Traditional Individual Retirement Accounts

With a traditional IRA, youre able to save for retirement with some pretty sweet tax advantages. The contributions you make to a traditional IRA have the potential to be fully or partially tax deductible. Plus, these contributions arent typically taxed until you start taking out distributions at retirement age.3

The Takeaway: Solo 401 Vs Sep Ira

If youre deciding between a solo 401 and a SEP IRA, and you have employees, the choice is easy: SEP IRA. You cant open a solo 401 plan if you have an employee other than your spouse.

But if youre self-employed with no employees, the choice depends on how much you plan to save. If you cant put away more than $6,000, you should go with the SEP IRA until you can afford to save more. If you dont want to defer taxes, you may want to open a solo Roth 401 or a Roth IRA, depending on how much you can save.

Disadvantages Of A Sep Ira

- The plan must treat employees the same as you: A SEP IRA is an employer-only contribution. Employees dont make their own contributions and you must contribute the same percentage of employee compensation as you do to your own account.

- No catch-up contributions: If youre over the age of 50, there are no catch-up contributions like you see with IRAs and 401s.

- No Roth option: Those who prefer socking away money with after-tax contributions and enjoying tax-free withdrawals are out of luck. There is no Roth option, so while your money will grow tax-free, you will still be on the hook for taxes when you take distributions.

- Penalties for early withdrawal: Like a traditional IRA, if you withdraw your money before age 59 1/2 , youll be hit with taxes and a 10 percent bonus penalty.

- Required minimum distributions: You have to withdraw a minimum amount from the account starting at age 72.

You May Like: What Is Pine Sol Good For

Read Also: Does My Solar Power Work If The Power Goes Out

Contribution Limits In A One

The business owner wears two hats in a 401 plan: employee and employer. Contributions can be made to the plan in both capacities. The owner can contribute both:

- Elective deferrals up to 100% of compensation up to the annual contribution limit:

- $20,500 in 2022 , or $27,000 in 2022 if age 50 or over plus

If youve exceeded the limit for elective deferrals in your 401 plan, find out how to correct this mistake.

Total contributions to a participants account, not counting catch-up contributions for those age 50 and over, cannot exceed $61,000 for 2022 .

Example: Ben, age 51, earned $50,000 in W-2 wages from his S Corporation in 2020. He deferred $19,500 in regular elective deferrals plus $6,500 in catch-up contributions to the 401 plan. His business contributed 25% of his compensation to the plan, $12,500. Total contributions to the plan for 2020 were $38,500. This is the maximum that can be contributed to the plan for Ben for 2019.

A business owner who is also employed by a second company and participating in its 401 plan should bear in mind that his limits on elective deferrals are by person, not by plan. He must consider the limit for all elective deferrals he makes during a year.

Immediately Convert Roth Solo 401k Contribution To Roth Ira Question:

Can I convert the employee Solo Roth 401k contribution to a Roth IRA immediately without penalty? I am 30 years old and am not sure if I can perform this rollover without incurring a penalty. I am wanting to perform this rollover to avoid the RMD that comes with a Roth 401k but is not present with a Roth IRA. If I am able to perform this rollover, would it allow me to avoid the RMD for these funds?

Recommended Reading: How To Design Solar Panel

It Can Support A Growing Business

If you expect to hire new employees in the near future, a SEP IRA will cover you and your employees. A solo 401 covers only a self-employed individual and their spouse , but a SEP can be expanded to all employees.

Importantly, contributions from a SEP for each employee must be the same percentage of compensation for each employee. But the business owner has greater control over what percentage they contribute in any given year, ranging from 0% to 25%.

Solo 401 Withdrawals And Details

As with all qualified retirement plans, there are rules to when you can and must start taking withdrawals from your Solo 401 plan. You must begin taking the minimum required distribution no later than age 72 . There is a 10% early withdrawal penalty for distributions take before age 59 1/2, but exceptions may apply.

Please refer to the IRS page on individual 401s and review our Solo 401 Guide for additional details.

