Solar Investment Tax Credit Extension In 2022

Starting in 2022, solar tax credits will be phased out over the next three years until they are gone entirely. So what does that mean for you?

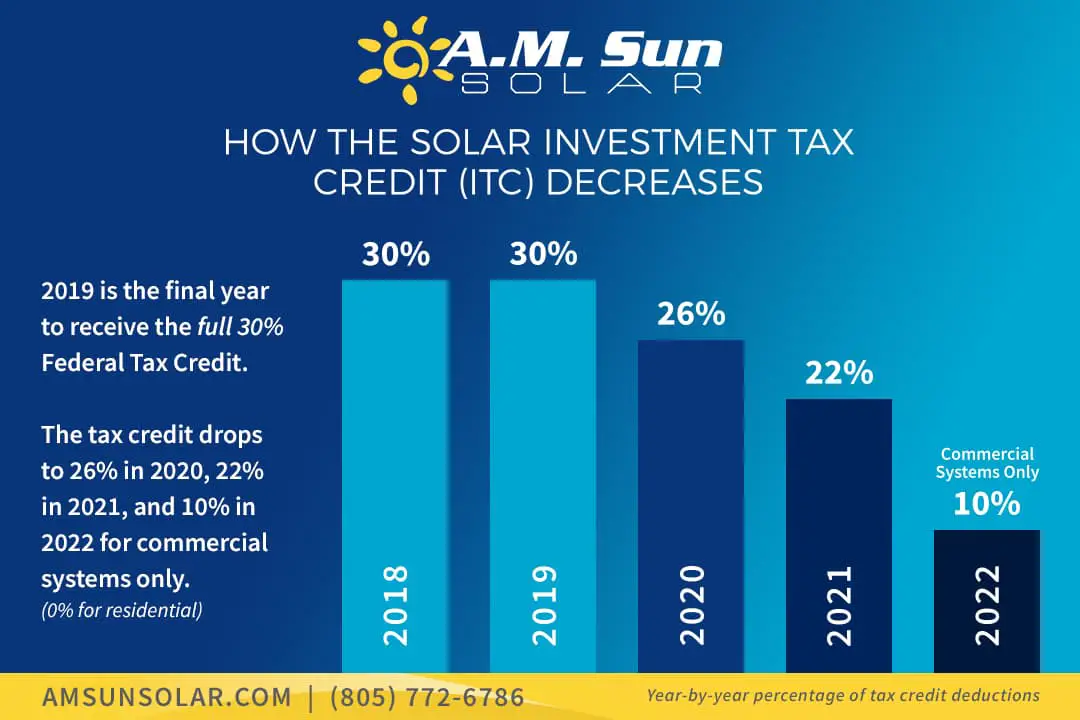

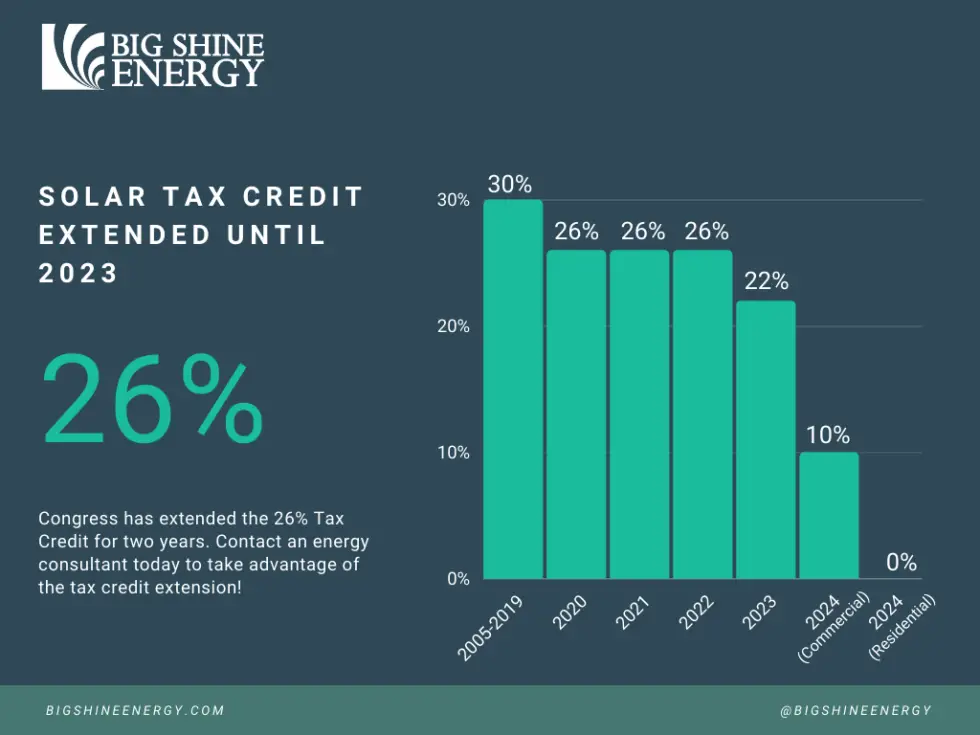

In 2022 the tax credit fell from 30% to 26%, then in 2023 it will fall again to 22% and finally, in 2024 it will drop to 0% for residential use and 10% for commercial use.

Solar Tax Credits For Photovoltaic & Solar Hot Water Systems

While the solar tax credit has made solar significantly more affordable for homeowners, the Federal Tax Credit will begin to decrease in 2023. Below we lay out what the State and Federal Tax credits are for photovoltaic systems.

What is the solar tax credit? How to Claim Your Credit Upcoming Changes

Eligibility For Solar Rebates

To qualify for solar rebates, you must purchase and install a solar energy system. There are no solar tax credit requirements for this incentive. Its also important to note that solar rebate amounts vary by state, so be sure to check with your local solar company for the specific amount available in your area.

Don’t Miss: Can I Have Solar Panels

What Is The Best Way To Finance Solar

Purchasing solar in cash will always provide the biggest return on your investment. However, financing solar through a loan is the best way to make the switch if you cant afford the full cost upfront.

Solar loans have become a popular and practical option for homeowners going solar. Though interest rates may tack on a few thousand to your total costs, financing solar via a solar loan provides far more long-term savings than a solar lease or power purchase agreement .

