What Is A Roth Solo 401k

A Roth Solo 401k is similar to a traditional Solo 401k except for the difference between the tax-free and tax-deferred savings. You can contribute to both a Roth Solo 401k and a traditional Solo 401k during the same tax year and split the contributions in whatever way you wish, as long as the total contribution amount is below the aggregate maximum contribution limit.

A Solo Roth 401k gives self-employed business owners a retirement boost that many business owners are not aware of. They may not be aware that they can set up a Solo 401k that resembles 401k plans offered by most major employers. But it gets much better because both a Solo 401k and Roth Solo 401k are almost always more generous on the profit-sharing side of the contribution. After all you are the boss, which means you can choose to share all of your profit exclusively with your retirement account. Major corporations have hundreds of thousands of shareholders that they must share the biggest part of the profits with rather than employees. As a result, corporations place limits on the annual amount of employee savings both the employee and profit sharing amounts.

Something else to know about a Roth Solo 401k is that because the taxes have already been paid, you can withdraw contributed funds at any time after the account has been established for five or more years. You can begin withdrawing the tax-free earnings as soon as you reach age 59 1/2 and have the account for five or more years.

What Is A Solo 401 // Individual & Self

When most people hear the term 401, they immediately think of it as a benefit that an employer provides to its employees. Many employers will make matching contributions to an employees 401 retirement account, effectively doubling the amount of savings that the employee puts away. But what about those individuals who are self-employed or own their own company? Does that mean that they cannot participate in a 401 plan and must save for retirement using other methods? Not necessarily! This is where the solo or individual 401k comes into play. If you are a freelancer, contractor, or other self-employed individual, then you need to keep reading! We will explain exactly what a solo 401 is, how you can start one, and what you need to know when contributing to that account.

Workers Of All Ages Can Benefit From Stashing Away After

If your employer offers a Roth option in your 401, itâs a great idea to invest in it, or at least consider investing a portion of your 401 contribution in the Roth. Contributions to a Roth 401 wonât reduce your tax bill now. While pretax salary goes into a regular 401, after-tax money funds the Roth. But as with Roth IRAs, withdrawals from Roth 401s are tax- and penalty-free as long as youâve had the account for five years and are at least 59½ when you take the money out.

Because there are no income limits on Roth 401 contributions, these accounts provide a way for high earners to invest in a Roth without converting a traditional IRA. In 2021, you can contribute up to $19,500 to a Roth 401, a traditional 401 or a combination of the two. Workers 50 or older can contribute up to $26,000 annually.

If you get matching funds from your employer, they go into a traditional pretax 401 account. However, a proposal in the Securing a Strong Retirement Act, which has been nicknamed the SECURE Act 2.0, would allow workers to have employer matching contributions invested in a Roth 401. The House Ways and Means Committee has approved the bill, though it still needs to be voted on by both chambers of Congress.

Donât Miss: What Companies Offer The Best 401k Match

Also Check: Do Solid Core Doors Reduce Noise

Next Steps To Consider

Fidelity does not provide legal or tax advice. The information herein is general and educational in nature and should not be considered legal or tax advice. Tax laws and regulations are complex and subject to change, which can materially impact investment results. Fidelity cannot guarantee that the information herein is accurate, complete, or timely. Fidelity makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information. Consult an attorney or tax professional regarding your specific situation.

Views expressed are as of the date indicated, based on the information available at that time, and may change based on market or other conditions. Unless otherwise noted, the opinions provided are those of the speaker or author and not necessarily those of Fidelity Investments or its affiliates. Fidelity does not assume any duty to update any of the information.

Keep in mind that investing involves risk. The value of your investment will fluctuate over time, and you may gain or lose money.

A distribution from a Roth 401 is federally tax free and penalty free, provided the five-year aging requirement has been satisfied and one of the following conditions is met: age 59½, disability, or death.

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Is Solo 401 Tax Deductible Solo 401 Tax Advantages

The nice thing about a solo 401 is you get to pick your tax advantage: You can opt for the traditional 401, under which contributions reduce your income in the year they are made. In that case, distributions in retirement will be taxed as ordinary income. The alternative is the Roth solo 401, which offers no initial tax break but allows you to take distributions in retirement tax-free.

In general, a Roth is a better option if you expect your income to be higher in retirement. If you think your income will go down in retirement, opt for the tax break today with a traditional 401.