Also Check: How Much Does A Solid Wood Interior Door Cost

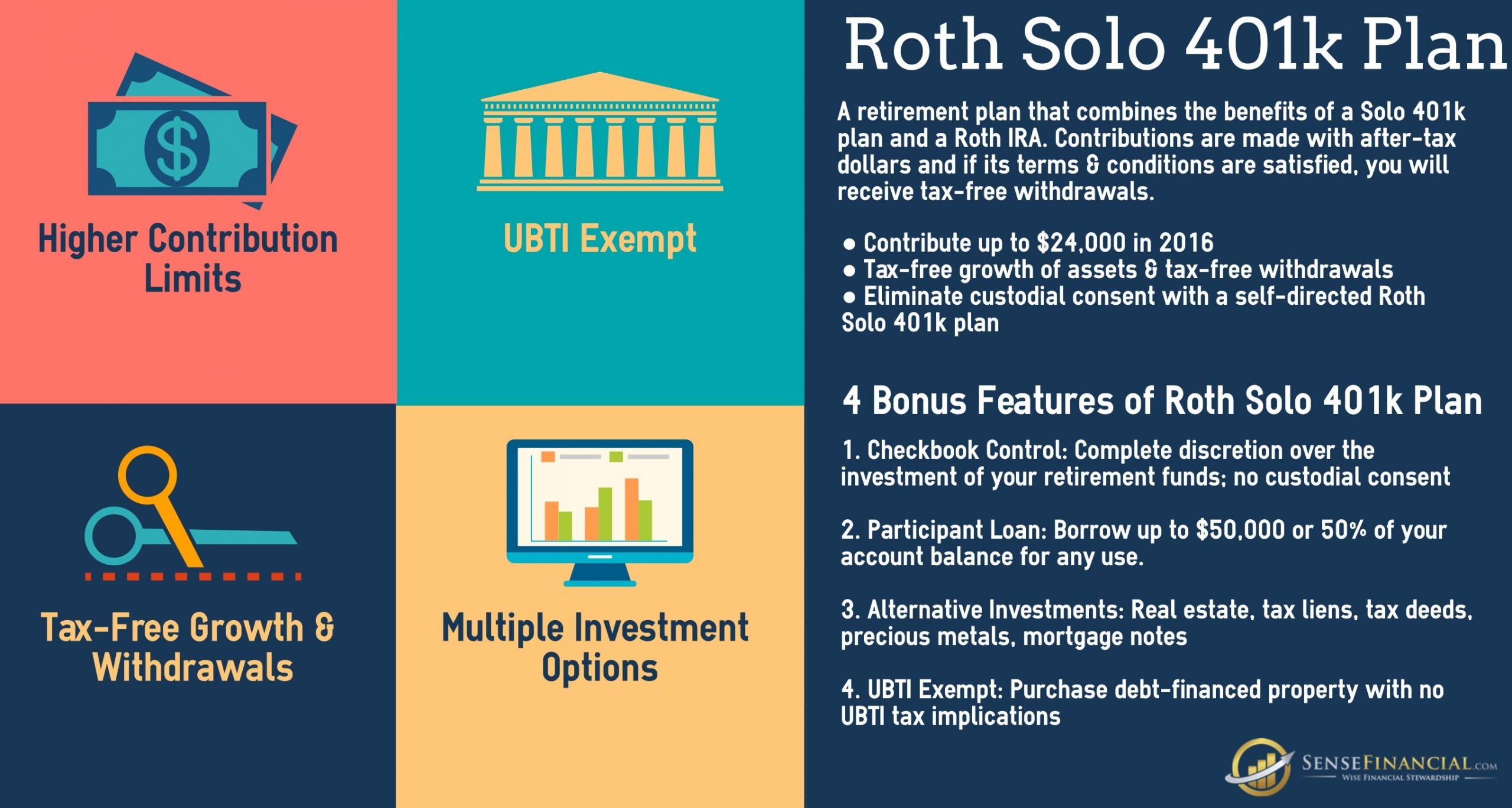

Pay Taxes Now No Taxes Later

The key benefit of a Roth retirement account such as a Roth IRA or Roth Solo 401 is the ability to create tax-free income. Unlike a traditional IRA or 401 where contributions are tax-deferred, contributions to a Roth account are taxed in the year they are earned. However, while future distributions from a tax-deferred account are taxed, the distributions you take from your Roth Solo 401 in retirement will not be taxed. All the earnings you create by investing your Roth 401 are tax free. This can be a huge benefit for investments that produce high return, or for younger investors with a long time to compound the growth of their savings.

When Is The Contribution Deadline For Solo 401 And Sep Ira

For 2020, the contribution deadline for the Solo 401 as well as the contribution deadline for the SEP IRA has been extended to May 17, 2021. This deadline is specifically for the employer contributions.

