How To Qualify For A Solo 401k

Michael Atias, director of OTA Tax Pros, explains how investors can generate self-employed income and become qualified for the Solo 401k plan.

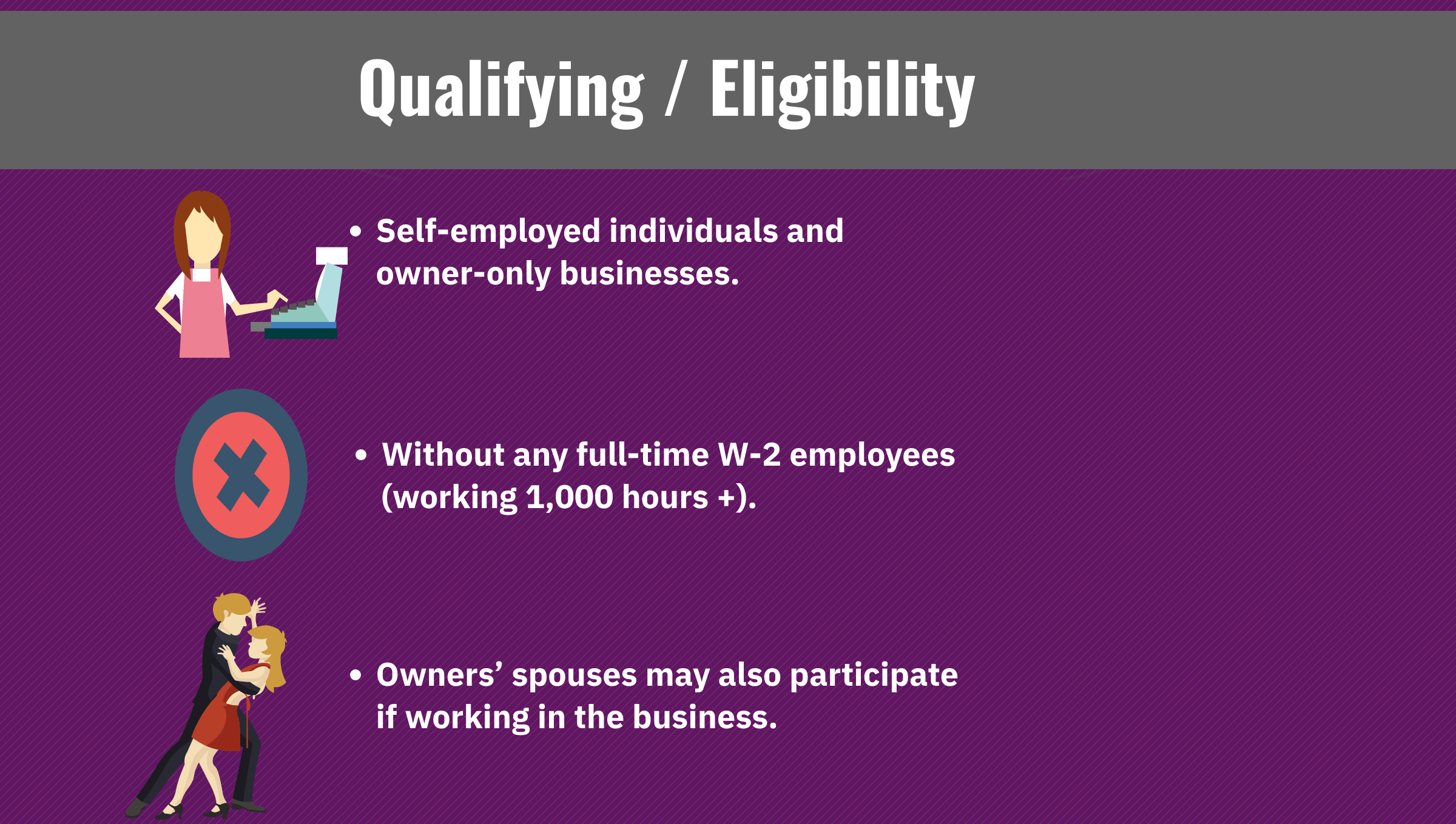

Absence of Full-Time Employees

Solo 401k plans, unlike regular 401k plans, can be implemented only by self-employed persons or small-business owners who have no other full-time workers.

An exception exists if the owners spouse is a full-time employee. In that case, the business owner and spouse are technically considered owner-employees rather than employees. In addition to the full-time employee restriction, self-employed owners or operators of a business cannot have any full-time employees working at any other business owned by them or their spouse.

