Obtain A Tax Id Number For Your Small Business

Home » Learn » Obtain a Tax ID Number for your Small Business | EIN Number Application

Even small businesses need Employer Identification Numbers, and thats true even if the business doesnt have employees. EIN Numbers and Federal Tax ID Numbers are one in the same: Theyre a unique number used to identify your business for the federal government and financial institutions. Heres what you need to know about getting one.

How Sole Proprietors Are Taxed

Taxes are simple when youre a sole proprietor in California because you and your business are one and the same for tax purposes. You dont need to pay taxes or file tax returns separately for your California sole proprietorship. California taxes you, the owner, on the income you earn from your business, instead.

Instead, you report the income that you earn, or the losses that you incur, on your personal tax return .

If your business earns a profit, youll add that money to any other income that you have. Other income can be interest income or your spouses income if youre married and file jointly. Youll get your total income that will be taxed at your personal tax rate.

If you incur a loss, you can use it to offset income from other sources.

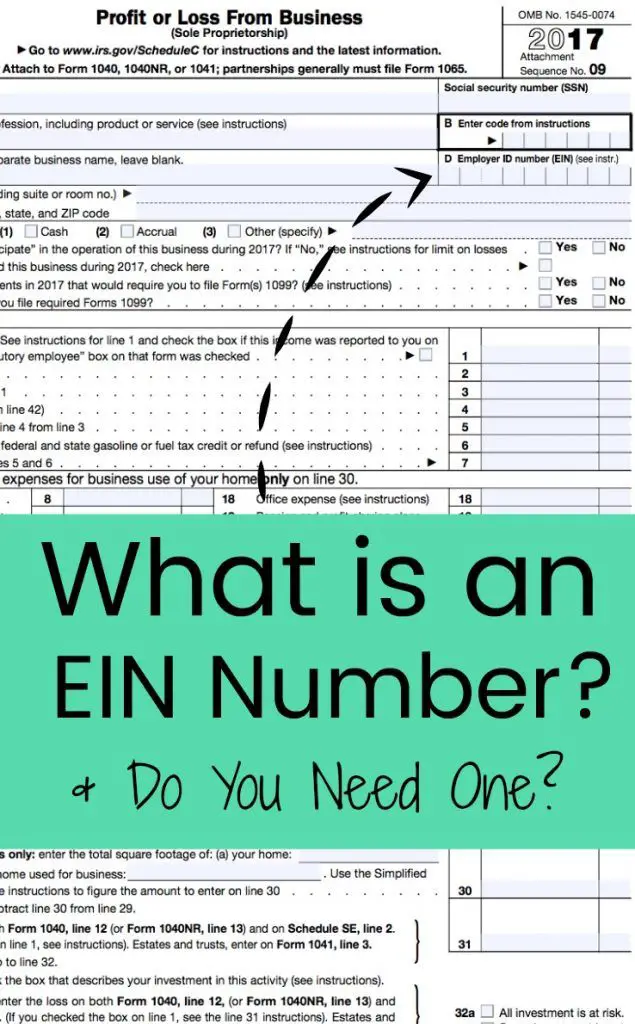

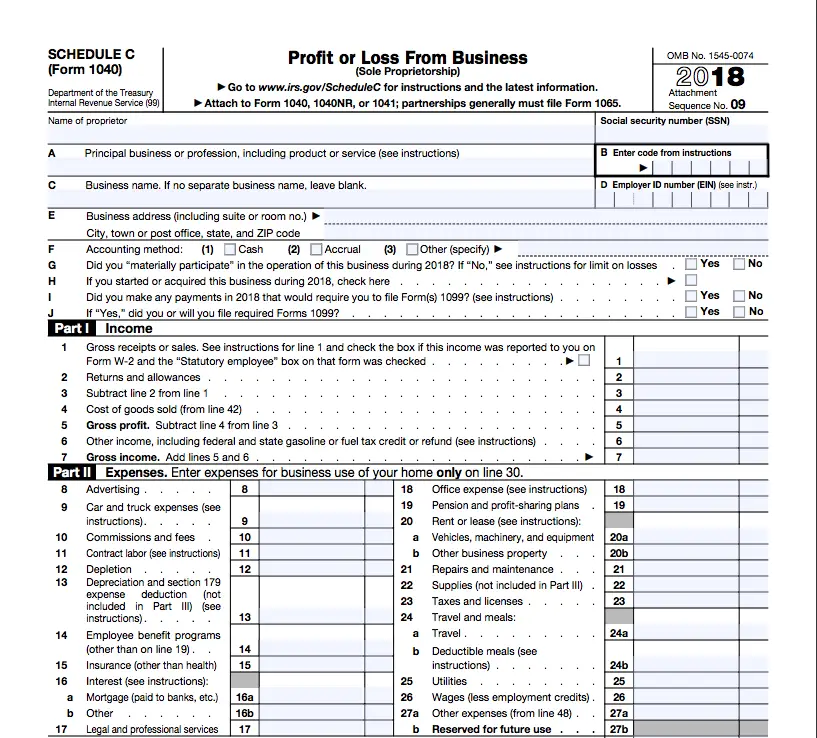

To show whether you have a profit or loss from your sole proprietorship, file IRS Schedule C, Profit or Loss from Business, with your tax return. On the form, list all of your business income and your deductible expenses.

Just remember that, if you have more than one sole proprietor business, you must file a separate Schedule C for each.

Save The Document With Your Ein

After all sections of the application are completed, the system will generate you a new EIN that you can start using immediately. You will receive an official IRS document that confirms your application was successful and provides your EIN. Save a copy on your computer and print one out for your records.

This article will also discuss:

NOTE: FreshBooks Support team members are not certified income tax or accounting professionals and cannot provide advice in these areas, outside of supporting questions about FreshBooks. If you need income tax advice please contact an accountant in your area.

Read Also: What Kind Of Battery Is Used For Solar Panels

How To Obtain An Ein

Obtaining an EIN is easy and free. The fastest and easiest way is to apply directly at the IRS website. The IRS has an online EIN Assistant tool you can use. If you are not comfortable sending information via the Internet, you can download IRS Form SS-4, Application for Employer Identification Number and send it by postal mail. Alternatively, you can receive your EIN by calling the IRS at 800-829-4933 from 7:00 a.m. to 10:00 p.m. local time .

Apply For A Sole Proprietorship Tax Id Number Online

