What Is A Limited Partnership

- A partnership composed of both general and limited partners.

- This type of partnership allows each partner to determine and/or limit his or her personal liability.

- Unlike general partners, limited partners are not responsible for the partnerships actions, debts and obligations.

- General partners have the right to manage the business. Limited partners do not.

- Both general and limited partners benefit from the businesss profits.

- Contact an attorney or an accountant to determine if this structure works for you.

Obtain Licenses And Permits

You may also need to apply for licenses and permits at the state, county, and municipal levels to operate your business. This involves filling out an application, paying a fee, and submitting it to the appropriate authorities.

Types of permits to look for include:

- Premises permits: You may need a home occupancy certificate, sign permits, or other facilities permits to operate your business. These are often required at the local level.

- Occupational licenses: Every state licenses its own set of professions, from nail salons to funeral homes. Before you begin offering goods or services, make sure you know the licenses required for your profession.

- Regulated activities: You may need permits for regulated activities such as food service and games of chance.

Why You Should Form An Llc

There are several benefits to starting an LLC that may or may not matter to a business owner. But, regardless of any other factor, a business owner needs to form an LLC when they start to earn a profit or carry risk.

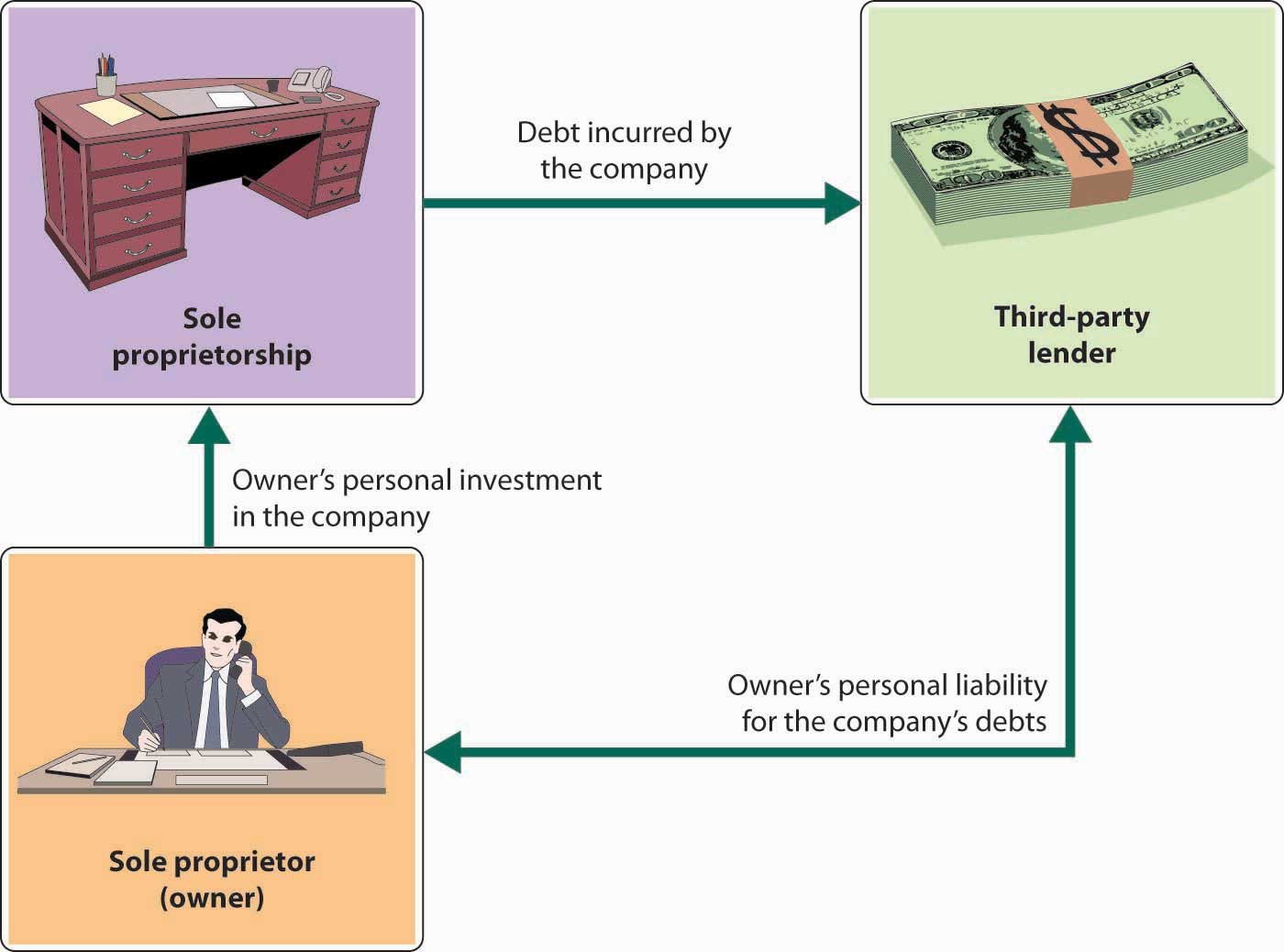

This is because profit and risk open the door to liability. A sole proprietor’s personal assets are completely exposed to creditors and lawsuits because legally, the sole proprietor is the business. In an LLC, the business can be legally separate from the business owner.

- Protect your savings, car, and house

- Increase your peace of mind

- Protect your privacy

You May Like: How Reliable Is Solar Power

Prepare An Operating Agreement

Prepare and submit articles of organization to your state division of corporations and a signed operating agreement .

An operating agreement is an internal document that outlines how business decisions will be made, what percentage of ownership each person has, and any other special rules that apply to your LLC.

Sole Proprietorship Vs Llc

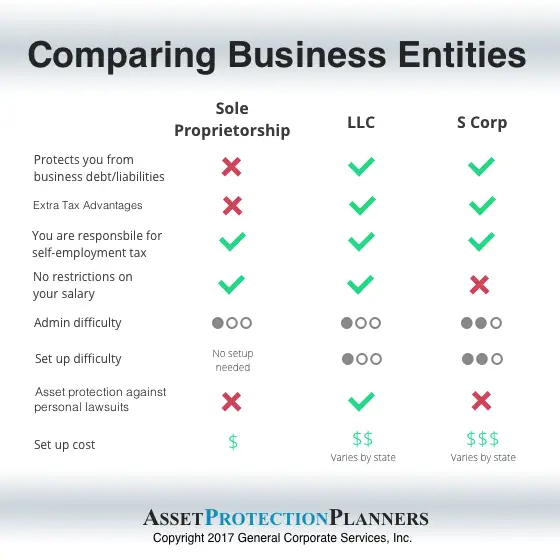

A limited liability corporation provides the business owner liability protection and tax advantages, while sole proprietors bear personal liability for their business. Additionally, an LLC can be owned by investors, while a sole proprietorship is usually owned and managed by an individual.