Karsten Neumeister is a writer and solar energy specialist with a background in writing and the humanities. Before joining EcoWatch, Karsten worked in the energy sector of New Orleans, focusing on renewable energy policy and technology. A lover of music and the outdoors, Karsten might be found rock climbing, canoeing or writing songs when away from the workplace.

Karsten Neumeister

Solar Expert

How Do I Make Sure Im Eligible To Claim The Solar Tax Credit

To be on the safe side, your solar project should be fully installed and paid for before 2022 to be absolutely certain that you can claim the tax credit in 2022s taxes.

This isnt a concern in early January 2021, but the urgency increases towards the end of 2022.

Even though physically installing a solar system usually does not take more than a single day, many homeowners do not realize that a solar project may take weeks to complete after contract signing. This is due to factors such as permitting, financing approval, utility approval, and so on. Read more about the solar installation process here.

Therefore, to be 100% sure that you can claim the 26% ITC, the sooner you move forward with your project, the better.

Towards the end of 2022, as word begins to spread about the incentive stepping down, solar installers will likely get busier and busier, meaning your installation may be scheduled farther out than normal.

Don’t Miss: Does My House Qualify For Solar Panels

How Is The Federal Solar Tax Credit Calculated

The gross system cost can include any improvements needed to facilitate the solar installation. This includes any electrical work needed for the installation such as a panel box upgrade, and also includes roof work under the solar array. Please speak to your tax advisor for specific advice for your given circumstances.