You can apply for a sole proprietorship EIN online, and if you want to receive your number as quickly as possible, this is typically the best option. With an online application, you need to share the details mentioned above. You also need to provide an electronic signature for yourself. You can also designate another party to complete the application on your behalf.

Once you have all the required details, you can complete an online application from the comfort of your business, home, or any other location where you have access to the internet. Try to give yourself at least a half an hour to ensure that you have ample time to answer all the questions.

Also Check: Which Solar Battery Is Best

How Can I Obtain An Ein If Im A Sole Proprietor

Unlike many dealings with the IRS, the process of obtaining an EIN is simple and free of charge. The IRS provides an EIN assistant that allows you to fill out an online application. Alternatively, you can simply fill out Form SS-4. As a last resort, you might consider actually calling the IRS at their toll-free number: 800-829-4933.

Federal Employer Identification Number

Sole proprietors who do not have employees, who are not required to file information returns, who do not have a retirement plan for themselves, and who are not required to pay federal excise taxes in connection with their business generally may use their social security number as their federal employer identification number ). Single-member limited liability companies that have elected to be taxed as a sole proprietorship may follow that rule, too.

All other business entities are required to obtain a federal employer identification number by filing Form SS-4 with the Internal Revenue Service. Note also that an independent contractor doing commercial or residential building construction or improvements in the public or private sector is considered to be, for workers compensation purposes, an employee of any person or entity for whom or which that independent contractor performs services unless, among other things, that independent contractor has a federal employer identification number.

Form SS-4 may be obtained from the Internal Revenue Service by calling the IRS at the telephone number listed in the Resource Directory section of this Guide. The form and instructions can also be printed directly from the IRS website at Forms and Publications, go to Forms, Instructions & Publications.

To obtain a federal employer identification number from the Internal Revenue Service :

You May Like: Can I Add More Batteries To My Solar System

Think A Sole Proprietorship In California Is The Right Way To Go

If youre ready to become a sole proprietor, awesome! All you have to do now is start earning self-employment income and youre officially a California sole proprietorship.

Still wondering if an LLC is a better fit for your business? See how an LLC compares to a sole proprietorship in California.

