What Is The Amount Of The Federal Solar Tax Credit In 2021

Youll be eligible for the federal solar Investment Tax Credit at the federal level . In 2021, the ITC will offer a 26 percent tax credit on solar panel installation costs, as long as your taxable income exceeds the credit amount.

This ultimately translates to a 26% reduction on your home solar system for most households. So, if your system costs $20,000, the ITC will allow you to claim a tax credit of roughly $5,200.

How The Solar Investment Tax Credit Works

To make sure you understand the value of the tax credit and capitalize on its potential, its important to understand how the Solar Investment Tax Credit works.

The ITC was put in place to promote solar use, but not everyone who uses solar can qualify and be eligible to make a claim. To be eligible for the ITC, you must meet the following criteria:

- Installation of the solar power system began between January 1, 2006, and December 31, 2023

- Solar power system was installed in your primary or secondary residence within the United States

- Solar power system is new or being put to use for the first time

- You must own the solar power system, as leased equipment does not qualify

Any costs incurred during the installation of the solar power system can be included in the tax credit. These include components such as mounting equipment, batteries, and wires, as well as related costs such as labor, assembly, and inspection.

After purchasing your solar power system, you should file for the Solar Investment Tax Credit within the tax year, just like you file your federal taxes. For the solar tax credit, you are required to use Form 5695 for Residential Energy Credits. Regardless of whether you use the federal income tax or the alternative income tax to calculate your tax liability, you can still claim the full value of the ITC and receive residential energy credit, as it can be used against both.

History Of The Solar Itc

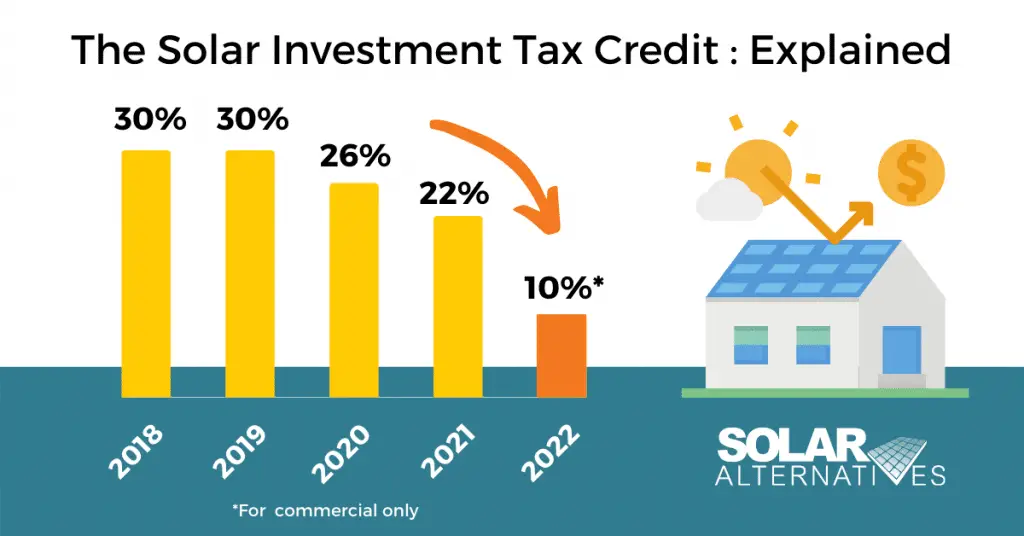

The solar investment tax credit was originally created through the Energy Policy Act of 2005, which has enjoyed bipartisan support since its inception. As originally written, the credit was set to expire in 2007. It proved pretty popular with homeowners across the country, however, prompting Congress to renew the credit multiple times.

As it stands, the credit will be available at least through 2023 for residential systems and 2024 for commercial solar. However, an act of Congress could extend it even further, allowing future homeowners and solar adopters to reap this financial benefit.