The credit is a dollar for dollar income tax reduction. This means that the credit reduces the amount of tax that you owe. Many clients mistakenly believe that getting a tax return would make them ineligible for the ITC, but this is not the case. As long as youve been paying taxes in some form throughout the year, if you get a tax return and claim your ITC in the same year, your ITC is simply added to the amount of your tax return .

Other Solar Tax Credit Options

If you are looking to offset some of the costs associated with your solar panel installation project, the options do not end at the federal solar tax credit. There are numerous credits, rebates, and incentives available to help you go solar.

The best place to start is the Database of State Incentives for Renewable Energy . This database provides an extensive, searchable summary of renewable energy and energy efficiency incentives broken out by state.

Some of the general types of incentives available to homeowners include:

- Solar loan programs. Offered at the federal and state level to purchase solar panel systems and equipment.

- Personal solar tax incentives. Incentives such as tax credits and deductions reduce the upfront cost of purchasing and installing a residential solar panel system if you decide to buy.

- Property solar tax incentives. Adding a solar panel system to your property may increase the value of your home, which could mean higher property taxes. Solar property tax incentives exclude or reduce this added value for taxation purposes.

- Solar rebate programs. Rebate programs for solar panelssuch as cash incentivesare available from states, local governments and utilities in varying amounts.

Your local utility company may also offer you a credit if your grid-connected system produces more energy than you use. You can actually sell that extra energy back to the grid. This is called net metering or net excess generation .