Once youve determined a sole proprietorship is right for you and your business, its time to talk to the experts.

You May Like: What Is A Sole Proprietorship Vs Llc

Sole Proprietorship Vs Corporation

Corporations are registered business structures and are separate taxable entities. As such, income tax is reported much differently compared to sole proprietorships.

Public corporations are also owned by multiple shareholders, which is not an option for sole proprietorships. Likewise, the company formation process and day-to-day operations are very different for a sole proprietor vs. corporation shareholder.

The following chart from SBA.gov compares different business structures:

How To Become A Kansas Sole Proprietor

When it comes to being a sole proprietor in the state of Kansas, there is no formal setup process. There are also no fees involved with forming or maintaining this business type. If you want to operate a Kansas sole proprietorship, all you need to do is start working.

However, just because its so easy to get started doesnt mean there arent some additional steps you should take along the way. While these parts of the process arent strictly required, many sole proprietors find that they are in their best interests.

Also Check: What Solid Foods To Introduce At 6 Months

Llc Vs Sole Proprietorship: Which Should You Choose

Many business owners, particularly freelancers or consultants, start out as sole proprietors because its easy. Minimal paperwork is required at the outset, and theres no big outlay of cost, which is attractive for new entrepreneurs, particularly those testing a business idea. Taxes are also simple for sole proprietors, since a separate business tax return need not be filed.

The rubber hits the road as your business starts growing. A sole proprietorship structure offers no legal protection for your personal assets, so you could end up personally bankrupt if your business doesnt succeed as planned, or faces an unexpected challenge. LLC owners, on the other hand, arent personally liable for business debts, so you get more protection in the event of a business bankruptcy or business lawsuit.

On top of this, LLCs offer tax flexibility. Most LLC owners stick with pass-through taxation, which is how sole proprietors are taxed. However, you can elect corporate tax status for your LLC if doing so will save you more money. All 50 states recognize the LLC structure to encourage small business growth. The best business structure for you will depend on many factors, and its best to consult a business lawyer before making this important decision. However, due to the combination of liability protection and tax flexibility, an LLC is often a great fit for a small business owner.

