What’s A Sole Proprietor

A sole proprietor has complete control over the revenue and operations of their business. However, the sole proprietor is also personally responsible for all debts, lawsuits, and taxes their company accrues. So, if their business is sued, personal assets like their home, credit score, and savings are unprotected.

Set Up Your Operations

- With your federal ID number, state UBI number, your governance document if youre a corporation or LLC , and some cash, you can set up a bank account. When selecting a bank that best meets your needs, consider:

- Access to credit .

- Business products and services and their costs.

- Convenience .

- Staff relationships.

Advantages Of Registering A Sole Proprietorship

Registering a Sole Proprietorship is the most common form of business operation beginnings in Ontario. The Sole Proprietorship far exceeds the number of General Partnerships under the Business Act or Incorporations in Ontario.

The advantages are as follows:

- Inexpensive to register

- Easy to change or cancel

Read Also: How Much Do Solar Panels Lower Your Electric Bill

Position Your New Sole Proprietorship For Success

Starting a business as a sole proprietor is one of the biggest choices youll ever make. Though the risk is great, so is the reward and the best part is that you can start it on your own without leasing a building, hiring others, or requiring expensive training. With the steps I shared in this post, youll build a strong foundation to ensure lasting success.

Editor’s note: This post was originally published in September 2018 and has been updated for comprehensiveness.

Youre Personally Liable For Debts And Lawsuits

Sole proprietors are personally liable for any incurred business debts and arent protected if a third party wants to take legal action against your business. As such, your personal assetslike your home, credit score, or personal savingsare on the line if someone decides to sue you or your business has to file for bankruptcy.

For instance, say you run a lawn care business and one of your employees accidentally damages a clients property. Your personal assets are at risk of seizure if the client decides to sue your company for damages.

Sole proprietorships can be a risky choice, especially if your company is in an industry where injury or property damage may occurand while insurance coverage can help protect you , its not foolproof.

Recommended Reading: How Does Solo Stove Work

Launching Your Business In Redmond

Moving from business idea to a real launch is more than a leap of faith. The first time is always the toughest because you are in unfamiliar territory and rookie entrepreneurs will make a lot of mistakes that prove to be very expensive later on. That is why listening and learning from others is so important.

Getting Started

The City of Redmond values the businesses within the community and understands the important role they play. Home to many, from small startups to corporate headquarters, we have several programs and services available to assist.

About the Business Licensing

A business license is required to engage in business in the City of Redmond whether you are located within Redmond, or simply conducting business in Redmond. Learn more

How To Register A Sole Proprietorship In Poland In 2022

Poland is currently the sixth-largest economy in the European Union . It is also the first post-communist nation to expand its economy to the level of developed countries around the world.

For those looking to start an IT company or any other business, Poland seems like the perfect destination. Registering a company there is probably easier than anywhere else is Europe, and it gives you access to the entire EU market. Moreover, it is cheaper and easier to start a company in Poland than in most developed countries such as Germany, the UK, and the USA.

This guide will tell you the procedure to register a sole proprietorship in Poland, including the costs involved.

Read Also: Do Solar Panels Increase Property Taxes In California

Register With The Irs

Next, you need to register your business with the IRS to receive your Employer Identification number . Your EIN is like a Social Security number for your business and is necessary for filing your taxes. You can sign up for one online here. Again, there are certain circumstances where you may not need one. To see if you do, the IRS has a short survey you can fill out.

How Much Does Registering A Sole Proprietorship Or Partnership Cost

There are costs for a few items if you decide to register or renew with the government directly. It will cost $60 online or $80 by mail or in-person for a sole proprietorship or a general partnership, and $210 for a limited partnership. A name search will be an additional cost, $8 $26 depending on the search type.

If you need more advice on what is needed to register your business, and speak with our business experts and let us get you started!

