Solar Renewable Energy Certificate

A Solar Renewable Energy Certificate , sometimes referred to as a Solar Renewable Energy Credit, is another type of state-level solar incentive. After you install your solar power system and register it with the appropriate state authorities, they will track your systems energy production and periodically offer you SRECs as a benefit. You can sell your SREC to your local energy utility to provide payment thats typically considered taxable income.

Compare Quotes From Top-rated Solar Panel Installers

Select a State To Get Started With Your No Commitment, Free Estimate

What Does The Federal Solar Tax Credit Cover

According to the EERE, the federal solar tax credit covers the following items:

- Panels: The credit covers solar PV panels or PV solar cells.

- Additional equipment: The credit covers other solar system components, including the balance-of-system equipment and wiring, inverters and other mounting equipment.

- Batteries: The ITC covers storage devices, such as solar batteries, charged exclusively by your solar PV panels. It also covers storage devices activated in a subsequent tax year to when the solar energy system is installed. Beginning on Jan. 1, 2023, stand-alone energy storage that doesnt charge solar panels exclusively will qualify for the ITC credit.

- Labor: Labor costs for on-site preparation, assembly or original solar installation are covered. This includes permitting fees, inspection costs and developer fees.

- Sales tax: The credit also covers sales taxes applied to these eligible expenses.

How To Claim Your Federal Solar Tax Credit In 202: A Step

RESIDENTIAL SOLAR TAX CREDIT *

Complete Form 1040 up to line 53 and then begin completing Form 5695.

- Calculate the amount of your solar credit.

Enter the amount listed on line 15 of Form 5695 and 53 of Form 1040. As always, consulting a tax professional is highly recommended.

COMMERCIAL SOLAR TAX CREDIT*

Recommended Reading: Solar Lights For The Driveway

Which Tax Credit Should I Choose

The 48C ITC is an upfront tax credit based on the capital investment in an industrial or manufacturing facility and does not vary by how much product a plant sells, while the 45X MPTC is earned over time based on the production and sale of specific, eligible components. Whether to choose the ITC or the MPTC depends foremost on whether the facility will be manufacturing MPTC-eligible components . If eligible for both, the decision depends on the comparative significance of capital cost versus operating cost for the facility.

In general, manufacturing facilities which produce components eligible for the 45X MPTC receive more value from the 45X MPTC than the 48C ITC.

How The New Solar Tax Credit In The Inflation Reduction Act Works

The Residential Clean Energy Credit allows you to subtract 30 percent of solar costs off your federal taxes, through 2032

Amid rising electricity and home energy costs across the country, the Inflation Reduction Act makes installing solar panels and storage batteries a more attractive investment for many homeowners than it was even a couple years ago.

With the new legislations Residential Clean Energy Credit, you can subtract 30 percent of the cost of installing solar heating, electricity generation, and other solar home products from your federal taxes. The credit is a reboot of an older, less valuable federal tax credit and will be available to taxpayers for more than a decade. That means homeowners considering solar installations have plenty of time to consider their options.

Here are key details.

Read Also: How Much To Pay For Solar Panels

The Solar Energy Credit: Where To Draw The Line

How much of the cost of a roof replacement can be included in calculating the credit?

To encourage investment in solar energy , the Internal Revenue Code offers a credit to taxpayers who install solar energy equipment. Specifically, the taxpayer may take a 30% credit for the costs of the solar panels and related equipment and material installed to generate electricity for use by a residential or commercial building.