You May Like: How Many Solar Panels To Make A Megawatt

What Will Happen When The Solar Tax Credit Steps Down

This is obviously speculative, but we foresee a couple of possible outcomes to the tax credit stepping down:

- States take charge

- As more and more states like California launch 100% Renewable Portfolio Standard targets, one can expect additional solar incentives to become available for homeowners residing in those areas.

- These incentives would ideally meet or exceed the federal tax credit as it goes away, but thats very uncertain.

The Federal Solar Tax Credit: What You Need To Know

Could investing in solar energy pay off sooner than you think? The short answer is, yes. Many residential home solar power systems are eligible for a federal investment tax credit, or ITC.

At the time of this writing, you can get up to 26% of your installation costs back by claiming the tax credit when you file with the IRS. The ITC benefits both residential and commercial customers, and there is no cap on its value.

Wondering how the solar tax credit works in 2021? Well cover everything you need to know in this post.

Lets dive in.

Don’t Miss: How Much Solar Energy Do I Need For My Home

What Is The Solar Panel Federal Tax Credit

First, lets take a short walk down memory lane. The Solar Investment Tax Credit was first offered via the Energy Policy Act of 2005. Thanks to its popularity and its contribution toward renewable energy goals, the ITC has been extended multiple times. While it was originally set to expire in 2007, the current federal solar tax credit extension is set to expire in 2024. Homeowners can use the federal tax credit for battery storage, installing new systems, and more.

Alright, now how does the solar tax credit work? If you want a basic overview of solar incentives without wading through the tax jargon, youre in the right place.

The bottom line is this: When you install a solar power system between 2020 and 2022, the federal government rewards you with a 26% tax credit for investing in solar energy. In short, 26% of your total project costs can be claimed as a credit on your federal tax return for that year.

A quick but necessary disclaimer: were solar experts, not tax accountants! We do our best to give accurate advice, but please check with a professional to be sure youre eligible to claim the credit.

A tax credit is a dollar-for-dollar reduction of the income tax you owe. $1 credit = $1 less you pay in taxes. Its that simple. If you spend $10,000 on your system, you owe $2,600 less in taxes the following year.

No Not Everyone Can Benefit From The Federal Solar Tax Credit

Most homeowners who install a home photovoltaic system can claim the federal solar ITC. Unfortunately, not everyone will be able to take full advantage of this lucrative financial incentive.

To benefit from the solar ITC, you must owe federal income taxes. If you dont if you break even or end up qualifying for a refund check you wont be eligible at least not this year.

The good news is that, as the policy stands, the ITC can be rolled over to future tax years. So if you have a tax liability next year, youll be able to claim the 30 percent credit. Speak to your tax accountant or attorney to learn how to restructure your finances to ensure you can maximize this incentive.

The photovoltaic energy experts at Intermountain Wind & Solar design and install residential and commercial systems in Utah and throughout the Intermountain West. Contact us today to learn more about how you can benefit from the federal solar tax credit.

Don’t Miss: What Is The Average Cost Of A Home Solar System

Is The Solar Tax Credit Refundable

Everyone wants to get a check at the end of tax season, but some of us end up having to send a check instead. With the federal solar tax credit , you wont have to worry about sending in a check but does that mean youll be getting a check? It depends. While the federal solar ITC is technically non-refundable, there are ways that it can get you a check in your mailbox.

Difference Between A Refundable And Non

Tax credits come in two primary categories: refundable and non-refundable tax credits. With refundable tax credits, you will receive a refund of the balance if your tax credit exceeds your tax liability. For instance, assume that you are eligible for a $1,000 tax credit, but your tax liability is only $800. Along with having your tax liability completely covered, you are also entitled to a refund of $200.