Whether you decide to form a sole proprietorship in California or an LLC, well be here, cheering you on from the sidelines.

When An Ein Is And Isnt Required

Many people associate EINs with big corporations, but even a freelancer or the owner of a very small business might need an EIN to file business taxes and for other purposes. If you do need a business tax ID, the best practice is to get one as soon as you open your business, as part of your business launch checklist.

The following types of businesses must get an EIN for tax purposes:

-

Any type of business entity with employees .

-

Corporations and any entity taxed as a corporation.

-

Multi-member LLCs.

-

If you buy a business or inherit a business.

-

If you have a Keogh plan or solo 401 retirement plan.

-

If you file for bankruptcy.

For further assistance determining if you need an EIN, check out the IRS questionnaire.

Unless you meet any of the descriptors above, you most likely dont need an EIN. That means millions of sole proprietors, including freelancers, technically dont need an EIN. But there are plenty of reasons to get one anyway.

Also Check: What Does The Average Solar System Cost

How To Get A Tax Id Number If You’re Self

- A Tax ID number, also known as an EIN number, is an ID number issued by the IRS to identify small businesses for tax purposes.

- To get a Tax ID number, you can speak with your accountant or bank, call the IRS directly, fill out a form and mail it to the IRS, or apply online.

- Visit Business Insider’s homepage for more stories.

Your Tax ID Number – sometimes also referred to as a Federal Tax Identification Number, a 95 Number, or EIN Number – is a nine-digit number issued by the IRS to be used by self-employed individuals for certain tax or business purposes.

If you’re not sure if you already have one, you can call the IRS Business & Specialty Tax Line , check with the institution that you think may have issued one for you , or take a look at your most recent tax return.

The IRS has a handy questionnaire to figure out if you need a Tax ID number, or if you can just use your Social Security number. If you answer “yes” to any of its six questions, like “Do you have employees?” and “Do you operate your business as a corporation or a partnership?” the IRS says you need a Tax ID number.

If you don’t currently have a Tax ID Number and need to get one, follow these steps.

What Do I Need Before I Register With The Department

If you have not created your business entity, you can use the Register my Business page to help you.

- Federal Employer Identification Number , if applicable issued by the Internal Revenue Service

- Legal Business/Owner name and number issued to you when registering with the Missouri Secretary of Stateâs office. .

- Tax Clearance or Certificate of No Tax Due – BEFORE you purchase an existing business, be sure that you obtain a Certificate of No Tax Due from the previous owner of the business. If you are purchasing a corporation, you will need a Tax Clearance Form 943 from the previous owners of the corporation. Without this document , you may also be purchasing existing sales tax, withholding tax and/or corporate tax obligations.

- A Certificate of No Tax Due is necessary if you will be

- Selling Liquor –

- Selling Fireworks –

- Obtain or renew your business license with the city/county where your business is located .

You May Like: How Do Solar Panels Hook Up To Your House

Open A Business Bank Account

Some banks allow sole proprietors to open a business bank account without an EIN, but others have stricter policies. Bank of America checking and savings accounts, for instance, require proof of EIN from sole proprietors and all other types of businesses.

Along with your EIN, youll need to provide a few other documents to open a business checking or savings account. These include your businesss formation date, business location, legal business name and personal information about the owner. And once you open a business bank account, make sure the only money going into or out of the account is for business purposes.

Foreign Nationals: Individual Taxpayer Identification Number

For those who do not have a Social Security Number — such as nonresidents and resident aliens — they may need to apply for an individual taxpayer identification number , which is also nine digits. To apply, you’ll need to file Form W-7: IRS Application for Individual Taxpayer Identification Number. You will be asked to provide proof of your legal resident or visitor status and will have to file it through an “Acceptance Agent” authorized by the IRS.

Don’t Miss: Why Is Solar So Expensive In The Us

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Minnesota Unemployment Insurance Employer Account Number

All business entities, other than sole proprietorships, single member limited liability companies, partnerships without employees or corporations and limited liability companies with no employees other than owner/officers with 25 percent or more ownership share, must register with the Department of Employment and Economic Development, Unemployment Insurance Program.