Don’t Miss: How To Wash Solar Panels On Roof

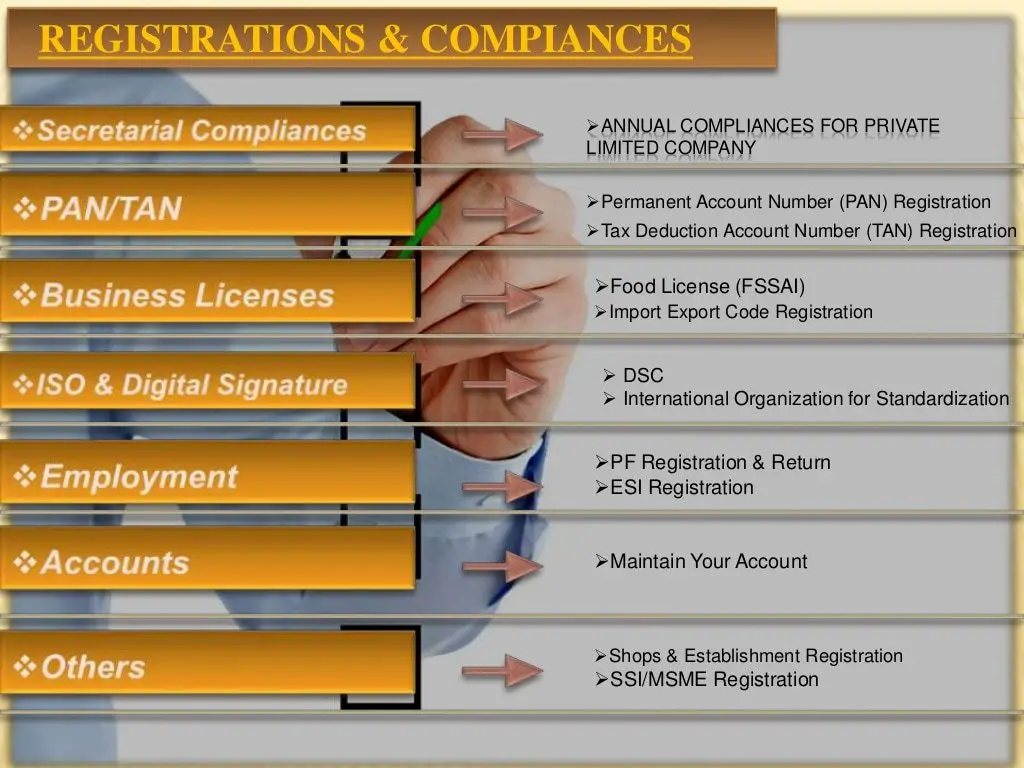

Obtain Required Licenses And Permits

Most businesses are required to be licensed at both the state and local levels, and many need professional licenses too. You will likely need licenses in every location where you do business not just where youre based. Also, some businesses require additional permits.

The online Business Licensing Wizard is a helpful tool. Use it to learn the licensing and permitting requirements for your specific business. Enter your intended business activity, location, and other key information, and receive an online list of specific licenses and permits that are likely to be required.

- When you file your Washington Business License Application, be prepared to address the following:

- Whether you will want unemployment insurance coverage for corporate officers. Officers who provide services in Washington are automatically exempt from unemployment insurance unless the employer specifically requests to cover them. If you want to cover your corporate officers, you must submit a Voluntary Election Form. Find out more here.

- General business information including physical location and ownership.

- A rough estimate of your expected gross annual revenues.

- Whether you intend to hire employees within 90 days of start-up.

- Whether you will want optional workers compensation coverage for business owners.

Sole Proprietorship Vs Llc: Formation

Understanding the formation process of both business structures is essential to comprehend the difference between LLC vs. Sole Proprietorship.

No precise method exists to create a sole proprietorship you may unknowingly operate one. Selling products and services without a partner is the default for a sole proprietor, regardless of whether your enterprise is located in a location where you must obtain business licenses, zoning permits, or both.

