Who Needs A Tax Id

An EIN is required for many reasons for businesses, taxable entities and non-profit organizations. If any of the follow apply to your business or entity you will need an EIN:

- Hiring Employees

- Operate your business as a Corporation or Partnership

- If you will file any of following tax returns: Employment, Excise or Alcohol, Tobacco and Firearms

- Have a Keogh Plan

- Plan Administrators

Does A Sole Proprietor Need A Tax Id

Starting a new business as a sole proprietorship is often a great way to test the waters and discover if the venture is worth developing as a more formally organized business. While startup companies that operate as sole proprietorships dont need to file their own tax returns — business activity is an extension of the sole proprietor’s personal finances — you may need to secure a tax identification number depending upon the circumstances of your business.

What If Im Not Sure I Need A Fein

If youre not sure you need a FEIN, you can consult the Internal Revenue Services website. According to Melvin Springer, a New York-based financial executive, a good rule of thumb is that if you record them on your personal tax return, you are not required to have one, as you can use your Social Security number. If you intend to report them on a business tax return, you will be required to have a FEIN.

If this is confusing to you, you can hire a online payroll service to help with processing and reporting payroll-related taxes.

You May Like: How To File As A Sole Proprietor

What Is An Ein And Does Your Business Need One

An Employer Identification Number is relatively easy to obtain and a usefulsometimes mandatorytool when starting a new business or considering a side business.

An Employer Identification Number is mandatory for some businesses and optional for others. But in general, an EIN is necessary for independent contractors and small business owners. Understanding who needs to apply and the benefits that come with having an EIN can give your business a real advantage.

Does Your Ein Ever Change

Once you obtain your EIN from the IRS, its effective immediately. You can start using it right away to apply for loans, open a bank account or to provide to a vendor. In most cases, your EIN will remain with you throughout the course of your business.

However, if the structure or ownership of your business changes, then youll need a new EIN. For instance, if you have a sole proprietorship but later decide to incorporate, youll need a new EIN. Similarly, if you decide to bring a partner on board, youll need a new EIN to reflect that change. However, smaller changes, such as changing your business name or adding a new business location, dont require a new EIN.

And if you ever lose or misplace your EIN, dont worry. Looking up your business tax ID number is pretty simple. You can locate your EIN on old tax papers or contact the IRS for assistance.

Read Also: What Is The Best Solar Panel To Buy

Sole Proprietors Arent Employees

A sole proprietorship doesnt pay payroll taxes on a sole proprietors income or withhold income tax. Because youre working as an independent contractor, your clients dont withhold taxes from your compensation.

Instead, as a sole proprietor, you pay self-employment taxes. Self-employment tax goes towards your Social Security and Medicare and is 15.3% of your net self-employment income. Youll also pay income taxes on your earnings. These taxes must be paid four times a year in the form of estimated taxes.

Anyone that pays you $600 or more within a year must file Form 1099-MISC to report the payment to the IRS.

How Do I Apply For An Ein

Here’s the good news. Applying for an EIN is easy and free. Establish your business type prior to requesting an EIN. For example, if you plan to operate your new business as an LLC, create the LLC prior to applying for an EIN. You can apply online on the IRS’s website, or you can use an independent service to complete the process for you. You can apply online, by fax, or by mail with the IRS. If you apply by fax or mail, you will need to complete the Form SS-4, Application for Employer Identification Number. When you apply online, you will be able to view and print your assigned EIN at the end of the online session. Via fax, the process is generally complete within four business days. Via mail, you can expect a wait time of approximately four weeks.

