Find Out If Your Business Name Is Available

Lets say that a sole proprietor is running her dog grooming business under the fictitious name , Furry Friends Salon. If she wants to form an LLC for her business, she must check that another LLC or corporation hasnt already registered a company using that name in her state. Most states offer an online database for checking business name registrations. CorpNets free CorpNet Name Search tool provides a way to check, too.

Why You Should Turn Your Sole Proprietorship Into An Llc

Youve probably heard it again and again for as long as youve had your small business: You should form an LLC. Its common advicebut is it really the right move for your business?

Most small businesses start as sole proprietorshipsits the most common form of business in the United States. Many of these businesses do eventually take the extra step of registering with the state and becoming an incorporated business like an LLC, but is it worth it? What is there to gain ?

To know if transitioning to an LLC is right for you, its important to understand exactly what it means to be a sole proprietorand how LLCs are different in the eyes of the law, the IRS, and the bank.

What Will I Need To Change After The Incorporation Has Been Completed

- Bank account incorporating puts your business in a new business category with most banks. A new bank account, credit card, and other banking items may be required

- Cheques new cheques will be needed with the business name including legal ending

- Tax accounts HST, payroll, WSIB, etc. will need to be set up or changed

- Business cards to reflect the new corporate name

- Letterhead to reflect the new corporate name

- Logo if the business name is listed

- Storefront/signage

Read Also: What Is Pine Sol Good For

Set Up A Business Bank Account

LLC owners must maintain a clear separation between their business and personal finances. Doing so shields their personal assets from the businesss liabilities. Also, it helps keep business records organized for tax reporting purposes.

After a state approves an LLCs Articles of Organization and the IRS issues the LLC an EIN, the business owner must set up a business account for the newly formed LLC. An LLC may not use an existing business bank account that was set up for a sole proprietorship.* This also applies to credit cards so that the correct legal entity name is associated with accounts.

Banks help entrepreneurs through the process of closing their sole proprietorships bank account, opening an LLC bank account, and moving existing business funds from the old account to the new one.

*Sometimes, sole proprietors dont even open a separate bank account for their businesses and use their personal bank and credit accounts instead. While thats legal, its not advisable! If the IRS were to audit the business owner, it might be difficult to produce accurate financial transaction documentation.

Are You Concerned About Retaining Your Status As An Independent Contractor

Many companies in Orange County, California decide to become a corporation because they are independent contractors and they want to make sure that the IRS or other government agencies will not reclassify them as an employee. Reclassification does not happen for incorporated independent contractors and this is why many clients insist that certain businesses incorporate first before they hire them.

You May Like: Can I Install Solar Panels In My Backyard

Overwhelmed By The Paperwork

There are many helpful online services that will aid you in the process of forming your business. Not only do they do most of the work for you, they provide step-by-step instructions, filing expertise, customer service and personalized legal protection. On top of everything else, they save time and almost always save you money!

When To Operate As A Sole Proprietorship

Sole proprietorships are best for businesses with these characteristics:

- They MUST be low risk

- They have a smaller customer base often friends, family, and neighbors

- They might be hobbies like photography, blogging, or video streaming

Sole Proprietorship Advantages

The biggest advantage of starting a sole proprietorship is simplicity it couldn’t be any easier or less expensive to get a business up and running.

Sole Proprietorship Disadvantages

No Personal Liability Protection. Sole proprietorships don’t offer personal liability protection. This means your personal assets are at risk in the event your business is sued or if it defaults on a debt.

Zero Tax Benefits. Sole proprietors pay self-employment taxes and income taxes on their net profit. When a business becomes profitable, it will be very expensive to be taxed as an informal business structure.

Limited Growth Potential. High tax burden and lack of liability protection can keep a business from being successful.

Reduced Credibility and Branding Opportunities. A sole proprietor or partnership must invoice, receive payment, open a bank account, and market with their surname unless their state allows them to register and maintain a doing business as name.

Read Also: How To Connect Bluetooth To Sole Treadmill

Sole Proprietorship Vs Llc

A sole proprietorship is an unincorporated business that one person owns. It is the easiest way to establish, maintain, and take apart , primarily because of the lack of government regulation. It allows small-scale business owners to try out the business venture. If its a small start-up business, its the only business structure that makes sense.