Sole proprietorships must apply for fictitious business names, DBA or doing business as certificates, and any company that operates under a trading name. Forming a sole proprietorship reasonably quickly and cheaply is possible since it requires the least amount of paperwork.

On the other hand, the procedure for forming an LLC is more involved than forming a Sole proprietorship, but it is still reasonably straightforward. Before you file, you must choose a suitable name for your company and be confident it is not used by anyone else. You must also select a registered agent. You may act as your single-member LLCs registered agent or one of your corporations partners if it is a multi-member LLC.

A business plan is essential in advancing this phase of forming an LLC. You must file Articles of Incorporation, draw up an operating contract, and pay a fee. You must obtain an EIN if you live in a state where it is required for tax purposes.

Also Check: How Much Voltage Does A Solar Panel Produce

Ensure A Sole Proprietorship Is Right For You

First, is starting a sole proprietorship right for you? Or should you launch another type of business?

Choosing the right business structure is key to your ventures success. As the SBA points out, The business structure you choose influences everything from day-to-day operations, to taxes, to how much of your personal assets are at risk.

Sole proprietorships, partnerships, limited liability companies , corporations, and cooperatives are just a few of the ways you can structure your business. While sole proprietorships andLLCs are two of the most common business structures, there are key differences between them.

Obtain A Business License And Other Permits

Its crucial that youre doing everything by the book and obtain all the appropriate business licenses and permits. Without the appropriate licenses or permits, you risk incurring hefty fines.

Licenses and permits will depend on the nature of your business and which state and local area youre operating in. For example, health and safety training is required if youre opening a daycare. Likewise, a health department permit is required if you want to prepare or serve food.

Read Also: How Do I Determine How Many Solar Panels I Need

How To Start A Sole Proprietorship

This article was co-authored by Madison Boehm. Madison Boehm is a Business Advisor and the Co-Founder of Jaxson Maximus, a mens salon and custom clothiers based in southern Florida. She specializes in business development, operations, and finance. Additionally, she has experience in the salon, clothing, and retail sectors. Madison holds a BBA in Entrepreneurship and Marketing from The University of Houston.There are 13 references cited in this article, which can be found at the bottom of the page.wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, 100% of readers who voted found the article helpful, earning it our reader-approved status. This article has been viewed 76,274 times.

A sole proprietorship is the easiest type of business to set up. Unlike corporations or limited liability companies, you dont have to file with your state. Instead, you should pick a business name and register it, if necessary. Also obtain all necessary permits and licenses in order to operate. Before operating your business, you should open a bank account and draft a business plan.

Check That Your Business Name Is Available

Before submitting an application to register your business, you should check to confirm that it has not been used by another business or trademarked.

You can start your search using the Enhanced Business Name Search feature of the Integrated Business Services Applicationwhich is available online.

Each search using this tool has a fee ranging from $8 to $26 depending on which report you choose, and it is limited to Ontario.

This search can be conducted from 8:00 a.m. to 6 p.m., Monday to Friday.

For a more detailed Canada-wide search for business names and trademarks, use the NUANS tool.

A NUANS report shows business names, trademarks, and corporate names similar to the one you are proposing, and each report costs $13.80.

In general, you should avoid a business name thats very similar to that of an existing business. While identical names are not prohibited under the Business Names Act, you could get into legal trouble.

Read Also: How Often Should You Clean Your Solar Panels

Register With Your Province Or Territory

Most businesses need to register with the provinces and territories where they plan to do business. In some cases, sole proprietorships operating under the name of the business owner do not need to register. See the website of your provincial or territorial business registrar for more information on their requirements.

Note: This list of links is provided for your convenience. It may not be a comprehensive list of the registration requirements in all provinces and territories. Please check with the authorities in your provincial or territorial government to determine if there is anything else you need to do.

