What’s A Sole Proprietor

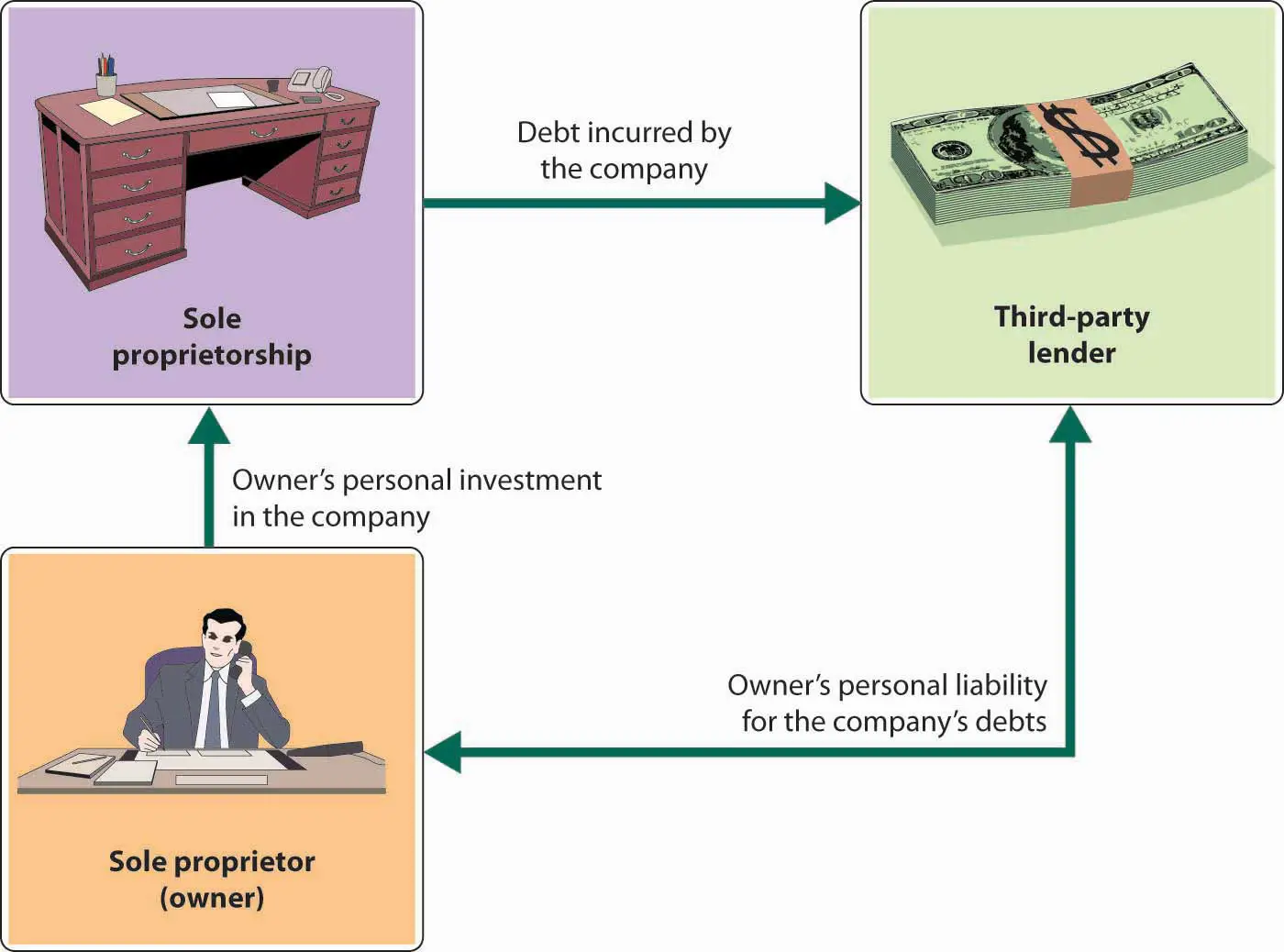

A sole proprietor has complete control over the revenue and operations of their business. However, the sole proprietor is also personally responsible for all debts, lawsuits, and taxes their company accrues. So, if their business is sued, personal assets like their home, credit score, and savings are unprotected.