When mulling over an LLC ownership, keep in mind that the advantage of being a sole proprietor is that, as the owner, you pay personal income tax on the earned profits. But a business owner of a sole proprietorship is not exempt from liabilities incurred by the business. The owners personal assets and savings are at risk in case of legal challenges or if the business incurs debt.

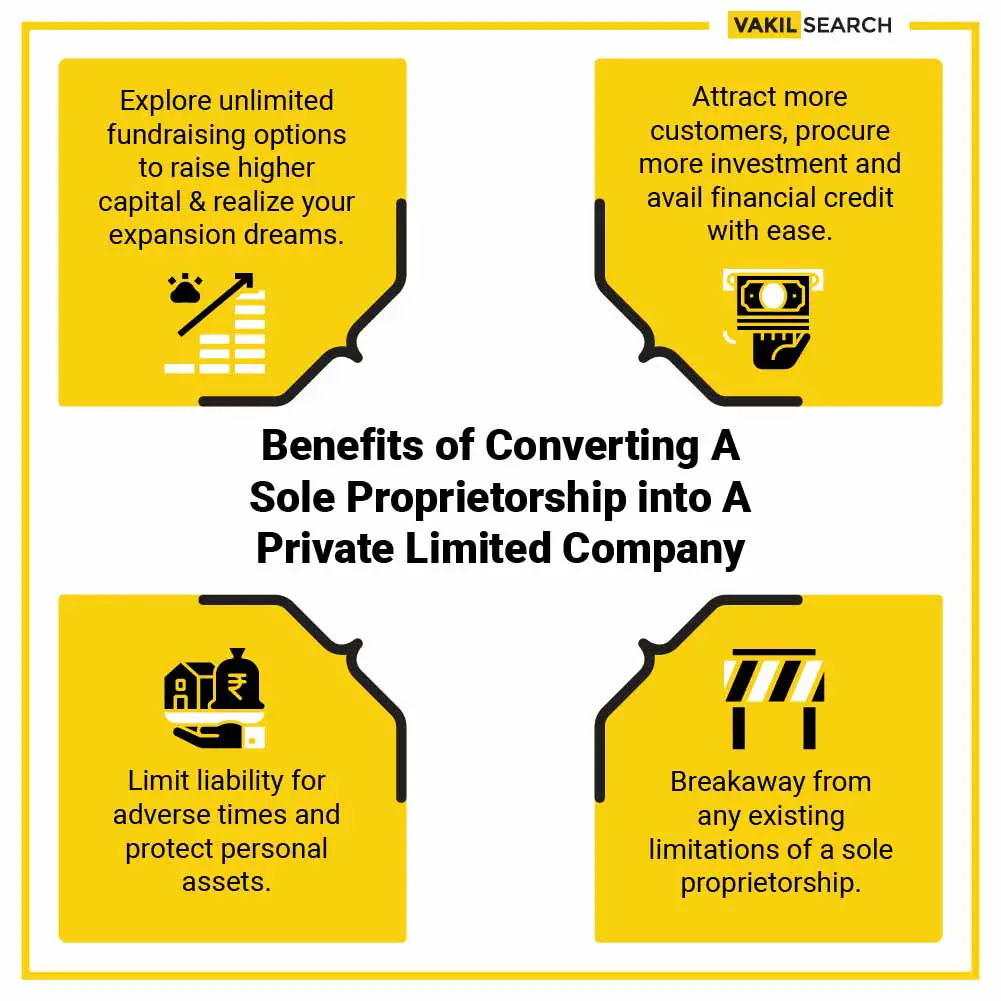

This is where turning a sole proprietorship into an LLC comes into play. The main feature of a limited liability company is that it separates the owners personal assets from the business and, therefore, protects the property, ensuring that the business debt remains with the company. This business structure is between a sole proprietorship and a partnership, allowing for multiple owners .

The requirements for LLCs are minimal, and though they are encouraged to follow the same guidelines as some corporations, they arent legally required to do so.

| NOTE: Northwest Registered Agent is thought to be a great LLC option. In addition, it offers a Free Registered Service Agent for one year, as well as IncAuthority, Swyft Filings, and MyCompanyWorks. |

Converting A Corporation To An Llc

One of the potentially most expensive conversions is one that changes a C-Corporation into a Limited Liability Company. The exact cost is determined by the value of company assets and whether or not a loss is being generated. The conversion can be accomplished by dissolving the corporation and forming an LLC with the assets of the liquidated corporation, although some states offer a simplified conversion process. Note that any reorganization that does not liquidate the original corporation entirely may be scrutinized by the IRS with all the consequences that entails.