As the name suggests, with non-refundable tax credits, you cannot receive any refund beyond the amount that the credit covers. As such, the maximum value you can receive is restricted to your total tax liability. This means you can lose out on the maximum potential benefits if your tax liability is too small for the investment tax credit. Suppose that you are eligible for a $1,000 tax credit, but your tax liability is only $600. While the tax credit will reduce your tax liability to $0, you will not get a refund for the additional $400 that was owed to you by the tax credit.

The Solar Investment Tax Credit is non-refundable, so you need to have enough solar tax liability available in order to receive the full value of that tax credit. However, there are options available if you dont have enough solar tax liability in a single tax year.

Also Check: How Much Do Tesla Solar Shingles Cost

Qualifying For The Solar Tax Credit

Many types of homes and apartments qualify for the solar tax credit, including single-family homes, mobile and manufactured homes, apartments and condominiums. Other less-traditional structures, such as houseboats, and cooperative apartments can qualify for the IRS solar tax credit as well.

You can even claim the solar ITC for rental properties you own, as long as you live there for a portion of the year. In this case, the percentage you can claim will depend on the amount of time you reside in your rental property each year. For example, if you live at your rental property for half of the year, and rent it out the other half of the year, you will be allowed to claim 50% of the IRS tax credit.

However, solar consumers who lease their system or enter into a solar power purchase agreement , are not eligible for the ITC. The federal tax credit for solar is only available if you purchase your solar energy system. If you do not own your solar setup, then the company that does own it is able to claim the solar ITC.

Why Am I Not Eligible For The Entire Solar Tax Credit

When submitting your 2021 taxes, you must meet the following criteria in order to claim the federal solar tax credit and receive money back on your solar investment:

- Between January 1, 2006, and December 31, 2021, your solar PV system must have been installed and operational.

- Either your primary or secondary residence must have had your system installed.

- Whether you bought cash or borrowed money, you must own the solar PV system.

- Its likely that the solar system was used for the first time. This credit can only be claimed once, for the initial installation of your solar PV equipment. You wont be able to claim a second credit if you move and take your panels with you to install on your new roof.

Recommended Reading: Should I Get A Solar Battery

Solar Panel Tax Credit Faqs

WHAT IF THE SOLAR PANEL TAX CREDIT EXCEEDS MY TAX LIABILITY? WILL I GET A REFUND?

This is a nonrefundable tax credit, meaning you will not get a tax refund for the amount of the solar tax credit that exceeds your tax liability. However, you can carryover any unused amount of the solar tax credit to the next tax year.

CAN I USE THE SOLAR PANEL TAX CREDIT AGAINST THE ALTERNATIVE MINIMUM TAX?

Yes. The tax credit can be used against either the federal income tax or the alternative minimum tax credit.

HOW DO I CLAIM THE SOLAR TAX CREDIT?

HOW MUCH LONGER IS THE SOLAR TAX CREDIT AVAILABLE?