How To Establish A Gtc Account:

If you have filed a return in Georgia, you can establish a GTC logon to access your individual income tax account. To establish your GTC account:

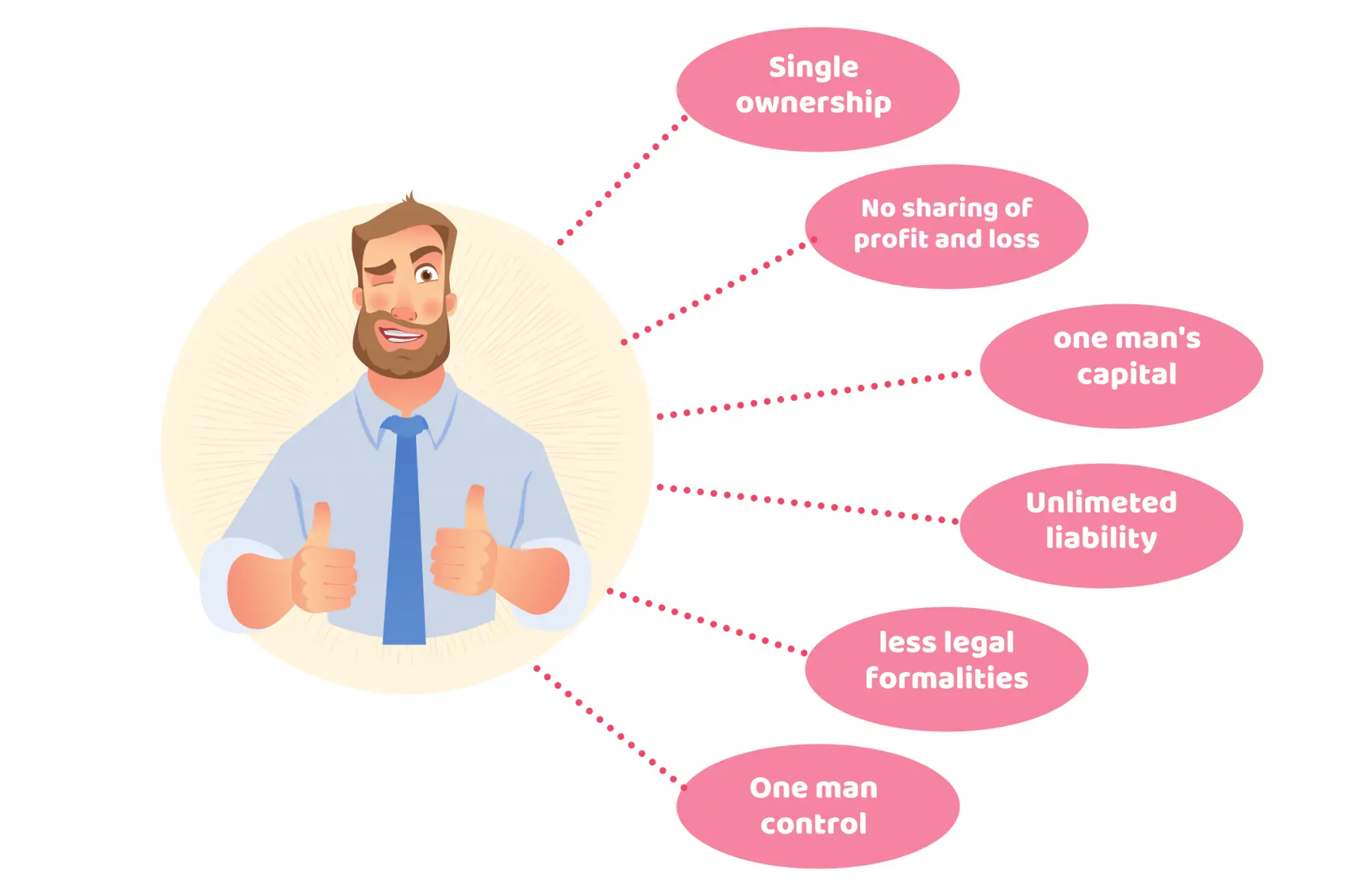

What Are The Disadvantages Of A Sole Proprietorship

Although a sole proprietorship is one of the simpler business entities, it puts a lot of responsibility on business owners. It offers zero legal protection of your personal assets, and there can be only one owner.

“If a business owner was sued, the owners could literally lose their personal car and personal home because of a business liability,” Jensen told Business News Daily.