Usually, when a business sets up a retirement plan, it has to include in the plan any full-time employees 21 and older , or part-time employees who work more than 1,000 hours a year. However, companies can employ part-time workers and independent contractors and still be eligible to establish Solo 401k plans.

Solo 401k plan rules exclude from coverage the following types of employees:

- Employees under 21 years of age

- Employees who work less than 1,000 hours per year

- Union employees

Who Qualifies For A Solo 401 Plan

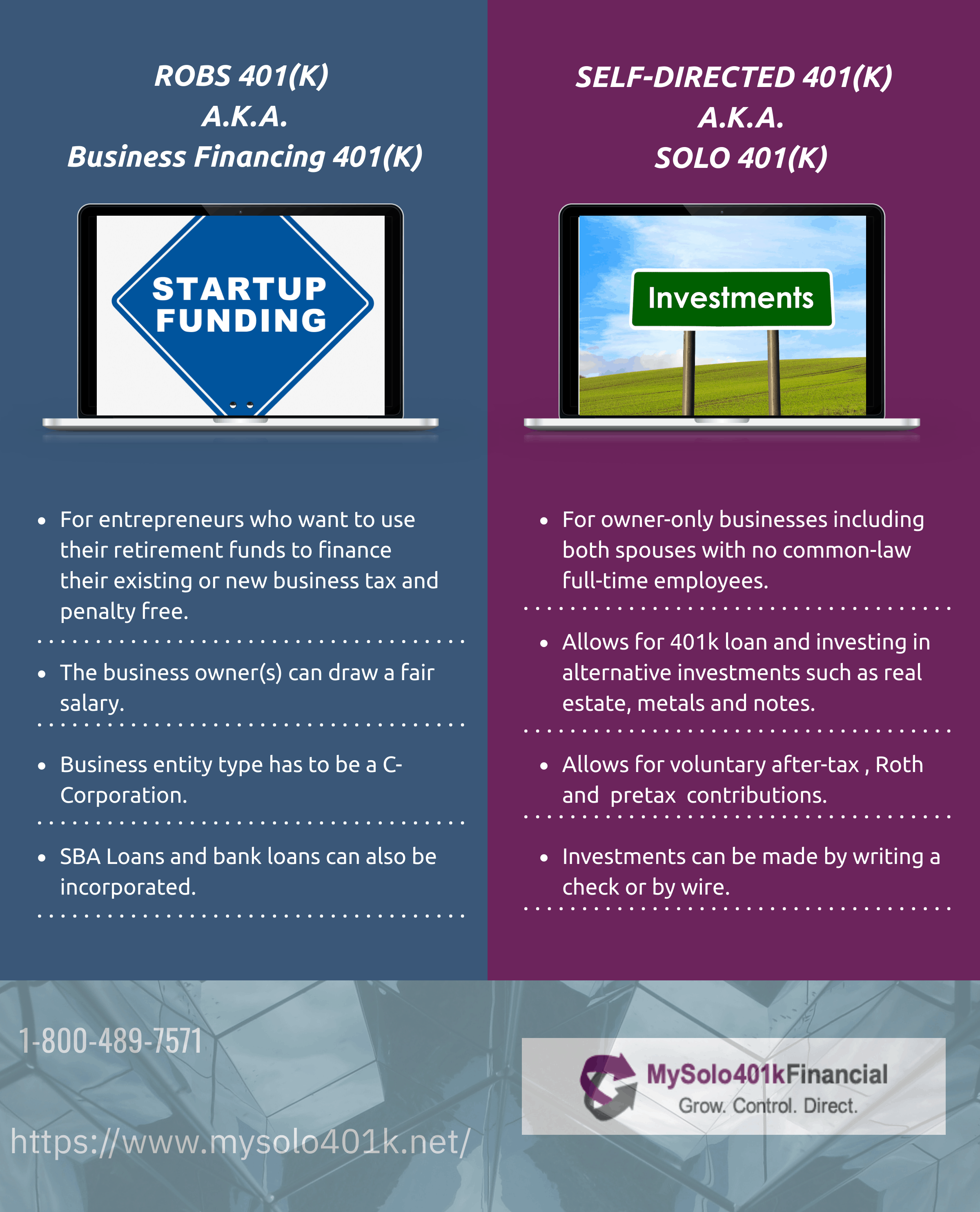

A Solo 401 plan is an employer sponsored retirement savings plan that is designed specifically for owner-only businesses. The lack of non-owner employees greatly simplifies the administration of the plan, and is a key part of what makes the Safeguard Solo 401 a great self-directed investing platform.