Also Check: Is Solar Power Worth It In Texas

Apply For An Employer Identification Number

All new corporations must apply for an Employer Identification Number from the IRS. You can apply online for free in a few minutes. Think of an EIN as a Social Security number for your business. Youll need this number to file your taxes, apply for business loans, open a business bank account, and more.

Incorporation Is It Time

There are many things to consider when looking at switching your business from a Sole Proprietorship to a Corporation. If you decide to incorporate, the great news is that the process to switch from one to the other is pretty straightforward and easier than you think.

We have compiled a list of commonly asked questions by our clients when they reach out, considering what is involved in making the transition to an incorporated company.

You May Like: What Would A 100 Watt Solar Panel Power

California General Stock Corporation

- The converting entity must be a California LLC, LP or GP or a Foreign Corp, LLC, LP, GP or Other Business Entity

- File Articles of Incorporation containing a statement of conversion. Article forms are available below for the following conversions. Please note, entities converting to a California corporation are not required to use the forms below, the entities may create their own Articles of Incorporation with Statement of Conversion that meets the minimum requirements of law.

Is It Time To Make A Change

If your business is growing, you want to take on partners, or youre looking to protect yourself from risk to your personal assets, it may be time to convert your sole proprietorship to an LLC.

Follow the guidelines for your state on forming an LLC. If you have any questions regarding the process or need help, consult an attorney.

Put a legal team in your corner

Learn more about LegalGuard and how you can get connected to a construction lawyer in your area. Receive on-demand legal advice, contract reviews, and more.

Recommended Reading: How Much To Install Tesla Solar Roof

When Should I Turn My Sole Proprietorship Into An Llc

As your business grows, the liability protection an LLC provides is going to be an important consideration for you. Deciding when to turn your sole proprietorship into an LLC is really a personal choice, but if you are committed to running a business full time and you are confident in your future income potential as a business owner, you should not wait to form an LLC.

Forming your LLC today can help you take advantage of potential tax benefits and enjoy the peace of mind of limited liability protection.

See If Your Name Is Available

Just because youve been operating as Beths Bonnets for years doesnt mean that name is necessarily available in the state where you want to form an LLC. Thats why you need to conduct a corporate name search to make sure its available for your new LLC. If the name you want isnt available, you might have to slightly modify it.

Read Also: What Do Solar Panel Installers Get Paid

Do I Need A New Ein For My Llc

If you already have an EIN for your Sole Proprietorship, you wont be able to use that for your LLC. Youll need to get a new EIN Number after your new LLC is approved.

If you follow the LLC filing instructions , well provide instructions on how to get a new EIN Number.

For more details, please see: Do I need a new EIN if I change from Sole Proprietor to LLC?

Can I Add Another Person To The Incorporation

Yes, if you wish to add someone to the incorporation as a director who was not part of your original business, now is the perfect time to add them. As a Sole Proprietor, you were not able to add other partners to your business registration however, this is not the case with incorporating, and new directors can be added to an incorporated company at any time.

Recommended Reading: How Much Energy From Solar Panels

Write Up An Operating Agreement

If you have more than one member in your LLC, then it pays to write up an operating agreement to document how you will do business.

Include things like how decisions will be made, how profits will be split, and what roles the members will take in the company. You can use online legal document generators to help write your operating agreement or consult with an attorney.

Transfer Assets From Yourself To Your Llc

You can transfer assets owned by your Sole Proprietorship to your LLC by:

- making a capital contribution,

A capital contribution means you are using your Sole Proprietorships assets as cash to purchase ownership interest in the LLC.

On the other hand, you can assign assets/property to your LLC or your LLC can purchase assets/property from yourself .

Youll want to speak with an account, since depending on the value of the assets being transferred, there could be tax benefits to one method over another.

If you need to transfer domain names or digital assets, please see the following pages:

You May Like: How Big Of A Solar Power System Do I Need

Disadvantages Of Forming An Llc

With an LLC, you have the following drawbacks as well:

- State-related paperwork will be required, including any specific industry licensing.