Because of these tax perks, the IRS has pretty strict rules about when you can tap the money you put into either type of account: With few exceptions, youll pay taxes and penalties on any distributions before age 59 ½.

»Want more info? Heres our in-depth comparison of Roth and traditional 401s

Read Also: What’s The Best Solar Panels

Potential Benefit Of The Roth Individual : Higher Contribution Limits

In 2020 you can annually contribute up to $19,500 and up to $26,000 if youre 50 or over through salary deferral. Plus, you can contribute a profit-sharing portion of your salary. In 2020 the limit from both sources is $57,000 .

In 2021 you can annually contribute up to $19,500 and up to $26,000 if youre 50 or over through salary deferral. Plus, you can contribute a profit-sharing portion of your salary. In 2021 the limit from both sources is $58,000 .

How To Maintain Your 401

You can’t just forget about your 401 after you’ve set it up. You must regularly revisit it to determine if you need to make any changes to your contribution amount or to your asset allocation. Check on your plan at least once or twice per year or following any major life event that could affect your finances or retirement plans.

First, look at how your investments are performing. Small losses here and there are to be expected, especially if you have a lot of your money invested in stocks. However, if you’re routinely losing money, that’s a sign something needs to change. You may also want to consider moving some of your money around if it’s underperforming major market benchmark indexes, like the Dow Jones Industrial Average and the S& P 500. In this case, switching to an affordable index fund that tracks these benchmarks may provide better, more predictable returns.

You should also evaluate how much money you’re contributing to your 401. Income usually rises over the course of one’s career, so you may feel more comfortable contributing more of each paycheck as your income grows. Some people choose to start small and increase their contributions by 1% of their salary every year until they reach their goal amount.

You May Like: What Is A Solar Skylight

Can I Contribute To A Roth Ira If I Am Self

Self -employed investors can use a Roth IRA to help fund part of their retirement. The only eligibility requirement to contribute to a Roth IRA is that you and / or your spouse have earned such salary income (vs.

How much can you contribute to an IRA if you are self-employed?

Contribute as much as 25% of your net income from self -employment , up to $ 61,000 for 2022 .

Can a self-employed person contribute to a SEP and a Roth IRA?

You can use self -employment income to fund SEP IRAs. If you maximize both, you can continue and open a Roth IRA for as long as you qualify. And if you make too much money to open a Roth IRA, keep in mind that SEP IRA contributions reduce your taxable income.

Checkbook Solo 401k Or Qrp: How To Open A Bank Account

Opening a bank account for a Checkbook Control Solo 401 Plan or QRP should be straightforward. However, being that many bankers are unfamiliar with Checkbook Control Solo 401K Plans and Checkbook Control IRAs, opening bank accounts for these tax-sheltered retirement plans can seem complicated.

The most important thing to convey to your banker is that they are just opening a business bank account for a trust they are not setting up a 401k Plan or IRA account.

In this post well provide all the info you and your banker need to set up accounts for your Self-Directed Solo 401K Trust.

Don’t Miss: How Much Does It Cost To Go Solar In Illinois

Who Can Have A Solo 401 Plan

According to Allec, there are three categories of people who can have solo 401 plans:

Other Financial Benefits Of A Solo 401

The solo 401 can be an excellent choice for those with a side gig as well, especially if theyre already able to live comfortably on their main salary. With the solo 401 you can go above the usual limits of a 401.

While you may contribute to multiple 401 accounts, your total employee contribution to all types of 401s may not exceed the annual maximum contribution, that is, $19,500 in 2020 and 2021.

But the solo 401 can be valuable even if you already have a 401 plan and even if youve maxed out that other plan for a given year. Thats because you can still make an employer contribution, allowing you to exceed the smaller employee-only contribution amount. So the solo 401 allows you to save more with the employer contribution, reducing your business taxes.

Another benefit of the solo 401 is that it doesnt prevent you from taking advantage of other retirement plans such as the IRA. You can still contribute up to the annual maximum there. If youre an individual looking to set up a traditional IRA or Roth IRA, then youll want to look at the benefits of those plans.

Like the typical 401 plan, the solo 401 also allows you to take out a loan against your account. loan.)

While I generally encourage clients to avoid that strategy, it can come in handy at times, Conroy says.