Many kinds of businesses can act as a plan sponsor, including those established as a sole proprietorship, LLC, partnership, or corporation. The enterprise needs to be engaging in a trade or business, with the intent to generate a profit, and have the potential to make future contributions to the plan.

Examples include:

- Professional service providers such as Attorneys, CPAs, Architects and Medical Practitioners

- Financial Advisors & CFPs

- Internet based sales or services businesses

- Physical Fitness Trainers, Coaches or Therapists

- Child or Adult Care Providers

- And many, many more.

Only active business endeavors such a providing a product or service are eligible. Passive earnings such as rental income or K-1 distributions are not viewed as wages, compensation, or self-employment income, and therefore cannot be used to make 401 contributions.

Solo And 401 Rules When You Have Employees And Multiple Businesses

A 401 is a great benefit normally associated with large companies where the employee makes contributions and the employer offers a match. The contribution limits are high and can allow for significant tax deferral on the income you earn each year. What a lot of people may not know is that you dont have to be a large company to have a 401 plan. In fact, you can be the only employee in your own business and have a retirement plan.

If it is just you in your business, your company can start a retirement plan known as a solo 401. The solo 401 allows you to adopt a retirement plan and make personal as well as company contributions to the plan for yourself and any of the owners of the company.

- You must have a business generating ordinary income to make to have a 401 plan.

- You can personally contribute up to $19,000 to the plan.

- Your company can contribute up to 25% of the income it pays you.

- For 2019 the total max 401 contribution is $56,000.

The 401 plan can be self-directed, which means you can invest the funds in almost any opportunity you find . The 401 also has a loan provision allowing you to borrow funds from the plan and use them for anything you want.

What If I have Multiple Businesses With Only Employees in Some?

Controlled Group Rules

| 100% |

Read Also: Can You Clean Solar Panels With A Pressure Washer

Solo 401k Contribution Rules

If youre under the age of 50, you can make a max contribution in the amount of $18,000. This amount can be made before or after tax.

On the profit sharing side, your business can also make a 25% profit sharing contribution up to $36,000. That comes out to a combined max of $54,000.

Note: If youre over the age of 50, the contributions are the same, except you can contribute $6,000 extra.

Income From The Below Qualifies

- Sole Proprietorship

- C Corporation

- S Corporation

- Limited Partnership

If you have income in some places such as rental income, that is passive income, you might need to work with your CPA, business, or personal pay structure to move some of your compensation to Earned income. Below is an example K1, where box 1 is where earned income typically goes. The three types of income are earned income passive income, and portfolio income

Recommended Reading: How To Use The Solo Stove

Mega Backdoor Roth Solo 401k Ban Question:

Since the Build Back Better bill did not pass in 2021, yes the solo 401k participant can still make voluntary after-tax solo 401k contributions for both 2021 and 2022 and subsequently convert the contributions to the Roth IRA or the Roth solo 401k. Since congress was not able to pass the BBB in 2021 which would have banned both the backdoor and the mega backdoor starting in 2022, if the bill is passed in 2022 it would be effective at the earliest starting in 2023 as this is how retirement regulation generally works .

Solo 401 Plan Design Options

Because solo 401 plans cover few employees and dont require much administration, 401 providers typically charge low fees to administer them. Thats the good news. The bad news is that solo 401 providers often fail to make popular 401 plan design options like participant loans or in-service distributions available to business owners to maximize their profit from these plans.

They rarely make voluntary after-tax contributions available either. These contributions are uncommon today because they make annual nondiscrimination testing difficult to impossible to pass. However, this shortcoming is moot with solo 401 plans because they dont require annual testing.

So why should you want voluntary after-tax contributions in your solo 401 plan? They make mega back door Roth IRA contributions possible. Under this tax strategy, you make voluntary after-tax contributions to your 401 account up to the 415 limit – and then immediately roll them to a Roth IRA where their investment earnings can grow tax-free. For the strategy to work, your solo 401 plan must also allow the in-service distribution of voluntary contributions at any time.