This article originally appeared on JustBusiness, a subsidiary of NerdWallet.

File Your Llcs Articles Of Organization

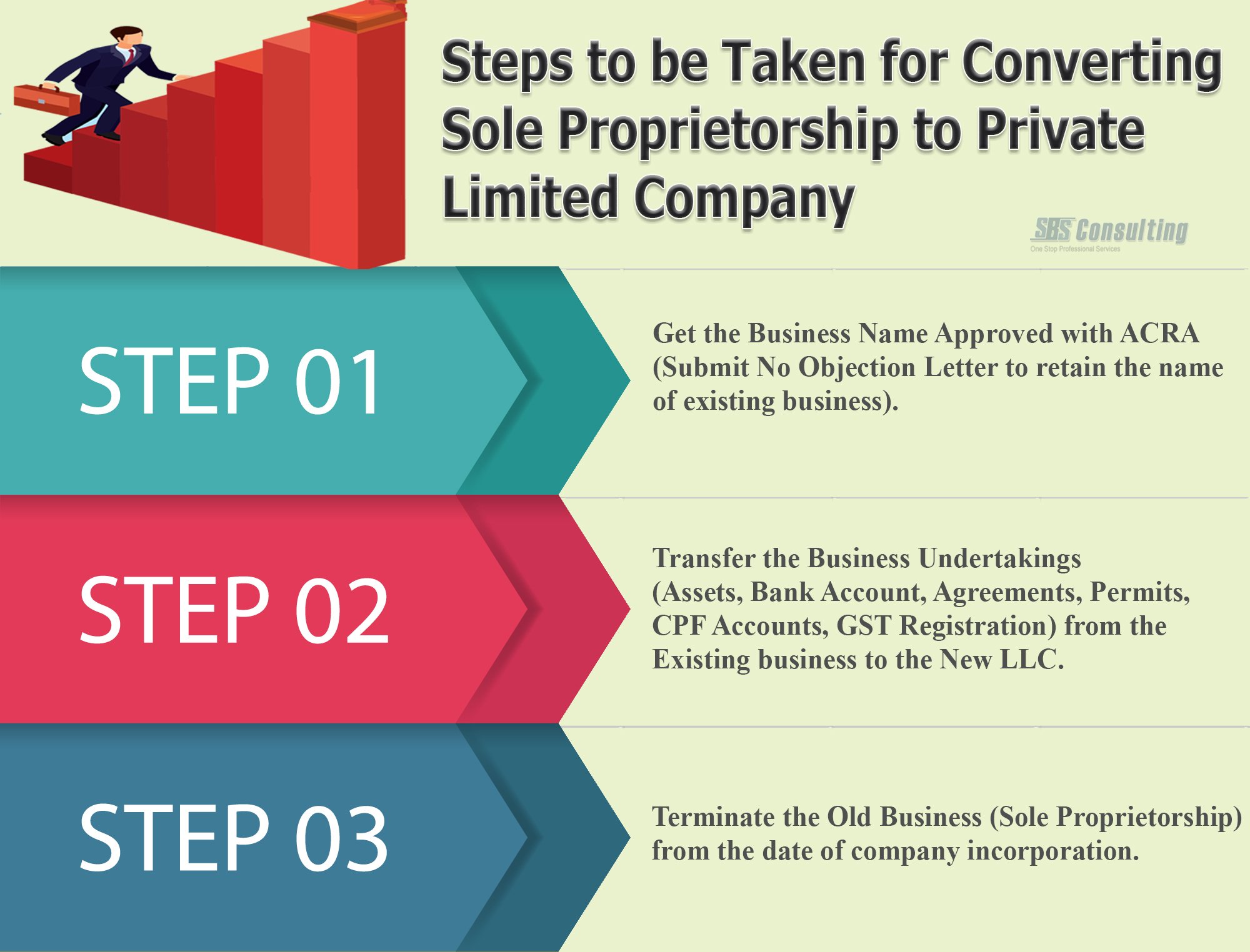

When you change from a sole proprietorship to an LLC, you must file an article of organization and register your business with your state.

An article of organization, also known as a , is a legal document that includes information about your new LLCs business name, its address, the names of its members, and your registered agent.

Also Check: How Much Does A Typical Solar System Cost

How To Change Your Sole Proprietorship To An Llc: 6 Easy Steps

Many small businesses get their start as a sole proprietorship. After all, its the default business structure. If youre a single business owner and never filed any official formation paperwork with the state, then youre operating as a sole proprietorship.