Also Check: Where Can I Watch Free Solo

Can An Llc Have A Retirement Plan

LLC retirement plan options are the same as for people who are self -employed. They include a SEP, SIMPLE IRA or 401 . Since you are both an owner and an employee, if you have other employees, you should give them the option to participate in the same plan.

Can my LLC contribute to an IRA?

Only the owner or the owners spouse can contribute to an IRA. An LLC or other entity can give money to your Roth IRA, but you must follow the contribution rules. Roth IRAs also have income caps that reduce or prohibit contributions. These limits may change each year.

Can an LLC have a 401k plan?

Can LLC owners contribute to a 401 ? Solo 401 plans are not limited to single proprietorships. Businesses that are structured as limited liability corporations , as well as partnerships, can also participate in these plans if they meet all of the requirements.

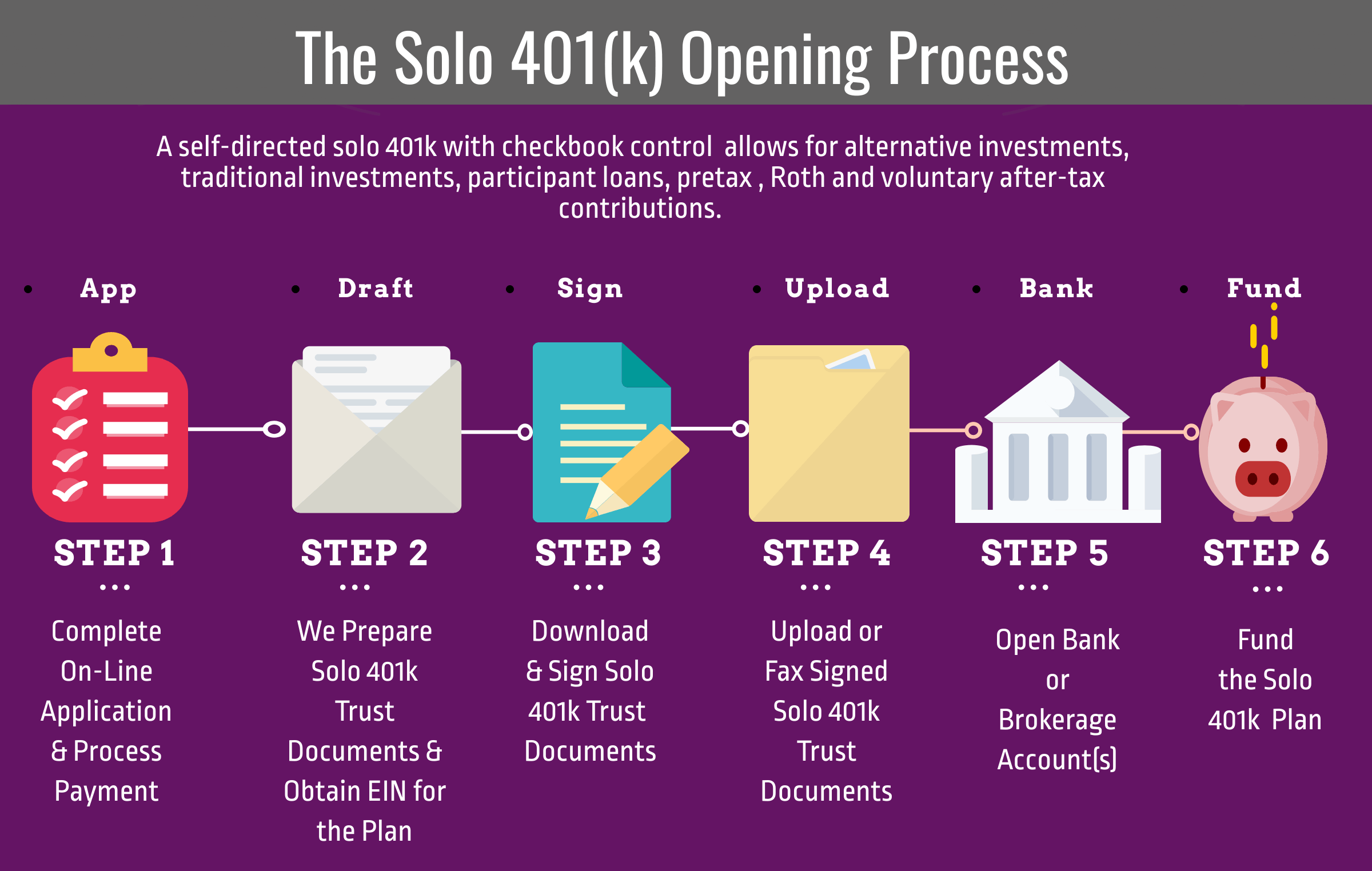

How To Set Up And Start A Solo 401

Opening a solo 401 is surprisingly simple, and the fees arent terribly onerous either, especially if your needs are simple. Now, a solo 401 is not as inexpensive to set up as an IRA which is typically free unless self-directed but you still dont have to break the bank to set up your plan either.