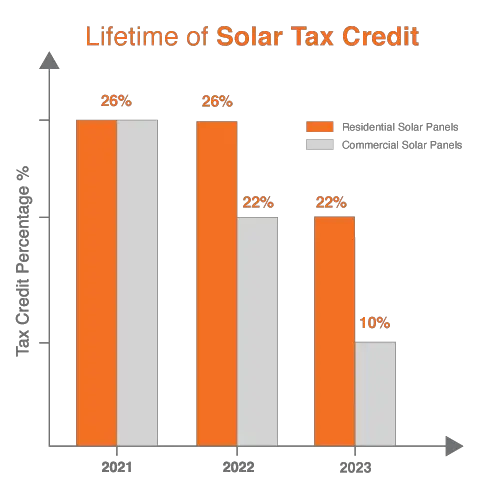

Sec. 25D provides a credit of 30% if the property was placed in service in a residence before Jan. 1, 2020, a 26% credit if the property was placed in service after Dec. 31, 2019, and before Jan. 1, 2021, and a 22% credit if the property was placed in service after Dec. 31, 2020, and before Jan. 1, 2022. Sec. 48 provides a 30% credit for solar energy equipment in commercial property if construction begins before Jan. 1, 2022.

This credit raises the question as to how much of the equipment and materials are properly includible for purposes of calculating the credit. Can a taxpayer include the entire cost of a new roof being installed in conjunction with the solar panels? Does it matter whether the roof is undamaged or in need of repair?

Sec. 25D Residential energy credit

Lastly, Notice 2013-70 provides two useful questions and answers:

A-21: The taxpayer may request that the homebuilder make a reasonable allocation or the taxpayer may use any other reasonable method to determine the cost of the property that is eligible for §25D.

. . .

What’s included?

Federal Solar Tax Credit

In this article: How Does the Credit Work | Do I Qualify? | Whats Covered? | How Do I Apply? | | Other Solar Incentives | Resources | | FAQs

Solar energy can save you money on your electric bills and reduce your carbon footprint, but it comes with a high up-front cost. Fortunately, the U.S. government offers a federal solar tax credit, which was recently extended in the Inflation Reduction Act, to help reduce this cost and make the transition to solar more affordable.

This article provides up-to-date information about what the federal solar tax credit is, how to use it, and other tax credits you can take advantage of.

Recommended Reading: Where Should I Solo Travel

Energy Storage And Excess Power

Some states have more generous subsidies than others, and more pro-consumer rules mandating that utilities pay higher prices for excess power that home solar systems create during peak production hours, or even extract from homeowners’ batteries.

California had among the most generous rules of all until this week. But state utility regulators agreed to let utilities pay much less for excess power they are required to buy, after power companies argued that the rates were too high, and raised power prices for other customers.

Wood Mackenzie said the details of California’s decision made it look less onerous than the firm had expected. EnergySage says the payback period for California systems without a battery will be 10 years instead of six after the new rules take effect in April. Savings in the years afterward will be about 60 percent less, the company estimates. Systems with a battery, which pay for themselves after 10 years, will be little affected because their owners keep most of their excess power instead of selling it to the utility, according to EnergySage.

“The new certainly elongate current payback periods for solar and solar-plus-storage, but not by as much as the previous proposal,” Wood Mackenzie said in the Dec. 16 report. “By 2024, the real impacts of the IRA will begin to come to fruition.”

“You have to do your homework before you sign,” Hurwitz said. “But energy costs always go up. That’s another hidden incentive.”

What Is The Residential Clean Energy Credit

The Residential Clean Energy Credit is a solar tax credit thats like a coupon for 30% off your home solar installation, backed and funded by the federal government. In the year that you install solar, the Residential Clean Energy Credit can greatly reduce or even eliminate the taxes that you would have otherwise owed to the federal government.

The Residential Clean Energy Credit is the current name of the solar tax credit that was originally known as The Investment Tax Credit and created by the Energy Policy Act of 2005.

Thanks to the ITC, the growth of the solar industry helped create hundreds of thousands of jobs, injected billions of dollars into the US economy, and was a significant step towards cutting down on greenhouse gases, so it was very popular. According to the Solar Energy Industries Association , The ITC has helped the U.S. solar industry grow by more than 10,000% percent since it was implemented in 2006.