Thereof How Do I Start A Sole Proprietorship In Massachusetts

To establish a sole proprietorship in Massachusetts, heres everything you need to know. Choose a business name. File a business certificate with city or town clerks office. Obtain licenses, permits, and zoning clearance. Obtain an Employer Identification Number. In respect to this, how do i look up a business license in massachusetts? To find a business license in Massachusetts may help you MA business license lookup. Or, you can visit the Massachusetts Secretary of State website and do the Corporation and Business Entity Search.

No other business can use the company name that you register at Companies House. If someone wanted to register your trading name as a limited company, they could also demand that you stop using it, because trading names dont receive this protection.

How much does it cost to form an limited liability company in Oregon? The Secretary of State in Oregon charges a fee to file the Articles of Organization. Each year, the Secretary of State requires Oregon companies to file an annual report. The filing fee for domestic limited liability companies is $100, while the fee for foreign limited liability companies is $275.

You May Like: How Much Solar Power Per Square Foot

You May Like: Do Solar Panels Add Value

What Are The Disadvantages Of The Sole Proprietorship

While the sole proprietorship is fast, easy and inexpensive to start, the major downside is that the assets of the business and the owner are the same. If the business is sued, the business owner could risk losing their personal assets.

The corporation and LLC offer liability protection.

Read: Sole Proprietorship vs LLC

How Does The Owner Of A Sole Proprietorship Pay Themselves

As a sole proprietor, provided money is in the business checking account, you can take money out or pay yourself whenever you want. You simply write a check to yourself and at this time you dont have to pay tax on the money received. This isnt technically a salary or wages, but instead a draw. A draw is an amount of money you take out of the business.

The profits of the business will eventually be taxed, regardless of how much money is drawn from the business. If money is left in the businesss bank account and not paid to the owner, that money will still be taxed.

Recommended Reading: How Many Kilowatts In A Solar Panel

Considerations In Forming A Sole Proprietorship

Sole proprietorships are the most common and simple form of business organization. They are formed by persons who own all or most of the business property and assets. They are 100% responsible for all of the control, liabilities and management of a business. A sole proprietorship, as its name states, has only one owner. The sole proprietorship is merely an extension of its owner: a sole proprietor owns his own business, and no one else owns any part of it.

As the only owner, the sole proprietor has the right to make all the management decisions of the business. In addition, all the profits of the business are his. In return for his complete managerial control and sole ownership of profits, he assumes great liability: he is personally liable for all the obligations of the business. All the debts of the business, including debts on contracts signed only in the name of the business, are his debts. If the assets of the business are insufficient to pay the claims of its creditors, the creditors may require the sole proprietor to pay the claims using his individual non-business assets, such as money from his bank account and the proceeds from the sale of his house. A sole proprietor may lose everything if his business becomes insolvent. Hence, the sole proprietorship is a risky form of business for its owner.

A sole proprietor may hire employees for the business, but they are employees of the sole proprietor.

Choose Your Preferred Form Of Accounting

You will have to choose an accountancy documentation for your business from these options:

Accounting books are necessary if your income is over â¬1.2M/year.

Revenue and expense ledger are for those following progressive tax or flat tax, with income less than â¬1.2M/year.

The last two options are for those who choose fixed tax amount or lump-sum tax.

You May Like: Does Pine Sol Deter Mice

How To Incorporate In Ontario Using Ownr

Ownr provides provincial and federal incorporation in Ontario, Alberta and British Columbia.

To get started, create an account and search for available business names. You can check up to 30 unique business names.

Fill out your business details, pay the registration fee and submit your application.

Ownr sends you the name search report within 1 business day.

Review and confirm your corporation name. The incorporation documents are delivered through email within 1 business day, with directions on the next steps.

Ownralso prepares your corporation documents including:

- First Directors Resolution

What does it cost?

Provincial incorporation in Ontario using Ownr costs $599 plus tax. This includes the $300 government fee.

You can claim up to $300 cash back when you open an RBC Business Bank Account within 60 days of incorporating with Ownr.

You also get a 15% discount here.

In addition, when you register a business with Ownr, you get access to perks including discounts on accounting software, phone plans, and office supplies.