Heres how to open a solo 401:

Read Also: How Much Solar Panels Do I Need

You Can Rollover Previous 401s

Lastly, you can rollover your old 401s-even from previous employer-sponsored plans-into your Solo 401.

When managing your retirement savings, consolidating your accounts makes it easy to monitor how well your investments are performing.

Beagle does the hard work for you to find your old 401s, identify any hidden fees you might be paying, and gives you advice on how best to consolidate them. for free to get started organizing your retirement accounts.

Tags

Do You Qualify For A Solo 401k

Solo 401 Account: Opening Solo 401 Next Steps: The Solo 401 is an Employee Benefit Plan that is exclusively for business owners that have no full-time employees besides themselves and a spouse. The Plan is adopted by a company, not an individual, that has earned ordinary income from the sale of goods or services.

Step 1: Select the plan that works best for you

Full Service $995

- Includes 60-minute consultation with a KKOS Associate Attorney

- Plan Set-Up with IRS Approved Documents and Plan EIN

- How-to Plan Binder

- Includes Plan Set-Up with IRS Approved Documents and Plan EIN

- How-to Plan Binder

- Includes Plan Set-Up with IRS Approved Documents and Plan EIN

- How-to Plan Binder

Step 2: Select your annual account

Custodial Account Option$350 for 1 account, $250 for eachadditional/annually

- Receipt of IRS Plan Amendments so that your Plan stays in compliance with the IRS and the DOL

- Directed Trust Company will handle your record keeping and the IRS Filings

- You can obtain checkbook control via a Trust Checking Account or investment Entity

Annual Compliance Plan $150/annually

- Receipt of IRS Plan Amendments so that your Plan stays in compliance with the IRS and the DOL

- Immediate checkbook control via a Trust Account at a bank of your choice

- You will be responsible for your own record keeping and IRS Filings

Also Check: What Are The Best Solar Panels For Home

What Are Bank Account Opening Instructions That Are Unique To Solo 401s

- Do not accept any credit card offers. Doing so may be a prohibited transaction. Debit cards are OK just be careful to use them for Solo 401k expenses, only.

- We recommend not allowing overdrafts . To avoid prohibited transactions, we want to avoid any scenario in which the bank is extending credit based on your creditworthiness.

- We strongly recommend that you do NOT deposit any personal funds into the account to avoid anything that may be construed as a prohibited transaction or improper contribution. Funding for the account should come from your properly calculated Solo 401k contributions or transfers/rollovers from other retirement plans.

How Do You Open A 401

Do the following to open your 401:

Read Also: How To Get A Sole Proprietorship In Texas

Talk To Hr About Enrolling In Your 401

If you’re interested in opening a 401, talk with your employer to learn about how your company’s plan works. Some employers automatically enroll employees and withhold a default amount of their paychecks, which you can change yourself at any time. You can also opt to stop contributing to the plan if you’re not interested in doing so right now.

Other companies require participants to declare their desire to participate in the 401. You’ll have to fill out paperwork saying that you’d like to contribute to the plan and how much money you’d like to set aside initially. You can always change this later.

You’ll also need to choose your beneficiary — the person you’d like to inherit your 401 if you die — when you sign up. Usually you choose a primary beneficiary and a secondary, or contingent, beneficiary who will inherit the 401 if the primary beneficiary is deceased or doesn’t want the money.

Solo 401 Withdrawals And Details

As with all qualified retirement plans, there are rules to when you can and must start taking withdrawals from your Solo 401 plan. You must begin taking the minimum required distribution no later than age 72 . There is a 10% early withdrawal penalty for distributions take before age 59 1/2, but exceptions may apply.

Please refer to the IRS page on individual 401s and review our Solo 401 Guide for additional details.

Recommended Reading: How To Change Your Business From Sole Proprietor To Llc