Sole proprietorship also poses some security risks. “Another con is that when a business identification number is needed, the owner has to give out their Social Security number, greatly increasing the chance of identity fraud,” Jensen said.

Another drawback is that sole proprietors are not eligible for certain business tax breaks and small business loans. They could, however, be eligible for certain tax deductions intended for self-employed individuals.

Key takeaway: Sole proprietorships provide no legal protection for business owners’ personal assets and aren’t eligible for certain business tax breaks or small business loans.

You May Like: How Do Plug And Play Solar Panels Work

When Is A Verbal Agreement Legally Binding

For any contract to be binding, there are four major elements which need to be in place. The crucial elements of a contract are as follows:

Therefore, an oral agreement has legal validity if all of these elements are present. However, verbal contracts can be difficult to enforce in a court of law. In the next section, we take a look at how oral agreements hold up in court.

Optional: Add Payment Terms And Referral Incentives

At the bottom of the invoice, you can include instructions for payment terms. Sometimes you can include a short phrase, “Terms: Net 30” which means you expect to be paid in full in the next 30 days. In this example, if you set the payment guidelines to be 30 days and the client is late, follow up with an email.

It is not uncommon for a sole proprietor or sole trader to charge 1.5 percent interest per month on outstanding bills as a late fee. Just be sure you work out clear guidelines with your clients. By charging a late fee, you’ll give your customers a nice incentive to send money on time.

Try this government calculator to sum up your late fee interest.

You could also include a small note to attract new clients. After all, finding more work or new business is one of the hardest tasks as a self-employed business owner. When invoicing clients, include a small note to state you’ll give a discount on your services or a referral kickback if they introduce or mention you to a new customer.

Don’t Miss: What Size Solar System For My House

What Is A Sole Proprietorship And How Do I Register

Home » FAQ » What is a sole proprietorship and how do I register?

Quick Reference

Confused about what is required to start and run a sole proprietorship? We break down what the sole proprietorship is, the advantages and disadvantages of structuring your business as one, how to register one, taxes and more.

Quick Reference

Registration And Licensure Of A Sole Proprietorship

When a sole proprietor conducts business under an assumed name, that name must be registered with the Utah Division of Corporations and Commercial Code using an application available from the Division. Also, be certain to obtain all required local and municipal business licenses before commencing business.

Don’t Miss: Are Solar Panels Worth It In Michigan

Business Address And Use Of Home Address

Many home businesses start as Sole Proprietorships, and your home address is available to use for your companys business address. The address must be a physical location where you are located. The address for both the business owner and the business itself cannot have a postal box including in the address. If you live in a rural community, you can provide the lot and concession number to register your business.

Check On Other Permits Or Licenses

The fees associated with not having the correct licenses or permits can be debilitating to a young business. Be sure that youve gotten the correct federal licenses and permits and state licenses and permits. These might include:

- A health department permit for preparing or serving food

- A federal license for transporting animals

- A health and safety training for opening a daycare

- A certification exam to become a financial advisor

- A zoning permit to operate your business from home

- Registration with the state tax authority if you have employees or collect sales tax

Do the legwork up front and find out what licenses and permits you need. The fees youll pay during this process are nothing compared to the fines youll pay if you havent filed the right paperwork.

Don’t Miss: Is Sole Proprietorship A Business Entity

Taxes And Sole Proprietorships

A sole proprietor pays federal and state income taxes on all the net income of the business , even if you don’t have cash on hand to pay these taxes.

Your business income is included with your personal income on your personal tax return. The tax rate you pay may on your business income can be hard to determine because it’s all combined. The corporate tax rate is a flat 21% for all corporate income levels, so your tax rate might be higher or lower, depending on your personal tax rate.

And don’t forget the self-employment tax. Sole proprietors must pay self-employment tax on the profits of their business. This withheld from your business income, so you’ll probably have to make quarterly estimated tax payments for this and your business income tax.

The IRS publishes a Tax Guide for Small Business, which you might find helpful in dealing with federal taxes.

Does A Sole Proprietor Need An Ein

The EIN or Employer Identification Number is a unique identifying number with the Internal Revenue Service for a business. A sole proprietor is not required to have an EIN unless they have employees. A sole proprietorship without employees will simply use the owners social security number .

