Prohibited Transactions And Self

While you can invest in virtually any asset class through your solo 401 apart from collectibles, the one thing you cant do with your solo 401 investments is self-deal.

What is self-dealing? Let me put it to you this way: if your solo 401 is engaging in a transaction with you , your ancestral or lineal descendent, or a business entity controlled by you or one of these family members, youre probably self-dealing through your solo 401.

These kinds of transactions are prohibited by the rules governing solo 401 plans, and you will be subject to taxes and penalties.

Who Can Have A Solo 401 Plan

According to Allec, there are three categories of people who can have solo 401 plans:

Rules Change Regarding Offering Solo 401k Plan To Par

QUESTION 5: Have the rules changed for 2020 regarding whether I can still fund my solo 401k if I have two part-time employees that work less than 1000 hrs/year, but more than 500 hrs/year? Would I have to open up retirement accounts for them?

ANSWER: In short yes resulting from the SECURE Act, but it would be for those part-time employees who satisfy the new rule by 2024. Effective for tax year 2021 , solo 401k plans will need to be offered to part-time employees who have three consecutive 12-month periods of 500 hours of service and who satisfy the plans minimum age requirement. Hours of service during 12-month periods beginning before January 1, 2021, are not taken into account for this rule. We are waiting for the IRS to release more guidance on this new rule in 2020. See Section 112 of the ACT for more information.

Last Weeks Most Popular Solo 401k FAQs

Read Also: Can Solar Panels Work On Cloudy Days

Potential Benefit Of The Roth Individual : Higher Contribution Limits

In 2020 you can annually contribute up to $19,500 and up to $26,000 if youre 50 or over through salary deferral. Plus, you can contribute a profit-sharing portion of your salary. In 2020 the limit from both sources is $57,000 .

In 2021 you can annually contribute up to $19,500 and up to $26,000 if youre 50 or over through salary deferral. Plus, you can contribute a profit-sharing portion of your salary. In 2021 the limit from both sources is $58,000 .

Bankruptcy & Creditor Protection For Solo 401k Plan

QUESTION 4: I am trying to better understand the protections of the solo 401k. I believe it qualifies for unlimited bankruptcy protection, but does it also have unlimited lawsuit protection under ERISA ?

ANSWER:

- Bankruptcy: Solo 401K plans have creditor protection under the federal bankruptcy rules.

- As far as protection from non bankruptcy creditors, the protection falls at the state level. While solo 401K plans are not covered by the federal creditor protection rules of ERISA, they are generally protected under most state laws subject to certain carve outs .

Also Check: Do It Yourself Solar Water Heater

What Are The Deadlines For Opening And Making Contributions To A Solo 401

The deadline to both open and contribute to a Solo 401 is now the applicable tax-filing deadline of the taxpayer, including extensions, thanks to the SECURE Act passed in late 2019. This means that, depending on the business entity, a Solo 401 could be opened as late as September or October of the following year for prior year contributions, as is the case for .

Importantly, if you open a Solo 401 in the following calendar year, but still plan to make prior year contributions, please consult your accountant. The SECURE Act extended the establishment deadline to open a Solo 401, but the IRS has not changed its guidance that the plan participant must make his/her salary deferral election by the last day of the calendar year. In other words, to make salary deferrals that first year, the plan needs to be in existence by December 31st! The good news is that the same rule does not apply to profit-sharing contributions, which can still be made the following calendar year.

What Is A Solo 401

A solo 401 is a type of retirement savings account for self-employed individuals, or for employers with no employees besides themselves and their spouses.

To be eligible to open a solo 401, you need to claim some self-employment income on your tax return. It’s important to keep in mind that self-employment doesn’t need to be your only source of income. For example, if you work a full-time job for an employer and do some consulting work on the side, you can use a solo 401 to set aside some of that extra income.

The only real requirement, other than making self-employment income, is not having any full-time employees other than yourself and your spouse. If you operate a small business with part-time workers , you can still open a solo 401 account.