Don’t Miss: How Much Do Tesla Solar Shingles Cost

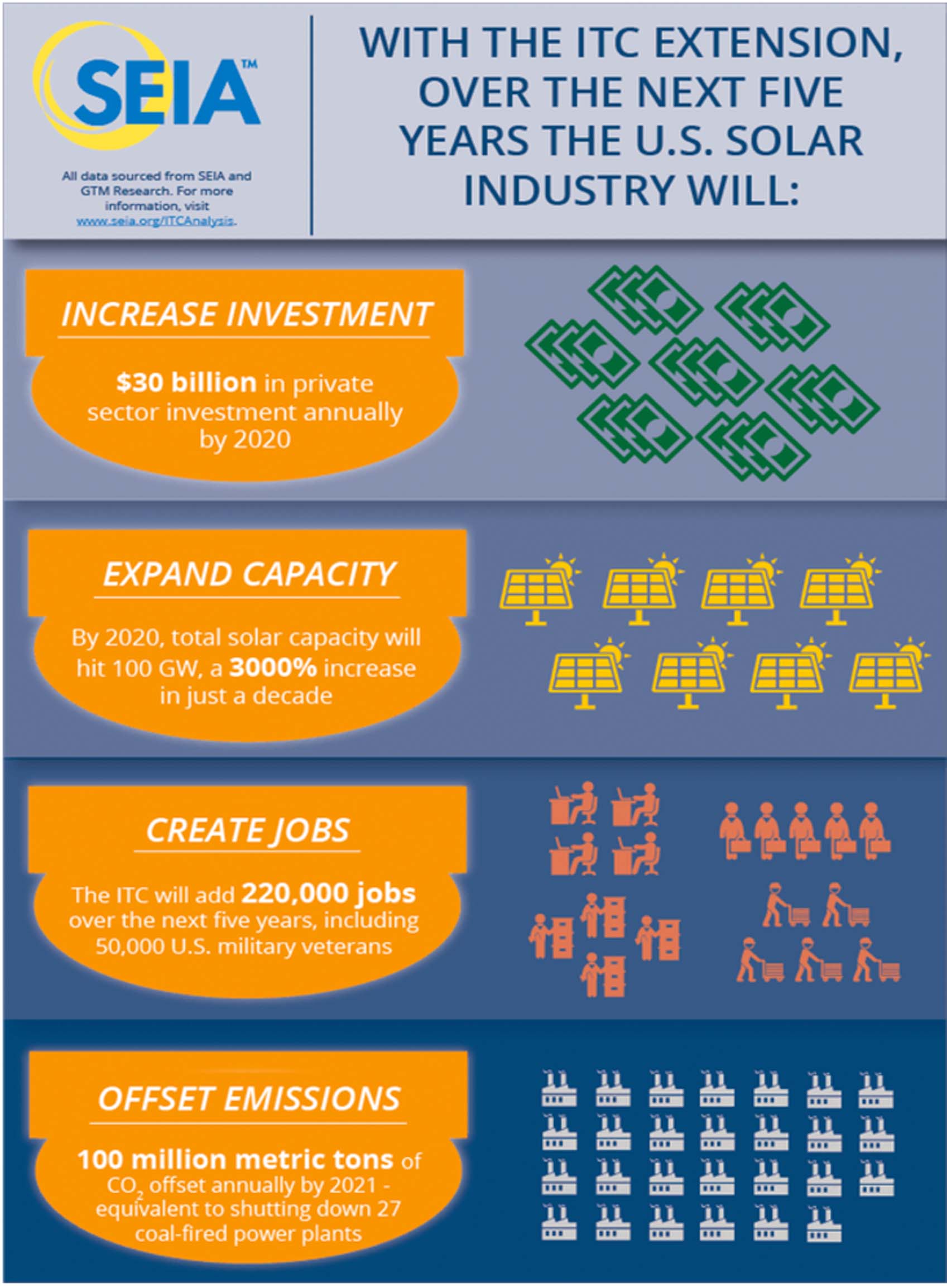

Will Solar Incentives Increase

Climate policy and energy independence have taken center stage in recent years, and many hope this will result in expanded incentives for adopting solar. However, most current incentives were set long before the cost of solar reached the low levels where it currently stands. Seeing as costs are low and demand for renewable energy is high, we wouldnt recommend waiting to install a photovoltaic system in hopes of seeing better solar incentives.

Read Also: How To Calculate Savings From Solar Panels

Join The Solar Revolution

The federal solar tax credit has been extended to 2021 to further solar adoption across the U.S. It enables a greater number of homeowners to install a home solar system since they can apply this incentive to reduce their overall cost.

With this legislation extension, homeowners may now claim the tax credit as soon as construction is completed, as long as it is operational by the end of 2023. Previously, the system had to be operational in order to claim the tax credit.

The notable caveat to the extension is that the solar tax credit will be reduced on January 1, 2020.

Plus, other incentives are offered depending on your location. Sunrun solar advisors freely provide knowledge on all available incentives. Well ensure you receive your solar energy system with all possible incentives applied.

You May Like: How Much Power Does A 9kw Solar System Produce

Q What Improvements Qualify For The Residential Energy Property Credit For Homeowners

A. In 2018, 2019, 2020, and 2021, an individual may claim a credit for 10% of the cost of qualified energy efficiency improvements and the amount of the residential energy property expenditures paid or incurred by the taxpayer during the taxable year .Qualified energy efficiency improvements include the following qualifying products:

- Energy-efficient exterior windows, doors and skylights

- Roofs and roof products

- Insulation

When Does The Federal Solar Tax Credit Expire

The federal solar tax credit is set to expire at the end of 2023. There is hope that the tax credit may be extended once again. The Biden Administration has plans to include a 10-year extension of the tax credit in future legislation. But, theres no guarantee that this will be approved by Congress and it may be at a lower rate.

Because of that, our best advice is to try and add solar panels as soon as possible so youre guaranteed to get the 26% credit.

The best time to go solar is now because the 26% ITC will decrease to 22% in 2023 before becoming unavailable for residential solar systems installed in 2024 and beyond.

Don’t Miss: How Much Pine Sol In A Spray Bottle

Availability Of Solar Rebates

Solar rebates are available in most US states. However, they are not available in every state. You can check with your local solar company to see if solar rebates are available in your area.