If youre setting up a solo 401 just now for the tax year 2020, you cannot contribute as an employee, unfortunately. But you can do so for the tax year 2021. The takeaway is you still have time to create and put in money to either a solo 401 or a SEP IRA, as the Employer. Make sure you do this before the deadline. Take a break from uploading your TikTok video for a day!

Round 3 Winner: Its a tie. The Solo 401 contribution deadline and SEP IRA contribution deadline are the same.

Also Check: How Do Solar Batteries Work

You May Like: How Much Does An 8kw Solar System Cost

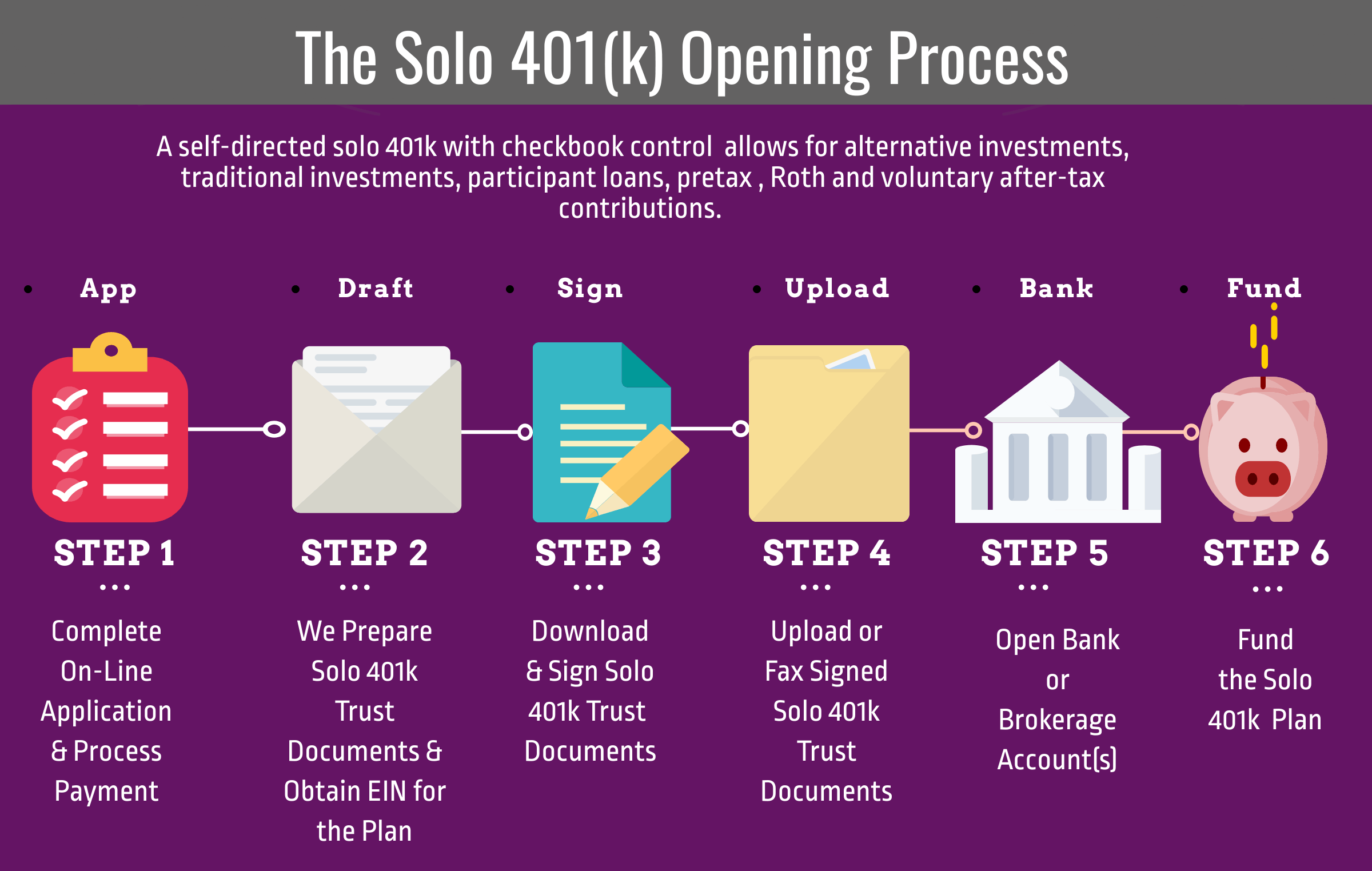

Time To Open Your 2021 Solo 401k Or Ira Account

December 21, 2021 by Madeline DeFrank

2021 is quickly coming to a close. If you still want all the financial and security benefits that come with a Solo 401k, you must open your Solo 401k by Dec. 31, 2021, to make contributions for the 2021 tax year. Getting started is as simple as filling out the application but what is important is that your Solo 401k plan documents are executed/signed by 12/31/2021. After receiving your application, Nabers Group typically only needs 1 or 2 hours to prepare and deliver the documents back to you. Still, we need to obtain your tax ID number as well as prepare your plan and trust. There is time but it is running out before the Dec. 31, 2021 deadline!