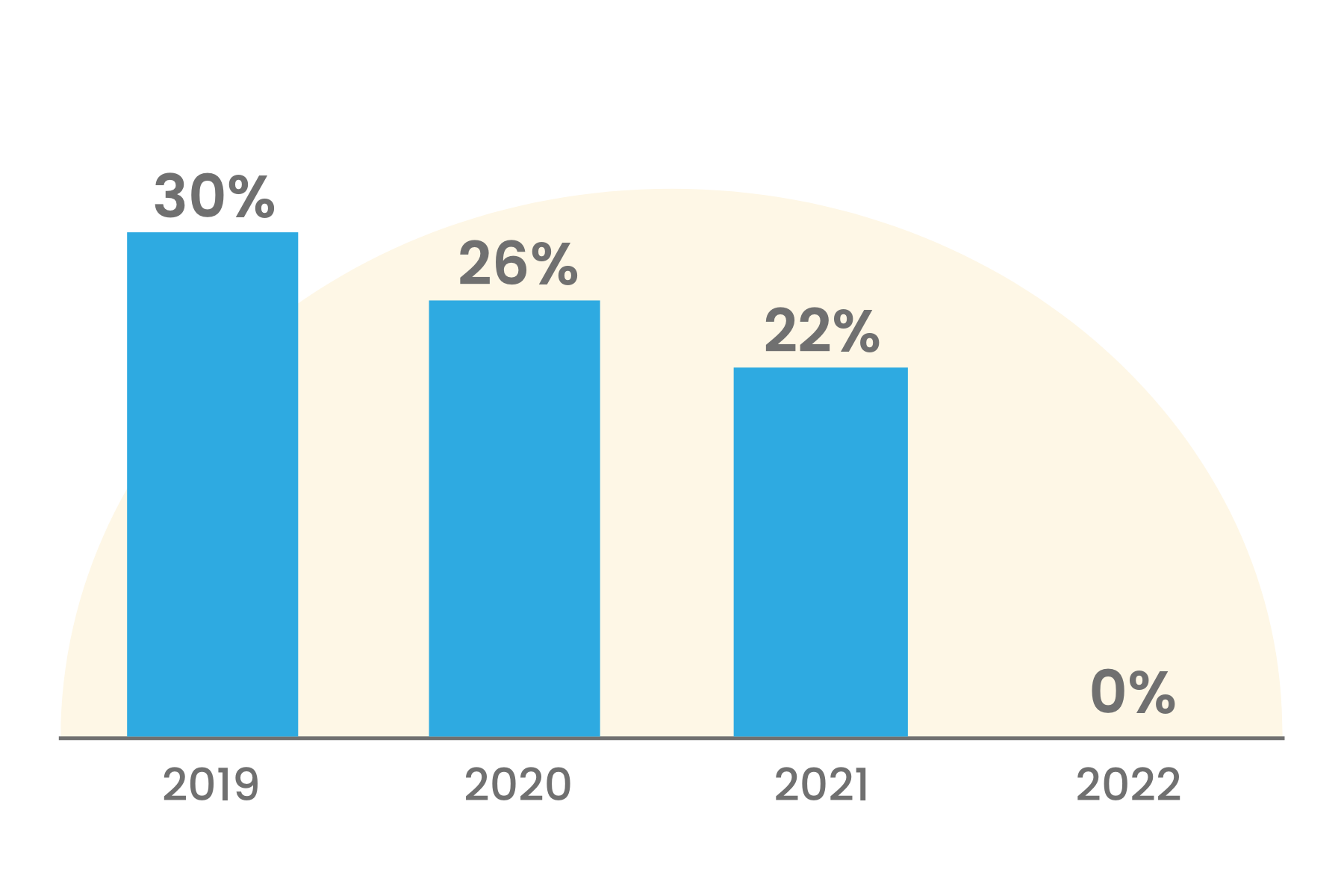

Sadly, the amazing solar tax credit that caused such growth for the solar industry is on its proverbial last leg. In 2022, the tax credit will be 26% and in 2023 it will step down to 22%. Starting in 2024, the tax credit is scheduled to be removed altogether.

The solar investment tax credit was extended once before in 2015, but that extra time is quickly running out. The table below details how much longer the tax credit is available for, and for how much.

|

Year |

Have more questions about the federal solar tax credit? Check out our TOP 10 FREQUENTLY ASKED QUESTIONS ABOUT THE FEDERAL SOLAR TAX CREDIT blog for additional information!

MORE QUESTIONS

Internal Revenue Service, located at 1111 Constitution Avenue, N.W., Washington, DC 20224, and phone at 829-1040.

Now is the time to take advantage of the solar investment tax credit. Contact our team of dedicated solar experts today!

How Can I Claim The Federal Solar Tax Credit In 2021

If youre ready to take advantage of the ITC in 2021, but not sure where to start, youre not alone.

The first step is to ensure you meet all of the eligibility requirements listed above, including that you must own your system. Once youve ensured all the eligibility statements apply to you and your system, its smart to talk to a CPA or other tax professional about the implications of claiming the tax credit.

