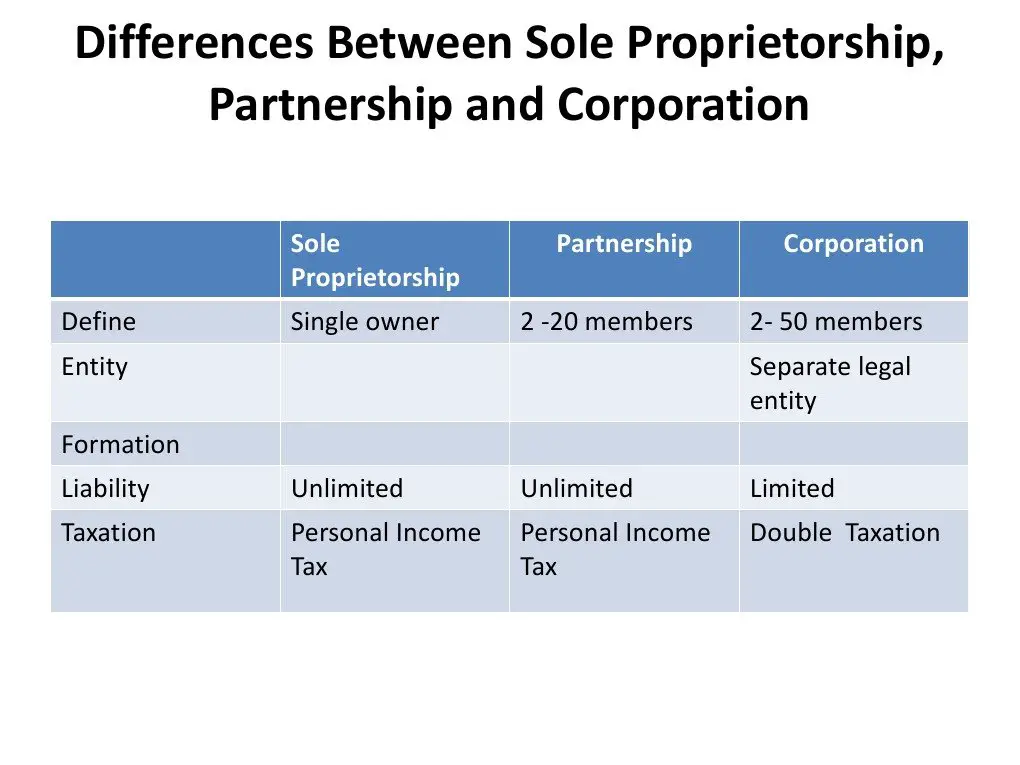

Differences Between Llcs And Sole Proprietorships

Now its time to compare the differences between LLCs and sole proprietorships. There are more differences between these business structures than similarities. Rather than just listing bullet points, well take a closer look at various categories you should evaluate. This will make it much easier for you to decide which one is right for your business.

Become A Flight Attendant

Flight attendants are always on the move, and they get to travel the world for free. You do not need to worry about booking flights, hotels, or accommodations youll have a place to stay at your destination.

The downside is that flight attendant jobs are notoriously difficult to land, requiring an extensive application process and interview. The upside is that many airlines hire new flight attendants yearly, so all you have to do is keep trying.

Dont Miss: Are Solar Powered Roof Vents Worth It

Don’t Miss: What Is The Benefit Of Llc Over Sole Proprietorship

Disadvantages Of Forming An Llc

With an LLC, you have the following drawbacks as well:

- State-related paperwork will be required, including any specific industry licensing.

- Annual state filings will be required as well, including any specific industry licensing fees that are required.

- Besides paying personal federal, state, local and the self-employed version of FICA taxes, you might also be required to pay State Business Taxes and Unemployment Taxes.

- Costs for completing the tax return of an LLC may be higher than that of a sole proprietorship.

Sole Proprietorship Vs Llc: Legal Protection

The biggest advantage to choosing an LLC over a sole proprietorship is liability protection.

Since sole proprietorships arenât separate entities from the business owner, what the business is liable for, so is the business owner. For example, if you got a loan to buy new equipment for your lawn care business, defaulting on the loan could mean the lender will come after your personal assets as collateral.

An LLC is a separate legal entity from the business owners. The owners are granted liability protection, so their personal assets are protected.