Solo 401k Vs Sep Ira What You Should Choose If Are Self

As a self-employed person, you have more control over your retirement plan. One reason is because you get to choose your retirement plan. There are two plans that self-employed people commonly choose between:

- The solo 401k retirement plan and

- The Simplified Employee Pension IRA

In this article, well talk about the features of each plan. At the end, youll get a clear idea of which one you should go for.

Read Also: Where Are Jinko Solar Panels Made

Are There Any Alternatives To The Solo 401

The solo 401 is not your only option. There are a few other retirement plans out there that may work better for you. You also have some options in addition to your solo 401 to help you save even more for retirement. The bottom line? Youve got choices, people!

The other retirement plan options for business owners include:

Who Should Choose A Sep

The ability to open and fund a SEP-IRA account as late as the date your business return is due for the prior tax, including extensions, offers a high level of flexibility for business owners. If this type of flexibility is important to you then a SEP-IRA may be beneficial.

If your company has non-owner employers then a SEP-IRA is the better of the two options. That said, it is important to remember that you will be required to fund the employeeâs accounts at the same percentage of compensation that you fund your own account. This can get expensive. There may be other types of small business retirement accounts that are more cost effective for you.

Recommended Reading: Can I Get Sole Custody Of My Child

Why Choose A Solo 401k Plan Vs Simple Ira

A SIMPLE IRA plan is similar to a Solo 401k Plan in that it is funded by employee deferrals and additional employer contributions. However, unlike a Solo 401k Plan, a SIMPLE IRA plan uses an IRA-type trust to hold contributions for each employee, rather than a single plan trust that is typical of a traditional employer 401 Plan. A SIMPLE IRA can be opened with a bank, insurance company or other qualified financial institution. However, unlike a Solo 401k Plan, the employee owns and controls the SIMPLE IRA.

When Can I Withdraw Money

A must-ask when considering what type of account to invest in, is when you can access your funds, and whether there will be substantial penalties imposed should you require access earlier than anticipated. The rules are fairly similar for both accounts.

With a SEP IRA, an employee can access their funds and make a withdrawal at any time after the age of 59½.

However, withdrawing money from a SEP IRA will still be subject to the relevant federal income taxes and, if under the age of 59½, the employee may be subject to a 10% penalty.

Solo 401k You cannot take withdrawals from the plan until a trigger event occurs, such as turning age 59½, disability, and/or plan termination. But as your own employer, you could terminate yourself.

Just like with a SEP, withdrawals would be subject to the relevant federal income taxes and, if under the age of 59½, may be subject to a 10% penalty.

You May Like: Do It Yourself Home Solar System

Recommended Reading: How Do Solar Panel Kits Work

Ira Owes Ubit Or Udfi

UDFI can trigger owing taxes to the IRS and has filing requirements. UDFI is a type of UBTI when using debt to finance an investment . The taxable amount is in proportion to the amount borrowed to finance the investment. For instance, if your self-directed IRA invests 60% and borrows 40% to purchase a real estate property, the 40% of earnings attributed to the borrowed funds is taxable. The IRS definition of UDFI is in IRC Section 514.

However, with a Solo 401k plan you can use a non-recourse mortgage without being subject to the UDFI rules and UBTI tax. This exemption provides significant tax advantages by using a Solo 401k plan instead of an IRA to purchase real estate.

If an LLC owned by an IRA incurs UBTI or UDFI, Form 990-T must be completed to report the income and pay the tax. It is generally only these two situations that give rise to taxable income for the self-directed IRA. The self-directed IRA owes taxes. Therefore, the self-directed IRA prepares the return using the IRA EIN. IRA funds must pay the taxes.

Solo 401k Contribution Deadline 2021

The 2020 contribution deadline has passed for almost all businesses. The final 2020 tax returns were due October 15, 2020, unless you are in a FEMA identified disaster area and your tax filing deadline has been extended. The good news is that you have plenty of time to contribute for 2021. You can set up and fund your new Solo 401k plan all the way until you file your taxes in 2022. Depending on your business structure this could be either March 15 or April 15, 2022. If you have an S Corp or Partnership your deadline is March 15. With a Sole Proprietorship or C Corp your deadline is April 15th. If you file an extension, you could set up and fund your Solo 401k all the way until either September 15 or October 15 .