Recommended Reading: How Does A Residential Solar System Work

Closing Down The Solo 401kquestion

Specific IRS rules apply when closing down a retirement plan including a solo 401k plan. When you are no longer self-employed or decide to terminate the plan, the plan funds can be transferred to the respective IRAs. We would prepare the final Form 1099-Rs and Form 5500-EZ to formally close the solo 401k plan with the government. The closure of the solo 401k plan is covered in our annual fee and no additional fees apply.

I Qualify Is The Self

Hold up there. Check if the Solo 401 is something you want to do. The Solo 401 is very powerful but can be a more complicated product to administer for our customers compared to a Self-Directed IRA, which is simple and straightforward.

- Are you trying to save over $6,000 per year in tax-advantaged retirement dollars?

- Will you have consistently have sufficient self-employed income each year to meet your contribution goals?

- Are you trying to take out loans from your retirement account?

- Are you trying to save both Traditional and Roth Dollars, or do after-tax conversions?

- Are you going to be doing matching or profit-sharing contributions? Can you handle calculating these contributions yourself or with a trusted CPA?

If you answered no to all or most of these questions, it might be best to stick with the IRA. You can read more about the Self-Directed IRA vs. the Self-Directed Solo 401 comparison here.

If it made more sense, a traditional IRA can have much more steady contributions each year as you will not have to worry about your Self Employment Income, hiring plans, or business structure.

Also Check: How Much Electricity Does A 4kw Solar System Produce

How Much Does It Cost To Open A Solo 401

There is no cost to open a 401 account but watch out for those fees later on. While you’re researching your options, check for account maintenance fees, transaction fees and commissions, mutual fund expense ratios, and sales loads.

A fractionally higher fee can mean a big hit to a retirement portfolio. If you make the right choices you can minimize the fees you pay.

Solo 401k Minimum Income Requirements

There is no minimum income required in order to qualify for a Solo401k. As long as you have a self-employed business activity with intention to generate income, you are qualified to have a Solo401k plan. The business activity can be full-time or part-time. Also, the contribution is at your discretion. If you find yourself with limited cash flow one year, you can decide to contribute as little as you want, or even suspend contribution for that year. There will be no tax or penalty for not contributing to the plan. However, in order for your plan to retain its Qualified-Status substantial contributions must be made occasionally.

Don’t Miss: Is It Worth Getting A Solar Battery

Profit Sharing Contribution Question:

Yes, provided you each spouse separately has the necessary net self-employment income to satisfy said contribution amounts, as solo 401k contributions are based on each participants separate net self-employment income. For example, if the self-employed business is an LLC that is taxed as as sole proprietorship, both spouses will need to file a separate Schedule C and their solo 401k contributions will be based on their respective Schedule C net self-employment income figure, so line 31 of the Schedule C.

Receiving Disability Retirement Question:

I retired early from a government job through a disability retirement. The plan allows me to work part-time as long as I dont exceed a certain limit. My question is: Can I open a solo 401-K when I am receiving retirement income? I will be 60 years old next month.

ANSWER:

Good question and the answer is yes you can open a solo 401k plan from a solo 401k qualifying perspective, regardless if you are receiving disability income, as long as you perform at minimum part-time self-employment activity and do not have any full-time W-2 employees working under your self-employed business.

You May Like: How To Apply For Federal Solar Tax Credit

Contribute To Solo 401k And Day

Your wifes ability to contribute to a solo 401 depends on the self employment income that she receives from the partnership. Specifically, in order to determine how much she could contribute to the solo 401 she would take the amount reported on line 14 of her K-1 and reduce it by one half of the self-employment tax. Of that number, she could contribute for 2021: up to $26,000 as an employee contribution plan sponsored by her daytime employer) and a profit-sharing contribution to the solo 401 equal to 20% of that same number provided that her overall contribution to the solo 401 cannot exceed $64,500 for 2021. For 2022, the overall limit is $67,500.

What Is The Maximum Contribution To A Solo 401k

Contribution limits to a Solo 401k are very high. For 2021, the max is $58,000 and $64,500 if you are 50 years old or older. This is up from $57,000 and $63,500 in 2020. This limit is per participant. So if your spouse is earning money from your small business that means they can also contribute up to the same amount into the Solo 401k. If you are both 50 years old or older, this means that combined contributions could be up to $129,000 per year!

Solo 401k contributions are much higher than all other retirement plans. Traditional and Roth IRA limits are just $6,000. The catch up contribution is $1,000 more if you are 50 years old or older. The IRS typically increases contribution limits every couple years as a cost of living increase to keep up with inflation. Therefore, its a fair bet to expect contribution limits to continue going up over time.