Don’t Miss: How Many Solar Panels To Run A Freezer

How A Solo 401 Works

Solo 401s are available only to self-employed workers with no employees, with an exception for business owners who employ their spouses. To open one of these accounts, you must have an employer identification number , which you can get from the U.S. Internal Revenue Service .

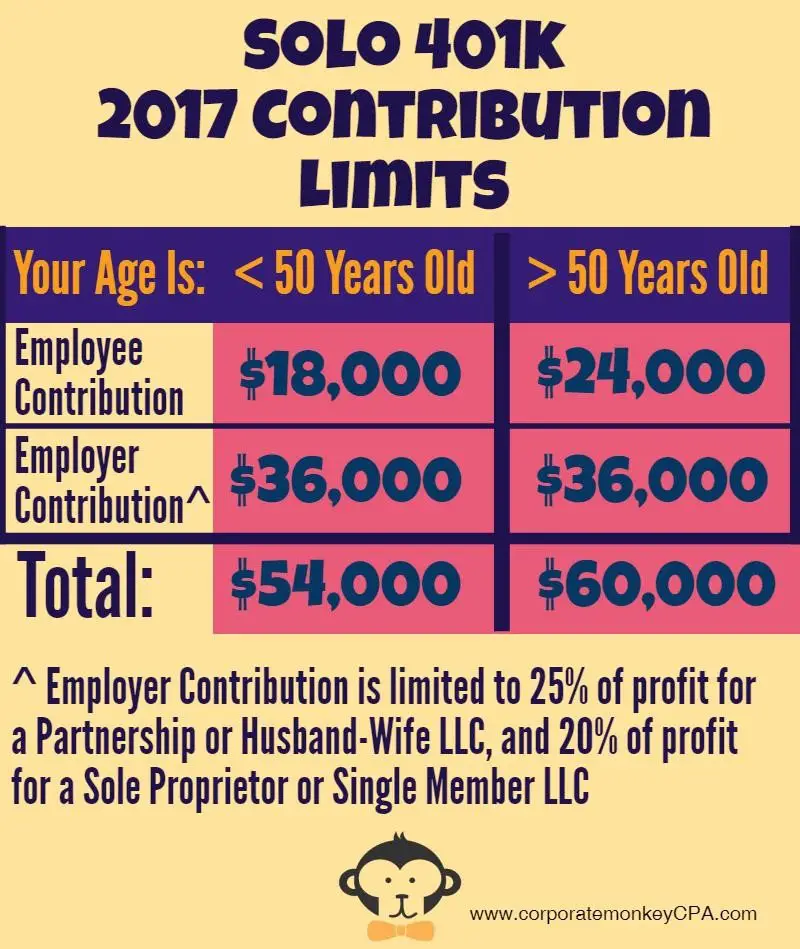

You’re allowed to make two types of contribution to your solo 401: an employee contribution and an employer contribution. Your employee contribution limit is the same as the 401 contribution limit for any traditionally employed worker — $19,500 in 2021, or $26,000 if you’re 50 or older. These rates increase in 2022 to $20,500, or $27,000 if you’re 50 or older.

If you’d like to contribute more than this, you can make additional contributions as an employer, but this calculation is a little more complicated. You may contribute up to 25% of your net self-employment income for the year. That is all the money you’ve earned from your business minus any business expenses, half of your self-employment taxes, and the money you contributed to your solo 401 as an employee contribution.

Only the first $290,000 in net self-employment income counts for the year, and the total amount you may contribute to your solo 401 as employee and employer in 2021 is $58,000, or $64,500 if you’re 50 or older. In 2022, those increase to $61,000, or $67,500 if you’re 50 or older.

What Is A Solo 401 Plan And How Does It Work

A solo 401 plan, also called a one-participant 401 or a solo K, offers self-employed people an efficient way to save for retirement. There are no age or income restrictions, but participants must be business owners with no employees .

The solo K has very high and flexible contribution limits, typically allowing more contributions than SEPs, traditional IRAs and Roth IRAs or SIMPLEs, says Joe Conroy, CFP and founder of Harford Retirement Planners in Bel Air, Maryland.