If solar rebates are not currently offered in your state, dont worry! There are other solar incentives that may be available.

Additionally, solar rebates are changing rapidly. You can check with your solar company for the most up-to-date information about solar rebate programs in your area or visit EnergySages Rebate Database to see what solar rebate opportunities exist near you!

What Are The Criteria To Claim The Solar Energy Credit

You can claim the credit once toward the original installation of the equipment. You must own the solar photovoltaic system and it must be located at your primary or secondary residence. If you are leasing solar panels, you don’t get the tax incentives.

There is no maximum amount that can be claimed, though. In addition, if you financed the system through the manufacturer and are contractually obligated to pay for it in full, you can claim the credit based on the full cost of the system.

You don’t even have to be connected to the electric grid to claim the federal solar tax credit, though there are definite financial incentives to being connected.

If Congress doesn’t renew it, the Federal Solar Investment Tax Credit will vanish in 2024.

Don’t Miss: What Can A 25 Watt Solar Panel Run

Solar Rebates And Incentives

While the cost of solar has declined significantly over the last decade, it is still a significant investment for home and business owners looking to lower their electricity bills. In order to encourage the greater adoption of solar, the federal government, state and local governments, and even some utilities offer incentives to help make solar more affordable and accessible. These incentives typically take the form of solar rebates, tax benefits and/or performance based incentives, and can reduce the cost you pay for solar from anywhere to 26 to 50 percent!

All of the financial benefits listed below accrue to the owner of the solar panel system. If you buy your system upfront or with a solar loan, youre eligible to receive the tax credits, solar rebates, and SRECs for the system. However, if you lease your system, the third-party owner will receive all of the solar incentives.

Also Check: Can You Put A Solar Panel On A Golf Cart

Federal Solar Tax Credit Filing Step

Fill in Form 1040 as you normally would. When you get to line 53, its time toswitch to Form 5695.

Step 1: Find out how much your solar credit is worth.

- Enter the full amount you paid to have your solar system installed, in line 1. This includes costs associated with the materials and installation of your new solar system. As an example, well say $27,000.

- For this example, well assume you only had solar installed on your home. Enter 0 for lines 2, 3 and 4.

- Line 5 Add up lines 1 through 4. Example: 27,000 + 0 + 0 + 0 = 27,000

- Line 6 Multiply the amount in line 5 by 26% Example: 27,000 x .26 = 7,020

- Line 7 Check No. Again, for this example, were assuming you didnt have any other systems installed, just rooftop solar.

- Lines 8, 9, 10 and 11 Dont apply to you in this example for the same reason. You can fill each with 0 and skip down to line 12.

Step 2: Roll over any remaining credit from last years taxes.

- Line 12 If you filed for a solar tax credit last year and have a remainder you can roll over, enter it here. If this is your first year applying for the ITC, skip to Line 13.

- Line 13 Add up lines 6, 11 and 12 Example: 7,020 + 0 + 0 = 7,020

Step 3: Find out if you have any limitations to your tax credit.

Also Check: How Much Would Solar Panels Cost For A House

Unlimited Inspection Reports & Digitization

Get unlimited inspection reports and analytics from the market leader in aerial thermography. Raptor inspections are input agnostic drones, planes, satellites or sensors yours or ours. Access industry-leading training to ensure your data collection meets specifications. Each solar anomaly is identified, classified, localized and prioritized. Raptor Solar can even digitize, standardize and store historical third party reports. Compare to each other or to your Raptor reports for degradation measurements and a holistic view of your assets.

California Solar Incentive Battery Cover Self

As a residential homeowner in California, you are qualified for an SGIP rebate of $200-$1,000/watt-hour of storage. It increases with the level of KWh you install. If you get battery storage in a property serviced by Southern California, SCE, SDG& E, or PG& E, then you can grab the chance for the SGIP incentive.