Read Also: What Is A Sole Proprietorship Vs Llc

Contributions And Allocations Are Limited

Contributions to a 401 plan must not exceed certain limits described in the Internal Revenue Code. The limits apply to the total amount of employer contributions, employee elective deferrals and forfeitures credited to the participant’s account during the year. See 401 and Profit-Sharing Plan Contribution Limits.

Minimum Vesting Standard Must Be Met

A 401 plan must satisfy certain requirements regarding when benefits vest. To “vest” means to acquire ownership. The vested percentage is the participant’s percentage of ownership in his or her account. All participants must be fully vested in their 401 elective deferrals. A traditional 401 plan may require completion of a specific number of years of service for vesting in employer discretionary or matching contributions. For example, a plan may require 2 years of service for a 20% vested interest in employer contributions and additional years of service for increases in the vested percentage. Matching contributions must vest at least as rapidly as a 6-year graded vesting schedule. A safe harbor and SIMPLE 401 plan must provide for 100% vesting in employer and employee contributions at all times.

Read Also: How To Switch From Sole Proprietor To Llc

Other Financial Benefits Of A Solo 401

The solo 401 can be an excellent choice for those with a side gig as well, especially if theyre already able to live comfortably on their main salary. With the solo 401 you can go above the usual limits of a 401.

While you may contribute to multiple 401 accounts, your total employee contribution to all types of 401s may not exceed the annual maximum contribution, that is, $19,500 in 2020 and 2021.

But the solo 401 can be valuable even if you already have a 401 plan and even if youve maxed out that other plan for a given year. Thats because you can still make an employer contribution, allowing you to exceed the smaller employee-only contribution amount. So the solo 401 allows you to save more with the employer contribution, reducing your business taxes.

Another benefit of the solo 401 is that it doesnt prevent you from taking advantage of other retirement plans such as the IRA. You can still contribute up to the annual maximum there. If youre an individual looking to set up a traditional IRA or Roth IRA, then youll want to look at the benefits of those plans.

Like the typical 401 plan, the solo 401 also allows you to take out a loan against your account. loan.)

While I generally encourage clients to avoid that strategy, it can come in handy at times, Conroy says.

Turn Your House Into Cash Flow

Are you looking to dip your toe into real estate ? Start by renting out a room in your house on Airbnb. Its a great way to earn some extra cash flow and a short term rental business may qualify as earned income. As we travel more, home-sharing is a more attractive option. The prices are more competitive than a hotel, and you get a local guide to share the experience with. If you own rental properties personally, doing some short-term rentals on Airbnb may be a great way to generate some income and qualify for the Solo 401k plan.

Recommended Reading: How To Use Solar Energy At Home

The Modern Small Business Owner Is Lean And Efficient

While employment offered stability for factory workers and factory owners in the Industrial Era, employment has many disadvantages in the modern Information Era.

Disadvantages of employment to the worker now include:

- Employment is becoming harder and harder to find

- Over 70% of college graduates today will not work in their field of study

- Employees get less tax deductions

- Employees usually have their retirement money locked up in the stock market, leaving their financial future at high risk

- Employees in the Information Era are less likely to have career stability because their employers are less lean and efficient than modern small businesses

Disadvantages of employment to the business owner now include:

- Its harder to attract great staff because with employment more money goes to taxes and less goes to the staffs take-home paycheck

- Its nearly impossible to provide powerful retirement and investment tools to employees

- Its more difficult to compete with lean and efficient companies and respond to changes in the marketplace with employees

Walk Dogs For Extra Cash

Turn your love for animals into a stream of income! Services like WagWalking.com and Rover.com will match you with pets and pet owners. Each company claims you can earn an extra $1,000 per month working for their service. What would an extra $12,000 per year do for you financially? Remember, the Solo 401k allows you to contribute up to 100% of your net compensation tax-deductible. Thats at least $12k/year you can put toward your retirement savings.

Read Also: Do Solar Screens Save Money

Vanguard Vs Fidelity 401k

We have many clients who are comparing a Vanguard plan to a solo 401k plan offered by Fidelity. The truth is we are fans of both plans.

We have contacts at both companies and are familiar with both plans. The reality is that the business owner needs to decide which company they would rather work with. It usually comes down to which one you currently have accounts with.

It might make more sense to you to open up an account with a company that you are already doing business with. That way you can use their app to consolidate your financial holdings.