One key difference between the solo 401 and other self-employed retirement plans is that employees can contribute all of their salary up to the annual maximum contribution. Theyre not limited to 25 percent of their salary, as in some other plans. This feature can allow them to minimize taxes, though this contribution doesnt help them avoid the self-employment tax.

In other respects, the solo 401 operates like any other 401 plan, whether its a traditional 401 or a Roth 401. If you set up your solo 401 to take tax-deductible contributions, it will operate like a traditional 401, allowing you to contribute pre-tax money and get a break on this years taxes. On the other hand, if you opt for a Roth, youll make after-tax contributions, but will benefit from the tax-free withdrawals in retirement.

If you think tax rates will be higher in the future, like I do, then a Roth can be a very valuable account to reduce your future tax burden in retirement, Conroy says.

You May Like: Is Pine Sol Safe For Vinyl Plank Flooring

Looking To Reduce Excessive 401k Fees

Sign up for Personal Capital for free and use their Portfolio Fee Analyzer tool. The tool will show you how much in fees youre paying. I had no idea I was paying $1,700 in 401 fees four years ago until I ran the tool.

Now Im only paying about $300 a year in fees. Excessive fees is one of the biggest drags on making more money and retiring earlier.

You can also use Personal Capital to track your net worth, track your cash flow, and optimize your investments.

For more nuanced personal finance content, join 100,000+ others and sign up for the free Financial Samurai newsletter. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009.

Filed Under: Entrepreneurship

I started Financial Samurai in 2009 to help people achieve financial freedom sooner, rather than later. Financial Samurai is now one of the largest independently run personal finance sites with 1 million visitors a month.

I spent 13 years working at Goldman Sachs and Credit Suisse. In 1999, I earned my BA from William & Mary and in 2006, I received my MBA from UC Berkeley.

In 2012, I left banking after negotiating a severance package worth over five years of living expenses. Today, I enjoy being a stay-at-home dad to two young children. In June 2022, Ill be publishing a new book entitled, Buy This, Not That Spending Your Way To Financial Freedom.

Current Recommendations:

You May Like: What Age Can You Take Out 401k

How Do You Qualify For A Solo 401

The IRS rules say that you cannot have a solo 401 if your business has employees other than the owner, their spouse and/or a business partner. The partners in a partnership are generally considered to be self-employed.

In order to be eligible to contribute to a solo 401:

- You must engage in some sort of self-employment activity that generates income for you.

- Your business cannot have employees other than the owner and their spouse.

You May Like: Does Solar Really Pay For Itself

Is Solo 401 Tax Deductible Solo 401 Tax Advantages

The nice thing about a solo 401 is you get to pick your tax advantage: You can opt for the traditional 401, under which contributions reduce your income in the year they are made. In that case, distributions in retirement will be taxed as ordinary income. The alternative is the Roth solo 401, which offers no initial tax break but allows you to take distributions in retirement tax-free.

In general, a Roth is a better option if you expect your income to be higher in retirement. If you think your income will go down in retirement, opt for the tax break today with a traditional 401.

Because of these tax perks, the IRS has pretty strict rules about when you can tap the money you put into either type of account: With few exceptions, youll pay taxes and penalties on any distributions before age 59 ½.

»Want more info? Heres our in-depth comparison of Roth and traditional 401s

The Final Word On Solo 401k Contributions

If youre self-employed, a solo 401k may be a great solution to your retirement savings account needs. With contribution limits of $57,000 in 2020 and $58,000 in 2021, you can potentially stash more away than with other self-employed retirement plans.

Remember that your contribution limits apply by person, not plan. So if youre also contributing to an employer 401k plan, the amount you can contribute as an employee to your solo 401k is affected.

You May Like: How To Run Your House On Solar Power

Next Steps To Consider

Keep in mind that investing involves risk. The value of your investment will fluctuate over time, and you may gain or lose money.

The change in the RMD age requirement from 70½ to 72 only applies to individuals who turn 70½ on or after January 1, 2020. Please speak with your tax advisor regarding the impact of this change on future RMDs.