The incentive comes in three tiers:

- Residential equity storage

- Residential equity resiliency storage

Residential Equity Storage Incentive

SGIP has an equity budget set aside for solar batteries installed in low-income areas. In addition, the federal government started the residential equity incentive to promote and encourage more battery storage in disadvantaged areas. The rebate received is $850/kWh installed.

Residential Storage

If you have a battery storage system smaller than 10kW in your residential property, you are qualified for a $200/kWh incentive. As a homeowner, you are eligible for this incentive.

Residential Equity Resilience Storage

This equity resilience incentive works for homes located in areas that have experienced more than one planned safety power shut-off or Tier 3 or Tier 4 fire district. Power outages can be an inconvenience and create a negative effect on the household.

You May Like: How To Become A Solar Sales Representative

Am I Eligible For The Federal Solar Tax Credit

Any taxpayer who pays for a solar panel installation can claim the solar tax credit, as long as they have tax liability in the year of installation. You must be the owner of the solar panel system in order to qualify for the tax credit, meaning if you lease your system you are not eligible.

When leasing a system, the solar company will get the tax credit instead of you. We recommend you buy your system outright if you can afford to. The money you save in the long run is more. Leasing also makes it harder to sell your home, as buyers don’t want to take over a 25-year lease.

How Many Times Can You Claim The Solar Tax Credit

You can only claim the solar tax credit one time for your solar power installation, and you cannot technically claim the tax credit twice if you own your home. However, if you have any unused amount remaining on your tax credit that you are unable to claim in a single tax year, you may be able to carry over that value for up to five years.

If you own more than one home, you may be able to claim separate tax credits for solar installations on each of those homes. In addition, if you add additional equipment to an existing solar installation, you may be able to claim a tax credit for that added installation cost as well. In general, we always advise customers to speak with a tax professional about any specific tax credit questions, as each situation is unique.

Don’t Miss: What Is Sole Custody Mean

Federal Incentives And Programs

-

Capital Cost Allowance Renewable Energy

The CCA provides business tax incentive to those in industry who are utilizing systems that produce energy by using renewable sources or fuels from waste, or conserve energy by using fuel more efficiently. Such equipment is eligible for accelerated capital cost allowance according to the Schedule II of the Income Tax Regulations under classes 43.1 and 43.2. This means that eligible equipment under class 43.1 may be written-off at 30 percent per year on a declining balance basis. Equipment that is eligible under class 43.1 that was acquired after February 22, 2005 and before year 2020 may be written-off at 50 percent per year on a declining balance basis under Class 43.2.

Natural Resources Canada provides a technical guide to Classes 43.1 and 43.2:

-

Canadian Renewable and Conservation Expenses

The CRCE provides income tax incentives for certain start-up expenses associated with clean energy generation and energy conservation projects. Income Tax Regulations allows such expenses to be fully deducted in the year they are incurred, carried forward indefinitely and deducted in future years, or transferred to investors through a flow-through share agreement.

-

Natural Resources Canada provides a technical guide to CRCE:

How To Qualify For The Solar Tax Credit

In order to qualify for the solar panel tax credit, you must own your home and you must pay enough taxes to the federal government that the ITC can offset your tax payment.

For example, if you paid $10,000 to install solar on your home in 2021, then the 26% ITC would mean you are eligible for a tax credit of $2,600. In order to claim that credit, you need to have owed at least $2,600 in federal taxes before the solar tax credit. If you owed more than $2,600 then the ITC would reduce the total amount that you owe. If you owed less than $2,600 then the ITC would eliminate your tax liability for that year.

In addition, if you do owe less than your total ITC savings for the year that you install your solar power system, you can actually roll over any remaining credits to the following year, so that you dont lose the value of those credits. For example, if you were eligible for $6,500 in tax credit, but only owed $4,000 that year, then you would completely eliminate your tax payment for that year, and the next year you would be able to deduct an additional $2,500 from that years tax payment as well.

Read Also: How Many Solar Panels Can I Have On My Roof