Some sole proprietors will get an EIN even if they are not required to as some of their clients will require the business to supply an identifying number which will be used to issue a 1099 at the end of the year. They could choose to use their SSN, but dont want to share it for privacy reasons.

Applying for an EIN for a sole proprietorship with the IRS takes about 5 minutes and there is no cost.

You May Like: How Does Solar Power Energy Work

How To Set Up A Sole Proprietorship In Arizona

This article was co-authored by wikiHow Staff. Our trained team of editors and researchers validate articles for accuracy and comprehensiveness. wikiHow’s Content Management Team carefully monitors the work from our editorial staff to ensure that each article is backed by trusted research and meets our high quality standards.There are 11 references cited in this article, which can be found at the bottom of the page. This article has been viewed 24,556 times.Learn more…

A sole proprietorship is a fairly easy business form to set up in Arizona. It has one owneryou. You usually dont need the states permission, and you can use your Social Security Number as your tax ID. However, if you want to use a trade name or hire employees, youll need to complete additional steps.

Is Sole Proprietor Easy To Dissolve

In spite of their advantages, they also have disadvantages, the most significant of which is that owners can be held personally liable for any losses and liabilities incurred. The formation, maintenance, and dissolution of sole proprietorships are relatively easy, especially since you only need minimal licenses and forms to follow.

Read Also: What Will A 25 Watt Solar Panel Run

Get One Step Closer To Being Your Own Boss

Once you know how to start a sole proprietorship, youll discover its an affordable and relatively easy way to launch your own business. There are few barriers to entry and it allows you to truly be your own boss. However, it does come with some risks, like being vulnerable to unlimited liability.

Determine if a sole proprietorship is the right fit for your business endeavor. When youre ready to move forward, check out these six questions to ask yourself when starting a business.

Report Your Taxes Correctly

If you have no employees, you and your business are legally the same, so you can report your income with an IRS Schedule C or Schedule C-EZ, which is part of Form 1040 , using your Social Security number.

However, if you hire staff or want to set up a retirement plan, you will need to obtain a federal employer identification number and use that to file your taxes. Also, as an employer, keep in mind that you should file your taxes every quarter, as opposed to yearly filings for employees. Lastly, be sure to do your research and see if your state requires you to charge any sales tax.

While becoming a sole proprietor is relatively easy, its also a bit risky, as you maintain full liability for all its debts. As your business progresses, it may be in your best interest to create a corporation or limited liability company to protect your personal assets from business liabilities.

To see the pros and cons of a sole proprietorship, click here. For more info on different types of business entities, see our videos on selecting the right business formation.

You May Like: What’s The Cost Of Solar Panels

Transferability Of A Sole Proprietorship

A sole proprietorship is highly transferable. “Transferability of ownership ” refers to the ability of an owner of a business to sell or convey that ownership interest to another. Transferability also refers to the impact such a transfer will have on an existing business venture. Transferability varies greatly among business organizations.

The sole proprietor is, essentially, the business. If a proprietor sells his business the proprietorship ends for that person, while a new one is formed by the buyer.

When Are Verbal Agreements Not Enforceable

There are some types of contracts which must be in writing.

The Statute of Frauds is a legal statute which states that certain kinds of contracts must be executed in writing and signed by the parties involved. The Statute of Frauds has been adopted in almost all U.S states, and requires a written contract for the following purposes:

- The sale of real estate or vehicles

- Real estate leases lasting longer than one year.

- Property transfer following the death of the owner.

- The case of a party agreeing to pay debt for someone else.

- Any contract that requires more than a year to fulfil.

- A contract involving and exceeding a specified amount of money .

Typically, a court of law won’t enforce an oral agreement in any of these circumstances under the statute. Instead, a written document is required to make the contract enforceable.

Contract law is generally doesn’t favor contracts agreed upon verbally. A verbal agreement is difficult to prove, and can be used by those intent on committing fraud. For that reason, it’s always best to put any agreements in writing and ensure all parties have fully understood and consented to signing.

Don’t Miss: How To Start A Solar Farm Business

Converting From A Sole Proprietorship To An Llc

If you start your Maine business as a Sole Proprietorship, and then later want to convert to an LLC or Corporation, its a large headache with many steps involved.