There comes a time when a sole proprietor wants to formalize the business. Perhaps you realized that your side hobby is now a legitimate and blossoming business. Perhaps you realized that operating as a sole proprietorship puts your personal savings and assets at risk should your business incur any debt or be sued. Or maybe you want to take on a new client who requires you to operate as an LLC or corporation.

No matter the reason, the bottom line is its affordable and relatively simple to create a Limited Liability Company . And, there wont be many changes in the way you operate your business. On the plus side, the LLC puts separation between your business and your personal assets and youll have more flexibility in how your business is taxed. You may even change your perception of your business and feel more motivation to see it grow.

If youre interested in forming an LLC, heres the general process. Note that specifics will vary by state, but these six steps will give you a general idea of what to expect.

File For An Ein If Necessary And Review Tax Requirements

For many sole proprietorships, obtaining an Employer Identification Number from the IRS is unnecessary. You are only required to get one if you hire employees or plan to open a retirement account.

However, securing an EIN is a step you should consider regardless of the requirement. If you plan on opening a business bank account, for instance, most banks prefer an EIN. Your EIN works as an identifier, much like a Social Security number.

If you do not have an EIN, you must use your Social Security number, which opens you up to potential fraud. Obtaining your EIN is also relatively simple. You can fill out the form through the IRS. This is a free service, and youll be able to use your EIN immediately.

Also Check: What’s Better Llc Or Sole Proprietorship

Is An Llc Always The Best Choice

Life is all about making choices and choosing to form an LLC can be a very important one. Asset protection consultants routinely market to business owners stating that an LLC is always a good idea, but I do not believe this to be true. Some entities are actually better suited for a sole proprietorship as the additional costs of an LLC do not provide any significant benefits over operating as a sole proprietor.

Also, understand that with the concept of an LLC providing liability protection against commercial acts of your business, a savvy attorney is going to try to find any loophole he can in your current setup to pierce the corporate veil and go after personal assets.

In addition, some courts may not look favorably upon sole member LLCs, and the question comes up in legal proceedings as to whose interests are you being protected against if technically, you are the only member of the LLC.

How To Register Your Business As A Sole Proprietor

A sole proprietor can act as an independent contractor , business owner or franchisee. Keep in mind that since you are self-employed, your paycheques do not have adequate deductions at the time of payment. Instead, you can expect to pay quarterly estimated tax payments and cover the difference or get a refund for bottlenecks or overruns during tax season. Sole proprietors are responsible for all debts. Sole proprietors are personally responsible for all obligations of the company, including responsibility for the employee`s actions in the workplace. Keep in mind that creditors can look for your personal assets to collect your company`s outstanding debts. Success and failure are the sole responsibility of the owner. Do you need state and federal business permits or licenses? Most likely, yes. The best way to know which licenses are relevant to your sole proprietorship is to use the CalGold database. This website is simply designed and guides you based on locations and businesses. In the state of California, whether the business is large or small, the business must apply for a general urban business license. Regulatory and professional licenses for a hairdresser, real estate agent, restaurant, and any type of business find regional, local, state, and federal information in the database. It`s always a good idea to contact your local chamber of commerce and ask them any questions you may have about your business.

Don’t Miss: Is An Ein Needed For A Sole Proprietorship

Benefits Of Sole Proprietorships

A sole prop is a common choice for new businesses and entrepreneurs because it offers the following advantages compared to LLCs:

- Simplicity. Its relatively easy and inexpensive to establish. If youre the only owner and employee performing your business activities, then youve already formed your own sole prop. Establishing other business structures, like an LLC, requires paperwork and processing.

- Income tax filing considerations. The owner and business are considered the same entity and generally will only have to file one federal income tax return and one state income tax return so income is only taxed once. Single-member LLCs could offer this same advantage If a second owner joins the businesses, the sole proprietorship will then be required to file partnership tax returns.

- Fewer guidelines. Sole props have fewer regulatory requirements than other business structures. LLCs require a formal registration process including a separate and unique business name and registering an agent to correspond on behalf of the company. Many states charge filing fees for LLCs.

What Is A Corporation

- A corporation is an independent legal entity that exists separately from the people who own, control and manage it.

- It does not dissolve when its owners die because it is considered a separate person.

- A corporation can enter into contracts, pay taxes, transact business, etc.

- The owners have limited liability.

- Contact an attorney or an accountant to determine if this structure works for you.

Recommended Reading: What Do Solar Panels Do For Your House

Types Of Businesses That Do Well As Sole Proprietorships

Any one-owner business where the lack of limited liability isnt a big deal is a great candidate for a sole proprietorship.