Note that:

- Your principal business must be located in the U.S. or a U.S. territory

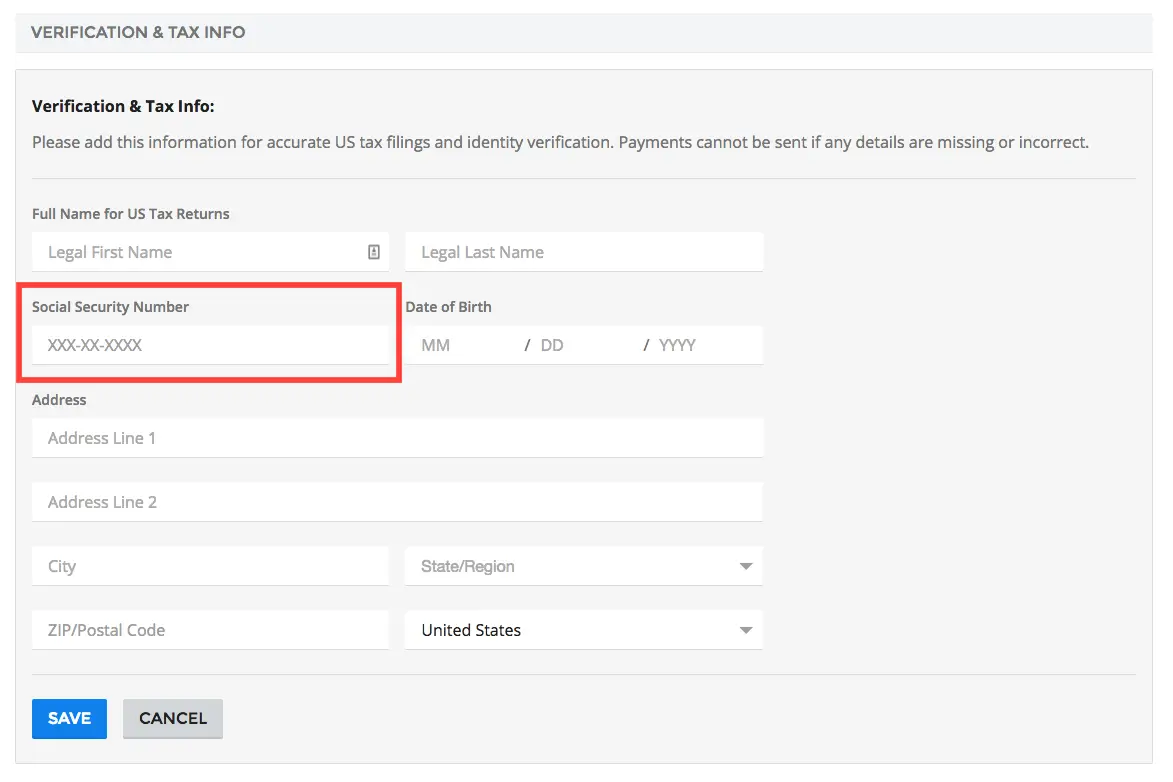

- You must have a Social Security Number, Individual Taxpayer Identification Number , or preexisting EIN.

- You must be considered a responsible party,” which means you’re the person who ultimately owns or controls the entity applying or exercises ultimate effective control over the entity.

Now that you can see the advantages and ease of obtaining an EIN, acquiring an EIN should be one of the first steps you take when creating a new business.

About the Author

Boni Peluso

Boni Peluso is an award-winning Creative Director and Content Strategist who has written extensively for the legal, healRead more

Also Check: How Expensive Is It To Install Solar Panels

Legal Info & Disclaimer:

Easy Doc Filing, LLC, and its employees, agents, and representatives, are not affiliated with the Internal Revenue Service or any other governmental or regulatory body or agency. Easy Doc Filing, LLC provides paid services to obtain Federal Tax Identification Numbers from the IRS. As a Third Party Designee, pursuant to IRS Form SS-4, Easy Doc Filing, LLC prepares and submits applications for an Employer Identification Number to the IRS on behalf of its clients. Easy Doc Filing, LLC does not verify EIN application submissions and is not responsible for the accuracy of the information provided. Any individual may obtain and submit his or her own EIN application at no cost through the official IRS website at www.irs.gov Easy Doc Filing, LLC may derive revenue from the partnerships we have entered with, and/or our promotional activities may result in compensation paid to Easy Doc Filing, LLC. Fundbox makes capital available to businesses through business loans and lines of credit made by First Electronic Bank, a Utah chartered Industrial Bank, member FDIC, in addition to invoice-clearing advances, business loans and lines of credit made directly by Fundbox.

