How To Become A Texas Sole Proprietorship In 2022

If youre currently self-employed in the state of Texas, or if youre looking to enter the world of one-person business ownership, youve probably looked into becoming a sole proprietor.

The sole proprietorship is the simplest business format in America, but that doesnt mean that there arent rules and regulations to follow when you operate one. In addition, there are some limits to the functionality of a sole proprietorship.

In this guide, we’ll walk you through the steps to setup a sole proprietorship properly, and help you determine whether or not a sole proprietorship is a good choice for your business.

Guru Tip: Its important to understand that a sole proprietorship does not offer personal asset protection as the LLC does. The LLC is the most popular entity for small businesses and is easy to create by doing forming it yourself or hiring a cheap LLC service.

How To File A Dba In Texas

A Texas DBA is called an assumed name. Texas assumed name registration allows a business to operate under a name thats different from its legal name.

DBA registration wont protect your personal assets like forming an LLC or corporation will. Learn why in our DBA vs LLC guide.

Use our How to File a DBA in Texas guide below to register a Texas assumed name yourself.

How to Use This Guide

To get started, choose your business entity type:

2021-12-16

Our Legal Team Can Help You Determine Whether A Sole Proprietorship Is Right For You

As experienced Brazoria County business formation attorneys located in Lake Jackson, the Cordoba Law Firm, PLLC can easily help you establish a sole proprietorship. One of the many benefits it offers clients is that it allows them to be fully in charge of their business. While there are less moving parts with a sole proprietorship and it may be less expensive to set up, sometimes clients find being personally liable on debts and on judgments just isnt worth it.

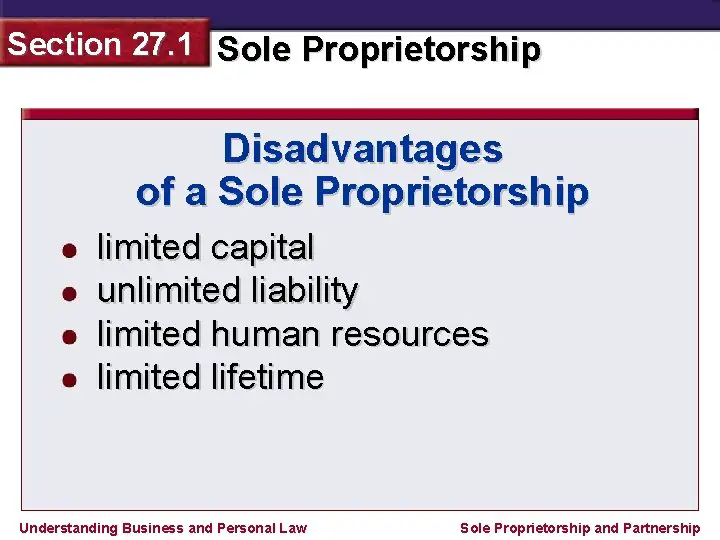

Some of the downsides to sole proprietorships that you need to be aware of include:

- You will be unable to raise capital by selling shares of your business

- You face unlimited personal liability for any losses that occur

- There is no separation from your personal assets to your business assets

- Potential exposure of personal liability to judgment creditors

- As you are the sole proprietor, the business is unlikely to survive unexpected events, such as disability or death and

- Protecting your business name and trademarks can be more difficult as you only make a sole proprietorship filing in the county in which you are doing business.

Also Check: What Can You Run Off Solar Panels

Do Sole Proprietors File Self Employment Tax

Owners of sole proprietorships are not employees they pay self-employment taxes instead. Social Security and Medicare, as well as a 15% self-employment tax, are funded by this tax. You must contribute 3% of the net self-employment income you earn. On top of that, your earnings will be subject to income taxes.

How To Become A Sole Proprietor In Texas

Related

Creating a corporation in Texas or any other state involves jumping through multiple hoops and filing plenty of paperwork. Becoming a sole proprietor in Texas is easier, faster and cheaper. If you’re not doing business under an assumed name, Texas state law has almost no hoops for you to jump through.

Tip

All you have to do to become a Texas sole proprietor is launch your business. Sole proprietorships in Texas don’t require filing any special paperwork. However, there may be licensing and permits for your particular line of work.

Don’t Miss: Can You Negotiate Solar Panels

Get An Ein From The Irs

If you have employees, you are required to get an EIN. EINs are a nine-digit ID number issued by the IRS to identify businesses for tax purposes. You can apply for an EIN for free online using the IRS EIN Assistant.

If you dont have employees, you are not required to get an EIN as a sole proprietor. However, it can be useful to get an EIN. They are often required to open a business bank account and can be used in place of your social security number for most business applications.

Important Note about Sole Proprietor EINs:

Since sole proprietorships are not viewed as separate from an individual, sole proprietor EINs are issued under their names, not their DBA names. As a result, you will only be issued 1 EIN as a sole proprietor for your lifetime. This will be used for any and all businesses you will operate as a sole proprietor. If you apply for an EIN as a sole proprietor and receive reference error 101, this likely means that you have already been issued an EIN previously. If you cannot recall your EIN or have not been issued an EIN previously, you will need to call the IRS Business and Specialty Tax Assistance line at 1-800-829-4933 and use the prompts related to reference number 101.