Fidelity does not provide legal or tax advice. The information herein is general and educational in nature and should not be considered legal or tax advice. Tax laws and regulations are complex and subject to change, which can materially impact investment results. Fidelity cannot guarantee that the information herein is accurate, complete, or timely. Fidelity makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information. Consult an attorney or tax professional regarding your specific situation.

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

What Are The Pros And Cons Of A Solo 401

One of the biggest benefits of opening a solo 401 is that it comes with some of the highest contribution limits. Since you can make contributions as an employer and an employee, you can maximize your contributions.

And while you do have to be self-employed to open a Solo 401, it doesn’t have to be your only source of income. If you have a full-time job and consult on the side, you’re eligible to open a solo 401.

You can also choose from a much broader range of assets than you can with a traditional employer-sponsored 401. For instance, you can invest in index funds, mutual funds, exchange-traded funds , stocks, and bonds.

However, there are some downsides you should consider. Like most retirement plans, you’ll get hit with taxes and fees if you withdraw the funds before the age of 59½.

“One disadvantage is that you must have a triggering event, usually retirement or ending employment, to take a distribution,” says deMauriac.

And you’re responsible for managing the plan and handling the paperwork on your own.

|

Pros |

|

|

|

Read Also: Can You Mix Pine Sol And Fabuloso

What Is A Brokerage Firm

A brokerage firm is a company that helps buyers and sellers complete financial transactions. They earn money based on fees, or in some cases commissions, involved with the transaction. In many cases, special licensing is required to buy and sell financial products, which is where brokers are necessary and helpful. You might also find individual brokers who work independently, but typically brokers are connected to a larger team that can collaborate to help with transactions.

The 2021 Solo 401k Establishment/ Adoption Deadline Is Fast Approaching

The deadline to setup a solo 401k plan for 2021 is fast approaching. The good news is that as long as the solo 401k establishment documents is signed by 12/31/2021 business owners will be able to fund both the employee and employer contributions for tax year 2021 in 2022 by their business tax return due date including the business tax return extension.

Read Also: Can I Have An Llc And A Sole Proprietorship

Who Does A Solo 401 Make Sense For

A Solo 401 is well suited for those with self-employment income, stable cash flow, no employees , and no plans to hire any in the foreseeable future. While having self-employment income and no employees are requirements, ensuring that there is sufficient cash flow to make contributions is also important.

The plan can also be a fit for those who are self-employed, but only on a part-time basis, and still earn W-2 income from a corporate employer. As a result, contributions can be made to both a Solo 401 and company 401 plan as long as each employer is substantially unrelated. There are also contribution limits that apply.

Calculations For An S Corporation C Corporation Or An Llc Taxed As A Corporation

The annual Solo 401k contribution consists of a salary deferral contribution and a profit sharing contribution. The total allowable contribution adds these 2 parts together to get to the maximum Solo 401k contribution limit. The 2021 Solo 401k contribution limit is $58,000 and $64,500 if age 50 or older.

Calculations for an S corporation and C corporation are based on the W-2 salary that is paid to the business owner. For example, S corporation K-1 distributions are not included when making the contribution limit calculation. Also, the calculation is only based on W-2 wages for an LLC which pays W-2 wages to the business owner.

Don’t Miss: Can You Install Solar Panels On Tile Roof

How Does The Money Grow In A Self

Bergman says thatdepending on the provider you choose to house your plan, you can invest in almost anything. However, if you select a financial institution to oversee your plan, you must invest in their products. Otherwise, opportunities remain limitless. Go the traditional route with stocks or mutual funds, or turn to alternative investments like real estate, gold or cryptocurrencies.

What To Expect When Working With A Broker

Not all brokerage firms are created equal. You can find some that take a hands on approach to managing your finances and others that will step back and allow you to do-it-yourself if that is your preference. You should expect that all brokers will charge a fee or commission. Some brokers might provide additional tools or resources, such as a mobile app or financial educational trading, that could make them a preferable option.

We compared some of the top providers to help you narrow down your list of potential options. There are lots of excellent brokerage firms out there with various pros and cons,

Don’t Miss: How Large Of A Solar System Do I Need