Easy Doc Filing, LLCEasy Doc Filing, LLCEasy Doc Filing, LLCEasy Doc Filing, LLCEasy Doc Filing, LLCEasy Doc Filing, LLC Easy Doc Filing, LLC

How To Get An Ein

You can apply for an EIN online through the IRS website â the process is simple and takes just a few minutes. Youâll need to provide some basic information about your business, such as the name and address, trade name, as well as your Social Security number.

If you apply online Monday through Friday between 7 a.m. and 10 p.m., local time, you should receive your EIN within minutes. You can also fill out Form SS-4 by fax or mail.

The problem with using fax or mail, though, is that they take much longer than online applications. For instance, you’ll get your EIN within three days if you send a fax. And if you send a mail, it can take up to four weeks for your EIN to be processed.

To obtain an EIN, your sole proprietorship must be located in the United States and you must have your own tax identification number, such as a social security number.

Also Check: How Many Different Types Of Solar Panels Are There

Why You May Want An Ein Even If It Is Not Required

Even though most sole proprietors will not need to obtain an EIN, it can be beneficial to obtain one in some cases.

First, sole proprietors who act as independent contractors can help protect their identities by obtaining and using an EIN with their clients, rather than providing their own Social Security Numbers.

Having an EIN may also make an independent contractor or sole proprietor appear more professional to potential clients. Some sole proprietors find this helps them land and solidify client relationships more easily.

Benefits Of An Ein Even If Its Not Required

Getting an EIN takes anywhere from five minutes with the online EIN application to up to five weeks for the mail-in appliation, depending on your method of submission. A few benefits to consider to having an EIN include:

- Reducing the potential for identity theft since you arent using your SSN for the business