With the signing of The Inflation Reduction Act Of 2022, the ITC was renamed the Residential Clean Energy Credit, the value was increased to 30%, and the deadline was extended through December 31 of 2034.

You May Like: How To Open A Solo Roth 401k

Am I Eligible For The Federal Solar Tax Credit

According to the Office of Energy Efficiency & Renewable Energy , the following criteria determines your eligibility to claim the federal solar tax credit:

- Date of installation: Your solar PV system is installed between .

- Original installation: The solar PV system is new or being used for the first time. The credit can be claimed only on the original installation of solar equipment.

- Location: The solar PV system is located at your primary residence or secondary home in the United States. It can also be for an off-site community solar project if the electricity generated is credited against your homes electricity consumption and does not exceed it.

- Ownership: You own the solar PV system. You are not leasing or in an agreement to purchase electricity generated by the system, such as a solar power purchase agreement .

Get a Quote on Your Solar Installation

What Is The Solar Tax Credit

The Residential Clean Energy Credit, also known as the Solar Investment Tax Credit is a 30% tax incentive on your gross solar system cost.

The only requirements are that you:

Note, if your 30% tax credit is $6,000 total, and you only have $5,000 in personal income taxes one year, you can roll over the remaining $1,000 to next years income taxes.

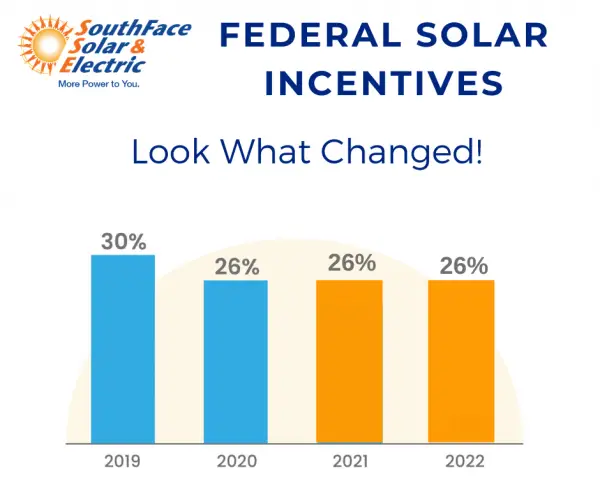

This incentive has been huge for home and business owners since 2005 as part of the Energy Policy Act. The federal government has already extended the incentive expiration date three times before. The most recent extension in 2020 added a 26% extension until 2022 and step down schedule that gradually phases out the credit over a few years.

Read Also: Solar Panel Charge Time Calculator

How Do You Claim The Solar Tax Credit

You can claim the solar tax credit by filing Form 5695 with your Form 1040 Individual Tax Return. Form 5695 asks for your eligible expenses and helps you to calculate your credit.

Like other tax credits and deductions, you need to keep receipts for all of the expenses youre claiming. Your documentation should cover all of the eligibility requirements, such as showing that you own your system through financing instead of that youre leasing it.

If you received paper receipts instead of online documentation, you may want to check out how to keep receipts from fading.

Does The Itc Cover Solar Battery Systems Installation

Yes! Solar battery storage systems are currently covered by the Investment Tax credit! PPM Solar is a certified Florida Tesla Powerwall company that offers free estimates on installing solar battery storage systems.

Keep in mind, however, that the residential battery storage system can only be charged with energy provided 100% by solar power. None of the energy can come from the grid, per the Solar Energy Industries Association .

The SEIA guidelines for commercial battery storage systems differ slightly from those for residential systems. Commercial solar batteries are still eligible for the ITC if they are at least charged with energy obtained by 75% of solar power.

Using 25% grid energy to charge the battery is allowed.

Recommended Reading: How Much Solar Panel Generate Electricity

State Solar Tax Credits And Incentives

Unlike utility incentives, state government incentives usually dont need to be deducted before the federal tax credit is calculated.