Read Also: Can You Clean Solar Panels

Traditional Or Roth Ira

Best for: Those just starting out. If youre leaving a job to start a business, you can also roll your old 401 into an IRA.

IRA contribution limit: $6,000 in 2021 and 2022 .

Tax advantage: Tax deduction on contributions to a traditional IRA no immediate deduction for Roth IRA, but withdrawals in retirement are tax-free.

Employee element: None. These are individual plans. If you have employees, they can set up and contribute to their own IRAs.

How to get started: You can open an IRA at an online brokerage in a few minutes. See NerdWallet’s picks for the best IRA providers for more details.

You Have Checkbook Control

Another great benefit to the solo 401k or QRP is that you, as the owner, account holder and investor have checkbook control. You write the checks for your 401ks investments. Now that could be good or bad.

Remember with a solo 401k, you are more in control with this type of account. You are administrator at that point. You have to do the government reporting. You might want a bookkeeper for that, but you also write the checks. You have the flexibility to write the checks for your 401ks investments. It can be a benefit for some, not a benefit for others. That is one of the differences with the 401k that you dont get with the SEP is the checkbook control.

You May Like: How Much Can Solar Panels Save Me

What Is A Tax Id Number

A tax identification number, or TIN, is a unique nine-digit number that identifies you to the IRS. It’s required on your tax return and requested in other IRS interactions. Social Security numbers are the most popular tax ID numbers, but four other kinds are popular too: the ITIN, EIN, ATIN and PTIN.

Advantages Of A Solo 401

Here are some of the top benefits of a solo 401 plan:

- Access to a 401 retirement plan if youre self-employed. You dont have to be a W-2 employee at a large company to get access to a 401. If youre self-employed, a solo 401 gives you another option.

- Can make employee and employer contributions. A SEP IRA, which is the biggest alternative to a solo 401 for the self-employed, allows only employer contributions.

- Much higher contribution limits than an IRA. If you contribute to an Individual Retirement Account, youre allowed to put in a maximum of $6,000 per year . With a solo 401, you can set aside up to $58,000 per year in a tax-advantaged retirement account.

- Potential for a range of attractive features. Depending on the specifics of your solo 401 plan, you may be able to contribute to a Roth solo 401, access a huge range of investment options and take out a loan from your 401. Clark strongly advises against taking out a loan against your 401.

You May Like: Where Is Pine Sol Made

Apply 5 Year Roth 401k Designated Account Clock To Previous Year Question:

My OBJECTIVE here is to start the 5-year clock on 01/01/2020, so that beginning 01/01/2025, withdrawals can be made without penalty or tax on growth. This is in contrast to the 5-year clock starting on 01/01/2021. I made the first Roth solo 401k contribution in 2021 by my business tax return due date and the contribution was meant for tax year 2020. Can my Roth solo 401k clock start in 2025?

Round #3 When Is The Contribution Deadline For Solo 401 And Sep Ira

For 2020, the contribution deadline for the Solo 401 as well as the contribution deadline for the SEP IRA has been extended to May 17, 2021. This deadline is specifically for the employer contributions.

If youre setting up a solo 401 just now for the tax year 2020, you cannot contribute as an employee, unfortunately. But you can do so for the tax year 2021. The takeaway is you still have time to create and put in money to either a solo 401 or a SEP IRA, as the Employer. Make sure you do this before the deadline. Take a break from uploading your TikTok video for a day!

Round 3 Winner: Its a tie. The Solo 401 contribution deadline and SEP IRA contribution deadline are the same.

You May Like: What Are The Government Incentives For Solar

Administering A Solo 401 Plan

Once your Solo 401 plan exceeds $250,000 in assets at the end of the year, the IRS requires you file an annual Form 5500 EZ. Or if you ever terminate the plan, you must also file a Form 5500 EZ.

Unlike Traditional 401 plans, there are no compliance testing requirements to ensure Solo 401 plans do not favor highly compensated employees and are non-discriminatory, as long as you have no employees participating in the plan.

These plans can be called Self-Directed 401, Individual 401, Individual Roth 401, Self-Employed 401, Personal 401 or One-Participant 401 depending upon the vendor offering the plan services.