- Using an EIN can help build business credit in some cases

- May be needed when applying for business licenses and permits

You May Like: How Much Do Solar Companies Make

What Is A Federal Tax Identification Number

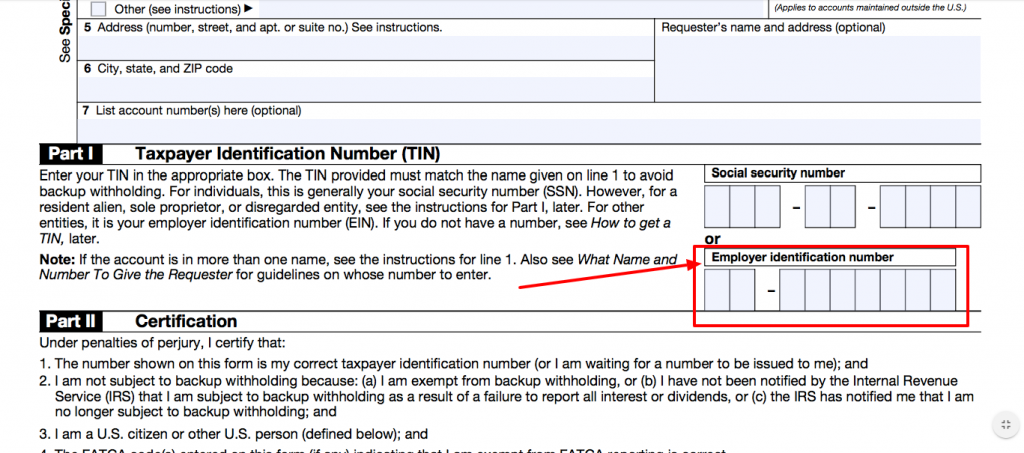

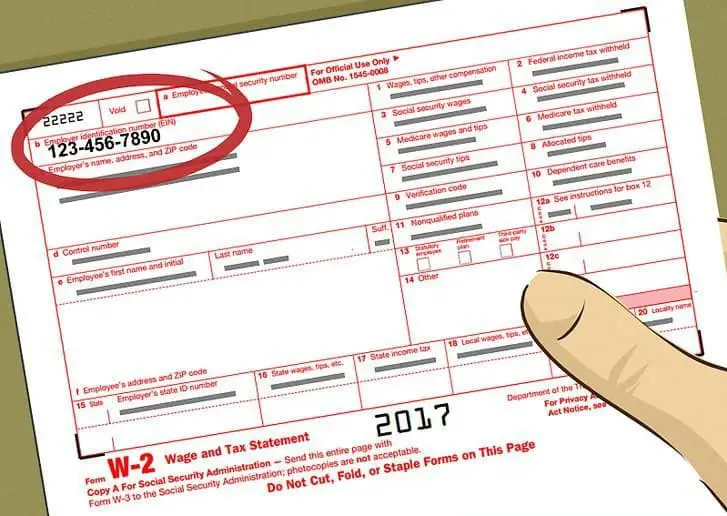

A federal tax identification number, also known as a FEIN or an employer identification number , is issued to entities that do business in the United States. The FEIN is a unique nine-digit corporate ID number that works the same way a Social Security number does for individuals. The tax number for individuals, also referred to as a tax identification number or TIN, is an individuals Social Security number. Its easy to get the two types of numbers mixed up. Just remember that one is for business entities, and one is for individuals.

A FEIN is a way for the IRS and other government entities to identify and track business entities tax and financial activities. Its required to file tax returns, as well as to set up retirement accounts and health accounts to offer medical and dental benefits to employees, among other uses.

Who Is Required To Have An Ein

Sole proprietorships, in general, are not required to have an EIN. However, an EIN is required if:

- You have employees or plan to hire them.

- You want to offer a Keogh or solo 401 retirement plan

- You’re inheriting or thinking of buying a sole proprietorship

- You need to file for bankruptcy

The IRS also requires EINs for trusts created by estate funds and representatives who oversee an estate that operates a business after the owner’s death.

Independent contractors, freelancers, people running small businesses out of their homes, and people with side jobs who capitalize on the gig economy are generally not required to get an EIN. Still, there are plenty of reasons why they should.

Recommended Reading: How Much Solar Panels Do I Need

When Do I Need To Change My Fein

Once youve received your FEIN, you do not have to change your FEIN unless under special circumstances as deemed by the IRS.

If your business is a corporation, youll be required to change your FEIN if:

- Your business changes to a sole proprietorship or a partnership.

- A new corporation is created through a merger.

- Your business becomes subsidiary to another corporation.

If your business is a partnership, youll be required to change your FEIN if:

- The business changes to a sole proprietorship.

- Your business becomes a corporation.

- A new partnership is formed over an old one.

If you have a FEIN as a sole proprietor or an LLC, youll be required to change your FEIN if:

- Youre in bankruptcy proceedings.

- You change your business to a corporation or a partnership.

- You gain ownership of another business.

You dont need to change your FEIN if the name or location of your business changes.

Protection Against Identity Theft

Without a business EIN, youâll be forced to use your Social Security Number on various business applications and documents. By frequently putting your SSN out there, you increase the risk of it landing in the hands of an identity thief.

If that happens, the thief can use your details to obtain credit and even file fraudulent tax returns in your name. You can easily avoid that by getting a business EIN and using it on all business documentation. The added advantage is that you get to keep your SSN private.

Also Check: How To Clean Solar Panels On Garden Lights

Is Sole Proprietorship Still The Best Option For My Business

If your sole proprietorship is large enough or successful enough to hire employees, then you could be in the position to consider converting your sole proprietorship into an LLC. Forming an LLC is the next step in growing a business.

While being a sole proprietor can be an easy option to run a business with very low profit and low risk, you have zero liability protection.

There are many benefits to holding your business in an LLC, but the most impactful is liability protection. An LLC separates the business owners personal assets from the business. This means your personal assets arent in jeopardy in the event that the business is sued or cant pay a debt.

Learn more about getting an EIN as a foreign person.