Beyond that, businesses that incur little to no debt will also work well as sole proprietorships. Here are a few other things to consider:

- Sole proprietorships are inexpensive. That makes it a great choice for any business that expects to earn a low income, at least at first. New small businesses or side businesses are both great candidates. And, if your business ends up being successful, you can always switch to an LLC or corporation later.

- Most sole proprietorships are small operations that dont have employees. Theres no law that this needs to be the case, though, and some sole proprietors do own large companies that have employees. However, if youre ready to hire employees, its best to form a business entity like an LLC or a corporation. That way the entity, rather than you, will be the employer. This can help you avoid being held personally liable for your employees actions.

- Its easier to borrow money as an LLC. If you need to borrow a lot of money to get your business going, you might want to think about getting the limited liability status that comes with an LLC.

Sole Proprietorship Vs Llc How To Choose Between Two

For entrepreneurs, it is essential to decide which kind of business they want to start. Perhaps this is why they find themselves in so much of a dilemma, especially when it comes to the sole proprietorship vs. LLC. Both these businesses are perfect for small and medium-scale businesses.

However, when we are talking about the corporate level, these two business structures are very different from each other on so many grounds. And thats the reason why its essential to know about these business entities in detail.

On this page, youll learn about the following:

You May Like: How To Change From Sole Proprietorship To Corporation

What Are Examples Of A Sole Proprietorship

Sole proprietors are anyone engaging in independent business activity, meaning they generate profit for themselves rather than receive a salary as an employee for another business. Common examples of sole proprietors are freelancers, independent contractors, part-time gig economy workers, small business owners, etc.

Duration Of A Sole Proprietorship

The “duration of a business” is the measure of the business’ ability to operate even upon the death, retirement, or other incapacity of the owner. The business’ duration depends heavily on the form of business organization selected. A sole proprietorship usually terminates automatically upon the death or incapacitation of the owner/proprietor.

Recommended Reading: Is Getting Solar Panels A Good Idea

Differences Between Llcs And Sole Proprietorships

Now its time to compare the differences between LLCs and sole proprietorships. There are more differences between these business structures than similarities. Rather than just listing bullet points, well take a closer look at various categories you should evaluate. This will make it much easier for you to decide which one is right for your business.

Limited Liability Company Versus A Sole Proprietorship

One of the key benefits of an LLC versus the sole proprietorship is that a members liability is limited to the amount of their investment in the LLC. Therefore, a member is not personally liable for the debts of the LLC. A sole proprietor would be liable for the debts incurred by the business. This liability, however, is dependent upon following the rules associated with an LLC. If you treat the LLC the way you would a sole proprietorship, you lose the liability protections.

For example, creditors can go after a sole proprietors home, car and other personal property to satisfy debts, while an LLC that is properly maintained can protect the owners personal assets.

- Difficult to obtain financing in the business name

- Harder to build business credit

Don’t Miss: Where Is Pine Sol Made

What Is Sole Proprietorship

As the name implies, it can be understood that in a sole proprietorship, the owner will have unlimited control on every aspect of the venture, be it the finances, legal matters, taxations, and so on. This kind of business model is unincorporated, which means that the company and the owner wont be two separate identities. Rather, all the business requirements will be fulfilled under the name of the sole proprietor.

Change Your Business Name

If you want your business to legally be called a name other than your own, you will have to establish what is known as a DBA. In a sole proprietorship, the sole owner is legally required to use their personal name as their domain name unless they follow the process to change the name.

To change the name of the sole proprietorship to a brand name, you must file a doing-business-as application, which gives you the option of using a different name. You must file the doing-business-as application with the state, often through the secretary of state’s office, though the specific agency can vary from state to state. A DBA application can cost between $5 and $100 depending on the state.

When choosing a name, you must make sure it doesn’t already belong to someone else. You also don’t want to pick a name that is too similar to someone else’s. To check whether the name you want is available, visit the U.S. Patent and Trademark Office site or search your state’s DBA registry.

Don’t Miss: How Much Solar Energy Do I Need For My Home

Sole Proprietorship Vs Llc: Which Should You Choose

If youre starting a business, you may be wondering what type of business structure you should set up. Learn about the two most popular options for small business owners: sole proprietorship and LLC.

By: Jamie Johnson, Contributor

Sole proprietorships and LLCs are the two most common business structures favored by small business owners. But which one is right for you?

When youre starting a new business, its important to set up the right business structure. And most small business owners favor setting up either a sole proprietorship or an LLC. But how do you know which to choose?