Once youve talked to a tax professional, the next step is to fill out IRS form 5695, and add the energy credit information to the form 1040 you complete at the end of the year.

After completing IRS Form 569516, attach it to your federal tax return. Information and instructions on filling out the form are available here.

Don’t Miss: How Many Watts Can One Solar Panel Produce

How Much Is The Federal Tax Credit For Solar Panels

The federal solar tax credit is presently at 26 percent, the highest rate possible. When its time to file your taxes, youll be able to save a lot of money. For another two years, the federal solar tax credit of 26% offers a significant savings opportunity. The current rate is due to freshly enacted legislation that eliminated the tax credits previously specified timetable.

Instead of expiring at the end of 2020, the 26% solar tax credit will now be renewed in 2021 and extended until 2022. The tax credit will be reduced to 22% in 2023 after 2022.

This is a promising sign of things to come, as further legislation is expected to be introduced in the future years to encourage more houses to install clean, renewable energy systems.

Other Frequently Asked Questions

If the tax credit exceeds my tax liability, will I get a refund?

This is a nonrefundable tax credit, which means you will not get a tax refund for the amount of the tax credit that exceeds your tax liability. Homeowners may get a tax refund at the end of the year due to the tax credit, if the reduction in tax liability means there was overpayment during the year. This can often occur when employers deduct taxes for employees over the course of the year. However, such refund is still limited by the taxpayers total tax liability. However, you can carry over any unused amount of tax credit to the next tax year.

Can I use the tax credit against the alternative minimum tax?

Yes. The tax credit can be used against either the federal income tax or the alternative minimum tax.

I bought a new house that was constructed in 2020 but I did not move in until 2021.

May I claim a tax credit if it came with solar PV already installed?

Yes. Generally, you can claim a tax credit on the expenses related to the new solar PV system that already came installed on the house for the year in which you moved into the house in other words, you may claim the credit in 2021. For example, you can ask the builder to make a reasonable allocation for these costs for purposes of calculating your tax credit.

How do I claim the federal solar tax credit?

Don’t Miss: Can You Make Money On Solar Panels

How Solar Energysystems Work

Solar energysystems vary depending on the needs of each homeowner. They all have one thing in common, though they produce electricity that can be used to power your home or business.

The federal tax credit for solar panels is equal to 10% of the cost, with no maximum cap for individuals who install new systems on their homes. The federal tax credit will expire in 2019, so if youre thinking about getting a solar energy systeminstalled at your home, now is the time!

How Do Other Incentives I Receive Affect The Federal Tax Credit

For current information on incentives, including incentive-specific contact information, visit the Database of State Incentives for Renewables and Efficiency website.

Rebate from My Electric Utility to Install Solar

Under most circumstances, subsidies provided by your utility to you to install a solar PV system are excluded from income taxes through an exemption in federal law. When this is the case, the utility rebate for installing solar is subtracted from your system costs before you calculate your tax credit. For example, if your solar PV system was installed before December 31, 2022, cost $18,000, and your utility gave you a one-time rebate of $1,000 for installing the system, your tax credit would be calculated as follows:

0.26 * = $4,420

Payment for Renewable Energy Certificates

When your utility, or other buyer, gives you cash or an incentive in exchange for renewable energy certificates or other environmental attributes of the electricity generated , the payment likely will be considered taxable income. If that is the case, the payment will increase your gross income, but it will not reduce the federal solar tax credit.

Rebate from My State Government

0.26 * $18,000 = $4,680

State Tax Credit

For example, the net percentage reduction for a homeowner in New York who claims both the 25% state tax credit and the 26% federal tax credit for an $18,000 system is calculated as follows, assuming a federal income tax rate of 22%:

0.26 + * = 45.5%

+ = $4,680 + $3,510 = $8,190

Also Check: When Will Solar Panels Be Affordable