Do I Need An Ein If Im Filing For A Sole Proprietorship

An employer identification number, also known as an EIN or federal tax identification number, is a nine-digit set of unique numbers assigned to your company and used by the Internal Revenue Service to identify your business for tax-related purposes.

The Need and Importance of an EIN

The IRS wants company owners to apply for an EIN online under certain circumstances, including if they have workers, are part of a Keogh plan or are involved with trusts, estates, non-profits, farmers cooperatives, or plan administrators. They should also file if they operate as a partnership or corporation, or withhold taxes on income, other than pay, for a non-resident alien.

Banks may require a business to have an employer identification number to open a business banking account.

What Is a Sole Proprietorship?

A sole proprietorship is a company that has a sole owner not registered with the state as a corporation or limited liability company. This entity type is affordable and relatively easy to establish. You dont have to file paperwork in order to get it set up.

Do I Need an EIN for a Sole Proprietorship?

It is not necessary to obtain an EIN for sole proprietorship. This is because you can use your social security number. However, many business owners choose to obtain an employer identification number to protect them from giving out their social security numbers. If you have hired an employee, an EIN is required.

EIN Online Application

Legal Info & amp Disclaimer

Don’t Miss: Is Solar Energy Bad For The Environment

It Helps Minimize The Risk Of Identity Theft

Your Social Security number is one of the most important pieces of information about you. Giving it out to every business you work with leaves you vulnerable to identity theft. Identity thieves can get hold of your personal social security number and use it to file fraudulent tax returns. With an EIN, you can keep your SSN for personal use and still have a unique identifier for your business.

Do I Need A Tax Id Number

If you operate a sole proprietorship without any employees, or a single person LLC, you donât need a tax ID number to file your taxes.

All other business structures, including any businesses with employees, need tax ID numbers to file their taxes.

And, as mentioned, youâll need a tax ID number for business banking.

Also Check: Is Solar Worth It In Southern California

What Is A Responsible Party

Every EIN application requires that a person who is a principal officer, general partner, grantor, owner or trustor be designated as the primary point of contact and responsible for receiving correspondence from the IRS related to the entity. This person is called the responsible party by the IRS. This person controls, manages or directs the applicant entity and disposition of funds and assets. If there is more than one responsible party for the entity, please list the primary person that you would like the IRS to recognize as the responsible party.

Under the current revised version of the IRS EIN application, a responsible party is defined as:For entities with shares or interests traded on a public exchange, or which are registered with the Securities and Exchange Commission, responsible party is the principal officer, if the business is a corporation, a general partner, if a partnership, the owner of an entity that is disregarded as separate from its owner , or a grantor, owner, or trustor if a trust.

What Is A Single

A single-member LLC provides the sole proprietor personal protection from business liability. As with most other incorporated businesses, an LLC structure keeps the owner’s assets from being seized to cover business obligations or debts. An LLC has the distinction of also providing charging order protection, in which a business and business assets can’t be seized to settle personal debts.

A single-member LLC also serves as a pass-through entity for taxation purposes. This means LLC owners can pay the business’s income taxes on their individual tax returns. LLCs in this situation do not need EIN numbers unless they are required to file excise taxes or have employees. Instead, you’ll simply use your own tax ID number or Social Security number. In most cases, an LLC owned by a married couple will still be considered a sole proprietorship by the IRS.

Also Check: Is Solar Worth The Cost

Making Changes To Your Employer Identification Number

Keep in mind that just because you have an EIN, donât assume itâs written in stoneâthere are occasions when you may need to change your EIN. There are other cases where your EIN may remain the same, but you will still need to notify the IRS of changes to your business.

If you have an EIN, you need to get in touch with the IRS in the event that:

- you change your business name*

- you change your business address*

- your business changes ownership

- your business management team changes

- your business changes entity types*

* In these circumstances your EIN doesnât change, but the IRS still needs to be notified

If youâre unsure whether you need to notify the IRS of a change, check out their page on EIN changes.