The Unemployment Insurance Program issues identification numbers that are different from those issued by the Minnesota Department of Revenue and the Internal Revenue Service. Register at Employers and Agents. Employers may contact the Unemployment Insurance Program at 651-296-6141, option 4. The UI Program requests that businesses not register for a UI Employer account number until wages have actually been paid.

Also Check: How Much Solar Panels Do I Need

When Is An Ein Required For A Sole Proprietor

Basically, getting an EIN allows you, as a sole proprietor, to do make more business moves. Without an EIN, a sole proprietor would not be able to:

- Hire employees

- Have a Keogh or 401

- Buy an existing business

- Form an LLC

- File for bankruptcy

In addition, theres going to be some banks that refuse to set up a business account for you unless you have an EIN.

Even if those are things you dont think youre ever going to need, there are still a number of reasons why having an EIN is a good idea.

- EINs can help you avoid identity theft. Identity thieves can steal social security numbers to file fraudulent tax returns.

- EINs can help you establish independent contractor status. Independent contractor status is distinct from employee status. Using an EIN can make you more attractive to potential clients.

Does A Sole Proprietor Need A Tax Id

Starting a new business as a sole proprietorship is often a great way to test the waters and discover if the venture is worth developing as a more formally organized business. While startup companies that operate as sole proprietorships dont need to file their own tax returns — business activity is an extension of the sole proprietor’s personal finances — you may need to secure a tax identification number depending upon the circumstances of your business.

Recommended Reading: How Many Solar Panels To Produce 10kw

So What Should You Do

If you decide to form an LLC, wait for your LLC to be approved, then apply for a new EIN for your LLC.

Note: In a few states, you actually need to get your EIN before your LLC is filed , however, in most states, you want to wait for your LLC to be approved before applying for your EIN. Check out our how to form an LLC page for instructions on all 50 states.

You dont have to write final return on your Sole Proprietor Schedule C. Youll just file a new Schedule C to report the LLCs income for next tax year. If your Sole Proprietorship has a DBA, you can cancel/withdraw it after your close your Sole Proprietorship.

Changing Your Legal Structure

You can change your legal structure from sole trader to private limited company . One of the advantages is, that not you but the bv will be liable for the company, including its finances and debts. Also, if your company’s turnover has grown, you may claim certain tax benefits if you have a bv. There are several ways in which you can turn your sole tradership into a private limited company.

You can also decide to join a commercial or general partnership or, if you practice a regulated profession , a public partnership . Joining a partnership doesnt change your liability, but enables you to collaborate and share costs.

for advice on changing your legal structure.

Recommended Reading: How To Measure Sunlight For Solar Panels

Sole Trader And Employees

Despite the name, sole traders can employ staff. The Dutch term ‘eenmanszaak’ simply refers to the legal structure, and has nothing to do with the number of people employed by your business. The first time you hire an employee, you have to register as an employer with the Dutch Tax Administration and notify the Netherlands Chamber of Commerce KVK. .

You Own The Business Personally

This means that you make all of the decisions and dont need to consult with anyone. Youre the supreme ruler of your business. *muwhahahahaha*

Everything that your business owns, you personally own. In other words, all of the money that your business earns is your personal money. Even though its wise to have a separate bank account for your business, its not legally required.

Don’t Miss: Can I Get Solar Panels On My House

How To Apply For An Ein

Applying for an Employer Identification Number is a free service offered by the Internal Revenue Service. Beware of websites on the Internet that charge for this free service.

All EIN applications must disclose the name and Taxpayer Identification Number of the true principal officer, general partner, grantor, owner or trustor. This individual or entity, which the IRS will call the responsible party, controls, manages, or directs the applicant entity and the disposition of its funds and assets. Unless the applicant is a government entity, the responsible party must be an individual , not an entity.

Is Sole Proprietorship Still The Best Option For My Business

If your sole proprietorship is large enough or successful enough to hire employees, then you could be in the position to consider converting your sole proprietorship into an LLC. Forming an LLC is the next step in growing a business.

While being a sole proprietor can be an easy option to run a business with very low profit and low risk, you have zero liability protection.

There are many benefits to holding your business in an LLC, but the most impactful is liability protection. An LLC separates the business owner’s personal assets from the business. This means your personal assets aren’t in jeopardy in the event that the business is sued or can’t pay a debt.

Learn more about getting an EIN as a foreign person.

Also Check: How Many Solar Panels To Make A Megawatt