- Annual state filings will be required as well, including any specific industry licensing fees that are required.

- Besides paying personal federal, state, local and the self-employed version of FICA taxes, you might also be required to pay State Business Taxes and Unemployment Taxes.

- Costs for completing the tax return of an LLC may be higher than that of a sole proprietorship.

How To Convert A Sole Proprietorship To A Partnership

| There are no formal auditing requirements in respect of a partnership which can reduce costs somewhat, and it is relatively easy to convert a partnership into a private company if the need arises. |

A Sole Proprietorship is easy to start but can hamper your growth. After all, its difficult to build a big business as a single person. If one is looking to add partners to their business without any hassle or hindrance, then it is recommended to switch to a partnership.

Also Check: Do You Need Insurance For A Sole Proprietorship

What Is An Llc

Unlike a sole proprietorship, an LLC ensures that the personal assets of its owners will not be seized in the event of a lawsuit or debt collection action. In many states, an LLC’s owners, who are also called members, are able to receive distributions of the company’s profits without having to pay taxes at the company level. The members also enjoy greater flexibility in profit distribution compared to a corporation.

Make Sure You Qualify

Not all businesses can become S corporations. Before you apply for S corporation status, you should verify that your company meets IRS requirements.

- The corporation may have no more than 100 shareholders .

- You must be a domestic company in any state.

- The corporation must have only one class of stock.

- You are not an insurance company, bank, or international sales corporation.

- All shareholders must agree to the S corporation structure.

If you meet all of these requirements, youre ready to proceed.

You May Like: How Much Does Solar Power Cost

Is Your Business Engaged In Risky Activities

Some businesses in Orange County, CA are inherently riskier than others when it comes to putting their personal assets in danger. Examples of businesses that engage in risky activities are those that use hazardous materials, those that manufacture or sell food products, those that involve caring for children or animals and those that build or repair structures and/or vehicles. If your business engages in risky activities, you must consider incorporating it or converting it to a limited liability company. Limited liability companies and corporations are business structures that provide the protection of limited liability. This means that your personal assets will be shielded from debts and claims that are business-related.

Taxes For A Sole Proprietorship Vs Llc

With both an LLC and a sole proprietorship, the profit of the business passes through to the owners personal tax return. But LLCs have more flexibility in how they are taxed, which may result in tax savings.

Sole proprietors typically report their business income and expenses on Schedule C. This form is filed with the owners personal tax return. The net profit from the business indicates the net profit of the business and it passes through to the owners personal tax return.

Pass through entities like LLCs and sole proprietorships may benefit from the Qualified Business Income deduction that allows them to deduct 20% of QBI. Not all business income qualify, so talk with a tax professional.

Single-member LLCs are automatically treated as sole proprietors for tax purposes, but may elect to be taxed as an S Corporation or C Corporation. This may provide tax savings but will also carry additional requirements. Check with your tax professional to choose the right filing status for your business.

Dont forget about self-employment tax! The current self-employment tax rate is 15.3%. Normally this is split between the employer and the employee, but when you are the employer you pay the full amount yourself.

You May Like: How Do You Clean Solar Panels On Garden Lights

Have Your Personal Assets Grown

Evaluate your personal assets and check whether they have grown since you started your business. Having a significant amount of personal assets is adequate reason to convert your sole proprietorship to a limited liability company or a corporation. Limited liability protection is offered a limited liability company or a corporation. Without this protection, your personal assets can be in danger if your company cannot pay off business-related debts or satisfy court judgments made against it.

What Do I Do With My Sole Proprietorship After Incorporation Has Been Completed

It typically will take a week or two to get everything set up for the new corporation including, business bank account, cheques, business credit card etc. Once completed, you may want to cancel the current registration to put an end date to the operation of the registration. If you have existing HST, WSIB, payroll accounts with the registration, these should also be cancelled and set up under the newly incorporated company.

Besides assisting you in completing the new incorporation, we can also complete the cancellation of your current Sole Proprietorship in Ontario.

If you wish to complete a cancellation for another province, please contact our friendly and knowledgeable staff to obtain a quote today! 1-800-280-1913 or

Don’t Miss: What Do I Need For A Grid Tie Solar System