So, if you installed a $20,000 system and got a $1,000 state government rebate, the solar tax credit would be based on the initial price of $20,000. In this example, that means the tax credit would be worth 30% of $20,000, for a federal tax credit worth $6,000. That would mean you would get a total of $7,000 in incentives.

The same goes for state tax incentives. But, getting a state tax credit will end up increasing your taxable income on your federal tax returns, as you will have fewer state income taxes to deduct. Currently, ten states offer state tax credits, including Arizona, Massachusetts, and New Mexico.

How Much Is The Federal Tax Credit

First and foremost, its important to understand three little words the government slips in front of the $7,500 credit may and up to. As in, you may qualify for up to $7,500 in federal tax credit for your electric vehicle. At first glance, this credit may sound like a simple flat rate, but that is unfortunately not the case.

For example, if you purchased a Ford F-150 Lightning and owed say, $3,500 in income tax this year, then that is the federal tax credit you would receive. If you owed $10,000 in federal income tax, then you would qualify for the full $7,500 credit.

Its important to note that any unused portion of the $7,500 is not available as a refund, nor as a credit for next years taxes. Bummer.

However, under new terms of the tax deal, you may be able to snag that credit up front at the point of sale of your EV. More on that below.

Also Check: Will Pine Sol Kill Bed Bugs

Homeowners Guide To The Federal Tax Credit For Solar Photovoltaics

This webpage was updated September 2022.

View this webpage in Spanish. Vea esta página web en Español.

Disclaimer: This guide provides an overview of the federal investment tax credit for residential solar photovoltaics . . It does not constitute professional tax advice or other professional financial guidance and may change based on additional guidance from the Treasury Department. And it should not be used as the only source of information when making purchasing decisions, investment decisions, tax decisions, or when executing other binding agreements.

How To Qualify For The 30% Federal Solar Tax Credit In 2022

As we said earlier, most Americans will qualify for the federal tax credit. But, there are some cases where you might not be eligible. The eligibility requirements are as follows:

- You must be the owner of the solar panel system.

- You must have a taxable income.

- The solar system must be installed at your primary or secondary residence.

- It must be claimed on the original installation of the project.

Owning your solar system: If you go solar using a solar lease or a solar PPA, you cannot claim the federal solar tax credit because you are not the owner of the solar system. If you purchase solar using a solar loan, you can still take advantage of the tax credit because you are the owner of the system.

You May Like: Flag Pole Led Solar Light

Will There Be Solar Tax Credits In 2023

In August of 2022, the federal government renewed and extended the Solar Investment Tax Credit as part of the Inflation Reduction Act , raising the rate from 26% to 30% and ensuring that the credit will be in place at that level until the end of 2032.Even better, the legislation is retroactive to include solar energy systems that have been activated since January 1, 2022.

What Expenses Are Included

The following expenses are included:

- Solar PV panels or PV cells

- Contractor labor costs for onsite preparation, assembly, or original installation, including permitting fees, inspection costs, and developer fees

- Balance-of-system equipment, including wiring, inverters, and mounting equipment

- Energy storage devices that have a capacity rating of 3 kilowatt-hours or greater . If the storage is installed in a subsequent tax year to when the solar energy system is installed it is still eligible, however, the energy storage devices are still subject to theinstallation date requirements). Note: A private letter ruling may not be relied on as precedent by other taxpayers.

- Sales taxes on eligible expenses

Don’t Miss: How Much Can Solar Panels Save Me

Can You Claim The Solar Tax Credit Twice

Technically you cannot claim the solar tax credit twice if you own your home. However, if you own more than one home, you may be able to claim separate tax credits for solar installations on each of those homes.

In addition, if you add additional equipment to an existing solar installation, you may be able to claim a tax credit for that added installation cost as well. In general, we always advise customers to speak with a tax professional about any specific tax credit questions, as each situation is unique.