After Filing Your Texas Dba

If filing a DBA marks the beginning of your business journey, then there are a few more steps that you should take before getting started:

- Create your Businesss Website – Every business needs a website. Luckily, drag-and-drop builders like GoDaddy and Wix make the job quick and easy. Check out our Best Website Builder article to find the tool thats best for you.

- Get your Business Finances in Order – Youll need to separate your business finances from your personal ones. This is accomplished by opening a business bank account. If your business has long lead times or other cash flow irregularities, you can also look into a business credit card.

- Protect Your Business – While an LLC will help to protect your personal assets in the case of a lawsuit, your businesss assets also need protection. Having the right business insurance will ensure that youre covered if the worst happens. Most businesses start with general liability insurance as their base coverage.

Recommended Reading: How Much Does A Solar Roof Cost

Determine Your Business Structure

You need to choose the type of legal, for-profit business entity you want your business to be, which depends on a few factors. This includes what kind of business youre starting, whether youll have employees and your comfort with liability. Some structures are free to register, others have a low fee and are subject to the state franchise tax.

Some of the most common choices include:

Sole proprietorship: The most common and simplest form of business structure, a sole proprietorship is perfect for one person who owns all the business assets. This person is 100% liable for the business. Their sole proprietorship assumes their name, unless they want to create a DBA certificate to give it another name, to be filed in all counties where business is conducted. These structures are not subject to the state franchise tax.

General partnership: Similar to a sole proprietorship, but it’s for two or more individuals. Its a separate business entity from those people, but creditors can still hit up the partners personal assets to satisfy debts and liabilities. They are not subject to state franchise tax.

For more details, check out our comprehensive guide to forming in LLC in Texas.

If your business was formed in a state or entity other than Texas but you want to transact business in the state, you need to file an application for registration with the Texas secretary of state as a foreign entity.

What Is A Texas Dba Name

Texas businesses are usually created and operated as one of the following business structures:

If you want to operate your business under any name other than its legal name, you must create and file a DBA name. In Texas, a DBA name is known as an assumed name. Where you file your Assumed Name Certificate depends on the type of business you own.

For example, sole proprietorships and general partnerships file with the county clerk where their business is located. If they dont have a main place of business, they must file in all counties where they conduct business under their assumed name. Corporations, LLCs, LLPs, and LPs must register their assumed names with the Texas Secretary of State.

The advantages of using a DBA name also vary depending on the type of business you own. Here are some benefits that you may experience from using an assumed name:

Its important to note that a DBA name is not a business entity type, like a corporation. Its simply a new name that you can do business under once its registered with the Secretary of State or the proper county or counties. Therefore, it does not change anything about your taxes or legal status. Learn more below about how to obtain and maintain a DBA name in Texas.

Don’t Miss: How Much Is An Off Grid Solar System

How Do I File A Sole Proprietorship In Texas

Texans are not subject to state income taxes, so they are not required to file with the state. In the case of sole proprietorships, the business profit and loss statements are filed with the individuals tax return. Keep separate bank accounts for business income and expenses and keep accurate records to simplify the tax filing process.

Can I File My Own Taxes As A Sole Proprietor

Despite the fact that you have to file sole proprietor taxes, you can make the process much easier if you understand them. Its quite possible that you will be able to file your taxes on your own if your return is fairly straightforward, but if your income or expenses are complex, you may want to consult a professional accountant.

Don’t Miss: How Much Does It Cost To Solar Power Your Home

How To Start A Business In Texas: The Bottom Line

If youre interested in starting a business in Texas, youre definitely in luck: The barrier for entry is low and the number of resources at your disposal is high.

It may be really, really hot down there in the summer, but thats a small price to pay for getting your foot in the door of the small business world and keeping it there.

Texas appears to have a vested interest in helping you succeeddont take that for granted. Its hard enough to stay afloat in todays economy, and a state government that has your back is a benefit few should turn down.

This article originally appeared on JustBusiness, a subsidiary of NerdWallet.

About the author:Eric is a former insurance writer at NerdWallet.Read more

Limited Liability Company In Texas

What is an LLC?

A Limited Liability Company is a balance between the simplicity of a sole proprietorship and the complexity of a corporation. While not as well-suited to a large enterprise with many stakeholders as a corporation may be, starting an LLC in Texas offers similar debt and liability protections that are not available to sole proprietors. LLCs can require less administrative work than a corporation, though since LLCs are subject to both state and federal taxation, they can require filling out additional paperwork.

Is an LLC right for you?

An LLC may be the right choice for you if you are planning a small to medium-sized business with some employees. An LLC might also be a good option for early-stage startups that want to get off the ground quickly, without the time and expense of setting up a corporation right away.

Get an Employer Identification Number

While sole proprietors are not required to file for an Employer Identification Number , owners of LLCs most certainly are. An EIN acts like a Social Security Number for your business. Be sure that you have your personal SSN or Individual Taxpayer Identification Number handy before starting the interview-style registration process on the IRS website or registering by fax, mail, or telephone.