There isnt a one-step process to convert a Sole Proprietorship to LLC. In fact, there are often multiple steps and multiple filings you must make with various state departments and local governments.

For example, you need to update the state, the IRS, and the bank that your business type has changed. And if your business requires a license or permit to operate, you will need to re-apply for those as the new business. You may also need to redo contracts with your clients and vendors, and update your website and marketing materials.

So if youre on the fence about which type of Maine business to choose, and you have the money to spend on an LLC, we recommend starting an LLC in Maine.

Disadvantages Of A Sole Proprietorship

The primary disadvantage of a sole proprietorship is that your personal finances and those of your business are one and the same. You’re personally liable for any debts or obligations of the business when you’re the owner. Lawsuits or creditors may be able to access your personal accounts, assets, or property if your business can’t pay its bills.

You can’t file bankruptcy for your business without filing personal bankruptcy. Filing bankruptcy for your sole proprietorship means involving your personal assets. A bankruptcy case involving a sole proprietorship includes both the business and personal assets of the owners and debtors.

The issues of personal liability and involvement of personal assets outweigh the advantages of sole proprietorship structure for many businesspersons. Consider forming a limited liability company or corporation instead if this is the case for you.

You May Like: How Much Does It Cost For One Solar Panel

How Do You Turn A Business Into A Partnership

How To Start A Sole Proprietorship In India

Starting a sole proprietorship business in India is a fairly easy affair. You just need to take care of the following before thinking of how to open a proprietorship firm in India.

1, Decide on a suitable business name

You May Like: How To Stop A Solar Farm

Video Result For Sole Proprietorship Software

Lab Connect Project 1 Journal Entries for Sole…

Accounting Cycle Step 6: Adjusted Trial Balance for…

Business Structure: Sole Proprietorship VS LLC

How to File Taxes If Self-Employed In Canada | Small…

Business Registration and Set up for Sole…

How to Start Your First Business As a Sole Proprietor

Corporation vs Sole Proprietorship Tax Breaks : What…

S-Corporation Tax Calculator –When & How…

Do It Yourself Bookkeeping For Sole Proprietors

Single Member LLC vs Sole Proprietorship: Pros, Cons & …

Sole Proprietorship Taxes 2021-2022 | Self-Employed…

Difference between a Sole proprietor, LLC and…

How To Register Your Business

The Sole Proprietor Superhero | Why You Should…

Tax Benefits of LLC vs. Sole Proprietor vs. S-corp -…

Uber Drivers: Yes, You’re Self-Employed – TurboTax Tax…

HOW to START a BUSINESS in CANADA // REGISTER Sole…

When Does an S Corporation Make Financial Sense? |…

How to Set Your Business Up For Taxes: Sole…

Vermont CDBG Sole Proprietor Grant Pre Application

A Guide to Bookkeeping for Sole Traders and…

Sole-proprietor Paycheck Protection SBA Loan – FREE…

LLC Vs. Sole Proprietorship Tax Benefits

HOW TO REGISTER YOUR SUNGLASSES BUSINESS IN 2021 |…

Business Accounting: Income and Expenses [Self…

How to Start a Small Business California – How to…

preparation of final accounts of sole proprietors

How to fill out a W9 form as a contractor or sole…

Top 10 Tax Tips to Safely Maximize Your Tax Refund

CP500 for Sole Proprietor

Can You Hire Employees If You’re A Sole Proprietor

According to LegalZoom, a sole proprietor can hire employees, but you must be careful to avoid violating any local or state regulations. Further, you need to first obtain an employer identification number . The EIN is needed for tax purposes, and the sole proprietor can’t use his or her Social Security number in place of a legal EIN.

You May Like: Can I Use Pine Sol On Wood

Establish And Publish A Dba Statement

Doing Business As is also known as your fictitious name and is not required. Sole proprietors tend to file a DBA for practical reasons such as sales and marketing. The county clerks office requires a signed affidavit of your published statement within thirty days after the final publication. In the majority of California counties, the published DBA statement must be in a local paper once a week for four weeks. Just make sure that the publication you decide to go with will provide an affidavit with the county clerks office, after requirements are met. A DBA must be filed anytime you dont choose to use your last name or a different last name. It is important to keep in mind having a registered name with California doesnt protect or give you exclusive rights to use that name. Only when you register a trademark under that name it allows for an exclusive right to use that name.

Step three