Recommended Reading: Is Tesla Solar Roof Available In Illinois

When Should You Open An Llc

There are a few reasons to open up an LLC instead of operating as a sole proprietorship:

- You want to expand the company to more than one owner in the future, which is easy with an LLC

- You want to protect your personal assets from potential financial and legal liability

- You want to take advantage of any applicable local, state or federal tax benefits that come with forming an LLC

In summary, setting up an LLC could position you for growth and protect you from liability. People also consider opening up an LLC when they reach a certain income threshold in their business and the additional fees and paperwork make sense from a tax perspective. This varies by state and the type of business, so its a good idea to speak to your accountant and compare the taxes youll be paying with each business structure.

Determining Your Business Structure Is A First Step In Launching A Startupheres How To Decide Whats Best For You

This Small Business Saturday, were helping small business owners navigate what kind of businessto launch, how to write a business plan, and how to set up a workspace that improves productivity.

Despite the hardships COVID-19 has brought to the economy, many people have chosen this time to become entrepreneurs. Entrepreneurship brings new ideas, greater competition, and increased job creation. However, when it comes to starting your own business, there are countless considerations that will determine your companys success, including the way its structured.

Determining your business structure, or the way your organization will be legally recognized, is a first step in launching a business. Sole proprietorships and limited liability companies are two business structures typically used by entrepreneurs as a starting point, and this article explores their differences, benefits, and drawbacks.

Read Also: How Many Different Types Of Solar Panels Are There

Ownership Of An S Corporation

The IRS is more restrictive regarding ownership for S corporations. These businesses are not allowed to have more than 100 principal shareholders or owners. S corporations cannot be owned by individuals who are not U.S. citizens or permanent residents. Further, the S corporation cannot be owned by any other corporate entity. This limitation includes ownership by other S corporations, C corporations, LLCs, business partnerships, or sole proprietorships.

Why Would You Choose An S Corporation

An S corporation provides limited liability protection so that personal assets cannot be taken to satisfy business debts by creditors. S corporations also can help the owner save money on corporate taxes since it allows the owner to report the income that’s passed through the business to the owner to be taxed at the personal income tax rate. If there will be multiple people involved in running the company, an S corp would be better than an LLC since there would be oversight via the board of directors. Also, members can be employees, and an S corp allows the members to receive cash dividends from company profits, which can be a great employee perk.

Recommended Reading: How To Obtain Sole Custody

Llc Vs Sole Proprietorship Vs Corporation

Both sole proprietorships and limited liability companies are relatively simple to form and maintain. But some companies need a more formal structure than either of these entity types can provide. In that case, the business might consider incorporation.

When you incorporate your new business, you have the option of structuring your business as a C corporation or an S corporation. You may also elect to have your LLC taxed like a C corporation or an S corporation.

Sole Proprietorship Vs Llc: Closing Thoughts

Many business owners begin with a sole proprietorship because its the easiest, no-fuss option with the least paperwork and costs. However, an LLC gives your business the most benefits in the long run, so its the recommended option for most businesses. Whichever kind of structure you choose, its important to make the decision that best aligns with your business needs. Soon enough, youll be accepting payments for the sole proprietorship or LLC you always dreamed of running.

Article Sources

You May Like: How Much Does It Cost For 1 Solar Panel

When To Use A Sole Proprietorship

Sole proprietorships do offer small advantages and benefits in certain circumstances.

Example: A sole proprietorship can be a good way to start out if you are doing business on a small scale or want to try out a low-risk venture to see how successful it will be.

Sole proprietorships are best for small businesses with the following characteristics:

- They MUST be low-profit and low-risk .

- They have a smaller customer base often friends, family, and neighbors.

- They sometimes start as hobbies like photography, blogging, or video streaming.

Sole Proprietorship Advantages and Disadvantages

The only advantage to starting a sole proprietorship vs. an LLC is having to spend no money or energy up front to form a business. This advantage may seem attractive, but it can be costly in the long run.

Disadvantages:

- No Personal Liability Protection. Your personal assets are at risk in the event your business is sued or if it defaults on a debt.

- No Tax Benefits. Sole proprietors pay taxes on their profits and also pay full FICA taxes . When your business becomes profitable, taxes will be expensive.

- Limited Growth Potential. When a business becomes more profitable, risk increases. When risk and profit increase, so does the need for a legal formal business structure.

- Less Credibility and Branding Opportunities. A sole proprietor must invoice, receive payment, open a bank account, and market with their surname unless their state allows them to register and maintain a doing business as name.