Register your LLC

Choose a registered agent

Pay state tax

Prepare an operating agreement

Recommended Reading: How Many Panels Needed For Solar Home

How Long Does It Take To Start A Business In Texas

Registering a sole proprietorship in Texas can take as little as a few days, whereas an LLC or corporation could take upwards of several months to officially launch. Your timeline will be affected by how complex your business structure is, how many licenses and permits you need, and how quick you are at assembling the required information.

Obtain Necessary Licenses And Permits

After you start a sole proprietorship in Texas, the immediate requirement would be a business license. Different states have different licensing requirements but the common factor is that without a license or permit, businesses cannot become operational. You can conduct a business activity search for sole proprietorship in Texas as the type of license and the fee varies according to the type of activity and location of the entity.

You will not only require business licenses and permits but your company needs to be compliant with local regulations and must have necessary zoning clearances. You will have to check with the city and county offices for information specific to zoning. If you are wondering how to start a sole proprietorship in Texas and obtain business licenses then you can check our Business License Research Report service. This research report contains a list of filing instructions, supporting document requirements, and fees for all business licenses and permits for your sole proprietorship business in Texas.

You May Like: How To Size Solar Power System

Choose A Business Idea

The first step for starting a business in Texas is having a good business idea. Maybe you already have an idea picked out, or maybe you are still deciding on one. Regardless, you can check out our library of business ideas to get detailed industry information, trends, costs to start, tips, and lots more.

Create A Business Plan

The State of Texas may not require you to write a business plan. However, most bank loan officers will want to see one before granting you a business loan, and a business plan is also the ideal way to keep yourself on track, organized, and goal-oriented.

A business plan is a document that outlines:

- Company description

- Logistics and operations plan

- Financial plan

Writing a business plan is a fairly straightforward, methodical exercise in analyzing and explaining your business idea. Shopify has business plan templates available to help you get started. For more inspiration, check out some business plan examples to see whats possible.

Read Also: When Can I Introduce Solid Food To My Baby

If The Business Is Conducted Under An Assumed Name Then An Assumed Name Certificate Should Be Filed With The Office Of The County Clerk In The County Where A Business Premise Is Maintained In Accordance With Section 3610 Of The Texas Business & Commerce Code

Steps to start a sole proprietorship in texas. Business entity registration sole proprietorship & general partnership a sole proprietorship or general partnership doing business under a name other than the name of the owner requires a dba (doing business as. Choose a business name for your sole proprietorship and check for availability. A sole proprietor in texas who wants to operate under a business name other than his personal name must register an assumed business name with the county clerk’s office where the sole proprietorship is located.

A texas sole proprietorship will automatically assume the owner’s legal name. Remember that texas doesnt charge state income taxes for its residents. This allows you to focus on other aspects of your new business rather than get.

Picking a business name is the initial and most crucial step in setting up your llc in texas. How to become a texas sole proprietor. Starting a business is a big step packed with lots of risks and daunting procedures.

You need to acquire the licenses as well as legal permits to operate. After deciding on the business entity, the next step in starting a business in texas is to register the business name. There are also no fees involved with forming or maintaining this business type.

A sole proprietorship is a business owned and operated by one person. Choose a name for the sole proprietorship. If you want to operate a texas sole proprietorship, all.

Submitting an application for a sole proprietorship.

How To Set Up A Sole Proprietorship In Texas

This article was co-authored by wikiHow Staff. Our trained team of editors and researchers validate articles for accuracy and comprehensiveness. wikiHow’s Content Management Team carefully monitors the work from our editorial staff to ensure that each article is backed by trusted research and meets our high quality standards.There are 12 references cited in this article, which can be found at the bottom of the page. This article has been viewed 84,964 times.Learn more…

A sole proprietorship is a business owned and operated by one person. You need to do very little to set one up in Texas. Pick a business name and register it with the appropriate office. If you want to hire employees, then you will need to take additional steps.

Recommended Reading: How Much Commission Does A Solar Salesman Make

Select A Business Entity

The next step to starting a business in Texas is selecting a business entity.

The business entity is sometimes referred to as a business structure or legal entity, which refers to how a business is legally organized. There are four primary business entities: sole proprietorship, partnership, corporation, and Limited Liability Company . A brief description of each is below.

A Sole Proprietorship is an individual that decides to go into business. This is the easiest and least expensive of the four entities to set up as there is no state filing. The ease of startup is a big selling point however, a major downside to the sole proprietorship is that the owner is personally responsible for all debts and actions of the company. If the business is sued, the owners personal assets are potentially at risk. Another potential downside is that the owner will pay self-employment tax on all business profits and may be more costly than some other entities.

Related: What is a sole proprietorship?

General Partnerships consist of two or more people conducting a business together. Like the sole proprietorship, there is no formal state filing. Also, like the sole proprietorship, the partnership has unlimited liability. If the partnership were to be sued, the partners personal assets are equally at risk. The partnership itself does not pay tax from business income. Instead, profits and losses are passed through to the owners personal tax return. This income is subject to self-employment tax.